3D Printing Pellet Extruder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435162 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

3D Printing Pellet Extruder Market Size

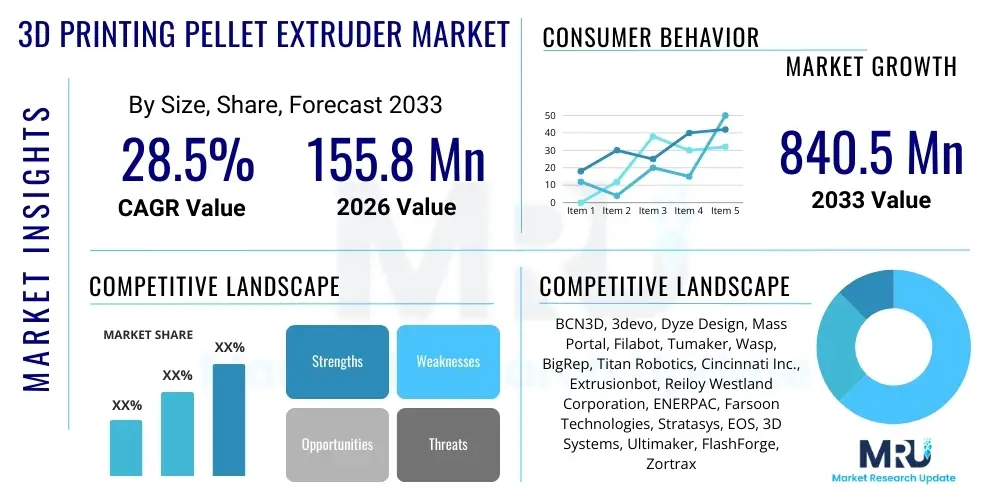

The 3D Printing Pellet Extruder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2026 and 2033. The market is estimated at USD 155.8 Million in 2026 and is projected to reach USD 840.5 Million by the end of the forecast period in 2033.

3D Printing Pellet Extruder Market introduction

The 3D Printing Pellet Extruder Market encompasses technologies and devices designed to process raw polymer pellets directly into filament or utilize them in large-format additive manufacturing systems. These extruders, often referred to as granular or pellet-based extruders, bypass the conventional filament production stage, offering significant cost savings and greater material flexibility compared to traditional fused deposition modeling (FFDM) or fused filament fabrication (FFF) methods. This technological shift is pivotal for industrial applications where material costs and compatibility with engineering-grade, high-performance polymers are critical factors. The market growth is fundamentally driven by the increasing demand for sustainable manufacturing practices and the capability to use recycled or custom composite materials directly.

The core product is the extruder head assembly, which features a heated barrel and a screw mechanism designed to melt and pressurize thermoplastic pellets before extrusion through a nozzle. Major applications span several high-value sectors, including aerospace, automotive prototyping and tooling, construction, and specialized consumer goods manufacturing. These extruders enable the use of industrial-grade resins that are not readily available or cost-effective in standard filament form, such as carbon fiber-filled polycarbonates, specialized PEEK, and custom material blends. The ability to utilize virgin, industrial pellets directly translates into parts possessing superior mechanical properties and thermal resistance, making this technology crucial for functional prototypes and end-use parts.

Key benefits driving market adoption include substantial reduction in material costs, which can be up to 10 times lower than purchasing pre-spooled filament, and enhanced material versatility, allowing users to rapidly test and deploy novel material formulations. Furthermore, pellet extruders are integral to the expansion of large-format additive manufacturing (LFAM), where the volume and speed of material deposition necessitate high throughput systems that filament-based methods cannot effectively sustain. The market is experiencing technological evolution with advancements in screw geometry, thermal management systems, and sophisticated closed-loop control mechanisms to ensure precise material flow and thermal stability, thus increasing the reliability and repeatability required for demanding industrial environments.

3D Printing Pellet Extruder Market Executive Summary

The 3D Printing Pellet Extruder Market is characterized by robust business trends centered on industrial integration and material innovation. Manufacturers are increasingly focusing on developing modular and retrofittable extruder systems that can be integrated into existing FFF platforms, lowering the entry barrier for industrial users. Strategic partnerships between material suppliers and extruder manufacturers are accelerating the availability of specialized engineering materials tailored for pellet extrusion processes, specifically high-flow and high-temperature polymers. A dominant business trend involves the shift towards open-source material platforms, encouraging greater customization and adoption among research institutions and specialized manufacturing firms. The imperative to reduce waste and utilize low-cost, high-volume materials is cementing the pellet extruder's role as a cornerstone of economical additive manufacturing.

Regional trends indicate North America and Europe maintaining leadership, primarily driven by strong aerospace, automotive, and defense sectors which demand large, complex, and high-performance parts. These regions benefit from established research ecosystems and early adoption of industrial 3D printing technologies. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by rapid industrialization, increasing governmental investments in manufacturing automation, and the proliferation of low-cost manufacturing hubs in countries like China and India. The focus in APAC is shifting towards utilizing pellet extrusion for tooling, molds, and mass customization, leveraging the material cost advantages inherent in pellet usage. Latin America and MEA are nascent but emerging markets, with initial adoption concentrated within oil & gas and educational research sectors, primarily seeking low-cost prototyping solutions.

Segment trends highlight the dominance of industrial-scale extruders (screw diameters exceeding 30mm) in revenue generation, catering to large-format additive manufacturing systems critical for producing end-use parts in automotive and infrastructure. However, the desktop and laboratory-scale segment (smaller screw diameters) is projected to exhibit rapid volume growth, driven by academic research, custom filament creation, and small-scale prototyping due to their accessibility and lower investment requirements. Material segmentation is leaning heavily towards standard thermoplastics like PLA and ABS for initial adoption, yet high-performance polymers such as PEEK, PEI, and specialized composites containing carbon fiber or glass fillers are driving the premium segment's growth, reflecting the market's trajectory towards high-value industrial applications.

AI Impact Analysis on 3D Printing Pellet Extruder Market

User queries regarding the intersection of Artificial Intelligence (AI) and 3D printing pellet extrusion overwhelmingly focus on process optimization, quality control, and predictive maintenance. Common questions include: "How can AI minimize material waste during pellet extrusion?" "Can machine learning predict nozzle clogging or material flow deviations?" and "What role does AI play in developing new custom pellet formulations?" This collective interest highlights user expectations that AI will move beyond simple operational monitoring to actively manage the complex variables involved in melting, mixing, and extruding granular plastics, particularly in large-format printing where failures are costly. Users are keen on leveraging AI for real-time thermal and flow dynamics corrections, ensuring part integrity across complex geometries, and optimizing print parameters for novel, untested composite materials. The goal is automation, repeatability, and sophisticated failure mitigation, transforming the pellet extrusion process from an operator-intensive technique into a highly reliable industrial standard.

AI's primary influence will be in enhancing the reliability and throughput of pellet extrusion systems, addressing one of the technology’s major historical drawbacks: inconsistency with varied material batches. AI algorithms can ingest massive datasets derived from thermal cameras, pressure sensors, and visual inspection systems, allowing for the creation of digital twins of the extrusion process. These models can instantaneously adjust screw speed, barrel temperature profiles, and cooling rates to compensate for ambient variations or inconsistencies in pellet size and moisture content. This capability is paramount for printing exotic, high-temperature materials where temperature stability window is extremely narrow. Furthermore, Generative AI is being explored for optimizing the internal geometry of the extruder screw itself, seeking designs that maximize melt efficiency and minimize shear stress degradation, leading to superior material properties in the final printed part.

The deployment of machine learning for predictive maintenance represents a significant cost-saving opportunity. By analyzing vibration data and current draw from the extruder motor, AI can anticipate component wear, such as screw erosion or heater element failure, scheduling maintenance before catastrophic equipment breakdown occurs. This continuous monitoring capability significantly increases the uptime of expensive large-format printers. Ultimately, the integration of AI transforms pellet extrusion into a smart manufacturing process, accelerating the development cycle for new materials and ensuring that printed components meet stringent aerospace and automotive quality standards by minimizing porosity and maximizing layer adhesion through precise, AI-driven process control.

- AI-driven real-time thermal compensation for enhanced material stability.

- Machine Learning optimization of material flow rate and deposition consistency.

- Predictive maintenance analytics for extruder screw wear and heating elements.

- Automated defect detection and correction using computer vision during the printing process.

- Generative AI assistance in formulating and optimizing custom material blends (composites, recycled plastics).

- Closed-loop control systems powered by AI to ensure layer adhesion and geometric accuracy.

DRO & Impact Forces Of 3D Printing Pellet Extruder Market

The 3D Printing Pellet Extruder Market is strongly influenced by compelling drivers, persistent restraints, and transformative opportunities, all synthesized into high-impact forces shaping its trajectory. The primary driver is the necessity for cost reduction in additive manufacturing, achieved through the utilization of inexpensive raw pellets versus costly specialized filaments, making industrial printing economically viable for larger components and higher volumes. Simultaneously, the demand for utilizing engineering-grade and highly customized composite materials that are often difficult or impossible to convert into standard filament form is pushing adoption, particularly in specialized sectors like aerospace and medical devices. These two core drivers—cost efficiency and material versatility—form a potent force accelerating industrial migration toward pellet extrusion technology. Furthermore, the proliferation of large-format 3D printing (LFAM) necessitates the high material throughput capacity inherent in pellet systems, solidifying their market position in infrastructure and tooling production.

However, the market faces significant restraints that temper its explosive growth potential. A major hurdle is the complexity associated with processing and calibrating various pellet materials. Unlike standardized filaments, raw pellets exhibit greater batch-to-batch variation in size, moisture content, and flow characteristics, requiring sophisticated and often manual calibration of the extruder parameters, leading to a steeper learning curve for operators. Furthermore, the technology currently lags in fine feature resolution compared to high-end FFF systems, making it less suitable for applications requiring extremely intricate details. The initial capital investment for high-throughput pellet extrusion systems and compatible printing gantry systems is also substantially higher than traditional desktop printers, presenting a financial barrier for smaller enterprises or research facilities with limited budgets. These restraints necessitate ongoing technological improvements in ease-of-use and resolution capabilities.

The central opportunity lies in the burgeoning circular economy and sustainable manufacturing movement. Pellet extruders are ideally positioned to utilize recycled plastics (post-consumer and industrial waste) and bio-plastics directly, offering manufacturers a clear path towards sustainable operations and reduced carbon footprint. Another significant opportunity exists in the decentralized manufacturing model, where customized pellets can be manufactured locally and extruded on-site, shortening supply chains and enabling just-in-time production, particularly in remote locations or during crises. The impact forces acting on the market are highly positive, primarily driven by the "Economies of Scale" force, where pellet extrusion unlocks cost-effective production of large parts, fundamentally disrupting traditional manufacturing lead times and costs, ensuring long-term market expansion.

Segmentation Analysis

The 3D Printing Pellet Extruder Market is meticulously segmented based on key factors including product type (focusing on size and throughput capacity), material utilized (distinguishing between commodity and engineering polymers), and the crucial end-use industry applications. This segmentation provides a granular view of market dynamics, revealing where investment and innovation are concentrated. The market structure reflects the dichotomy between R&D focused desktop solutions and high-volume industrial machines, each addressing distinct user needs regarding resolution, speed, and material handling capabilities. Understanding these segments is vital for businesses aiming to tailor their product development and marketing strategies to specific high-growth verticals.

- By Product Type:

- Desktop/Laboratory Extruders (Low throughput, R&D focused)

- Industrial Extruders (High throughput, Large format manufacturing)

- Integrated Systems (Pellet extrusion head sold as part of a complete printer)

- Standalone/Retrofit Extrusion Heads (Sold separately for upgrading existing printers)

- By Material Type:

- Standard Thermoplastics (PLA, ABS, PETG)

- Engineering Thermoplastics (Nylon, PC, ASA)

- High-Performance Polymers (PEEK, PEI, PSU, PPSU)

- Composite Materials (Carbon Fiber Reinforced, Glass Fiber Reinforced, Wood/Metal Filled)

- By Application:

- Prototyping and Tooling

- Functional Parts Manufacturing (End-use parts)

- Research and Development (Material testing and creation)

- Custom Filament Manufacturing

- By End-Use Industry:

- Automotive

- Aerospace & Defense

- Construction

- Medical Devices

- Consumer Goods

- Academic & Research Institutions

Value Chain Analysis For 3D Printing Pellet Extruder Market

The value chain for the 3D Printing Pellet Extruder Market starts upstream with raw material procurement, involving major petrochemical and polymer companies that supply the base thermoplastic pellets (e.g., HDPE, PEEK, ABS). This upstream segment is characterized by high volume, low cost, and stringent quality control, as material inconsistencies directly impact extrusion performance. Key activities include polymerization, pelletization, and the integration of additives (such as carbon fibers or flame retardants). Manufacturers of the extruder components, including screw machining specialists, heating element suppliers, and sensor producers, also form a critical part of the upstream segment, demanding high precision engineering to ensure reliable material throughput and temperature control.

The midstream stage centers on the extruder manufacturers and system integrators. These companies design, assemble, and test the pellet extrusion heads, often integrating advanced components like servo motors and sophisticated control software (firmware customized for flow dynamics). This segment adds significant value through intellectual property related to optimized screw geometry and thermal management systems, differentiating products based on throughput, material compatibility, and precision. The midstream players collaborate closely with software developers to create slicers and calibration tools specifically optimized for pellet deposition, addressing the challenges of layer height and cooling inherent in large-volume extrusion.

Downstream activities involve distribution channels, which are bifurcated into direct sales and indirect sales. Direct channels are predominantly used for large industrial systems and customized solutions, facilitating close interaction between the manufacturer and the end-user (e.g., major automotive firms or aerospace OEMs) for installation, training, and maintenance. Indirect channels rely on specialized 3D printing distributors and resellers who cater to SMEs, research institutions, and small-scale manufacturers, providing localized support and rapid fulfillment. The ultimate downstream buyers utilize the technology for applications ranging from creating customized tooling and fixtures to producing large-scale functional end-use parts. The efficiency of the downstream servicing and support network is paramount, as complex industrial machinery requires specialized maintenance to maintain operational uptime.

3D Printing Pellet Extruder Market Potential Customers

The primary consumers and end-users of 3D Printing Pellet Extruders are large-scale industrial manufacturers across sectors requiring high material throughput, cost-efficiency, and the use of specialized engineering polymers. The largest potential customer base resides within the automotive industry, which utilizes these extruders for producing large-scale jigs, fixtures, molds, and prototyping components, leveraging the cost benefits of raw pellets to quickly iterate on tooling designs without the excessive expense of traditional filament. Similarly, the aerospace and defense sectors are critical customers, specifically demanding the use of high-performance polymers (like PEEK and PEI) and composite pellets for mission-critical, lightweight functional parts where material traceability and mechanical integrity are non-negotiable.

Another rapidly expanding customer segment is construction and infrastructure, particularly those involved in large-format concrete or polymer printing applications. These customers utilize pellet extruders for large-scale production of non-load-bearing architectural components, customized forms, and specialty insulation structures, capitalizing on the ability of pellet systems to handle large volumes of material rapidly. Furthermore, academic research laboratories and specialized material science companies constitute a significant customer group, as pellet extruders allow them to rapidly compound, test, and prototype new thermoplastic formulations, including blends incorporating recycled content or bio-based polymers, effectively serving as in-house custom filament manufacturers for R&D purposes.

Finally, the tooling and molding sector—including foundries and injection molding companies—represent robust potential customers. They use pellet extrusion technology to rapidly manufacture sacrificial tooling, sandcasting patterns, or direct molds, significantly reducing lead times and costs associated with traditional machining processes. These customers value the ability to print robust parts with engineering plastics that mimic the mechanical properties required for the subsequent casting or molding process. The shared characteristic among all potential customers is the need to minimize operational material costs while maximizing material flexibility and scaling capabilities beyond the scope of traditional filament-based 3D printing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 155.8 Million |

| Market Forecast in 2033 | USD 840.5 Million |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BCN3D, 3devo, Dyze Design, Mass Portal, Filabot, Tumaker, Wasp, BigRep, Titan Robotics, Cincinnati Inc., Extrusionbot, Reiloy Westland Corporation, ENERPAC, Farsoon Technologies, Stratasys, EOS, 3D Systems, Ultimaker, FlashForge, Zortrax |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

3D Printing Pellet Extruder Market Key Technology Landscape

The technological core of the 3D Printing Pellet Extruder Market revolves around specialized screw extrusion principles adapted for additive manufacturing deposition rates and precision. Unlike traditional plastic injection molding extruders, 3D printing pellet systems require rapid start-stop capabilities and precise volumetric control. Key technologies include optimized screw geometry, which must efficiently melt and convey pellets with minimal material degradation. Screw designs are highly customized, often featuring high-shear or low-shear zones depending on the intended material (e.g., highly abrasive composites vs. delicate bio-polymers), ensuring homogeneous melt pool creation while maintaining necessary flow characteristics for rapid deposition. Dual-screw or twin-screw configurations are gaining traction in industrial systems to handle highly filled composites and improve material mixing capabilities for color or additive incorporation.

Thermal management and heating technology are paramount, especially for high-temperature polymers like PEEK, which require temperatures exceeding 400°C. Advanced systems utilize multi-zone heating elements and precise PID controllers to maintain highly stable temperature profiles throughout the barrel and nozzle, mitigating thermal drift that leads to porosity and weakened layer adhesion. Innovations in nozzle technology, including actively heated nozzles and interchangeable inserts made of wear-resistant materials (e.g., tungsten carbide), are crucial for managing abrasive composite materials without premature failure. The integration of high-resolution temperature and pressure sensors along the melt path provides real-time data for closed-loop control systems, enhancing process reliability and reproducibility.

Furthermore, the reliance on advanced material handling is a distinguishing technological feature. Pellet extruders require robust drying systems (often integrated desiccant dryers) to ensure raw pellets are free of moisture, preventing material degradation (hydrolysis) and surface defects during extrusion. Sophisticated software algorithms and specialized slicers are essential, capable of compensating for the high volumetric output and anisotropic cooling effects typical of large-format pellet printing. These slicers manage variable layer height deposition and dynamic toolpath planning to optimize fill density and minimize warping, transforming the raw pellet input into structurally sound, large-scale components. Sensor fusion, combining visual inspection, thermal feedback, and mechanical data, is the emerging technological trend enabling the AI-driven optimization discussed previously, promising significant improvements in quality control and process automation.

Regional Highlights

- North America (NA): North America dominates the market in terms of technology adoption and revenue share, primarily due to the strong presence of major aerospace and defense contractors and the automotive sector's high investment in advanced manufacturing techniques. The region benefits from a robust ecosystem of research institutions and key market players, driving the development of highly specialized, high-throughput industrial pellet extrusion systems. The U.S. government's focus on reshoring manufacturing and developing digital factory capabilities further accelerates the demand for large-format, cost-effective additive solutions, cementing NA's role as a leader in industrial-scale pellet printing applications, particularly those involving high-performance polymers.

- Europe: Europe represents a mature market characterized by stringent quality standards in industries like medical technology, machinery manufacturing, and complex tooling. Countries such as Germany, the UK, and Italy are leading adopters, driven by the strong emphasis on Industry 4.0 integration and sustainable manufacturing practices. The European market exhibits high demand for pellet extruders capable of handling customized and recycled materials, aligning with regional environmental directives. Innovation often focuses on integrating pellet extrusion with robotics and multi-axis systems to enable large-volume, continuous production runs and complex geometry creation.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region globally, fueled by massive government initiatives in China, South Korea, and India to modernize manufacturing sectors and increase industrial automation. The growth is particularly strong in the automotive supply chain and consumer electronics industries, which seek the cost advantages provided by raw pellet materials for mass customization and rapid tooling. While historically focused on lower-cost desktop solutions, the region is rapidly transitioning to large-format industrial pellet systems to address infrastructure and construction needs, capitalizing on local material sourcing opportunities.

- Latin America (LATAM): The LATAM market is emerging, with adoption concentrated in oil & gas, mining, and specific localized automotive manufacturing hubs in Brazil and Mexico. Demand is generally driven by the need for on-demand replacement parts and low-cost prototyping solutions. Market growth is gradually accelerating as local manufacturers recognize the competitive advantages of utilizing locally sourced, lower-cost pellets, offsetting high import costs associated with traditional 3D printing filaments.

- Middle East and Africa (MEA): MEA is still in an early adoption phase, with primary usage centered in the energy sector (oil & gas, particularly in Saudi Arabia and UAE) and higher education/research institutions. Investments are strategically focused on utilizing additive manufacturing to localize supply chains and reduce reliance on international sourcing for critical spares and tooling. The market shows great potential, particularly as regional infrastructure projects expand, requiring large-scale, customizable polymer components that pellet extruders can efficiently produce.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the 3D Printing Pellet Extruder Market.- BCN3D

- 3devo

- Dyze Design

- Mass Portal

- Filabot

- Tumaker

- Wasp

- BigRep

- Titan Robotics

- Cincinnati Inc.

- Extrusionbot

- Reiloy Westland Corporation

- ENERPAC

- Farsoon Technologies

- Stratasys

- EOS

- 3D Systems

- Ultimaker

- FlashForge

- Zortrax

Frequently Asked Questions

Analyze common user questions about the 3D Printing Pellet Extruder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary cost advantage of using a 3D printing pellet extruder?

The primary cost advantage stems from utilizing raw polymer pellets, which are commodity materials purchased in bulk at significantly lower prices—often 5 to 10 times less—than pre-spooled 3D printing filament. This substantial reduction in material input cost makes large-volume additive manufacturing economically feasible, particularly for large parts or production runs.

How does pellet extrusion impact the mechanical properties of the printed parts?

Pellet extrusion can enhance mechanical properties, especially in large-format printing, due to its higher material throughput and ability to use specialized, high-performance polymers and high-fill composites. The system allows for more consistent material processing and optimal layer deposition, reducing porosity and maximizing the structural integrity often required for engineering-grade functional components and tooling.

What types of materials are compatible with pellet extrusion technology?

Pellet extrusion technology offers broad material compatibility, ranging from common thermoplastics like PLA, ABS, and PETG to demanding engineering plastics such as Nylon, PC, and high-performance polymers like PEEK and PEI. Crucially, these systems are also optimized to handle custom composite materials containing high loadings of carbon fiber or glass filler directly in pellet form.

Is pellet extrusion suitable for high-resolution 3D printing applications?

Generally, pellet extrusion systems excel at high throughput and large-format printing but may offer slightly lower fine feature resolution compared to high-end, dedicated filament (FFF) systems, particularly those using smaller nozzles. While suitable for functional parts and tooling, precision components requiring micron-level detail often utilize alternative, higher-resolution additive manufacturing methods.

What are the main technical challenges associated with operating pellet extruders?

The main technical challenge involves material variability and calibration. Raw pellets can differ in size, shape, and moisture content, requiring continuous calibration of extruder parameters (temperature profile, screw speed, and deposition rate) to ensure consistent melt flow and defect-free printing, often requiring a higher level of operational expertise.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager