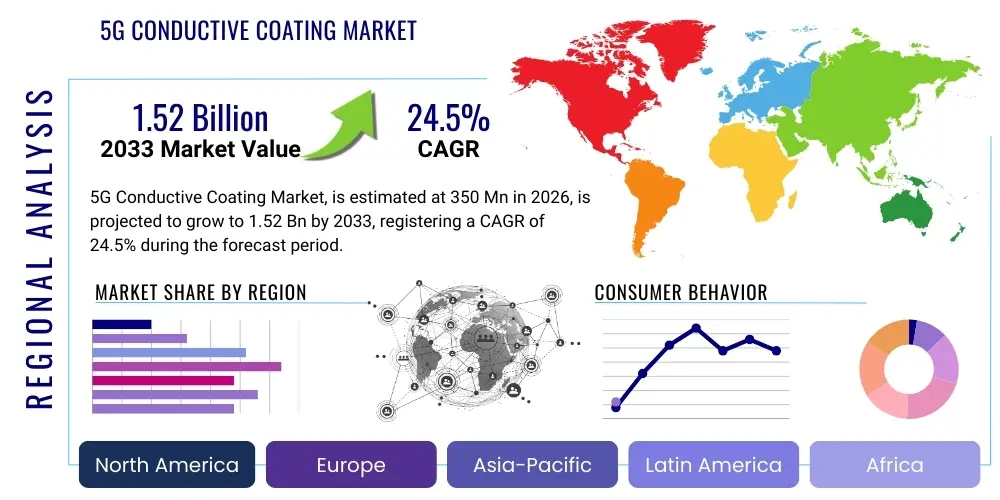

5G Conductive Coating Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439637 | Date : Jan, 2026 | Pages : 249 | Region : Global | Publisher : MRU

5G Conductive Coating Market Size

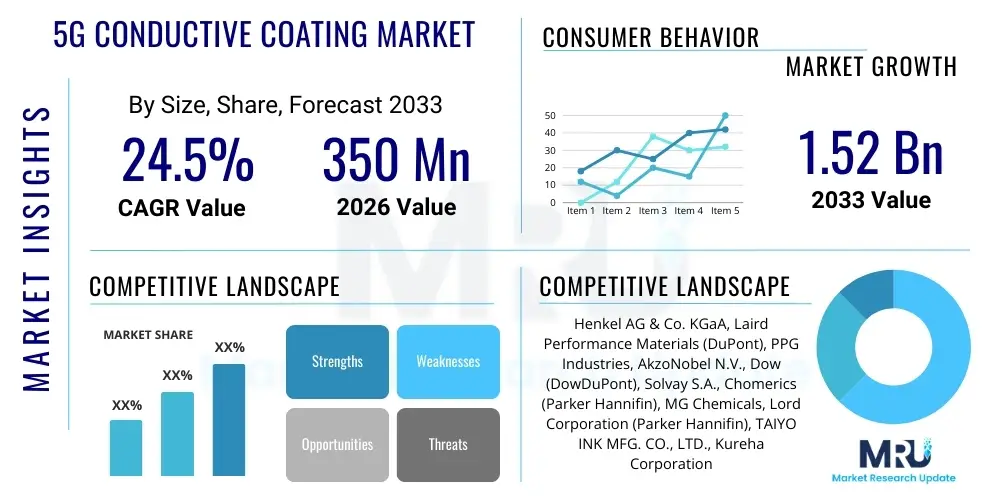

The 5G Conductive Coating Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 24.5% between 2026 and 2033. The market is estimated at 350 Million USD in 2026 and is projected to reach 1.52 Billion USD by the end of the forecast period in 2033.

5G Conductive Coating Market introduction

The 5G conductive coating market encompasses advanced material solutions designed to enhance the performance, reliability, and longevity of next-generation 5G communication infrastructure and devices. These specialized coatings are crucial for managing electromagnetic interference (EMI) shielding, ensuring signal integrity, and facilitating efficient thermal management in high-frequency 5G applications. As 5G technology rolls out globally, the demand for robust and effective conductive coatings in various electronic components is experiencing significant growth.

Key applications for 5G conductive coatings span across consumer electronics, telecommunications infrastructure, automotive, and industrial IoT. In consumer devices like smartphones and laptops, these coatings provide essential EMI shielding, preventing interference between densely packed components and enabling faster data processing. For 5G base stations, antennas, and network equipment, they ensure optimal signal transmission and protection against external electromagnetic disruptions, which is vital for maintaining high-speed, low-latency connectivity. The numerous benefits include improved device performance, enhanced data security, reduced power consumption, and extended operational life for sensitive electronic components.

The market's expansion is primarily driven by the escalating global deployment of 5G networks, the increasing proliferation of 5G-enabled devices, and the growing complexity and miniaturization of electronic components. The need for advanced materials to handle higher frequencies (such as millimeter-wave bands), greater data volumes, and increased device density in the 5G ecosystem directly fuels the demand for innovative conductive coating solutions. Additionally, the development of new materials and application techniques further contributes to market growth by offering more efficient and cost-effective shielding and thermal management properties.

5G Conductive Coating Market Executive Summary

The 5G conductive coating market is currently undergoing a transformative phase driven by rapid technological advancements and the global expansion of 5G networks. Key business trends include an intensified focus on research and development for novel materials, such as graphene and advanced composites, to meet the stringent performance requirements of higher frequency bands and miniaturized components. Strategic collaborations between material manufacturers, coating providers, and original equipment manufacturers (OEMs) are becoming prevalent to develop integrated solutions that address specific application needs. Furthermore, there is a growing emphasis on sustainable and environmentally friendly coating formulations in response to increasing regulatory pressures and corporate social responsibility initiatives, influencing product development cycles and market offerings.

Regionally, Asia-Pacific dominates the market due to robust 5G infrastructure deployment in countries like China, South Korea, and Japan, coupled with a booming consumer electronics manufacturing sector. North America and Europe are significant markets, characterized by strong R&D investments, early adoption of advanced 5G technologies, and a high demand for high-performance coatings in automotive, aerospace, and defense applications. Emerging economies in Latin America, the Middle East, and Africa are also showing promising growth as they accelerate their 5G rollout plans, creating new opportunities for conductive coating providers. Each region presents unique market dynamics influenced by local regulatory frameworks, technological readiness, and industrial landscape.

Segment-wise, the market is primarily driven by the material type, with silver and copper-based coatings holding substantial shares due to their excellent conductivity. However, carbon-based and graphene coatings are rapidly gaining traction due to their lightweight properties and flexibility, particularly for wearable and flexible electronics. In terms of application, consumer electronics and telecommunications infrastructure remain the largest segments, but the automotive sector, driven by autonomous vehicles and advanced driver-assistance systems (ADAS), is poised for significant growth. The increasing complexity of electronic circuits and the pervasive need for robust EMI shielding and thermal management across all these segments underscore the critical role of advanced conductive coatings in the successful deployment and operation of 5G technologies.

AI Impact Analysis on 5G Conductive Coating Market

The integration of Artificial Intelligence (AI) is poised to revolutionize the 5G conductive coating market by optimizing material discovery, enhancing manufacturing processes, and enabling predictive maintenance for coated components. Users are frequently concerned with how AI can accelerate the development of novel conductive materials with superior properties, reduce time-to-market for advanced coatings, and improve the precision and efficiency of coating application techniques. Furthermore, there is significant interest in AI's role in analyzing vast datasets related to material performance under various environmental conditions, predicting potential failures, and optimizing the lifespan of 5G infrastructure and devices. Users also anticipate AI to personalize coating solutions, tailor them to specific application requirements, and potentially lead to the creation of 'smart' coatings capable of self-diagnosis and adaptation.

- AI-driven material discovery accelerates the identification and synthesis of novel conductive polymers, nanoparticles, and composites with enhanced EMI shielding and thermal management properties for 5G applications.

- Predictive analytics powered by AI optimizes manufacturing processes for conductive coatings, reducing material waste, improving batch consistency, and enhancing overall production efficiency and quality control.

- AI algorithms can analyze real-time performance data of coated 5G components, enabling predictive maintenance schedules and optimizing the operational lifespan of base stations, antennas, and consumer devices.

- Generative design tools using AI assist in engineering custom coating architectures and patterns, providing tailored EMI shielding and thermal dissipation solutions for complex 5G device geometries.

- AI-enabled quality inspection systems enhance defect detection in coated surfaces, ensuring high reliability and performance standards for critical 5G components.

- Advanced AI models facilitate the simulation of coating behavior under various 5G frequency bands and environmental stressors, reducing the need for extensive physical prototyping.

DRO & Impact Forces Of 5G Conductive Coating Market

The 5G conductive coating market is propelled by a confluence of strong drivers, while also navigating significant restraints and presenting abundant opportunities, all shaped by various impact forces. The primary drivers include the relentless global rollout of 5G networks, demanding superior EMI shielding and thermal management solutions for higher frequency operations and increased data traffic. The exponential growth of IoT devices, coupled with the miniaturization and higher component density in electronic devices, necessitates more effective and compact coating solutions. Furthermore, the increasing adoption of advanced driver-assistance systems (ADAS) and autonomous vehicles, which rely heavily on robust sensor performance immune to interference, significantly boosts demand for these specialized coatings.

However, the market faces several restraints that could impede its growth. The high cost of advanced conductive materials, such as silver nanoparticles and certain specialized polymers, poses a challenge, particularly for cost-sensitive applications. The complexity associated with the precise formulation and application of these coatings, especially for intricate 5G components, requires specialized equipment and expertise, leading to higher manufacturing overheads. Additionally, stringent environmental regulations regarding the use of certain chemicals and heavy metals in coating formulations can constrain product development and market entry, requiring significant investment in R&D for compliant and sustainable alternatives. Material compatibility issues with diverse substrates further add to the developmental complexities.

Despite these challenges, the market presents substantial opportunities. The expansion into millimeter-wave (mmWave) technology for 5G, requiring even more sophisticated EMI shielding, opens new avenues for advanced coating development. The burgeoning industrial IoT sector and smart city infrastructure projects offer fertile ground for specialized coatings in robust, long-lasting communication modules. Moreover, continuous innovation in nanotechnology and material science, including the development of graphene-based and carbon nanotube-enhanced coatings, promises lighter, more flexible, and highly efficient solutions. The increasing demand for flexible electronics and wearable devices also creates a niche for innovative, bendable conductive coatings. These opportunities are significantly impacted by the pace of technological advancements, the evolving regulatory landscape surrounding chemicals and electronics, global economic conditions influencing investment in 5G infrastructure, and the competitive intensity among market players driving innovation and pricing strategies.

Segmentation Analysis

The 5G conductive coating market is comprehensively segmented to provide a detailed understanding of its diverse applications and material compositions. These segmentations are critical for identifying key growth areas, understanding competitive landscapes, and tailoring product development strategies. The market can be broadly categorized by material type, application, and end-use, each with its unique demand drivers and technological requirements. This granular analysis allows stakeholders to pinpoint specific market niches and develop targeted solutions for the rapidly evolving 5G ecosystem, addressing everything from high-performance telecommunications infrastructure to compact consumer electronics and emerging automotive applications.

- By Material Type

- Silver

- Copper

- Nickel

- Carbon-based (e.g., Carbon Nanotubes, Graphite)

- Graphene

- Others (e.g., Conductive Polymers, Composites)

- By Application

- Consumer Electronics (Smartphones, Tablets, Laptops, Wearables)

- Telecommunications Infrastructure (Base Stations, Antennas, Routers, Modems)

- Automotive (ADAS, In-Car Connectivity, Radar Systems)

- Aerospace & Defense (Avionics, Communication Systems)

- Healthcare (Medical Devices, Wearable Sensors)

- Industrial IoT & Smart Cities

- Others (e.g., Robotics, Drones)

- By End-Use Industry

- Devices (Handheld, IoT)

- Network Equipment

- RF Components

- Control Systems

Value Chain Analysis For 5G Conductive Coating Market

The value chain for the 5G conductive coating market is a complex ecosystem involving several key stages, from raw material sourcing to end-product integration. Upstream activities primarily focus on the extraction and refinement of base materials such as silver, copper, nickel, and carbon, alongside the synthesis of specialty chemicals like polymers, binders, and solvents. This stage involves a limited number of specialized raw material suppliers who provide high-purity inputs essential for creating effective conductive formulations. Research and development also play a crucial role here, driving innovation in nanomaterials like graphene and carbon nanotubes, which are increasingly critical for advanced 5G applications requiring superior conductivity and flexibility.

The midstream segment of the value chain involves the formulation and manufacturing of the conductive coatings themselves. This stage is dominated by specialty chemical companies and coating manufacturers who possess the expertise in blending various components to achieve desired electrical, thermal, and mechanical properties. These manufacturers invest heavily in R&D to develop custom formulations tailored to specific 5G requirements, such as high-frequency shielding, thermal dissipation, and adhesion to diverse substrates. Quality control, testing, and compliance with industry standards are paramount at this stage to ensure the reliability and performance of the coatings in demanding 5G environments.

Downstream activities involve the distribution of these coatings and their integration into final 5G products and infrastructure. Distribution channels can be direct, where coating manufacturers supply directly to large original equipment manufacturers (OEMs) in the consumer electronics, telecommunications, or automotive sectors. Alternatively, indirect channels involve distributors and value-added resellers who provide coatings along with technical support and customization services to smaller manufacturers or specialized integrators. End-users, such as telecom operators, automotive manufacturers, and consumer device brands, then incorporate these coatings into their 5G base stations, smartphones, advanced automotive systems, and other connected devices, marking the final stage of value creation and consumption in this market.

5G Conductive Coating Market Potential Customers

The potential customers for 5G conductive coatings are diverse, spanning multiple industries that are critical to the development and deployment of the 5G ecosystem. These customers are primarily end-users and buyers of the product who require advanced material solutions to ensure the optimal performance, reliability, and regulatory compliance of their 5G-enabled devices and infrastructure. Their needs typically revolve around achieving superior electromagnetic interference (EMI) shielding, effective thermal management, and robust signal integrity in increasingly complex and miniaturized electronic systems, all of which are paramount for the high-frequency and high-bandwidth demands of 5G technology.

Key customer segments include major Original Equipment Manufacturers (OEMs) in the consumer electronics sector, such as smartphone, tablet, laptop, and wearable device manufacturers. These companies integrate conductive coatings into their products to prevent internal interference, protect sensitive components, and enhance overall device performance and user experience. Telecommunications infrastructure providers and equipment manufacturers, including those producing 5G base stations, antennas, routers, and small cells, represent another significant customer base. Their demand for conductive coatings is driven by the need to ensure reliable signal transmission, protect critical network components from environmental factors and external interference, and meet stringent performance standards for network stability and efficiency.

Furthermore, the rapidly evolving automotive industry, particularly manufacturers of advanced driver-assistance systems (ADAS), infotainment systems, and autonomous vehicles, is a growing customer segment. Conductive coatings are vital here for shielding sensitive radar, LiDAR, and communication modules from interference, ensuring the safety and reliability of critical vehicle functions. Aerospace and defense contractors also procure these coatings for avionics and secure communication systems, where robust EMI shielding and environmental protection are non-negotiable. Other emerging potential customers include manufacturers in the industrial IoT, medical device, and smart city sectors, all of whom leverage 5G connectivity and require specialized conductive coatings for their high-performance, long-lasting electronic components.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | 350 Million USD |

| Market Forecast in 2033 | 1.52 Billion USD |

| Growth Rate | 24.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Henkel AG & Co. KGaA, Laird Performance Materials (DuPont), PPG Industries, AkzoNobel N.V., Dow (DowDuPont), Solvay S.A., Chomerics (Parker Hannifin), MG Chemicals, Lord Corporation (Parker Hannifin), TAIYO INK MFG. CO., LTD., Kureha Corporation, Poly Science & Engineering, Advanced Polymer Inc., NanoMarkets, Hitachi Chemical Co., Ltd., Shin-Etsu Chemical Co., Ltd., Wacker Chemie AG, BASF SE, Covestro AG, Arkema S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

5G Conductive Coating Market Key Technology Landscape

The 5G conductive coating market is shaped by a dynamic technological landscape driven by advancements in material science, nanotechnology, and manufacturing processes. One of the most significant technological trends involves the development of novel conductive materials, moving beyond traditional metals like silver and copper to embrace advanced composites and nanoparticles. Graphene and carbon nanotubes (CNTs) are at the forefront of this innovation, offering exceptional electrical conductivity, mechanical strength, and lightweight properties. These next-generation materials enable the creation of ultra-thin, flexible, and highly efficient coatings that can meet the stringent demands of high-frequency 5G signals and miniaturized electronic components, particularly in areas requiring superior electromagnetic interference (EMI) shielding and thermal management within limited space.

Another crucial technological development is the refinement of coating application techniques. Precision deposition methods, such as spray coating, dip coating, screen printing, and increasingly, additive manufacturing (3D printing), are essential for applying conductive coatings accurately and uniformly onto complex geometries and delicate substrates found in 5G devices and infrastructure. These advanced techniques not only improve the efficacy of the coatings but also enhance manufacturing efficiency and reduce material waste. Furthermore, the integration of multi-functional coatings that combine EMI shielding with other properties like corrosion resistance, self-healing capabilities, or improved adhesion is a key area of focus, offering comprehensive protection and performance enhancement for 5G components exposed to various operational environments.

The ongoing miniaturization of electronic devices and the push towards higher operating frequencies (including millimeter-wave bands) in 5G necessitate coatings that can perform effectively without adding significant bulk or weight. This drives research into transparent conductive coatings for displays and sensors, as well as highly efficient thermal interface materials to manage the increased heat generated by dense 5G circuitry. Additionally, sustainable and environmentally friendly coating formulations are gaining prominence, with a focus on reducing volatile organic compound (VOC) emissions and utilizing recyclable or bio-based materials. This aligns with global regulatory trends and consumer demand for greener technologies, pushing manufacturers to innovate in eco-conscious material development and production processes, thereby ensuring that the technological evolution of 5G conductive coatings addresses both performance and environmental considerations.

Regional Highlights

- North America: This region is a major hub for research and development in advanced materials and 5G technology. Significant investments in 5G infrastructure deployment and early adoption of innovative conductive coating solutions across aerospace, defense, and automotive sectors drive market growth. The presence of leading technology companies and stringent performance requirements foster demand for high-end, specialized coatings.

- Europe: Europe demonstrates robust growth driven by increasing investments in 5G network expansion and a strong focus on industrial IoT and smart manufacturing. Regulatory emphasis on environmental sustainability also pushes for the development of eco-friendly coating solutions. Germany, the UK, and France are key contributors, particularly in the automotive and telecommunications segments.

- Asia Pacific (APAC): APAC holds the largest market share and is projected to exhibit the highest growth rate. This dominance is attributed to rapid 5G network rollouts in China, South Korea, and Japan, coupled with a massive consumer electronics manufacturing base. India and Southeast Asian countries are also emerging as significant markets due to accelerating digital transformation initiatives and infrastructure development.

- Latin America: This region is an emerging market with gradual but steady 5G infrastructure expansion. Increased government initiatives to improve connectivity and digital inclusion are expected to drive demand for conductive coatings in telecommunications equipment and a growing consumer electronics market. Brazil and Mexico are key markets here.

- Middle East and Africa (MEA): MEA is experiencing significant 5G deployment, particularly in GCC countries, driven by smart city initiatives and economic diversification efforts. While still in nascent stages compared to other regions, the increasing investment in digital infrastructure and growing tech-savvy populations present considerable opportunities for market growth in the long term.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the 5G Conductive Coating Market.- Henkel AG & Co. KGaA

- Laird Performance Materials (DuPont)

- PPG Industries

- AkzoNobel N.V.

- Dow (DowDuPont)

- Solvay S.A.

- Chomerics (Parker Hannifin)

- MG Chemicals

- Lord Corporation (Parker Hannifin)

- TAIYO INK MFG. CO., LTD.

- Kureha Corporation

- Poly Science & Engineering

- Advanced Polymer Inc.

- NanoMarkets

- Hitachi Chemical Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Wacker Chemie AG

- BASF SE

- Covestro AG

- Arkema S.A.

Frequently Asked Questions

Analyze common user questions about the 5G Conductive Coating market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are 5G conductive coatings and why are they important?

5G conductive coatings are specialized materials applied to electronic components and devices to manage electromagnetic interference (EMI), ensure signal integrity, and facilitate thermal dissipation in 5G networks. They are crucial for preventing signal degradation, enhancing device performance, and protecting sensitive electronics from electromagnetic radiation, especially given the higher frequencies and greater device density of 5G.

What types of materials are commonly used in 5G conductive coatings?

Common materials include highly conductive metals like silver, copper, and nickel, often in powder or flake form embedded in polymer binders. Emerging materials like carbon-based (e.g., carbon nanotubes, graphene) and conductive polymers are also gaining traction due to their lightweight properties, flexibility, and excellent shielding capabilities, particularly for advanced and flexible 5G applications.

What are the primary applications of 5G conductive coatings?

The primary applications span consumer electronics (smartphones, tablets, wearables), telecommunications infrastructure (5G base stations, antennas, network equipment), automotive (ADAS, in-car connectivity), aerospace & defense, and industrial IoT devices. These coatings ensure the reliable operation of electronic systems by providing essential EMI shielding and thermal management.

How does the 5G conductive coating market address challenges like cost and environmental impact?

The market addresses cost by exploring more economical material alternatives and optimizing manufacturing processes. Environmental concerns are tackled through research into sustainable formulations, reduced VOC emissions, and the development of recyclable or bio-based conductive materials, driven by increasing regulatory pressures and industry demand for greener solutions.

What is the growth outlook for the 5G conductive coating market?

The 5G conductive coating market is projected for significant growth, driven by the accelerating global deployment of 5G networks, the proliferation of 5G-enabled devices, and the increasing demand for high-performance electronic components. The market is anticipated to expand substantially, with strong CAGR forecasts, particularly in the Asia-Pacific region, due to continuous technological advancements and infrastructure investments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager