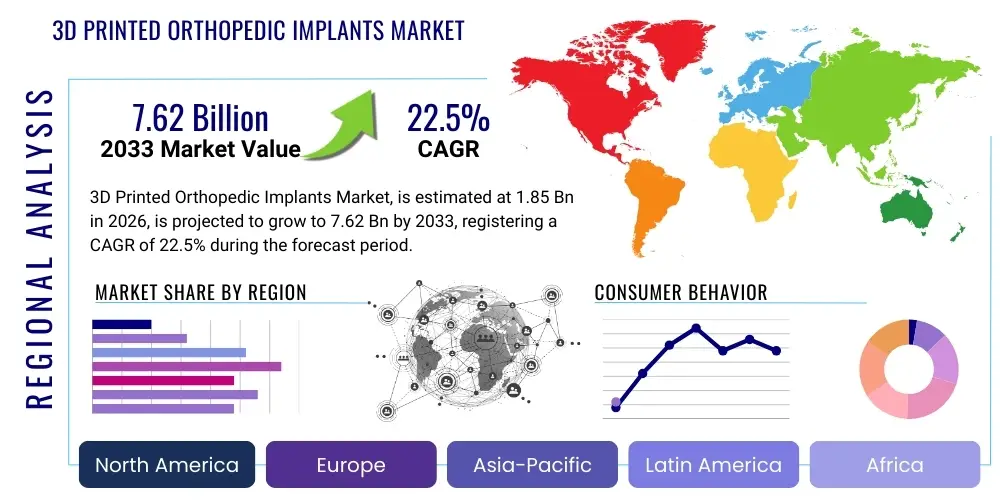

3D Printed Orthopedic Implants Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439898 | Date : Jan, 2026 | Pages : 243 | Region : Global | Publisher : MRU

3D Printed Orthopedic Implants Market Size

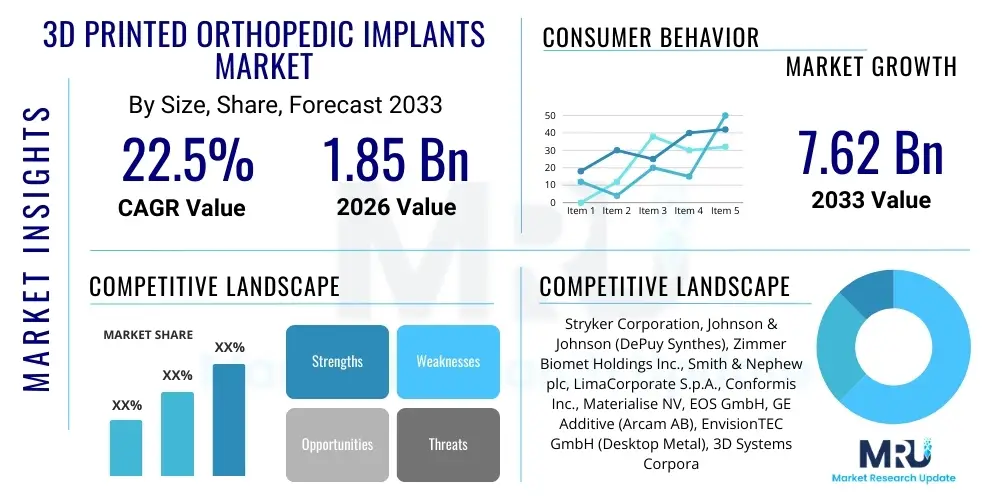

The 3D Printed Orthopedic Implants Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 22.5% between 2026 and 2033. The market is estimated at USD 1.85 billion in 2026 and is projected to reach USD 7.62 billion by the end of the forecast period in 2033.

3D Printed Orthopedic Implants Market introduction

The 3D Printed Orthopedic Implants Market is experiencing robust expansion, fundamentally transforming the landscape of musculoskeletal healthcare through the application of additive manufacturing techniques. These implants represent a paradigm shift from conventional mass-produced devices to highly customized, patient-specific solutions, designed to perfectly match individual anatomical requirements. The product description emphasizes the use of biocompatible materials, such as titanium alloys, PEEK, and bioceramics, processed with advanced 3D printing technologies like Selective Laser Sintering (SLS), Electron Beam Melting (EBM), and Direct Metal Laser Sintering (DMLS) to create intricate, porous structures that promote better osseointegration and reduce recovery times. Major applications span across various orthopedic fields, including joint reconstruction (hips, knees, shoulders), spinal fusion, trauma fixation, and cranio-maxillofacial reconstruction, addressing a wide array of degenerative diseases, injuries, and congenital deformities. The profound benefits include enhanced surgical precision, improved patient outcomes, reduced surgical complexity, and the potential for greater implant longevity due to superior biological integration and mechanical properties. Key driving factors propelling this market include the global aging population, leading to a higher incidence of orthopedic conditions; the increasing demand for personalized medicine; continuous technological advancements in materials science and additive manufacturing processes; and a growing awareness among healthcare professionals and patients regarding the advantages of customized implants.

3D Printed Orthopedic Implants Market Executive Summary

The 3D Printed Orthopedic Implants Market is characterized by dynamic business trends reflecting significant innovation and strategic collaborations, aiming to capitalize on the increasing demand for patient-specific medical devices. Companies are heavily investing in research and development to explore novel materials, optimize printing technologies, and streamline regulatory pathways, which are critical for market entry and expansion. Mergers and acquisitions are common as larger medical device corporations seek to integrate specialized 3D printing capabilities and intellectual property, consolidating market leadership and fostering innovation. From a regional trends perspective, North America and Europe currently dominate the market due to established healthcare infrastructures, substantial R&D investments, and favorable reimbursement policies, while the Asia Pacific region is rapidly emerging as a high-growth market, driven by a large patient pool, improving healthcare access, and increasing medical tourism. Segment trends highlight a robust growth across various applications, with joint replacement and spinal implants leading the charge, supported by advancements in titanium and PEEK-based materials that offer superior biomechanical properties and biocompatibility. The market also observes an increasing adoption of specialized implants for cranio-maxillofacial and trauma applications, underscoring the versatility and evolving capabilities of 3D printing in orthopedics. This confluence of technological progress, strategic business maneuvers, and expanding geographical reach defines the highly competitive and rapidly evolving landscape of 3D printed orthopedic implants.

AI Impact Analysis on 3D Printed Orthopedic Implants Market

The integration of Artificial Intelligence (AI) into the 3D Printed Orthopedic Implants market is profoundly reshaping design, manufacturing, and application methodologies. Users frequently inquire about AI's role in optimizing implant geometry for superior biomechanical performance, enhancing the precision of surgical planning, and enabling truly personalized patient solutions. Common questions also revolve around AI's ability to predict material behavior, ensure quality control in the printing process, and streamline regulatory approval pathways by providing robust data analysis. The overarching themes reflect a strong expectation that AI will drive efficiency, significantly improve patient outcomes, and accelerate the development of next-generation implants. However, concerns regarding data security, the ethical implications of autonomous design, and the validation of AI-generated medical devices are also prevalent, underscoring the need for transparent and rigorously tested AI applications within this critical healthcare sector.

AI's analytical prowess allows for the rapid processing of complex patient-specific data, including CT and MRI scans, to generate optimal implant designs that perfectly match individual anatomy and biomechanical requirements. This capability moves beyond simple customization, enabling generative design algorithms to explore thousands of design permutations, identifying the most efficient structures for load bearing, stress distribution, and osseointegration. Such advanced computational design not only reduces design cycle times but also opens avenues for creating novel, highly optimized implant architectures previously unattainable through traditional methods. The meticulous precision offered by AI is crucial in ensuring that each implant is tailored for maximum efficacy and minimal complications, a significant leap forward in personalized medicine.

Furthermore, AI plays a pivotal role in refining the manufacturing process and ensuring the quality of 3D printed orthopedic implants. Through machine learning algorithms, AI can monitor the additive manufacturing process in real-time, detecting anomalies and predicting potential defects based on sensor data from printers. This predictive analytics capability significantly reduces material waste and production errors, leading to higher yield rates and more consistent product quality. Beyond manufacturing, AI also contributes to predictive analytics for post-implantation performance, leveraging vast datasets of patient outcomes to identify factors influencing implant longevity and success rates. This feedback loop allows for continuous improvement in implant design and material selection, contributing to a more data-driven and evidence-based approach to orthopedic care.

- Generative Design and Optimization: AI algorithms analyze patient anatomical data and biomechanical stresses to autonomously generate highly optimized, patient-specific implant designs, improving fit, function, and osseointegration. This reduces design time and allows for complex lattice structures that enhance mechanical properties and biological ingrowth.

- Enhanced Surgical Planning: AI-powered software integrates patient imaging data with implant models to create precise surgical guides and simulate procedures, leading to more accurate implant placement, reduced operative time, and improved surgical outcomes.

- Predictive Material Science: AI models predict the performance and biocompatibility of new additive manufacturing materials, accelerating the development of advanced alloys and polymers with superior mechanical strength and biological responses.

- Real-time Quality Control and Process Monitoring: Machine learning algorithms monitor 3D printing processes in real-time, detecting deviations in temperature, laser power, or material deposition to ensure consistent quality, reduce defects, and improve manufacturing efficiency.

- Personalized Biomechanics Simulation: AI enables advanced simulations of how a patient's body will interact with the implant over time, factoring in individual gait, activity levels, and bone density to predict long-term durability and potential complications.

- Supply Chain Optimization: AI optimizes inventory management and production scheduling for custom implants, reducing lead times and ensuring timely delivery of patient-specific devices to surgical centers globally.

- Data-Driven Clinical Decision Support: AI analyzes vast clinical datasets to provide surgeons with evidence-based recommendations for implant selection and surgical approaches, enhancing treatment efficacy and patient safety.

DRO & Impact Forces Of 3D Printed Orthopedic Implants Market

The 3D Printed Orthopedic Implants Market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces that shape its trajectory. A primary driver is the accelerating global aging population, which naturally leads to a higher incidence of age-related degenerative orthopedic conditions such as osteoarthritis and osteoporosis, necessitating joint replacements and spinal fusions. This demographic shift, coupled with an increasing prevalence of sports injuries and traumatic accidents, significantly boosts the demand for advanced and durable orthopedic solutions. Furthermore, the relentless pace of technological advancements in 3D printing, including improvements in resolution, material diversity, and printing speed, alongside sophisticated software for design and simulation, continually expands the possibilities for personalized implant fabrication. The growing preference for patient-specific implants, which offer superior fit, reduced surgical time, and enhanced recovery, further fuels market growth, aligning with the broader trend towards personalized medicine across healthcare sectors.

Despite these powerful drivers, several significant restraints challenge the market's full potential. The high initial capital investment required for 3D printing equipment, specialized software, and advanced materials poses a barrier to entry for smaller manufacturers and can increase the overall cost of implants, potentially affecting patient access in cost-sensitive markets. Stringent regulatory approval processes, particularly in major economies like the U.S. and Europe, add considerable time and expense to product development, as each patient-specific device or new material often requires rigorous validation to ensure safety and efficacy. Moreover, the scarcity of skilled professionals proficient in both additive manufacturing and orthopedic biomechanics represents a workforce challenge, limiting the widespread adoption and optimal utilization of these advanced technologies. Concerns regarding intellectual property rights for customized designs and the potential for device failure due to manufacturing complexities or material fatigue also act as significant impediments.

However, the market is rife with opportunities that promise substantial future growth. Emerging economies, particularly in Asia Pacific and Latin America, present untapped markets with large patient populations and rapidly developing healthcare infrastructures, offering significant expansion potential as healthcare expenditure rises and technological adoption increases. Continued research and development into novel biocompatible materials with enhanced mechanical properties and biological integration capabilities, such as advanced titanium alloys with superior porous structures, offer avenues for product innovation and differentiation. The expansion of 3D printing into new and complex orthopedic applications, including limb salvage, bone tumor resections, and pediatric orthopedics, further diversifies the market. The increasing trend of mass customization, where implants can be tailored on a larger scale while maintaining cost-effectiveness, represents a pivotal opportunity to democratize access to personalized orthopedic care, solidifying the market's long-term growth prospects.

Segmentation Analysis

The 3D Printed Orthopedic Implants market is meticulously segmented to provide a granular understanding of its diverse components, reflecting the varied applications, materials, and technologies that characterize this innovative sector. This segmentation allows for precise market analysis, identifying key growth areas, competitive landscapes, and strategic opportunities across different product types, the materials utilized in their fabrication, the underlying 3D printing technologies employed, and the end-user facilities where these advanced implants are primarily adopted. Such a detailed breakdown illuminates the specific dynamics within each sub-market, enabling stakeholders to make informed decisions regarding product development, market entry, and investment strategies, all while catering to the evolving demands of orthopedic patients and healthcare providers globally.

- By Product Type:

- Hip Implants: These include acetabular cups and femoral stems, often printed with porous structures to promote osseointegration and reduce aseptic loosening, catering to total hip arthroplasty procedures.

- Knee Implants: Comprising femoral components, tibial trays, and patellar components, designed for total or partial knee replacement, benefiting from personalized fit to improve kinematics and patient comfort.

- Spinal Implants: Such as interbody fusion devices (cages) and vertebral body replacements, which leverage 3D printing to create complex geometries and porous surfaces that enhance fusion rates and provide structural support.

- Craniomaxillofacial (CMF) Implants: Used for reconstructing facial bones, skulls, and jawbones following trauma, tumor resection, or congenital defects, offering unparalleled anatomical precision and aesthetic outcomes.

- Dental Implants: Although often considered a distinct market, intraoral bone grafts and patient-specific surgical guides for dental procedures frequently utilize 3D printing for superior fit and predictable results.

- Other Orthopedic Implants: This category encompasses custom implants for shoulder, ankle, wrist, and finger joints, as well as specialized devices for trauma fixation, limb salvage, and pediatric deformities.

- By Material:

- Titanium and Titanium Alloys: The most widely used material due to its excellent biocompatibility, high strength-to-weight ratio, and ability to form porous structures conducive to bone ingrowth.

- PEEK (Polyether Ether Ketone): A radiolucent polymer offering mechanical properties similar to bone, making it suitable for spinal cages and craniomaxillofacial applications where imaging artifacts are a concern.

- Cobalt-Chrome Alloys: Known for their high wear resistance and mechanical strength, primarily used in articulating surfaces of joint implants, though less common in 3D printed form compared to titanium.

- Bioceramics (e.g., Hydroxyapatite, Tricalcium Phosphate): Often used as coatings or composite materials to enhance osteoconductivity and promote faster bone healing, sometimes printed directly as scaffolds.

- Stainless Steel: While traditional, 3D printing applications for stainless steel in orthopedics are emerging for specific load-bearing trauma devices where its strength is advantageous.

- By Technology:

- Selective Laser Sintering (SLS): Uses a laser to selectively fuse powdered material, layer by layer, suitable for complex geometries and various polymers and metals.

- Electron Beam Melting (EBM): Utilizes an electron beam to melt metal powder in a vacuum, known for producing dense, strong metal parts with excellent material properties, especially for titanium alloys.

- Direct Metal Laser Sintering (DMLS)/Selective Laser Melting (SLM): Similar to SLS but for metals, creating fully dense metal parts with intricate details, offering high precision for medical implants.

- Fused Deposition Modeling (FDM)/Fused Filament Fabrication (FFF): Extrudes thermoplastic filaments layer by layer, primarily used for surgical guides and prototypes due to its cost-effectiveness and versatility with biocompatible plastics.

- Stereolithography (SLA) & Digital Light Processing (DLP): Uses UV light to cure liquid resin, layer by layer, offering high resolution and smooth surface finishes, suitable for surgical models and some temporary implants.

- Binder Jetting: Involves jetting a liquid binding agent onto a powder bed, layer by layer, to build a part. It allows for various materials, including metals, and is known for its speed and ability to produce complex forms.

- By End-User:

- Hospitals: The largest end-user segment, where complex orthopedic surgeries and high-volume procedures involving 3D printed implants are performed.

- Ambulatory Surgical Centers (ASCs): Increasingly adopting 3D printed implants for less complex, outpatient orthopedic procedures due to efficiency and cost-effectiveness.

- Specialty Orthopedic Clinics: Focus on specific musculoskeletal conditions and often utilize customized implants for enhanced patient care and specialized treatments.

- Research & Academic Institutions: Engaged in R&D of new materials, printing techniques, and implant designs, contributing to the pipeline of future orthopedic solutions.

Value Chain Analysis For 3D Printed Orthopedic Implants Market

The value chain for the 3D Printed Orthopedic Implants Market is a sophisticated ecosystem, commencing with the upstream activities of raw material procurement and software development, extending through manufacturing and distribution, and culminating in direct and indirect engagement with end-users. Upstream analysis reveals a critical dependency on specialized suppliers providing high-quality, medical-grade metal powders (primarily titanium and its alloys, cobalt-chrome) and polymer filaments (such as PEEK). These materials must meet stringent biocompatibility and mechanical strength standards. Alongside material suppliers, the upstream segment also includes providers of advanced design software, such as CAD/CAM solutions and simulation tools, which are indispensable for creating intricate, patient-specific implant geometries. The intellectual property generated at this stage, particularly in material science and software algorithms, significantly influences the downstream manufacturing capabilities and overall market competitiveness, emphasizing the importance of innovation and robust supply chain partnerships.

Moving downstream, the value chain encompasses the actual manufacturing process performed by specialized additive manufacturing service providers or in-house facilities of large medical device companies. This stage involves converting digital designs into physical implants using various 3D printing technologies like EBM, DMLS, or SLS. Post-processing, which includes heat treatment, surface finishing, and sterilization, is equally crucial to ensure the implant's biomechanical integrity and sterility before it reaches the patient. Distribution channels then play a vital role in connecting manufacturers with healthcare providers. This can involve direct sales forces employed by major medical device companies, who engage directly with orthopedic surgeons and hospital procurement departments, offering technical support and training. Alternatively, indirect channels involve third-party distributors and medical device wholesalers who manage logistics, warehousing, and sales to a broader network of hospitals, clinics, and ambulatory surgical centers.

The market's distribution channels are bifurcated into direct and indirect models, each with distinct advantages and challenges. Direct distribution allows manufacturers greater control over product messaging, pricing, and customer relationships, fostering deep clinical partnerships essential for high-value, patient-specific devices. It often involves specialized sales teams that work closely with surgeons to understand their specific needs and provide customized solutions. In contrast, indirect distribution leverages the existing networks and logistical expertise of third-party distributors, offering wider market reach, especially in geographically dispersed or emerging markets, often at a lower operational cost for the manufacturer. Both channels are critical for market penetration and depend heavily on efficient supply chain management, regulatory compliance for medical device distribution, and effective communication between all stakeholders to ensure timely and safe delivery of these highly specialized orthopedic implants to the end-user patients.

3D Printed Orthopedic Implants Market Potential Customers

The primary potential customers and end-users of 3D printed orthopedic implants are diverse healthcare entities and professionals actively involved in musculoskeletal care, each seeking advanced solutions to improve patient outcomes and operational efficiencies. Orthopedic surgeons form the core group of decision-makers and direct users, as they prescribe, plan, and implant these devices in patients. Their demand is driven by the need for enhanced surgical precision, reduced operative time, and superior long-term results, which patient-specific implants can deliver. Hospitals, particularly those with advanced surgical departments and research capabilities, represent a significant end-user segment, leveraging these implants for complex joint reconstructions, spinal fusions, and trauma cases. These institutions are motivated by the desire to offer cutting-edge treatments, attract top medical talent, and improve their overall patient care metrics. The administrative and procurement departments within hospitals play a crucial role in evaluating cost-effectiveness, regulatory compliance, and supply chain reliability.

Ambulatory Surgical Centers (ASCs) are increasingly emerging as vital consumers of 3D printed orthopedic implants, especially for elective and less complex procedures. The efficiency, reduced overhead, and focused patient care environment of ASCs make them ideal settings for the adoption of customized implants that can streamline surgical workflows and minimize hospital stays. These centers prioritize solutions that contribute to faster patient recovery, lower infection rates, and overall cost reduction compared to traditional hospital settings. Specialty orthopedic clinics, which often focus on specific areas like sports medicine, spine surgery, or limb reconstruction, also represent a significant customer base. Their demand is often driven by the need for highly specialized and innovative solutions for unique patient cases, allowing them to maintain a competitive edge and provide highly tailored care that distinguishes them in the market.

Beyond direct patient care facilities, academic and research institutions are also crucial potential customers, utilizing 3D printed orthopedic implants for advanced research, material testing, and the development of next-generation devices. Their engagement is critical for pushing the boundaries of what is possible in additive manufacturing for medical applications. Additionally, defense and veteran healthcare systems, often dealing with complex trauma and reconstructive surgeries, are significant consumers, recognizing the unparalleled benefits of customized implants for service members. The overarching motivation across all these customer segments is the pursuit of superior functional outcomes for patients, reduced healthcare costs through optimized procedures and implant longevity, and the continuous advancement of orthopedic treatment modalities through innovative technology. Manufacturers must therefore tailor their marketing, sales, and support strategies to address the distinct needs and priorities of each of these varied customer groups.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 7.62 Billion |

| Growth Rate | 22.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stryker Corporation, Johnson & Johnson (DePuy Synthes), Zimmer Biomet Holdings Inc., Smith & Nephew plc, LimaCorporate S.p.A., Conformis Inc., Materialise NV, EOS GmbH, GE Additive (Arcam AB), EnvisionTEC GmbH (Desktop Metal), 3D Systems Corporation, Renishaw plc, Osseus Fusion Systems, Oxford Performance Materials (OPM), Medacta International SA, Sygnis AG, Xtant Medical Holdings Inc., Additive Orthopaedics, BellaSeno GmbH, Orthofix Medical Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

3D Printed Orthopedic Implants Market Key Technology Landscape

The technological landscape of the 3D Printed Orthopedic Implants Market is characterized by continuous innovation across multiple fronts, including advanced additive manufacturing processes, sophisticated material science, and intelligent software solutions. At the core are the diverse 3D printing technologies themselves, each offering unique advantages for specific applications. Direct Metal Laser Sintering (DMLS) and Electron Beam Melting (EBM) are predominant for producing metallic implants, particularly from titanium alloys, due to their ability to create fully dense, mechanically robust parts with intricate internal structures that promote optimal osseointegration. These technologies allow for the precise fabrication of porous scaffolds and lattice structures, which are critical for biological integration and stress shielding reduction. The ongoing refinement of these metal printing techniques focuses on improving surface finish, reducing build times, and expanding the range of printable alloys to enhance implant functionality and longevity.

Beyond metallic printing, technologies such as Selective Laser Sintering (SLS) and Fused Deposition Modeling (FDM) are pivotal for polymer-based implants and surgical guides. SLS, in particular, is gaining traction for manufacturing PEEK implants, offering radiolucency and mechanical properties that closely mimic bone. FDM is widely adopted for creating patient-specific anatomical models and surgical guides due to its cost-effectiveness and rapid prototyping capabilities. Stereolithography (SLA) and Digital Light Processing (DLP) are utilized for high-resolution polymer parts, often for intricate models or temporary implants requiring fine detail. The evolution of these polymer printing methods centers on developing new biocompatible resins and filaments that offer improved strength, flexibility, and sterilizability, expanding their utility in direct implant applications and patient-specific instrumentation.

Complementing the printing hardware are significant advancements in material science and digital design software. The development of novel biomaterials, including resorbable polymers and advanced composite materials, is opening new avenues for temporary and regenerative orthopedic implants. These materials are engineered to degrade at controlled rates while facilitating natural bone regeneration. On the software front, powerful CAD/CAM tools, alongside generative design algorithms and finite element analysis (FEA) for biomechanical simulation, are indispensable. These tools enable engineers and surgeons to convert patient-specific imaging data into complex 3D models, optimize implant geometry for performance, and simulate post-operative biomechanics with unprecedented accuracy. The integration of artificial intelligence (AI) and machine learning (ML) further augments this by automating design processes, predicting material behaviors, and ensuring quality control throughout the manufacturing workflow, collectively driving the market towards more personalized, efficient, and effective orthopedic solutions.

Regional Highlights

- North America: This region stands as the undisputed leader in the 3D Printed Orthopedic Implants market, primarily driven by its highly advanced healthcare infrastructure, significant investments in research and development, and a strong presence of key market players and innovation hubs. The U.S., in particular, boasts a high adoption rate of advanced medical technologies, favorable reimbursement policies for innovative treatments, and a large aging population prone to orthopedic conditions, further fueling demand. Stringent regulatory frameworks, while challenging, also ensure high product quality and safety, fostering trust and market growth.

- Europe: Following North America, Europe represents a substantial market, characterized by sophisticated healthcare systems, a growing elderly population, and increasing awareness regarding personalized medicine. Countries such as Germany, the UK, France, and Italy are at the forefront, driven by supportive government initiatives for additive manufacturing in healthcare and a robust academic-industrial collaboration network. The region benefits from a strong focus on clinical research and the widespread adoption of advanced surgical techniques, contributing significantly to market expansion.

- Asia Pacific (APAC): The Asia Pacific region is projected to be the fastest-growing market for 3D printed orthopedic implants during the forecast period. This growth is attributable to a large and rapidly expanding patient pool, improving healthcare infrastructure, rising disposable incomes, and increasing medical tourism. Countries like China, India, Japan, and South Korea are heavily investing in medical technology and adopting advanced manufacturing techniques. The increasing prevalence of orthopedic disorders and the rising demand for high-quality, personalized healthcare solutions are key drivers in this dynamic region.

- Latin America: This region is experiencing nascent but steady growth in the 3D Printed Orthopedic Implants market. Factors contributing to this include improving healthcare access, increasing healthcare expenditure, and a growing awareness of advanced orthopedic treatments. Brazil and Mexico are leading the charge, with developing medical device manufacturing capabilities and increasing collaborations with international players, although challenges such as economic instability and less developed regulatory frameworks persist.

- Middle East and Africa (MEA): The MEA region is an emerging market, driven by increasing investments in healthcare infrastructure, particularly in the Gulf Cooperation Council (GCC) countries, and a rising prevalence of musculoskeletal disorders. Government initiatives to diversify economies and enhance healthcare services are creating opportunities for market penetration. However, the region faces challenges related to lower adoption rates of advanced technologies and varying regulatory landscapes across different countries, necessitating tailored market entry strategies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the 3D Printed Orthopedic Implants Market.- Stryker Corporation

- Johnson & Johnson (DePuy Synthes)

- Zimmer Biomet Holdings Inc.

- Smith & Nephew plc

- LimaCorporate S.p.A.

- Conformis Inc.

- Materialise NV

- EOS GmbH

- GE Additive (Arcam AB)

- EnvisionTEC GmbH (Desktop Metal)

- 3D Systems Corporation

- Renishaw plc

- Osseus Fusion Systems

- Oxford Performance Materials (OPM)

- Medacta International SA

- Sygnis AG

- Xtant Medical Holdings Inc.

- Additive Orthopaedics

- BellaSeno GmbH

- Orthofix Medical Inc.

Frequently Asked Questions

What are 3D printed orthopedic implants and how do they differ from traditional implants?

3D printed orthopedic implants are medical devices fabricated layer-by-layer using additive manufacturing, primarily from biocompatible materials like titanium or PEEK. They differ from traditional, mass-produced implants by offering patient-specific customization, allowing for precise anatomical fit, optimized biomechanics, and complex porous structures that promote superior bone ingrowth and reduced recovery times.

What are the primary benefits of using 3D printed orthopedic implants for patients?

For patients, the primary benefits include a more precise and comfortable fit due to customization, potentially leading to reduced surgical time and complications. These implants can also enhance functional recovery, minimize pain, and improve long-term outcomes by fostering better osseointegration and reducing the risk of implant loosening, ultimately improving quality of life.

Which materials are commonly used in 3D printed orthopedic implants and why?

The most common materials are titanium and its alloys, favored for their excellent biocompatibility, high strength-to-weight ratio, and ability to form intricate, porous structures conducive to bone ingrowth. PEEK (Polyether Ether Ketone) is also widely used for its radiolucency and bone-like mechanical properties, particularly in spinal and craniomaxillofacial applications.

What are the main challenges hindering the growth of the 3D Printed Orthopedic Implants market?

Key challenges include the high initial capital investment for 3D printing equipment and materials, the stringent and time-consuming regulatory approval processes for customized medical devices, the scarcity of skilled professionals with expertise in both additive manufacturing and orthopedic surgery, and intellectual property concerns related to unique designs.

How is Artificial Intelligence (AI) impacting the development and application of 3D printed orthopedic implants?

AI is profoundly impacting the market by enabling generative design algorithms to create optimized, patient-specific implant geometries, enhancing surgical planning through precise simulations, and improving manufacturing quality control. AI also aids in predicting material performance and analyzing clinical data to refine implant designs, leading to more efficient development and better patient outcomes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager