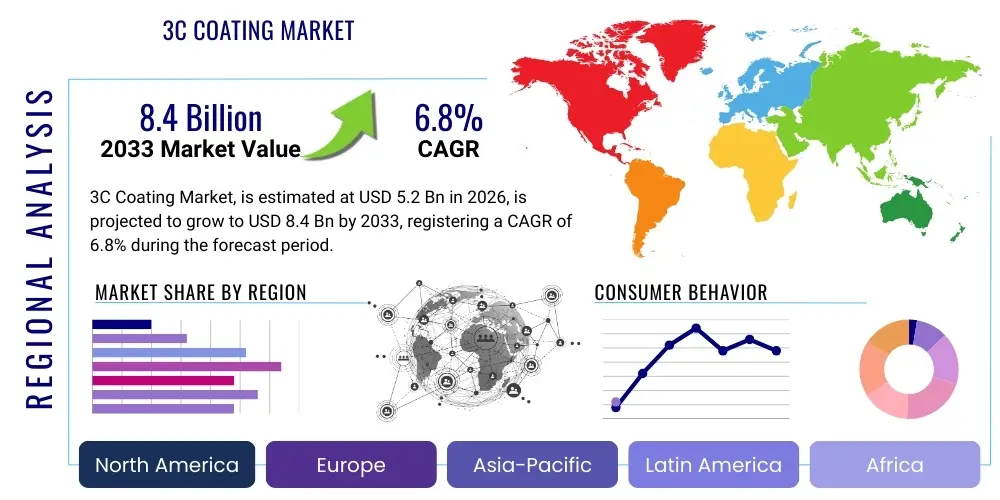

3C Coating Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437501 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

3C Coating Market Size

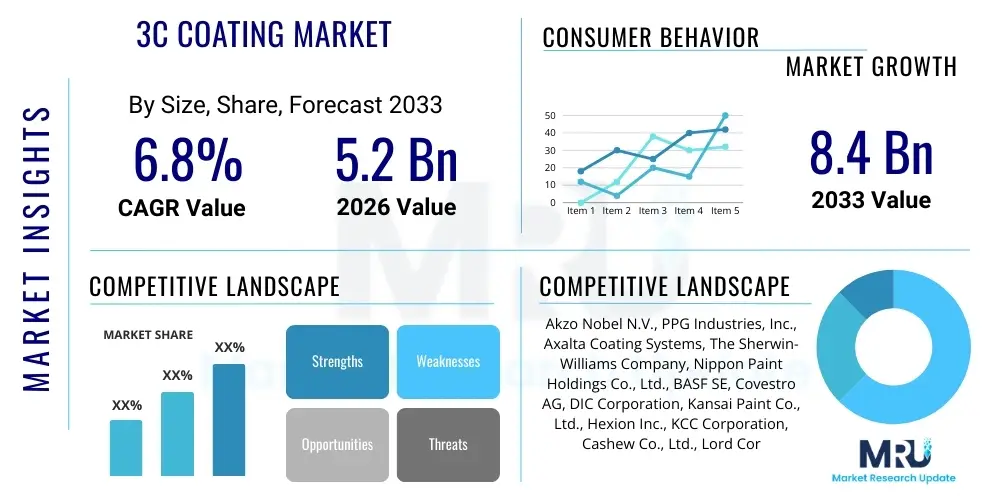

The 3C Coating Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 8.4 Billion by the end of the forecast period in 2033.

3C Coating Market introduction

The 3C coating market encompasses specialized surface treatments applied primarily to products within the communication, computer, and consumer electronics sectors. These high-performance coatings are crucial for enhancing the aesthetic appeal, durability, and functionality of devices such as smartphones, laptops, tablets, and wearables. Products range from specialized metallic finishes and soft-touch coatings to functional layers that provide crucial protection against external factors, including scratches, abrasion, UV radiation, and chemical exposure. The evolution of device design towards sleeker, more durable, and environmentally conscious materials is directly driving demand for advanced 3C coating formulations.

The primary function of 3C coatings extends beyond mere decoration; they play a vital role in device longevity and user experience. Functional coatings, such as anti-fingerprint (AF) coatings and anti-glare (AG) coatings, improve screen clarity and tactile feel, which are critical performance indicators for modern electronic devices. Furthermore, electromagnetic interference (EMI) shielding coatings are increasingly utilized, particularly in densely packed modern electronics, to ensure operational integrity and regulatory compliance. The shift towards miniaturization and increasing complexity in printed circuit boards (PCBs) and internal components necessitates highly specialized conformal coatings to protect against moisture and vibration.

Major applications of these coatings are predominantly found in the external casings (housings), displays, and internal components of electronics. The market is characterized by stringent quality requirements due to the high-value nature of the underlying devices and rapid technological cycles. Key benefits driving market expansion include enhanced device aesthetics, improved tactile properties, superior scratch and abrasion resistance, and the ability to incorporate sustainable or biocompatible materials. The major driving factor currently shaping the market trajectory is the relentless global proliferation of smart devices and the consumer demand for premium, long-lasting electronic finishes.

3C Coating Market Executive Summary

The 3C coating market is experiencing robust growth fueled by continuous innovation in consumer electronics design and escalating demand for durable, aesthetically pleasing finishes. Business trends indicate a significant shift away from traditional solvent-based systems toward environmentally sustainable alternatives, primarily UV-cured and waterborne coatings, driven by strict environmental regulations and corporate sustainability mandates across major technology original equipment manufacturers (OEMs). Furthermore, the integration of advanced functionalities, such as self-healing properties and superior haptic feedback coatings, is positioning specialized high-margin products as key differentiators for coating suppliers, thereby transforming the competitive landscape toward value-added solutions.

Regional trends demonstrate that Asia Pacific (APAC) maintains its dominance in both consumption and manufacturing, driven by the concentration of global electronic assembly and manufacturing hubs in countries like China, South Korea, Taiwan, and Vietnam. While APAC provides the primary manufacturing volume, North America and Europe lead in research and development, focusing on high-performance and specialty coatings tailored for premium product segments and stringent regulatory compliance standards, particularly concerning volatile organic compounds (VOCs). The rapid expansion of 5G infrastructure and associated smart device refresh cycles in emerging economies are further accelerating market penetration in these high-growth regions.

Segment trends highlight the burgeoning importance of UV-curable coatings due to their rapid curing speed, reduced VOC emissions, and excellent physical properties, making them ideal for high-throughput assembly lines. Application-wise, the smartphone and wearable segment remains the largest consumer, although the laptop and gaming device categories are exhibiting faster growth, propelled by increased remote work adoption and the booming gaming industry requiring specialized thermal management and decorative coatings. Technology segments focusing on soft-touch finishes and advanced anti-smudge capabilities are experiencing high demand as consumers prioritize comfortable and clean interaction surfaces, reflecting a market moving toward user-centric material innovation.

AI Impact Analysis on 3C Coating Market

User queries regarding the impact of Artificial Intelligence (AI) on the 3C coating market primarily revolve around three key areas: optimizing coating formulations, enhancing quality control and inspection processes, and predicting material performance and durability under various stress conditions. Users are particularly interested in how AI can accelerate R&D cycles, moving away from lengthy traditional trial-and-error methods to data-driven predictive modeling for new coating chemistries, especially those incorporating nanotechnology or complex multi-layer structures. There is also significant concern regarding the integration of AI-powered machine vision systems into high-speed manufacturing lines to detect microscopic defects that human inspection systems often miss, ensuring zero-defect output essential for premium electronics.

The core expectation is that AI will introduce unprecedented efficiency and precision into the 3C coating value chain. By analyzing vast datasets related to raw material properties, application parameters (temperature, humidity, flow rate), and final product performance metrics, AI algorithms can suggest optimal parameters for specific device requirements, reducing waste and material consumption. Furthermore, the implementation of predictive maintenance facilitated by AI allows manufacturers to anticipate equipment failures in coating lines, minimizing costly downtime and ensuring consistent quality output throughout production batches. This shift from reactive to predictive quality management is vital for meeting the high-volume, just-in-time manufacturing demands of the 3C sector.

Overall, AI is anticipated not only to optimize the manufacturing process but also to influence the types of coatings developed. For instance, AI can model the interaction between complex coating matrices and new substrate materials (like foldable screen polymers or lightweight metal alloys), leading to the faster commercialization of specialized coatings required for next-generation devices. Users expect AI tools to become standard in formulation labs, offering simulation capabilities that allow chemists to virtually test thousands of variations before physical synthesis, ensuring that innovations in anti-scratch, thermal dissipation, and haptic feedback coatings are market-ready quicker and possess superior reliability.

- AI-driven optimization of coating formulation parameters to reduce material waste and accelerate R&D timelines.

- Implementation of AI machine vision systems for real-time, high-precision defect detection on coating surfaces.

- Predictive modeling of coating performance and longevity under simulated environmental and usage stress.

- Enhanced automation of robotic coating application systems using AI for adaptive path planning and uniform thickness control.

- Utilization of AI in supply chain management for predicting raw material demand volatility and optimizing inventory specific to specialty coating ingredients.

DRO & Impact Forces Of 3C Coating Market

The dynamics of the 3C Coating Market are profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively shaping the impact forces. Key drivers include the exponential increase in global smartphone and wearable penetration, the cyclical demand for aesthetically advanced and functionally enhanced electronic casings, and the continuous innovation in display technologies requiring specialized protective films and coatings. Furthermore, stringent environmental regulations regarding VOC emissions in industrialized regions are actively driving manufacturers toward investing heavily in eco-friendly alternatives such as UV-cured and waterborne systems, inadvertently creating a technological advancement cycle that reinforces market growth. These drivers collectively exert a significant positive impact force on market valuation and technical complexity.

Conversely, the market faces notable restraints that moderate growth. The primary restraint is the inherent volatility in raw material pricing, particularly petroleum-derived resins and specialty solvents, which subjects manufacturers to fluctuating operational costs and pressure on profit margins. Secondly, the rapid obsolescence cycle inherent in the 3C electronics sector requires constant, rapid reformulation and re-qualification of coatings, posing technical challenges and increasing R&D expenditure. Intense price competition, particularly among commodity coating segments in high-volume manufacturing regions, also acts as a dampening force on overall profitability, pushing vendors toward specialization.

Opportunities for expansion lie primarily in the emerging applications of advanced functional coatings, such as coatings optimized for flexible displays, enhanced thermal management coatings for high-power computing devices, and bio-compatible coatings for medical and fitness wearables. The growing market for refurbished and customized electronics also presents a niche opportunity for specialized repair and re-coating solutions. The dominant impact force moving forward is the convergence of sustainability mandates and performance enhancement requirements; companies that successfully develop high-performance, low-VOC coatings that address both aesthetic and functional demands (e.g., integrated conductivity or anti-microbial properties) will capture significant market share and exert strong competitive pressure on legacy providers.

Segmentation Analysis

The 3C coating market segmentation provides a detailed structural breakdown based on material composition, application technology, functional characteristics, and end-use application areas. This multi-faceted analysis is crucial for understanding specific market dynamics, pinpointing high-growth segments, and tailoring strategic marketing efforts. The segmentation reflects the diverse needs of electronic manufacturers, ranging from high-gloss decorative requirements for exterior casings to critical protection needs for internal circuit boards. The largest segment by type generally includes specialized high-performance resins optimized for UV curing, while the most significant application segment remains the external housing of mobile communication devices due to sheer volume.

- By Type: Waterborne Coatings, Solvent-based Coatings, Powder Coatings, UV-cured Coatings.

- By Application: Communication Equipment (Smartphones, Tablets), Computer Equipment (Laptops, Desktops, Peripherals), Consumer Electronics (Wearables, Gaming Consoles, Audio Devices).

- By Technology: Soft-touch Coatings, Anti-fingerprint Coatings (AF), Anti-glare Coatings (AG), Electromagnetic Interference (EMI) Shielding Coatings, Thermal Management Coatings.

- By Region: North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA).

Value Chain Analysis For 3C Coating Market

The value chain for the 3C Coating Market begins with upstream analysis, which involves the procurement and processing of fundamental raw materials. This segment includes suppliers of key chemical components such as resins (epoxy, acrylic, polyurethane), pigments, solvents, and specialized additives (e.g., flow modifiers, curing agents, UV absorbers, and nanotechnology particles for functional attributes). The quality and consistency of these upstream components are critical, as they directly dictate the performance characteristics and cost structure of the final coating product. Suppliers operating in this highly specialized segment often require extensive chemical manufacturing expertise and robust quality assurance protocols to meet the stringent demands of the electronics sector, where failure tolerances are extremely low.

The midstream section of the value chain is dominated by coating manufacturers and formulators. These entities transform raw chemicals into finished coating systems, often tailoring formulations to specific Original Equipment Manufacturer (OEM) specifications related to substrate adhesion, layer thickness, environmental resistance, and specific functional properties like haptic feedback or thermal conductivity. Distribution channels play a vital intermediate role. Direct channels involve large-scale supply agreements between major coating manufacturers and Tier 1 electronics assembly plants, often involving technical support and on-site application guidance. Indirect channels utilize specialized distributors and technical sales agents who serve smaller manufacturers, aftermarket service providers, and niche electronic component suppliers, offering localized logistics and immediate inventory availability.

The downstream analysis focuses on the end-use application and consumption. This involves the 3C device manufacturers—the assemblers of communication, computer, and consumer electronics—who apply the coatings during the final stages of production using techniques like spray coating, dipping, vacuum deposition, and electrophoretic deposition. After application, the coating performance affects the final consumer experience and device durability. The consumer electronics market demands continuous innovation, feeding back requirements for new coating functionalities (e.g., ultra-thin, highly flexible coatings for foldable screens). The efficiency of the distribution network, particularly the technical support provided, is paramount for ensuring seamless integration into high-volume, automated manufacturing lines globally.

3C Coating Market Potential Customers

Potential customers and primary end-users of 3C coatings are highly centralized within the global technology manufacturing ecosystem, revolving around the assembly and production of electronic devices. The most significant customer segment comprises Tier 1 Original Equipment Manufacturers (OEMs) specializing in mobile communication devices, notably major smartphone, tablet, and wearable producers. These buyers demand extremely high volumes, stringent quality standards, and often require bespoke coating formulations for proprietary designs and color schemes. Their purchasing decisions are heavily influenced by adherence to global environmental safety standards (e.g., RoHS, REACH) and the ability of the coating supplier to support global supply chains consistently.

A secondary, yet rapidly growing, customer base includes manufacturers of computer equipment, such as laptops, gaming PCs, and peripheral devices (keyboards, mice, monitors). This segment places a premium on coatings that offer enhanced durability, thermal stability, and specific aesthetic characteristics like matte or tactile soft-touch finishes. For internal components, especially PCBs and highly sensitive electronic components, the buyers are focused on specialized conformal coatings that offer protection against dust, humidity, and chemical ingress, often driven by industrial and enterprise computing standards rather than pure consumer aesthetics.

The third major segment consists of manufacturers in the broader consumer electronics space, including smart home devices, high-end audio equipment, fitness trackers, and automotive electronics suppliers. These buyers leverage 3C coatings for product differentiation, employing specialized metallic or holographic effects for premium finishes, alongside functional coatings for moisture resistance (e.g., in outdoor or sports wearables). Furthermore, the aftermarket repair and refurbishment industry represents a sustainable growth area, requiring smaller batches of specialized coatings for restoring the original appearance and functionality of used electronic devices.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 8.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Akzo Nobel N.V., PPG Industries, Inc., Axalta Coating Systems, The Sherwin-Williams Company, Nippon Paint Holdings Co., Ltd., BASF SE, Covestro AG, DIC Corporation, Kansai Paint Co., Ltd., Hexion Inc., KCC Corporation, Cashew Co., Ltd., Lord Corporation (Parker Hannifin), Wacker Chemie AG, Dymax Corporation, Specialty Coatings Systems (SCS), Henkel AG & Co. KGaA, The Dow Chemical Company, RPM International Inc., Sika AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

3C Coating Market Key Technology Landscape

The technological landscape of the 3C Coating Market is dominated by advances in UV-curing technology and the development of high-solids, low-VOC formulations. UV-curing systems are rapidly gaining prominence due to their environmental advantages—drastically reduced solvent emissions—and significant operational benefits, including near-instantaneous curing speeds at lower temperatures. This efficiency is critical for the high-speed, high-volume production lines characteristic of electronics manufacturing. Recent innovations focus on developing UV-LED curable resins, which offer greater energy efficiency and compatibility with heat-sensitive substrates, such as plastic enclosures and flexible display materials used in modern wearables and foldable devices. Furthermore, research is intensely focused on making these UV coatings scratch-resistant and highly resilient without compromising aesthetic clarity or feel.

Another crucial area of technological advancement involves functional nanocoatings, specifically leveraging nanotechnology to embed specialized performance characteristics. This includes the widespread adoption of fluoropolymer-based anti-fingerprint (AF) and anti-smudge coatings for displays and camera lenses, ensuring easy cleaning and maintaining visual quality. Furthermore, specialized thermal interface materials (TIMs) and thermal management coatings are increasingly vital, particularly in high-performance computing devices and powerful smartphones where heat dissipation is critical for component longevity and device safety. These thermal coatings, often utilizing ceramic or metallic fillers, help manage the high heat generated by advanced chipsets and fast charging capabilities, representing a complex material science challenge.

The market is also witnessing rapid development in electromagnetic interference (EMI) shielding coatings, necessitated by the increasing density of internal components and the proliferation of wireless connectivity standards (like 5G and Wi-Fi 6E). These coatings, frequently incorporating conductive fillers like silver or carbon nanotubes, are applied internally to prevent signal cross-talk and ensure device compliance with rigorous electromagnetic compatibility (EMC) standards. Concurrently, the rise of flexible electronics demands ultra-flexible and durable barrier coatings that can withstand repeated folding or bending cycles without cracking, signaling a shift toward polymer chemistry solutions that balance hardness with elastic deformation capabilities. Sustainability remains a core technological driver, pushing continuous innovation in robust waterborne polyurethane and acrylic systems that mimic the performance of traditional solvent-based counterparts.

Regional Highlights

- Asia Pacific (APAC) Market Dominance: The APAC region is unequivocally the largest and fastest-growing market for 3C coatings globally. This dominance stems from the region's position as the world's primary manufacturing and assembly hub for consumer electronics, including nearly all major global smartphone, laptop, and tablet production lines located in China, South Korea, Taiwan, and Vietnam. The sheer volume of electronics produced here dictates the massive demand for coatings, particularly high-throughput UV-cured systems and cost-effective solvent-based coatings (though the latter is diminishing). The intense competitive environment in APAC also drives rapid adoption of process improvements and highly customized coating solutions tailored to specific OEM specifications, forcing suppliers to innovate constantly in efficiency and performance. Regulatory changes in countries like China, aimed at reducing VOC emissions, are now rapidly accelerating the adoption of green coating technologies in the region, shifting the market dynamics away from reliance on older, highly solvent-based systems toward sustainable alternatives.

- North America Market Innovation and Premiumization: The North American market is characterized by high demand for premium, high-specification coatings, often serving as the initial testing ground for advanced functionalities. While manufacturing volumes are lower than in APAC, the region leads in the development and consumption of specialty coatings for flagship devices, sophisticated gaming consoles, high-end wearables, and medical electronics. Key drivers here include stringent environmental and safety regulations, fostering high demand for ultra-low VOC and bio-compatible coatings. North American OEMs emphasize aesthetic differentiation, driving demand for unique tactile finishes, advanced anti-glare properties for high-resolution displays, and sophisticated metal effect coatings, contributing significantly to the market value rather than volume.

- Europe Market Regulatory Compliance and Sustainability Focus: Europe represents a mature market segment heavily defined by rigorous environmental regulations, most notably REACH and various national directives concerning VOC limits. This regulatory pressure has established Europe as a leader in the adoption of waterborne, powder, and UV-curable coating technologies, often preceding global trends. The demand here is centered on coatings for high-quality, long-life products, with a strong focus on circular economy principles, necessitating coatings that are durable yet compatible with recycling processes. Key applications include specialized coatings for automotive-related electronics and industrial computing, where durability, thermal performance, and low environmental impact are non-negotiable requirements.

- Latin America Market Growth Potential: The Latin American 3C coating market is smaller but demonstrates promising growth potential, primarily driven by increasing consumer access to affordable smart devices and the expansion of local electronic assembly operations, particularly in Brazil and Mexico. The market is highly cost-sensitive, often favoring proven, robust coating technologies. However, as disposable incomes rise and local manufacturing capabilities mature, there is a gradual shift toward slightly higher-performance coatings, especially for mobile devices. Infrastructure development and growing regulatory alignment with international standards are anticipated to drive the demand for functional coatings, particularly those offering improved protection against environmental factors like humidity and dust.

- Middle East and Africa (MEA) Emerging Dynamics: The MEA market for 3C coatings is highly dependent on imports of finished electronic goods, but local assembly and manufacturing operations are slowly emerging, especially in the UAE, Saudi Arabia, and South Africa. Demand for coatings is driven by localized assembly needs and aftermarket services. Unique environmental conditions, particularly high heat and intense UV exposure, necessitate specialized coatings offering superior thermal stability and UV resistance, creating niche demand for high-performance protective layers. Market growth is closely tied to digital transformation initiatives and government investment in telecommunications and smart city infrastructure, leading to a steady, albeit moderate, increase in demand for coated electronic components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the 3C Coating Market.- Akzo Nobel N.V.

- PPG Industries, Inc.

- Axalta Coating Systems

- The Sherwin-Williams Company

- Nippon Paint Holdings Co., Ltd.

- BASF SE

- Covestro AG

- DIC Corporation

- Kansai Paint Co., Ltd.

- Hexion Inc.

- KCC Corporation

- Cashew Co., Ltd.

- Lord Corporation (Parker Hannifin)

- Wacker Chemie AG

- Dymax Corporation

- Specialty Coatings Systems (SCS)

- Henkel AG & Co. KGaA

- The Dow Chemical Company

- RPM International Inc.

- Sika AG

Frequently Asked Questions

Analyze common user questions about the 3C Coating market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary types of coatings utilized in the 3C electronics market?

The 3C market primarily uses four types of coatings: UV-cured coatings, known for their rapid curing and low VOC content; waterborne coatings, valued for their environmental sustainability; solvent-based coatings, which offer robust performance but face regulatory scrutiny; and powder coatings, mainly used for durable metal casings due to their thickness and finish quality. UV-cured systems are currently the fastest-growing segment due to high-speed production requirements.

How do environmental regulations, specifically regarding VOCs, impact the 3C coating industry?

Stringent environmental regulations, particularly in North America, Europe, and increasingly in APAC, mandate lower emissions of Volatile Organic Compounds (VOCs). This directly forces manufacturers to phase out traditional high-solvent systems and adopt eco-friendly alternatives like UV-cured, waterborne, and high-solids coatings. This regulatory push is a primary driver of technological innovation and market shift toward sustainable chemistry.

Which application segment holds the largest share in the 3C coating market?

The communication equipment segment, primarily smartphones and tablets, holds the largest market share by volume. This dominance is attributed to the extremely high global production volumes of mobile devices and the continuous consumer demand for aesthetic enhancement, durability, and specialized functional coatings (like anti-fingerprint and scratch resistance) on device casings and displays.

What are functional coatings, and why are they increasingly important in consumer electronics?

Functional coatings are specialized layers applied to impart specific performance characteristics beyond basic aesthetics and protection. Examples include anti-fingerprint (AF) coatings for displays, Electromagnetic Interference (EMI) shielding coatings for signal integrity, and thermal management coatings for heat dissipation. They are critical because modern devices require enhanced user interaction, greater internal component density, and improved durability to justify premium pricing.

What role does nanotechnology play in the advancement of 3C coating materials?

Nanotechnology is crucial for developing next-generation 3C coatings by incorporating nanomaterials (e.g., nano-silica, carbon nanotubes) to significantly enhance physical properties. This inclusion allows for the formulation of ultra-thin, highly flexible coatings for foldable screens, superior scratch resistance, and embedded functionalities such as advanced anti-microbial or self-healing capabilities, pushing the boundaries of material performance in small form factors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager