3DS Authentication Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433123 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

3DS Authentication Market Size

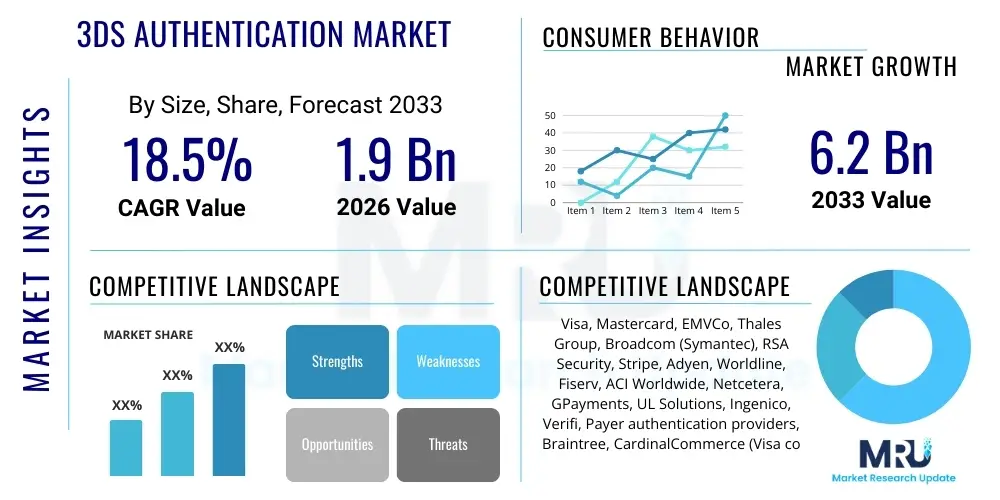

The 3DS Authentication Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $1.9 Billion in 2026 and is projected to reach $6.2 Billion by the end of the forecast period in 2033.

3DS Authentication Market introduction

The 3DS Authentication Market encompasses solutions and services designed to secure card-not-present (CNP) transactions using the EMV 3-D Secure protocol, a standardized messaging mechanism that enables issuer authentication during online purchases. This technology acts as a critical security layer, shifting liability for fraudulent transactions from the merchant to the card issuer when authentication is successful, significantly mitigating risk in the rapidly expanding e-commerce landscape. The core product offering includes the 3DS Server, which integrates with merchant environments, the Directory Server (DS), operated by payment networks, and the Access Control Server (ACS), managed by issuers, all working in concert to facilitate risk-based authentication.

Major applications of 3DS authentication span across various sectors, most notably e-commerce and retail, where transaction volume is immense, and the risk of identity theft and credential compromise is high. Financial services, including banking and insurance, also heavily utilize 3DS to secure digital payments, customer onboarding, and account maintenance activities. The primary benefits of adopting 3DS 2.x include enhanced security through sophisticated data exchange, reduced cart abandonment rates due to the introduction of the frictionless flow, and improved compliance with strict global payment regulations, particularly the Payment Services Directive 2 (PSD2) in Europe, which mandates Strong Customer Authentication (SCA).

The market's trajectory is fundamentally driven by the escalating frequency and sophistication of online payment fraud attempts, necessitating robust security measures for both consumers and merchants. Mandatory regulatory frameworks like PSD2/SCA are key driving factors, forcing widespread adoption of advanced authentication methods that support data-rich transaction analysis. Furthermore, the global shift towards mobile and in-app purchasing environments, which require highly optimized authentication experiences to maintain conversion rates, is bolstering demand for the latest 3DS 2.x solutions that are natively integrated into mobile SDKs and applications, offering a seamless user experience while maximizing security posture.

3DS Authentication Market Executive Summary

The 3DS Authentication market is currently experiencing robust growth, primarily driven by the global mandate for Strong Customer Authentication (SCA) and the transition from legacy 3DS 1.0 protocols to the superior, data-rich EMV 3-D Secure 2.x standard. Key business trends include the consolidation of payment security providers, the increased integration of 3DS solutions into comprehensive fraud prevention suites, and a pronounced focus on minimizing friction in the consumer checkout journey. The shift towards frictionless authentication flows, where risk-based analysis approves the majority of transactions without user intervention, is critical to maintaining high e-commerce conversion rates while meeting compliance obligations globally. Investment in AI and machine learning capabilities within 3DS platforms is a dominant trend, aimed at enhancing the accuracy of risk scoring and reducing false positives, thus optimizing the balance between security and user experience.

Regionally, Europe remains the epicenter of adoption due to the strict enforcement of PSD2 and SCA requirements, making it the most mature market for 3DS 2.x deployment and driving significant technological advancements. North America is accelerating its adoption, spurred by rising CNP fraud rates and the desire of large e-commerce players to shift liability. Asia Pacific (APAC) is emerging as the fastest-growing region, fueled by massive growth in mobile commerce, increasing regulatory pressure in markets like India and China, and the rapid expansion of digital payment infrastructure across Southeast Asia. Developing regions are prioritizing mobile-first 3DS integrations to secure nascent digital economies.

Segment-wise, the Solutions component, particularly the 3DS Server segment, holds the largest market share, reflecting the foundational requirement for merchants and payment processors to facilitate the protocol exchange. However, the Services segment, specifically Managed Services, is projected to exhibit the highest CAGR as organizations increasingly outsource the complexity of deployment, monitoring, and compliance management to specialized third parties. By application, the E-commerce and Retail sector dominates due to volume, but the BFSI sector is showing specialized demand for enterprise-level, integrated authentication platforms that go beyond transaction security to cover account protection and data governance, leveraging the protocol's flexibility for diverse authentication scenarios.

AI Impact Analysis on 3DS Authentication Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the 3DS Authentication market commonly revolve around its ability to refine fraud detection, minimize checkout friction, and handle the exponential growth in transaction data. Users frequently ask how AI can improve the accuracy of the risk-based decisioning (RBA) engine—the core mechanism enabling frictionless flow—and whether AI implementation can reduce the number of legitimate transactions being incorrectly flagged (false positives). Another major theme is the integration of AI models with biometrics and behavioral analytics to create a holistic, adaptive authentication environment that anticipates fraud vectors before they materialize, moving beyond traditional static rulesets. Users are seeking assurances that AI-enhanced 3DS solutions can future-proof their payment security against evolving synthetic identity fraud and deepfake attempts.

AI is transforming the 3DS authentication landscape by dramatically enhancing the precision and speed of risk assessment. Machine learning algorithms analyze vast datasets encompassing transaction history, device characteristics, behavioral biometrics, and contextual information shared during the 3DS 2.x flow (over 100 data points). This advanced analysis allows Issuers to accurately determine the legitimacy of a transaction in real-time, enabling the frictionless flow for low-risk transactions, thus satisfying Strong Customer Authentication requirements without negatively impacting the customer experience. The deployment of AI-driven risk engines is critical for compliance in regions like Europe, where SCA mandates strict adherence while simultaneously requiring businesses to maintain high conversion rates.

Furthermore, AI models facilitate adaptive authentication by learning from every transaction outcome, continuously optimizing the risk models to detect subtle anomalies indicative of sophisticated fraud attempts that might bypass traditional rules-based systems. This continuous learning capability ensures the 3DS platform remains agile in the face of rapidly evolving fraud tactics, such as bot attacks or account takeover (ATO). The integration of AI extends the utility of 3DS 2.x beyond simple authentication, allowing it to function as a core data collection and intelligence hub, providing valuable insights back to the fraud teams and contributing to a significantly safer overall digital payment ecosystem.

- AI enhances Risk-Based Authentication (RBA) accuracy, enabling higher rates of frictionless flow and minimizing user intervention.

- Machine learning algorithms analyze over 100 data elements shared via the 3DS 2.x protocol to generate real-time, precise risk scores.

- AI integration drastically reduces false positives, ensuring legitimate transactions are not incorrectly challenged or declined, thereby improving conversion rates.

- It facilitates adaptive security measures, allowing the authentication process to dynamically adjust based on behavioral patterns and device intelligence.

- AI assists in identifying complex, low-volume fraud schemes such as synthetic identity fraud and sophisticated account takeover attempts.

- Generative AI tools may be used to analyze large volumes of fraud data to predict future attack vectors and proactively adjust authentication rulesets.

- The adoption of AI-driven fraud detection is accelerating the decommissioning of outdated, static fraud prevention tools, streamlining security stacks.

DRO & Impact Forces Of 3DS Authentication Market

The 3DS Authentication Market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), all modulated by significant internal and external impact forces. The primary driver is the mandated regulatory compliance, particularly PSD2/SCA in Europe, which compels adoption, coupled with the undeniable need to combat persistently rising global CNP fraud rates. These drivers create a compelling, immediate need for sophisticated, liability-shifting security protocols like EMV 3-D Secure 2.x. However, the market faces restraints centered around integration complexity, the fragmented technological landscape among issuing banks (ACS readiness), and initial implementation costs for smaller merchants. Furthermore, the inherent risk of introducing friction, even minimized through RBA, remains a concern for conversion-sensitive e-commerce platforms.

Opportunities in the market are abundant, notably the potential expansion of 3DS applications beyond traditional e-commerce to secure new payment modalities, such as recurring payments, subscription services, and digital wallet tokenization. The shift towards secure, mobile-native authentication via SDK implementation presents a massive growth opportunity, allowing providers to deliver superior user experiences and richer data collection. The ongoing global migration from 3DS 1.0 to 3DS 2.x represents a sustained, multi-year upgrade cycle, ensuring continued revenue streams for solution providers focusing on migration and enhanced feature deployment. Key vendors are capitalizing on the integration opportunity by embedding 3DS solutions deeply within payment gateways and fraud management platforms, offering holistic security ecosystems.

The impact forces currently shaping the market are predominantly technological and regulatory. Regulatory mandates act as a powerful external force, dictating timelines and feature requirements, while advancements in risk assessment technology (AI/ML) serve as internal forces pushing innovation toward better accuracy and reduced friction. The COVID-19 pandemic accelerated the shift to digital commerce, amplifying the need for secure CNP solutions, thus acting as a major market accelerator. Conversely, the continuous emergence of new sophisticated fraud techniques acts as a persistent pressure, forcing solution providers to invest heavily in R&D to maintain efficacy. The balancing act between compliance, security, and user experience dictates the success and adoption rate of new 3DS offerings.

Segmentation Analysis

The 3DS Authentication Market segmentation provides a granular view of its structure based on component offerings, authentication flow, application industries, and the underlying technological version being deployed. This analysis highlights areas of current market dominance, such as the solution component within the retail sector, and identifies emerging high-growth segments, particularly managed services and the widespread adoption of the friction-reducing challenge flow. Understanding these segments is crucial for stakeholders to tailor their product offerings and strategic investments toward the areas exhibiting the highest anticipated growth and demand, driven primarily by evolving regulatory environments and increased digital commerce volumes worldwide.

The segmentation by Component is vital as it distinguishes between the foundational software (Solutions) necessary to run the protocol and the ongoing support and operational outsourcing (Services) required for compliance and maintenance. As complexity increases with 3DS 2.x, driven by requirements for real-time risk scoring and sophisticated data handling, the Managed Services segment is growing rapidly, favored by institutions that prefer to outsource operational burden and liability updates. Similarly, the breakdown by Authentication Type—Frictionless versus Challenge Flow—is perhaps the most commercially relevant segmentation, directly correlating market success with the provider's ability to maximize frictionless authentication while minimizing regulatory risk, underscoring the importance of highly precise Risk-Based Analysis (RBA) engines.

Furthermore, segmenting by Application provides insight into industry-specific security needs. While E-commerce and Retail dominate the volume metrics, the Banking, Financial Services, and Insurance (BFSI) segment often demands the most advanced, enterprise-grade customization, integrating 3DS data deeply into their wider fraud and compliance systems. Finally, the segmentation by Version, primarily between the outdated 3DS 1.0 and the current standard 3DS 2.x, illustrates the maturity of the migration process globally. Markets that have fully transitioned to 3DS 2.x demonstrate higher data throughput, better security, and significantly improved mobile compatibility, setting the benchmark for the rest of the world.

- By Component:

- Solutions (3DS Server, Directory Server Integration, ACS, SDKs/Plugins)

- Services (Managed Services, Professional Services, Consulting & Advisory)

- By Authentication Type:

- Frictionless Flow (Risk-Based Authentication)

- Challenge Flow (Biometric, OTP, Knowledge-based)

- By Application:

- E-commerce and Retail

- Banking, Financial Services, and Insurance (BFSI)

- Travel and Hospitality

- Digital Goods and Entertainment

- Others (Government, Healthcare)

- By Version:

- 3DS 2.x (EMV 3-D Secure)

- 3DS 1.0 (Legacy)

- By Deployment Model:

- Cloud-based

- On-premise

- By Organization Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

Value Chain Analysis For 3DS Authentication Market

The value chain for the 3DS Authentication Market is intricate, involving multiple specialized entities working synergistically to secure the payment process. Upstream activities begin with core technology development, primarily driven by EMVCo, which defines the 3DS protocol standards. Solution providers, including software vendors and payment processors, take these standards and develop the fundamental components: the 3DS Server (used by merchants/acquirers), the Directory Server (DS, managed by card networks like Visa and Mastercard), and the Access Control Server (ACS, managed by card issuers). Innovation at this stage focuses heavily on building robust, scalable, and AI-enabled risk engines to maximize the frictionless flow success rate, requiring specialized cryptography and low-latency network optimization.

The midstream and downstream segments involve the deployment and operation of these solutions. Payment Gateways and Acquirers (downstream) act as the primary distribution channel for merchants, integrating the 3DS server technology into their existing infrastructure. They handle the routing and initial risk scoring for transactions. Card Issuers (downstream/end-users) operate the ACS, which performs the final authentication decision. Their investment in upgrading the ACS is critical to supporting 3DS 2.x’s extensive data requirements and ensuring compliance with SCA. Distribution channels are predominantly indirect, flowing from core technology providers through major Payment Service Providers (PSPs) and processors to reach the vast merchant base. Direct sales often occur only for large enterprise clients or issuing banks requiring custom ACS deployment.

The profitability across the value chain is highest for entities controlling the core data flow and offering high-value managed services. Payment networks (Visa, Mastercard) benefit immensely from their central role in operating the Directory Server and enforcing compliance, which drives transaction volume. Solution vendors offering highly optimized, cloud-native 3DS servers and SDKs capture value through licensing and transaction fees. Issuers bear the operational cost of the ACS but gain significant value by shifting fraud liability away from themselves when authentication is successful, provided their ACS is robust. The value chain is continuously optimized toward reducing latency and improving the data quality shared between the merchant environment and the issuer environment to enhance risk-based decisioning, which directly translates into higher e-commerce conversion rates.

3DS Authentication Market Potential Customers

The potential customer base for 3DS Authentication solutions is expansive, fundamentally encompassing any entity engaged in card-not-present (CNP) transactions that needs to secure payments, reduce fraud liability, and adhere to regulatory mandates like Strong Customer Authentication (SCA). The primary buyers fall into two major categories: organizations focused on accepting payments (merchants/acquirers) and organizations focused on approving payments (issuers/banks). E-commerce retailers, particularly those operating across borders or dealing with high-value goods, are mandatory adopters, seeking the liability shift benefit offered by successful 3DS authentication to protect their bottom line against chargebacks.

Furthermore, payment service providers (PSPs) and acquiring banks are crucial intermediary customers, often buying 3DS solutions or managed services to offer white-labeled authentication capabilities to their downstream merchant clients. For PSPs, providing seamless, compliant 3DS 2.x integration is a critical competitive differentiator. Financial institutions (Issuing Banks and Credit Unions) constitute a specialized, high-value customer segment, requiring robust Access Control Servers (ACS) that must integrate deeply with their internal fraud detection systems and comply fully with mandates regarding customer communication and challenge mechanisms. These buyers prioritize sophisticated risk engines and high availability.

Secondary, yet rapidly growing, customer segments include digital subscription services, online travel agencies (OTAs), and gaming/digital entertainment platforms, all of which rely heavily on recurring or high-volume instant transactions. For these users, minimizing friction is paramount, making the success rate of the frictionless 3DS flow a core purchase criterion. The global migration cycle from legacy 3DS 1.0 ensures that virtually all major organizations processing digital payments are either current customers undergoing upgrades or prime prospects for advanced 3DS 2.x solution providers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.9 Billion |

| Market Forecast in 2033 | $6.2 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Visa, Mastercard, EMVCo, Thales Group, Broadcom (Symantec), RSA Security, Stripe, Adyen, Worldline, Fiserv, ACI Worldwide, Netcetera, GPayments, UL Solutions, Ingenico, Verifi, Payer authentication providers, Braintree, CardinalCommerce (Visa company), Entersekt |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

3DS Authentication Market Key Technology Landscape

The technology landscape of the 3DS Authentication Market is defined by the core EMV 3-D Secure 2.x protocol, which facilitates the secure exchange of over 100 data points between the merchant's environment and the card issuer's Access Control Server (ACS). Key technological components include the 3DS Server, which manages the communication lifecycle on the merchant/acquirer side; the ACS, which houses the issuer’s proprietary risk engine; and the Directory Server (DS), which coordinates message routing between the participants. The most critical technological advancement within this framework is the deployment of sophisticated Risk-Based Authentication (RBA) engines, often powered by Artificial Intelligence and machine learning, which utilize behavioral biometrics, device fingerprinting, and transactional history to make near-instantaneous, high-fidelity risk decisions.

The transition to 3DS 2.x necessitates the use of dedicated SDKs (Software Development Kits) for mobile and in-app commerce, ensuring native integration rather than relying on browser-based redirects (which characterized 3DS 1.0). These SDKs are essential for providing a seamless, branded user experience and for collecting rich device and contextual data critical for RBA. Furthermore, the reliance on secure, low-latency API architecture is paramount, as the entire authentication process must complete within milliseconds to avoid transaction timeouts and customer frustration. Cryptographic standards, including robust encryption and digital signature processes, underpin the integrity and non-repudiation of the data shared across the payment ecosystem participants, ensuring compliance with strict data protection regulations.

Future technology trends focus heavily on integrating 3DS authentication with broader identity and access management (IAM) frameworks and advanced biometrics. The convergence of 3DS data streams with sophisticated fraud detection systems leveraging distributed ledger technology (DLT) or advanced graph databases is gaining traction. This holistic approach moves beyond securing a single transaction to protecting the entire customer journey and account lifecycle. Moreover, the market is seeing a growing focus on optimizing cloud-native deployment models for both the 3DS Server and ACS components, facilitating scalability, enhanced geographic redundancy, and accelerated implementation timelines, particularly for global payment processors and large-scale issuing institutions.

Regional Highlights

The dynamics of the 3DS Authentication Market vary significantly across major geographical regions, driven primarily by the maturity of e-commerce markets, the stringency of local regulations, and the prevalence of digital payment adoption. Understanding these regional nuances is essential for market players to prioritize investment, tailor compliance strategies, and focus sales efforts.

- Europe: Europe holds the largest market share and is the most advanced region for 3DS 2.x deployment. This dominance is entirely attributable to the binding regulatory requirements imposed by the Payment Services Directive 2 (PSD2) and its associated mandate for Strong Customer Authentication (SCA). The deadline-driven compliance requirements forced a rapid, widespread migration from 3DS 1.0 to 2.x across the entire ecosystem (issuers, acquirers, and merchants). European vendors lead in developing sophisticated Risk-Based Authentication (RBA) engines necessary to balance SCA compliance with minimizing checkout friction, making the region a critical hub for innovation and managed service adoption.

- North America: North America represents a substantial and rapidly growing market, driven not primarily by regulatory mandates but by the escalating costs associated with card-not-present (CNP) fraud and the financial incentive of liability shift. Although regulatory pressure is less centralized than in Europe, major card networks (Visa, Mastercard) are aggressively pushing 3DS 2.x adoption as a best practice to mitigate fraud risk. The region's large e-commerce players are adopting 3DS to protect revenue, often prioritizing integration with complex domestic payment ecosystems and seeking solutions that are deeply embedded into mobile applications to serve a highly mobile-centric consumer base.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market, characterized by immense growth in mobile commerce and a vast, digitally emerging consumer base, particularly in India, China, and Southeast Asia. While regulatory frameworks are fragmented across the region, countries like India have strong domestic authentication requirements that align well with 3DS capabilities. The high volume of low-value transactions necessitates highly efficient and scalable 3DS solutions. Market growth here is further fueled by local payment schemes and domestic card networks adopting EMVCo standards to secure cross-border trade and increasing digital wallet usage.

- Latin America (LATAM): The LATAM region presents unique challenges and opportunities due to high CNP fraud rates and varying degrees of payment infrastructure maturity. Adoption is accelerating as international merchants expand into the region, requiring standardized security protocols. Brazil and Mexico are leading the way in integrating 3DS 2.x, primarily driven by the need to increase consumer trust in digital payments and reduce merchant exposure to fraud chargebacks. Mobile connectivity and the need for optimized solutions for diverse connectivity speeds are key technical requirements.

- Middle East and Africa (MEA): This region is in an earlier phase of mass digital transformation, but market growth is strong due to government-backed digital economy initiatives and increasing internet penetration. Key drivers include securing newly established e-commerce platforms and developing robust financial services infrastructure. Adoption often focuses on cloud-based, easily scalable 3DS solutions to rapidly equip new market entrants and financial institutions with essential payment security tools.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the 3DS Authentication Market.- Visa

- Mastercard

- EMVCo

- Thales Group

- Broadcom (Symantec)

- RSA Security

- Stripe

- Adyen

- Worldline

- Fiserv

- ACI Worldwide

- Netcetera

- GPayments

- UL Solutions

- Ingenico

- Verifi

- Payer authentication providers

- Braintree

- CardinalCommerce (Visa company)

- Entersekt

Frequently Asked Questions

Analyze common user questions about the 3DS Authentication market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between 3DS 1.0 and 3DS 2.x?

The primary difference is the approach to authentication and data exchange. 3DS 1.0 relied on static redirects and resulted in friction (user interruption). 3DS 2.x utilizes native in-app SDKs and exchanges over 100 data points (device, context, transaction details) to enable Risk-Based Authentication (RBA), allowing the majority of transactions to be authenticated frictionlessly without user interaction, significantly improving the checkout experience while enhancing security.

How does 3DS Authentication impact chargeback liability for merchants?

Successful 3DS authentication, particularly under the 2.x protocol, shifts the liability for fraudulent card-not-present (CNP) transactions from the merchant (or acquirer) to the card issuer. This liability shift provides a critical financial protection mechanism for e-commerce businesses against fraud-related chargebacks, making successful implementation a core business imperative.

Is 3DS Authentication mandatory globally, and what role does SCA play?

3DS Authentication is not universally mandatory but is heavily enforced in regions subject to Strong Customer Authentication (SCA) requirements, most notably the European Economic Area (EEA) under the Payment Services Directive 2 (PSD2). SCA mandates the use of at least two independent verification elements for most digital transactions, which 3DS 2.x is specifically designed to fulfill via its frictionless and challenge flows.

How does Artificial Intelligence improve 3DS Risk-Based Authentication (RBA)?

AI improves RBA by processing the vast amount of data shared during a 3DS 2.x transaction using machine learning models. This allows the issuer’s Access Control Server (ACS) to make more accurate, real-time risk decisions, minimizing false declines and maximizing the volume of secure transactions that can pass through the system without requiring customer challenge (frictionless flow).

What is the 'Frictionless Flow' in 3DS 2.x, and why is it important for e-commerce?

The Frictionless Flow is the core feature of 3DS 2.x where a transaction is authenticated entirely in the background, without requiring the consumer to enter a password or OTP. It is vital for e-commerce as it maintains conversion rates by providing a seamless checkout experience, directly addressing the major drawback (cart abandonment) associated with the friction caused by the legacy 3DS 1.0 system.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager