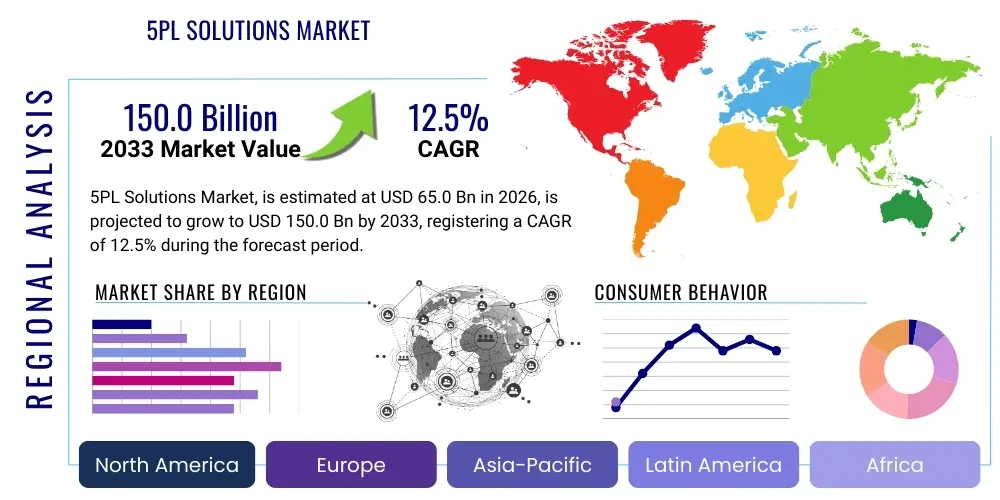

5PL Solutions Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434972 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

5PL Solutions Market Size

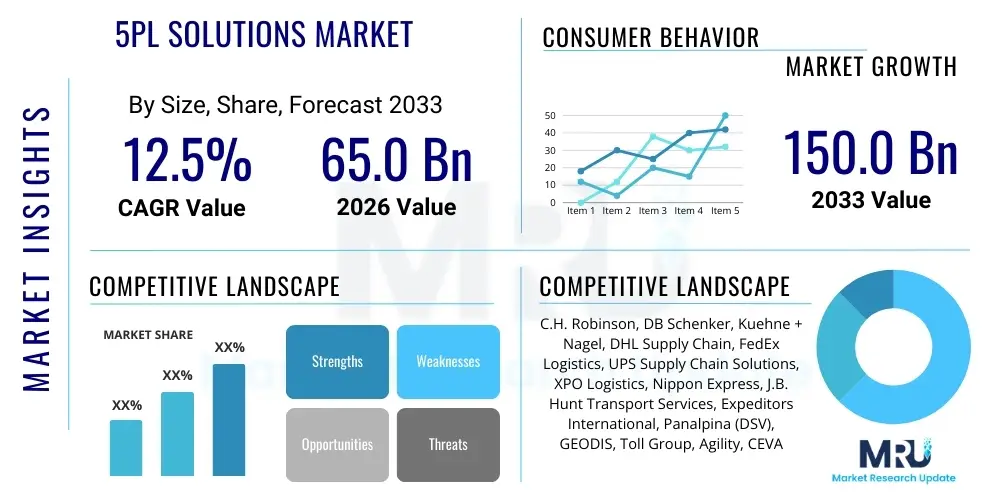

The 5PL Solutions Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 65.0 Billion in 2026 and is projected to reach USD 150.0 Billion by the end of the forecast period in 2033.

5PL Solutions Market introduction

The Fifth-Party Logistics (5PL) Solutions Market encompasses highly advanced, integrated supply chain management services where providers act as supply chain orchestrators, leveraging proprietary technological platforms and massive networks to optimize entire logistics ecosystems. Unlike traditional 3PLs (operational focus) or 4PLs (management focus), 5PL providers manage and execute complex, high-volume logistics demands, integrating emerging technologies like Artificial Intelligence (AI), Big Data analytics, and the Internet of Things (IoT) to achieve unparalleled efficiency and cost reduction across global distribution networks. This holistic approach is essential for businesses operating in highly dynamic and complex global trade environments, seeking scalable, sustainable, and entirely digitized logistics solutions.

The primary services offered within the 5PL domain include comprehensive supply chain planning, freight management, warehousing orchestration, integrated inventory management, and last-mile delivery optimization, all underpinned by sophisticated software infrastructure. Major applications span high-volume sectors such as e-commerce, automotive manufacturing, pharmaceutical distribution, and retail, where demand volatility and rapid delivery expectations necessitate real-time responsiveness and system integration. 5PL models are particularly attractive to large multinational corporations and rapidly scaling direct-to-consumer (D2C) businesses that lack the internal resources or technological capabilities to manage such intricate global logistics themselves.

Key benefits driving the adoption of 5PL solutions include significant improvements in supply chain visibility, predictive capabilities regarding demand fluctuations, optimization of resource utilization, and drastic reductions in operational expenses through automation and network scaling. Furthermore, 5PL providers offer expertise in regulatory compliance and sustainable logistics practices, such as optimizing transportation modes to reduce carbon footprints. The continuous innovation in cloud-based platforms and machine learning algorithms allows 5PL operators to offer dynamic pricing and routing strategies, positioning them as essential strategic partners rather than mere service vendors in the modern global economy.

5PL Solutions Market Executive Summary

The 5PL Solutions Market is experiencing robust expansion, fundamentally driven by pervasive digital transformation initiatives and the unprecedented growth of global e-commerce. Business trends indicate a shift towards highly customized and tech-centric service offerings, emphasizing predictive analytics and automated decision-making. Companies are increasingly demanding full transparency and resilient supply chains capable of navigating geopolitical disruptions and trade complexity, pushing 5PL providers to invest heavily in blockchain for verifiable transactions and AI for risk mitigation. The consolidation of smaller logistics players into global technological platforms is a dominant market trend, aiming to create synergistic operational efficiencies and enhance global coverage.

Regionally, the Asia Pacific (APAC) market is exhibiting the fastest growth due to burgeoning manufacturing hubs, increasing urbanization, and massive cross-border e-commerce volumes, particularly in China and India. North America and Europe, while mature, maintain dominance in terms of technological adoption and market value, primarily driven by the need for advanced cold chain logistics (pharmaceuticals) and sophisticated returns management systems in mature retail markets. Regional trends highlight the increasing importance of localized micro-fulfillment centers integrated into the global 5PL network architecture to meet demanding same-day delivery timelines in metropolitan areas.

Segment trends reveal that the Technology and Software segment within 5PL solutions is anticipated to register the highest Compound Annual Growth Rate (CAGR), reflecting the market’s reliance on proprietary Transportation Management Systems (TMS), Warehouse Management Systems (WMS), and Supply Chain Execution (SCE) platforms. Application-wise, the E-commerce sector remains the largest consumer, requiring sophisticated handling of diverse inventory, fragmented shipping, and complex reverse logistics. Conversely, the Manufacturing segment, particularly automotive and heavy industry, is driving demand for highly specialized inventory synchronization and just-in-time (JIT) delivery services, integrating the 5PL platform directly into their production planning systems.

AI Impact Analysis on 5PL Solutions Market

Common user questions regarding AI's influence on the 5PL market often center on the extent of automation in decision-making, the security of proprietary data shared across AI platforms, and the potential for disruption in traditional logistics job roles. Users frequently inquire about the feasibility of AI achieving truly autonomous supply chain orchestration without human intervention and how quickly AI can adapt to sudden, unforeseen external shocks (like pandemics or port closures). The analysis reveals a dominant user expectation: AI must deliver tangible results in demand forecasting accuracy, dynamic pricing optimization, and proactive risk management, moving beyond simple automation to sophisticated prediction and prescriptive action. Key themes revolve around the necessity of explainable AI (XAI) in regulatory environments and the seamless integration of machine learning models into legacy operational systems.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally redefining the operational and strategic capabilities of 5PL providers. AI models are employed to crunch massive datasets, including real-time weather, traffic, global economic indicators, and consumer purchasing patterns, enabling predictive logistics management. This allows 5PLs to anticipate bottlenecks before they materialize, optimize resource allocation dynamically, and fine-tune inventory placement closer to predicted demand centers. Furthermore, AI algorithms are crucial for optimizing complex multi-modal route planning, minimizing empty miles, and significantly enhancing fuel efficiency, contributing directly to sustainability goals sought by major corporate clients.

Beyond optimization, AI is transforming customer interaction and warehouse operations. Conversational AI and chatbots are being deployed to handle high volumes of customer inquiries regarding tracking and scheduling, freeing up human resources for complex problem resolution. In the warehouse, AI drives robotics deployment, automating picking, packing, and sorting processes with higher accuracy and speed than manual systems. The resulting impact is a highly resilient and autonomous supply chain structure where AI continuously learns and adjusts execution strategies based on real-time feedback, ensuring service level agreements (SLAs) are met even under extreme volatility, thereby solidifying the competitive advantage of tech-forward 5PL operators.

- AI enhances demand forecasting accuracy, reducing safety stock requirements and minimizing obsolescence.

- Machine learning optimizes global multi-modal route selection and load consolidation for cost and fuel efficiency.

- Predictive maintenance schedules for fleets and warehouse equipment are enabled by AI-driven sensor data analysis.

- Computer vision and AI streamline quality control and inventory verification within automated warehouses.

- Generative AI tools assist in scenario planning and risk assessment across complex international trade routes.

- Automated pricing models, driven by real-time market conditions and capacity constraints, optimize revenue management.

DRO & Impact Forces Of 5PL Solutions Market

The 5PL Solutions Market is being propelled by several powerful drivers, chief among them the relentless expansion of global e-commerce, which necessitates ultra-fast, reliable, and scalable logistics networks. Restraints, primarily centered on the massive capital expenditure required for establishing advanced IT infrastructure and global networks, create high barriers to entry. Opportunities lie in the adoption of next-generation technologies like blockchain for secure, transparent supply chain transactions, and specializing in niche, high-value logistics sectors such as cold chain or hazardous materials. These forces collectively exert significant impact, accelerating market transformation and favoring large, financially robust players capable of continuous technological investment and global network scaling, while forcing smaller competitors into consolidation or specialized roles.

Drivers: The increasing complexity of global supply chains, characterized by multi-jurisdictional trade regulations and diversified sourcing strategies, necessitates the orchestration capabilities provided by 5PLs. Moreover, the pervasive push towards sustainability mandates that major corporations seek logistics partners capable of minimizing carbon emissions, which 5PLs address through advanced route optimization and smart warehousing. The crucial requirement for real-time visibility and transparency throughout the supply chain, fueled by consumer expectations and regulatory mandates, is a primary catalyst for 5PL adoption, as their platforms integrate end-to-end data streams.

Restraints: The primary impediments to market growth include the substantial initial investment required to develop and integrate cutting-edge technological platforms (AI, IoT, Big Data infrastructure) and the subsequent high operational costs associated with maintaining cybersecurity and data integrity across vast networks. Furthermore, the standardization and interoperability challenges inherent in integrating disparate legacy systems of clients and sub-contractors present technical hurdles. The reliance on highly specialized, technical talent for managing these complex systems creates talent shortages and increases labor costs, posing a significant restraint, particularly in emerging markets.

Opportunities: Significant market opportunities exist in deploying specialized 5PL services tailored to complex industries such as healthcare (precision temperature control and compliance), high-tech manufacturing (just-in-time synchronization), and reverse logistics for e-commerce returns. The development of collaborative logistics platforms utilizing blockchain technology offers an opportunity to drastically improve trust, reduce administrative overheads, and enhance the security of cross-border shipments. Furthermore, the expanding focus on Middle Mile and Final Mile optimization, integrating drones and autonomous vehicles, presents lucrative avenues for technology-focused 5PL operators seeking innovation leadership.

Impact Forces: The impact forces of globalization and technological disruption are profoundly shaping the 5PL landscape. Rapid technological shifts demand continuous adaptation, creating a dynamic environment where market leadership is determined by innovation speed and successful platform integration. Economic volatility and geopolitical instability intensify the need for robust risk management and supply chain resilience, services that 5PLs are uniquely positioned to offer. Regulatory changes, especially concerning data privacy (GDPR, CCPA) and environmental standards, also impact operational procedures, necessitating flexible and compliant technological architectures.

Segmentation Analysis

The 5PL Solutions Market is comprehensively segmented based on the type of services offered, the end-user industry receiving the services, and the operational mode deployed. This granular segmentation allows market participants to tailor their technological investments and operational expertise to specific vertical requirements. Service segmentation distinguishes between infrastructure management, which includes physical assets and networking, and the platform/software layer, which involves the proprietary AI and data analytics tools central to 5PL value proposition. The end-user analysis highlights the dominance of sectors with high logistics complexity and volume, such as e-commerce and automotive, which require advanced synchronization and predictive scheduling capabilities.

The market divides broadly into major operational segments based on delivery models. Integrated 5PL providers offer end-to-end management, utilizing both owned and outsourced assets, while non-asset-based providers primarily focus on the strategic orchestration and technological layer. The analysis of these segments reveals that the integrated model often provides greater control over quality and execution, whereas the non-asset model offers scalability and flexibility. Geographic segmentation further details the varying maturity levels and growth rates across global regions, heavily influenced by regional trade agreements, infrastructural development, and local e-commerce adoption rates.

Crucially, the ongoing trend toward hyper-specialization is leading to the emergence of highly focused sub-segments, particularly in niche areas like cold chain logistics (for biopharmaceuticals) and managing high-value, time-sensitive components (for aerospace). Successful 5PL providers are those that can effectively integrate specialized vertical knowledge into their overarching technological platforms, offering customized solutions that go far beyond generic freight forwarding or warehousing services, ensuring optimal performance and compliance for their specialized clientele.

- By Service Type:

- Transportation Management (TMS)

- Warehouse Management (WMS)

- Inventory and Optimization Services

- Integrated Supply Chain Planning

- Information Technology and Consulting

- By End-User:

- E-commerce and Retail

- Manufacturing (Automotive, High-Tech)

- Healthcare and Pharmaceuticals

- Food and Beverage

- Energy and Utilities

- By Mode of Operation:

- Asset-Based 5PL (Integrated Operations)

- Non-Asset-Based 5PL (Platform and Orchestration Focus)

Value Chain Analysis For 5PL Solutions Market

The 5PL value chain is highly interconnected, placing significant emphasis on technological inputs and data processing rather than solely physical assets. Upstream activities are dominated by technology development, encompassing the creation and maintenance of proprietary logistics software, AI algorithms, cloud infrastructure, and cybersecurity protocols. Key upstream participants include specialized software vendors, cloud service providers (like AWS, Azure), and data analytics firms that license critical capabilities to 5PL operators. Strategic partnerships in the upstream segment focus on securing access to cutting-edge predictive modeling tools and secure data architecture, ensuring the 5PL platform maintains a technological edge over competitors and is resistant to cyber threats.

The core middle segment of the value chain involves the execution and optimization of logistics services, driven entirely by the 5PL's central decision-making platform. This stage includes global network management, real-time data ingestion from IoT devices (trackers, sensors), dynamic allocation of freight capacity across multiple carriers and modes, and overall supply chain risk management. The 5PL acts as the central intelligence hub, coordinating 3PLs, 4PLs, shippers, and customs brokers. Efficiency in this segment relies heavily on the quality and robustness of the proprietary TMS/WMS integration, ensuring seamless flow of goods and information globally.

Downstream activities involve the final delivery of goods and the associated customer services. This segment is characterized by direct engagement with end-users/shippers and the management of final-mile logistics, including complex reverse logistics operations for returns. Distribution channels are typically indirect, relying on a vast network of subcontracted carriers, regional warehouses, and last-mile specialists, all managed and optimized through the 5PL platform. The direct channel often involves high-level strategic consulting and direct IT integration services offered to large multinational clients, solidifying the 5PL as a strategic business partner rather than merely a logistical facilitator.

5PL Solutions Market Potential Customers

Potential customers for 5PL solutions are large enterprises and hyper-growth companies characterized by high volume, complex distribution needs, and a critical reliance on speed and inventory accuracy. The primary end-users are concentrated in sectors experiencing rapid digital transformation and globalization. E-commerce platforms and major retailers constitute the largest customer base, demanding solutions capable of handling fragmented orders, rapid scaling during peak seasons, and complex cross-border fulfillment, including efficient management of product returns and refurbishment.

The manufacturing sector, particularly automotive, electronics, and heavy machinery, represents another critical customer group. These companies require intricate just-in-time (JIT) delivery systems, highly synchronized supply chains to feed global production lines, and specialized handling of sensitive components. 5PL providers are essential here for integrating production scheduling directly with logistics planning, minimizing inventory carrying costs and ensuring zero production downtime due to supply chain failures. The integration often requires deep technical partnerships between the manufacturer’s ERP system and the 5PL’s operational platform.

Furthermore, the healthcare and pharmaceutical industries are increasingly reliant on 5PL services due to stringent regulatory requirements, the necessity for cold chain integrity, and the high value of products. Customers in this domain require verifiable, compliant, and transparent logistics services capable of managing specialized storage and distribution for temperature-sensitive drugs and biologics. Other growing customer segments include large food and beverage conglomerates seeking freshness optimization and reduced spoilage, and multinational technology companies requiring sophisticated spare parts and field service logistics management globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 65.0 Billion |

| Market Forecast in 2033 | USD 150.0 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | C.H. Robinson, DB Schenker, Kuehne + Nagel, DHL Supply Chain, FedEx Logistics, UPS Supply Chain Solutions, XPO Logistics, Nippon Express, J.B. Hunt Transport Services, Expeditors International, Panalpina (DSV), GEODIS, Toll Group, Agility, CEVA Logistics, Coyote Logistics, Blue Yonder, SAP SE (Software Providers Integrated), Oracle Corporation (Cloud/Software), WiseTech Global, GXO Logistics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

5PL Solutions Market Key Technology Landscape

The technological landscape of the 5PL Solutions Market is fundamentally defined by the convergence of several frontier technologies designed to automate decision-making and enhance end-to-end visibility. Central to 5PL operations are advanced integrated digital platforms, which supersede traditional enterprise resource planning (ERP) systems in logistics by embedding artificial intelligence (AI) and machine learning (ML) at the core of their Transportation Management Systems (TMS) and Warehouse Management Systems (WMS). These platforms utilize algorithms for predictive modeling, dynamic capacity pricing, and real-time risk simulation, enabling 5PL providers to execute proactive, data-driven strategies rather than reactive operational adjustments. The adoption of cloud-native architecture ensures scalability and flexibility, allowing these platforms to quickly integrate third-party data sources and accommodate fluctuations in global demand efficiently.

Crucial enabling technologies include the widespread deployment of IoT sensors and telematics across fleets, warehouses, and individual packages. This real-time data generation feeds the 5PL's Big Data reservoirs, providing granular information on location, environmental conditions (temperature, humidity), and asset utilization. Furthermore, the implementation of blockchain technology is gaining traction, specifically for creating decentralized, immutable ledgers that enhance the security and transparency of transactional data, particularly in complex cross-border logistics involving multiple regulatory bodies and customs clearance processes. This move toward verifiable data integrity is crucial for compliance and building trust among global trading partners.

The future technology stack involves Digital Twin simulations and advanced robotics. Digital Twins allow 5PL operators to create virtual replicas of their entire supply chain, or specific parts like a large distribution center, enabling them to simulate the impact of various scenarios (e.g., port closures, labor strikes, demand surges) and test optimization strategies without disrupting physical operations. In warehousing, autonomous mobile robots (AMRs) and automated guided vehicles (AGVs), orchestrated by AI-powered WMS, are standardizing the high-throughput, low-error handling required by e-commerce giants. These technologies collectively transform the 5PL service from simple coordination to autonomous, intelligent supply chain orchestration.

Regional Highlights

North America: North America represents a mature yet highly dynamic market for 5PL solutions, driven by a strong focus on technological integration, sophisticated e-commerce fulfillment, and advanced supply chain resilience requirements. The region, particularly the United States, is characterized by large, decentralized consumer markets and a high prevalence of high-tech companies demanding hyper-efficient logistics for complex products. Key growth drivers include the massive investment in cold chain logistics to support the pharmaceutical sector and the continuous need for optimized reverse logistics services in the retail sector. Regulatory frameworks, while complex, foster high levels of automation and data transparency, pushing 5PL providers to adopt leading-edge AI and data security protocols to maintain compliance and competitive advantage.

The competitive environment in North America is fierce, dominated by established global logistics giants and innovative technology-focused start-ups specializing in specific niches like predictive analytics or last-mile automation. Investment in infrastructure is primarily directed toward digital platforms and automation within existing facilities rather than building extensive new physical infrastructure. The proximity to major innovation hubs also accelerates the adoption of emerging technologies such as autonomous trucking trials and drone delivery integration, ensuring the region remains a leader in defining the future operational model of 5PL services.

Europe: Europe is characterized by a fragmented market necessitating seamless cross-border logistics management across diverse regulatory and language environments. The demand for 5PL services is strong, fueled by the bloc’s emphasis on sustainability and circular economy models. European corporations are actively seeking logistics partners capable of demonstrating reduced carbon emissions and optimized multimodal transportation solutions (rail, road, sea), aligning with stringent EU green mandates. Germany, the UK, and France are key contributors, primarily driven by automotive manufacturing and high-value consumer goods distribution, requiring intricate inventory synchronization and high reliability.

The European 5PL market is heavily influenced by geopolitical shifts and trade agreements. Providers focus on integrating services across the Single Market while managing varied customs and tax requirements for external trade. Technology adoption centers on standardizing data exchange formats and utilizing sophisticated control tower technology to maintain visibility across complex international routes. Labor costs and regulations are relatively high, accelerating the urgency of automation within warehousing and fulfillment operations, making the technological orchestration layer provided by 5PLs crucial for maintaining profitability.

Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market globally for 5PL solutions, primarily due to unprecedented e-commerce penetration, rapid urbanization, and the region's status as a global manufacturing powerhouse. Countries like China, India, Japan, and Southeast Asian nations are driving demand for scalable, high-volume logistics solutions that can handle massive transactional loads. The sheer geographical diversity and infrastructural gaps in some areas necessitate highly flexible and adaptive 5PL models, capable of integrating varied local carriers and overcoming logistical bottlenecks through advanced planning.

In APAC, 5PL providers focus heavily on building extensive physical networks alongside digital platforms, addressing the need for both physical capacity and technological management. Cross-border trade within APAC is a critical growth area, requiring specialized expertise in customs clearance and regional trade compliance. The deployment of mobile-first logistics solutions and the reliance on digital ecosystems (often integrated with local e-commerce giants) are hallmarks of the 5PL operation in this region, which balances high volume requirements with the constant need for cost-efficiency.

Latin America, Middle East, and Africa (LAMEA): The LAMEA region represents a nascent but rapidly developing market for 5PL solutions, characterized by significant infrastructural investments and burgeoning e-commerce adoption. In the Middle East, the focus is on developing sophisticated logistics hubs (e.g., UAE and Saudi Arabia) driven by large-scale government visions aimed at diversifying economies away from oil and positioning the region as a gateway between Europe, Asia, and Africa. These markets prioritize rapid deployment of high-tech, integrated platforms to leapfrog older logistics models.

Latin America and Africa face specific challenges related to security, fragmented infrastructure, and regulatory complexity, making the strategic guidance and network consolidation offered by 5PLs particularly valuable. Demand in these regions is primarily driven by industries related to resource extraction, growing consumer markets, and the urgent need for supply chain optimization to mitigate high operational risk. 5PL success in LAMEA relies on establishing robust partnerships with local asset owners and implementing advanced risk mitigation strategies powered by predictive analytics.

- North America leads in technological maturity and high-value pharmaceutical logistics.

- Europe emphasizes sustainability mandates and complex cross-border trade harmonization.

- Asia Pacific (APAC) shows the highest growth rate driven by massive e-commerce volumes and manufacturing scaling.

- Middle East leverages 5PLs to establish world-class regional logistics and trade hubs.

- Latin America focuses on mitigating operational risks and overcoming infrastructural gaps through advanced orchestration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the 5PL Solutions Market.- C.H. Robinson

- DB Schenker

- Kuehne + Nagel

- DHL Supply Chain

- FedEx Logistics

- UPS Supply Chain Solutions

- XPO Logistics

- Nippon Express

- J.B. Hunt Transport Services

- Expeditors International

- Panalpina (DSV)

- GEODIS

- Toll Group

- Agility

- CEVA Logistics

- Coyote Logistics

- Blue Yonder (Technology Provider)

- SAP SE (Integrated Software Solutions)

- Oracle Corporation (Cloud and Logistics Platforms)

- GXO Logistics

Frequently Asked Questions

Analyze common user questions about the 5PL Solutions market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between 4PL and 5PL solutions?

The core difference lies in scale and technology integration. A 4PL (Fourth-Party Logistics) acts as an integrator managing a client's entire supply chain, coordinating various 3PLs and resources. A 5PL (Fifth-Party Logistics) builds upon this by functioning as an orchestrator of multiple supply chains, utilizing proprietary technological platforms, AI, and Big Data analytics to achieve large-scale network optimization, often catering to global e-commerce volumes and complex, multi-layered logistics demands.

How does 5PL integration enhance supply chain sustainability?

5PLs use advanced Artificial Intelligence and predictive analytics to optimize routes and consolidate shipments globally, drastically reducing unnecessary mileage and fuel consumption, thereby lowering carbon emissions. They also facilitate the adoption of sustainable packaging and support circular economy initiatives, providing clients with data-backed reports on their environmental performance, ensuring compliance with strict global environmental regulations.

What major technological trends are driving investment in 5PL platforms?

Key technological trends include the integration of Artificial Intelligence (AI) for predictive demand forecasting and risk assessment, the deployment of IoT sensors for real-time asset tracking and condition monitoring, and the adoption of blockchain technology to ensure verifiable security and transparency of cross-border transactions and contracts, leading to highly autonomous decision-making processes.

Which industry vertical is the primary driver of current 5PL market growth?

The E-commerce and Retail sector is the primary driver, demanding hyper-scalable logistics solutions to manage high volume, volatile demand, and complex reverse logistics processes associated with online sales. These industries require the global network orchestration, speed, and real-time visibility that only a technologically advanced 5PL provider can reliably offer.

What are the main risks associated with transitioning to a 5PL model?

The primary risks include high initial integration costs, potential data security vulnerabilities due to reliance on centralized platforms, and the challenge of seamlessly migrating legacy IT systems to the 5PL's proprietary technology stack. Dependency risk is also present, requiring clients to ensure the 5PL maintains robust contingency plans and continuous technological investment to safeguard long-term supply chain resilience.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- 5PL Solutions Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- 5PL Solutions Market Statistics 2025 Analysis By Application (Electronic Commerce, Traders, Logistics Company, Other), By Type (Transportation, Warehousing), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager