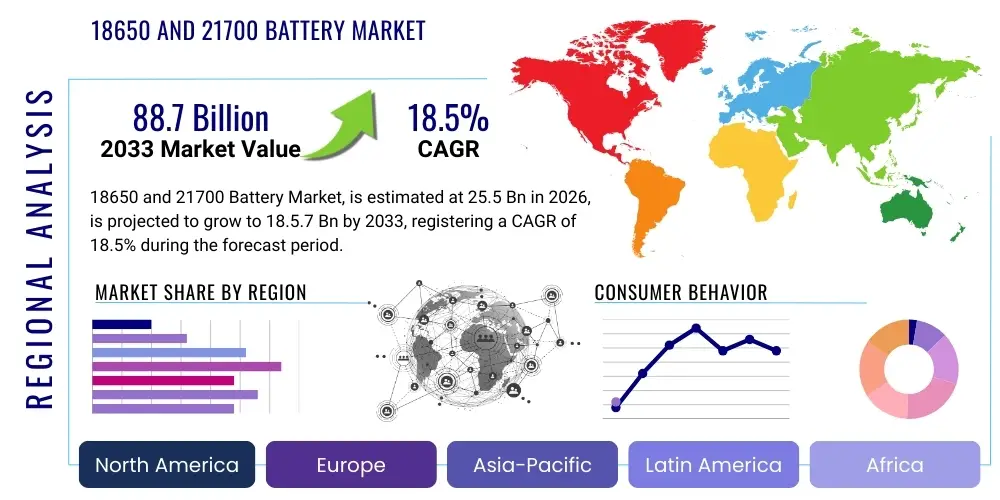

18650 and 21700 Battery Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440243 | Date : Jan, 2026 | Pages : 253 | Region : Global | Publisher : MRU

18650 and 21700 Battery Market Size

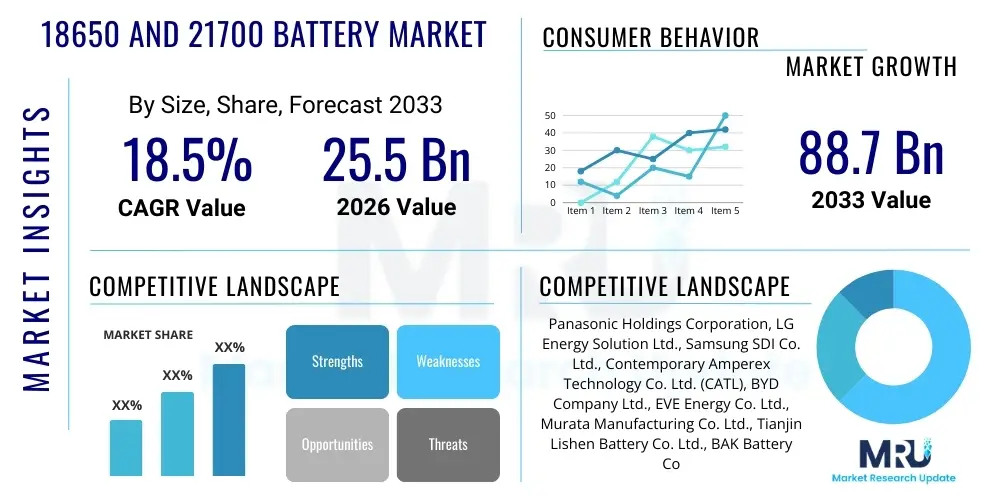

The 18650 and 21700 Battery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 25.5 Billion in 2026 and is projected to reach USD 88.7 Billion by the end of the forecast period in 2033. This robust expansion is fueled by an accelerating demand for high-performance, compact energy storage solutions across diverse industries, notably electric vehicles (EVs), portable electronics, and renewable energy storage systems. The inherent advantages of both 18650 and 21700 cells, including their energy density, modularity, and established manufacturing processes, position them as foundational components in the global energy transition.

18650 and 21700 Battery Market introduction

The 18650 and 21700 battery market encompasses the production, distribution, and consumption of cylindrical lithium-ion battery cells, characterized by their specific dimensions: 18mm diameter by 65mm length for 18650, and 21mm diameter by 70mm length for 21700. These cells are at the forefront of modern energy storage technology, offering high energy density, long cycle life, and excellent power output, making them indispensable for a wide array of applications. The 18650 cell has historically been a workhorse in consumer electronics and early electric vehicles, establishing a significant market presence due to its proven reliability and cost-effectiveness. Its widespread adoption paved the way for the development of larger, higher-capacity alternatives.

The 21700 cell, introduced more recently, represents an evolution in cylindrical battery design, offering approximately 35-50% more energy capacity than a standard 18650 cell, while maintaining a similar form factor and thermal management characteristics. This increased energy density per cell reduces the number of cells required for a given battery pack, leading to potential benefits in terms of weight, volume, and complexity of battery pack design. Major applications for these batteries span across electric vehicles (EVs), including passenger cars, electric bikes, and commercial vehicles, where their performance directly influences range and power. Beyond mobility, they are crucial in consumer electronics such as laptops, power banks, and cordless power tools, providing the necessary power for extended operation and quick charging capabilities.

Furthermore, these battery types are vital for grid-scale energy storage systems, supporting renewable energy integration by storing excess solar or wind power and releasing it during peak demand or when generation is low. Medical devices, drones, and robotics also leverage these batteries due to their compact size and reliable power delivery. The primary benefits include high energy-to-weight ratio, extended operational times, and relatively quick charging cycles. Key driving factors for market growth include the global push for decarbonization and electrification in transportation, increasing demand for portable and smart electronic devices, advancements in battery manufacturing technologies, and supportive government policies promoting EV adoption and renewable energy infrastructure development. Continuous innovation in battery chemistry and cell design also plays a pivotal role in expanding their market reach and improving overall performance metrics.

18650 and 21700 Battery Market Executive Summary

The 18650 and 21700 battery market is experiencing vigorous growth, primarily driven by transformative shifts in the automotive and energy sectors. Business trends indicate a strong focus on strategic partnerships and mergers among battery manufacturers, raw material suppliers, and automotive OEMs to secure supply chains, optimize production costs, and accelerate technological innovation. There is an increasing emphasis on sustainable manufacturing practices, including responsible sourcing of critical minerals like lithium, cobalt, and nickel, and the development of robust recycling infrastructure to enhance the circular economy of battery materials. Companies are also heavily investing in research and development to improve energy density, cycle life, safety, and fast-charging capabilities, crucial for meeting evolving consumer and industrial demands. The competitive landscape is characterized by a few dominant players alongside a growing number of specialized manufacturers, all vying for market share through product differentiation and economies of scale. Furthermore, the market is witnessing a rise in customization, with manufacturers offering tailored battery solutions to specific client requirements, particularly in the burgeoning EV and grid storage segments.

Regional trends highlight Asia Pacific as the undeniable powerhouse of the 18650 and 21700 battery market, accounting for the largest share in both production and consumption. This dominance is attributed to the presence of major battery manufacturers in China, South Korea, and Japan, coupled with robust manufacturing bases for electric vehicles and consumer electronics. Government incentives and a vast domestic market for EVs in China further solidify its leading position. Europe and North America are also demonstrating substantial growth, fueled by ambitious electrification targets, increasing investments in giga-factories, and supportive regulatory frameworks aimed at fostering domestic battery production and supply chain resilience. Latin America, the Middle East, and Africa, while smaller in market size, are emerging with nascent growth driven by increasing industrialization, rising adoption of renewable energy projects, and selective EV market penetration, albeit at a slower pace compared to developed regions.

Segmentation trends reveal that the electric vehicle sector remains the most significant and fastest-growing application segment for both 18650 and 21700 batteries, driven by advancements in battery performance, increasing consumer acceptance of EVs, and stringent emission regulations globally. Within EVs, the shift towards longer-range vehicles is particularly boosting demand for higher capacity 21700 cells. The consumer electronics segment, while mature, continues to provide a stable demand base, especially for 18650 cells in laptops, power tools, and portable devices, albeit with a slower growth trajectory compared to EVs. Energy storage systems, encompassing residential, commercial, and utility-scale applications, are rapidly gaining traction as the integration of intermittent renewable energy sources escalates. This segment benefits from the modularity and scalability offered by both battery types. By cell type, 21700 cells are experiencing a higher growth rate due to their superior energy density and increasing adoption by leading EV manufacturers, gradually challenging the long-standing dominance of 18650 cells in new designs, though 18650 cells retain a significant market share in established applications.

AI Impact Analysis on 18650 and 21700 Battery Market

User questions regarding AI's impact on the 18650 and 21700 battery market frequently revolve around efficiency improvements in manufacturing, predictive maintenance for battery longevity, optimization of battery management systems (BMS), and the discovery of novel materials. Concerns often touch upon the initial investment required for AI integration, data privacy, and the need for specialized skills to leverage AI effectively. Expectations are high for AI to significantly reduce costs, enhance safety, and accelerate innovation in battery technology. Users anticipate AI will not only streamline current processes but also unlock new possibilities for battery design and application, pushing the boundaries of what these cylindrical cells can achieve in terms of performance and sustainability.

- AI-driven optimization of manufacturing processes significantly enhances production efficiency, reduces waste, and improves quality control by identifying anomalies and predicting equipment failures in real-time. This leads to higher yields and lower manufacturing costs for both 18650 and 21700 cells.

- Predictive analytics powered by AI enables more accurate forecasting of raw material prices and supply chain disruptions, allowing manufacturers to optimize inventory management and mitigate risks associated with volatile commodity markets.

- Advanced Battery Management Systems (BMS) integrate AI algorithms to monitor cell health, predict degradation, and optimize charging/discharging cycles, thereby extending the lifespan and enhancing the safety of battery packs in EVs and energy storage systems.

- AI accelerates the discovery and development of new battery chemistries and materials by simulating molecular interactions and predicting material properties, leading to breakthroughs in energy density, power output, and thermal stability for future 18650 and 21700 variants.

- The deployment of AI in quality inspection systems allows for faster and more precise defect detection during cell production, ensuring only high-quality batteries enter the market and significantly reducing recall risks.

- AI-enabled smart charging solutions optimize charging profiles based on user behavior, grid conditions, and battery health, further prolonging battery life and improving overall energy efficiency for devices using 18650 and 21700 cells.

- Data analytics and machine learning can personalize battery pack designs for specific applications, considering factors like weight, volume, and operational environment, leading to more customized and efficient energy solutions.

- AI contributes to the circular economy by optimizing battery recycling processes through better sorting and identification of materials, thus improving recovery rates of valuable components from spent 18650 and 21700 batteries.

DRO & Impact Forces Of 18650 and 21700 Battery Market

The 18650 and 21700 battery market is dynamically shaped by a confluence of drivers, restraints, and opportunities, all underscored by various impact forces. Key drivers include the exponential growth in electric vehicle adoption globally, spurred by stringent environmental regulations and increasing consumer awareness regarding sustainable transportation. The escalating demand for grid-scale energy storage solutions, essential for integrating renewable energy sources like solar and wind into national grids, also significantly propels market expansion. Furthermore, the relentless advancement and miniaturization in portable consumer electronics, coupled with the rising demand for high-performance cordless power tools, continue to be strong demand-side contributors. These factors collectively create a robust environment for sustained market growth, with continuous innovation in battery chemistry and manufacturing processes further enhancing performance and cost-effectiveness.

Despite the strong growth trajectory, several restraints challenge the market. The volatility and ethical concerns associated with the sourcing of critical raw materials such as lithium, cobalt, and nickel pose significant supply chain risks and can lead to price fluctuations. Safety concerns, particularly regarding thermal runaway and potential fire hazards in high-energy-density batteries, necessitate continuous research and development into safer chemistries and robust battery management systems. The initial high upfront cost of electric vehicles, heavily influenced by battery pack prices, can still deter broader consumer adoption in some markets, despite decreasing battery costs over time. Moreover, the lack of a fully developed global charging infrastructure for EVs, alongside the nascent but growing challenge of end-of-life battery recycling and disposal, represent considerable hurdles that require substantial investment and policy support to overcome.

Opportunities in this market are abundant and transformative. The ongoing research into next-generation battery technologies, such as solid-state batteries and silicon anodes, promises even higher energy densities, faster charging capabilities, and improved safety profiles, potentially extending the application scope of these cylindrical cells. The burgeoning circular economy initiatives, focusing on battery recycling, repurposing, and second-life applications, offer a pathway to reduce environmental impact and ensure sustainable resource management, creating new revenue streams and alleviating raw material dependency. Emerging applications in aerospace, marine propulsion, and advanced robotics also present significant untapped potential for high-performance battery solutions. The increasing global focus on energy independence and decentralized power grids further fuels the demand for modular and scalable energy storage solutions, positioning 18650 and 21700 batteries as critical enablers for future energy landscapes. Impact forces, including supportive government policies and subsidies for EVs and renewable energy, geopolitical dynamics influencing raw material supply, and rapid technological advancements in manufacturing and material science, continuously reshape the competitive landscape and strategic priorities of market players.

Segmentation Analysis

The 18650 and 21700 battery market is meticulously segmented to provide a granular understanding of its diverse components and drivers. This segmentation allows for precise market analysis, identifying key growth areas and competitive dynamics across various dimensions such as cell type, material chemistry, end-use application, capacity, and geographical region. Understanding these segments is critical for manufacturers, investors, and policymakers to develop targeted strategies and capitalize on emerging opportunities within this rapidly evolving energy storage landscape. Each segment responds to unique market demands and technological advancements, highlighting the versatility and adaptability of these cylindrical battery cells.

- By Cell Type

- 18650 Batteries

- 21700 Batteries

- By Material Chemistry

- Lithium Nickel Manganese Cobalt (NMC)

- Lithium Iron Phosphate (LFP)

- Lithium Cobalt Oxide (LCO)

- Lithium Nickel Cobalt Aluminum Oxide (NCA)

- Others (e.g., LTO)

- By Application

- Electric Vehicles (EVs)

- Passenger EVs

- Commercial EVs

- Electric Bikes/Scooters

- Consumer Electronics

- Laptops

- Power Banks

- Portable Audio Devices

- Digital Cameras

- E-Cigarettes/Vape Devices

- Power Tools

- Cordless Drills

- Impact Drivers

- Saws

- Energy Storage Systems (ESS)

- Residential ESS

- Commercial ESS

- Utility-Scale ESS

- Medical Devices

- Portable Medical Equipment

- Implantable Devices

- Industrial Applications

- Robotics

- Drones

- Material Handling Equipment

- Other Applications (e.g., Military, Aerospace)

- Electric Vehicles (EVs)

- By Capacity Range

- Below 2500 mAh (for 18650)

- 2500 mAh - 3500 mAh (for 18650)

- Above 3500 mAh (for 18650)

- Below 4000 mAh (for 21700)

- 4000 mAh - 5000 mAh (for 21700)

- Above 5000 mAh (for 21700)

- By End-User Industry

- Automotive

- Consumer Goods

- Energy & Utilities

- Healthcare

- Manufacturing

- Aerospace & Defense

Value Chain Analysis For 18650 and 21700 Battery Market

The value chain for the 18650 and 21700 battery market is intricate and extends from the extraction of raw materials to the end-of-life management of battery cells, involving multiple stages and diverse stakeholders. Upstream activities primarily focus on the mining and processing of critical raw materials such as lithium, cobalt, nickel, manganese, graphite, and aluminum. These materials undergo extensive refining and chemical processing to produce cathode and anode active materials, electrolytes, and separators, which are the fundamental components of lithium-ion cells. This segment is characterized by significant capital investment, geopolitical considerations influencing supply, and a strong emphasis on ethical sourcing and environmental sustainability. Major players in this stage include specialized mining companies and chemical processing firms, often operating globally.

The midstream segment involves the highly specialized manufacturing of the 18650 and 21700 battery cells themselves. This includes electrode coating, cell assembly (winding or stacking), electrolyte filling, sealing, and formation processes. Battery cell manufacturers, often large multinational corporations with extensive R&D capabilities, play a pivotal role here, focusing on optimizing cell design, improving energy density, enhancing safety features, and achieving economies of scale. Following cell production, these cells are then integrated into larger battery modules and packs, which often involve sophisticated Battery Management Systems (BMS) for monitoring and control, thermal management systems, and robust enclosures. This stage is crucial for ensuring the overall performance, safety, and reliability of the final battery product tailored for specific applications like electric vehicles or grid storage systems.

Downstream activities encompass the distribution and sales of these battery packs to various end-user industries. Distribution channels can be both direct and indirect. Direct channels involve manufacturers selling directly to large original equipment manufacturers (OEMs) in the automotive, consumer electronics, or energy sectors, often through long-term supply contracts. Indirect channels involve distributors, wholesalers, and retailers who supply smaller businesses or individual consumers, providing a broader market reach for replacement batteries or components. Post-sale services, including warranty support, maintenance, and eventually, end-of-life services like recycling and repurposing, complete the value chain. The growing emphasis on sustainability and circular economy principles is driving innovation in recycling technologies and business models for spent 18650 and 21700 batteries, aiming to recover valuable materials and minimize environmental impact.

18650 and 21700 Battery Market Potential Customers

The 18650 and 21700 battery market serves a broad and diverse base of potential customers, spanning multiple high-growth industries that rely heavily on advanced portable and stationary energy storage solutions. The primary category of potential customers includes electric vehicle manufacturers, ranging from established automotive giants to emerging EV startups, for whom these batteries are the core power source dictating vehicle performance, range, and cost. These customers seek high energy density, long cycle life, and robust safety features, often demanding customized battery pack designs tailored to specific vehicle platforms. The rapid electrification of transportation, including passenger cars, commercial vehicles, and two-wheelers, makes this segment the largest and fastest-growing consumer of 18650 and 21700 cells, driving significant market volumes and technological advancements.

Another substantial customer segment comprises manufacturers of consumer electronics. This includes leading brands producing laptops, smartphones, tablets, power banks, and portable audio devices, all of which benefit from the compact size, high energy density, and reliability of these cylindrical cells. The demand here is driven by the continuous evolution of portable devices that require extended battery life and faster charging capabilities. Similarly, the power tools industry, encompassing cordless drills, impact drivers, garden tools, and other handheld equipment, represents a significant customer base. Professionals and DIY enthusiasts alike seek durable batteries that deliver high power output for demanding tasks and long operational times between charges, making 18650 and 21700 cells ideal for these applications.

Furthermore, the energy storage systems (ESS) market constitutes a rapidly expanding segment of potential customers. This includes utility companies implementing large-scale grid storage solutions to balance supply and demand from renewable energy sources, as well as commercial and residential users seeking backup power or energy independence. These customers prioritize long-term reliability, scalability, and cost-effectiveness. The medical device industry also relies on these batteries for portable diagnostic equipment, implantable devices, and emergency medical tools, where consistent and reliable power is paramount. Other emerging customer groups include manufacturers of drones, robotics for industrial and logistics applications, and specialized military and aerospace equipment, all requiring high-performance, lightweight, and durable battery solutions to power their advanced technologies. The diverse needs of these end-users underscore the widespread applicability and critical importance of 18650 and 21700 battery technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 88.7 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Panasonic Holdings Corporation, LG Energy Solution Ltd., Samsung SDI Co. Ltd., Contemporary Amperex Technology Co. Ltd. (CATL), BYD Company Ltd., EVE Energy Co. Ltd., Murata Manufacturing Co. Ltd., Tianjin Lishen Battery Co. Ltd., BAK Battery Co. Ltd., Sanyo Electric Co. Ltd. (now part of Panasonic), VARTA AG, A123 Systems LLC, Farasis Energy, Envision AESC, SK Innovation Co. Ltd., Northvolt AB, StoreDot Ltd., Tesla Inc. (for in-house production), Coslight Technology International Group Limited, ATL (Amperex Technology Limited) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

18650 and 21700 Battery Market Key Technology Landscape

The technological landscape of the 18650 and 21700 battery market is characterized by relentless innovation aimed at enhancing energy density, improving safety, extending cycle life, and reducing manufacturing costs. A primary focus is on advanced material science, particularly in the development of novel cathode and anode materials. For cathodes, there is a strong push towards high-nickel NMC (Nickel Manganese Cobalt) and NCA (Nickel Cobalt Aluminum) chemistries, which offer superior energy density, essential for longer-range electric vehicles. Simultaneously, Lithium Iron Phosphate (LFP) batteries are gaining renewed traction due to their enhanced safety, longer cycle life, and lower cost, making them particularly attractive for stationary storage and certain EV segments. On the anode side, research is heavily invested in silicon-based anodes and lithium-metal anodes, which promise significantly higher theoretical energy capacities compared to traditional graphite, though challenges related to volume expansion and dendrite formation still require extensive R&D.

Beyond material composition, advancements in cell design and manufacturing processes are critical. This includes optimizing cell internal structures to improve power delivery and thermal management, which is crucial for preventing thermal runaway and ensuring battery longevity. Innovations in dry electrode manufacturing, for instance, aim to reduce the energy-intensive and environmentally impactful solvent-based processes, leading to more sustainable and cost-effective production. Furthermore, the integration of advanced Battery Management Systems (BMS) is paramount. Modern BMS leverages sophisticated algorithms, often incorporating artificial intelligence and machine learning, to precisely monitor cell voltage, temperature, and current, thereby optimizing charging and discharging cycles, predicting battery health, and ensuring optimal safety and performance throughout the battery's operational life. These intelligent systems are key to unlocking the full potential of high-performance 18650 and 21700 cells.

The field of fast charging technology is another major area of technological focus, driven by consumer demand for reduced charging times, especially in electric vehicles. This involves developing improved electrode designs, specialized electrolyte formulations, and sophisticated thermal management systems that can dissipate heat efficiently during rapid charging without compromising battery integrity or safety. Moreover, the development of solid-state battery technology represents a potential paradigm shift. While still in early commercialization stages for cylindrical cells, solid-state electrolytes promise higher energy densities, enhanced safety by eliminating flammable liquid electrolytes, and longer lifespans. Concurrently, advancements in battery diagnostics and sensing technologies are improving the ability to detect internal faults and monitor battery degradation with greater accuracy, contributing to overall system reliability. The convergence of these technological advancements is continuously pushing the boundaries of performance and applicability for 18650 and 21700 batteries, cementing their role as fundamental components in the global energy transition.

Regional Highlights

- Asia Pacific (APAC): Dominates the global 18650 and 21700 battery market, driven by the presence of major battery manufacturers (China, South Korea, Japan), robust electric vehicle production, and a vast consumer electronics industry. China, in particular, leads in both manufacturing capacity and EV adoption, supported by significant government subsidies and strategic investments in the battery supply chain. South Korea and Japan are strong in R&D and high-performance cell production.

- Europe: Emerging as a significant growth hub, propelled by ambitious decarbonization targets, stringent emission regulations, and substantial investments in giga-factories across Germany, France, and Scandinavia. The region is focusing on establishing a localized, sustainable battery value chain, reducing reliance on Asian imports, and driving innovation in battery recycling and second-life applications.

- North America: Experiencing rapid expansion, primarily due to growing EV demand, increasing government incentives (e.g., Inflation Reduction Act in the US), and significant private sector investments in battery manufacturing facilities. Tesla's pioneering use of 21700 cells and other automotive giants' commitments to electrification are major market drivers, particularly in the automotive segment.

- Latin America: Demonstrating nascent growth, with increasing adoption of electric buses and a slow but steady rise in EV sales in countries like Brazil and Mexico. The region holds significant lithium reserves, presenting future opportunities for upstream supply chain development, though local manufacturing of cells remains limited.

- Middle East and Africa (MEA): Currently a smaller market, but with growing interest in renewable energy projects and smart city initiatives, which could drive demand for energy storage solutions. Investment in oil-rich nations diversifying their economies and improving infrastructure presents long-term potential for battery applications, albeit at a slower pace compared to other regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the 18650 and 21700 Battery Market.- Panasonic Holdings Corporation

- LG Energy Solution Ltd.

- Samsung SDI Co. Ltd.

- Contemporary Amperex Technology Co. Ltd. (CATL)

- BYD Company Ltd.

- EVE Energy Co. Ltd.

- Murata Manufacturing Co. Ltd.

- Tianjin Lishen Battery Co. Ltd.

- BAK Battery Co. Ltd.

- Sanyo Electric Co. Ltd. (now part of Panasonic)

- VARTA AG

- A123 Systems LLC

- Farasis Energy

- Envision AESC

- SK Innovation Co. Ltd.

- Northvolt AB

- StoreDot Ltd.

- Tesla Inc.

- Coslight Technology International Group Limited

- ATL (Amperex Technology Limited)

Frequently Asked Questions

What are the primary differences between 18650 and 21700 batteries?

The primary differences lie in their physical dimensions and energy capacity. 18650 batteries measure 18mm in diameter and 65mm in length, while 21700 batteries are larger at 21mm in diameter and 70mm in length. This larger size allows 21700 cells to store significantly more energy, typically offering 35-50% higher capacity (e.g., 4000-5000 mAh for 21700 vs. 2500-3500 mAh for 18650). This increased capacity per cell means fewer cells are needed for a given battery pack, potentially leading to lighter, more compact, and simpler battery pack designs, particularly advantageous for electric vehicles and high-power applications.

Which applications most benefit from 21700 batteries compared to 18650 cells?

21700 batteries primarily benefit applications demanding higher energy density and power output, such as electric vehicles (EVs), where they can contribute to longer range and faster acceleration. Their superior capacity also makes them ideal for high-drain power tools, large-scale energy storage systems (ESS), and high-performance e-bikes. While 18650 cells remain prevalent in many consumer electronics and some power tools due to their established ecosystem and compact size, 21700 cells are increasingly preferred for new designs that prioritize maximum energy storage and performance in a compact footprint.

What are the key drivers for the growth of the 18650 and 21700 battery market?

The key drivers for market growth include the accelerating global adoption of electric vehicles due to environmental regulations and increasing consumer preference for sustainable transport. Simultaneously, the expanding demand for renewable energy storage solutions, essential for grid stability and integration of solar/wind power, is a significant catalyst. Furthermore, the continuous innovation in portable consumer electronics and high-performance cordless power tools, all requiring robust and long-lasting energy sources, further propels the demand for these advanced cylindrical lithium-ion cells. Decreasing battery production costs and supportive government policies also play crucial roles.

What are the main challenges facing the 18650 and 21700 battery market?

The market faces several challenges, including the volatility and ethical concerns surrounding the sourcing of critical raw materials like lithium, cobalt, and nickel, which can lead to supply chain disruptions and price fluctuations. Safety concerns, particularly the risk of thermal runaway in high-energy-density cells, necessitate ongoing research into safer chemistries and improved battery management systems. Additionally, the high upfront cost of battery packs, especially for EVs, can be a barrier to broader adoption, despite continuous price reductions. Developing a robust global recycling infrastructure for end-of-life batteries also remains a significant challenge.

How is artificial intelligence (AI) impacting the 18650 and 21700 battery market?

AI is profoundly impacting the market by optimizing manufacturing processes, improving efficiency, and enhancing quality control through predictive analytics and anomaly detection. It is also revolutionizing Battery Management Systems (BMS) by enabling more precise monitoring of cell health, predicting degradation, and optimizing charging cycles, thereby extending battery lifespan and ensuring safety. Furthermore, AI accelerates materials discovery and design for new battery chemistries, leading to higher energy density and improved performance. It also plays a role in optimizing supply chains, reducing costs, and facilitating the circular economy through improved recycling processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager