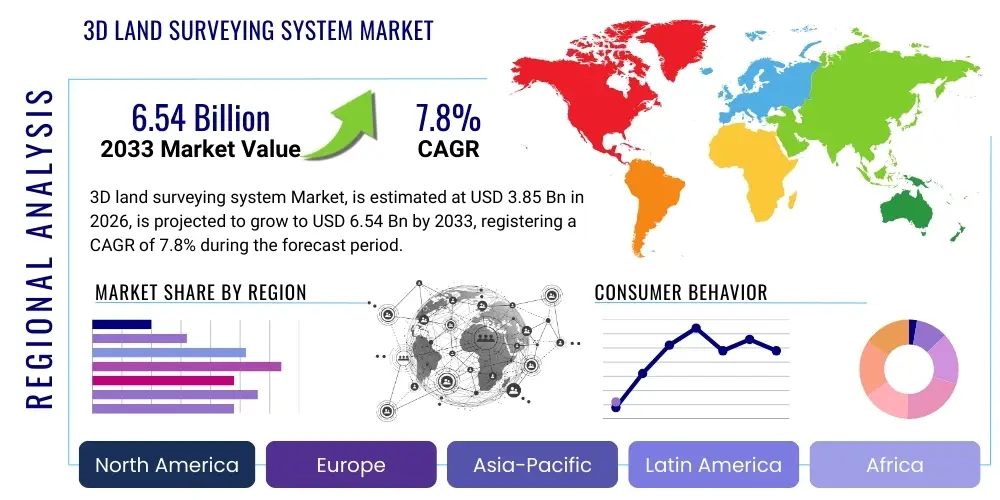

3D land surveying system Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436057 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

3D land surveying system Market Size

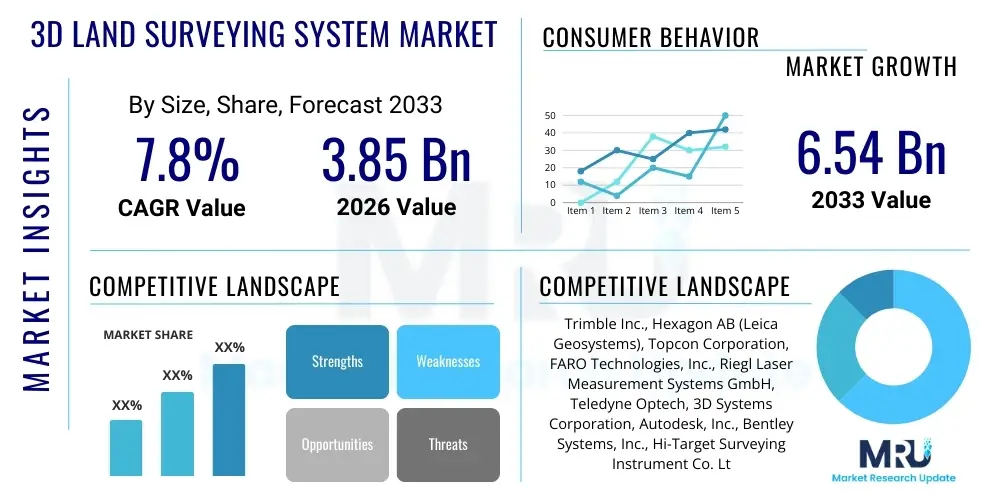

The 3D land surveying system Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 3.85 Billion in 2026 and is projected to reach USD 6.54 Billion by the end of the forecast period in 2033.

3D land surveying system Market introduction

The 3D land surveying system market encompasses advanced technologies used for accurately mapping and measuring geospatial data, creating highly detailed three-dimensional models of terrains, built environments, and infrastructure. These systems integrate various components, including high-precision instruments such as Total Stations, Global Navigation Satellite Systems (GNSS) receivers, Light Detection and Ranging (LiDAR) scanners, and photogrammetry solutions, all coupled with sophisticated software for data processing and visualization. The primary goal is to replace traditional, time-consuming 2D surveying methods with faster, more comprehensive, and highly accurate 3D data capture, which is critical for decision-making across multiple industries.

Major applications of 3D land surveying systems are prominently found in the Architecture, Engineering, and Construction (AEC) industry, infrastructure development (roads, railways, and utilities), mining operations, and archaeological mapping. These systems allow for precise volume calculations, deformation monitoring, clash detection in construction projects, and the creation of accurate digital twins for asset management. The enhanced precision minimizes rework, reduces project timelines, and significantly improves safety during complex mapping tasks, particularly in hazardous or difficult-to-reach areas, driving strong adoption globally.

Driving factors for this market include the global surge in infrastructure investment, the increasing demand for high-definition mapping data required for Smart City initiatives, and technological advancements such as the miniaturization of sensors and the integration of these systems onto unmanned aerial vehicles (UAVs or drones). Furthermore, regulatory mandates concerning detailed surveying and safety protocols in sectors like mining and construction further accelerate the integration of automated 3D data capture solutions, positioning the market for sustained, robust growth over the forecast period.

3D land surveying system Market Executive Summary

The 3D land surveying system market is experiencing significant transformation, driven by fundamental shifts toward digital integration and automation across major end-use sectors. Key business trends highlight a move from standalone hardware sales to bundled solutions that combine high-performance sensing equipment with cloud-based processing software and subscription services, enabling real-time data access and collaborative workflows. Regional trends indicate that the Asia Pacific (APAC) region is emerging as the fastest-growing market, primarily fueled by massive governmental expenditure on new infrastructure projects and rapid urbanization, particularly in China and India. North America and Europe, while mature, remain dominant in terms of technological adoption and software integration maturity, often pioneering the use of artificial intelligence and machine learning for automated feature extraction and quality control.

Segment trends demonstrate strong leadership by LiDAR technology, specifically terrestrial and airborne laser scanning, due to its unmatched ability to generate dense, accurate point cloud data regardless of ambient lighting conditions. However, the GNSS segment, while foundational, is seeing growth through the adoption of multi-frequency, high-precision receivers essential for real-time kinematic (RTK) and network RTK corrections, crucial for construction site control. Services, including data acquisition, processing, and consulting, are forecasted to exhibit the highest CAGR, reflecting the shift where end-users prefer outsourcing complex data handling to specialized geospatial firms rather than investing heavily in internal capacity and specialized personnel.

The competitive landscape is characterized by strategic mergers, acquisitions, and partnerships aimed at creating vertically integrated solutions, securing supply chains, and expanding geographic reach. Companies are focusing heavily on developing user-friendly software interfaces and improving data interoperability to cater to non-specialized users, thereby expanding the market's reach beyond traditional surveying firms. Overall, the market is positioned for high growth, underpinned by technological convergence, digital infrastructure demands, and the imperative for precision in industrial applications globally.

AI Impact Analysis on 3D land surveying system Market

Common user questions regarding AI’s influence on the 3D land surveying system market primarily revolve around the automation capabilities of data processing, the accuracy enhancement potential, and the long-term impact on the geospatial professional workforce. Users frequently ask how AI can automatically classify objects within massive point cloud datasets (e.g., distinguishing vehicles from buildings or vegetation) and how machine learning algorithms improve the efficiency of error detection and noise reduction, which traditionally require extensive manual effort. There is significant interest in predictive modeling—how AI can analyze historical deformation monitoring data to forecast structural failures or predict optimal site logistics in construction, transforming surveying from a purely descriptive function to a predictive tool.

The key themes emerging from this analysis confirm high expectations for AI to drastically reduce post-processing time, which often constitutes the largest bottleneck in 3D surveying workflows. Users anticipate tools that can intelligently manage sensor fusion, combining data seamlessly from disparate sources like LiDAR, photogrammetry, and thermal imaging, ensuring data consistency and maximizing output reliability. Concerns, however, persist regarding data privacy, the high initial investment required for sophisticated AI-integrated software licenses, and the necessity for current surveyors to acquire advanced data science skills to effectively operate and manage these intelligent systems.

Consequently, the market is witnessing the rapid deployment of AI-powered solutions that enhance feature recognition and classification, enabling surveyors to deliver project deliverables faster and with greater consistency. AI is becoming integral to automated quality assurance protocols, performing rapid checks on large datasets for completeness and accuracy, minimizing the risk of errors passing through the workflow. This transformative impact positions AI not merely as an add-on but as a core technological layer that elevates 3D surveying systems from data capture tools to holistic, intelligent geospatial information platforms.

- AI enables automated feature extraction and classification from dense point cloud data.

- Machine learning algorithms enhance data fusion capabilities across heterogeneous sensor inputs (LiDAR, photogrammetry, GNSS).

- Predictive analytics facilitated by AI allows for proactive infrastructure maintenance and deformation monitoring forecasting.

- AI significantly reduces post-processing time, improving workflow efficiency and reducing labor costs.

- Automated quality control (QC) checks leverage deep learning to identify data anomalies and ensure survey precision.

- AI supports the creation and maintenance of dynamic Digital Twins by intelligently updating 3D models with real-time sensor data.

DRO & Impact Forces Of 3D land surveying system Market

The dynamics of the 3D land surveying system market are dictated by a confluence of accelerating drivers, significant restraining factors, and attractive opportunities, collectively shaping the market's trajectory and intensity of competition. The primary drivers include massive global investment in infrastructure renewal and new construction, particularly within emerging economies, alongside the widespread adoption of Building Information Modeling (BIM) methodologies that mandate highly accurate 3D input data. Restraints predominantly center on the high capital expenditure required for sophisticated surveying equipment, such as high-definition laser scanners and integrated drone platforms, alongside a persistent shortage of skilled professionals proficient in handling, processing, and interpreting complex 3D geospatial data. Opportunities lie largely in the integration of Unmanned Aerial Vehicles (UAVs) to facilitate aerial data capture and the expansion into niche applications such as augmented reality-based field visualization and precise forestry management.

Impact forces analysis reveals that technological shifts exert the strongest influence. The continuous miniaturization and cost reduction of LiDAR sensors, coupled with advances in Simultaneous Localization and Mapping (SLAM) technology, are democratizing access to high-accuracy 3D surveying solutions, moving them beyond large enterprise users. Furthermore, regulatory forces, especially those concerning asset tracking, safety standards in mining, and mandated precision in public works projects, strongly reinforce the adoption curve. The threat of substitutes, while present in traditional methods, is mitigated by the increasing inability of 2D methods to meet modern data accuracy and volume requirements, pushing firms toward 3D solutions for compliance and efficiency.

Overall market forces favor high growth, driven by an imperative for efficiency and precision across industrial sectors. The initial high cost restraint is being systematically addressed through Subscription-as-a-Service (SaaS) models and Equipment-as-a-Service (EaaS) offerings, making advanced equipment more accessible to smaller surveying firms and contractors. The market's competitive structure is intensifying as software providers gain influence, shifting the competitive edge from hardware specifications alone to integrated software platforms capable of managing vast point cloud data and interoperating seamlessly with existing project management ecosystems like BIM and GIS platforms.

- Drivers: Global infrastructure development spending; Regulatory mandates for high-precision surveying; Increased adoption of BIM; Demand for Digital Twins.

- Restraints: High initial investment costs of advanced hardware; Shortage of specialized geospatial data professionals; Complex data processing requirements.

- Opportunities: Integration of 3D systems with UAV/Drone platforms; Expansion into monitoring and maintenance applications; Advancements in SLAM technology for mobile mapping.

- Impact Forces: Technological Advancements (High); Competitive Intensity (Medium to High); Threat of Substitutes (Low); Supplier Bargaining Power (Medium).

Segmentation Analysis

The 3D land surveying system market is broadly segmented based on Component, Technology, Application, and End-User, providing a detailed view of the varied needs and adoption patterns across the industry landscape. The Component segment distinguishes between hardware (scanners, receivers, total stations), software (processing, modeling, visualization), and services (data acquisition, maintenance, consulting), with services exhibiting rapid growth due to the trend of outsourcing complex data management tasks. Technology segmentation is crucial, differentiating between established methods like GNSS and Total Stations and the high-growth categories of Terrestrial Laser Scanning (TLS), Airborne Laser Scanning (ALS), and increasingly, Mobile Mapping Systems (MMS).

The Application segment focuses on the specific use cases driving demand, with construction and infrastructure development being the most dominant due to the necessity for site preparation, volume calculation, and as-built documentation. Other vital applications include oil and gas exploration, environmental mapping, and precise guidance systems in the agriculture sector. Analyzing end-users—such as engineering and construction firms (E&C), government agencies, mining companies, and dedicated surveying firms—provides insight into specific purchasing behaviors, scale requirements, and preferences for integration capabilities, often favoring ruggedized, high-throughput systems for field deployment.

The dynamic interplay between these segments highlights key market trends, such as the increasing demand for integrated solutions that combine high-accuracy GNSS with UAV-mounted photogrammetry or LiDAR for efficient data capture over large areas. This segmentation framework aids stakeholders in identifying high-potential market niches, understanding competitive landscapes specific to technology types, and formulating targeted strategies that address the evolving requirements of diverse end-user groups seeking precise, actionable geospatial intelligence.

- By Component:

- Hardware (Total Stations, GNSS Receivers, 3D Scanners/LiDAR)

- Software (Point Cloud Processing, CAD, GIS, Modeling)

- Services (Data Acquisition, Consulting, Support & Maintenance)

- By Technology:

- LiDAR (Terrestrial, Airborne, Mobile)

- Global Navigation Satellite System (GNSS)

- Total Stations (Robotic and Manual)

- Photogrammetry and Remote Sensing

- By Application:

- Construction and Infrastructure Development

- Mining and Aggregates

- Oil & Gas Exploration and Pipelines

- Environmental Monitoring and Forestry

- Archaeology and Cultural Heritage

- By End-User:

- Engineering and Construction Firms

- Surveying and Mapping Agencies

- Government and Public Sector

- Mining Companies

Value Chain Analysis For 3D land surveying system Market

The value chain for the 3D land surveying system market begins upstream with the suppliers of critical components. This includes manufacturers of high-precision sensors (laser diodes, inertial measurement units or IMUs), optical components, advanced processors, and specialized GNSS chipsets. These upstream activities are highly specialized and often involve stringent quality control, as component performance directly dictates the final system's accuracy and reliability. Key players in this stage often hold proprietary technology and patents, giving them significant bargaining power over system integrators and manufacturers.

Midstream activities involve the design, assembly, integration, and calibration of the complete 3D surveying systems. This stage is dominated by major global players who integrate purchased components with proprietary software and firmware to create market-ready products like robotic total stations, sophisticated LiDAR scanners, and integrated mobile mapping platforms. This manufacturing stage requires substantial R&D investment to ensure interoperability, ruggedness, and compliance with industry standards. Effective integration and efficient manufacturing processes are critical for competitive pricing and maintaining high margins.

Downstream distribution channels involve getting the final products and services to the end-users. This typically involves a mix of direct sales channels for large enterprise clients (like government defense or large E&C firms) and indirect distribution through certified resellers, local dealers, and value-added resellers (VARs) who provide local sales support, technical training, and calibration services. The growing services segment involves specialized geospatial service providers (GSPs) who use these tools to offer contract data acquisition and processing services. The efficiency and reach of the distribution network, particularly the quality of after-sales support and calibration services, are crucial determinants of market success and customer retention in this technology-intensive market.

3D land surveying system Market Potential Customers

The primary consumers and end-users of 3D land surveying systems are organizations requiring high accuracy, speed, and volumetric data for planning, execution, and maintenance of physical assets. Engineering and Construction (E&C) firms represent the largest segment, using 3D systems for site preparation, progress monitoring, verifying design adherence against as-built conditions, and minimizing costly clashes and rework. The adoption of digital workflows, particularly BIM, makes precise 3D data acquisition mandatory for nearly all large-scale projects, establishing E&C firms as key long-term potential customers.

Government agencies are another massive customer base, encompassing national mapping authorities, departments of transportation (DOTs), public works departments, and regulatory bodies. These entities utilize 3D systems for national mapping updates, infrastructure planning (roads, utilities, dams), land administration, and coastal erosion monitoring. Their procurement is often characterized by large tender volumes and long procurement cycles, prioritizing system reliability, security, and proven accuracy standards for public safety applications.

Furthermore, specialized industrial sectors such as mining, oil and gas, and utilities are crucial buyers. Mining companies rely on 3D systems for accurate stockpile volume calculations, blast planning, and slope stability monitoring, where safety and operational efficiency are paramount. Utility providers use these systems for mapping complex underground infrastructure and maintaining above-ground assets (power lines, telecom towers), utilizing mobile mapping and UAV solutions to reduce time and cost while ensuring high precision for regulatory compliance and predictive maintenance programs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.85 Billion |

| Market Forecast in 2033 | USD 6.54 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Trimble Inc., Hexagon AB (Leica Geosystems), Topcon Corporation, FARO Technologies, Inc., Riegl Laser Measurement Systems GmbH, Teledyne Optech, 3D Systems Corporation, Autodesk, Inc., Bentley Systems, Inc., Hi-Target Surveying Instrument Co. Ltd., senseFly SA, Phoenix LiDAR Systems, GeoSLAM Ltd., Z+F GmbH, Quantum Spatial (NV5 Geospatial), Velodyne LiDAR, Inc., CHC Navigation, Carlson Software, Inc., DJI, and Microdrones GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

3D land surveying system Market Key Technology Landscape

The current technology landscape in the 3D land surveying system market is rapidly evolving, driven primarily by sensor fusion and increased automation. LiDAR technology, encompassing both high-definition terrestrial laser scanners (TLS) and airborne laser scanners (ALS), remains central due to its speed in acquiring millions of highly accurate 3D points (point clouds). Recent innovations focus on reducing the size, weight, and cost of LiDAR sensors, enabling their widespread integration onto UAV platforms, which dramatically enhances accessibility and speed for large-area surveys and complex urban environments. The transition from pulsed time-of-flight systems to newer Frequency Modulated Continuous Wave (FMCW) LiDAR promises enhanced performance in challenging conditions and increased range resolution.

Simultaneously, the maturation of Simultaneous Localization and Mapping (SLAM) algorithms has revolutionized mobile mapping. SLAM allows 3D systems, whether handheld, backpack-mounted, or vehicle-mounted, to create accurate 3D models of large areas like interior spaces or complex industrial facilities while simultaneously tracking their own position without relying solely on GNSS signals. This capability is critical for mapping areas where GNSS is denied or obstructed, such as underground tunnels or dense urban canyons, significantly expanding the deployability and efficiency of high-density 3D capture systems across previously challenging environments.

Furthermore, the technology landscape is heavily influenced by software advancements. Cloud-based platforms for point cloud data management, processing, and collaborative sharing are becoming standard, addressing the challenge of handling massive datasets generated by 3D scanners. These software solutions increasingly incorporate AI and machine learning tools for automated feature recognition, classification, and data cleansing, which streamlines the process from raw data capture to final deliverable creation. Interoperability with core industry tools like BIM and GIS is paramount, driving the development of open standards and APIs to ensure seamless data exchange across the project lifecycle.

Regional Highlights

The global 3D land surveying system market exhibits varied growth dynamics across major geographical regions, influenced by infrastructure maturity, regulatory environments, and technological adoption rates.

- North America: North America remains a highly advanced and dominant market, characterized by rapid adoption of cutting-edge technologies like UAV-LiDAR integration, mobile mapping systems, and AI-driven data analytics. The region benefits from significant investments in large-scale energy infrastructure (pipelines, utility grids) and continuous modernization of civil infrastructure. Key adoption drivers include the maturity of BIM standards and the presence of leading technology vendors (e.g., Trimble, FARO).

- Europe: Europe represents a mature market with strong regulatory support for precision mapping and geospatial data standards, particularly driven by directives related to Digital Twins and smart city initiatives. Countries such as Germany, the UK, and France show high utilization rates, particularly in heritage preservation, highly accurate asset management, and complex brownfield development projects, often prioritizing integrated hardware-software ecosystems.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region during the forecast period due to large-scale government-led infrastructure investments, rapid urbanization, and industrial expansion in countries like China, India, and Southeast Asia. The demand here is primarily volume-driven, focusing on high-throughput, moderately priced systems for massive projects like rail networks, new city construction, and large mining operations.

- Latin America (LATAM): Growth in LATAM is driven by investments in mining, oil and gas, and infrastructure upgrades, particularly in Brazil and Mexico. The market is increasingly adopting 3D systems to improve operational safety and efficiency in resource extraction, though capital constraints often favor service models (EaaS) over outright equipment purchase.

- Middle East and Africa (MEA): The MEA region is characterized by substantial mega-projects (e.g., NEOM in Saudi Arabia, large construction projects in the UAE) which necessitate the deployment of the most advanced 3D surveying systems for speed and accuracy in project execution. High oil and gas sector activity also fuels demand for pipeline monitoring and precision mapping.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the 3D land surveying system Market.- Trimble Inc.

- Hexagon AB (Leica Geosystems)

- Topcon Corporation

- FARO Technologies, Inc.

- Riegl Laser Measurement Systems GmbH

- Teledyne Optech

- Z+F GmbH

- Hi-Target Surveying Instrument Co. Ltd.

- GeoSLAM Ltd.

- Phoenix LiDAR Systems

- Velodyne LiDAR, Inc.

- CHC Navigation

- Bentley Systems, Inc. (Software Provider)

- Autodesk, Inc. (Software Provider)

- DJI (UAV Platform Integrator)

- Carlson Software, Inc.

- Quantum Spatial (NV5 Geospatial)

- Microdrones GmbH

Frequently Asked Questions

Analyze common user questions about the 3D land surveying system market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of 3D land surveying systems over traditional methods?

The primary factor is the imperative for precision and efficiency in modern construction and infrastructure projects, particularly the mandatory requirement for accurate 3D data input necessitated by Building Information Modeling (BIM) workflows and the need for comprehensive digital twins.

How is LiDAR technology segmented within the 3D land surveying market?

LiDAR technology is segmented primarily into Terrestrial Laser Scanning (TLS) for detailed site scans, Airborne Laser Scanning (ALS) for broad regional mapping, and Mobile Mapping Systems (MMS) which integrate sensors onto moving platforms (vehicles, backpacks) for rapid corridor mapping.

What role does Artificial Intelligence (AI) play in processing 3D survey data?

AI significantly enhances data processing by enabling automated classification and feature extraction from massive point clouds, conducting quality control checks, reducing manual intervention, and facilitating predictive analytics for asset monitoring and maintenance.

Which geographical region is expected to show the fastest growth rate for 3D land surveying systems?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth, fueled by substantial government investments in new large-scale infrastructure projects, rapid urbanization, and increasing industrial demands across countries like China and India.

What are the key differences between 3D land surveying hardware and software components?

Hardware components include the physical sensors (LiDAR scanners, GNSS receivers, Total Stations) used for data capture, while software components are necessary for post-processing the raw data, visualization, modeling (e.g., CAD/GIS platforms), data management, and generating final deliverables.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager