3D Printed Dentures Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433754 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

3D Printed Dentures Market Size

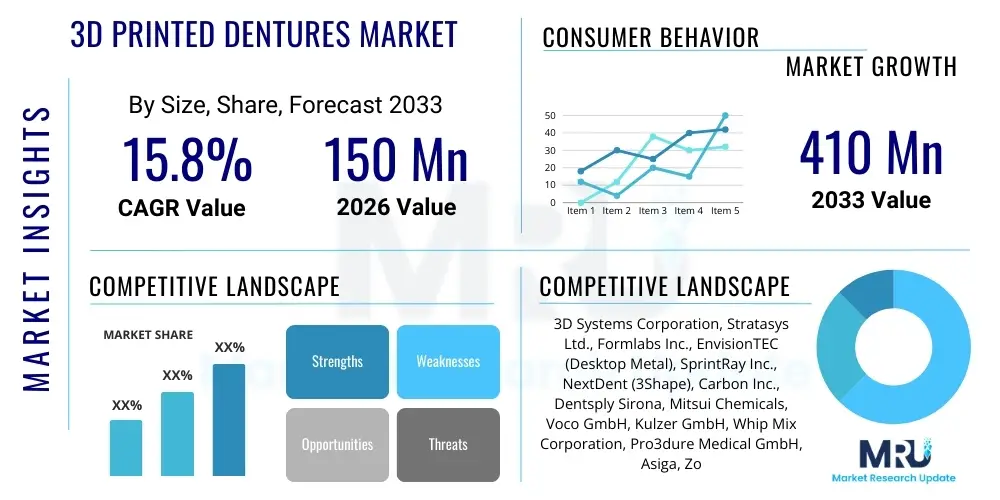

The 3D Printed Dentures Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 150 million in 2026 and is projected to reach USD 410 million by the end of the forecast period in 2033.

3D Printed Dentures Market introduction

The 3D Printed Dentures Market encompasses the production and utilization of dental prosthetic devices fabricated through additive manufacturing (AM) technologies, primarily stereolithography (SLA), Digital Light Processing (DLP), and Material Jetting. This transformative shift from conventional analog denture fabrication methods—which involve labor-intensive procedures like lost-wax casting and compression molding—is driven by the need for increased precision, efficiency, customization, and cost reduction within the dental laboratory workflow. 3D printing allows for the rapid iteration of prosthetic designs based on intraoral scans or conventional impressions converted into digital files, leading to superior fit, reduced chair time for patients, and optimized material usage. Key applications include complete dentures, partial dentures, try-in devices, and immediate dentures, utilizing specialized biocompatible resins and polymers approved for intraoral use, ensuring longevity and patient safety. The technology fundamentally changes the supply chain dynamics, enabling distributed manufacturing and quicker turnaround times for dental restorations globally.

The increasing prevalence of edentulism, particularly among the aging population worldwide, is the primary demographic driver sustaining the demand for dentures. Concurrently, technological advancements in 3D printing hardware, coupled with continuous refinement of dental-specific materials—such as high-strength, aesthetic, and FDA-cleared denture base and tooth resins—are fueling market adoption. These advanced materials provide durability and aesthetic qualities that closely match natural dentition, addressing key patient dissatisfaction points associated with older prosthetic technologies. Furthermore, the integration of Computer-Aided Design/Computer-Aided Manufacturing (CAD/CAM) workflows, where digital scanning and design software precisely map the patient’s oral anatomy, ensures optimal prosthetic fit and function, positioning 3D printed dentures as a superior solution in modern restorative dentistry. Educational initiatives aimed at dental professionals regarding the efficiency gains and clinical benefits of digital denture fabrication are also crucial for widespread market penetration.

Major driving factors include the escalating geriatric population base requiring prosthetics, the rising adoption of digital dentistry solutions across dental clinics and laboratories seeking automation, and the compelling evidence supporting the enhanced accuracy and reproducibility offered by additive manufacturing processes compared to traditional methods. The benefits of 3D printed dentures extend beyond manufacturing efficiency to improved patient experience, characterized by fewer adjustments, better retention, and overall comfort due to the personalized, highly accurate fit derived from digital design. These benefits collectively enhance clinical outcomes and practice profitability, solidifying the transition towards fully digital denture production. Challenges remain regarding the initial investment costs associated with 3D printers and specialized software, alongside the need for standardization of material properties and regulatory frameworks specifically tailored for additive manufactured medical devices, but the overarching trend strongly favors digital transformation.

3D Printed Dentures Market Executive Summary

The 3D Printed Dentures Market is undergoing rapid transformation, characterized by significant shifts in business models, accelerated technological integration, and intense competition among hardware, software, and material providers. Business trends indicate a movement towards vertically integrated solutions, where key players offer comprehensive ecosystems encompassing scanners, CAD software, printers, and proprietary materials, simplifying the adoption curve for dental labs. Partnerships between traditional dental material suppliers and additive manufacturing specialists are increasing, aiming to leverage existing distribution networks while providing validated digital workflows. Furthermore, the decentralization of manufacturing is becoming prominent, allowing smaller dental labs and even large dental clinics to bring production in-house, significantly disrupting the centralized lab model, resulting in faster production cycles and greater control over quality assurance. The market also observes an increasing focus on subscription models for software and material procurement, fostering predictable recurring revenue streams for vendors and reducing large upfront capital expenditure barriers for end-users, thereby accelerating market access and adoption across diverse clinical settings globally.

Regionally, North America and Europe currently dominate the market due to high healthcare expenditure, established digital infrastructure, early adoption of advanced dental technologies, and favorable reimbursement policies supporting sophisticated restorative procedures. The United States, in particular, showcases high market maturity driven by regulatory acceptance of printed dental materials and a high concentration of technologically adept dental professionals. However, the Asia Pacific (APAC) region is projected to register the highest growth rate during the forecast period. This accelerated growth is primarily attributed to rising dental tourism, increasing awareness of advanced dental care, substantial investments in healthcare infrastructure in emerging economies like China and India, and a vast, underserved population requiring prosthetic solutions. Government initiatives aimed at improving oral health and supporting local manufacturing capabilities further contribute to APAC's burgeoning status. Latin America and the Middle East and Africa (MEA) are also exhibiting moderate growth, driven by urbanization and improvements in dental access, albeit constrained by challenges related to regulatory clarity and the affordability of high-end printing systems in specific localized markets.

Segmentation analysis highlights that the Materials segment, specifically high-performance dental resins for denture bases and teeth, holds significant revenue potential, driven by continuous innovation focused on improved strength, biocompatibility, and long-term color stability. The Technology segment is dominated by DLP/SLA technologies due to their high resolution and cost-effectiveness suitable for intricate dental applications, though advancements in binder jetting are being explored for future large-scale production. By End-User, Dental Laboratories remain the largest consumers, rapidly integrating 3D printing to automate high-volume production, while Dental Clinics represent the fastest-growing segment, driven by the desire for chairside customization and immediate prosthetic solutions, enabled by compact, user-friendly desktop 3D printers. The Complete Dentures sub-segment maintains the largest market share owing to the high prevalence of complete edentulism, whereas partial dentures and temporary prosthetics segments are demonstrating robust incremental growth, reflecting the versatility of additive manufacturing in covering the entire spectrum of restorative needs.

AI Impact Analysis on 3D Printed Dentures Market

User questions regarding the impact of Artificial Intelligence (AI) on the 3D Printed Dentures Market center around themes of automated design validation, material optimization, and improved clinical predictability. Common inquiries focus on whether AI can entirely automate the design phase (CAD), specifically how algorithms can calculate optimal bite registration, occlusion, and fit based on patient-specific anatomical data derived from intraoral scans and CBCT imaging, thereby minimizing human error and required design expertise. Users are keenly interested in AI’s role in material science, asking if machine learning models can predict the long-term durability, fracture resistance, and wear characteristics of different 3D printing resins under various clinical loads, helping practitioners select the best material for each patient. Furthermore, there is significant anticipation concerning AI-driven quality control, utilizing image recognition to inspect printed dentures for structural defects, layer irregularities, or aesthetic inconsistencies immediately post-printing, assuring clinical quality standards are consistently met before prosthetics leave the lab environment.

The primary concern among dental professionals is the integration complexity and the potential disruption to established workflows. They question the learning curve associated with new AI-enabled design software and the reliability of fully automated clinical recommendations, demanding substantial validation data demonstrating that AI-designed dentures surpass those created through traditional human expertise. Dental laboratories are focused on return on investment (ROI), querying how AI integration affects throughput—specifically, if the time saved in design and quality control justifies the often high investment in specialized AI dental software licenses and computational resources required for advanced machine learning operations. Another critical area of user inquiry involves ethical and data privacy implications, specifically related to the secure handling and processing of vast quantities of sensitive patient oral anatomy data used to train and refine AI algorithms for prosthetic design and fabrication processes.

Expectations are high that AI will dramatically accelerate the entire digital denture workflow, making personalized prosthetics accessible and affordable on a global scale. Users anticipate that AI will facilitate true mass customization by rapidly generating hundreds of unique design variations tailored to specific functional and aesthetic requirements, far beyond the capability of human designers working manually. This includes optimizing the denture path of insertion, determining ideal flange extension for retention, and balancing occlusal forces with precision previously unattainable. The integration of AI tools is anticipated to lead to a significant reduction in required chairside adjustments and remakes, which are major cost and time drains in conventional denture fabrication. Ultimately, users expect AI to elevate the standard of care in edentulous patient treatment, leading to superior functional and psychological outcomes by guaranteeing a near-perfect fit and highly aesthetic result every time, further solidifying the necessity of 3D printing in modern restorative dentistry.

- AI algorithms automate complex prosthetic design, optimizing occlusion, fit, and retention parameters based on digital scan data.

- Machine learning models predict material performance and durability, ensuring optimal resin selection for long-term clinical success.

- AI enhances quality control by automatically detecting structural defects and aesthetic flaws in printed prosthetics post-fabrication.

- Predictive analytics driven by AI minimizes errors, reducing the need for chairside adjustments and expensive denture remakes.

- AI accelerates the overall digital workflow, significantly decreasing the turnaround time from patient impression to final prosthetic delivery.

DRO & Impact Forces Of 3D Printed Dentures Market

The market dynamics for 3D Printed Dentures are shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces that dictate strategic shifts and growth trajectories. Primary drivers include the global demographic shift towards an older population segment, which inherently requires increased prosthetic solutions due to higher rates of edentulism; the documented precision and accuracy advantages of digital workflows over traditional manufacturing, leading to clinically superior outcomes; and the continuous reduction in manufacturing costs and time achieved through additive manufacturing technologies, making high-quality dentures more economical. Restraints primarily revolve around the high initial capital investment required for industrial-grade 3D printers, specialized curing units, and advanced dental CAD software, posing barriers to entry for smaller dental laboratories. Furthermore, the limited availability of high-strength, long-term approved biocompatible materials for denture teeth, coupled with the necessity for specialized training for dental technicians and clinicians, temporarily impedes rapid, widespread adoption across less digitally mature markets. These factors necessitate targeted strategies focusing on financing options and standardized educational curricula to mitigate adoption resistance.

Significant opportunities exist in expanding the application scope of 3D printing beyond full arch dentures to include more complex partial frameworks, immediate loading temporary restorations, and aesthetic try-in models, broadening the revenue potential across diverse patient needs. The development of next-generation 3D printing materials, specifically those exhibiting antimicrobial properties and enhanced strength comparable to conventional acrylics, represents a massive market opening for material science companies. Geographic expansion into high-growth, underserved emerging markets, particularly in the Asia Pacific region where dental infrastructure is rapidly modernizing, offers substantial avenues for market penetration. Furthermore, fostering robust partnerships between hardware manufacturers, software providers, and major dental group practices can streamline the implementation of full digital denture workflows, creating integrated solutions that are easier for end-users to adopt, capitalizing on the increasing demand for customized and streamlined patient care protocols.

The primary impact force shaping the market is Technological Disruption, stemming from the continuous and rapid evolution of additive manufacturing techniques, making previous generations of equipment obsolete quickly and forcing constant reinvestment and adaptation within the dental supply chain. Regulatory Scrutiny constitutes another crucial impact force; as these devices are permanent implants/prosthetics, regulatory bodies (like FDA and CE) are continuously updating standards for 3D printed materials and manufacturing quality systems, requiring manufacturers to invest heavily in rigorous testing and clinical validation to ensure safety and efficacy. Economic Impact Forces include the growing pressure on healthcare systems globally to reduce costs, positioning 3D printing as a crucial tool for cost-effective, high-volume production, compelling laboratories to transition or risk losing competitive edge. Finally, shifts in Consumer Preference, driven by social media and patient education, lead to greater demand for customized, aesthetically superior, and faster-delivered dental solutions, pushing clinicians to embrace digital workflows to meet these modern patient expectations effectively.

Segmentation Analysis

The 3D Printed Dentures Market segmentation provides a granular view of revenue opportunities based on technology, material, end-user, and product type, reflecting the varied applications and adoption rates across the dental industry landscape. Analyzing these segments is critical for stakeholders to tailor product development and market entry strategies effectively. The market is primarily categorized by the specific additive manufacturing technique used, which dictates the precision and throughput capability; the proprietary resin or polymer utilized, which defines the clinical functionality and aesthetic result; the setting where the prosthetic is manufactured, encompassing both centralized laboratories and localized clinical settings; and the specific type of denture being produced, ranging from full arches to temporary devices. This comprehensive segmentation allows for the identification of high-potential growth pockets and the subsequent allocation of resources toward the most commercially viable sub-segments, ensuring market relevance and sustained competitive advantage in a rapidly evolving technological environment.

Technology segmentation remains a critical indicator of market maturity, with resin-based printing techniques like Digital Light Processing (DLP) and Stereolithography (SLA) commanding the largest share due to their superior resolution necessary for dental applications and their widespread adoption across labs globally. However, Material Jetting (MJ) and Fused Deposition Modeling (FDM) are emerging for specific niche applications like temporary or try-in devices, signifying diversification in manufacturing approaches. Material segmentation is heavily focused on biocompatible photopolymer resins, which must meet stringent regulatory standards for long-term oral contact. Innovation in this area centers on enhancing mechanical properties, such as flexural strength and surface hardness, to rival traditional materials, driving robust growth in the materials sub-segment as new, improved formulations are introduced to the market, often requiring specialized printing platforms.

End-User segmentation clearly differentiates between the large-scale production requirements of Dental Laboratories, which require high-throughput industrial printers, and the smaller, increasingly decentralized requirements of Dental Clinics and Hospitals, which prefer compact, user-friendly chairside systems for immediate patient care. While dental labs currently represent the bulk of the market volume, the clinic segment is projected to grow faster as dentists gain confidence in operating in-house 3D printing facilities to reduce external dependence and speed up treatment times. Product type segmentation distinguishes between Complete Dentures, which hold the dominant volume share, and Partial Dentures, which represent a faster growth opportunity due to increasing preventative dental care minimizing full tooth loss. This detailed breakdown ensures market players can accurately target their sales efforts and align their product portfolio with the prevailing clinical demand, maximizing overall commercial success and optimizing distribution channel effectiveness across various geographical jurisdictions.

- By Technology:

- Stereolithography (SLA)

- Digital Light Processing (DLP)

- Material Jetting (MJ)

- Fused Deposition Modeling (FDM)

- By Material:

- Resins and Polymers (Denture Base and Teeth)

- Biocompatible Materials

- Advanced Composites

- By Product Type:

- Complete Dentures

- Partial Dentures (Removable)

- Denture Try-in Models

- Immediate Dentures

- By End User:

- Dental Laboratories

- Dental Clinics and Hospitals

- Academic and Research Institutes

Value Chain Analysis For 3D Printed Dentures Market

The Value Chain for the 3D Printed Dentures Market starts with Upstream Analysis, which focuses primarily on raw material suppliers and technology development. This stage involves chemical companies providing specialized monomers and photopolymerizable components crucial for formulating high-performance, biocompatible dental resins. Key upstream players are responsible for the purity, color matching, and mechanical strength characteristics of the final printing material, which must meet stringent ISO and regulatory standards. Additionally, hardware manufacturers involved in the initial design and production of high-precision 3D printing systems (SLA, DLP components, laser systems, and optical components) are critical upstream contributors. Their innovations in print speed, resolution, and build platform size directly influence the efficiency and quality of the subsequent manufacturing steps. Establishing long-term, reliable supply agreements in this stage is vital due to the proprietary nature of many dental resins and the complexity of sourcing specialized optical components for professional-grade printers.

The mid-stream segment encompasses the core processes: digital design (CAD software providers), manufacturing (dental laboratories utilizing 3D printers), and post-processing (washing, curing, and finishing units). Downstream analysis focuses on the distribution channel and the ultimate delivery to the end-user. Distribution channels are generally categorized into direct sales and indirect sales. Direct distribution involves hardware and material manufacturers selling directly to large dental chains or industrial laboratories, providing immediate technical support and tailored solutions. Indirect distribution relies heavily on authorized dental distributors and dealers who manage sales, inventory, localized training, and after-sales service to numerous smaller labs and independent dental practices, particularly in regions where manufacturers lack a physical presence. The efficiency of the downstream logistics, including inventory management of materials with shelf-life limitations and timely delivery of complex equipment, significantly impacts market responsiveness and customer satisfaction.

The movement from centralized lab production (indirect to clinic) to decentralized chairside production (direct to clinic) is transforming the value chain structure. In the traditional indirect model, the prosthetic moves from the specialized lab (the buyer of the equipment) through a dental distributor or directly to the clinic (the user). In the increasingly popular direct model, the dental clinic purchases the entire system (printer, software, materials) and performs the manufacturing in-house, significantly shortening the value chain and capturing greater profit margins while reducing the overall turnaround time for the patient. Successful companies are implementing hybrid models, offering high-throughput industrial solutions for centralized production alongside compact, economical desktop solutions aimed at clinics, ensuring market coverage across all end-user sizes and operational models. This strategic duality maximizes market penetration and responds effectively to the shifting economic demands and workflow preferences of the dental industry.

3D Printed Dentures Market Potential Customers

The primary End-Users and buyers of 3D printed dentures and associated technology are broadly classified into Dental Laboratories, Dental Clinics, and specialized academic/research institutions, each possessing unique purchasing motivations and scale requirements. Dental Laboratories represent the largest volume consumers of both 3D printing hardware and bulk materials. Their purchasing decisions are highly focused on industrial efficiency: maximizing throughput, minimizing operational costs, and ensuring high reproducibility to handle massive volumes of orders from numerous dental practices. They invest in high-end, multi-unit 3D printing systems and robust post-processing lines, valuing technical specifications such as large build volumes, high print speeds, and automated monitoring systems to maintain continuous production flow. The transition to 3D printing allows them to mitigate labor shortages inherent in traditional manufacturing and offer competitive pricing and superior product quality to their clinical clients, driving their long-term viability in a highly competitive outsourcing market.

Dental Clinics and Hospitals are the fastest-growing segment of potential customers, particularly those adopting chairside or in-house digital dentistry solutions. Their motivation centers on immediate service delivery, enhanced patient experience, and greater control over the quality and timing of prosthetic delivery. While they typically require smaller, more affordable, and user-friendly desktop 3D printers and smaller volumes of material, their purchasing decisions are heavily influenced by the ease of integration with existing intraoral scanners and CAD software, as well as validated, simple workflows that minimize the learning curve for clinical staff. The capability to print immediate dentures, temporary prosthetics, and try-in devices rapidly during a single patient visit is a significant driver for this customer group, differentiating their service offerings and reducing reliance on external laboratory turnaround times, thereby maximizing clinical efficiency and patient satisfaction scores.

Academic and Research Institutes, though smaller in procurement volume, act as crucial early adopters and validation centers. These customers focus on exploring novel biocompatible materials, refining printing methodologies, and conducting clinical trials to validate the long-term performance and safety of 3D printed prosthetics. Their purchasing is driven by the need for cutting-edge technology and materials to support innovative research in areas such as tissue engineering, personalized orthodontics, and maxillofacial reconstruction, often requiring highly specialized, flexible 3D printing systems and comprehensive material analysis tools. Furthermore, their role in training the next generation of dental professionals ensures that 3D printing becomes an integrated part of standard dental education, indirectly influencing future adoption rates among the clinical and laboratory customer bases. Targeting these institutions with specialized research-grade equipment and academic pricing structures is essential for maintaining technological leadership and fostering future market expansion.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 150 million |

| Market Forecast in 2033 | USD 410 million |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3D Systems Corporation, Stratasys Ltd., Formlabs Inc., EnvisionTEC (Desktop Metal), SprintRay Inc., NextDent (3Shape), Carbon Inc., Dentsply Sirona, Mitsui Chemicals, Voco GmbH, Kulzer GmbH, Whip Mix Corporation, Pro3dure Medical GmbH, Asiga, Zortrax S.A., DMG America, Keystone Industries, GC Corporation, SHINING 3D, Planmeca Oy |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

3D Printed Dentures Market Key Technology Landscape

The technology landscape of the 3D Printed Dentures Market is dominated by resin-based additive manufacturing techniques that provide the necessary resolution and surface finish for accurate dental restorations. Stereolithography (SLA) and Digital Light Processing (DLP) are the foundational technologies, leveraging photopolymerization to solidify liquid resins layer by layer using UV light sources. SLA is known for its high precision and smooth surface finish, making it suitable for intricate dental molds and try-in bases, although it can be slower than DLP. DLP utilizes a digital micromirror device (DMD) to project an entire layer image at once, significantly accelerating the printing process, making it the preferred method for high-volume production of denture bases and teeth in centralized laboratories. Recent advancements in Continuous DLP (CDLP) further enhance speed and minimize the visible layer lines, improving both aesthetics and mechanical performance while simultaneously reducing post-processing requirements, reinforcing DLP’s position as a market leader for dental applications that demand both speed and fidelity.

Material Jetting (MJ) represents another important technology, particularly for creating highly detailed, multi-material prosthetics. MJ printers deposit droplets of photopolymer material that are cured instantly by UV light, similar to an inkjet printer. This technology uniquely enables the simultaneous printing of different materials with varied mechanical properties, such as printing the rigid denture base and the flexible soft tissue interfaces in a single run. While MJ systems typically involve higher capital expenditure and material costs, their ability to produce color-graded, highly aesthetic dentures and complex surgical guides provides a valuable niche application, particularly in advanced restorative and maxillofacial contexts. Fused Deposition Modeling (FDM) holds a smaller, yet growing, role, primarily limited to printing inexpensive temporary fixtures, training models, and specialized fixtures due to its lower resolution compared to photopolymer-based systems, but its material versatility and cost-effectiveness continue to drive interest in specific low-stakes applications.

Crucially, the technological landscape extends beyond the printing hardware to encompass the entire digital workflow ecosystem. This includes highly sophisticated Computer-Aided Design (CAD) software, such as 3Shape Dental System and Exocad, optimized specifically for digital denture creation, which handles complex tasks like automatic tooth placement, occlusal plane setting, and articulation matching. Equally vital are the integrated post-processing units—high-intensity UV curing chambers and washing stations—which are essential for achieving the final mechanical properties, biocompatibility, and regulatory compliance of the printed denture. The evolution of this integrated ecosystem, emphasizing seamless data exchange (e.g., standardizing STL and OBJ file formats) and rigorous quality assurance protocols, is arguably as significant as the advancements in printer hardware itself, ensuring reliable, high-quality production outputs across various technical platforms and facilitating the crucial transition from physical impressions to a fully digital prosthetic solution workflow.

Regional Highlights

- North America: Market dominance characterized by high healthcare spending, advanced digital adoption, and stringent regulatory standards (FDA approval), leading to robust implementation in large dental chains and specialized labs. The US is the single largest national market, driven by high technology penetration and readily available specialized training programs.

- Europe: High market maturity in Western Europe (Germany, UK, France), propelled by supportive government mandates for digitalization in healthcare and a strong presence of key dental manufacturers and material science companies. Central and Eastern Europe are emerging as high-growth manufacturing hubs dueating to lower operational costs.

- Asia Pacific (APAC): Fastest-growing region due to expanding healthcare infrastructure, rising incidence of oral diseases, and increasing adoption of Western dental technology, particularly in China, Japan, and South Korea. Dental tourism also fuels demand for high-quality, rapidly produced prosthetics.

- Latin America (LATAM): Moderate growth driven by increasing urbanization and improved access to middle-class dental care, with Brazil leading market growth. Challenges include regulatory fragmentation and reliance on imported hardware and materials.

- Middle East and Africa (MEA): Nascent but promising market, centered in the Gulf Cooperation Council (GCC) countries benefiting from government investment in modern healthcare facilities. Growth is constrained by lower overall dental expenditure and complex logistics in many African nations.

North America maintains its leading position in the 3D Printed Dentures Market, primarily driven by the region's early and aggressive adoption of digital dentistry workflows, which includes intraoral scanning and advanced CAD/CAM technologies. The United States and Canada boast highly sophisticated healthcare infrastructures and high per capita expenditure on dental care, creating a fertile ground for premium restorative solutions. The regulatory environment, particularly the rigorous but clear FDA approval processes for dental resins and devices, provides confidence to both manufacturers and clinicians, accelerating the market introduction and acceptance of new 3D printed denture products. Furthermore, the strong presence of major market players—including both hardware and software giants—and numerous academic institutions focused on digital dental research contribute to a culture of rapid innovation and professional education, ensuring a continuous supply of skilled technicians capable of operating complex additive manufacturing systems, solidifying the region's revenue dominance and technological leadership in this sector.

The European market exhibits high maturity, paralleling North America in technological sophistication, especially within key Western European economies such as Germany, the UK, and France. European market growth is supported by consistent investments in healthcare digitalization and a robust network of centralized dental laboratories that have efficiently transitioned high-volume production to 3D printing methods. The standardization facilitated by CE mark certification and the collaborative efforts between professional dental associations and technology providers ensure a high baseline quality for 3D printed prosthetics across the continent. Eastern Europe is increasingly important, not only as a consumer market but as a lower-cost manufacturing base for dental outsourcing, attracting investment from global players seeking efficient production and distribution centers. Furthermore, favorable public health policies emphasizing preventative care and early prosthetic intervention sustain a stable, high-demand environment for both complete and partial 3D printed denture solutions, ensuring steady long-term market expansion across diverse socioeconomic strata.

The Asia Pacific (APAC) region is projected to experience the most rapid growth, transforming into the largest consumer base over the forecast period, driven by unparalleled demographic changes and significant economic development. Rapid industrialization and urbanization in countries like China, India, and Southeast Asia have led to a massive increase in the aging population and greater access to disposable income for advanced healthcare services, translating directly into escalating demand for quality prosthetics. Government investments in developing modern dental hospitals and promoting oral health awareness are creating new market opportunities. Moreover, the region is becoming a global center for low-cost, high-volume manufacturing, with local companies increasingly adopting 3D printing technology to serve both domestic markets and international outsourcing demands. The combination of an enormous, underserved population and the swift adoption of cost-effective digital production methods positions APAC as the primary engine for future market expansion, despite current challenges related to fragmented distribution chains and the need for standardized technical training.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the 3D Printed Dentures Market.- 3D Systems Corporation

- Stratasys Ltd.

- Formlabs Inc.

- EnvisionTEC (Desktop Metal)

- SprintRay Inc.

- NextDent (3Shape)

- Carbon Inc.

- Dentsply Sirona

- Mitsui Chemicals

- Voco GmbH

- Kulzer GmbH

- Whip Mix Corporation

- Pro3dure Medical GmbH

- Asiga

- Zortrax S.A.

- DMG America

- Keystone Industries

- GC Corporation

- SHINING 3D

- Planmeca Oy

Frequently Asked Questions

Analyze common user questions about the 3D Printed Dentures market and generate a concise list of summarized FAQs reflecting key topics and concerns.What specific advantages do 3D printed dentures offer over conventional fabricated dentures?

3D printed dentures provide enhanced accuracy, resulting in a superior fit and reduced need for chairside adjustments, significantly improving patient comfort and minimizing required clinical time. The digital workflow ensures high reproducibility and faster manufacturing turnaround, making personalized prosthetic solutions more efficient and cost-effective compared to traditional labor-intensive analog processes.

Which 3D printing technologies are most commonly utilized for manufacturing dental prosthetics?

Digital Light Processing (DLP) and Stereolithography (SLA) are the predominant technologies used for 3D printed dentures. DLP is favored for high-volume production due to its speed, while SLA offers exceptionally high resolution and surface finish. Both methods rely on high-precision photopolymerization of specialized, biocompatible dental resins to achieve clinical quality standards.

What are the primary restraints affecting the growth and wider adoption of 3D printed dentures?

The main restraints include the high initial capital investment required for purchasing sophisticated 3D printing hardware, integrated curing units, and specialized CAD software licenses. Additionally, a perceived learning curve for dental professionals and the need for standardized high-strength, long-term approved materials sometimes slow down widespread adoption across smaller laboratories and independent clinics.

How is Artificial Intelligence (AI) expected to transform the digital denture workflow?

AI is expected to transform the workflow by automating the design phase, calculating optimal fit and occlusion based on patient scan data, thereby reducing human error and design time. Furthermore, AI enhances quality control by automatically detecting structural flaws post-printing, ensuring a consistently high standard of prosthetic quality and reducing remake rates significantly.

Which geographic region currently leads the market for 3D printed dentures and why?

North America currently leads the market, primarily due to high technological penetration, substantial healthcare expenditure, robust digital infrastructure adoption in dental practices, and a clear regulatory pathway established by bodies such as the FDA. The presence of major technology innovators and a large geriatric population also drives sustained high demand.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager