3D Profilometers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433450 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

3D Profilometers Market Size

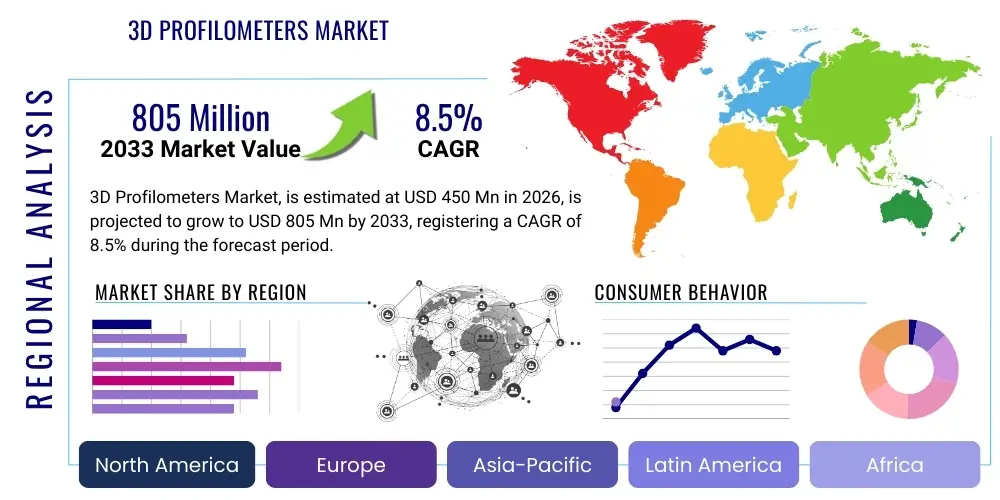

The 3D Profilometers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 805 Million by the end of the forecast period in 2033.

3D Profilometers Market introduction

The 3D Profilometers Market encompasses advanced metrology systems designed to measure and analyze surface topography in three dimensions. These instruments are crucial for characterizing parameters such as surface roughness, waviness, shape deviation, and film thickness with high precision and non-contact methodology, particularly in intricate manufacturing processes. They utilize various technologies, including optical interferometry, confocal microscopy, and structured light projection, to generate detailed point cloud data that provides a comprehensive digital representation of the measured surface. The increasing demand for stringent quality control, miniaturization of components, and the need for sub-micron level accuracy across diverse industrial sectors are foundational elements driving market expansion.

Major applications of 3D profilometers span across sectors requiring meticulous surface examination, including semiconductor manufacturing for wafer inspection, aerospace and defense for critical component assessment, and medical device manufacturing for ensuring biocompatibility and functional integrity of implants and instruments. These devices offer substantial benefits over traditional 2D stylus profilometers by providing area-based measurements, which yield a much richer dataset for complex surface analysis and defect detection. This comprehensive data is vital for optimizing manufacturing yields, reducing material waste, and ensuring compliance with increasingly strict international quality standards, thereby solidifying their indispensability in modern industrial settings.

Driving factors for this market include the global trend toward Industry 4.0 integration, which emphasizes automated, high-speed metrology solutions; the continuous advancement in optical sensor technology, leading to faster data acquisition and improved vertical resolution; and the burgeoning complexity of products in the automotive and electronics sectors. Specifically, the proliferation of micro-electromechanical systems (MEMS) and advanced packaging technologies in the electronics industry necessitates the capabilities of 3D profilometers to monitor and control deposition layers and structural integrity at the micro and nano scales, sustaining the robust demand for sophisticated measurement tools capable of handling complex geometries and highly reflective surfaces.

3D Profilometers Market Executive Summary

The global 3D Profilometers Market is undergoing significant evolution, primarily characterized by a strategic shift towards non-contact optical technologies, necessitated by the increasing precision requirements in end-user industries like semiconductor and medical devices. Business trends indicate strong investment in integrating artificial intelligence and machine learning algorithms into profilometry software for enhanced automated defect classification (ADC) and real-time process monitoring, thereby accelerating inspection throughput and reducing reliance on manual interpretation. Furthermore, key market players are focusing on developing hybrid systems that combine multiple measurement principles (e.g., interferometry and focus variation) to overcome the limitations inherent in single-technology solutions, aiming to capture a broader range of surface types and roughness levels efficiently.

Regionally, Asia Pacific (APAC) stands as the dominant market, propelled by massive manufacturing capabilities and rapid growth in the electronics and automotive sectors in countries such as China, South Korea, and Japan, which are massive consumers of high-precision metrology equipment. North America and Europe, while mature, are characterized by high adoption rates of advanced, high-cost systems, driven by rigorous R&D expenditure and strict regulatory environments, especially in aerospace and medical domains. Segment trends highlight that non-contact optical profilometers, particularly those utilizing Coherence Scanning Interferometry (CSI), maintain the largest market share due to their exceptional speed and vertical measurement capabilities, proving critical for high-volume inspection tasks in electronics manufacturing. The application segment is heavily skewed toward quality control and inspection, which constitutes the primary operational use across all manufacturing verticals.

The competitive landscape is defined by technological innovation, where manufacturers are striving to enhance the robustness and repeatability of their instruments under demanding industrial conditions. Mergers, acquisitions, and strategic partnerships, particularly between metrology equipment providers and software analytics companies, are common strategies to consolidate market position and offer integrated measurement and analysis platforms. The overarching market dynamic reflects a continuous pursuit of higher throughput, greater automation, and the capability to measure challenging materials, including transparent, highly sloped, or extremely smooth surfaces, ensuring the market's trajectory remains steeply upward throughout the forecast period.

AI Impact Analysis on 3D Profilometers Market

User queries regarding the impact of AI on 3D Profilometers primarily center on how artificial intelligence can automate and enhance the data analysis pipeline, address the complexities of handling massive point cloud datasets, and improve the reliability of defect classification. Key themes include the feasibility of integrating machine learning for adaptive measurement strategies, concerns about the required computing infrastructure, and the potential for AI to standardize surface analysis across different operators and instruments. Users are keen to understand if AI can move profilometry from being a high-precision but time-consuming inspection step to a fully automated, real-time quality control tool integrated directly into the production line, especially for identifying subtle, complex defects that manual inspection or traditional algorithms often miss. There is strong user expectation that AI will be the key differentiator enabling true Industry 4.0 metrology by ensuring consistent, autonomous decision-making based on vast historical measurement data.

The adoption of AI fundamentally transforms the operational paradigm of 3D profilometry by shifting the focus from simply acquiring surface data to intelligently interpreting that data. AI algorithms, particularly deep learning models, are now being trained on vast libraries of surface scans to automatically identify, categorize, and quantify defects such as scratches, pits, burrs, and uniformity deviations with speed and accuracy far surpassing traditional thresholding methods. This capability drastically reduces the time required for post-processing and analysis, which traditionally acted as a bottleneck in high-volume manufacturing environments. Moreover, AI enables predictive maintenance of the measurement equipment itself and facilitates adaptive sampling, where the instrument dynamically adjusts its measurement parameters (e.g., resolution, area of interest) based on real-time surface characteristics, maximizing efficiency and minimizing data redundancy.

Furthermore, AI integration is vital for optimizing the setup and calibration of complex optical systems. Machine learning models can learn the optimal parameters for measuring various materials and geometries, minimizing operator error and ensuring consistent measurement performance across diverse batches and products. This level of automation is particularly critical in industries like semiconductor manufacturing, where cycle times are minimal and slight variations in surface characteristics can lead to catastrophic component failure. The ability of AI to correlate measured surface data with final product performance metrics offers unprecedented insight, moving 3D profilometry beyond just inspection into a proactive tool for process optimization and yield improvement, thus enhancing the overall value proposition of these sophisticated metrology systems.

- AI enhances Automated Defect Classification (ADC), improving accuracy and speed in identifying complex surface anomalies.

- Machine learning optimizes measurement recipes and parameters for diverse materials, reducing operator dependence and setup time.

- Deep learning models facilitate real-time, in-line process monitoring by analyzing high-throughput point cloud data instantaneously.

- AI algorithms enable predictive quality control by correlating surface topography metrics with final product performance outcomes.

- Integration of AI supports data compression and efficient storage/retrieval of massive 3D surface datasets within industrial networks.

DRO & Impact Forces Of 3D Profilometers Market

The market for 3D profilometers is primarily driven by the escalating demand for high-precision manufacturing, especially in micro-electronics and automotive components, which necessitate measurement accuracy down to the nanometer scale. Restraints largely center on the high initial capital investment required for advanced optical systems and the necessity for highly skilled personnel to operate and interpret the complex data generated by these instruments, presenting a barrier to entry for smaller enterprises. Significant opportunities arise from the increasing adoption of these technologies in emerging fields such as additive manufacturing (3D printing), where rigorous surface finish verification is essential for functional components, and the integration of these systems into fully automated production lines through Industry 4.0 frameworks. The key impact forces driving this dynamic include technological advancements leading to faster acquisition speeds and improved resolution, coupled with stringent global quality standards (e.g., ISO guidelines for surface texture) that mandate the use of traceable and highly accurate metrology tools, forcing manufacturers across sectors to upgrade their inspection capabilities.

The drivers are robust and structural. The miniaturization trend, particularly in semiconductor and MEMS devices, mandates surface inspection capabilities beyond the scope of traditional contact methods. Non-contact 3D profilometers offer the necessary sub-micron vertical resolution without damaging delicate surfaces. This is compounded by the increasing regulatory pressure in sectors like medical devices, where surface texture significantly impacts product safety and performance (e.g., osseointegration of implants), making 3D surface characterization a critical compliance requirement. Furthermore, the global competitive manufacturing landscape necessitates continuous process improvement, and 3D profilometers provide the detailed feedback required to optimize tool wear, material deposition, and machining parameters, directly contributing to cost reduction and yield enhancement.

Conversely, the high cost associated with advanced technologies like Coherence Scanning Interferometry (CSI) and the complex maintenance cycles act as persistent restraints, particularly in developing economies or small-to-medium enterprises (SMEs) where budget constraints are significant. However, the opportunity landscape is expanding rapidly. The aerospace sector is increasingly using profilometers for inspecting turbine blades and critical structural components for fatigue analysis and coating integrity. The development of portable and handheld 3D profilometry solutions is also opening up new markets for field inspection and maintenance, mitigating some of the traditional restraints related to the immobility of laboratory-grade equipment. The overall impact of these forces is overwhelmingly positive, pushing the market toward higher throughput, enhanced automation, and broader industrial applicability.

Segmentation Analysis

The 3D Profilometers Market is comprehensively segmented based on the underlying technology utilized, the nature of contact with the measured surface, the specific application area, and the target end-user industry. The dominant technological segmentation includes optical methods such as interferometry (White Light, Phase-Shifting), confocal microscopy, and focus variation, alongside traditional contact-based stylus methods. Segmentation by application highlights the prevalence of quality control and inspection tasks, followed by research and development activities and process monitoring. Analyzing the end-user landscape reveals that electronics and semiconductor manufacturing, followed by automotive and aerospace, are the primary revenue generators, driven by their critical need for ultra-high precision surface measurements.

Non-contact methods have rapidly eclipsed contact technologies, primarily because they eliminate the risk of surface damage, provide faster area measurements, and offer superior resolution for complex geometries. Within non-contact, Coherence Scanning Interferometry (CSI) and Focus Variation are highly valued for their ability to handle a wide range of surfaces, from rough machined components to highly polished silicon wafers. Market dynamics within the segmentation show that electronics is the fastest-growing segment, fueled by continuous innovation in microchip architecture and packaging, demanding ever higher inspection speeds and lateral resolution. The continuous evolution of additive manufacturing further necessitates specialized 3D profiling solutions capable of accurately assessing anisotropic surfaces and determining layer characteristics, creating lucrative niche markets.

- By Technology:

- Non-contact (Optical, Laser)

- Contact (Stylus Profilometry)

- By Optical Technology Sub-type:

- Coherence Scanning Interferometry (CSI)

- Phase Shifting Interferometry (PSI)

- Confocal Microscopy

- Focus Variation

- Structured Light

- By Application:

- Quality Control & Inspection

- Research & Development (R&D)

- Process Monitoring & Control

- Reverse Engineering

- By End-User Industry:

- Electronics & Semiconductor

- Automotive

- Aerospace & Defense

- Medical Devices

- Academia & Research

- Precision Manufacturing (General)

Value Chain Analysis For 3D Profilometers Market

The value chain for the 3D Profilometers Market begins with sophisticated upstream activities involving the sourcing and manufacturing of high-precision optical components, advanced sensor arrays (CCD/CMOS), high-speed computing hardware, and specialized software development for data processing and analysis. Key upstream suppliers include manufacturers of laser diodes, achromatic objectives, piezoelectric stages, and specialized camera systems crucial for achieving the required measurement accuracy and speed. Innovation at this stage, particularly in developing faster sensors and more robust software algorithms, directly determines the performance capabilities and cost structure of the final profilometry systems.

The midstream focuses on system assembly and integration, dominated by specialized Original Equipment Manufacturers (OEMs) who combine the sourced components into robust, calibrated instruments. This phase involves extensive calibration, testing, and system validation to ensure metrological traceability and compliance with international standards (e.g., ISO 25178 for surface texture). Distribution channels are critical, comprising both direct sales teams for complex, high-value systems requiring specialized technical support and indirect channels utilizing authorized distributors and value-added resellers (VARs) who provide local sales, installation, training, and first-line maintenance services, particularly in geographically diverse markets like APAC.

Downstream activities involve the final end-user application, encompassing installation, operator training, ongoing maintenance, and software updates to adapt to evolving measurement requirements. Direct distribution is favored for large industrial clients (e.g., major semiconductor fabs) where customized solutions and tight technical integration are necessary. Indirect distribution effectively handles the broader base of smaller manufacturing firms and academic institutions. The efficiency of the downstream segment is highly dependent on the quality of application support and the ability of the distributor network to rapidly address calibration and repair needs, thereby maximizing instrument uptime in critical manufacturing environments.

3D Profilometers Market Potential Customers

Potential customers for 3D Profilometers represent a wide spectrum of industries characterized by the manufacture of components where surface integrity, texture, and dimensional accuracy are paramount to function and longevity. The primary end-users are large-scale manufacturing enterprises and specialized precision engineering firms. Customers in the electronics and semiconductor sector utilize profilometers extensively for flatness measurements, solder paste inspection, thin-film thickness analysis, and critical dimension verification on wafers and PCBs. These buyers prioritize speed, automation integration, and high lateral resolution to manage high-throughput production lines effectively.

The second major cohort includes the automotive and aerospace industries. Automotive manufacturers are increasingly investing in profilometers for inspecting critical engine components, transmission parts, brake systems, and ensuring proper sealing surface preparation, where surface roughness dictates performance and efficiency. Aerospace customers, including OEMs and Tier 1 suppliers, rely on 3D profiling for evaluating the integrity of specialized coatings, inspecting turbine blade geometry, and checking for wear and tear in maintenance, repair, and overhaul (MRO) operations. These buyers demand instruments with high repeatability and traceability, often seeking specialized features for measuring complex, free-form surfaces typical in aerospace designs.

Furthermore, medical device manufacturers are high-value customers, requiring profilometers to confirm the surface finish of orthopedic implants, cardiovascular stents, and surgical instruments, ensuring compliance with strict biocompatibility standards. Research and development laboratories, both academic and corporate, form another significant customer base, requiring versatile, high-resolution instruments for materials science research, tribology studies, and developing new manufacturing processes. These diverse end-users share a common requirement for non-destructive, quantitative, and objective measurement capabilities that 3D profilometers uniquely offer.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 805 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zygo Corporation, Keyence Corporation, Bruker Corporation, Mitutoyo Corporation, Taylor Hobson (AMETEK), KLA Corporation, Olympus Corporation, Sensofar, NanoFocus AG, Mahr GmbH, GBS GmbH, Polytec GmbH, Optosurf GmbH, Starrett, STIL, Alicona Imaging GmbH, FISBA AG, Ametek Inc. (Solartron Metrology), Carl Zeiss AG, CyberOptics (Nordson), Creaform. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

3D Profilometers Market Key Technology Landscape

The technology landscape of the 3D Profilometers Market is dominated by non-contact optical techniques, which offer superior measurement speed and accuracy compared to older stylus-based methods. Coherence Scanning Interferometry (CSI), often referred to as White Light Interferometry (WLI), represents the gold standard for measuring highly smooth surfaces and film thickness, offering exceptional vertical resolution (sub-nanometer). CSI operates by scanning an objective vertically while monitoring the interference fringes generated by light reflected from the sample and a reference surface. Its main advantages include speed and robustness against mechanical vibrations, making it essential for quality control in semiconductor and hard-disk manufacturing.

Another pivotal technology is Confocal Microscopy, which uses a pinhole aperture to block out-of-focus light, resulting in high-contrast images and the ability to measure steep slopes effectively. Confocal systems are highly valued in applications requiring high lateral resolution and the ability to measure surfaces with complex topographical features, such as those found in micro-fluidics or specialized tooling. Focus Variation technology, while typically offering slightly lower vertical resolution than CSI, excels at measuring rough or steeply sloped surfaces (up to 70 degrees) and is highly versatile across materials. It works by determining the vertical position where a specific point on the surface is optimally focused through a series of captured images, making it popular in automotive and general precision machining industries.

Furthermore, Structured Light Profilometry (SLP) is gaining traction, particularly for large-area measurements and high-speed inspections where measurement volume is more critical than ultra-high vertical resolution. SLP projects known patterns onto the object's surface and captures the distortion of these patterns using cameras, translating this deformation into 3D geometry. While typically used for larger parts in aerospace or automotive stamping, recent technological advancements are pushing SLP capabilities toward higher precision, bridging the gap between high-volume inspection and high-accuracy metrology, showcasing the continuous innovation aimed at increasing measurement versatility and automation within the industrial environment.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, fundamentally driven by the enormous scale of electronics and semiconductor manufacturing, particularly in China, Taiwan, South Korea, and Japan. The region benefits from substantial government investment in high-tech manufacturing parks and the relocation of global consumer electronics supply chains, leading to a massive demand for in-line and off-line 3D metrology solutions for quality assurance of microchips, PCBs, and displays. The rapid expansion of the electric vehicle (EV) market in China is also fueling demand for profilometers to inspect battery components and complex power electronics, making APAC the key growth engine.

- North America: This region is characterized by high adoption of high-end, specialized profilometers, driven primarily by the stringent requirements of the aerospace & defense industry and advanced medical device manufacturing. North American companies are early adopters of AI-integrated metrology systems and are heavily invested in R&D, particularly for new materials and additive manufacturing processes. The market here prioritizes innovation, data integrity, and compliance with stringent quality standards, leading to a focus on premium instruments, often supplied by domestic market leaders.

- Europe: The European market, led by Germany, France, and the UK, shows consistent demand, strongly influenced by the high-quality standards set by the automotive and precision engineering sectors. The focus in Europe is heavily on efficiency and process integration, driven by Industry 4.0 initiatives. European manufacturers are keen on fully automated, traceable measurement solutions that can provide rapid feedback for closed-loop manufacturing control, particularly utilizing Focus Variation and Confocal technologies for industrial shop floor environments.

- Latin America (LATAM): The LATAM market is emerging, with growth concentrated in industrial centers, primarily Brazil and Mexico, linked to outsourced automotive and appliance manufacturing. Adoption is generally slower, focusing on cost-effective, robust systems. The market is increasingly recognizing the necessity of high-precision metrology to compete globally, driving a gradual shift away from traditional manual methods toward non-contact solutions.

- Middle East and Africa (MEA): The MEA market is the smallest but is showing potential growth, largely tied to burgeoning investments in localized manufacturing, particularly in aerospace maintenance facilities (MRO) in the UAE and diversification efforts in Saudi Arabia's industrial base. Demand is sporadic and concentrated, often relying on imported European and North American systems for high-value applications in the energy sector and defense industries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the 3D Profilometers Market.- Zygo Corporation (AMETEK)

- Keyence Corporation

- Bruker Corporation

- Mitutoyo Corporation

- Taylor Hobson (AMETEK)

- KLA Corporation

- Olympus Corporation

- Sensofar

- NanoFocus AG

- Mahr GmbH

- GBS GmbH

- Polytec GmbH

- Optosurf GmbH

- Starrett

- STIL S.A.

- Alicona Imaging GmbH

- FISBA AG

- Carl Zeiss AG

- CyberOptics (Nordson)

- Creaform (AMETEK)

Frequently Asked Questions

Analyze common user questions about the 3D Profilometers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between 3D profilometers and 2D profilometers?

3D profilometers measure surface topography across an area (areal measurement), providing comprehensive data on roughness, waviness, and form in X, Y, and Z dimensions. 2D (stylus) profilometers measure only a single line profile, offering limited data on complex surfaces.

Which 3D profilometry technology is best suited for measuring optical surfaces and thin films?

Coherence Scanning Interferometry (CSI), also known as White Light Interferometry (WLI), is generally considered the best technology for measuring ultra-smooth optical surfaces and characterizing transparent thin films due to its exceptional vertical resolution (sub-nanometer) and non-contact nature.

How does the integration of Industry 4.0 affect the future adoption of 3D profilometers?

Industry 4.0 integration drives the need for high-speed, automated, and networked 3D profilometers capable of in-line measurement. This trend necessitates robust software interfaces, automated data analysis (often via AI), and seamless integration into manufacturing execution systems (MES) for closed-loop process control.

In which end-user industry is the demand for 3D profilometers growing fastest?

The Electronics and Semiconductor industry shows the fastest growth, primarily due to continuous miniaturization and the transition to advanced packaging technologies (e.g., 3D stacking, MEMS), requiring high-throughput, non-destructive inspection of flatness, coplanarity, and film thickness on wafers and components.

What are the key technical constraints limiting the performance of non-contact profilometers?

Key constraints include the inability to measure surfaces with extremely steep slopes (high angles) or highly transparent materials effectively without specialized accessories, and susceptibility to environmental factors like vibration and temperature fluctuations, which can compromise sub-micron measurement accuracy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager