A4 Laser Printer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432150 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

A4 Laser Printer Market Size

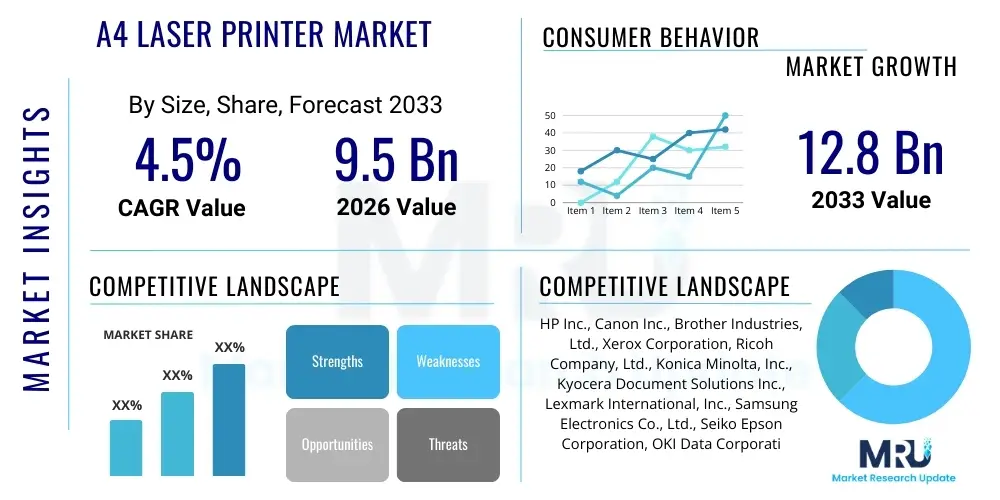

The A4 Laser Printer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 9.5 Billion in 2026 and is projected to reach USD 12.8 Billion by the end of the forecast period in 2033.

A4 Laser Printer Market introduction

The A4 Laser Printer Market encompasses the global sales and usage of printing devices designed to handle the standard A4 paper size, utilizing laser technology. These printers employ xerographic processes, using a laser beam to project an image onto a rotating, electrically charged drum. Toner powder then adheres to the charged image area and is subsequently fused onto the paper using heat and pressure. This technology is highly valued across various sectors due to its superior speed, high-volume capacity, and exceptionally low cost per page compared to alternative printing methods, such as inkjet technology, making it the preferred choice for environments requiring high duty cycles.

Major applications for A4 laser printers span across Small Office/Home Office (SOHO) setups, Small and Medium Businesses (SMBs), large enterprises, educational institutions, and government bodies. In corporate environments, the demand is primarily driven by the need for crisp, professional text documents, high-speed document output, and reliable networked printing solutions. The benefits include enhanced security features integrated into modern devices, durable print quality resistant to smudging, and the overall efficiency derived from minimized maintenance and long-lasting toner cartridges. These factors contribute significantly to streamlined operational workflows and reduced total cost of ownership (TCO).

Driving factors supporting market growth include the increasing global expansion of the SMB sector, necessitating reliable and economical printing solutions, and the persistent, though evolving, requirement for physical documentation in regulatory and legal fields. Furthermore, advancements in laser technology, such as the development of faster processors, improved energy efficiency (meeting stricter environmental standards), and seamless connectivity options like Wi-Fi Direct and cloud printing capabilities, continue to sustain the market relevance of A4 laser printers despite the broader trend toward digital transformation. The integration of multi-function printer (MFP) capabilities within A4 formats further boosts their appeal by consolidating printing, scanning, copying, and faxing functions into a single efficient unit.

A4 Laser Printer Market Executive Summary

The A4 Laser Printer market demonstrates resilient growth, underpinned by strong demand from professional sectors prioritizing speed and cost-efficiency, despite pervasive digital headwinds. Key business trends indicate a definitive shift toward Multi-Function Printers (MFPs) that offer enhanced security protocols and remote management capabilities, favoring providers that integrate these solutions into broader Managed Print Services (MPS) contracts. Geographically, the Asia Pacific region, fueled by rapid industrialization and the proliferation of SMBs, is set to be the dominant growth engine, while established markets in North America and Europe focus on replacing aging infrastructure with more sustainable, energy-efficient models. Segmentation trends highlight the enduring popularity of monochrome laser printers for high-volume text printing, although the color segment is capturing incremental value by offering competitive cost-per-page metrics suitable for professional marketing and internal reports.

AI Impact Analysis on A4 Laser Printer Market

Users frequently inquire about how Artificial Intelligence (AI) will influence the necessity of physical printing, the security of print data, and the efficiency of printer management systems. The prevailing user concerns center on whether AI-driven workflows, which promote digital document creation and storage, will drastically reduce the volume of printing, rendering hardware investments obsolete. Conversely, users expect AI to significantly improve the operational aspects of their printer fleet. Key themes revolve around AI’s potential to automate supply ordering, predict maintenance failures (predictive maintenance), and enhance cybersecurity by monitoring print job anomalies and user access patterns, thereby turning the printer from a simple output device into a smart node within the corporate IT infrastructure. This dual influence—reducing overall volume but increasing hardware intelligence—defines the current market discourse regarding AI integration.

AI's direct influence on the A4 laser printer market is transforming how devices are managed rather than eliminating the need for them entirely. Manufacturers are integrating machine learning algorithms into firmware and supporting software to optimize fleet performance. For example, AI can analyze usage patterns across an organization to determine optimal device placement, automatically balance loads, and proactively alert IT departments to component degradation before a failure occurs. This shift towards smart maintenance drastically improves uptime, which is a critical metric for enterprise clients relying on continuous, high-volume output. Furthermore, AI tools are essential in streamlining the process of digitizing physical documents (scanning) by improving Optical Character Recognition (OCR) accuracy and automatically classifying and routing scanned files.

The security aspect is another vital area where AI provides substantial value. Given that printers are often overlooked endpoints in a network, they are vulnerable to cyberattacks. AI-powered security features are now being deployed to continuously monitor network traffic to and from the printer. These systems can detect unusual access attempts, unauthorized modifications to firmware, or abnormally large print jobs that might signify data exfiltration attempts. By establishing a baseline of normal printing behavior, AI effectively serves as a vigilant digital guardian, providing necessary assurance to high-security sectors such as finance, government, and healthcare that their sensitive documents remain protected both during transmission and while stored temporarily in printer memory before and after printing.

- AI-driven Predictive Maintenance: Anticipating toner depletion and component failure to maximize device uptime.

- Enhanced Print Security: Utilizing machine learning to detect and block anomalous print jobs indicative of security breaches (Print Security as a Service).

- Workflow Automation: Automated document capture, categorization, and routing following scanning operations (OCR improvement).

- Optimized Fleet Management: Load balancing, energy consumption optimization, and automated supply chain replenishment using usage data.

- Reduced Paper Consumption: Promoting "print less" strategies and optimizing print layouts based on AI analysis of historical document relevance.

DRO & Impact Forces Of A4 Laser Printer Market

The A4 Laser Printer Market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO) that define its trajectory, while key impact forces reshape competition and technological focus. The primary drivers revolve around the essential need for fast, high-quality, and cost-effective text printing in professional environments, particularly within expanding SMBs in emerging economies, alongside regulatory requirements necessitating physical archiving. Conversely, the market faces significant restraints, chiefly the accelerating trend towards digital transformation, cloud-based document management systems (DMS), and environmental concerns regarding paper waste and toner disposal, which pressure organizations to reduce their print output overall. Opportunities arise from expanding Managed Print Services (MPS), integrating sophisticated security and AI-based operational intelligence into devices, and developing environmentally conscious printing technologies, such as cartridge-free or solid ink solutions, for laser-equivalent performance.

Impact forces currently dominating the market include substitution threats from digital alternatives, high buyer power due to the commoditized nature of basic A4 printing, and moderate supplier power for critical components like imaging drums and specialized polymer toners. The intense competitive rivalry among established OEMs (Original Equipment Manufacturers) pushes innovation primarily towards lower Total Cost of Ownership (TCO) and improved device connectivity. Furthermore, the increasing stringency of global environmental regulations acts as a crucial force, compelling manufacturers to invest heavily in sustainable manufacturing processes, developing hardware with extended lifecycles, and improving the efficiency of recycling programs for both hardware and consumables, thereby redefining product differentiation beyond mere speed and resolution.

Segmentation Analysis

Segmentation analysis provides a granular view of the A4 Laser Printer market structure, categorized primarily by the type of output (monochrome versus color), the end-user application (SOHO, SMB, Enterprise), and the connectivity and functional capabilities (standalone vs. Multi-Function Printer or MFP). The MFP segment currently dominates the market share due to its functional consolidation, addressing the corporate requirement for versatile devices that save space and capital expenditure by combining printing, scanning, copying, and faxing. The monochrome segment, characterized by high speed and durability, remains essential for bulk text printing (e.g., invoices, legal drafts), while the color segment is expanding its penetration by offering significantly improved color accuracy and lower running costs, making professional in-house color document creation economically viable for marketing and compliance departments.

- By Type:

- Monochrome Laser Printers

- Color Laser Printers

- By Connectivity:

- USB Connected

- Networked (Ethernet)

- Wireless (Wi-Fi, Bluetooth)

- By Function:

- Single Function Printers (SFP)

- Multi-Function Printers (MFP)

- By End-User:

- Small Office/Home Office (SOHO)

- Small and Medium Businesses (SMBs)

- Large Enterprises

- Government and Education

Value Chain Analysis For A4 Laser Printer Market

The value chain for the A4 Laser Printer Market begins with the upstream sourcing of highly specialized raw materials and electronic components. This phase includes the procurement of imaging drum materials (photoconductor), sophisticated semiconductor chips for controller boards, custom plastic molding for chassis, and crucial toner formulation ingredients (polymers, waxes, pigments). Upstream analysis reveals that key suppliers of these specialized components, particularly imaging units and ASIC chips, hold significant leverage, impacting production costs and technological pace. Manufacturers (OEMs) then undertake the assembly, integration of proprietary firmware, quality control, and testing, often leveraging highly automated global manufacturing centers located predominantly in Asia to achieve economies of scale and reduce labor costs associated with high-volume production.

The downstream segment focuses on market access and customer service, where distribution channels play a pivotal role. Direct channels involve OEMs selling large fleet orders directly to major enterprise clients, often packaged within comprehensive Managed Print Services (MPS) contracts. This direct approach allows for tailored solutions and deeper integration into the client’s IT infrastructure. Indirect channels, which handle the majority of SOHO and SMB sales, rely heavily on a global network of specialized IT distributors, value-added resellers (VARs), and major e-commerce platforms and retail electronics chains. VARs are essential for providing regional support, installation, and integration services, particularly for complex networked MFP installations.

Effective value chain management in this market hinges on optimizing logistics and inventory control, especially for consumables (toner cartridges). Direct and indirect channels both necessitate efficient reverse logistics systems for handling warranty returns, repairs, and, increasingly importantly, the retrieval and recycling of used toner cartridges to comply with environmental mandates and promote circular economy initiatives. The long-term profitability often shifts from the initial sale of hardware to the continuous revenue generated by high-margin consumables, making control over authorized distribution and combating counterfeit cartridges a critical strategic imperative for all major OEMs.

A4 Laser Printer Market Potential Customers

The primary consumers and end-users of A4 Laser Printers are organizations that prioritize high-speed, high-volume, and reliable text output combined with a low cost per print. This demographic is broadly categorized into corporate entities, professional service firms, and institutional buyers. Large enterprises, including multinational corporations and financial institutions, constitute a key customer base, heavily reliant on fleet management and highly secure devices to handle vast amounts of internal and external documentation, making them prime targets for high-end MFPs and comprehensive MPS contracts that cover all hardware and consumables. These customers demand advanced features such as secure pull printing, centralized management dashboards, and robust integration with existing cloud services and document management systems to ensure compliance and efficiency.

The Small and Medium Business (SMB) sector, often consisting of law offices, accounting firms, real estate agencies, and regional trading companies, represents the fastest-growing customer segment, particularly in emerging markets. These businesses require reliable, affordable solutions that offer superior output quality for client-facing documents without the complexity or high upfront cost associated with enterprise-grade solutions. Their purchase decisions are generally driven by the Total Cost of Ownership (TCO) and the versatility of a single MFP unit, which often serves multiple roles within a resource-constrained environment, leading to high adoption rates of durable, mid-range monochrome and color A4 MFPs offering excellent cost-per-page metrics.

Furthermore, the institutional segments—including government bodies, public administration, and the educational sector—form a stable foundation of potential customers. These institutions require standardized, durable, and easily maintainable hardware for printing high volumes of official forms, educational materials, and administrative documents. Decisions in these sectors are frequently influenced by public tenders that emphasize reliability, adherence to energy efficiency standards (like ENERGY STAR), and the availability of locally sourced service and support contracts, ensuring sustained demand for standard A4 desktop and workgroup laser models.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 9.5 Billion |

| Market Forecast in 2033 | USD 12.8 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | HP Inc., Canon Inc., Brother Industries, Ltd., Xerox Corporation, Ricoh Company, Ltd., Konica Minolta, Inc., Kyocera Document Solutions Inc., Lexmark International, Inc., Samsung Electronics Co., Ltd., Seiko Epson Corporation, OKI Data Corporation, Dell Technologies Inc., Panasonic Corporation, Lenovo Group Ltd., TallyGenicom, Sharp Corporation, Toshiba Corporation, Fujitsu Ltd., Riso Kagaku Corporation, Muratec America, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

A4 Laser Printer Market Key Technology Landscape

The A4 Laser Printer market is characterized by several key technological advancements focused on improving efficiency, security, and integration. Core technology centers around improved electrophotographic engines, which now boast faster processing speeds and reduced warm-up times, maximizing productivity in busy office settings. Modern devices incorporate advanced toner technology, utilizing chemically grown (CG) or polymerized toner particles that are smaller and more uniform than traditional pulverized toner. This innovation not only enhances image quality and color vibrancy but also allows the fusing process to occur at lower temperatures, resulting in significant energy savings and reduced wear on internal components, directly addressing sustainability concerns and lowering operational expenditure for end-users.

Beyond the core printing mechanism, connectivity and security technologies are paramount differentiators. Contemporary A4 laser printers feature robust wireless capabilities, supporting complex network environments, cloud printing protocols (like Google Cloud Print replacement technologies and Mopria), and secure mobile printing directly from various device platforms. Furthermore, manufacturers are heavily investing in security protocols, embedding Trusted Platform Module (TPM) chips, providing secure boot processes, and implementing extensive firmware encryption. These features are critical for protecting sensitive data both in transit and at rest within the printer's internal memory, mitigating risks associated with print-related data breaches, and meeting stringent corporate and regulatory compliance standards such as GDPR and HIPAA.

The integration of IoT and smart diagnostics represents another crucial technological area. Modern A4 laser devices are designed as intelligent endpoints capable of communicating their status, usage metrics, and maintenance needs directly to fleet management software or Managed Print Services (MPS) providers. This transition from passive peripherals to active, network-aware devices enables predictive maintenance, automated supply ordering based on real-time consumption rates, and remote firmware updates. This centralized, proactive management drastically reduces IT workload and minimizes downtime, offering compelling value propositions to large enterprises seeking operational excellence and simplified maintenance across distributed office environments.

Regional Highlights

- Asia Pacific (APAC): This region is anticipated to exhibit the highest growth rate, driven by robust industrial growth, rapid urbanization, and a massive expansion in the number of Small and Medium Businesses (SMBs), particularly in emerging economies like India, China, and Southeast Asian nations. High population density and increasing office worker populations translate into high demand for cost-effective, high-volume A4 printing solutions.

- North America: Characterized by high adoption of Managed Print Services (MPS) and a strong focus on security and environmental compliance. The market here is mature, with growth driven primarily by technology refresh cycles, replacement of older models with smart, IoT-enabled MFPs, and stringent demand for devices with integrated cybersecurity features.

- Europe: The European market maintains stable demand, heavily influenced by strong regulatory standards pertaining to energy efficiency (e.g., EU Ecolabel) and data protection (GDPR). Key trends involve consolidation of printing resources and a preference for vendor solutions offering comprehensive sustainability programs and effective toner recycling schemes.

- Latin America (LATAM): Growth is steady, fueled by increasing digitization in public and private sectors. Market demand often favors durable, entry-to-mid-level monochrome laser printers where initial cost and component longevity are prioritized over advanced features, although connectivity improvements are becoming increasingly sought after.

- Middle East and Africa (MEA): This region is seeing infrastructural investment in corporate and government sectors, particularly in the Gulf Cooperation Council (GCC) countries. Demand is split between high-end secure MFPs for government entities and basic, robust models for smaller commercial operations, with total ownership cost being a key purchasing determinant.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the A4 Laser Printer Market.- HP Inc.

- Canon Inc.

- Brother Industries, Ltd.

- Xerox Corporation

- Ricoh Company, Ltd.

- Konica Minolta, Inc.

- Kyocera Document Solutions Inc.

- Lexmark International, Inc.

- Samsung Electronics Co., Ltd.

- Seiko Epson Corporation

- OKI Data Corporation

- Dell Technologies Inc.

- Panasonic Corporation

- Lenovo Group Ltd.

- Sharp Corporation

- Toshiba Corporation

- Riso Kagaku Corporation

- TallyGenicom

Frequently Asked Questions

Analyze common user questions about the A4 Laser Printer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the continued demand for A4 Laser Printers?

The primary driver is the need for speed, reliability, and the lowest possible cost per page for high-volume text and corporate document printing, making laser technology essential for professional and enterprise environments where high duty cycles are required.

How are A4 Multi-Function Printers (MFPs) influencing the market share?

MFPs dominate market share by consolidating printing, scanning, copying, and faxing into one secure device. This functionality reduces total hardware expenditure, saves space in office environments, and simplifies centralized device management.

What impact does digital transformation have on the A4 Laser Printer Market forecast?

Digital transformation acts as a restraint by reducing overall print volume. However, the market remains resilient as printers evolve into smart, secure endpoints integrated with Managed Print Services (MPS) and cloud document workflows, shifting focus from volume to essential, secure output.

Which geographic region is expected to show the fastest growth for A4 Laser Printers?

The Asia Pacific (APAC) region is projected to register the fastest growth due to rapid expansion of the Small and Medium Business (SMB) sector, increased foreign investment, and high demand for cost-efficient office infrastructure in emerging economies.

How is cybersecurity being addressed in modern A4 Laser Printers?

Modern A4 laser printers integrate advanced security features, including secure boot processes, firmware encryption, and AI-powered monitoring systems that detect and prevent unauthorized access or data exfiltration attempts during the print lifecycle, protecting sensitive corporate information.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager