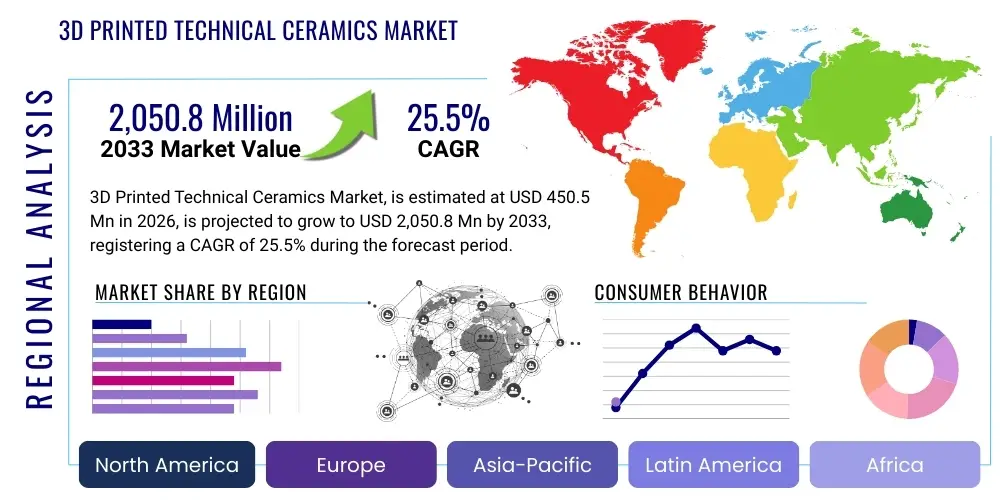

3D Printed Technical Ceramics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437212 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

3D Printed Technical Ceramics Market Size

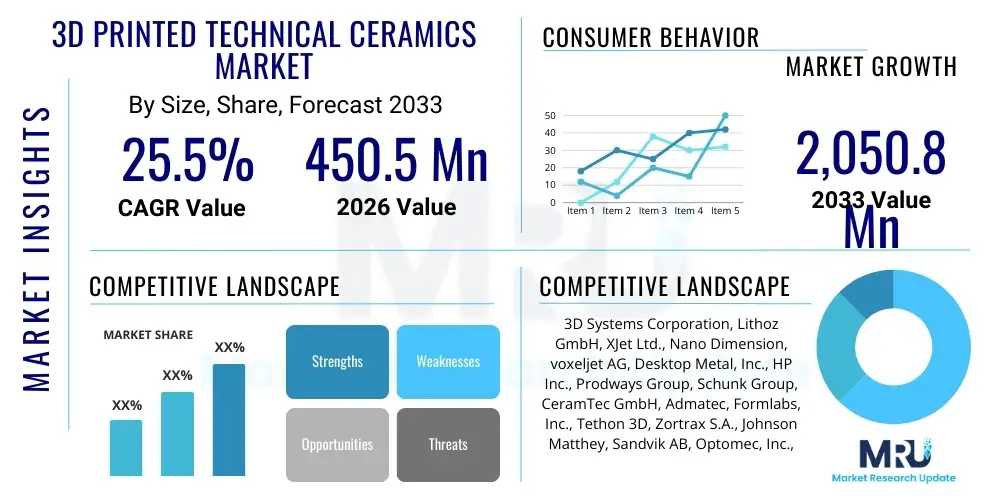

The 3D Printed Technical Ceramics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 25.5% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 2,050.8 Million by the end of the forecast period in 2033.

3D Printed Technical Ceramics Market introduction

The 3D Printed Technical Ceramics Market encompasses the industrial application of additive manufacturing (AM) techniques to fabricate parts using high-performance ceramic materials such as Alumina, Zirconia, Silicon Carbide, and Silicon Nitride. Technical ceramics are crucial due to their superior properties, including extreme hardness, chemical inertness, high temperature resistance, and excellent dielectric strength, making them indispensable in environments where traditional metals or polymers fail. Additive manufacturing revolutionizes ceramic processing by enabling the creation of complex geometries—such as internal channels, lattices, and highly customized components—that are often impossible or prohibitively expensive to achieve through conventional ceramic shaping methods like pressing, sintering, or injection molding. This technological synergy addresses critical manufacturing constraints, opening new design possibilities across various high-value sectors.

The primary driver accelerating market adoption is the increasing demand for customized, high-performance components in specialized industries. Major applications span across aerospace and defense (for high-temperature turbine components and heat shields), biomedical (for dental implants, prosthetics, and surgical instruments), and electronics (for intricate insulation components and sensors). The benefit derived from 3D printing lies in its ability to significantly reduce material waste, accelerate prototyping cycles, and enable rapid iteration of designs, which is particularly valuable in sectors adhering to stringent regulatory standards and demanding tight tolerances. Furthermore, the light weighting potential of complex ceramic structures designed through AM contributes to overall system efficiency, especially in moving parts and aerospace assemblies.

Key driving factors include relentless technological advancements in AM hardware, specifically the development of reliable processing methods like Stereolithography (SLA), Digital Light Processing (DLP), and Binder Jetting optimized for ceramic slurries and powders. Simultaneously, innovations in material science are expanding the portfolio of printable ceramic feedstock, improving material compatibility, and ensuring the final parts maintain the required mechanical and structural integrity after post-processing (sintering). As the costs associated with AM equipment and materials gradually decrease and the scalability of production increases, the value proposition of 3D printed technical ceramics becomes overwhelmingly attractive for mass customization and specialized small-to-medium batch production across highly regulated industrial landscapes.

3D Printed Technical Ceramics Market Executive Summary

The 3D Printed Technical Ceramics Market is undergoing rapid industrialization, marked by substantial investments from both established ceramic manufacturers and pure-play additive manufacturing companies, fostering a collaborative business environment focused on achieving industrial scale and repeatability. A defining business trend is the shift from purely prototyping applications toward end-use parts production, driven by improvements in printer resolution and material consistency, satisfying the rigorous quality requirements of aerospace and medical industries. Furthermore, the market is characterized by strategic partnerships between material developers and AM service bureaus to standardize processes and offer certified materials, thereby streamlining the supply chain and accelerating commercial adoption globally.

Regional trends indicate North America and Europe retaining leadership positions, primarily due to robust R&D infrastructure, high concentration of aerospace and defense contractors, and strong governmental backing for advanced manufacturing initiatives. However, the Asia Pacific region, particularly China and Japan, is emerging as the fastest-growing market segment, fueled by rapid industrial expansion, increasing electronics manufacturing capabilities, and significant adoption in the automotive sector for lightweight components. Competitive dynamics within these regions are focused on intellectual property related to printing techniques and proprietary ceramic formulations, which dictates market share and technological leadership.

Segmentation trends highlight the Material segment, specifically Alumina and Zirconia, dominating the market due to their established industrial use and ease of processability across various AM platforms. Technological segmentation shows Photopolymerization-based techniques (SLA/DLP) holding a large share, favored for their high resolution and ability to produce intricate parts required by the medical and microelectronics sectors. Meanwhile, the End-Use Industry segment reveals the Medical & Dental sector as a critical growth engine, capitalizing on the biocompatibility and customization benefits of 3D printed ceramics for devices like personalized surgical guides and ceramic crowns.

AI Impact Analysis on 3D Printed Technical Ceramics Market

User queries regarding the intersection of Artificial Intelligence (AI) and 3D Printed Technical Ceramics primarily revolve around three critical areas: design optimization, process control, and predictive quality assurance. Users are keenly interested in how AI algorithms, specifically Generative Design and Machine Learning (ML), can overcome the traditional complexities of ceramic manufacturing, such such as shrinkage during sintering and material anisotropy. Key themes include the expectation that AI will automate the compensation of geometric distortion in the green body stage and optimize print parameters in real-time to minimize defects, thereby dramatically improving first-pass yield rates, which are crucial for the high cost associated with technical ceramic feedstock. Concerns center on the need for high-quality, vast datasets derived from printing processes to effectively train these models and the integration challenges with existing proprietary AM hardware platforms.

- AI-driven Generative Design facilitates the creation of topology-optimized ceramic structures, ensuring maximum performance with minimal material usage, particularly critical for aerospace components.

- Machine Learning models optimize the printing parameters (e.g., laser power, scanning speed, slurry viscosity) in real-time, adapting to environmental variations and ensuring layer-by-layer consistency.

- Predictive Maintenance utilizing AI monitors sensor data from AM machines to anticipate component failure or process drift, maximizing machine uptime and reducing unexpected production losses.

- Computer vision and AI systems perform rapid, high-resolution defect detection during the printing or post-sintering stage, ensuring stringent quality standards are met for regulated applications like medical implants.

- AI accelerates the development of new ceramic formulations by predicting optimal binder compositions and material sintering behavior based on simulated and experimental data.

DRO & Impact Forces Of 3D Printed Technical Ceramics Market

The market dynamics are governed by powerful drivers and restraining forces that collectively define its trajectory, while inherent opportunities guide future investment strategies, all subject to significant impact forces stemming from regulatory and technological environments. A primary driver is the unparalleled functional performance of technical ceramics, enabling applications in harsh environments (high heat, high wear, corrosive chemicals) where metal alloys degrade rapidly, leading to surging demand from the energy, industrial, and petrochemical sectors for robust components. Coupled with this is the opportunity AM provides to consolidate complex assemblies into single, monolithically printed ceramic parts, eliminating weak points associated with traditional joining methods and reducing overall component weight and part count.

However, the market faces significant restraints, chiefly high capital expenditure required for specialized ceramic AM equipment and post-processing machinery (such as high-temperature furnaces), which creates substantial barriers to entry for smaller manufacturers and service providers. Furthermore, the scarcity of industrial-grade ceramic feedstock tailored specifically for AM processes, coupled with the complexity and lengthy duration of the sintering step—which dictates the final mechanical properties and is sensitive to residual stresses—slows down full-scale commercial adoption. These technical hurdles require continuous R&D investment to develop more robust, faster, and cost-effective processing routes.

Opportunities abound in emerging niche applications, particularly in the advanced semiconductor industry for precision components used in etching chambers, leveraging the electrical insulation properties of ceramics, and in the growing field of solid-state battery technology, which requires high-performance ceramic separators. The impact forces are significantly influenced by rapid shifts in global manufacturing mandates towards personalized medicine and complex industrial IoT devices, mandating customized ceramic parts, thereby pressuring manufacturers to adopt flexible AM techniques. Regulatory frameworks, especially in the biomedical and aerospace sectors, act as critical impact forces, as successful compliance and material certification validate the reliability and repeatability of 3D printed ceramic parts, serving as a major catalyst for mainstream integration and confidence building among major industrial buyers.

Segmentation Analysis

The 3D Printed Technical Ceramics Market is segmented based on Material, Technology, Application, and End-Use Industry to provide a granular view of market dynamics and opportunity areas. Material segmentation is crucial as it dictates the component's final physical and chemical properties and compatibility with AM processes. Technology segmentation reflects the varied capital investment and geometric complexity achievable, ranging from high-resolution vat photopolymerization to larger-scale extrusion methods. Application and End-Use segments define the value chain and consumption patterns, highlighting the shift toward high-value, performance-critical components in specialized industrial verticals requiring stringent material specifications and quality control.

- By Material:

- Alumina

- Zirconia

- Silicon Carbide

- Silicon Nitride

- Others (e.g., Boron Carbide, Aluminum Nitride)

- By Technology:

- Stereolithography (SLA) / Digital Light Processing (DLP)

- Binder Jetting

- Extrusion-based (Material Extrusion, Fused Deposition Modeling)

- Powder Bed Fusion (Selective Laser Sintering - Limited Application)

- By Application:

- Prototyping

- Tooling & Molds

- End-Use Parts Manufacturing

- By End-Use Industry:

- Aerospace & Defense

- Medical & Dental

- Electronics & Electrical

- Automotive

- Industrial & Energy

Value Chain Analysis For 3D Printed Technical Ceramics Market

The value chain for 3D Printed Technical Ceramics begins in the upstream sector with specialized material suppliers who formulate and process high-purity ceramic powders into AM-compatible feedstock, such as photosensitive slurries for SLA/DLP or specialized binder-coated powders for Binder Jetting. This stage is critical as the quality and rheological properties of the feedstock directly determine the success of the printing process and the structural integrity of the final sintered part. Key players in this phase focus heavily on ensuring minimal contamination and achieving perfect particle size distribution, requiring substantial material science expertise and often involving proprietary chemical formulations developed in collaboration with AM equipment manufacturers.

The core manufacturing stage is dominated by AM equipment providers and service bureaus. Equipment manufacturers develop sophisticated 3D printing systems tailored for ceramics, capable of handling highly viscous materials and ensuring precise geometric accuracy during the "green body" formation. Service bureaus play a crucial intermediary role, especially for smaller companies, offering specialized printing and post-processing capabilities, including crucial high-temperature sintering. They also manage the complex workflow, from design file preparation (often involving shrinkage compensation models) to final component quality assessment, bridging the gap between raw material and end-use part.

The downstream distribution channel involves both direct sales to large industrial customers (e.g., aerospace OEMs acquiring dedicated AM systems) and indirect sales through specialized distributors and service networks. Direct channels prioritize integration and certification support, while indirect channels provide accessibility and flexibility, particularly for customized or low-volume requirements from medical labs or smaller electronics firms. The ultimate end-users/buyers are high-technology sectors prioritizing performance and customization over volume, confirming that the value chain is weighted towards high-precision engineering services rather than mass production logistics.

3D Printed Technical Ceramics Market Potential Customers

The potential customers for 3D Printed Technical Ceramics are concentrated in high-reliability and performance-demanding sectors where component failure is economically costly or safety-critical. In the Medical & Dental sector, key buyers include specialized dental labs requiring highly customized ceramic crowns, bridges, and alignment tools, as well as medical device manufacturers seeking biocompatible ceramic implants and surgical instruments offering superior wear resistance and inertness. These customers value the high resolution and material certification offered by ceramic AM to meet strict regulatory compliance standards.

Another major segment comprises Aerospace & Defense Original Equipment Manufacturers (OEMs) and their Tier 1 suppliers. These buyers require components capable of surviving extreme thermal and mechanical stresses, such as lightweight structural parts, sensor housings, and hot-section components in turbine engines. For these customers, 3D printing offers rapid iteration of complex, optimized designs that are impossible to machine conventionally, providing a critical competitive edge in performance and fuel efficiency. Reliability, traceability, and material consistency are paramount buying criteria for this customer group.

Furthermore, specialized segments within the Electronics and Semiconductor industries represent a growing customer base. Manufacturers of advanced microelectronics require highly complex ceramic fixtures, insulators, and heat sinks used in wafer processing and high-frequency applications. These components demand micron-level precision and specific dielectric properties that ceramic AM techniques, particularly DLP, are uniquely positioned to deliver. The ability to produce complex internal geometries for cooling channels or integrated circuits differentiates AM from traditional ceramic forming processes, solidifying these sectors as high-value, long-term consumers of technical ceramic AM products and services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 2,050.8 Million |

| Growth Rate | 25.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3D Systems Corporation, Lithoz GmbH, XJet Ltd., Nano Dimension, voxeljet AG, Desktop Metal, Inc., HP Inc., Prodways Group, Schunk Group, CeramTec GmbH, Admatec, Formlabs, Inc., Tethon 3D, Zortrax S.A., Johnson Matthey, Sandvik AB, Optomec, Inc., ExOne (a Desktop Metal Company), Velo3D, EOS GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

3D Printed Technical Ceramics Market Key Technology Landscape

The technological landscape for 3D Printed Technical Ceramics is dominated by methods adapted from polymer AM but refined to handle ceramic slurries and powders, focusing on achieving high green strength and density prior to the crucial sintering step. Stereolithography (SLA) and Digital Light Processing (DLP) are the most prevalent techniques, capitalizing on the use of UV light to solidify photosensitive ceramic-loaded resin (slurry) layer-by-layer. DLP offers faster printing speeds and higher resolution across the build platform, making both methods ideal for producing intricate, small-to-medium-sized parts required by the medical and microelectronics industries. The key advantage of these vat photopolymerization techniques is their ability to produce parts with excellent surface finish and fine feature resolution, which minimizes subsequent finishing requirements, a significant benefit for extremely hard materials like technical ceramics.

Binder Jetting technology represents the next significant pillar in the ceramic AM landscape, offering potential for higher throughput and larger-scale part production compared to vat photopolymerization methods. This process involves depositing a liquid binding agent selectively onto a ceramic powder bed, layer by layer, followed by a depowdering and subsequent thermal treatment (sintering or infiltration). Binder Jetting is appealing due to its ability to process a wider range of ceramic materials and its cost-effectiveness in high-volume production, largely because it does not require expensive lasers or complex optics inherent to some other AM processes. However, challenges remain in controlling the shrinkage and warping during the sintering phase, necessitating sophisticated process modeling and control systems.

Material Extrusion techniques, sometimes referred to as ceramic Fused Deposition Modeling (FDM) or paste extrusion, involve pushing a highly loaded ceramic paste through a nozzle to build the part geometry. While generally simpler and less expensive in terms of equipment, these methods typically produce parts with lower resolution and potentially greater anisotropy compared to SLA/DLP. Extrusion techniques are often preferred for larger, less geometrically complex components, tooling, or refractory applications where material throughput and gross structural integrity are prioritized over micron-level detailing. The choice of technology is often dictated by the specific ceramic material, the required complexity of the part, and the acceptable tolerance levels mandated by the end application.

Regional Highlights

- North America: This region holds a dominant share, primarily driven by robust government funding for R&D in defense and aerospace sectors, particularly the development of high-temperature ceramic matrix composites (CMCs) and parts for space exploration. The presence of major AM technology developers and high-volume demand from leading medical device manufacturers in the U.S. ensures continuous innovation and high commercial uptake.

- Europe: Europe is a key innovator, with Germany and Switzerland leading in precision engineering and high-end industrial machinery. The region benefits from strong collaboration between academic institutions and industrial consortia (like those focused on Industry 4.0), accelerating the integration of ceramic AM into mature manufacturing processes, especially in the automotive (for specialized sensors and engine components) and industrial power generation sectors.

- Asia Pacific (APAC): APAC is projected to exhibit the fastest growth, fueled by massive investment in electronics manufacturing, a rapidly expanding automotive production base, and increasing healthcare spending, particularly in countries like China, Japan, and South Korea. China's focused governmental initiative to become a global leader in advanced manufacturing, including AM, is significantly driving the installation base of ceramic 3D printing equipment.

- Latin America (LATAM): The LATAM market is nascent but shows potential, primarily in the dental and specialized industrial repair sectors. Growth is currently limited by the high cost of imported equipment and the need for localized technical expertise, though increasing infrastructure spending offers long-term opportunity.

- Middle East and Africa (MEA): This region's adoption is concentrated in the energy (oil and gas) sector, where 3D printed ceramic components are valued for their exceptional corrosion and temperature resistance in harsh operating environments. Defense modernization programs in the Middle East also contribute to specialized, albeit smaller, market segment requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the 3D Printed Technical Ceramics Market.- 3D Systems Corporation

- Lithoz GmbH

- XJet Ltd.

- Nano Dimension

- voxeljet AG

- Desktop Metal, Inc.

- HP Inc.

- Prodways Group

- Schunk Group

- CeramTec GmbH

- Admatec

- Formlabs, Inc.

- Tethon 3D

- Zortrax S.A.

- Johnson Matthey

- Sandvik AB

- Optomec, Inc.

- ExOne (a Desktop Metal Company)

- Velo3D

- EOS GmbH

Frequently Asked Questions

Analyze common user questions about the 3D Printed Technical Ceramics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using 3D printing for technical ceramics over traditional methods?

3D printing enables the creation of highly complex geometries, lattice structures, and internal cooling channels impossible with conventional pressing or machining, drastically reduces material waste, and accelerates design iteration cycles for high-performance ceramic components.

Which industries are driving the highest demand for 3D printed technical ceramics?

The highest demand is driven by the Aerospace and Defense sector for lightweight, heat-resistant components, and the Medical and Dental sector for biocompatible implants, customized prosthetics, and high-precision tooling.

What is the most commonly used technology for printing high-resolution ceramic parts?

Stereolithography (SLA) and Digital Light Processing (DLP), both photopolymerization-based techniques, are most common as they offer the superior resolution and fine feature detailing necessary for microelectronics and customized medical applications.

What is the main bottleneck or challenge in the commercial adoption of ceramic AM?

The primary challenge is the high complexity and cost associated with the post-processing stage, particularly the precise high-temperature sintering required to achieve the necessary density, strength, and minimal shrinkage control in the final ceramic component.

How does the cost of 3D printed ceramic parts compare to conventionally manufactured parts?

For high-volume, simple parts, traditional manufacturing is cheaper. However, for highly customized, complex, or low-volume specialized parts, 3D printing offers a superior cost-benefit ratio due to reduced tooling costs and material consolidation, justifying the higher unit price.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager