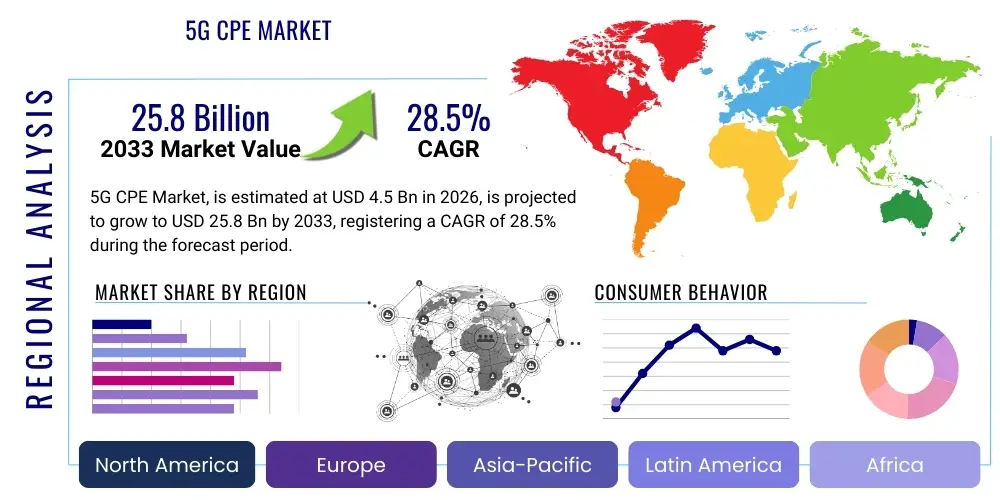

5G CPE Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435543 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

5G CPE Market Size

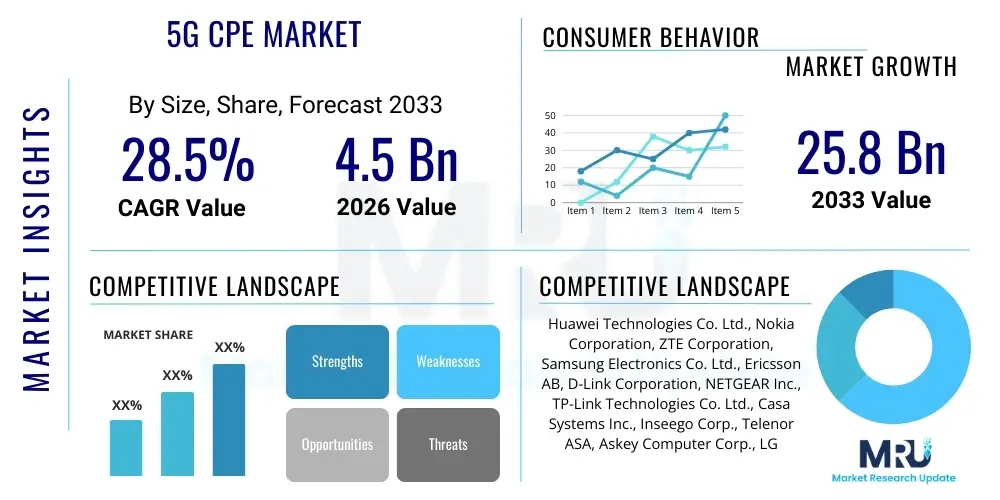

The 5G CPE Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 25.8 Billion by the end of the forecast period in 2033.

5G CPE Market introduction

The 5G Customer Premises Equipment (CPE) market encompasses devices deployed at the subscriber's location to enable connectivity to the 5G network infrastructure. These devices, which include routers, gateways, and modems, are critical for translating the high-speed 5G wireless signal into usable internet access within homes, enterprises, and industrial environments. The primary product categories are Indoor CPE, designed for residential and small office environments, and Outdoor CPE, which are typically installed on exterior walls or roofs to maximize signal reception, particularly in areas with lower cell density or challenging line-of-sight conditions. The evolution from 4G to 5G CPE introduces capabilities such as enhanced throughput, ultra-low latency, massive connectivity, and support for millimeter-wave (mmWave) frequencies, fundamentally reshaping how end-users consume bandwidth-intensive services.

Major applications of 5G CPE are prominently centered around Fixed Wireless Access (FWA), where 5G networks provide a viable, often superior, alternative to traditional fiber or cable broadband infrastructure, especially in areas where laying physical cables is cost-prohibitive or impractical. Beyond residential FWA, 5G CPE is essential for enabling industrial applications, including massive machine-to-machine communications (M2M), remote monitoring, and automated manufacturing processes, falling under the umbrella of Industrial IoT (IIoT). The immediate benefits of widespread 5G CPE deployment include democratizing high-speed internet access, supporting advanced services like 4K/8K streaming, virtual and augmented reality (VR/AR), and facilitating the migration of enterprise private networks onto robust, secure 5G architecture.

Key factors driving market expansion include the rapid global deployment of 5G infrastructure, stimulated by aggressive capital expenditure from mobile network operators (MNOs) striving to monetize their new spectrum holdings. Furthermore, the increasing demand for high-bandwidth applications, coupled with government initiatives promoting digital inclusion and smart city development, accelerates the adoption rate of 5G CPE. The ongoing development of sophisticated chipset solutions that reduce device cost while enhancing performance, alongside the growing maturity of standalone (SA) 5G networks that unlock true low-latency capabilities, ensures a sustained growth trajectory for the CPE market throughout the forecast period.

5G CPE Market Executive Summary

The 5G CPE market is defined by vigorous technological innovation driven primarily by the need to satisfy escalating global data consumption and the competitive landscape of the Fixed Wireless Access (FWA) sector. Current business trends indicate a strong focus on developing CPE supporting both sub-6 GHz and high-frequency mmWave spectrum bands to maximize coverage flexibility and speed capacity. Enterprises are increasingly investing in private 5G networks, necessitating specialized industrial-grade CPE that offers enhanced reliability, security, and integration capabilities with edge computing platforms. Strategic partnerships between chipset manufacturers, network equipment vendors, and telecom operators are crucial in accelerating the time-to-market for cost-effective and high-performance devices, particularly those incorporating Wi-Fi 6 or Wi-Fi 7 standards to ensure seamless last-mile connectivity within premises.

Regionally, Asia Pacific (APAC) stands out as the dominant and fastest-growing market, driven by high population density, rapid urbanization, and significant government backing for 5G deployment in countries like China, Japan, and South Korea. North America and Europe, while having higher initial Average Revenue Per User (ARPU) for 5G services, are seeing market growth spurred by FWA penetrating previously underserved rural areas and replacing older cable infrastructure. In contrast, emerging regions in Latin America and the Middle East and Africa (MEA) represent high-potential markets, characterized by mobile-first connectivity strategies where 5G FWA provides a leapfrog opportunity over traditional fixed broadband solutions. Regulatory frameworks regarding spectrum allocation and device certification play a pivotal role in shaping regional adoption curves, favoring regions that have quickly released mid-band and high-band spectrum.

Segment trends highlight the growing prominence of Outdoor CPE (OCPE) units, which are essential for achieving optimal performance in mmWave deployments due to their superior signal processing and antenna arrays. The application segment is overwhelmingly dominated by FWA, which continues to challenge traditional wireline incumbents globally. Furthermore, the integration of advanced security features, remote management capabilities, and support for network slicing is becoming standard across all product segments. As 5G standalone (SA) networks mature, the demand for CPE that can effectively utilize ultra-low latency capabilities for time-sensitive applications, such as remote surgery or automated vehicle control, will drive innovation, moving the market beyond simple high-speed data delivery toward complex, tailored connectivity solutions.

AI Impact Analysis on 5G CPE Market

Analysis of common user questions regarding AI's impact on 5G CPE reveals significant interest centered on how Artificial Intelligence and Machine Learning (ML) can improve network efficiency, device performance, and user experience. Key themes include the use of AI for dynamic resource allocation, predictive maintenance of CPE devices, and enhanced security posture against evolving cyber threats. Users frequently inquire about AI-driven antenna optimization within CPE to improve signal strength and throughput without manual configuration, as well as the potential for AI to manage interference in dense urban environments. Furthermore, there is growing interest in how AI at the edge, integrated directly within the CPE or local access network, can process data locally, reduce backhaul congestion, and enable real-time applications such as video analytics and smart home automation.

AI's integration fundamentally transforms 5G CPE from passive network access points into intelligent, adaptive edge nodes. By utilizing ML algorithms, CPE devices can autonomously learn usage patterns, predict network bottlenecks, and dynamically adjust parameters like channel selection, power output, and quality of service (QoS) prioritization on a per-device or per-application basis. This proactive management capability significantly reduces operational expenditure for service providers by minimizing truck rolls for troubleshooting and maximizing network uptime. AI also facilitates sophisticated management of battery life and heat dissipation in mobile CPE units, ensuring consistent performance under heavy load conditions, which is crucial for applications requiring sustained high throughput.

Moreover, AI is pivotal in enabling the effective implementation of network slicing, a core capability of 5G. Intelligent CPE can recognize the service type originating from a device (e.g., mission-critical IoT versus standard browsing) and automatically map that traffic to the appropriate network slice, ensuring guaranteed service level agreements (SLAs). In terms of security, AI algorithms embedded in the CPE can detect anomalous traffic patterns indicative of Denial-of-Service (DoS) attacks or malware intrusion far faster than traditional signature-based methods, offering a first line of defense at the customer premises boundary. This holistic application of AI streamlines operations, enhances performance metrics, and establishes a robust, future-proof platform for diverse 5G services.

- AI-driven optimization of antenna beamforming and signal strength maximization.

- Predictive maintenance and fault detection within CPE hardware and software.

- Intelligent traffic classification and dynamic Quality of Service (QoS) allocation.

- Enhanced cybersecurity through real-time anomaly detection at the edge.

- AI-enabled management of network slicing capabilities for guaranteed SLAs.

- Autonomous energy efficiency management in portable 5G CPE devices.

DRO & Impact Forces Of 5G CPE Market

The 5G CPE market is shaped by a powerful combination of drivers (D), restraints (R), and opportunities (O), whose collective impact forces market trajectory significantly toward high growth. Major drivers include the accelerating global deployment of 5G infrastructure, particularly the rollout of Fixed Wireless Access (FWA) services that directly rely on CPE for consumer and enterprise connectivity. The insatiable demand for high-speed, low-latency connectivity to support bandwidth-intensive applications such as cloud gaming, AR/VR, and massive IoT deployment further fuels adoption. Restraints primarily involve the high initial cost of 5G CPE, particularly mmWave-capable units, compared to legacy 4G or fixed broadband equipment, and persistent regulatory complexities regarding spectrum harmonization across diverse regions, which slows standardization and market penetration. Opportunities lie strongly in the expansion of private 5G networks for industrial use cases, the integration of 5G CPE with emerging smart home and smart factory ecosystems, and leveraging edge computing capabilities to offer advanced, value-added services directly through the CPE device. These market forces collectively exert strong upward pressure, indicating substantial long-term growth despite short-term cost barriers.

Specific market drivers include government initiatives globally, such as the Digital India program and the European Union’s 5G action plan, which mandate improved broadband coverage and accelerate infrastructure investments, thereby creating a large addressable market for CPE. The decline in the cost of crucial 5G chipsets, fueled by increased competition among semiconductor manufacturers like Qualcomm, MediaTek, and Huawei, is progressively making 5G CPE more accessible to mass-market consumers. Furthermore, the shift from non-standalone (NSA) to standalone (SA) 5G architecture is a critical driver, as SA allows CPE to fully capitalize on ultra-low latency and network slicing features, unlocking higher-value enterprise applications that necessitate guaranteed quality of service. The ability of 5G FWA to bypass the high capital expenditure associated with trenching fiber optic cables in difficult terrains positions CPE as a cost-effective last-mile solution, especially in rural and suburban areas.

Conversely, significant restraints must be overcome for sustained growth. Spectrum fragmentation and the inconsistent allocation of mid-band and mmWave frequencies across different countries create complexities for CPE manufacturers in developing truly global products, driving up R&D costs. Security concerns related to CPE, particularly concerning firmware updates, device vulnerability to remote attacks, and unauthorized access to private networks, require continuous investment and standardization. The performance gap between theoretical 5G capabilities and real-world results in congested or poorly optimized network environments can also deter consumer adoption, necessitating robust quality assurance and network monitoring protocols. Overcoming these adoption barriers requires proactive regulatory support and industry collaboration to ensure interoperability and secure device deployment.

The primary opportunity for market players revolves around specialized CPE development for verticals. Deploying industrial-grade outdoor CPE designed to withstand harsh environments (temperature, vibration, dust) for oil and gas, mining, or agriculture sectors presents a high-margin niche. Another major opportunity is the integration of advanced Wi-Fi standards (Wi-Fi 6E/7) within the CPE to prevent internal network bottlenecks, ensuring the high 5G throughput is fully utilized by end devices. Furthermore, service providers can use intelligent CPE to host virtual network functions (VNFs) or containerized edge applications, enabling them to monetize the device beyond simple internet connectivity by offering services like cloud security or parental controls directly from the CPE unit. The emerging market for private 5G networks, where enterprises purchase and manage their own dedicated CPE ecosystems, offers substantial long-term growth potential distinct from the consumer FWA segment.

Segmentation Analysis

The 5G CPE market segmentation provides a granular view of market dynamics, determined by technology specifications, installation environment, and target application. The market is primarily dissected based on device type (Indoor vs. Outdoor CPE), which addresses varying deployment scenarios and signal reception needs. Further segmentation by technology (Sub-6 GHz vs. mmWave) reflects the varying maturity and performance characteristics of different spectrum bands. The application landscape is crucial, with Fixed Wireless Access (FWA) dominating, followed by enterprise connectivity solutions and various Industrial IoT applications. Understanding these segments is vital for manufacturers to tailor product specifications, pricing strategies, and distribution models effectively to capture specific market needs, whether optimizing for residential ease of use or industrial robustness and reliability.

The distinction between Indoor CPE and Outdoor CPE is foundational. Indoor units prioritize aesthetics, ease of setup (plug-and-play), and robust internal Wi-Fi distribution, typically utilizing Sub-6 GHz frequencies. Conversely, Outdoor CPE units are built to withstand environmental extremes, feature high-gain directional antennas to optimize signal capture over long distances or challenging non-line-of-sight paths, and are essential for maximizing the potential of high-frequency mmWave deployments where range is inherently limited. The segmentation by distribution channel reflects the primary route to the customer, where telecom operators remain the dominant channel due to bundled service offerings, but online retail and system integrators are becoming increasingly relevant for unlocked devices and private network installations.

- By Type:

- Indoor CPE

- Outdoor CPE

- By Technology:

- Sub-6 GHz 5G CPE

- mmWave 5G CPE

- Combined (Sub-6 GHz and mmWave) 5G CPE

- By Application:

- Fixed Wireless Access (FWA) (Residential and Enterprise)

- Mobile Broadband (Hotspots and Portable Devices)

- Industrial Internet of Things (IIoT)

- Smart Home and Smart City Applications

- By Distribution Channel:

- Telecom Operators

- Online Retail

- System Integrators and VARs

Value Chain Analysis For 5G CPE Market

The value chain of the 5G CPE market is complex, beginning with upstream raw material and component suppliers and extending through to downstream distribution and end-user services. Upstream analysis focuses heavily on semiconductor manufacturing, particularly the fabrication of 5G modems, RF front-end modules, and advanced system-on-chips (SoCs). Key players in this phase (e.g., Qualcomm, MediaTek, Intel) dictate technological feasibility, cost structures, and the pace of innovation, often requiring massive R&D investment to miniaturize and optimize antenna arrays for both sub-6 GHz and mmWave. Component sourcing also includes specialized plastics, heat management solutions, and high-performance Wi-Fi modules (Wi-Fi 6/7) necessary for converting the 5G signal into a high-speed local area network. The efficiency and reliability of this upstream stage are crucial determinants of the final CPE product's quality and competitiveness.

The midstream segment involves the original equipment manufacturers (OEMs) and original design manufacturers (ODMs) responsible for assembling components, designing enclosures, integrating software, and performing regulatory certification (e.g., CE, FCC). This manufacturing stage requires high-precision assembly, especially for integrating complex mmWave antennas and ensuring optimal thermal performance. Following manufacturing, the distribution channel acts as the crucial link to the end customer. Direct distribution is predominantly handled by global telecom operators (MNOs) like Verizon, AT&T, Vodafone, and China Mobile, who often subsidize or lease the CPE as part of a bundled service contract. This direct channel ensures installation support and centralized device management, leading to high-volume sales tied to service subscriptions.

Indirect distribution involves system integrators and value-added resellers (VARs) who target the enterprise and private 5G markets, providing customized solutions, as well as online and offline retail channels for unlocked devices. Downstream analysis focuses on the end-user adoption across residential FWA and specialized vertical applications (IIoT, smart factory). The profitability of the downstream market is heavily reliant on the quality of after-sales support, ongoing firmware updates, and the ability of the CPE to support new, value-added services like edge computing and advanced parental controls. The entire chain is characterized by tight collaboration between chipset vendors and OEMs to meet the stringent technical requirements imposed by MNOs.

5G CPE Market Potential Customers

Potential customers for 5G CPE devices span a broad spectrum, categorized mainly into residential users seeking high-speed broadband, enterprise customers requiring robust primary or backup connectivity, and specialized vertical industries leveraging the capabilities of private 5G networks. Residential consumers are the largest segment, driven by the rollout of Fixed Wireless Access (FWA) services that offer competitive speeds and simpler installation compared to traditional cable or DSL. These users prioritize high throughput, reliable in-home Wi-Fi coverage (often requiring Wi-Fi 6 or 7 integrated CPE), ease of setup, and aesthetic design, making Indoor CPE the dominant product choice for this demographic. The purchasing decision is heavily influenced by telecom operators, as CPE is typically acquired through a service contract.

Enterprise customers represent a high-value segment, utilizing 5G CPE for various applications ranging from branch office connectivity and temporary site deployments to providing resilient backup links. Small and Medium Enterprises (SMEs) often adopt 5G FWA as their primary broadband solution due to its quick deployment time and cost-effectiveness. Large enterprises, particularly those with geographically dispersed operations, are increasingly using specialized, high-security 5G gateways and routers to support critical business applications and enable secure communication across their network. These customers prioritize features such as VPN support, advanced security protocols, reliable remote management tools, and support for high-density user environments.

Furthermore, specialized industrial sectors constitute a rapidly emerging potential customer base. Manufacturing plants, logistics hubs, healthcare facilities, and mining operations are adopting private 5G networks, necessitating ruggedized, high-performance Outdoor CPE units optimized for Industrial IoT (IIoT) applications. These customers are focused not just on speed, but critically on ultra-low latency, massive device connectivity, and extreme reliability to support time-sensitive operations like robotic control and real-time monitoring. For these industrial applications, the CPE acts as a critical interface for integrating operational technology (OT) systems with the high-speed, secure 5G cellular network infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 25.8 Billion |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Huawei Technologies Co. Ltd., Nokia Corporation, ZTE Corporation, Samsung Electronics Co. Ltd., Ericsson AB, D-Link Corporation, NETGEAR Inc., TP-Link Technologies Co. Ltd., Casa Systems Inc., Inseego Corp., Telenor ASA, Askey Computer Corp., LG Electronics, Compal Electronics Inc., Cradlepoint (Ericsson), Sercomm Corporation, Technicolor SA, Zyxel Communications Corp., Fibocom Wireless Inc., Quectel Wireless Solutions. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

5G CPE Market Key Technology Landscape

The core technology driving the 5G CPE market revolves around sophisticated modem chipsets capable of supporting various 5G New Radio (NR) standards, spanning low-band, mid-band (Sub-6 GHz), and high-band (mmWave) spectrums. Critical components include advanced RF Front-End (RFFE) modules and phased array antenna technology, particularly essential for mmWave CPE to effectively utilize beamforming techniques. Beamforming allows the CPE to focus the energy of the signal in a specific direction, compensating for the inherently short range and propagation challenges of mmWave frequencies, ensuring reliable connectivity and high throughput. The shift toward 5G Standalone (SA) architecture requires CPE devices to support advanced features like network slicing, which necessitate enhanced software intelligence within the device to manage and prioritize traffic based on specific service level agreements (SLAs).

Beyond the fundamental 5G connectivity, the technological landscape is increasingly defined by convergence. Modern CPE often integrates next-generation Wi-Fi standards, such as Wi-Fi 6 (802.11ax) and the emerging Wi-Fi 7 (802.11be), ensuring that the gigabit-plus speeds delivered by the 5G connection are not bottlenecked by the internal local area network. This integration is vital for high-density environments and smart home applications. Furthermore, the incorporation of edge computing capabilities is transforming CPE into intelligent network nodes. This allows for local processing of data, running containerized applications, and hosting virtualized network functions (VNFs), thereby reducing latency for real-time services and decreasing reliance on central cloud infrastructure, an essential feature for industrial automation and mission-critical applications.

Security technology embedded within the CPE is also paramount, utilizing hardware-based root-of-trust mechanisms and secure boot processes to mitigate tampering and unauthorized firmware modification. Manufacturers are increasingly implementing AI/ML-based security software directly on the CPE for real-time intrusion detection and behavioral analysis of connected devices. Power efficiency and thermal management technologies are crucial, especially for high-power mmWave devices and portable CPE, utilizing advanced materials and optimized chipset design to maintain performance without overheating. The adoption of Open RAN (O-RAN) principles, while primarily impacting the network side, influences CPE by encouraging standardized interfaces and potentially fostering greater interoperability among different vendor ecosystems, although CPE remains largely proprietary in its software implementation.

Regional Highlights

- Asia Pacific (APAC): APAC is the global leader in 5G CPE adoption, driven by early and aggressive 5G infrastructure rollouts in major economies like China, South Korea, and Japan. High population density facilitates the rapid deployment of FWA services, and governmental support for digital transformation fuels both consumer and industrial uptake. China dominates the market volume due to massive network investments by operators such as China Mobile and China Telecom. The shift towards manufacturing and smart cities across the region creates immense demand for industrial-grade CPE to support extensive IIoT deployments and private networks, ensuring that APAC maintains the highest growth rate throughout the forecast period.

- North America: North America, led by the United States, represents a highly lucrative market segment characterized by high ARPU and robust demand for mmWave technology, particularly in dense urban centers where ultra-high throughput is critical. Major operators like Verizon and T-Mobile have aggressively promoted 5G FWA as a direct competitor to cable, successfully penetrating suburban and rural areas where broadband competition was traditionally limited. The market here focuses heavily on security features, integrating sophisticated network management tools, and leveraging CPE for advanced enterprise applications and critical infrastructure connectivity.

- Europe: The European market shows steady but fragmented growth, influenced by varied regulatory environments and inconsistent spectrum allocation across member states. The emphasis is balanced between residential FWA and specialized industrial applications, particularly in Germany and the Nordics where Industry 4.0 initiatives are strong. Deployment strategies often prioritize Sub-6 GHz for wider coverage, but key cities are starting to deploy mmWave CPE solutions. The market is competitive, featuring strong regional players alongside global vendors, and regulatory efforts are continually focused on harmonizing spectrum to accelerate cross-border 5G service deployment.

- Latin America (LATAM): LATAM is characterized by mobile-first strategies and high potential for FWA to address significant broadband gaps. Countries like Brazil and Mexico are leading the way in 5G auctions and initial network deployment, offering vast opportunities for Outdoor CPE to serve large, underserved geographical areas economically. Market growth is primarily driven by the need for digital inclusion and replacing unreliable fixed-line infrastructure, making cost-effective and ruggedized CPE solutions highly sought after.

- Middle East and Africa (MEA): The MEA region, particularly the Gulf Cooperation Council (GCC) countries, has demonstrated fast adoption of 5G, driven by national visions for digitalization and smart city development. Saudi Arabia and the UAE are early adopters of 5G FWA, utilizing its capabilities to build high-tech urban centers. Africa represents a massive long-term opportunity, where 5G CPE is anticipated to provide primary internet access, bypassing the need for extensive fixed infrastructure rollout, although current adoption rates are constrained by high device costs and limited spectrum availability outside major economic hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the 5G CPE Market.- Huawei Technologies Co. Ltd.

- Nokia Corporation

- ZTE Corporation

- Samsung Electronics Co. Ltd.

- Ericsson AB

- D-Link Corporation

- NETGEAR Inc.

- TP-Link Technologies Co. Ltd.

- Casa Systems Inc.

- Inseego Corp.

- Telenor ASA

- Askey Computer Corp.

- LG Electronics

- Compal Electronics Inc.

- Cradlepoint (Ericsson)

- Sercomm Corporation

- Technicolor SA

- Zyxel Communications Corp.

- Fibocom Wireless Inc.

- Quectel Wireless Solutions

Frequently Asked Questions

Analyze common user questions about the 5G CPE market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is 5G CPE and how does it differ from a standard Wi-Fi router?

5G CPE (Customer Premises Equipment) is a gateway device that captures the wireless 5G signal from a cellular tower and converts it into a local Wi-Fi or wired Ethernet connection for internal devices. Unlike a standard Wi-Fi router which connects to a physical cable or fiber line, 5G CPE acts as a modem and router combined, utilizing cellular technology (Fixed Wireless Access or FWA) for its primary internet source, enabling significantly higher speeds and lower latency derived from the 5G network.

What are the primary challenges restraining the widespread adoption of 5G CPE?

Key restraints include the relatively high initial cost of advanced 5G CPE, particularly those supporting millimeter-wave (mmWave) spectrum, which increases CapEx for consumers and operators. Additionally, regulatory inconsistencies in spectrum allocation across different countries complicate manufacturing and global deployment. Technical challenges like optimizing signal penetration for indoor use and ensuring robust cybersecurity protocols also pose hurdles to mass adoption.

How does the integration of Wi-Fi 6 or Wi-Fi 7 enhance the value of 5G CPE?

The integration of advanced Wi-Fi standards like Wi-Fi 6 or 7 is crucial because the high throughput delivered by 5G (often exceeding gigabit speeds) must be efficiently distributed within the premises. These standards provide higher internal bandwidth, better handling of simultaneous connected devices (high density), and reduced internal latency, preventing the high-speed 5G cellular connection from being bottlenecked by an outdated local area network technology within the home or office.

What role does Fixed Wireless Access (FWA) play in the 5G CPE market growth?

FWA is the single largest driver of the 5G CPE market. FWA utilizes 5G networks to provide high-speed broadband connectivity as an alternative to fiber or cable. 5G CPE devices are essential for FWA, enabling telecom operators to quickly and cost-effectively deploy high-speed internet services to residential and enterprise customers, particularly in areas where laying new fiber infrastructure is prohibitively expensive, thereby expanding the total addressable market significantly.

What are the differences between Indoor CPE and Outdoor CPE units?

Indoor CPE is designed for simple plug-and-play installation inside the building, usually supporting Sub-6 GHz frequencies and prioritizing aesthetics and Wi-Fi coverage. Outdoor CPE (OCPE) is ruggedized and weather-resistant, designed for exterior mounting. OCPE utilizes higher-gain and often directional antennas, making them essential for receiving weak signals or utilizing high-frequency mmWave bands over greater distances or in challenging non-line-of-sight environments, maximizing external signal strength before piping the connection inside.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager