4K UHD Camera Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431825 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

4K UHD Camera Market Size

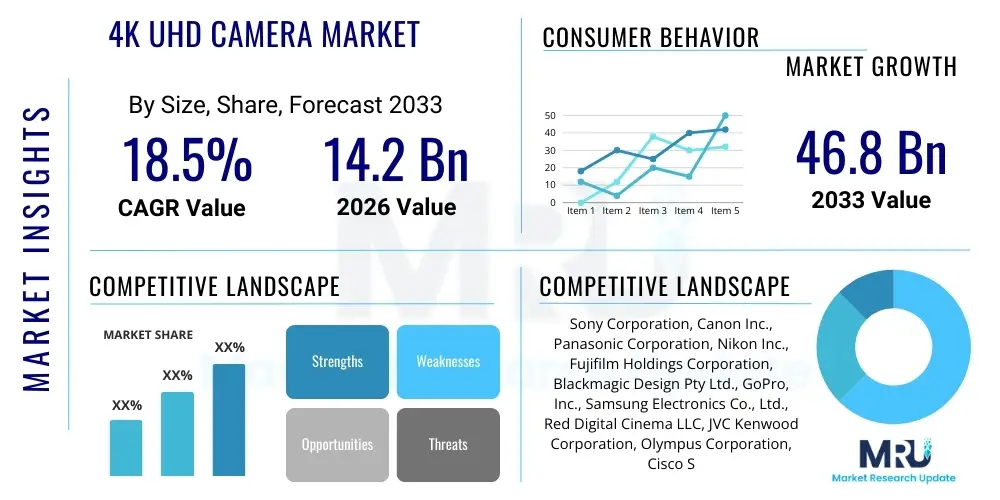

The 4K UHD Camera Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $14.2 Billion in 2026 and is projected to reach $46.8 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the accelerating global demand for ultra-high-definition content across consumer electronics, professional media production, and specialized industrial applications such as advanced surveillance and medical imaging. The continuous reduction in the cost of 4K sensor technology and improved processing power in smaller form factors are key enablers for market expansion, pushing 4K UHD capabilities into mainstream devices and new vertical markets.

4K UHD Camera Market introduction

The 4K UHD Camera Market encompasses devices capable of capturing video and still images at a resolution of approximately 4000 horizontal pixels, typically 3840 x 2160 pixels (UHD-1) or 4096 x 2160 pixels (DCI 4K). These cameras provide significantly enhanced image fidelity, superior color depth, and improved capabilities for post-production cropping and stabilization compared to Full HD (1080p) devices. This elevated resolution meets the stringent requirements of modern broadcasting, cinematic production, and high-stakes security installations, ensuring future-proof content quality. The product portfolio ranges from high-end professional cinema cameras and robust security cameras to consumer-grade mirrorless cameras and action cameras, catering to a broad spectrum of end-users demanding superior visual clarity.

Major applications driving this market include the burgeoning media and entertainment sector, which requires 4K acquisition for streaming platforms and theatrical releases, and the rapidly advancing security and surveillance industry, where 4K resolution enables forensic detailing and broader area coverage with fewer units. Furthermore, industrial inspection, medical diagnostics (e.g., surgical cameras), and automotive safety systems are increasingly adopting 4K UHD technology due to its unparalleled detail rendering. The inherent benefits of 4K UHD—including enhanced viewing experience, superior data capture, and professional workflow integration—are essential catalysts for market growth, solidifying its position as the standard for high-quality visual data capture across virtually all digital domains.

The primary driving factors sustaining the market include the widespread proliferation of 4K display devices (TVs, monitors, smartphones), the aggressive competitive landscape pushing technological innovation (especially in low-light performance and frame rates), and the dramatic increase in user-generated content, which necessitates professional-grade yet accessible camera systems. Additionally, advancements in video compression standards (like HEVC) and faster data transfer protocols (like USB 4.0 and 5G networks) make managing large 4K files practical, removing historical barriers to adoption. These combined forces ensure sustained investment and expansion across both consumer and commercial segments globally, making 4K UHD the benchmark resolution for future imaging applications.

4K UHD Camera Market Executive Summary

The 4K UHD Camera Market exhibits robust growth driven by converging trends in content consumption, digital security, and technological miniaturization. Business trends highlight a pronounced shift towards mirrorless interchangeable lens cameras (ILCs) among prosumers and professionals, offering superior image quality and compact design, effectively displacing traditional DSLRs. Enterprise investment is heavily focused on integrated systems that combine 4K capture with real-time processing and deep learning capabilities, particularly in Smart City surveillance and industrial quality control. Furthermore, subscription services and leasing models for high-end cinematic cameras are gaining traction, allowing production houses to access cutting-edge technology without massive upfront capital expenditure, thus accelerating the refresh cycle for premium devices.

Regional trends indicate that Asia Pacific (APAC) is the dominant and fastest-growing region, fueled by massive manufacturing bases, rapid deployment of advanced infrastructure (Smart Cities), and a massive consumer base driving demand for affordable 4K devices and action cameras. North America and Europe maintain high market share primarily due to mature media and entertainment industries and high adoption rates of sophisticated surveillance technologies. Specifically, regions with strong cinematic output, such as Hollywood and Bollywood, continue to represent significant demand hubs for high-performance 4K cinema cameras, while urbanization patterns in emerging economies necessitate widespread adoption of high-resolution security solutions.

Segment trends emphasize the rapid commercialization of fixed-lens 4K cameras, dominating the security and surveillance application segment due to their cost-effectiveness and rugged design. Conversely, interchangeable lens cameras continue to lead in professional photography and video production, offering flexibility in specialized shooting environments. By distribution channel, online platforms are experiencing exponential growth, particularly for consumer and prosumer models, offering better price comparison and direct-to-consumer accessibility, though specialized professional gear still relies heavily on offline, specialized retail channels for consultation and support. The blending of consumer and professional features is blurring segment lines, leading to higher average selling prices in traditionally mid-range segments.

AI Impact Analysis on 4K UHD Camera Market

User queries regarding AI in the 4K UHD camera space frequently revolve around how AI enhances image quality, specifically through better noise reduction and enhanced dynamic range reconstruction, and how AI optimizes data handling by enabling intelligent compression and selective recording. Key concerns focus on the integration of edge computing capabilities—asking whether the AI processing occurs on the camera itself (edge) or relies on cloud infrastructure, and the subsequent implications for latency and security in real-time applications like security and autonomous vehicles. Users also show high expectations for AI-driven automation, inquiring about features such as enhanced subject tracking, automated scene recognition, and predictive maintenance for professional equipment, signaling a demand for cameras that are not merely capture devices but intelligent sensory nodes within larger connected ecosystems.

The integration of Artificial Intelligence (AI) fundamentally transforms the value proposition of 4K UHD cameras, shifting them from passive data acquisition tools to active, intelligent components within operational frameworks. AI processing, often implemented via dedicated Neural Processing Units (NPUs) or specialized silicon within the camera body (on-edge), dramatically improves the quality and utility of the captured data. For instance, AI algorithms are crucial for sophisticated noise reduction in low-light 4K capture, achieving clarity that was previously impossible. Furthermore, deep learning models enable immediate, accurate metadata generation, such as object detection, behavioral analysis, and biometric identification, making 4K surveillance systems significantly more proactive and effective than legacy systems, thus generating substantial new demand across public safety and industrial monitoring sectors.

Beyond image processing, AI greatly impacts data management efficiency, a critical challenge given the immense file sizes associated with 4K UHD video. AI-driven intelligent compression and storage management prioritize critical data based on real-time event analysis, reducing bandwidth requirements without compromising essential information. In professional cinematography, AI assists in optimizing complex camera settings, such as autofocus systems that predict subject movement with high accuracy (predictive focusing), and automated gimbal stabilization that anticipates shifts in camera operator movement. This pervasive integration of AI enhances user experience, minimizes operational costs, and unlocks previously inaccessible applications for 4K imaging, particularly in automated manufacturing inspection and highly complex remote surgical procedures.

- AI-Enhanced Image Processing: Utilizes deep learning for superior noise reduction, dynamic range optimization, and sharpening, especially under challenging lighting conditions.

- Intelligent Video Analytics (IVA): Enables real-time object detection, facial recognition, behavioral analysis, and automated threat assessment directly at the camera edge, reducing latency.

- Data Optimization and Compression: AI-driven codecs selectively compress non-critical background data while maintaining fidelity on areas of interest, significantly lowering storage and bandwidth needs.

- Automated Workflow Integration: Facilitates smart autofocus, predictive tracking, and scene recognition in professional cameras, automating complex setup and operation tasks.

- Predictive Maintenance: AI algorithms monitor camera performance and internal sensor health, predicting potential failures and scheduling maintenance before operational downtime occurs.

DRO & Impact Forces Of 4K UHD Camera Market

The market for 4K UHD cameras is powered by several interconnected drivers, notably the exponential demand for high-resolution content spurred by major streaming services (Netflix, Amazon Prime Video) and the widespread deployment of 4K TVs and monitors globally, making 4K capture a necessity for content creators. Simultaneously, the accelerating adoption of advanced video surveillance in urban environments, often mandated by government smart city initiatives, requires the forensic detail only 4K can provide. However, growth is constrained by restraints such as the high cost associated with professional 4K production ecosystems (including lenses, storage, and processing hardware) and the substantial technical challenges related to managing the extremely large file sizes and high bandwidth requirements of raw 4K footage. These technical bottlenecks create friction, particularly for smaller production houses and consumer users relying on older storage infrastructure.

Opportunities for market expansion are vast, primarily centered on the increasing deployment of 4K resolution in non-traditional applications like telemedicine, industrial machine vision, and drone-based mapping and inspection. The convergence of 4K imaging with advanced technologies such as 5G connectivity and edge AI represents a significant pathway for innovation, allowing cameras to process and transmit high-fidelity data almost instantaneously from remote locations. Specifically, the development of smaller, more energy-efficient 4K sensors tailored for specialized devices, such as embedded systems in robotics and augmented reality (AR) devices, presents high-growth niches that are currently underserved by traditional consumer or professional camera manufacturers, creating lucrative avenues for specialized market entrants.

The market is characterized by strong impact forces, dominated by intense price competition in the consumer and prosumer segments, which continuously drives down the average selling price and necessitates innovation to maintain profitability. Regulatory forces, particularly concerning privacy laws (like GDPR) and the ethical use of surveillance technology, significantly impact the security camera segment, forcing manufacturers to integrate robust encryption and data anonymization features. Technologically, the transition to newer sensor architectures, such as stacked CMOS sensors offering higher readout speeds, and the proliferation of open-source software and standardized APIs for camera control are democratizing access to professional features, reshaping the competitive landscape and accelerating the pace of product obsolescence. These forces mandate that manufacturers maintain high agility in product development to capitalize on emerging opportunities while navigating stringent technical and regulatory constraints.

Segmentation Analysis

The 4K UHD Camera Market is comprehensively segmented based on product type, application, and distribution channel, reflecting the diverse requirements of end-users ranging from individual consumers to large-scale industrial enterprises. Product types are broadly categorized into fixed lens and interchangeable lens systems, where fixed lens cameras predominantly serve robust, dedicated applications like surveillance and industrial inspection, prioritizing durability and specific focal lengths. Conversely, interchangeable lens systems (DSLRs, Mirrorless, Cinema Cameras) offer creative flexibility and modularity essential for high-end cinematic and professional photography tasks. The segmentation ensures that manufacturers can tailor product offerings precisely to the performance, mobility, and cost requirements of specific market verticals, maximizing penetration across the complex digital imaging ecosystem.

Application-based segmentation reveals the highest revenue streams originating from Media and Entertainment, driven by constant demand for premium content acquisition for film, television, and high-definition virtual reality (VR) content. However, the Security and Surveillance segment is projected to exhibit the fastest growth, propelled by global urbanization and the need for enhanced public safety and intelligent traffic monitoring systems that leverage 4K’s ability to capture detailed evidence. Other critical applications, including Healthcare (surgical imaging, diagnostics), Commercial (web conferencing, corporate videography), and Industrial (machine vision, quality inspection), provide resilient, high-margin revenue streams, often requiring specialized, ruggedized camera systems built to withstand extreme operating conditions.

Analyzing the distribution channel split highlights the evolving procurement strategies across different buyer types. The online channel dominates the consumer and prosumer markets, valued for its vast inventory, competitive pricing, and ease of access to reviews and technical specifications. Conversely, specialized, high-cost professional cinema cameras, industrial systems, and integrated security solutions typically rely on the offline distribution channel, involving specialized integrators, value-added resellers (VARs), and direct sales teams. These channels provide essential pre-sales consultation, custom configuration, technical support, and critical after-sales services required for complex deployments, ensuring system compatibility and regulatory compliance in professional environments.

- By Type:

- Interchangeable Lens Cameras (ILCs):

- Digital Single-Lens Reflex (DSLR)

- Mirrorless Cameras (MSCs)

- Professional Cinema Cameras

- Fixed Lens Cameras:

- Action Cameras

- Security/Surveillance Cameras (Dome, Bullet, PTZ)

- Camcorders/Prosumer Cameras

- Machine Vision Cameras

- By Application:

- Media and Entertainment (Film Production, Broadcasting, Streaming)

- Security and Surveillance (Public Safety, Commercial Buildings, Residential)

- Commercial/Enterprise (Webcams, Corporate Videography, Live Event Coverage)

- Healthcare (Surgical Imaging, Medical Diagnostics)

- Industrial and Manufacturing (Machine Vision, Quality Control, Inspection)

- Automotive and Transportation (ADAS, Dashboard Cameras)

- By Distribution Channel:

- Online Sales Channels (E-commerce Platforms, Manufacturer Websites)

- Offline Sales Channels (Specialized Retailers, Value-Added Resellers, System Integrators)

- By Resolution Standard:

- UHD-1 (3840 x 2160)

- DCI 4K (4096 x 2160)

Value Chain Analysis For 4K UHD Camera Market

The value chain of the 4K UHD Camera Market begins with the upstream segment, dominated by highly specialized component suppliers responsible for critical technologies like CMOS image sensors, advanced optical lens assemblies, and powerful image processing chipsets (ASICs/FPGAs). This stage is capital-intensive and concentrated among a few global technology giants (e.g., Sony, Samsung, Omnivision) that dictate technical specifications and pricing for core components. Access to cutting-edge sensor technology and proprietary processing algorithms is a key determinant of competitive advantage for downstream camera manufacturers, as sensor performance directly influences the final image quality and low-light capability, which are primary purchasing criteria in both consumer and professional markets.

The manufacturing and assembly stage involves major camera brands that integrate these components, focusing heavily on miniaturization, thermal management, software optimization, and ergonomic design. Significant value is added through proprietary firmware development and ecosystem creation (e.g., lens mounts, accessory compatibility). The distribution channel acts as a crucial midstream element. Direct sales channels are often employed for high-end cinema cameras requiring customization and direct customer support, while indirect channels—comprising mass retailers, e-commerce giants, and specialized system integrators—handle the high volume of consumer and security camera sales. Integrators are particularly vital in the security sector, adding substantial value through installation, networking setup, and integration with existing enterprise security infrastructure.

The downstream analysis focuses on the end-users and the after-sales services. Direct distribution through company websites (Direct-to-Consumer or D2C) is increasingly important, offering higher margin potential and direct customer feedback loops. For professional equipment, technical support, firmware updates, repair services, and warranty provisions are non-negotiable value additions that sustain customer loyalty and ensure operational continuity. The lifecycle management of 4K cameras, especially high-cost professional gear, includes rental and leasing services, which extend the device’s economic utility. The overall value chain is highly interconnected, with success depending on seamless collaboration between component suppliers, core manufacturers, and sophisticated system integrators who customize the technology for final consumption.

4K UHD Camera Market Potential Customers

The potential customers for 4K UHD cameras are highly diversified, encompassing professional creative industries, large governmental and private security organizations, and a mass market of technology-savvy consumers. The highest value customers are typically found within the Media and Entertainment vertical, including major Hollywood and global film studios, independent production companies, broadcast networks, and rapidly expanding Over-The-Top (OTT) streaming platforms. These entities require high frame rates, high dynamic range (HDR) capability, and color science fidelity offered by professional cinema and broadcast 4K cameras, often investing in complete ecosystems of associated equipment, thereby representing large, recurring revenue streams due to frequent technology upgrades and replacement cycles essential for maintaining competitive production standards.

The second major cohort consists of security system buyers, including municipal governments implementing Smart City surveillance, large commercial enterprises requiring comprehensive perimeter and internal monitoring, and financial institutions necessitating forensic-level detail for incident investigation. These customers prioritize reliability, durability, advanced integration with existing infrastructure (e.g., VMS systems), and embedded AI capabilities for intelligent monitoring. The procurement decisions in this segment are often driven by regulatory compliance, total cost of ownership (TCO), and the camera’s ability to perform reliably under challenging environmental conditions, demanding specialized bullet, dome, and robust Pan-Tilt-Zoom (PTZ) 4K units designed for continuous operation and secure data transmission over vast networks.

Finally, the consumer and prosumer segment forms a massive volume customer base. This group includes vloggers, content creators on platforms like YouTube and TikTok, professional photographers, and general consumers seeking enhanced features in action cameras or mirrorless systems for personal use. While their individual purchasing power is lower than that of studios or governments, their sheer volume and rapid upgrade cycles make them crucial. These customers are highly sensitive to price, form factor, and ease of use, driving demand for innovative features like advanced stabilization, connectivity, and intuitive interfaces. The penetration of 4K UHD technology into general consumer electronics ensures that virtually any modern device user is a potential customer for entry-level to mid-range 4K cameras, continuing to fuel market expansion at the entry point of the value curve.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $14.2 Billion |

| Market Forecast in 2033 | $46.8 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sony Corporation, Canon Inc., Panasonic Corporation, Nikon Inc., Fujifilm Holdings Corporation, Blackmagic Design Pty Ltd., GoPro, Inc., Samsung Electronics Co., Ltd., Red Digital Cinema LLC, JVC Kenwood Corporation, Olympus Corporation, Cisco Systems, Inc., AXIS Communications AB, Hikvision Digital Technology Co., Ltd., Dahua Technology Co., Ltd., ARRI AG, Z CAM, EKEN, Insta360, DJI. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

4K UHD Camera Market Key Technology Landscape

The technological landscape of the 4K UHD Camera Market is rapidly evolving, defined by continuous innovation in sensor design and processing power, which are critical for maximizing resolution capabilities without sacrificing performance. Key advancements include the widespread adoption of Stacked CMOS sensors, which integrate the pixel array and the processing circuits into separate layers. This architecture dramatically increases data readout speeds, enabling high frame rates (e.g., 4K at 120fps or higher) and minimizing the rolling shutter effect, crucial for capturing fast-moving subjects with minimal distortion. Furthermore, advancements in back-side illumination (BSI) and the transition to global shutter technology, particularly in high-end cinema and industrial machine vision cameras, address historical limitations related to low-light sensitivity and motion artifacts, setting a new benchmark for image fidelity across the industry.

Another fundamental technological pillar is the advancement in dedicated Image Signal Processors (ISPs) and specialized chipsets incorporating Neural Processing Units (NPUs). These processors are engineered to handle the massive data throughput of 4K sensors while performing complex, real-time computational photography tasks. This includes multi-frame noise reduction, high dynamic range (HDR) merging, and sophisticated color science processing necessary for professional grading. The development of advanced, highly efficient video compression standards, such as H.265 (HEVC) and the newer AV1 codec, is also paramount. These compression technologies allow for the capture and storage of high-quality 4K footage in more manageable file sizes, mitigating the previously mentioned constraints associated with massive data storage requirements and enhancing the viability of network transmission for remote monitoring systems.

Finally, connectivity and integration technologies are defining the next generation of 4K camera systems. The increasing integration of high-speed interfaces like USB 4.0, Thunderbolt, and native HDMI 2.1 outputs facilitates high-speed data transfer necessary for uncompressed 4K workflows. Crucially, the deployment of 5G connectivity is unlocking new potential for remote production and decentralized security networks, allowing 4K feeds to be streamed or uploaded reliably from virtually anywhere. Within the security segment, Power over Ethernet (PoE) technology continues to simplify deployment by combining power and data transmission into a single cable, further driving the adoption of high-resolution IP cameras across diverse environments, solidifying the market's trajectory towards highly connected, intelligent visual nodes.

Regional Highlights

Geographic analysis reveals distinct consumption patterns and growth drivers across major global regions, reflecting economic maturity, technological infrastructure, and regulatory environments concerning visual data.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market, characterized by immense growth potential driven by significant government investments in Smart Cities infrastructure in China, India, and Southeast Asia, leading to massive deployment of 4K security and surveillance systems. Furthermore, the region is a global manufacturing hub for consumer electronics, fostering intense price competition and rapid technology adoption among a massive consumer base eager for affordable 4K mirrorless and action cameras. South Korea and Japan maintain leadership in sensor manufacturing and high-end broadcasting equipment, while China dominates the volume production of surveillance hardware (Hikvision, Dahua). The demand is also heavily supported by the region's dynamic content creation ecosystem, particularly in India and South Korea, which produce vast amounts of 4K content for local and international streaming platforms.

- North America: North America holds a substantial market share, defined by its mature and highly capitalized media and entertainment industry, particularly Hollywood, which dictates global standards for cinema camera technology (e.g., Red Digital Cinema, ARRI). High-end professional equipment adoption is robust and rapid. The region also exhibits strong demand in the commercial sector for advanced enterprise security and web conferencing solutions. Innovation is driven by leading tech companies integrating AI and cloud computing directly into 4K security cameras. Consumer demand is stable, driven by high disposable income and the established prevalence of 4K HDR television sets in households. Regulatory complexity surrounding data privacy and federal surveillance standards often influences the technical specifications and data handling capabilities of cameras sold here.

- Europe: Europe is a high-value market, characterized by strong demand for sophisticated broadcast equipment due to established public service broadcasters and private media groups. Industrial application of 4K, particularly in advanced manufacturing (Germany, France) for quality control and robotic guidance (Machine Vision), is a key growth area. The region’s strict General Data Protection Regulation (GDPR) forces manufacturers to implement robust encryption and privacy-by-design features in their security camera offerings, driving up the technical requirements. Western Europe maintains high average selling prices for premium prosumer and professional interchangeable lens systems, reflecting a culture of quality and technical specification preference over pure price consideration.

- Latin America (LATAM): LATAM is an emerging market with increasing penetration rates, primarily focused on affordable surveillance solutions and consumer electronics. Economic volatility often restricts investment in the highest-end professional equipment, leading to higher reliance on more cost-effective solutions. However, growth is accelerating, particularly in major economies like Brazil and Mexico, fueled by expanding local content production for streaming services and growing awareness regarding the benefits of high-resolution monitoring for addressing security challenges in rapidly growing metropolitan areas. The market for action cameras and accessible prosumer equipment is gaining traction as disposable incomes improve.

- Middle East and Africa (MEA): The MEA market is largely driven by large-scale government infrastructure projects and oil and gas sector investments requiring robust, high-resolution surveillance systems. Major initiatives in the UAE and Saudi Arabia (e.g., NEOM project) necessitate cutting-edge 4K monitoring for security, traffic management, and construction monitoring. High defense spending also contributes to specialized military and defense applications of 4K imaging. Consumer adoption is growing, often concentrated in high-income urban centers. Market penetration is highly uneven, with high-tech adoption in the Gulf Cooperation Council (GCC) countries contrasting with slower growth in less developed African nations, focusing heavily on imported surveillance technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the 4K UHD Camera Market.- Sony Corporation

- Canon Inc.

- Panasonic Corporation

- Nikon Inc.

- Fujifilm Holdings Corporation

- Blackmagic Design Pty Ltd.

- GoPro, Inc.

- Samsung Electronics Co., Ltd.

- Red Digital Cinema LLC

- JVC Kenwood Corporation

- Olympus Corporation

- Cisco Systems, Inc.

- AXIS Communications AB

- Hikvision Digital Technology Co., Ltd.

- Dahua Technology Co., Ltd.

- ARRI AG

- Z CAM

- EKEN

- Insta360

- DJI

Frequently Asked Questions

Analyze common user questions about the 4K UHD Camera market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between DCI 4K and UHD-1, and how does this affect my purchasing decision for professional applications?

The primary difference lies in the exact pixel count and aspect ratio. UHD-1 (3840 x 2160 pixels) is the consumer standard, utilizing a 16:9 aspect ratio, aligning with modern televisions and monitors. DCI 4K (4096 x 2160 pixels) is the cinematic standard, featuring a wider 1.9:1 aspect ratio, mandated by the Digital Cinema Initiatives (DCI) consortium for theatrical projection. For professional buyers in broadcasting, UHD-1 compatibility is often prioritized due to distribution requirements. However, cinematic production houses typically require DCI 4K cameras to ensure future-proofing for film festivals and standard theatrical releases. The choice dictates necessary post-production cropping and compatibility with specific lenses and projectors. Modern high-end 4K cameras frequently offer capture options for both standards, but security and general consumer cameras almost exclusively utilize the UHD-1 specification, focusing on practical resolution benefits for general viewing and monitoring.

How significantly do bandwidth requirements and data storage costs restrain the widespread adoption of 4K surveillance systems?

Bandwidth and storage requirements pose significant restraints, especially for large-scale, continuous recording 4K surveillance deployments. Uncompressed 4K video requires exponentially more data throughput (upwards of 12-15 Mbps per camera, even with efficient H.265 compression, or significantly more for high-frame-rate streams) compared to traditional 1080p systems. This necessitates substantial upgrades to network infrastructure (higher-grade PoE switches, fiber backbones) and massive investment in Network Video Recorders (NVRs) with terabytes of redundant storage capacity. While advanced AI-driven compression techniques (like smart VBR encoding or recording only upon event detection) help mitigate the issue by reducing the amount of non-critical data saved, the total cost of ownership (TCO) for a robust 4K surveillance ecosystem remains high, especially for small to medium-sized enterprises (SMEs). System integrators must carefully balance resolution demands with infrastructure capability and budget constraints when designing enterprise security solutions.

What are the critical AI-driven features transforming the performance of 4K security cameras, and where does edge processing fit in?

AI is critically transforming 4K security camera performance by enabling sophisticated real-time analytics directly on the device, a process known as edge processing. Key features include highly accurate object classification (distinguishing between humans, vehicles, and animals), advanced facial recognition, and complex behavioral analysis (e.g., loitering detection, fall detection, crowd density monitoring). Edge processing, facilitated by embedded NPUs, is vital because it eliminates the need to transmit raw, high-bandwidth 4K video streams constantly to a central server for analysis. By performing the heavy computational lifting at the camera level, latency is drastically reduced, ensuring faster response times to critical events. The camera sends only metadata or alerts, significantly conserving network resources and enhancing the system's scalability. This shift makes 4K systems proactive intelligence tools rather than passive recording devices, offering enhanced operational efficiency and forensic capability for public safety and enterprise security applications globally.

How does the transition from traditional DSLR to mirrorless technology affect the professional segment of the 4K UHD Camera Market?

The transition from Digital Single-Lens Reflex (DSLR) to mirrorless interchangeable lens camera (MILC) technology has fundamentally reshaped the professional and prosumer segments, predominantly due to superior performance advantages in video capture and form factor. Mirrorless cameras utilize the imaging sensor constantly for both viewing and focusing, which allows for advanced features like phase-detect autofocus across the entire sensor plane, resulting in significantly more reliable and faster autofocus tracking—a necessity for professional 4K video work. Furthermore, the absence of a mirror box allows manufacturers to design smaller, lighter bodies while maintaining large sensor sizes (full-frame, APS-C), improving portability and making them ideal for gimbal and drone operation. While DSLRs still possess advantages in battery life and legacy lens compatibility, the rapid innovation in MILCs—including higher frame rates, better thermal management for continuous 4K recording, and superior electronic viewfinders—is driving most professionals to migrate, establishing MILCs as the new standard platform for future 4K camera technology development and driving competitive intensity among major vendors like Sony, Canon, and Nikon.

What key technological innovations are expected to drive the 4K UHD Camera market growth over the next five years, beyond basic resolution improvements?

Future market growth will be driven by innovations focusing on sensor efficiency, computational imaging, and connectivity rather than just raw pixel count. Crucially, the mass implementation of Global Shutter technology in consumer and prosumer cameras, which eliminates the rolling shutter effect (skewing fast motion), will significantly enhance video quality across all applications. Advancements in computational photography, leveraging machine learning, will allow cameras to synthesize complex images—such as 16-bit color depth or ultra-high dynamic range—from multiple sequential exposures in real-time, greatly exceeding the limits of traditional sensor hardware. Furthermore, the adoption of standardized open protocols for camera control (e.g., industry-wide APIs) and the integration of native 5G modules will turn cameras into fully connected, remote-operable digital nodes. These elements will foster new workflow efficiencies in broadcasting, remote collaboration, and automated industrial inspection, making the 4K sensor the central hub of intelligent data acquisition systems rather than merely a high-resolution capture mechanism, thereby stimulating demand for specialized, highly integrated 4K solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager