800V Fast Charging Pile Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432852 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

800V Fast Charging Pile Market Size

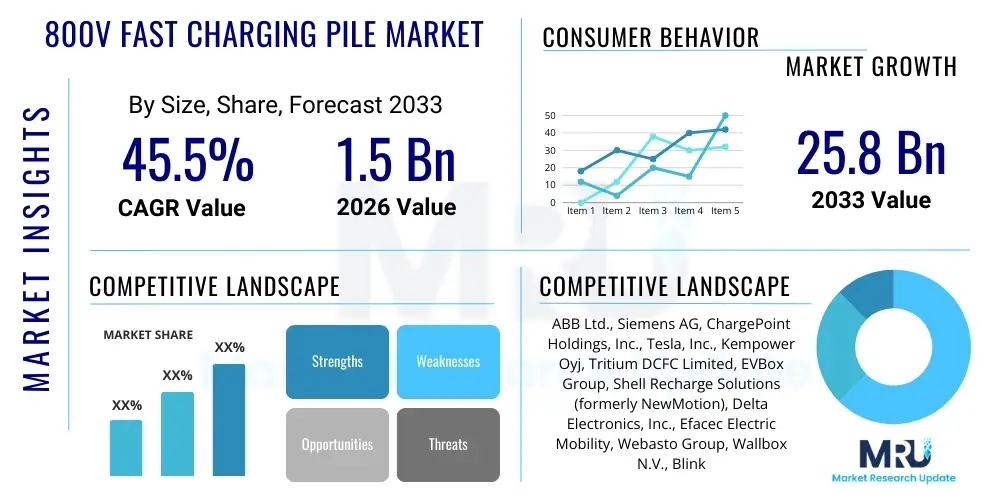

The 800V Fast Charging Pile Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 45.5% between 2026 and 2033. The market is estimated at $1.5 Billion in 2026 and is projected to reach $25.8 Billion by the end of the forecast period in 2033.

The transition toward higher voltage architectures, specifically 800V systems, is fundamentally driven by consumer demand for reduced charging times and the increasing availability of long-range electric vehicles (EVs). This market expansion is intrinsically linked to advancements in power electronics, particularly the widespread adoption of Silicon Carbide (SiC) semiconductors, which enable higher efficiency, reduced heat generation, and increased power density necessary for ultra-fast charging infrastructure. Furthermore, original equipment manufacturers (OEMs) are increasingly standardizing 800V architectures in premium and mid-range EV models, compelling infrastructure developers and charging network operators to rapidly deploy compatible piles globally to meet the burgeoning ecosystem requirements.

Geographical expansion is a significant factor contributing to market size increase, with Asia Pacific, particularly China and South Korea, leading the deployment due to aggressive governmental mandates supporting electric mobility and significant investments by domestic automotive and charging solution providers. North America and Europe are catching up through public-private partnerships aimed at establishing high-density charging corridors, essential for long-distance travel. Regulatory support, combined with standardized protocols like CCS (Combined Charging System) adapted for 800V capabilities, further catalyzes investment, cementing the market’s robust growth trajectory through the forecast period.

800V Fast Charging Pile Market introduction

The 800V Fast Charging Pile Market encompasses the infrastructure and hardware designed to deliver direct current (DC) power to electric vehicles utilizing 800-volt battery architecture, enabling significantly faster charging speeds than traditional 400V systems. This technology leverages advanced power conversion stages, often incorporating SiC modules, sophisticated thermal management systems, and smart grid integration capabilities. The primary application is public charging stations, dedicated EV fleet depots, and high-utilization commercial settings where rapid turnaround is critical. Key benefits include dramatically reduced charging times—often allowing EVs to recoup 60% to 80% state-of-charge in less than 20 minutes—improved energy efficiency due to lower current flow, and enhanced reliability. Driving factors for adoption are the rising penetration of 800V-native EVs, evolving consumer expectations for charging convenience, and global regulatory pushes toward decarbonization and electric vehicle fleet expansion.

The product description of an 800V fast charging pile includes specialized high-voltage connectors, modular power conversion units capable of outputting power levels typically ranging from 150 kW up to 600 kW or more, sophisticated metering and billing systems, and advanced safety interlocks designed to handle high DC voltages. These piles are critical for addressing range anxiety and promoting mass EV adoption, fundamentally reshaping the energy delivery landscape for transportation. The technical complexity requires robust control systems and constant communication between the pile, the grid, and the vehicle's Battery Management System (BMS) to ensure optimal and safe power transfer. Furthermore, the development of reliable cooling mechanisms, such as liquid cooling for cables and components, is integral to maintaining efficiency and longevity under high-power operations, distinguishing these units from lower-voltage alternatives.

The major applications span highway charging networks, urban ultra-fast charging hubs, commercial logistics centers supporting electric trucks and buses, and specialized depots for high-performance electric sports cars. The efficiency gains derived from 800V systems mean less infrastructural overhead for charging network operators relative to the power delivered. The market benefits from substantial research and development investments aimed at improving power density and reducing the physical footprint of these units, making deployment easier in space-constrained urban environments. Strategic partnerships between energy companies, technology providers, and vehicle manufacturers are pivotal in establishing compatibility and interoperability standards, ensuring seamless user experience across different vehicle models and charging networks.

800V Fast Charging Pile Market Executive Summary

The 800V Fast Charging Pile Market is experiencing unprecedented growth, driven by rapid technological maturation and global shifts in EV adoption strategies. Key business trends indicate a consolidation among hardware manufacturers and software providers, focusing on integrated solutions that offer smart grid connectivity, predictive maintenance capabilities, and advanced user interface design. The market is moving toward modular and scalable power architectures that can dynamically adjust output based on grid availability and vehicle demand, optimizing energy consumption and minimizing operational costs for network operators. Investment in vertically integrated supply chains, particularly securing access to SiC components, is a crucial competitive differentiator for leading vendors seeking to manage production scalability and cost efficiencies in a rapidly expanding sector.

Regionally, Asia Pacific maintains dominance, fueled by China's aggressive infrastructure buildout and strong domestic EV production base, positioning the region as the epicenter for 800V adoption and manufacturing. Europe is characterized by stringent emission reduction targets and cross-border cooperation on charging corridor deployment, leading to high-power charger penetration, particularly in Western European nations. North America is poised for accelerated growth, supported by significant federal funding initiatives, such as the NEVI program, specifically targeting high-power, reliable charging infrastructure along major transportation routes. Regional trends also highlight a focus on battery energy storage system (BESS) integration with 800V piles in regions with fluctuating grid stability, ensuring reliable fast charging irrespective of instantaneous grid load.

Segmentation trends reveal that the 'Over 350 kW' segment, representing ultra-high-power output, is projected to command the highest growth rate, reflecting the market’s persistent pursuit of minimizing charging downtime. By application, public charging stations dominate the current market share, but dedicated fleet charging solutions are emerging as a rapidly expanding segment, driven by the electrification of commercial vehicles and logistics. Furthermore, segmentation by connector type shows that CCS remains the prevalent standard outside of specific Asian markets, driving standardization efforts crucial for consumer confidence and interoperability. The evolution of liquid cooling technologies within the segment focused on hardware components underscores the increasing requirements for operational efficiency and equipment durability under extreme power loads.

AI Impact Analysis on 800V Fast Charging Pile Market

User questions regarding AI's impact on the 800V Fast Charging Pile Market commonly center on efficiency optimization, predictive maintenance, and sophisticated load management capabilities. Users frequently ask how AI can dynamically adjust charging profiles to maximize battery longevity while maintaining rapid charging speeds, and how machine learning models can accurately forecast power demand at individual stations to prevent grid overloads and optimize energy procurement. A significant area of concern relates to the security of networked charging infrastructure and the use of AI for anomaly detection and cybersecurity threat mitigation. Overall, users expect AI to transition the market from reactive infrastructure management to proactive, intelligent energy delivery ecosystems.

The integration of Artificial Intelligence (AI) algorithms into 800V fast charging infrastructure is transformative, primarily by enabling highly sophisticated energy management and system diagnostics. AI allows charging network operators to utilize real-time data streams—encompassing vehicle battery status, local grid constraints, renewable energy availability, and time-of-use tariffs—to create adaptive charging schedules. This level of optimization ensures that the pile operates at peak efficiency, minimizing electricity costs and reducing the strain on the distribution grid during peak hours. Moreover, AI-driven predictive maintenance drastically lowers operational expenditure by identifying component degradation, such as cooling system failures or power module irregularities, long before they lead to downtime, thereby improving asset utilization rates which is crucial for the high investment cost associated with 800V infrastructure.

Furthermore, AI plays a pivotal role in enhancing the user experience through optimized queuing and pricing strategies. Machine learning models analyze historical usage patterns and current traffic conditions to guide drivers to the least busy charging spots, improving throughput and customer satisfaction. The high power and complexity of 800V charging necessitate robust safety protocols; AI systems continuously monitor internal parameters (temperature, voltage fluctuations, cable integrity) to ensure safe operation, immediately halting or modifying charging sessions if anomalies are detected, offering a critical layer of safety protection not achievable with traditional rule-based systems. This intelligent layer is fundamental to scaling 800V deployment responsibly across densely populated urban centers and critical transportation corridors.

- AI-powered Predictive Maintenance: Forecasting hardware failures in power modules and cooling systems, minimizing downtime.

- Dynamic Load Balancing: Optimizing energy allocation across multiple piles based on real-time grid conditions and vehicle demand.

- Optimized Charging Profiles: Using machine learning to adjust voltage and current flows dynamically to maximize charging speed while protecting high-voltage battery health.

- Grid Interaction Optimization: Forecasting energy demand for informed participation in demand response programs and leveraging renewable energy sources.

- Enhanced Cybersecurity: Detecting and mitigating cyber threats and unauthorized access attempts on networked charging infrastructure.

- User Experience Personalization: Providing optimized routing and personalized pricing based on user patterns and network congestion.

DRO & Impact Forces Of 800V Fast Charging Pile Market

The 800V Fast Charging Pile Market is characterized by strong drivers rooted in technological superiority and regulatory support, tempered by significant restraints related to infrastructure costs and grid integration challenges. Opportunities exist in pioneering Vehicle-to-Grid (V2G) integration and expanding into emerging commercial fleet segments. The primary drivers include the inherent speed advantage of 800V technology and the rapid adoption of 800V-native EVs by major automotive manufacturers. Restraints largely revolve around the high capital expenditure required for power upgrades at charging sites and the complexity of ensuring grid capacity matches ultra-fast charging demand. Opportunities center on developing smart, modular infrastructure and penetrating untapped markets in developing economies. Impact forces are overwhelmingly positive, driven by accelerating EV sales projections and governmental mandates prioritizing charging infrastructure expansion.

Drivers are profoundly shaping the market trajectory. The move to 800V systems significantly improves the utilization rate of charging assets, making investments more economically viable for operators. Furthermore, the mandatory push by governments in key regions (like the EU's AFIR and US investment programs) to install high-power charging along major highways creates guaranteed demand. Technological drivers, especially the maturity of SiC semiconductor technology, enable the high-efficiency power conversion necessary for 800V output with minimal thermal loss. The competitive pressure among EV manufacturers to offer the fastest charging capability directly fuels the demand for compatible 800V piles, creating a symbiotic ecosystem where vehicle technology dictates infrastructure development pace.

Conversely, significant restraints hinder immediate, widespread deployment. The primary challenge is the capital cost associated with acquiring, installing, and upgrading the local power infrastructure (e.g., transformers and medium-voltage connections) necessary to support multiple 350 kW+ charging piles simultaneously. Grid integration presents a major hurdle, particularly in regions with aging electricity networks, requiring substantial investment in grid reinforcement. Additionally, the need for sophisticated thermal management (liquid cooling) and advanced power electronics contributes to higher unit costs compared to standard 400V chargers. Opportunities abound in modular design solutions that simplify installation and scale deployment based on demand, and in the integration of local BESS to buffer peak loads, mitigating grid dependency and unlocking deployment in previously constrained locations. The development of standardized liquid-cooled connectors and protocols is also a key area of opportunity for lowering proprietary barriers and speeding up cross-manufacturer compatibility.

Segmentation Analysis

The 800V Fast Charging Pile Market is primarily segmented by Power Output, Application, and Component. Segmentation by Power Output categorizes the infrastructure based on the maximum power delivered, reflecting the evolution towards ultra-high power levels necessary for large-format batteries and commercial vehicles. Application segmentation differentiates between the primary use cases, with public charging remaining dominant but commercial fleet operations showing the fastest anticipated growth. Component segmentation highlights the critical hardware and software elements essential for 800V operation, where power modules utilizing advanced semiconductors like SiC are foundational to performance and efficiency, heavily influencing market dynamics and vendor competition.

Analyzing the segmentation reveals crucial trends. Within the Power Output category, the "Over 350 kW" segment is critical for market leadership, as operators seek future-proof infrastructure capable of charging next-generation electric trucks and large SUVs that require massive energy input in short durations. The market is witnessing a race among vendors to introduce 480 kW and 600 kW systems. By Application, the shift is noticeable from general public charging toward specialized logistics and mass transit depot charging. Fleet operators require extremely high utilization and reliability, making the advanced diagnostics and remote management capabilities inherent in modern 800V piles highly valuable. Component trends underscore the dependency on robust, high-performance power conversion technology, indicating that suppliers of SiC MOSFETs and diodes hold significant influence over the cost and efficiency of the final pile product.

Furthermore, geographic segmentation is vital for understanding deployment strategies, where Asian markets prioritize density and volume, while European and North American markets focus on high power and network interoperability. The evolving regulatory landscape continually influences these segment dynamics, as mandates often specify minimum power outputs (e.g., 150 kW or 350 kW) for federally funded installations, thereby boosting demand for the upper tiers of power output segmentation. The competitive landscape is therefore shaped by a vendor's ability to offer a complete portfolio covering various power outputs and specialized software tailored for different application environments, from transient public stops to continuous fleet operations.

- By Power Output:

- 150 kW to 300 kW

- 301 kW to 350 kW

- Over 350 kW

- By Application:

- Public Charging Stations

- Commercial Fleet Charging (Logistics, Bus Depots)

- Residential (Emerging Niche for High-Power Home Charging)

- By Component:

- Hardware (Power Modules, Rectifiers, Connectors, Cables)

- Software (CSMS, Billing Systems, Monitoring Software)

- Services (Installation, Maintenance, Upgrades)

Value Chain Analysis For 800V Fast Charging Pile Market

The value chain for the 800V Fast Charging Pile Market is complex, beginning with upstream semiconductor manufacturing and culminating in the downstream operation and maintenance of charging networks. Upstream activities are dominated by specialized component suppliers, particularly manufacturers of high-performance Silicon Carbide (SiC) and Gallium Nitride (GaN) power devices, which are essential for the efficiency of the power conversion modules. Midstream involves the assembly of these sophisticated components into the final charging pile hardware, alongside the development of proprietary software for charging station management (CSMS). Downstream includes the distribution, installation, and operation of the charging infrastructure, primarily handled by Charging Point Operators (CPOs) and Energy Service Providers (ESPs). Distribution channels are primarily direct sales to large CPOs or indirect through specialized electrical infrastructure contractors, ensuring compliance with rigorous safety and grid connection standards.

Upstream analysis highlights the critical nature of the semiconductor supply chain. Shortages or price volatility in SiC wafers and power modules directly impact the cost and production timeline of 800V piles. Key players in this segment include specialized material science companies and semiconductor foundries. The complexity and high cost of 800V power electronics mean that hardware manufacturers must focus heavily on supply chain reliability and strategic sourcing. The assembly phase (midstream) requires specialized engineering expertise, particularly in thermal management systems (liquid cooling) to ensure safety and longevity under continuous high-power operation, distinguishing the leaders in manufacturing from generic hardware providers.

Downstream market dynamics are characterized by intense competition among CPOs seeking prime locations and seamless user experience. Distribution often follows a hybrid model: direct engagement is common for large-scale governmental or utility tenders, while indirect channels leverage specialized electrical contractors familiar with high-voltage installations and local regulatory requirements. The role of software in the downstream sector is paramount; effective CSMS and integration with national smart grids are necessary for monetizing the infrastructure. The direct relationship between CPOs and end-users (EV drivers) through mobile applications and loyalty programs reinforces the service aspect of the downstream value chain, shifting focus from hardware sales to recurring service revenue streams.

800V Fast Charging Pile Market Potential Customers

The primary end-users and buyers of 800V Fast Charging Piles are entities requiring high throughput and quick turnaround times for electric vehicles. This includes major Charging Point Operators (CPOs) and e-mobility service providers (EMSPs) focused on building vast public charging networks along critical transportation corridors and urban hubs. A rapidly growing segment of potential customers includes large commercial fleet operators, such as logistics companies, delivery services, and public transit authorities, who are transitioning their bus and truck fleets to 800V electric architectures and require dedicated, rapid-charging depots to ensure continuous operational uptime. Additionally, utilities and energy companies represent significant potential customers, often purchasing piles for grid research, demand response projects, or integrating charging infrastructure into smart cities and renewable energy generation sites.

CPOs constitute the largest customer base, as the shift to 800V is essential for maintaining a competitive edge and attracting drivers of premium and next-generation EVs. These customers prioritize high reliability, scalability, and robust software integration capabilities to manage thousands of charging points efficiently. The deployment requires high capital investment, making long-term service contracts and warranty provisions critical factors in procurement decisions. These customers are focused on total cost of ownership (TCO) and achieving rapid return on investment through high utilization rates, which 800V systems inherently support due to their speed advantage.

Commercial fleet operators, including those managing heavy-duty electric trucks and delivery vans, represent a high-value customer segment characterized by concentrated demand and predictable usage patterns. For this group, the primary requirement is operational continuity; 800V charging minimizes vehicle downtime, maximizing driver hours and operational efficiency. Their purchasing decisions are often tied to specific vehicle procurement cycles, favoring suppliers that offer tailored depot solutions, complex load management software, and integration with existing fleet management systems. Finally, governments and municipal entities often act as buyers, acquiring 800V piles for public infrastructure projects, regulatory demonstrations, or for supporting their own zero-emission vehicle fleets, often favoring vendors that meet strict national and local content requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.5 Billion |

| Market Forecast in 2033 | $25.8 Billion |

| Growth Rate | 45.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, ChargePoint Holdings, Inc., Tesla, Inc., Kempower Oyj, Tritium DCFC Limited, EVBox Group, Shell Recharge Solutions (formerly NewMotion), Delta Electronics, Inc., Efacec Electric Mobility, Webasto Group, Wallbox N.V., Blink Charging Co., NARI Technology Co., Ltd., Star Charge, XCharge Energy, Shinry Technologies, Rectifier Technologies, Infineon Technologies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

800V Fast Charging Pile Market Key Technology Landscape

The technological landscape of the 800V Fast Charging Pile market is defined by advancements in power conversion efficiency and thermal management required to handle extremely high DC power levels safely. Central to this is the extensive adoption of Silicon Carbide (SiC) semiconductors, replacing traditional silicon IGBTs. SiC MOSFETs and diodes offer superior switching performance, higher power density, and significantly reduced energy losses, allowing manufacturers to create smaller, lighter, and more efficient charging modules capable of 800V output. This transition is essential for minimizing heat generation, which is a critical operational constraint in ultra-fast charging environments. The inherent efficiency of SiC devices means less waste heat needs to be managed, simplifying the overall system design, though demanding higher precision in manufacturing processes.

Equally critical is the evolution of thermal management systems. Since charging cables and connectors must handle high currents up to 500 Amperes or more, passive cooling is inadequate. The market is thus shifting almost entirely toward advanced liquid cooling solutions for both the internal power electronics and the charging cables themselves. This specialized cooling technology ensures that components operate within safe temperature limits, prolonging the lifespan of the equipment and maintaining consistent charging speeds, even during consecutive high-power charging sessions in hot climates. Furthermore, modular power architecture is a prevalent technological approach, enabling CPOs to scale charging power incrementally and simplifying maintenance by allowing hot-swapping of power blocks without interrupting the operation of the entire station.

Finally, sophisticated software and communication protocols form the backbone of the 800V landscape. The piles rely heavily on the Open Charge Point Protocol (OCPP) 2.0.1 for managing complex interactions with the CSMS and leveraging features like smart charging and plug-and-charge functionality, which simplifies the user experience for high-voltage systems. Furthermore, high-speed digital communication between the pile and the vehicle's BMS is necessary to continuously negotiate the maximum safe charging rate for the 800V battery pack, demanding robust and standardized communication hardware and software to ensure interoperability across various OEM platforms utilizing the 800V architecture.

Regional Highlights

Regional dynamics heavily influence the adoption and growth rate of the 800V Fast Charging Pile Market, reflecting varying levels of governmental support, EV penetration rates, and grid maturity.

- Asia Pacific (APAC): APAC is the largest market, primarily driven by China, which holds a massive domestic EV manufacturing base heavily invested in high-voltage platforms. South Korea, home to key 800V EV OEMs like Hyundai and Kia, is aggressively expanding its public 800V infrastructure. The region prioritizes dense urban deployment and standardized domestic technologies, leading to high-volume manufacturing and cost efficiencies. Government incentives and mandatory infrastructure targets ensure continued dominance.

- Europe: Europe is characterized by a strong push toward standardized, interoperable high-power charging networks (HPC). Countries like Germany, Norway, and the Netherlands lead deployment, driven by stringent CO2 emission regulations and pan-European initiatives aimed at establishing ultra-fast charging corridors. The focus here is on reliable, high-quality hardware and seamless cross-border operation using CCS standards adapted for 800V.

- North America: North America is experiencing exponential growth, galvanized by significant federal funding (e.g., NEVI funding) explicitly supporting the deployment of high-power DC fast charging infrastructure (150 kW and above). The market benefits from strong commitments by major automakers to 800V architecture (e.g., GM and Ford's future platforms). Challenges remain in grid resiliency and large-scale utility upgrades, but substantial private investment is mitigating these hurdles, focusing deployment along major interstate routes.

- Latin America, Middle East, and Africa (MEA): These regions represent emerging markets where 800V adoption is currently limited to pilot projects and premium segments. Growth is anticipated to accelerate in urban centers of countries like UAE, Saudi Arabia, and Brazil, contingent upon future government commitments to large-scale EV adoption and associated charging infrastructure buildout. Initial deployment focuses heavily on commercial fleet opportunities due to centralized usage patterns.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the 800V Fast Charging Pile Market.- ABB Ltd.

- Siemens AG

- ChargePoint Holdings, Inc.

- Tesla, Inc. (Supercharger Network expansion)

- Kempower Oyj

- Tritium DCFC Limited

- EVBox Group

- Shell Recharge Solutions (formerly NewMotion)

- Delta Electronics, Inc.

- Efacec Electric Mobility

- Webasto Group

- Wallbox N.V.

- Blink Charging Co.

- NARI Technology Co., Ltd.

- Star Charge (Wanbang Digital Energy)

- XCharge Energy

- Shinry Technologies

- Rectifier Technologies

- Infineon Technologies (Component supplier influence)

- STMicroelectronics (Component supplier influence)

Frequently Asked Questions

Analyze common user questions about the 800V Fast Charging Pile market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of 800V fast charging over standard 400V charging?

The primary benefit is significantly reduced charging time. 800V architecture allows higher power transfer (often 350 kW to 600 kW) by enabling lower current flow compared to 400V systems at the same power level, leading to less heat generation, improved efficiency, and much quicker replenishment of the EV battery, minimizing user waiting time.

How does the shift to 800V affect the deployment cost of charging infrastructure?

The shift increases capital expenditure significantly due to the requirement for more sophisticated and expensive components, particularly Silicon Carbide (SiC) power modules and advanced liquid cooling systems. Additionally, major site electrical upgrades, including transformer and grid connection improvements, are often necessary to support the ultra-high power demands of 800V piles.

Are 800V charging piles compatible with all existing electric vehicles (EVs)?

800V piles are fully compatible with 800V-native EVs. They are also compatible with most 400V EVs, which use an internal DC/DC converter to adapt the voltage, allowing them to charge, though not at the maximum potential speed of the 800V pile. Interoperability relies on standardized connectors like CCS.

What role do Silicon Carbide (SiC) semiconductors play in 800V technology?

SiC semiconductors are crucial for 800V technology because they provide superior efficiency, higher switching frequencies, and greater thermal resilience compared to traditional silicon-based components. This enables the power conversion modules within the pile to handle the necessary high voltage and power output with reduced energy loss and smaller form factors.

What are the main applications driving the immediate demand for 800V charging piles?

The immediate demand is predominantly driven by public charging networks seeking ultra-fast capabilities to alleviate range anxiety and by commercial fleet operators (trucks, buses, logistics) requiring rapid, high-utilization depot charging to maintain critical operational schedules and vehicle uptime.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager