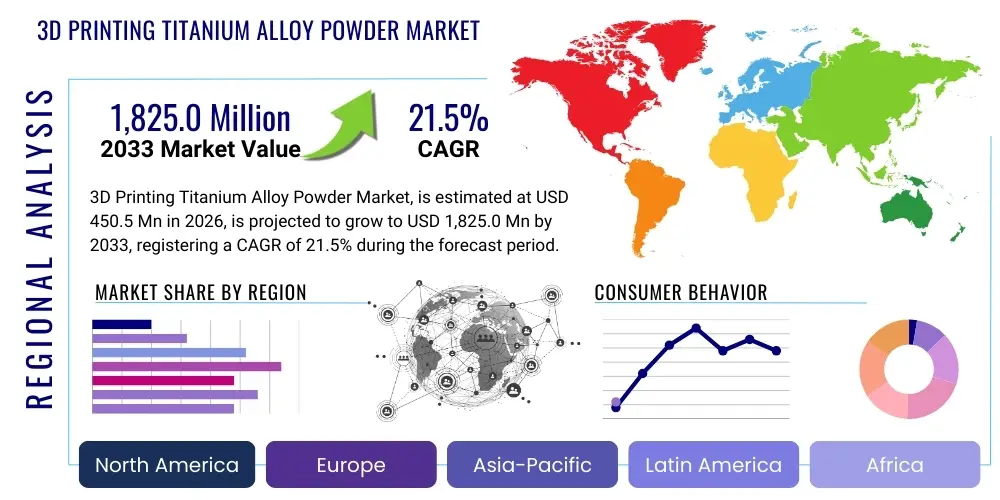

3D Printing Titanium Alloy Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434830 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

3D Printing Titanium Alloy Powder Market Size

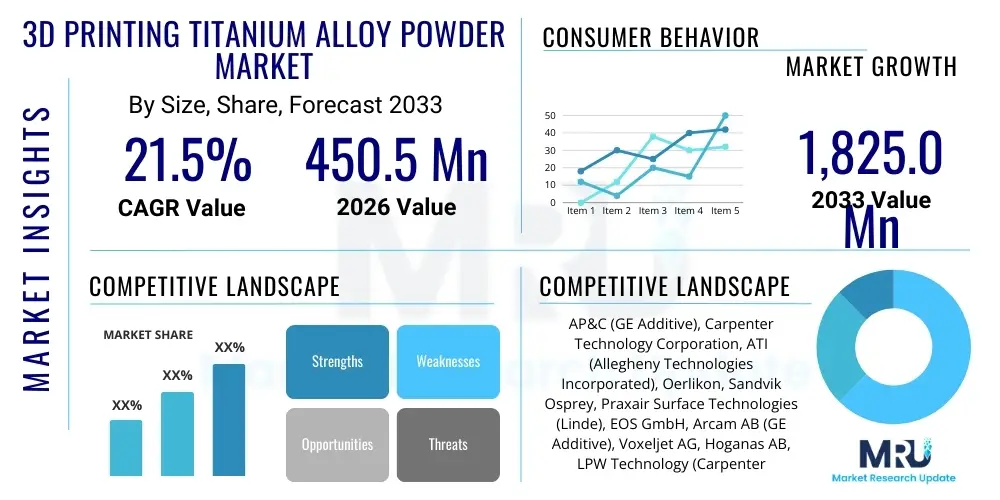

The 3D Printing Titanium Alloy Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 21.5% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 1,825.0 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for high-performance materials in critical sectors such as aerospace, medical device manufacturing, and high-end automotive applications where lightweight components and superior mechanical properties are non-negotiable requirements for operational efficiency and safety. The increasing investment in metal additive manufacturing technologies globally, coupled with advancements in powder production techniques ensuring high purity and consistent spherical morphology, further cements this robust growth trajectory.

3D Printing Titanium Alloy Powder Market introduction

The 3D Printing Titanium Alloy Powder Market encompasses the production, distribution, and consumption of specialized titanium-based powders utilized primarily in additive manufacturing (AM) processes like Selective Laser Melting (SLM), Electron Beam Melting (EBM), and Directed Energy Deposition (DED). These powders, predominantly based on alloys like Ti-6Al-4V, are characterized by exceptional mechanical strength, superior corrosion resistance, high biocompatibility, and an advantageous strength-to-weight ratio, making them essential materials for producing complex, high-precision components. The product description centers on highly spherical, flowable, and contamination-free powder particles optimized for layer-by-layer fusion. Major applications span structural components in aerospace engines and airframes, custom surgical implants and prosthetics in the medical field, performance parts in motorsports, and robust tooling in industrial machinery. These materials offer benefits including significant weight reduction, design freedom leading to complexity optimization, reduced material waste compared to traditional subtractive manufacturing, and faster iteration cycles for prototypes and end-use parts. Driving factors include the global shift towards customized and localized manufacturing, rapid certification of AM parts in regulated industries, and continuous cost reduction associated with powder atomization and recycling processes.

The market is defined by stringent quality requirements due to the demanding nature of end-use applications. For instance, aerospace components require powders with extremely tight particle size distributions, high sphericity to ensure optimal powder bed density, and zero porosity or contamination to maintain structural integrity under extreme operating conditions. The increasing availability of various titanium alloys beyond the standard Ti-6Al-4V, such as high-temperature alloys or those tailored for enhanced wear resistance, is expanding the addressable market across diverse industrial segments. Furthermore, the commercialization of large-format 3D printers capable of handling titanium powders at industrial scales is transitioning additive manufacturing from prototyping tool to mainstream production method, particularly for medium-volume, high-value components.

Technological improvements in powder metallurgy, such as Plasma Rotating Electrode Process (PREP) and advanced gas atomization, are key determinants of market growth, as they ensure the high quality necessary for mission-critical parts. The integration of closed-loop systems for powder handling and quality assurance, often incorporating sensors and artificial intelligence, is enhancing the reproducibility and reliability of the final components. This focus on industrialization and quality control is critical for overcoming historical barriers to adoption, particularly regarding concerns over part consistency and certification timelines in highly regulated industries. As manufacturing costs decrease through efficiency gains and material recycling optimization, the economic viability of titanium AM parts increases, further accelerating market penetration.

3D Printing Titanium Alloy Powder Market Executive Summary

The 3D Printing Titanium Alloy Powder Market is experiencing transformative growth, underpinned by significant technological advancements and strong commercial adoption across key vertical sectors. Business trends show a robust pattern of strategic mergers and acquisitions, where established material science companies are integrating powder manufacturing expertise with AM system providers to offer comprehensive solutions, thereby streamlining the supply chain and enhancing material traceability. Regional trends indicate that North America and Europe currently dominate the market share, fueled by mature aerospace and medical device industries and substantial governmental and private investment in R&D infrastructure related to additive manufacturing. However, the Asia Pacific region, particularly China and Japan, is projected to exhibit the highest CAGR due to rapid industrialization, increasing defense expenditure, and growing efforts to localize the production of medical implants. Segmentation trends emphasize the dominance of the Ti-6Al-4V alloy type, given its versatile mechanical properties and established certification history, while the Plasma Atomization and PREP manufacturing processes are gaining traction for producing highly spherical, cleaner powders required for high-end AM systems. The application segment continues to be led by aerospace and medical, representing the primary consumption drivers, characterized by high-value component production benefiting significantly from topology optimization and reduction in material waste.

Key strategic shifts driving market dynamics include the increasing focus on sustainable manufacturing practices, with titanium powder recyclability becoming a crucial factor in purchasing decisions. Market participants are heavily investing in developing cost-effective production methods for titanium powders, addressing the historically high cost that has restricted broader market entry. Furthermore, collaborations between powder manufacturers and end-users are becoming common to tailor powder specifications—such as particle size distribution and chemical composition—to specific AM machine platforms and application requirements, optimizing print parameters and ensuring part quality. This tailored approach is vital for penetrating sectors like high-performance automotive and industrial tooling, which require highly specialized material characteristics for extreme operating environments.

In essence, the market transition is characterized by a move from bespoke, specialized manufacturing to standardized, industrialized production. Standardization efforts, supported by organizations like ASTM and ISO, are crucial for establishing benchmarks for titanium powder quality and AM component performance, thereby boosting customer confidence and accelerating mainstream adoption. The continuous expansion of metal AM installed bases worldwide is directly translating into heightened demand for specialized, high-purity titanium alloys, cementing the market’s positive long-term outlook. The market is strategically moving toward scalable, automated production environments where material quality assurance and digital integration are paramount to achieving repeatable and cost-competitive manufacturing outputs.

AI Impact Analysis on 3D Printing Titanium Alloy Powder Market

Common user questions regarding AI's impact on the 3D Printing Titanium Alloy Powder Market frequently revolve around optimizing powder quality inspection, predicting print failures, and personalizing material compositions. Users are keenly interested in how Artificial Intelligence can mitigate variability—a persistent challenge in AM—by analyzing complex datasets derived from powder production (e.g., atomization parameters, morphology metrics) and linking these directly to final component performance and defect rates. The key themes summarized from user inquiries focus on AI's ability to enhance material traceability, improve process control in real-time within the printing chamber, and ultimately, reduce the overall cost of qualification and certification for critical titanium parts. Expectations are high concerning predictive maintenance for AM equipment and using machine learning algorithms to rapidly iterate new alloy formulations, significantly shortening the materials development lifecycle. Users anticipate that AI will serve as the indispensable tool for achieving the necessary reliability and scalability required for the mass production of titanium AM components, especially in highly regulated sectors like aerospace and medical implants.

- AI-driven optimization of powder atomization parameters leads to narrower Particle Size Distribution (PSD) and improved sphericity, directly enhancing powder bed density.

- Machine learning algorithms predict material feedstock quality variations, ensuring consistency and minimizing batch-to-batch discrepancies in chemical composition.

- Real-time monitoring using computer vision and sensor fusion analyzes powder bed consistency and melt pool dynamics during printing, preventing defects related to material flow or thermal stress.

- AI accelerates the qualification process by simulating mechanical performance based on microstructure analysis derived from print parameters and powder characteristics.

- Predictive maintenance schedules for 3D printing systems are optimized by AI analysis of wear patterns related to titanium powder abrasion, reducing unexpected downtime.

- Development of novel titanium alloy compositions is sped up through generative design and AI simulation, tailoring materials for specific extreme environments (e.g., high temperature, wear resistance).

- Enhanced material traceability systems utilize AI to track powder lineage from raw ingot through atomization, printing, and post-processing, crucial for regulated industries.

DRO & Impact Forces Of 3D Printing Titanium Alloy Powder Market

The market dynamics for 3D Printing Titanium Alloy Powder are shaped by powerful Drivers, inherent Restraints, and significant Opportunities, which together form the Impact Forces propelling or hindering growth. Primary drivers include the massive uptake of Additive Manufacturing in the aerospace sector for weight reduction and fuel efficiency, coupled with the increasing demand for customized, high-quality medical implants utilizing titanium's biocompatibility. Conversely, major restraints involve the high initial cost of titanium powder production compared to conventional materials, the complexity and expense associated with material qualification and certification processes for AM parts, and lingering concerns regarding consistency and repeatability of component properties across different AM platforms. Opportunities emerge from the potential for material recycling and reuse, expansion into new application areas like electric vehicles (EVs) and high-stress industrial tooling, and the development of cheaper, cleaner powder production technologies (e.g., novel atomization methods). These factors converge to exert substantial impact forces: the increasing regulatory acceptance acts as a push force, driving standardization, while the supply chain fragility and material cost act as friction forces, necessitating technological innovation to maintain momentum.

The core Impact Forces are characterized by a strong push from technological maturity and application success. The shift from prototyping to series production in aerospace and medical domains creates stable, high-volume demand. Furthermore, the competitive advantage gained by using AM—such as consolidating multiple parts into one complex geometry—justifies the premium cost of titanium powder. However, the high capital expenditure required for powder manufacturing facilities and sophisticated AM systems presents a significant barrier to entry for smaller players, centralizing market control among a few large, established corporations. This centralization also influences pricing and R&D direction. The ongoing global effort to establish robust standards for powder specification and part verification (especially fatigue performance) is crucial, as certified quality directly translates to market acceptance and accelerated adoption in safety-critical applications.

The long-term opportunity lies in scaling powder production volumes to achieve economies of scale, thereby significantly reducing the material cost per kilogram. Furthermore, advancements in post-processing technologies, such as Hot Isostatic Pressing (HIP) tailored for AM components, are improving the mechanical properties and reliability of titanium parts, thereby broadening their addressable market. The focus is shifting toward developing specialized, application-specific titanium alloys that can outperform traditional wrought materials in certain AM processes. Successfully navigating the regulatory landscape, particularly in the medical sphere where customized implants offer clear patient benefits, represents a substantial high-value growth avenue for powder manufacturers capable of ensuring the highest level of material purity and traceability.

Segmentation Analysis

The 3D Printing Titanium Alloy Powder Market is comprehensively segmented based on Alloy Type, Manufacturing Process, and Application. This segmentation provides a structured view of market dynamics, revealing where investment and innovation are concentrated. The Alloy Type category is dominated by Ti-6Al-4V due to its proven performance, but newer alloys are emerging to meet specific industry needs. Manufacturing Process segmentation highlights the technological competition between traditional methods like Gas Atomization and advanced methods like Plasma Atomization (PA) and Plasma Rotating Electrode Process (PREP), which yield superior spherical particles ideal for powder bed fusion systems. Application analysis consistently points toward Aerospace and Medical as the key revenue generators, leveraging the material's unique properties, followed by emerging opportunities in high-end Automotive and general Industrial sectors that seek performance enhancements and weight savings through customized manufacturing solutions.

- By Alloy Type:

- Ti-6Al-4V (Grade 5 and Grade 23)

- Pure Titanium (Grade 1, 2, 4)

- Titanium Aluminide (TiAl)

- Other Titanium Alloys (e.g., Ti-5Al-5V-5Mo-3Cr)

- By Manufacturing Process:

- Gas Atomization (GA)

- Plasma Atomization (PA)

- Plasma Rotating Electrode Process (PREP)

- Hydride-Dehydride (HDH)

- Other Processes (e.g., Cold Hearth Melting)

- By Application:

- Aerospace & Defense (Structural Components, Engine Parts, Military Hardware)

- Medical & Dental (Orthopedic Implants, Dental Prosthetics, Surgical Instruments)

- Automotive (Performance Parts, Motorsport Components)

- Industrial (Tooling, Energy, Chemical Processing Equipment)

- Research & Development

Value Chain Analysis For 3D Printing Titanium Alloy Powder Market

The value chain for 3D Printing Titanium Alloy Powder is characterized by high complexity and specialized technical requirements, beginning with upstream raw material sourcing and culminating in the highly technical downstream application processes. Upstream analysis involves the procurement of high-purity titanium sponge and alloying elements (such as aluminum and vanadium). This stage is critical for material quality, as contamination here can severely impact final part performance. Raw materials are then processed through specialized primary melting processes (e.g., vacuum arc remelting or cold hearth melting) to create high-quality ingots. The subsequent and most value-adding step is the powder manufacturing process—utilizing advanced methods like PREP or Plasma Atomization—which transforms the ingot into highly spherical, flowable powder meeting stringent AM specifications. The efficiency and quality control implemented at the powder production stage dictate the material's suitability for different AM platforms. Direct and indirect distribution channels facilitate the movement of these powders. Direct channels involve large manufacturers selling directly to major end-users (e.g., aerospace OEMs), providing technical support and tailored batch sizes. Indirect channels involve specialized material distributors who cater to smaller industrial users, service bureaus, and research institutions, often providing smaller quantities and localized support.

Downstream analysis focuses on the integration and use of the powder within the additive manufacturing ecosystem. This stage involves AM system manufacturers (printer OEMs), service bureaus, and finally, the end-users. The powder must be compatible with specific AM technologies (SLM, EBM, DED) and their proprietary parameters. Service bureaus play a crucial intermediary role, transforming the powder into certified components. End-users then integrate these components into final products, often requiring extensive post-processing (e.g., heat treatment, HIP, machining) and non-destructive testing (NDT). Effective collaboration across this entire chain—from material scientists defining powder specifications to AM engineers optimizing print strategies—is essential for maximizing component quality and reducing time-to-market. Transparency and material traceability across the supply chain are paramount, particularly for life-critical applications.

The dominant profit pools in the value chain reside in the specialized powder manufacturing and the downstream high-value AM component production and certification services. The high barriers to entry in specialized powder production (due to required capital and expertise) give material suppliers significant leverage. Furthermore, successful component qualification in sectors like aerospace creates substantial recurring revenue streams for those service providers and OEMs that master the complex quality assurance requirements. Optimization efforts across the chain are currently focused on reducing the cost of powder recycling and enabling more efficient, high-yield atomization processes, striving to shift titanium AM from a niche solution to a competitive manufacturing alternative for a broader range of applications.

3D Printing Titanium Alloy Powder Market Potential Customers

Potential customers for 3D Printing Titanium Alloy Powder are highly specialized organizations requiring components with exceptional strength, light weight, and bio-inert properties, often operating under extremely high regulatory and performance standards. The primary end-users or buyers of the product are major Aerospace & Defense OEMs (Original Equipment Manufacturers) such as Boeing, Airbus, and leading defense contractors, who utilize titanium powders for mission-critical parts like jet engine components, airframe structures, and specialized military hardware where performance gains translate directly to operational advantages. The second major customer group comprises Medical Device Manufacturers, including orthopedic implant leaders and dental product companies, who leverage titanium's biocompatibility for personalized hip, knee, and spine implants, as well as customized dental restorations. Furthermore, specialized AM Service Bureaus act as key intermediaries, purchasing large volumes of powder to produce parts for clients across various industries who lack in-house AM capabilities. Emerging customers include high-performance automotive teams (Formula 1, NASCAR) and industrial heavy equipment manufacturers seeking improved tooling life and reduced operational weight.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 1,825.0 Million |

| Growth Rate | 21.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AP&C (GE Additive), Carpenter Technology Corporation, ATI (Allegheny Technologies Incorporated), Oerlikon, Sandvik Osprey, Praxair Surface Technologies (Linde), EOS GmbH, Arcam AB (GE Additive), Voxeljet AG, Hoganas AB, LPW Technology (Carpenter Additive), Heraeus, TLS Technik Spezialpulver GmbH, Ametek Inc., GKN Powder Metallurgy. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

3D Printing Titanium Alloy Powder Market Key Technology Landscape

The technological landscape of the 3D Printing Titanium Alloy Powder market is predominantly focused on achieving superior powder characteristics—namely high sphericity, low oxygen content, high flowability, and narrow particle size distribution (PSD)—necessary for optimal performance in powder bed fusion processes. The key technologies employed are advanced atomization methods. Plasma Atomization (PA) and Plasma Rotating Electrode Process (PREP) are critical because they produce clean, perfectly spherical powders with minimal satellites and superior flowability, reducing defects during printing and maximizing powder bed density. While Gas Atomization (GA) remains a high-volume, cost-effective method, it often yields a broader PSD and less perfect spherical morphology compared to plasma-based techniques. The shift toward plasma-based methods reflects the industry’s need for the highest quality feedstock, particularly for critical aerospace and medical components where certification requires maximum material integrity. Continuous innovation in these processes aims to increase yield rates and reduce operational costs, making high-quality titanium powder more economically accessible for mainstream production applications.

Beyond powder production, technology is heavily invested in powder handling and recycling systems. Because titanium is highly reactive, integrated, inert atmosphere handling systems are crucial for maintaining powder purity and preventing oxidation or moisture absorption, which can severely compromise the mechanical properties of the final part. Sophisticated sieving and conditioning equipment, often integrated with the 3D printing machine itself, ensure that recycled, unused powder can be safely re-introduced into the printing cycle, significantly improving material utilization rates and reducing overall manufacturing costs. The development of specialized titanium alloy compositions designed specifically for AM is also a major focus; these new alloys are formulated to mitigate cracking and residual stress issues inherent in rapid solidification during the laser or electron beam melting process, expanding the design envelope for high-performance parts.

Furthermore, digital technologies, including advanced simulation software and in-situ monitoring tools, are integral to the current technology landscape. Simulation tools predict how different titanium powder characteristics (e.g., flowability, heat absorption) will behave within the AM machine, enabling engineers to optimize part geometry and print parameters before physical production. In-situ monitoring, utilizing high-speed cameras and thermal sensors, tracks the melt pool consistency and microstructure formation in real-time, providing the data necessary for immediate process correction or post-build quality verification. This integration of material science, mechanical engineering, and digital feedback loops is essential for achieving the industrialization of titanium AM, ensuring reliable, certified, and cost-effective production outputs.

Regional Highlights

The global 3D Printing Titanium Alloy Powder market exhibits distinct regional dynamics driven by varying levels of industrial maturity, regulatory frameworks, and sector-specific demand. North America, particularly the United States, represents the largest market share, attributable to the presence of major aerospace and defense contractors and the highest concentration of advanced medical device manufacturers globally. Robust R&D funding from government agencies (like NASA and DoD) and aggressive adoption of AM technology for certified, mission-critical applications solidify the region's dominance. This region benefits from a mature ecosystem where powder suppliers, machine OEMs, and end-users collaborate closely to accelerate material and process qualification, ensuring consistent high-volume demand for premium titanium powders such as aerospace-grade Ti-6Al-4V.

Europe holds the second-largest market share, driven by strong manufacturing sectors in Germany, France, and the UK, focusing heavily on high-end automotive, specialized industrial machinery, and the second-largest global aerospace industry base. European regulatory bodies have been proactive in standardizing AM processes, fostering greater industry confidence. Countries like Germany are leaders in industrial AM applications, utilizing titanium powders for tooling and complex machine components where weight reduction and material performance are prioritized. Scandinavian countries, with their strong material science heritage, are also significant contributors to specialized powder production and innovative AM applications in oil and gas and maritime sectors.

Asia Pacific (APAC) is forecast to be the fastest-growing region during the forecast period. This growth is primarily fueled by rapid expansion in manufacturing capacity, increasing defense budgets, and burgeoning medical tourism markets requiring high volumes of domestically produced orthopedic and dental implants. China, with its substantial government investment in indigenous additive manufacturing technology development and rapid industrial modernization, is poised to become a major consumer and producer of titanium alloy powders. Japan and South Korea are also accelerating their adoption, particularly in electronics and high-precision industrial tooling, recognizing AM as a key competitive advantage in advanced manufacturing. The focus in APAC is often on leveraging cost efficiencies while rapidly developing local supply chains capable of meeting global quality standards for titanium feedstock.

- North America: Dominant market, centered around aerospace and defense OEMs; strong regulatory support and high R&D investment. Focus on high-purity, certified Ti-6Al-4V for critical structural parts.

- Europe: Second-largest market; robust industrial and medical sectors; significant standardization efforts; leading in specialized automotive and industrial AM applications.

- Asia Pacific (APAC): Highest CAGR; driven by Chinese manufacturing expansion, increasing regional defense spending, and rapid adoption of AM in medical device localization.

- Latin America, Middle East, and Africa (LAMEA): Emerging markets; growth tied to infrastructure development and localized oil and gas industrial applications; slowly increasing adoption in specialized medical fields.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the 3D Printing Titanium Alloy Powder Market.- AP&C (GE Additive)

- Carpenter Technology Corporation

- ATI (Allegheny Technologies Incorporated)

- Oerlikon

- Sandvik Osprey

- Praxair Surface Technologies (Linde)

- Hoganas AB

- EOS GmbH

- Arcam AB (GE Additive)

- LPW Technology (Carpenter Additive)

- Heraeus

- TLS Technik Spezialpulver GmbH

- Ametek Inc.

- GKN Powder Metallurgy

- Renishaw plc

- Voxeljet AG

- PyroGenesis Canada Inc.

- SLM Solutions Group AG

- TRUMPF GmbH + Co. KG

- Tekna Plasma Systems Inc.

Frequently Asked Questions

Analyze common user questions about the 3D Printing Titanium Alloy Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of demand for titanium alloy powders in additive manufacturing?

The primary driver is the critical need for lightweight, high-strength, and corrosion-resistant components, particularly in the aerospace and medical industries. Titanium alloys like Ti-6Al-4V enable topology optimization, reducing component weight significantly while maintaining superior mechanical integrity required for flight safety and surgical success.

How do Plasma Atomization (PA) and PREP processes improve titanium powder quality?

PA and PREP utilize plasma energy to melt and atomize titanium, resulting in highly spherical powder particles with exceptional flowability and extremely low oxygen content. This superior morphology minimizes defects in the powder bed fusion process (SLM/EBM), leading to higher density and consistent mechanical properties in the final 3D printed parts.

What are the key restraints affecting the widespread adoption of 3D printing titanium?

The main restraints include the significantly high cost of raw titanium powder compared to conventional materials, the lengthy and expensive qualification and certification process required for AM components in regulated industries, and challenges related to process repeatability and standardization across different AM machine platforms.

Which application segment holds the largest market share for titanium alloy powders?

The Aerospace and Defense segment holds the largest market share. Titanium is indispensable for manufacturing critical components such as turbine blades, structural brackets, and complex engine parts where its strength-to-weight ratio directly contributes to fuel efficiency and operational performance of aircraft and defense systems.

How significant is the role of powder recycling in the long-term economics of titanium additive manufacturing?

Powder recycling is highly significant. Given the high initial cost of virgin titanium powder, effective and validated recycling protocols using inert gas handling and advanced sieving maximize material utilization, significantly lowering the total cost of ownership (TCO) for AM systems and improving the commercial viability of titanium 3D printed components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager