8K Display Resolution Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432471 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

8K Display Resolution Market Size

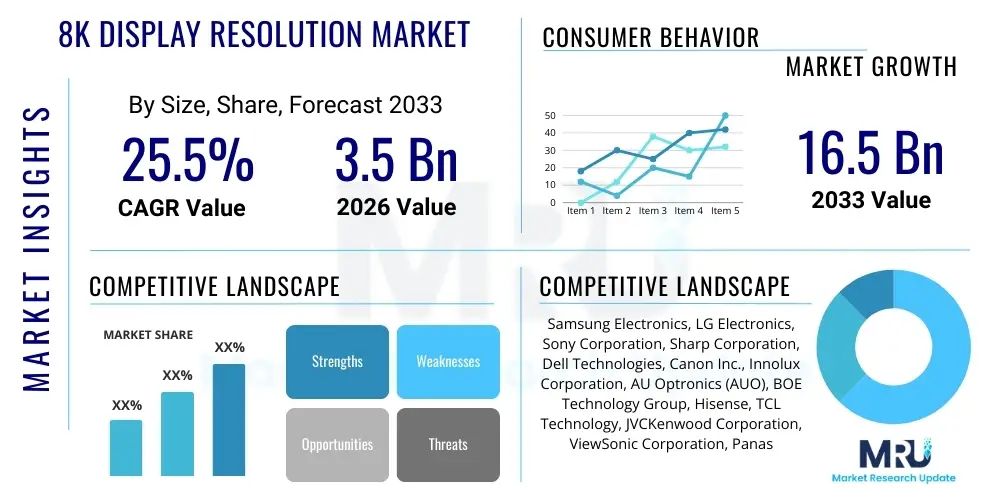

The 8K Display Resolution Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 25.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 16.5 Billion by the end of the forecast period in 2033.

8K Display Resolution Market introduction

The 8K Display Resolution Market encompasses the manufacturing, distribution, and sales of screens, panels, and associated hardware and software capable of displaying content at 7680 horizontal pixels by 4320 vertical pixels, totaling over 33 million pixels. This resolution offers four times the detail of 4K displays, setting a new benchmark for visual fidelity across various professional and consumer applications. Key products driving this market include high-end consumer televisions, professional medical imaging monitors, digital signage, and specialized broadcasting equipment. The increased demand for ultra-high-definition content consumption, particularly in media, entertainment, and gaming sectors, is a foundational driver for market expansion. Furthermore, professional domains requiring precise visual accuracy, such as advanced simulation and design, are increasingly adopting 8K technology to enhance operational efficiency and detail observation.

Major applications of 8K technology are rapidly emerging across several sophisticated industry verticals. In the consumer electronics sector, premium smart televisions represent the largest application segment, positioning 8K as a luxury offering focused on immersive viewing experiences. Beyond consumer use, 8K displays are critical in medical diagnostics, where granular image detail is essential for accurate analysis, and in the film and broadcasting industry for high-resolution content creation and archival. The technology’s benefits are significant, including unparalleled clarity, deeply immersive experiences, improved realism for virtual and augmented reality applications, and superior viewing quality even on very large screens where lower resolutions would pixelate. The necessity for advanced graphics processing units (GPUs) and higher bandwidth infrastructure to manage this massive data load also stimulates growth in adjacent technology sectors.

Driving factors for the 8K market are intrinsically linked to technological advancements in panel production, reduction in manufacturing costs, and the persistent drive by technology leaders to differentiate premium products. The proliferation of high-speed internet and the imminent rollout of advanced streaming codecs capable of handling 8K streams are lowering accessibility barriers. Additionally, major sporting events and global media platforms are beginning to invest in 8K capture and transmission technologies, creating a flywheel effect where increased content availability spurs hardware sales, and increased hardware penetration encourages more content production. This cycle, combined with the consumer desire for the 'best possible' viewing experience, continues to accelerate the adoption curve globally, despite initial price sensitivity and infrastructure constraints.

8K Display Resolution Market Executive Summary

The 8K Display Resolution Market is undergoing a rapid evolution characterized by aggressive technological competition, strategic partnerships aimed at content delivery infrastructure, and a gradual shift from niche professional applications to the mainstream premium consumer segment. Current business trends indicate a strong focus on enhancing the upscaling capabilities of display processors, allowing existing lower-resolution content (4K, HD) to be visually optimized for 8K screens, thereby mitigating the current scarcity of native 8K content. Market leaders are intensely focused on integrating advanced smart features, including AI-driven optimization engines, into their 8K product lines to justify premium pricing and sustain market differentiation. The long-term trend points towards standardization of 8K interfaces and widespread adoption across computing and enterprise environments, moving beyond pure entertainment.

Regionally, the Asia Pacific (APAC) stands out as the primary engine of growth, driven by high technology adoption rates in countries like Japan, South Korea, and China, where major display panel manufacturers are headquartered and premium consumer spending is robust. North America and Europe also contribute significantly, primarily driven by the professional sector (broadcasting, corporate signage, and medical) and affluent consumer segments willing to invest early in next-generation technology. Regional trends show that infrastructure readiness, specifically the deployment of high-speed fiber and 5G networks, directly correlates with market penetration rates, with technologically advanced urban centers exhibiting the earliest and strongest adoption of 8K display units. Government initiatives supporting ultra-high-definition broadcasting standards in key Asian nations further reinforce APAC's dominance in the forecast period.

Segmentation trends highlight that the Display Panel segment (specifically LCD and OLED 8K panels) holds the largest market share by volume, benefiting from mass manufacturing efficiency and diverse application use. However, the Projectors segment, although smaller, is projected to register the highest CAGR, propelled by cinema, large-venue entertainment, and high-fidelity simulation markets requiring immense screen sizes. By application, the Television segment remains dominant, but the Digital Signage and Commercial Display segment is experiencing substantial, steady growth as enterprises seek high-impact visual communication tools. Within the technology types, OLED technology is gaining traction due to its superior contrast and color rendition capabilities, increasingly challenging established LCD dominance in the high-end 8K consumer space, while microLED presents a future, highly disruptive technological pathway.

AI Impact Analysis on 8K Display Resolution Market

User queries regarding the intersection of Artificial Intelligence (AI) and 8K display technology overwhelmingly center on content accessibility and visual quality enhancement. Users frequently ask: "How does AI make 4K content look better on an 8K TV?" and "Will AI handle the massive data processing required for 8K streaming?" These questions reveal key themes: the reliance on AI upscaling algorithms (AI upscaling, deep learning super sampling) to overcome the lack of native 8K content, and the critical role AI plays in optimizing processing load and bandwidth management. Expectations are high that AI will be the crucial bridge technology that makes 8K viable for the average consumer by intelligently interpolating missing pixel data and adjusting display parameters in real-time based on content type and ambient lighting conditions, thereby enhancing the overall viewing experience while masking infrastructure limitations.

The direct impact of AI is profound, primarily manifesting through advanced image processing pipelines integrated into 8K display chipsets. AI-driven processors utilize neural networks trained on vast datasets of high- and low-resolution images to predict and generate highly accurate pixel data, effectively upscaling 4K or even HD signals to near-native 8K quality. This capability is paramount, as widespread native 8K content creation will take several years to mature fully. Consequently, AI upscaling has become the core value proposition for early 8K adopters, transforming a hardware-only solution into a sophisticated software-enhanced system that immediately addresses content disparity. Furthermore, AI contributes significantly to power efficiency and cooling management, optimizing the performance of the complex chips required to drive 33 million pixels.

Beyond simple upscaling, AI is fundamentally transforming the user interface and calibration of 8K devices. Generative Engine Optimization (GEO) principles are applied by manufacturers to utilize AI for personalized viewing experiences, where the display automatically optimizes color gamut, brightness, and motion handling based on the user's preferences, content genre (e.g., distinguishing between a sports broadcast and a cinematic movie), and real-time environmental data collected via embedded sensors. This intelligent optimization ensures that the extreme detail offered by 8K resolution is consistently delivered under optimal viewing parameters, minimizing user input and maximizing immersion, thus defining the next generation of smart display systems and strengthening consumer adoption.

- AI Upscaling: Essential for converting lower-resolution sources (4K, HD) into high-fidelity 8K output.

- Real-time Image Optimization: AI algorithms adjust contrast, brightness, and sharpness dynamically based on content scene and ambient light.

- Bandwidth Management: AI-enabled codecs optimize 8K data transmission efficiency, reducing streaming latency and infrastructure strain.

- Personalized Calibration: Deep learning models customize display settings based on user viewing history and preferences.

- Manufacturing Optimization: AI is utilized in display panel production lines for enhanced quality control and defect detection in ultra-high pixel density panels.

- Gaming Enhancement: AI-driven technologies like Deep Learning Super Sampling (DLSS) enable high frame rates in 8K gaming environments.

DRO & Impact Forces Of 8K Display Resolution Market

The 8K Display Resolution Market is shaped by a strong combination of technological push and market pull factors, countered by significant infrastructure and cost constraints. The primary drivers include the constant innovation cycle within the consumer electronics sector demanding higher resolutions, the investment by major technology firms in next-generation panel production, and the growing ecosystem of 8K professional content creation tools. These drivers establish a powerful trajectory for market expansion, pushing the boundaries of visual technology and setting new standards for display quality across media, entertainment, and enterprise visualization. The market opportunity lies particularly in the integration of 8K into specialized fields such as surgical robotics, industrial inspection, and advanced virtual reality, where its superior detail provides tangible operational advantages and safety improvements.

However, the rapid growth is substantially restrained by several key challenges. The scarcity of native 8K content remains the most significant impediment, making the high investment in 8K hardware less compelling for consumers outside of early adopters. Furthermore, the massive bandwidth requirements for transmitting uncompressed 8K data necessitate costly upgrades to home networking infrastructure and global broadcasting channels. The high initial cost of 8K display units and the power consumption demands associated with driving such a high number of pixels also act as deterrents for budget-conscious consumers and environmentally sensitive corporate buyers. The lack of standardized industry benchmarks and connectivity specifications, while improving, still presents minor friction in the adoption process across diverse hardware ecosystems.

The impact forces currently governing the market dynamics are heavily weighted toward the availability of affordable, high-performance GPUs and AI upscaling chips, which directly mitigate the content constraint (Opportunity). Restraining forces, such as high hardware cost and limited content, exert downward pressure on mass market adoption (Restraint). The compelling force is ultimately consumer expectation—once 4K becomes the baseline, the pursuit of superior visual realism will inevitably push consumers toward 8K (Driver). The overall net impact is positive but gradual, characterized by initial steep growth in the professional sector followed by a phased penetration into the mainstream consumer market as costs decrease and content ecosystems mature, likely accelerated significantly by advancements in compressed video standards and transmission technologies.

Segmentation Analysis

The 8K Display Resolution Market is systematically segmented based on Technology, Product Type, Application, and Region, allowing for granular analysis of demand drivers and growth pockets. Understanding these segments is crucial for strategic planning, as distinct market dynamics apply to components versus final products, and professional applications versus consumer usage. For example, while LCD remains cost-effective for larger displays, OLED dominates the premium segment requiring superior black levels and contrast, influencing where manufacturers allocate their R&D budgets. The rapid growth anticipated in the Digital Signage segment compared to the steady growth of the Television segment also dictates differentiated marketing strategies and distribution channel focus for market participants.

By dissecting the market along Product Type, it becomes evident that consumer televisions account for the bulk of current revenue due to their high volume sales, yet professional monitors and projectors hold significantly higher average selling prices (ASPs). The technology segmentation highlights the transition phase the industry is currently navigating, moving from established LCD technology towards next-generation display solutions like OLED and the emerging MicroLED, which promises even higher brightness and longevity, eventually impacting the industrial and high-ambient light commercial applications most profoundly. This segmented view provides a detailed map of current competitive landscapes and future disruptive forces.

The application segmentation is particularly revealing regarding the value proposition of 8K resolution. While Entertainment and Media are obvious beneficiaries, the highest value creation per unit is observed in specialized sectors like Healthcare (diagnostics, surgery visualization) and Industrial Design (CAD, high-fidelity simulation), where the extreme resolution translates directly into enhanced accuracy and error reduction. This differentiation underscores the dual nature of the 8K market—a mass consumer product and a high-value professional tool—necessitating a multi-faceted approach for companies targeting comprehensive market presence. Geographic segmentation confirms regional variations in adoption, tied closely to disposable income and digital infrastructure quality.

- By Technology:

- LCD (Liquid Crystal Display)

- OLED (Organic Light Emitting Diode)

- MicroLED (Micro Light Emitting Diode)

- By Product Type:

- 8K Television

- 8K Monitor (Professional and Gaming)

- 8K Projector

- 8K Digital Signage/Commercial Display

- 8K Smartphone/Tablet Display (Emerging)

- By Application:

- Media and Entertainment (Broadcasting, Gaming, Film)

- Healthcare and Medical Imaging

- Industrial Design and Engineering

- Defense and Aerospace Simulation

- Education and Research

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For 8K Display Resolution Market

The value chain for the 8K Display Resolution Market is complex and capital-intensive, starting with upstream raw material suppliers and panel component manufacturing, leading through sophisticated display module assembly, and concluding with downstream distribution and consumer retail. Upstream activities involve highly specialized manufacturing of thin-film transistors (TFTs), color filters, advanced backplanes, and critical components like specialized high-speed interface chips (e.g., HDMI 2.1 capable processors) and high-density LEDs for backlighting. This stage is dominated by a few large players who possess the necessary proprietary technology and massive fabrication facilities (fabs) required to produce panels with extremely tight pixel pitch and uniform quality, demanding stringent quality control and high R&D investment.

The middle segment involves the assembly of the display panel into the final product (e.g., a television or monitor) by Original Equipment Manufacturers (OEMs), integrating proprietary AI upscaling engines, smart platforms, and audio systems. Downstream activities involve global logistics and distribution channels, which are segmented into direct and indirect routes. Direct distribution channels are often leveraged for high-end, commercial, and professional-grade 8K products, utilizing specialized integrators who provide installation, calibration, and support services for corporate clients and broadcasters. This approach ensures technical expertise is maintained throughout the sales process, critical for complex professional deployments.

Indirect distribution relies heavily on mass-market retail channels, including major brick-and-mortar electronics stores, large e-commerce platforms, and specialized premium retailers, particularly for consumer 8K televisions. These indirect channels require strong marketing support, point-of-sale demonstrations (PSDs) to illustrate the perceived value of 8K, and efficient inventory management due to the large size and high unit cost of the products. The efficiency of the distribution channel is heavily dependent on optimizing logistics to minimize damage to delicate large-format panels and ensuring that the final consumer experience meets the high expectations set by the 8K label. Furthermore, strategic partnerships between panel makers, OEMs, and content providers (e.g., streaming services) are increasingly essential in the mid to downstream segments to accelerate content availability and consumer readiness.

8K Display Resolution Market Potential Customers

The potential customer base for the 8K Display Resolution Market is broadly categorized into premium consumers seeking the ultimate home entertainment experience and various professional enterprises requiring unparalleled visual detail and accuracy for mission-critical tasks. In the consumer space, the primary target demographic consists of high-net-worth individuals, avid gamers, and home cinema enthusiasts who prioritize cutting-edge technology and have high disposable income, often residing in developed urban markets. These buyers are typically early adopters who drive initial demand and influence mainstream adoption patterns, justifying the purchase based on future-proofing their home entertainment setup and achieving maximum immersion in visual content, particularly high-fidelity gaming.

On the enterprise side, key end-users include major film studios and broadcasting companies (e.g., sports networks and streaming giants) that utilize 8K for content acquisition, post-production, and archival, recognizing the long-term value of high-resolution masters. The healthcare sector represents a high-value customer group, specifically surgical theaters and advanced diagnostic centers, where 8K monitors facilitate precise visualization of intricate medical images, enhancing diagnostic accuracy and surgical precision. Furthermore, organizations involved in advanced simulation, military command centers, architectural visualization, and automotive design utilize 8K displays to create highly realistic, immersive training and design environments, significantly improving fidelity over previous generation displays.

The convergence of professional and consumer demands also points to specialized markets, such as high-end gaming cafés and esports venues, which require 8K monitors for competitive advantage and spectator viewing experiences. Digital signage clients, ranging from luxury retail brands to corporate headquarters, are adopting 8K displays to create impactful visual narratives and immersive brand experiences that capture consumer attention more effectively than standard high-definition displays. These diverse applications confirm that the market spans beyond simple home entertainment, emphasizing its critical role as an enabling technology across high-stakes industrial and professional visualization domains.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 16.5 Billion |

| Growth Rate | 25.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Samsung Electronics, LG Electronics, Sony Corporation, Sharp Corporation, Dell Technologies, Canon Inc., Innolux Corporation, AU Optronics (AUO), BOE Technology Group, Hisense, TCL Technology, JVCKenwood Corporation, ViewSonic Corporation, Panasonic Corporation, Vizio Inc., Red Digital Cinema, Christie Digital Systems, Digital Projection International, NVIDIA Corporation, AMD (Advanced Micro Devices). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

8K Display Resolution Market Key Technology Landscape

The technological landscape of the 8K market is defined by continuous advancements in panel manufacturing processes, particularly in achieving uniform pixel structure and high yield rates for ultra-high-density displays. Current market leadership is maintained through refinement of Liquid Crystal Display (LCD) technology, specifically leveraging technologies like Quantum Dots (QLED) to enhance color volume and brightness, making these displays highly competitive in brightly lit environments. However, the premium segment increasingly relies on Organic Light-Emitting Diode (OLED) technology, which offers perfect blacks and infinite contrast, crucial for cinematic viewing experiences, despite potential challenges related to screen size scaling and burn-in risks, which manufacturers are actively mitigating through sophisticated compensation algorithms and advanced materials science.

A critical enabling technology for 8K adoption, regardless of the panel type, is the evolution of high-speed connectivity interfaces. HDMI 2.1 is essential, providing the necessary 48Gbps bandwidth to handle uncompressed 8K video at 60 frames per second (fps), or compressed video at 120 fps. The industry is also heavily invested in developing superior video compression standards, such as VVC (Versatile Video Coding) and AV1, which are crucial for efficient transmission of 8K content over existing broadband infrastructure, addressing the significant data payload inherent to this resolution. These coding standards are necessary to make 8K streaming practical for general consumers and significantly impact data center infrastructure requirements and internet backbone traffic.

Looking ahead, MicroLED technology represents the most significant disruptive innovation on the horizon, promising the best attributes of both LCD (high brightness and longevity) and OLED (perfect blacks and fast response times). While currently constrained by extremely high production costs and complexity in manufacturing tiny, accurate LEDs, MicroLED is poised to revolutionize the high-end commercial display and large-format television sectors by offering unprecedented resolution density, brightness, and modular scalability. Concurrently, the proliferation of specialized System-on-Chips (SoCs) equipped with powerful Neural Processing Units (NPUs) dedicated to real-time AI upscaling and image processing is the immediate technology making 8K accessible and visually compelling even without native 8K source material, ensuring smooth adoption during the content creation lag phase.

Regional Highlights

- Asia Pacific (APAC): The APAC region is projected to dominate the global market, driven by the presence of major display panel manufacturers (e.g., Samsung, LG, BOE) and robust consumer electronics markets in China, South Korea, and Japan. High consumer enthusiasm for new technology and governmental support for 8K broadcasting initiatives, particularly around major global sporting events, further accelerate adoption.

- North America: Characterized by early technology adoption in the professional sectors (media production, defense, healthcare) and a strong market for premium consumer goods. High disposable income and advanced broadband infrastructure facilitate the quicker uptake of 8K streaming services and gaming consoles, establishing it as a key revenue generator.

- Europe: Europe exhibits steady growth, primarily focused on the high-end consumer segment and specialized corporate visualization applications. Demand is particularly strong in Western European countries, driven by high standards for cinematic content quality and a focus on industrial design and simulation technologies.

- Latin America (LATAM) and Middle East and Africa (MEA): These regions are nascent but show potential, with growth concentrated in urban centers and luxury segments. Adoption is highly dependent on improvements in local broadband infrastructure and the declining cost of 8K panels, which will make the technology accessible to a broader consumer base during the latter half of the forecast period.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the 8K Display Resolution Market.- Samsung Electronics Co. Ltd.

- LG Electronics Inc.

- Sony Corporation

- Sharp Corporation

- Dell Technologies Inc.

- Canon Inc.

- Innolux Corporation

- AU Optronics (AUO)

- BOE Technology Group Co. Ltd.

- Hisense Co. Ltd.

- TCL Technology Group Corporation

- JVCKenwood Corporation

- ViewSonic Corporation

- Panasonic Corporation

- Vizio Inc.

- Red Digital Cinema, LLC

- Christie Digital Systems USA, Inc.

- Digital Projection International

- NVIDIA Corporation

- AMD (Advanced Micro Devices)

Frequently Asked Questions

Analyze common user questions about the 8K Display Resolution market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving force behind the adoption of 8K displays?

The primary driving force is the consumer and professional demand for superior visual fidelity and realism, coupled with continuous manufacturing advancements that lower panel production costs and increase screen size availability. AI upscaling technology also significantly drives early consumer adoption by mitigating current native 8K content limitations.

Is 8K resolution beneficial for general viewing or only for large screens?

While the benefits of 8K resolution (elimination of visible pixels) are most pronounced on very large screens (75 inches and above) and when viewed closely, 8K technology also enhances image quality across all screen sizes through improved color depth, superior processing, and the advanced upscaling algorithms integrated into modern 8K panels.

What are the main constraints limiting the rapid mass adoption of 8K technology?

The main constraints include the high initial retail price of 8K display hardware, the significant lack of native 8K broadcast or streaming content, and the high bandwidth and infrastructure requirements necessary to transmit uncompressed 8K data efficiently to home users globally.

How does AI contribute to the 8K viewing experience?

AI is crucial for 8K viability, primarily through intelligent upscaling algorithms that analyze and reconstruct lower-resolution images (4K or HD) to approximate 8K detail in real-time. AI also optimizes display settings like brightness and contrast based on content type, significantly enhancing the overall visual quality.

Which display technology segment (LCD, OLED, MicroLED) is expected to dominate the future 8K market?

While LCD (QLED) currently holds the volume majority, the premium and high-end segments are transitioning towards OLED for superior contrast. However, MicroLED is anticipated to be the future dominant technology due to its potential for high brightness, longevity, and pixel accuracy, once mass production costs become economically viable.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager