4K Fluorescent Endoscope Imaging System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435663 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

4K Fluorescent Endoscope Imaging System Market Size

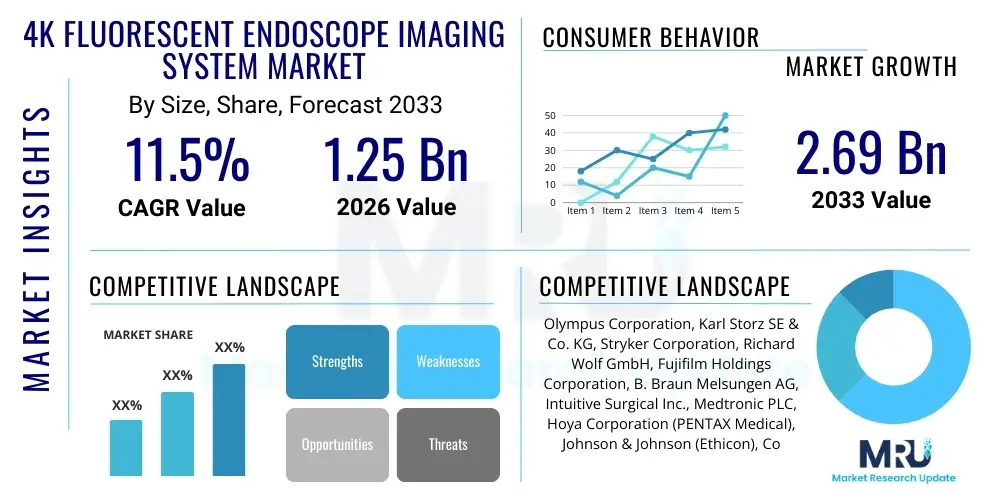

The 4K Fluorescent Endoscope Imaging System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% (CAGR) between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $2.69 Billion by the end of the forecast period in 2033.

4K Fluorescent Endoscope Imaging System Market introduction

The 4K Fluorescent Endoscope Imaging System Market encompasses advanced medical devices that integrate high-definition 4K imaging technology with real-time fluorescence detection capabilities. These systems provide surgeons with unparalleled visual clarity, offering four times the resolution of traditional HD systems, combined with the ability to visualize biological structures, perfusion, and lymph drainage that are otherwise invisible under standard white light. The core product includes the 4K camera head, light source (often incorporating specialized LEDs for fluorescence excitation), image processor, and the surgical display monitor. This convergence of high resolution and functional imaging is particularly vital in minimally invasive surgery (MIS), where enhanced tissue discrimination is critical for optimizing surgical margins and minimizing complications.

Major applications of these sophisticated systems span several surgical disciplines, including general surgery, urology, gynecology, and thoracic surgery, with a significant emphasis on oncological procedures. In oncology, fluorescence-guided surgery (FGS) utilizing specific contrast agents (such as Indocyanine Green or ICG) allows for the precise identification of tumors, sentinel lymph nodes, and perfusion defects, significantly improving procedural accuracy. The primary benefit driving market adoption is the enhanced patient safety and improved surgical outcomes resulting from superior visualization. Furthermore, the 4K resolution facilitates better anatomical recognition, reduces eye strain for the surgical team, and provides high-quality imagery essential for surgical training and documentation.

The market growth is primarily driven by the global shift towards minimally invasive procedures, increasing prevalence of complex chronic diseases requiring precise surgical intervention, and the continuous technological advancements in optical and sensor technologies. Furthermore, rising healthcare expenditure in developed and emerging economies, coupled with growing awareness among surgeons regarding the benefits of fluorescence imaging systems, contributes significantly to sustained market expansion. The integration of these high-end visualization tools is becoming a standard of care in leading surgical centers worldwide, positioning the market for robust growth throughout the forecast period.

4K Fluorescent Endoscope Imaging System Market Executive Summary

The 4K Fluorescent Endoscope Imaging System Market is experiencing rapid evolution, characterized by intense technological competition focused on integrating artificial intelligence, improving contrast agent compatibility, and achieving true plug-and-play operability within existing surgical infrastructure. Key business trends indicate a strong focus on strategic mergers and acquisitions among major medical device manufacturers to consolidate market share and acquire specialized fluorescence technology patents, alongside an increasing trend toward subscription or bundled service models for high-capital equipment. The market dynamics are highly influenced by regulatory approval timelines for new fluorophores and imaging systems, particularly in North America and Europe, which dictate the pace of new product introduction and commercialization. The strategic objective for leading companies remains the reduction of the system's physical footprint while simultaneously increasing image processing power and computational capabilities, ensuring seamless adoption in hybrid operating rooms.

Regionally, North America maintains the dominant market share, driven by high disposable income, sophisticated healthcare infrastructure, and the early adoption of advanced surgical techniques, particularly in complex robotic-assisted procedures where 4K fluorescence is increasingly leveraged. However, the Asia Pacific region is anticipated to exhibit the fastest growth rate, fueled by improving healthcare access, government investments in modernizing surgical facilities in countries like China and India, and a rapidly expanding patient pool requiring oncological and cardiovascular interventions. European growth is steady, bolstered by centralized healthcare funding mechanisms supporting high-quality, minimally invasive technology, with Western European nations being the primary revenue contributors due to high procedural volumes and stringent quality standards.

Segment trends reveal that the camera systems segment, particularly those featuring proprietary sensor technology for enhanced low-light performance necessary for fluorescence capture, holds the largest revenue share. Application-wise, General Surgery, encompassing cholecystectomy, colorectal, and hernia repair, remains the foundational segment, though specialized fields like Urology (for bladder and kidney cancer detection) and Gynecology (for hysteroscopy and endometriosis) are showing accelerating adoption rates. Furthermore, the trend toward utilizing modular and portable systems, driven by increasing demand in ambulatory surgical centers (ASCs) and smaller regional hospitals, is creating a distinct high-growth sub-segment within the end-user landscape, requiring manufacturers to develop more flexible and cost-effective system architectures without compromising 4K image quality or fluorescence sensitivity.

AI Impact Analysis on 4K Fluorescent Endoscope Imaging System Market

User inquiries regarding the convergence of Artificial Intelligence (AI) and 4K Fluorescent Endoscope Imaging primarily focus on automating image analysis, enhancing surgical guidance, and improving diagnostic precision. Common user questions revolve around: "How can AI reduce the dependency on subjective interpretation of fluorescence signals?", "Will AI integrate seamlessly with existing 4K platforms, or require complete system replacement?", and "What role does machine learning play in real-time tissue differentiation during FGS?" The key themes highlight expectations for AI to transcend simple visualization, moving towards automated pathological identification, prediction of surgical outcomes based on real-time perfusion data, and automated quality control of fluorescence signals to minimize artifacts. Concerns often center on data security, regulatory hurdles for AI-driven diagnostic tools, and the ethical implications of handing over critical decision-making processes to algorithms in the operating room. Users strongly anticipate that AI will maximize the data richness provided by 4K resolution, transforming raw images into actionable insights that surpass human visual and cognitive capacity, thereby standardizing surgical quality globally.

The integration of AI into 4K fluorescent endoscopy systems is poised to revolutionize minimally invasive surgery by moving beyond passive image capture to active, predictive surgical intelligence. AI algorithms, leveraging the massive dataset capacity provided by 4K resolution, can process fluorescence intensity maps and visual textures instantly, enabling enhanced delineation of tumor boundaries that are often subtle or indistinguishable to the naked eye. This capability significantly improves the probability of achieving clear surgical margins in oncology. Furthermore, AI systems can automatically compensate for lighting variations, camera shake, and tissue movement, ensuring a stable and optimized visual field for the surgeon, which is crucial during complex, long-duration procedures. This computational enhancement transforms the standard surgical view into an augmented reality display, overlaying critical, AI-derived information directly onto the live 4K feed.

Beyond intraoperative guidance, AI provides substantial benefits in post-operative analysis and quality assurance. Machine learning models can analyze recorded 4K fluorescence videos to correlate real-time perfusion dynamics with long-term patient outcomes, creating valuable feedback loops for surgeons and researchers. This allows institutions to refine surgical protocols and better select patients for FGS. Moreover, the high-resolution data streams captured by 4K systems are ideal for training robust deep learning models, making the entire surgical workflow a continuous learning environment. The ability of AI to instantly compare live images against vast databases of pathological images provides an instantaneous second opinion, thereby increasing surgeon confidence and accelerating the learning curve for less experienced practitioners utilizing these advanced imaging modalities, ultimately driving broader adoption across smaller surgical centers.

- Real-time automated tumor margin detection using deep learning algorithms.

- Enhanced perfusion assessment and quantification of tissue viability during complex flap procedures.

- Automated stabilization and artifact correction in 4K video streams for optimal visual clarity.

- Predictive modeling for sentinel lymph node identification based on fluorescence drainage patterns.

- AI-driven quality assurance and automated documentation of critical surgical steps.

- Optimization of contrast agent dosage and timing for maximum visualization efficacy.

DRO & Impact Forces Of 4K Fluorescent Endoscope Imaging System Market

The market for 4K Fluorescent Endoscope Imaging Systems is propelled by powerful drivers centered on clinical efficacy and technological advancement, counterbalanced by significant restraints primarily concerning costs and complexity, while opportunities arise from untapped surgical disciplines and geographic expansion. Key drivers include the proven ability of fluorescence-guided surgery (FGS) to reduce recurrence rates in certain cancers and minimize tissue damage, coupled with the increasing global incidence of chronic diseases necessitating MIS procedures. Restraints largely involve the high initial capital investment required for 4K systems, the steep learning curve for surgical staff, and the current limitations regarding the regulatory approval and availability of novel, target-specific fluorescent contrast agents beyond ICG. However, the expanding application scope into reconstructive surgery, combined with the push for cost-effective modular systems suitable for outpatient settings, presents substantial avenues for future growth. These forces collectively shape the market's trajectory, demanding that manufacturers prioritize system affordability, ease of integration, and demonstrable clinical return on investment to sustain growth.

Primary drivers contributing to the widespread adoption include the undeniable clinical benefits derived from superior visualization. The combination of 4K ultra-high definition and fluorescence imaging provides surgeons with an unprecedented level of detail, allowing for the differentiation between healthy and malignant tissue, and the precise assessment of vascular supply, which is critical in procedures such as bowel resection and breast reconstruction. This enhanced intraoperative guidance translates directly into improved surgical safety and reduced operating times, factors highly valued by both healthcare providers and payors. Moreover, the increasing public and professional recognition of minimally invasive surgery as the preferred standard of care globally is fundamentally accelerating the demand for the most sophisticated visualization tools available, pushing institutions to upgrade from standard HD or 2K systems to advanced 4K fluorescent platforms to remain competitive and meet evolving clinical standards. The robust integration capabilities of modern 4K systems with robotic platforms further amplify this driving force, ensuring future-proof investment for high-volume surgical centers.

Conversely, the high costs associated with both the capital equipment and the specialized consumables act as significant market restraints, particularly in mid-sized hospitals and emerging economies where budget constraints are severe. A complete 4K fluorescence tower can represent a substantial financial commitment, often leading institutions to delay upgrades or opt for refurbished equipment. Furthermore, while Indocyanine Green (ICG) is widely used, the development and regulatory pathway for novel, disease-specific fluorophores remain challenging and time-consuming, limiting the functional breadth of FGS in certain applications. Finally, the technical complexity involved in managing and interpreting the dual imaging modes (white light and fluorescence) requires specialized training and ongoing education for surgeons, anesthesiologists, and technicians. Addressing these restraints requires manufacturers to focus intensely on value engineering, creating scalable platforms, and investing in comprehensive clinical training programs that demonstrate measurable improvements in surgical efficiency and patient outcomes, thereby justifying the high initial investment.

- Drivers:

- Rapid growth in minimally invasive surgery (MIS) procedures globally.

- Proven clinical efficacy of fluorescence guidance in oncology and perfusion assessment.

- Technological advancements leading to superior image quality and real-time visualization (4K resolution).

- Increasing adoption of robotic surgery, which benefits significantly from integrated fluorescence capabilities.

- Growing surgical emphasis on reduced patient recovery time and improved cosmetic results.

- Restraints:

- High initial procurement cost of 4K imaging towers and associated maintenance expenses.

- Limited availability and regulatory complexity of novel, targeted fluorescent contrast agents.

- Need for specialized training and substantial learning curve for operating the integrated systems.

- Budgetary constraints and slow adoption rates in smaller hospitals and ambulatory surgical centers.

- Opportunities:

- Development of cost-effective, portable, and modular 4K fluorescence systems for outpatient settings.

- Expansion of application scope into non-traditional areas like neurosurgery, dental, and vascular surgery.

- Integration of advanced AI/ML capabilities for automated image analysis and surgical metrics.

- Untapped market penetration potential in emerging economies (APAC and LATAM).

- Strategic partnerships between imaging companies and pharmaceutical firms for co-developing novel fluorophores.

- Impact Forces:

- Degree of Competition: High, driven by innovation in sensor technology and AI integration.

- Bargaining Power of Buyers (Hospitals/GPOs): Moderate to High, due to high capital investment and preference for comprehensive vendor solutions.

- Threat of Substitutes (Alternative Imaging): Low, as 4K fluorescence offers real-time, intraoperative guidance unique to MIS.

Segmentation Analysis

The 4K Fluorescent Endoscope Imaging System market is meticulously segmented based on components, application, and end-user, reflecting the diverse needs and technical specifications across the surgical landscape. Understanding these segmentations is critical for manufacturers to tailor product development and market strategies. The Component segment, encompassing hardware elements such as camera heads, light sources, and visualization monitors, is driven by continuous innovation aimed at optimizing fluorescence sensitivity and achieving true-to-life color reproduction in 4K resolution. The Application segmentation dictates where the technology generates the highest revenue, with General Surgery and Urological procedures being primary targets, while the End-User segment differentiates adoption patterns between high-volume academic hospitals and specialized ambulatory surgery centers, influencing system design toward either integrated robotic compatibility or standalone portability.

Detailed analysis of the Components segment reveals that the Image Processing and Visualization Systems sub-segment consistently commands the largest share, as the core technological differentiation lies in the computational power required to merge and process 4K white light and near-infrared fluorescence data simultaneously without lag. Furthermore, the specialized 4K Endoscope Scopes (rigid and flexible) represent a high-value component due to the precision required in manufacturing the optical train capable of transmitting 4K quality while remaining compatible with fluorescence filters and illumination systems. Manufacturers are increasingly focused on creating modular components that can be integrated into pre-existing operating room infrastructure, reducing the barrier to entry for hospitals that are not yet prepared for a full system overhaul, thereby supporting steady growth in the component upgrade market.

The application landscape demonstrates a strong preference for 4K fluorescence in procedures where vascular perfusion assessment is critical for preventing complications, such as gastrointestinal surgeries (anastomotic integrity assessment) and plastic/reconstructive surgeries (flap viability). The high resolution of 4K systems is particularly advantageous in complex microsurgical procedures, providing superior detail that standard fluorescence systems cannot match, thereby justifying the investment. Moreover, the End-User segment analysis highlights that large academic medical centers and specialized cancer hospitals are the early and primary adopters, requiring high-end, fully integrated systems for training, research, and complex cases. Conversely, the forecasted rapid growth in the Ambulatory Surgical Centers (ASCs) segment necessitates the development of smaller, more affordable, and user-friendly systems optimized for routine procedures with quick turnover times, creating divergent product requirements for market stakeholders.

- By Component:

- Camera and Illumination System (4K Camera Heads, Light Sources)

- Image Processing and Visualization Systems (Processors, 4K Monitors)

- Endoscope Scopes (Rigid Endoscopes, Flexible Endoscopes)

- Accessories and Consumables (Fluorescence Filters, Drapes, Contrast Agents)

- By Application:

- General Surgery (Gastrointestinal, Colorectal, Cholecystectomy)

- Urology and Gynecology (Prostatectomy, Hysterectomy, Endometriosis)

- Oncology (Tumor Margin Detection, Sentinel Lymph Node Mapping)

- Cardiothoracic and Vascular Surgery (Perfusion Assessment)

- Plastic and Reconstructive Surgery (Flap Viability Assessment)

- By End User:

- Hospitals (Large Academic Centers, Community Hospitals)

- Ambulatory Surgical Centers (ASCs)

- Specialized Clinics

- By Technology:

- ICG Fluorescence Imaging Systems

- Targeted Molecular Imaging Systems (Emerging)

Value Chain Analysis For 4K Fluorescent Endoscope Imaging System Market

The value chain for the 4K Fluorescent Endoscope Imaging System Market begins with highly specialized upstream activities involving R&D and the procurement of advanced raw materials, particularly high-resolution 4K sensors, specialized optical glass, and high-intensity, filtered LED light sources necessary for fluorescence excitation. Manufacturing involves complex assembly processes to integrate delicate optical trains and powerful image processors capable of handling massive 4K data streams in real-time. This phase is capital-intensive and requires stringent quality control due to the critical nature of medical devices. Leading manufacturers often maintain tight control over their supply chain to ensure the quality and consistency of these high-precision components, often engaging in proprietary software development for image processing algorithms that enhance fluorescence contrast and noise reduction.

Downstream activities are dominated by sales, distribution, and critical after-sales support. The complexity and high cost of 4K fluorescence systems mandate a robust distribution channel, primarily relying on highly skilled direct sales forces supplemented by exclusive regional distributors who can provide technical expertise and installation support. Direct channels are preferred for engaging large institutional buyers (Tier 1 hospitals) and for major contract negotiations, ensuring customized integration into existing OR setups. Indirect channels, through specialized medical equipment dealers, are vital for market penetration into smaller clinics and ASCs. The service component, including maintenance, software updates, and continuous clinical training, forms a critical revenue stream and significantly influences customer satisfaction and retention, given the highly technical nature of the equipment.

The selection of distribution channels heavily depends on geographic reach and the type of end-user. Direct distribution offers manufacturers maximum control over pricing, branding, and customer relationships, crucial for sophisticated, high-value systems. Conversely, indirect distribution allows for rapid market expansion, leveraging local expertise and established relationships, particularly in emerging markets where a physical presence is challenging. The value chain is constantly optimized to manage regulatory compliance—a significant hurdle—and to minimize the time-to-market for new technological innovations, particularly the integration of AI modules. Success in this value chain hinges upon seamless coordination between proprietary R&D teams and clinical application specialists to ensure the technology meets real-world surgical demands.

4K Fluorescent Endoscope Imaging System Market Potential Customers

The primary end-users and buyers of 4K Fluorescent Endoscope Imaging Systems are large, specialized healthcare institutions globally that perform a high volume of complex minimally invasive surgeries, particularly those involving oncology, cardiovascular, and reconstructive procedures. Academic medical centers and university hospitals represent the most valuable customer segment, driven by their tripartite mission of advanced patient care, surgical training, and cutting-edge clinical research. These institutions possess the substantial capital budgets required for system acquisition and the clinical staff necessary to effectively utilize these sophisticated modalities, often purchasing integrated solutions that bundle 4K visualization with robotic surgical platforms and advanced data management systems. Their purchasing decisions are heavily influenced by demonstrable improvements in patient outcomes and the system’s utility for training the next generation of surgeons.

Secondary, yet rapidly growing, customer segments include specialized cancer treatment centers and large private hospital chains that aim to differentiate their service offerings through superior technology and reduced complication rates. For these buyers, the adoption of 4K fluorescence is viewed as a strategic investment to enhance institutional reputation and attract patients seeking the highest standard of care. Their procurement strategy often focuses on systems that offer a clear return on investment (ROI) through increased surgical efficiency and reduced readmission rates. Furthermore, government and military hospitals, particularly in North America and Western Europe, are also significant purchasers, driven by requirements to maintain advanced operational capabilities and support veterans' healthcare needs using state-of-the-art medical devices.

A crucial emerging customer segment consists of Ambulatory Surgical Centers (ASCs) and specialized outpatient clinics focusing on specific, high-volume procedures like hernia repair or bariatric surgery. While traditionally price-sensitive, ASCs are increasingly recognizing the value of 4K fluorescence, especially for preventing perfusion-related complications, leading to a demand for more compact, portable, and simplified systems. Manufacturers are developing tailored product lines for this segment, focusing on essential fluorescence capabilities integrated into smaller, non-tower-based setups. Therefore, the market's potential customer base is segmented by budget size, complexity of procedures performed, and the strategic objective (e.g., academic training vs. high-throughput efficiency).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $2.69 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Olympus Corporation, Karl Storz SE & Co. KG, Stryker Corporation, Richard Wolf GmbH, Fujifilm Holdings Corporation, B. Braun Melsungen AG, Intuitive Surgical Inc., Medtronic PLC, Hoya Corporation (PENTAX Medical), Johnson & Johnson (Ethicon), ConMed Corporation, Minimally Invasive Surgical Systems Inc., DORC International B.V., Visionsense Ltd., NOVADAQ Technologies Inc. (now part of Stryker), Mizuho Medical Co., Ltd., Boston Scientific Corporation, Schölly Fiberoptic GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

4K Fluorescent Endoscope Imaging System Market Key Technology Landscape

The technological landscape of the 4K Fluorescent Endoscope Imaging System market is defined by several intertwined innovations aimed at maximizing visual fidelity, diagnostic accuracy, and surgical workflow efficiency. The foundational technology involves the use of high-sensitivity Complementary Metal-Oxide-Semiconductor (CMOS) sensors capable of capturing images at 4K resolution (3840 x 2160 pixels) while maintaining high frame rates necessary for fluid surgical video. Crucially, these systems employ specialized dichroic filters and high-power Near-Infrared (NIR) light sources (typically 780-820 nm range) optimized to excite common fluorophores like Indocyanine Green (ICG). The challenge lies in minimizing cross-talk between the white light spectrum (for anatomical view) and the NIR fluorescence signal (for functional view) to achieve simultaneous, artifact-free display—a process known as real-time overlay or fusion imaging.

A significant technological differentiator among leading vendors is the image processing unit (IPU). Modern IPUs utilize powerful Graphical Processing Units (GPUs) and proprietary algorithms to manage the enormous data throughput of 4K video while executing complex fusion and enhancement techniques. Key technological features include dynamic range adjustment to handle varying tissue densities and distances, digital zooming capabilities without resolution loss, and noise reduction algorithms specifically tailored for the low-light environments inherent to fluorescence imaging. Furthermore, the development of rigid and flexible endoscopes that incorporate specialized optical fibers and lens systems designed to maintain 4K resolution across the entire field of view while efficiently transmitting both white and fluorescent light is a critical area of ongoing innovation, ensuring consistent image quality from the tip of the scope to the surgical monitor.

Future technological advancements are heavily leaning towards computational imaging and connectivity. This includes the development of 'smart' endoscopes equipped with integrated sensors and micro-processors, capable of performing initial image correction and data compression at the source before transmission. Wireless 4K video transmission, ensuring reduced cable clutter in the operating room, is becoming a standard feature. Most importantly, the rapid development and integration of novel, targeted molecular imaging agents, which provide more specific targeting than ICG (e.g., tumor-specific dyes), are driving the demand for systems capable of handling multiple, tunable wavelengths beyond the standard NIR band, thereby broadening the clinical utility of these advanced endoscopes into highly specialized diagnostics and personalized medicine.

Regional Highlights

North America currently dominates the 4K Fluorescent Endoscope Imaging System Market, accounting for the largest revenue share, primarily due to the region's highly developed healthcare infrastructure, substantial governmental and private investment in advanced surgical technologies, and high procedural volumes for complex diseases like cancer and cardiovascular conditions. The presence of major market players and early adoption rates of cutting-edge surgical modalities, including robotic-assisted surgery which synergizes well with 4K fluorescence, contribute significantly to this leadership. Furthermore, favorable reimbursement policies in the US and Canada for minimally invasive procedures and fluorescence-guided techniques encourage hospitals to adopt high-cost, high-value systems, ensuring a robust and stable demand base. The regional market is also characterized by strong emphasis on clinical trials and research, fostering continuous technological upgrades and rapid market acceptance of new fluorophores and imaging algorithms.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market during the forecast period. This accelerated growth is primarily attributed to rapidly improving healthcare infrastructure in emerging economies such as China, India, and South Korea, coupled with significant increases in public and private healthcare spending aimed at modernizing surgical facilities. The vast, aging population and the escalating incidence of chronic diseases, particularly gastrointestinal and lung cancers, drive the necessity for sophisticated diagnostic and therapeutic tools like 4K FGS. However, the APAC market demands different strategic approaches; while Japan and Australia align with North American technology adoption patterns, high price sensitivity in countries like India necessitates the development of localized, cost-effective product lines. Manufacturers are increasingly establishing local manufacturing and R&D centers in China and India to better serve regional demands and navigate diverse regulatory environments, signifying a pivotal shift in global market focus.

Europe represents a mature and high-value market, characterized by stringent regulatory standards and centralized healthcare procurement in countries like Germany, the UK, and France. Market growth in Europe is steady, driven by the replacement of aging HD equipment with 4K systems and the strong institutional commitment to improving surgical outcomes through enhanced visualization. Although the initial adoption rate may be slightly slower compared to the U.S. due to rigorous health technology assessment (HTA) processes required for new device introduction, once accepted, the penetration rate is high across national health services. Latin America and the Middle East & Africa (MEA) currently hold smaller market shares but offer long-term potential. Growth in these regions is heavily reliant on foreign direct investment in healthcare infrastructure and improved economic stability, focusing initially on major urban centers and high-tier private hospitals that serve medical tourism and affluent populations.

- North America (Dominant Market): Highest investment in R&D; early and widespread adoption of 4K technology in conjunction with robotics; favorable reimbursement landscape (especially the U.S.).

- Asia Pacific (Fastest Growing): Driven by healthcare modernization in China and India; massive patient pool; increasing medical tourism; demand for localized, cost-efficient systems.

- Europe (Steady Growth): Strong regulatory environment and high clinical quality standards; focus on upgrading legacy systems to 4K fluorescence across major economies (Germany, UK).

- Latin America & MEA (Emerging Potential): Growth concentrated in urban centers; high reliance on imported technology; opportunities for market entry via government tenders and private hospital expansion projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the 4K Fluorescent Endoscope Imaging System Market.- Olympus Corporation

- Karl Storz SE & Co. KG

- Stryker Corporation

- Richard Wolf GmbH

- Fujifilm Holdings Corporation

- B. Braun Melsungen AG

- Intuitive Surgical Inc.

- Medtronic PLC

- Hoya Corporation (PENTAX Medical)

- Johnson & Johnson (Ethicon)

- ConMed Corporation

- Minimally Invasive Surgical Systems Inc.

- DORC International B.V.

- Visionsense Ltd.

- NOVADAQ Technologies Inc. (now part of Stryker)

- Mizuho Medical Co., Ltd.

- Boston Scientific Corporation

- Schölly Fiberoptic GmbH

- Nihon Kohden Corporation

- Getinge AB

Frequently Asked Questions

Analyze common user questions about the 4K Fluorescent Endoscope Imaging System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of 4K Fluorescent Endoscopy over standard HD systems?

The primary advantage is the combination of superior 4K ultra-high resolution (four times the pixels of HD) with real-time fluorescence imaging, allowing surgeons to see anatomical structures and functional information (like blood flow or tumor margins using ICG) simultaneously, leading to enhanced surgical precision and reduced complications.

How does Artificial Intelligence integrate with 4K Fluorescence systems?

AI integrates by providing automated, real-time image analysis. It processes the large 4K data stream to automatically detect subtle tumor margins, quantify tissue perfusion, correct image artifacts, and provide augmented reality overlays for critical structures, transforming visualization into active surgical guidance.

What are the main financial constraints affecting market growth?

The main financial constraints are the high initial capital expenditure required to purchase a complete 4K imaging tower, coupled with the ongoing costs of specialized maintenance, software licensing, and necessary consumable contrast agents like ICG.

Which surgical applications benefit most from 4K Fluorescence Guidance?

General Surgery (especially colorectal anastomotic assessment), Oncology (sentinel lymph node mapping and tumor margin delineation), and Plastic/Reconstructive Surgery (flap viability assessment) benefit the most due to the critical need for precise real-time perfusion and tissue differentiation.

Which region is expected to exhibit the highest market growth rate?

The Asia Pacific (APAC) region is expected to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid modernization of healthcare infrastructure, increasing prevalence of target diseases, and expanding government initiatives focused on adopting advanced medical technologies, particularly in China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager