360Vue Multi-Camera Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433634 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

360Vue Multi-Camera Systems Market Size

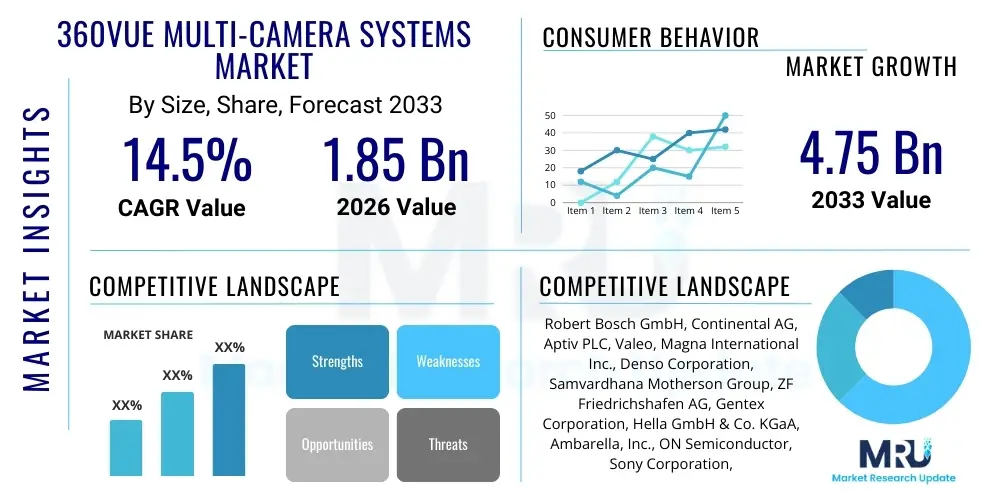

The 360Vue Multi-Camera Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at $1.85 Billion USD in 2026 and is projected to reach $4.75 Billion USD by the end of the forecast period in 2033.

360Vue Multi-Camera Systems Market introduction

The 360Vue Multi-Camera Systems Market encompasses sophisticated technologies designed to provide a comprehensive, bird's-eye view of a vehicle's or asset's immediate surroundings. These systems integrate four to six strategically placed cameras, advanced image stitching algorithms, and a central Electronic Control Unit (ECU) to create a seamless, synthesized 360-degree virtual perspective. Initially popularized in the high-end automotive sector as advanced parking assistance, these systems have rapidly transitioned into essential safety features, serving as critical components for Advanced Driver Assistance Systems (ADAS) and foundational technology for achieving higher levels of vehicle autonomy.

The primary function of 360Vue technology extends beyond simple parking aids; it significantly enhances situational awareness, mitigating blind spots (particularly crucial for large commercial vehicles), improving maneuvering capabilities in congested urban environments, and offering robust data streams for recording and security purposes. Key applications have broadened significantly to include commercial fleet management, off-road industrial machinery operations, robotics, and specialized surveillance sectors requiring perimeter monitoring. This market growth is fundamentally driven by stringent global safety regulations, consumer demand for sophisticated vehicle technology, and the continuous downward pressure on the cost of high-resolution image sensors and processing power.

Major driving factors influencing the market include the mandatory implementation of rearview and surround-view standards in major economies like North America and Europe. Furthermore, the seamless integration of 360Vue systems with other sensors, such as radar and LiDAR, facilitates complex sensor fusion capabilities essential for Level 2+ and Level 3 autonomous driving functionalities. The continuous development of higher resolution cameras (UHD/4K) and specialized software algorithms that enhance low-light performance and dynamic range are sustaining the technology's evolution and market adoption across diverse operational environments.

360Vue Multi-Camera Systems Market Executive Summary

The 360Vue Multi-Camera Systems Market is characterized by robust expansion, fueled predominantly by transformative advancements in automotive safety and the accelerating push toward vehicle automation. Business trends indicate a strong shift towards integrated sensor architectures, where the 360Vue system acts as the primary data input for perception algorithms. Tier 1 suppliers are focusing heavily on vertical integration, acquiring or partnering with software and AI specialists to offer complete, optimized packages rather than just hardware components. Key strategic developments include miniaturization of camera modules, enhanced cybersecurity features to protect sensitive video data streams, and the development of energy-efficient ECUs capable of managing multiple high-definition video inputs simultaneously, thereby appealing to the electric vehicle (EV) segment.

Regional trends reveal that Asia Pacific (APAC), particularly China, dominates both manufacturing capacity and adoption volume, driven by high automotive production rates and government support for intelligent vehicle infrastructure. North America and Europe remain pivotal markets, characterized by higher Average Selling Prices (ASPs) due to the demand for premium features, sophisticated regulatory compliance systems (Euro NCAP mandates), and early adoption in the high-end luxury and premium passenger vehicle segments. The adoption rate in the commercial vehicle sector across all regions is also rapidly accelerating, as fleet operators recognize the tangible benefits of reduced accident rates and lower insurance premiums derived from enhanced driver visibility.

Segment trends underscore the dominance of the automotive sector, specifically the Passenger Vehicle segment, which mandates high volumes. However, the Commercial Vehicle segment, driven by the complexity and size of Heavy Commercial Vehicles (HCVs) and construction equipment, is exhibiting the highest growth CAGR, necessitating highly ruggedized and reliable camera systems. Technology-wise, the migration from standard definition (SD) to High Definition (HD) and Ultra-High Definition (UHD) cameras is pervasive, directly supporting the high accuracy and detailed object recognition required by sophisticated AI-driven perception systems. The software and algorithm component segment is expected to outpace hardware growth, reflecting the increasing value placed on intellectual property related to image stitching, calibration, and machine learning inference capabilities.

AI Impact Analysis on 360Vue Multi-Camera Systems Market

User queries regarding the impact of Artificial Intelligence (AI) on 360Vue Multi-Camera Systems frequently center on critical performance metrics such as real-time object detection accuracy, system reliability in adverse weather conditions, and the potential for these systems to entirely replace human situational awareness in Level 4 (L4) autonomous vehicles. Common concerns revolve around the computational demands of running AI models on embedded systems, the robustness of sensor fusion algorithms when merging optical data with radar/LiDAR inputs, and the standardization required for safe mass deployment. Users and industry professionals are particularly interested in how AI enhances proactive hazard prediction—moving the system from merely displaying surrounding imagery to intelligently interpreting and flagging potential dangers long before they become immediate threats.

The introduction of deep learning models and neural networks has fundamentally transformed 360Vue systems, shifting their role from simple visualization tools to essential perceptual sensors for autonomous driving. AI enables highly accurate, real-time semantic segmentation of the captured imagery, allowing the system to distinguish between pedestrians, cyclists, road debris, and fixed infrastructure, even in complex, cluttered environments. This capability drastically improves ADAS functions like Automatic Emergency Braking (AEB) and Lane Keep Assist (LKA). Furthermore, AI-driven calibration and stitching algorithms overcome traditional geometrical distortion challenges inherent in wide-angle cameras, ensuring a more faithful and reliable digital representation of the vehicle's surroundings.

The strategic deployment of AI ensures the optimal fusion of data derived from the camera system with other vehicular sensors, mitigating the limitations of individual modalities. For example, AI can use optical data to provide rich texture and color information while simultaneously leveraging radar for precise distance and velocity measurements, resulting in a holistic and redundant perception layer. This advancement is crucial for safety redundancy in highly automated vehicles. Expectations are high for AI to further reduce false positives and negatives, improve robustness under changing light conditions (HDR processing), and ultimately drive down the total cost of ownership by making the systems more efficient and less dependent on complex, expensive processors through optimization techniques like model pruning and quantization.

- AI-enhanced Semantic Segmentation: Enables real-time, accurate classification of surrounding objects (vehicles, pedestrians, road signs).

- Improved Sensor Fusion: Uses machine learning to intelligently integrate camera data with inputs from radar and LiDAR for superior perception redundancy.

- Predictive Safety Algorithms: AI analyzes movement patterns to predict potential hazards and inform proactive intervention by ADAS or autonomous systems.

- Real-time Automated Calibration: Algorithms utilize AI to continuously adjust camera parameters, maintaining accurate stitching and perspective despite temperature changes or minor physical shifts.

- Reduced Computational Load: Optimized neural networks (e.g., using specialized NPUs) improve efficiency, enabling high-performance processing on automotive-grade embedded systems.

DRO & Impact Forces Of 360Vue Multi-Camera Systems Market

The dynamics of the 360Vue Multi-Camera Systems market are governed by a robust interplay of regulatory mandates, technological feasibility, and economic constraints. The primary drivers are rooted in global efforts to enhance vehicle safety, specifically the proliferation of ADAS features like parking assist, blind-spot monitoring, and increasingly, automated valet systems, all of which rely heavily on surround-view capabilities. Simultaneously, the restraints revolve largely around the complexity and cost associated with integrating and calibrating these multi-sensor setups, alongside the persistent technical challenges of ensuring reliable performance across highly variable operational environments (e.g., extreme temperatures, heavy precipitation, glare). Opportunities, conversely, are massive, driven by the impending transition to L4 and L5 autonomy across both passenger and commercial sectors, positioning 360Vue systems as indispensable vision components rather than mere convenience features.

Impact forces acting upon this market are predominantly structural and technological. Structural forces include stringent governmental safety regulations (e.g., NHTSA and UNECE mandates), which enforce the baseline requirements for driver visibility, compelling manufacturers to adopt these systems, thus transforming 360Vue from an optional extra to a standard feature across vehicle classes. Technological forces, such as the rapid development of high-resolution CMOS sensors, dedicated high-performance processors optimized for vision processing (VPUs), and sophisticated AI software, continuously drive performance improvements and cost reductions. These combined forces create an environment where the market is pushed by regulation and pulled by technological innovation, accelerating adoption faster than many component segments within the automotive industry.

Furthermore, consumer perception plays a substantial role. As drivers become accustomed to the enhanced safety and convenience provided by surround-view monitoring, the technology becomes a non-negotiable feature, putting pressure on mid-range and entry-level vehicle manufacturers to incorporate these systems competitively. The ability of these systems to record events (as a form of integrated dashcam) also provides significant value to fleet operators for liability and incident analysis. However, the market must continuously address hurdles related to data security and privacy, especially as the collected video data becomes more detailed and potentially linked to vehicle telematics, requiring robust encryption and compliance mechanisms to sustain consumer trust and regulatory acceptance.

Segmentation Analysis

The 360Vue Multi-Camera Systems Market is comprehensively segmented based on various technical and application parameters, reflecting the diverse requirements of end-user industries. The segmentation by component highlights the critical distinction between the hardware elements (cameras, ECU, display) and the high-value proprietary software and algorithms essential for stitching and object recognition. The segmentation by application clearly indicates the market's heavy reliance on the Automotive sector, which is further refined by vehicle type, acknowledging the specialized requirements (e.g., ruggedization, wider field of view) necessary for commercial vehicles compared to standard passenger cars. This detailed breakdown allows for precise market sizing and strategic targeting across high-growth niches.

The fundamental market structure is defined by the quality and complexity of the vision data. The technology segment distinguishes between systems based on resolution (SD, HD, UHD), directly correlating with the level of ADAS functionality supported—UHD systems are mandatory for L3 and L4 autonomy due to the precise detail required for perception algorithms. Geographically, the segmentation confirms the global nature of the supply chain and end-user adoption patterns, with APAC dominating volume due to manufacturing scale and adoption in new vehicle sales, while North America and Europe lead in the implementation of advanced, high-ASP autonomous features.

Understanding these segments is crucial for stakeholders. Component manufacturers must focus R&D on high-dynamic range sensors and efficient vision processing units, aligning with the shift towards UHD technology. Application providers need to tailor their software to specific vehicle types; for example, collision avoidance algorithms for construction equipment differ significantly from those used in small passenger cars. The convergence of these segments highlights a market prioritizing enhanced computational intelligence and sensor reliability over mere visual output.

- By Component:

- Cameras (Image Sensors, Lens Assemblies, Housings)

- ECU/Processor (Vision Processing Units, Microcontrollers)

- Display Modules (In-dash, Rearview Integration)

- Software/Algorithm (Image Stitching, Calibration, AI Perception Stack)

- Wiring Harness and Connectivity Modules

- By Application:

- Automotive

- Passenger Vehicles (P-segment)

- Commercial Vehicles (LCVs, HCVs)

- Surveillance and Security (Perimeter Monitoring)

- Industrial and Robotics (Autonomous Material Handling)

- Aerospace and Defense (Ground Support Equipment, Tactical Vehicles)

- Automotive

- By Technology:

- Standard Definition (SD)

- High Definition (HD)

- Ultra-High Definition (UHD/4K)

- By Vehicle Type (Automotive Segment Focus):

- Passenger Cars (Sedans, SUVs, Hatchbacks)

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs - Trucks, Buses)

Value Chain Analysis For 360Vue Multi-Camera Systems Market

The value chain for the 360Vue Multi-Camera Systems Market is characterized by highly specialized production stages, starting with raw material procurement and culminating in complex system integration at the OEM level. Upstream analysis involves key suppliers of fundamental components, specifically CMOS image sensor manufacturers (e.g., Sony, ON Semi), lens and optics providers, and semiconductor firms delivering the high-performance vision processing units (VPUs) and microcontrollers (MCUs) essential for real-time processing. This segment demands high capital expenditure in fabrication and adheres to stringent automotive quality standards (AEC-Q100). Expertise in optics and semiconductor design dictates competitiveness at this initial stage.

Midstream activities are dominated by Tier 1 suppliers (e.g., Continental, Bosch, Aptiv) who consolidate these components, manufacture the camera modules (including housing and waterproofing), develop proprietary image stitching and calibration software, and integrate the system into a cohesive package. These Tier 1 players hold the most significant value proposition, possessing the system integration expertise, validation capabilities, and direct OEM relationships required for large-scale production contracts. Their role is critical in ensuring the system meets functional safety standards (ISO 26262) and overall vehicle architecture compatibility.

Downstream analysis focuses on the distribution channels and end-users. Direct distribution channels primarily involve the dedicated supply agreements between Tier 1 suppliers and Original Equipment Manufacturers (OEMs), particularly in the automotive industry, where 360Vue systems are installed during vehicle assembly. Indirect channels involve the aftermarket—though smaller, this segment is growing, focusing on fleet upgrades, specialized commercial vehicles, and older passenger vehicles seeking enhanced safety features. Aftermarket distribution often relies on certified installers, specialized automotive electronics distributors, and retail chains. The ultimate end-user is increasingly demanding not just the system itself, but ongoing software updates and improvements, transferring emphasis to post-sale support and over-the-air (OTA) update capabilities.

360Vue Multi-Camera Systems Market Potential Customers

The potential customer base for 360Vue Multi-Camera Systems is broad, spanning several industries where enhanced situational awareness and collision avoidance are paramount, although the Automotive OEM segment represents the largest volume driver. These customers—global passenger vehicle manufacturers like Toyota, Volkswagen, and General Motors—are integrating these systems as standard or optional equipment across their entire model lineup to comply with safety regulations and meet consumer expectations for luxury and technology features. The purchasing decision for OEMs is heavily influenced by reliability, cost-effectiveness at scale, and the ability of the system to seamlessly integrate with their specific vehicle network architecture and ADAS stacks.

Beyond passenger cars, the commercial vehicle sector, encompassing fleet operators (logistics, public transport, waste management), represents a rapidly growing and high-value customer segment. For these buyers, the return on investment (ROI) is tangible, resulting from fewer accidents, lower insurance premiums, reduced downtime, and improved driver productivity, especially in complex maneuvering scenarios (docking, urban driving). They typically require systems that are highly durable, resistant to harsh environmental conditions, and scalable across a mixed fleet of vehicles ranging from delivery vans (LCVs) to heavy-duty articulated trucks (HCVs).

Other significant end-users include specialized entities such as construction and mining equipment manufacturers (e.g., Caterpillar, Komatsu), where blind spots pose extreme risks in confined sites; defense and specialized security contractors requiring perimeter surveillance for armored vehicles; and robotics and automation companies utilizing 360Vue systems for navigational awareness in autonomous industrial platforms. These niche customers prioritize robust integration with proprietary control systems and high customization capabilities, demanding specific fields of view, specialized housing, and military-grade encryption.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion USD |

| Market Forecast in 2033 | $4.75 Billion USD |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, Aptiv PLC, Valeo, Magna International Inc., Denso Corporation, Samvardhana Motherson Group, ZF Friedrichshafen AG, Gentex Corporation, Hella GmbH & Co. KGaA, Ambarella, Inc., ON Semiconductor, Sony Corporation, Veoneer Inc., Panasonic Corporation, KYOCERA Corporation, Autoliv Inc., Mobileye (Intel), Ficosa International S.A., NXP Semiconductors |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

360Vue Multi-Camera Systems Market Key Technology Landscape

The current technology landscape of the 360Vue Multi-Camera Systems market is dominated by advancements in high-resolution imaging, ultra-low latency processing, and sophisticated algorithmic integration. The core innovation lies in the transition from basic analog cameras to high-dynamic range (HDR) CMOS image sensors capable of capturing detailed images across vast illumination variations, essential for safe nighttime and tunnel driving. Furthermore, the adoption of automotive Ethernet (e.g., 100BASE-T1) is replacing older connectivity standards, providing the necessary bandwidth to transmit multiple streams of uncompressed HD or UHD video data simultaneously with minimal latency, which is non-negotiable for real-time decision-making in autonomous applications.

A second critical technological focus is on the Vision Processing Units (VPUs) and dedicated Application-Specific Integrated Circuits (ASICs) optimized for running deep neural networks. Companies like Ambarella, Mobileye, and NXP Semiconductors are developing chips that prioritize efficiency and speed, capable of executing complex image stitching, calibration, and object recognition algorithms within millisecond reaction times required by functional safety standards (ASIL B/C). This specialized hardware is key to maintaining system performance while adhering to strict thermal and power consumption constraints inherent in embedded vehicle systems, especially in the growing electric vehicle segment where energy efficiency is paramount.

Finally, the proliferation of advanced sensor fusion technology is shaping the long-term trajectory of 360Vue systems. Rather than operating as isolated components, these camera systems are now designed to feed calibrated, synchronized data directly into a central processing unit alongside radar and LiDAR data. This fusion significantly enhances the reliability of the overall perception stack, providing complementary information—cameras excel at identification and classification, while radar provides accurate velocity. Key innovations in this area include advanced software libraries that manage temporal alignment and geometric correlation between different sensor outputs, ensuring the synthesized 360-degree view is not just visually appealing but mathematically accurate for autonomous vehicle path planning.

Regional Highlights

Market adoption and growth rates for 360Vue Multi-Camera Systems exhibit distinct regional characteristics influenced by regulatory environments, manufacturing scales, and consumer wealth. The Asia Pacific (APAC) region is currently the largest and fastest-growing market, primarily driven by China's immense automotive manufacturing volume and its aggressive push for intelligent connected vehicles (ICV) through supportive national policies. South Korea and Japan also contribute significantly, focusing on incorporating high-end safety features and advanced parking systems into their domestic luxury and technologically advanced models. The high volume output in APAC provides scalability and drives down component costs, influencing global pricing trends.

North America holds a substantial share, characterized by high adoption rates in premium passenger vehicles and a mandatory safety standard environment (FMVSS 111, mandating rear visibility systems). The region is a pioneer in testing and deployment of Level 3 and Level 4 autonomous driving solutions, particularly within the commercial trucking and robo-taxi sectors, creating sustained demand for highly accurate, redundant 360Vue systems compliant with demanding operational design domains (ODD). Consumers in North America also show a strong willingness to pay for comprehensive ADAS packages, accelerating the uptake of surround-view technology across all vehicle segments, including large SUVs and pickup trucks.

Europe demonstrates high market maturity, driven by stringent safety rating requirements from organizations like Euro NCAP, which increasingly score vehicles based on the sophistication of their active safety features, including parking and maneuvering assistance. European manufacturers focus heavily on aesthetic integration, performance in diverse weather conditions, and maintaining privacy compliance (GDPR) related to onboard video data storage. While growth volume might be lower compared to APAC, the Average Selling Price (ASP) for systems sold in Europe remains high due to the preference for highly integrated, functionally reliable, and premium technology solutions, including integrated washing systems for cameras exposed to adverse road conditions.

- Asia Pacific (APAC): Dominates market volume due to high automotive production in China and government initiatives supporting Intelligent Connected Vehicles (ICVs). Focus on cost-effective, mass-market integration.

- North America: Strong demand driven by safety mandates and early large-scale investment in L3/L4 autonomous driving technologies, especially in commercial fleets. Focus on high-end features and robust sensor fusion integration.

- Europe: High adoption driven by stringent Euro NCAP ratings and emphasis on functional safety (ISO 26262). Market characterized by premium component quality and advanced integration across luxury vehicle segments.

- Latin America & MEA: Emerging markets with moderate growth, primarily driven by new vehicle safety regulations in countries like Brazil and high-end vehicle imports in the GCC countries. Adoption is often concentrated in fleet logistics and premium segments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the 360Vue Multi-Camera Systems Market.- Robert Bosch GmbH

- Continental AG

- Aptiv PLC

- Valeo

- Magna International Inc.

- Denso Corporation

- Samvardhana Motherson Group

- ZF Friedrichshafen AG

- Gentex Corporation

- Hella GmbH & Co. KGaA

- Ambarella, Inc.

- ON Semiconductor

- Sony Corporation

- Veoneer Inc.

- Panasonic Corporation

- KYOCERA Corporation

- Autoliv Inc.

- Mobileye (Intel)

- Ficosa International S.A.

- NXP Semiconductors

Frequently Asked Questions

Analyze common user questions about the 360Vue Multi-Camera Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the integration of 360Vue systems into mass-market vehicles?

The primary driver is the convergence of stringent global governmental safety mandates (like enhanced rear visibility requirements) and consumer demand for Advanced Driver Assistance Systems (ADAS). These mandates require effective solutions for eliminating blind spots and assisting low-speed maneuvering, making surround-view technology a standardized feature rather than a luxury add-on, thereby increasing mass-market penetration.

How does the quality of the 360Vue system affect autonomous driving capabilities?

The quality, particularly the resolution (UHD/4K) and High Dynamic Range (HDR) capability, directly impacts the precision of perception algorithms used in Level 3 and Level 4 autonomy. Higher quality systems provide richer, more reliable data necessary for accurate object identification, classification, and precise localization required for the vehicle’s path planning and functional safety in complex scenarios.

Which component segment is expected to show the highest growth rate within the 360Vue Multi-Camera Systems Market?

The Software and Algorithm segment, encompassing image stitching, calibration software, and proprietary AI perception stacks, is projected to exhibit the highest growth rate. While hardware production scales, the intellectual property associated with processing, sensor fusion, and optimizing performance across diverse conditions represents the highest value addition and R&D investment for Tier 1 suppliers.

What are the main technical challenges facing the widespread deployment of 360Vue technology?

Key challenges include maintaining precise camera calibration over the lifetime of the vehicle despite environmental stresses (temperature variation, vibration), ensuring the robustness of image stitching algorithms to avoid visual distortions, and managing the significant computational requirements of processing multiple high-resolution video streams in real-time on power-efficient, embedded automotive hardware.

Is the 360Vue market primarily focused on automotive applications, or are other industries significant consumers?

While the automotive sector (passenger and commercial vehicles) constitutes the largest application segment by volume, non-automotive sectors—such as industrial machinery, specialized robotics, and government/defense surveillance—are increasingly significant customers. These sectors demand highly ruggedized, specialized versions of the technology optimized for harsh operating environments and continuous perimeter awareness.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager