26650 Battery Pack Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431937 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

26650 Battery Pack Market Size

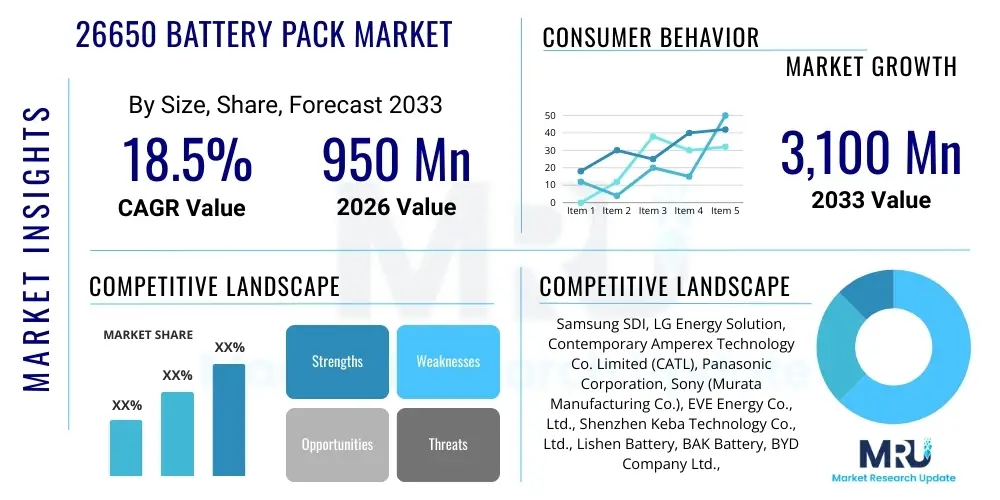

The 26650 Battery Pack Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 950 million in 2026 and is projected to reach USD 3,100 million by the end of the forecast period in 2033.

26650 Battery Pack Market introduction

The 26650 Battery Pack Market encompasses integrated power solutions built around 26mm diameter and 65mm length cylindrical lithium-ion cells. These packs are highly favored in industrial, military, and specific consumer electronics applications where high capacity, robust construction, and moderate energy density are prerequisites. The primary chemistries utilized include Lithium Iron Phosphate (LiFePO4 or LFP) and Lithium Nickel Manganese Cobalt Oxide (Li-NMC), with LFP being particularly prevalent due to its superior safety profile, thermal stability, and long cycle life, making it ideal for demanding environments and stationary energy storage systems (ESS). The inherent design of the 26650 format allows for excellent thermal management compared to larger prismatic cells, contributing significantly to the overall reliability and longevity of the final battery pack system.

Major applications driving the sustained growth of this market include specialized electric tools, high-drain portable devices, emergency lighting systems, medical equipment requiring robust power sources, and small-scale uninterruptible power supplies (UPS). Furthermore, the 26650 configuration has found a dedicated niche in specific military and defense sectors where durability and performance consistency are non-negotiable requirements. The packs typically include essential protection circuitry, such as Battery Management Systems (BMS), fuses, and thermal sensors, which are crucial for ensuring safe operation, preventing overcharge, over-discharge, and managing cell balancing throughout the life cycle of the pack. The robustness and established safety record of the 26650 format continue to attract diverse industrial users.

Key driving factors accelerating market expansion include the increasing global focus on renewable energy integration, which necessitates reliable and modular energy storage solutions, particularly in decentralized power generation. The ongoing miniaturization and efficiency improvements in power tools and demanding consumer electronics also fuel demand for high-performance, compact battery packs. Additionally, supportive regulatory frameworks promoting electric mobility and grid stability in developed economies are creating long-term opportunities for LFP-based 26650 packs in entry-level EV and grid support applications. The combination of established manufacturing processes, cost-effectiveness, and dependable performance positions the 26650 battery pack favorably against newer, higher-density formats for specific industrial use cases.

26650 Battery Pack Market Executive Summary

The global 26650 Battery Pack Market is experiencing robust expansion, fundamentally driven by sustained industrial and infrastructural investment across Asia Pacific and North America. Current business trends indicate a critical shift towards vertically integrated supply chains, with key manufacturers focusing on securing long-term contracts for raw materials, particularly lithium carbonate and cobalt, to mitigate escalating supply chain risks and price volatility. There is a noticeable technological trend emphasizing enhanced safety features, integrating sophisticated, predictive Battery Management Systems (BMS) that leverage machine learning algorithms to optimize charging cycles and predict potential cell failures, thereby extending the overall lifespan of the battery packs and increasing end-user trust in the product reliability.

Regionally, Asia Pacific, particularly China and South Korea, maintains dominance in both manufacturing capacity and domestic consumption, driven by the massive deployment of essential tools and specialized industrial machinery, coupled with governmental mandates supporting energy storage initiatives. North America is emerging as a rapidly expanding market due to significant investments in grid modernization and the adoption of high-performance portable military and medical devices, where the 26650 format’s high capacity and established safety track record provide a distinct advantage. European markets, while growing steadily, are prioritizing sustainability and closed-loop manufacturing, pushing manufacturers toward adopting greener production methods and focusing heavily on recyclability and second-life applications for the spent battery packs.

Segmentation trends highlight the increasing prominence of the Lithium Iron Phosphate (LFP) chemistry segment, which is favored for stationary storage and industrial applications due to its intrinsic thermal stability and lower cost profile compared to Li-NMC. In terms of application, the Electric Tools and Power Devices segment remains the highest consumer, although the Energy Storage Systems (ESS) segment is projected to exhibit the fastest Compound Annual Growth Rate (CAGR) over the forecast period, reflecting global efforts to stabilize renewable energy integration. Furthermore, customized battery pack solutions designed for niche industrial robotics and automated guided vehicles (AGVs) are emerging as critical high-value segments demanding specialized thermal and vibrational tolerance features tailored specifically for heavy-duty operational cycles.

AI Impact Analysis on 26650 Battery Pack Market

User queries regarding AI's influence on the 26650 Battery Pack Market primarily revolve around three core themes: manufacturing efficiency, product lifespan optimization, and supply chain resilience. Users frequently ask how AI can reduce manufacturing defects and improve yield rates in the complex cell assembly and pack integration processes, recognizing that quality control is paramount in high-voltage industrial packs. A secondary concern focuses on the role of predictive maintenance—specifically, how AI-driven BMS can use real-time data to forecast thermal runaways or capacity degradation, allowing for timely intervention and maximizing the battery's operational life in critical infrastructure. Finally, supply chain stakeholders are keen to understand how AI and machine learning models can be utilized to predict material cost fluctuations, optimize inventory levels for scarce resources like key cathode components, and forecast demand shifts, thereby minimizing logistical bottlenecks and ensuring stable pricing strategies in a volatile commodity market.

The implementation of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming both the production and performance characteristics of 26650 battery packs. In manufacturing, AI enables predictive quality assurance through advanced visual inspection systems and sensor fusion applied to welding and sealing processes, drastically reducing the chances of micro-defects that could lead to premature failure. Furthermore, ML algorithms are optimizing the formation cycle of newly manufactured cells, determining the precise charging and discharging protocol needed to maximize initial cell performance and longevity. This automated optimization process is crucial for maintaining the competitive edge in high-volume production facilities by lowering operational waste and accelerating time-to-market for reliably performing battery packs that meet stringent industrial quality standards.

Beyond manufacturing, AI-powered Battery Management Systems (BMS) are deploying sophisticated machine learning models to analyze complex usage patterns and environmental conditions in real-time. These intelligent BMS units move beyond simple monitoring to active, adaptive control, dynamically adjusting charge rates and discharge depths based on predicted load requirements and ambient temperature fluctuations, thereby mitigating stress on the cells. This capability is exceptionally valuable in grid-tied ESS applications where optimizing daily charge/discharge cycles based on grid needs and energy pricing is crucial for return on investment. Ultimately, AI enhances safety, extends the useful life of the 26650 packs, and allows for much more efficient deployment and resource management across diverse, demanding application environments, solidifying AI as a cornerstone technology for future battery innovation.

- AI optimizes manufacturing yield and quality control via predictive defect detection.

- Machine Learning (ML) enhances Battery Management Systems (BMS) for predictive maintenance and extended cycle life.

- AI-driven supply chain models forecast raw material price volatility and optimize component sourcing.

- Intelligent algorithms customize charging protocols to minimize cell degradation based on real-time usage.

- Automated formation cycling powered by AI ensures superior initial performance and homogeneity of cells within the pack.

- AI facilitates smart grid integration by optimizing ESS dispatch based on load forecasting and energy arbitrage opportunities.

DRO & Impact Forces Of 26650 Battery Pack Market

The 26650 Battery Pack Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming impact forces that dictate market trajectory. Key drivers include the escalating global demand for reliable, high-capacity portable power solutions across industrial sectors, coupled with the inherent safety and stability offered by the LFP chemistry commonly utilized in this format. This stability is critical for sectors like defense, medical, and long-term energy storage, where catastrophic failure is unacceptable. However, the market faces significant restraints, primarily the intense competition from higher energy density formats such such as 21700 and 4680 cylindrical cells, which offer superior volumetric energy density for specific electric vehicle applications, often leading to a perception of obsolescence for the 26650 format. Furthermore, geopolitical tensions and resource nationalism continue to introduce volatility in the cost and supply of critical raw materials, constraining profit margins and long-term production planning for pack assemblers.

Opportunities for growth are concentrated in specialized niche markets and the growing demand for secondary and tertiary battery solutions. The modularity of 26650 packs makes them highly adaptable for decentralized Energy Storage Systems (ESS), particularly in remote or off-grid locations, where maintenance simplicity and longevity outweigh the need for maximum volumetric efficiency. Moreover, the circular economy trend presents a major opportunity; as the lifecycle of these robust packs concludes in primary industrial use, they are increasingly repurposed for second-life applications in low-power stationary storage, leveraging their inherent durability and high residual capacity. Strategic partnerships between cell manufacturers and system integrators focused on standardized, scalable pack designs will be instrumental in capturing these emerging market opportunities and establishing dominant positions in industrial ESS deployment.

The combination of these forces creates a complex operational environment where sustained success hinges on technological differentiation and supply chain management. The impact forces are driving innovation toward enhanced thermal management systems within the pack, ensuring consistent performance even under extreme load conditions. Regulatory mandates promoting safety standards in battery use, particularly in industrial settings, exert significant positive pressure on the market, favoring the inherently safer LFP 26650 packs. Conversely, the market must constantly combat the pressure of technology commoditization, requiring continuous investment in differentiated features like intelligent BMS and superior cell chemistry variations that offer better power output and faster charging capabilities, ultimately determining which players can sustain profitable market share against highly aggressive global competition.

Segmentation Analysis

The 26650 Battery Pack Market segmentation provides a granular understanding of the diverse application landscape and technological preferences driving demand. The market is typically segmented based on Cell Chemistry, Capacity Range, and End-Use Application. Cell Chemistry differentiation is paramount, influencing safety profile, energy density, and cost structure, with LFP dominating industrial stationary applications due to its longevity, while Li-NMC retains relevance in power-intensive portable device segments. Capacity segmentation reflects the power needs of end-user devices, ranging from low-power devices requiring packs below 3,000 mAh to high-demand industrial systems utilizing packs exceeding 5,000 mAh per cell configuration, often dictating the complexity of the integrated BMS and cooling systems required for reliable operation across various environmental conditions.

The segmentation by End-Use Application is the most critical for strategic planning, showing where the highest growth potential resides. While the traditional segments like Flashlights and Portable Power Tools remain steady consumers, the significant growth catalysts are the emerging large-scale sectors, particularly Energy Storage Systems (ESS) for grid balancing and renewable integration, and specialized Industrial Robotics, including Automated Guided Vehicles (AGVs). These applications demand customized packs that offer high vibration resistance, rapid charging capabilities, and sophisticated thermal regulation. Understanding the specific performance benchmarks required by each application segment allows manufacturers to tailor their production, focusing on either optimizing for low cost (ESS) or maximizing power output and ruggedness (Industrial/Defense).

Geographic segmentation further divides the market based on regional manufacturing output and consumption patterns, recognizing that adoption rates and regulatory environments differ significantly. Asia Pacific, driven by robust industrial activity and major ESS projects, leads the global market. The complexity of the battery pack, encompassing the number of cells (S x P configurations), the housing material, and the integrated electronic components (BMS, protection circuits), dictates the final product cost and compliance level, necessitating specialized manufacturing lines tailored to meet the strict quality mandates of segments such as medical and aerospace, which utilize this established cylindrical format for its proven reliability characteristics.

- Cell Chemistry: LiFePO4 (LFP), Li-NMC, Other Chemistries (e.g., Li-MnO2)

- Capacity Range: Below 3,000 mAh, 3,000 mAh – 4,000 mAh, Above 4,000 mAh

- Application: Electric Tools and Power Devices, Energy Storage Systems (ESS), Medical Devices, Military and Defense, Electric Vehicles (Niche/Low-Speed), Industrial Robotics and AGVs, Flashlights and Lighting Systems

- Component: Cells, Battery Management Systems (BMS), Housing/Enclosure, Connectors and Wiring, Thermal Management Systems

Value Chain Analysis For 26650 Battery Pack Market

The value chain of the 26650 Battery Pack Market begins with upstream activities involving the extraction and processing of critical raw materials, including lithium, cobalt, nickel, manganese, and graphite. This phase is highly capital-intensive and geographically concentrated, making it vulnerable to geopolitical risk and supply shocks. Processed materials are then supplied to Cell Manufacturing facilities, which focus on precision engineering, cathode and anode preparation, electrolyte formulation, and the intricate assembly of the 26650 cylindrical cells. Quality control at this stage, particularly minimizing internal resistance and maximizing cell capacity, is vital as it dictates the performance ceiling of the final battery pack product. Cell manufacturers often invest heavily in patented electrode technologies to gain a competitive advantage in energy density or cycle life, setting the foundation for the entire downstream structure.

Midstream activities involve Pack Assembly, where the individual 26650 cells are configured into series and parallel arrangements (S x P), integrated with the complex Battery Management System (BMS), and encased within protective housing. This stage adds significant value through intellectual property related to thermal management and safety engineering. Downstream distribution involves direct sales to large Original Equipment Manufacturers (OEMs) in the power tool and ESS sectors, often through long-term, customized contracts. The channel also includes indirect sales via specialized distributors and wholesalers who cater to smaller industrial users and regional system integrators. The distribution channel must manage hazardous material logistics and regulatory compliance, particularly for international shipping of lithium-ion products, adding layers of complexity and specialized handling requirements to the logistics process.

Direct distribution paths are common for high-volume orders destined for major ESS providers or specialized defense contractors, ensuring tight control over quality and pricing. Indirect channels are crucial for market penetration into dispersed regional markets and for serving the MRO (Maintenance, Repair, and Operations) sector, which requires readily available replacement packs. The entire value chain is moving towards greater integration, with several large battery conglomerates acquiring interests in both raw material mining (upstream) and ESS installation services (downstream). This vertical integration strategy is designed to stabilize material costs, accelerate product development cycles, and ensure seamless delivery from resource acquisition to final application deployment, establishing significant barriers to entry for new market participants in this highly competitive industrial landscape.

26650 Battery Pack Market Potential Customers

Potential customers for 26650 battery packs span a wide range of industrial and specialized sectors, valuing the format primarily for its robustness, proven safety record, and balanced energy/power output capabilities. The largest segment of end-users are manufacturers of high-drain electric power tools, including drilling equipment, saws, and portable industrial machinery that require bursts of high current combined with prolonged operational runtime. These OEMs are highly sensitive to cell reliability and thermal performance, as tool operation often generates significant heat and vibration. Secondly, the rapidly expanding Energy Storage System (ESS) market, particularly for small-to-medium commercial and residential backup power, represents a massive customer base, drawn to the LFP 26650 packs for their long calendar life and superior safety characteristics compared to high-nickel chemistries used in mobility applications.

Specialized industries form another critical customer group. This includes defense and military contractors who utilize 26650 packs in secure communication equipment, night vision gear, and specialized portable sensing devices where failure is not an option and packs must withstand extreme environmental conditions. The medical device industry, relying on these packs for reliable power in portable X-ray machines, emergency ventilators, and surgical robots, also constitutes a high-value customer segment demanding stringent certification and validation standards. Furthermore, the growth of e-mobility in non-road applications, such as specialized utility vehicles, low-speed golf carts, and material handling equipment like forklifts and industrial sweepers, is increasing the demand for reliable, customized 26650 power solutions.

In the realm of emerging technology, manufacturers of advanced industrial robotics and Automated Guided Vehicles (AGVs) are significant potential buyers. These autonomous systems require robust, rapidly rechargeable power packs capable of executing complex duty cycles without degradation. Customers in this space look for sophisticated BMS integration and mechanical packaging designed to resist constant shock and vibration inherent in factory automation environments. The purchasing decision for all these end-users is heavily influenced not only by the cost per Watt-hour but critically by the manufacturer's ability to provide comprehensive warranty support, guaranteed cycle life, and compliance with specific regional and international safety standards (e.g., UL, IEC certifications).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 950 million |

| Market Forecast in 2033 | USD 3,100 million |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Samsung SDI, LG Energy Solution, Contemporary Amperex Technology Co. Limited (CATL), Panasonic Corporation, Sony (Murata Manufacturing Co.), EVE Energy Co., Ltd., Shenzhen Keba Technology Co., Ltd., Lishen Battery, BAK Battery, BYD Company Ltd., A123 Systems LLC, VARTA AG, Envision AESC, Boston-Power, Inc., DLG Group, Great Power, FDK Corporation, Hitachi Ltd. (Hitachi High-Tech), Amperex Technology Limited (ATL), Molicel |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

26650 Battery Pack Market Key Technology Landscape

The technological landscape of the 26650 Battery Pack Market is characterized by continuous refinements aimed at maximizing performance, safety, and longevity within the established cell format. A central technological focus involves enhancing the energy density of the standard 26650 cell without compromising the superior thermal stability inherent to its size, achieved through advancements in cathode and anode materials. Specifically, manufacturers are employing nano-structured LiFePO4 (LFP) materials and silicon-carbon composite anodes to boost specific energy while maintaining low internal resistance, which is vital for high-power output applications like electric tools. These material science advancements are crucial for the 26650 format to remain competitive against higher-density cells, ensuring it continues to meet the power demands of modern industrial equipment requiring both high capacity and high discharge rates.

Crucially, the integration of advanced Battery Management Systems (BMS) defines the modern 26650 pack technology. Contemporary BMS units are no longer simple protective circuits; they incorporate sophisticated microprocessors capable of precise cell balancing, state-of-charge (SoC) and state-of-health (SoH) monitoring, and active thermal control. The use of CAN bus or similar communication protocols allows these packs to interface seamlessly with industrial control systems and charging infrastructure, enabling predictive diagnostics and remote monitoring. Furthermore, advanced packaging techniques, including laser welding of interconnections and the use of specialized potting compounds, are employed to enhance the mechanical ruggedness and vibration resistance of the packs, ensuring reliable performance in harsh environments prevalent in military and heavy industrial applications.

Thermal management technology represents another critical area of innovation. Given the high current demands of many 26650 applications, effective heat dissipation is essential to prevent performance degradation and ensure safety. Manufacturers are implementing passive cooling solutions, such as phase change materials (PCMs) and optimized heat sinks integrated directly into the pack structure, to draw heat away from the cells. For high-power density applications, some specialized 26650 packs are now incorporating lightweight, compact active cooling loops, similar to those seen in electric vehicle powertrains, to maintain ideal operating temperatures under continuous load. These technological advancements collectively ensure that the 26650 format remains a robust, safe, and highly efficient power source for its core industrial and specialized market segments.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global 26650 Battery Pack Market, primarily due to the concentration of major cell and pack manufacturers, particularly in China, South Korea, and Japan. This region benefits from established supply chain infrastructure, massive manufacturing economies of scale, and supportive government policies focused on battery energy storage system (ESS) deployment and industrial automation. China, in particular, drives demand through its extensive manufacturing base for power tools and rapid expansion of grid-scale energy storage utilizing LFP chemistry, making it the central hub for production and consumption. The rapidly growing industrial sectors in India and Southeast Asia are also contributing significantly to regional consumption as they modernize their infrastructure and adopt high-performance portable equipment.

- North America: North America represents a high-value, rapidly growing market for 26650 packs, characterized by demand for high-specification products in defense, specialized medical devices, and sophisticated industrial equipment. The emphasis here is less on sheer volume and more on quality, reliability, and domestic compliance with stringent safety standards (e.g., UL certifications). Significant governmental and private sector investment in grid modernization and backup power solutions, particularly in decentralized residential and commercial energy storage, is accelerating the adoption of the inherently safer 26650 LFP battery packs. The US market dictates technological trends toward intelligent BMS integration and long-term performance guarantees.

- Europe: The European market demonstrates steady, quality-focused growth, with a strong emphasis on sustainability and the circular economy. Demand is robust across industrial automation, professional power tools, and high-end niche applications. European regulations, such as the upcoming Battery Regulation, are pushing manufacturers toward optimizing for recyclability, ethical sourcing, and minimizing the carbon footprint of production. Countries like Germany and the Nordic nations show high per capita consumption driven by advanced manufacturing requirements and early adoption of commercial ESS and low-speed electric mobility solutions utilizing the 26650 format.

- Latin America (LATAM): The LATAM region is an emerging market for 26650 packs, driven primarily by increasing industrialization, infrastructure development, and growing demand for reliable off-grid and backup power solutions in areas with unstable electrical grids. Economic factors often prioritize cost-effectiveness, favoring the mature and lower-cost LFP chemistry prevalent in the 26650 format. Key markets include Brazil and Mexico, where manufacturing sectors and mining operations require robust, high-capacity portable power sources.

- Middle East and Africa (MEA): Growth in MEA is concentrated around large-scale industrial projects, telecommunications infrastructure, and resource extraction operations. The demand profile is heavily skewed toward robust battery packs capable of operating reliably under extreme high-temperature conditions, making thermal management technology a key purchasing factor. ESS adoption, particularly for solar energy projects and reliable backup power for critical assets, is the primary growth engine, leveraging the inherent durability and long cycle life of the 26650 LFP battery solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the 26650 Battery Pack Market.- Samsung SDI

- LG Energy Solution

- Contemporary Amperex Technology Co. Limited (CATL)

- Panasonic Corporation

- Sony (Murata Manufacturing Co.)

- EVE Energy Co., Ltd.

- Shenzhen Keba Technology Co., Ltd.

- Lishen Battery

- BAK Battery

- BYD Company Ltd.

- A123 Systems LLC

- VARTA AG

- Envision AESC

- Boston-Power, Inc.

- DLG Group

- Great Power

- FDK Corporation

- Hitachi Ltd. (Hitachi High-Tech)

- Amperex Technology Limited (ATL)

- Molicel

Frequently Asked Questions

Analyze common user questions about the 26650 Battery Pack market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of 26650 battery packs over other cylindrical formats?

The primary advantage of the 26650 format is its robust construction and high thermal stability, especially when utilizing Lithium Iron Phosphate (LFP) chemistry, making it exceptionally safe and suitable for high-power industrial tools, military applications, and stationary Energy Storage Systems (ESS) where safety and longevity are prioritized over maximum energy density.

Which applications are driving the highest growth in the 26650 Battery Pack Market?

The highest growth is driven by the Energy Storage Systems (ESS) segment, including residential and commercial backup power, due to the 26650 LFP cell's long cycle life and established safety record. Additionally, specialized high-drain industrial tools and robust robotics systems continue to fuel steady demand.

How is the 26650 market responding to competition from higher-density 21700 and 4680 cells?

The 26650 market maintains relevance by focusing on applications where thermal stability and high discharge current capabilities are paramount, often using LFP chemistry. Manufacturers differentiate by offering superior ruggedness, sophisticated integrated Battery Management Systems (BMS), and focusing on industrial longevity rather than solely maximizing volumetric energy density like the newer, larger formats.

What role does AI play in optimizing the performance of 26650 battery packs?

AI is integrated into advanced BMS to optimize charging and discharging cycles based on predictive analytics, extending the battery pack's lifespan and preventing thermal stress. AI also improves manufacturing yield by identifying and correcting defects in real-time during the cell assembly and pack integration processes, ensuring higher quality control.

What are the main regional consumption trends for 26650 battery packs?

Asia Pacific leads in both production and consumption, driven by massive industrial infrastructure and ESS deployment, particularly in China. North America and Europe focus on high-specification, reliable packs for defense and medical devices, with increasing adoption in decentralized renewable ESS driven by strong safety standards and modernization efforts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager