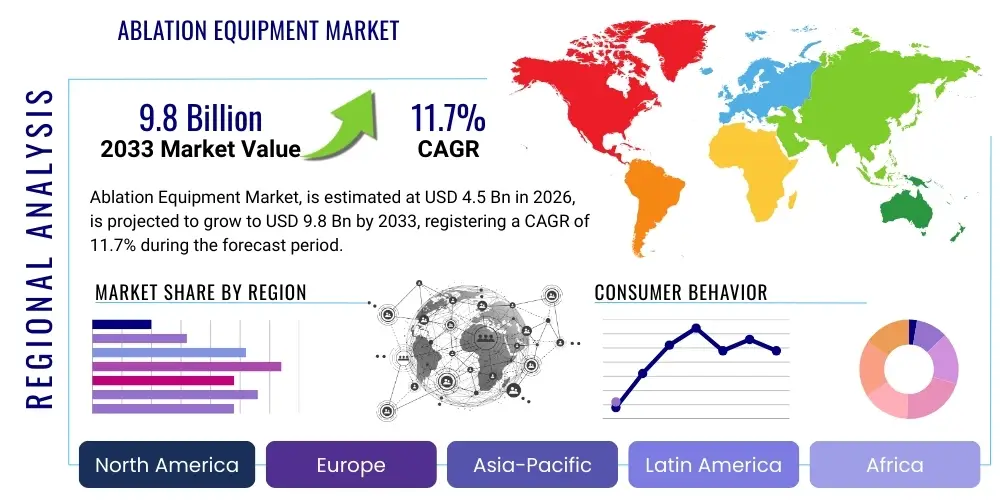

Ablation Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437747 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Ablation Equipment Market Size

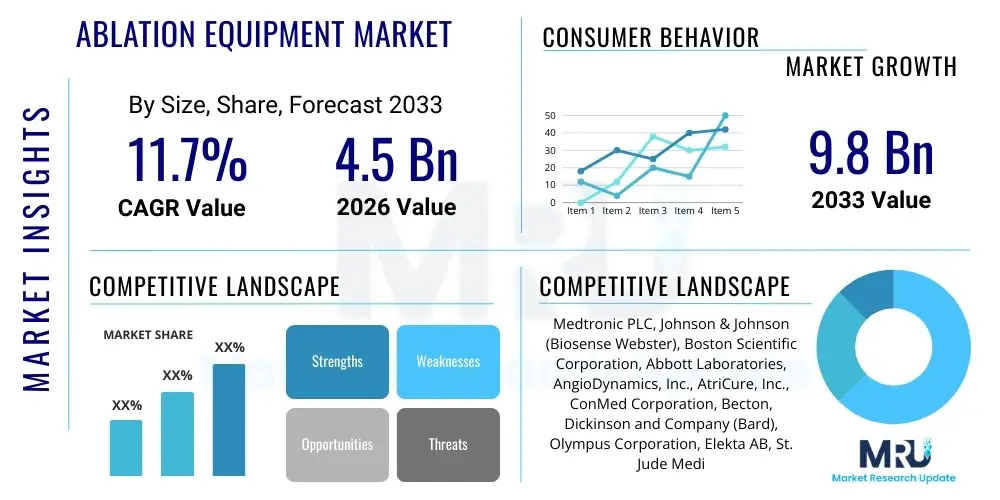

The Ablation Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.7% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 9.8 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the increasing global prevalence of chronic diseases, particularly cardiovascular disorders and various forms of cancer, which are primary targets for minimally invasive ablation therapies. The growing adoption of advanced image-guided procedures and the subsequent demand for highly precise, tissue-sparing techniques are major accelerators contributing to this robust market trajectory. Furthermore, improvements in healthcare infrastructure across emerging economies and enhanced reimbursement policies in developed regions are creating a favorable environment for the integration of new ablation technologies, ensuring sustained high growth throughout the forecast period.

Ablation Equipment Market introduction

The Ablation Equipment Market encompasses a broad spectrum of medical devices utilized for the targeted destruction of specific tissues, such as tumors, aberrant cardiac pathways, or dysfunctional nerves, using energy sources like radiofrequency, microwave, laser, or cryoablation. These devices facilitate minimally invasive surgical procedures, offering significant advantages over traditional open surgery, including reduced patient trauma, lower risk of complications, shorter hospital stays, and quicker recovery times. Key products include specialized generators, disposable probes, catheters, and sophisticated navigation systems crucial for accurate placement and delivery of energy to the target site. The application landscape is expansive, spanning critical areas such as interventional cardiology (for atrial fibrillation and supraventricular tachycardias), oncology (for liver, lung, kidney, and bone tumors), pain management, and gynecology.

The primary driving factors propelling the market include the global demographic shift towards an aging population, which inherently increases the prevalence of age-related chronic conditions requiring ablation treatment. Simultaneously, there is a distinct clinical preference shift from conventional surgical resection methods toward less invasive interventions that provide equivalent or superior therapeutic outcomes with enhanced quality of life for the patient. Technological innovations, such as the introduction of irreversible electroporation (IRE) and high-intensity focused ultrasound (HIFU), alongside sophisticated mapping and imaging technologies (like 3D electroanatomical mapping systems), are continuously expanding the treatable anatomical sites and improving procedure efficacy and safety profiles.

Ablation technology represents a cornerstone in modern interventional medicine, addressing a critical need for precision and efficiency in treating complex diseases. The evolution of these devices is characterized by continuous refinement aimed at increasing energy delivery efficiency, enhancing tissue selectivity, and minimizing collateral damage to healthy surrounding tissues. The inherent benefits—reduced morbidity, cost-effectiveness due to shorter inpatient stays, and high patient acceptance—firmly establish ablation equipment as a high-growth segment within the broader medical device industry. Market players are heavily focused on developing multi-modal systems and robotic assistance to further automate and standardize these complex procedures, ensuring consistent outcomes across diverse clinical settings.

Ablation Equipment Market Executive Summary

The Ablation Equipment Market is experiencing rapid expansion, fundamentally driven by the convergence of technological advancements in imaging and energy delivery systems, coupled with the rising global disease burden, particularly in cardiovascular and oncological fields. Business trends indicate a strong focus on strategic mergers and acquisitions, aimed at consolidating specialized technologies and expanding geographical reach, particularly into high-potential markets in the Asia Pacific. Major manufacturers are prioritizing the development of integrated platforms that combine diagnostic capabilities with therapeutic delivery, enhancing procedural workflow and improving clinical outcomes. Furthermore, the shift towards outpatient settings, such as Ambulatory Surgical Centers (ASCs), is influencing product design, favoring smaller, more portable, and cost-effective ablation systems suitable for high-throughput environments.

Regionally, North America maintains market dominance, primarily due to well-established healthcare infrastructure, high patient awareness, and favorable reimbursement structures for complex procedures like cardiac catheter ablation. However, the Asia Pacific region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid growth is fueled by increasing investments in modernizing healthcare facilities, rising disposable incomes leading to greater accessibility to advanced treatments, and the enormous, largely untapped patient pool in countries like China and India. European growth remains steady, supported by rigorous clinical trials and the adoption of cutting-edge technologies standardized across the European Union, focusing heavily on evidence-based treatment protocols and regulatory harmonization.

Segment trends reveal that the Radiofrequency (RF) ablation segment currently holds the largest market share due to its proven efficacy, versatility, and extensive clinical history across multiple specialties. However, the Microwave Ablation (MWA) segment is rapidly gaining traction, driven by its inherent advantages, such as larger ablation zones, faster procedure times, and reduced susceptibility to heat-sink effects in highly perfused tissues. In terms of application, Oncology remains the dominant segment, reflecting the high incidence of solid tumors and the increasing use of thermal ablation as a primary or adjunctive therapy. End-user analysis shows that Hospitals continue to be the largest consumers of ablation equipment, especially for complex, high-acuity procedures, although the growth rate of Ambulatory Surgical Centers (ASCs) is accelerating due to the decentralization of healthcare services and the growing feasibility of performing routine ablation procedures in non-hospital settings.

AI Impact Analysis on Ablation Equipment Market

User queries regarding AI's influence on the Ablation Equipment Market frequently center on the potential for autonomous targeting, real-time procedural guidance, and predictive outcome analysis. Specific concerns include how AI can enhance the precision of needle placement, improve tissue differentiation during energy delivery, and personalize treatment planning based on complex patient imaging data. Users are keen to understand if AI-driven navigation systems can reduce operator dependence and variability, thereby standardizing complex procedures, especially in organs subject to respiratory motion like the liver or lungs. Expectations are high that AI will significantly streamline the workflow, minimize the need for multiple attempts, and accurately predict the necessary energy dosage required to achieve complete lesion creation without damaging adjacent critical structures.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is poised to fundamentally transform the efficacy and accessibility of ablation procedures, moving them towards greater standardization and precision. AI algorithms are being deployed to analyze intricate pre-operative imaging (CT, MRI, Ultrasound) to automatically delineate tumor margins, define safe ablation corridors, and calculate the optimal probe trajectory, surpassing human capabilities in processing high-dimensional data quickly. Furthermore, during the procedure itself, AI-powered systems can integrate real-time data streams—such as temperature monitoring, impedance changes, and anatomical movement tracked via robotic systems—to dynamically adjust energy output, ensuring effective lesion size while preventing procedural complications like unintended burns or organ perforations.

This predictive and guidance capability derived from AI represents a significant leap forward in addressing the major challenges inherent in ablation therapy, namely, ensuring complete tumor destruction (complete response) and minimizing recurrence rates. By utilizing vast datasets of previous successful and unsuccessful ablations, ML models can identify complex patterns associated with treatment failure and provide immediate feedback to the clinician, effectively acting as an intelligent co-pilot. This enhanced precision is particularly vital in highly sensitive areas like cardiac tissue, where accurate mapping and automated lesion verification are paramount for successful arrhythmia management, thereby driving better patient safety and superior long-term results.

- AI-enhanced Image Segmentation and Targeting: Automated identification of target tissue and critical structures using pre-operative scans.

- Real-time Thermal Monitoring and Feedback: Dynamic adjustment of energy delivery based on instantaneous tissue temperature and impedance data.

- Robotic Navigation Optimization: Improved placement accuracy of ablation probes through AI-guided trajectory planning, particularly beneficial for complex angulations.

- Personalized Treatment Planning: Utilizing ML algorithms to predict optimal energy dose and duration based on patient-specific physiological parameters and tumor characteristics.

- Outcome Prediction and Quality Control: Analyzing procedural metrics to predict clinical success and flag potential risks of recurrence or complications immediately.

DRO & Impact Forces Of Ablation Equipment Market

The Ablation Equipment Market is characterized by a strong interplay of compelling growth drivers and necessary restraints, balanced by substantial future opportunities, all modulated by pervasive impact forces. Key drivers include the overwhelming clinical evidence favoring minimally invasive therapies, particularly in treating prevalent conditions such as hepatocellular carcinoma and atrial fibrillation, coupled with the rapid evolution of technology that continually improves procedural outcomes and expands applicability. Restraints primarily involve the high capital costs associated with procuring advanced ablation systems and the demanding training requirements necessary for specialized personnel, which limits adoption in resource-constrained environments. However, the immense opportunity lies in leveraging emerging technologies like nanotechnology-assisted ablation and focused ultrasound systems to treat previously unreachable targets, and expanding market penetration into high-growth, underdeveloped healthcare markets in Asia and Latin America.

The core drivers are sustained by increasing geriatric populations globally, resulting in a higher incidence of chronic, treatable conditions. Technological maturation has led to smaller, more powerful, and increasingly precise tools—such as irrigated-tip catheters and high-power, short-duration (HPSD) protocols—which enhance safety and reduce procedure variability. Regulatory environments are generally supportive of innovative, less-invasive techniques, further encouraging manufacturers to invest heavily in research and development. The growing awareness among both patients and physicians regarding the benefits of quick recovery times and reduced scarring offered by ablation procedures significantly accelerates market adoption across all geographic regions and application segments.

Restraining factors also include ongoing regulatory scrutiny, especially in the US and Europe, requiring extensive clinical validation before market entry for new generations of devices, which can prolong development cycles and increase costs. The steep learning curve associated with mastering complex navigation and mapping systems, particularly in cardiac ablation, necessitates continuous and costly physician training programs. Moreover, despite the overall cost-effectiveness, the initial capital outlay for equipment like sophisticated cryoablation units or robotic navigation systems poses a significant barrier to entry for smaller hospitals or clinics. The competitive landscape acts as a significant impact force, compelling companies to engage in rapid innovation and aggressive pricing strategies to maintain market share, alongside ongoing clinical efforts to ensure long-term efficacy data that supports favorable reimbursement decisions.

Segmentation Analysis

The Ablation Equipment Market is meticulously segmented based on the type of technology utilized, the specific application or disease target, and the end-user setting where the procedures are performed. This multi-faceted segmentation allows for targeted strategic planning and precise measurement of growth dynamics within specific niches. Technological segmentation is crucial as different energy sources (RF, Microwave, Cryo, Laser) possess distinct physical properties and clinical suitability, directly impacting market share distribution. The dominance of specific applications, such as cardiac rhythm management and tumor destruction, dictates the investment focus of major market players, while end-user categorization highlights the ongoing shift in procedural volume from tertiary care centers to specialized outpatient facilities.

The segmentation by Technology highlights the maturity and penetration rates of various energy platforms. Radiofrequency ablation (RF) remains a stalwart due to its historical use and broad applicability, particularly in pain management and cardiology. However, the growing preference for Microwave Ablation (MWA) in treating large or highly vascularized tumors is driven by its ability to achieve larger, more predictable ablation zones. Cryoablation is niche but highly effective, particularly favored in prostate and kidney treatments due to its ability to preserve the structural integrity of tissue collagen, reducing damage to adjacent structures, and offering pain management benefits inherent in freezing. Laser ablation, while precise, generally accounts for a smaller share but is critical in specific neurological and ophthalmic applications.

Analyzing the market through the lens of Application reveals the primary consumption drivers. Oncology holds the largest and fastest-growing share, fueled by the global cancer pandemic and the increasing utilization of ablation as a primary curative or palliative option for early-stage or metastatic disease. The Cardiology segment, driven by the persistent rise in atrial fibrillation incidence, requires highly advanced, high-precision tools like specialized RF catheters and 3D mapping systems. Pain Management, particularly spinal nerve and facet joint denervation, represents a high-volume, lower-cost segment that contributes consistently to overall market stability. Understanding these segment dynamics is paramount for stakeholders seeking to allocate resources effectively and tailor product development to meet the unique clinical demands of each specialty.

- By Technology:

- Radiofrequency (RF) Ablation

- Microwave Ablation (MWA)

- Cryoablation

- Laser Ablation

- Hydrothermal Ablation

- Irreversible Electroporation (IRE)

- High-Intensity Focused Ultrasound (HIFU)

- By Application:

- Cardiology (e.g., Atrial Fibrillation, Supraventricular Tachycardia)

- Oncology (e.g., Liver Cancer, Lung Cancer, Kidney Cancer, Bone Metastases)

- Pain Management (e.g., Vertebral, Facet Joint Denervation)

- Gynecology (e.g., Endometrial Ablation)

- Urology (e.g., Prostate Cancer, BPH)

- Ophthalmology and Others

- By End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

Value Chain Analysis For Ablation Equipment Market

The value chain for the Ablation Equipment Market commences with complex upstream activities involving the sourcing and refinement of high-purity raw materials—such as specialized polymers for catheter construction, precision metals for electrodes and probes, and high-performance electronic components for energy generators. Research and Development (R&D) forms the most critical upstream activity, focusing on intellectual property creation, clinical efficacy studies, and navigating stringent regulatory approval processes (FDA, CE Mark). Manufacturing involves high-precision assembly, sterilization, and strict quality control measures, given that these devices are often used in life-critical procedures. Efficiency in R&D and manufacturing scaling is key to maintaining competitive pricing and high-quality standards across diverse product lines, from bulky generators to highly intricate disposable catheters.

Midstream activities primarily encompass distribution and logistics, which are particularly complex due to the global nature of sales and the necessity of maintaining sterile supply chains. Distribution channels are varied, incorporating both direct sales forces, especially for large, capital-intensive equipment (like advanced cardiac mapping systems) sold directly to major hospital systems, and a vast network of authorized third-party distributors for smaller, consumable probes and accessories. Strategic inventory management is crucial to ensure hospitals have timely access to specialized disposable components, especially given the variability in surgical scheduling and high demand for key procedures. Training and technical support, often provided by the manufacturer or specialized distributors, are integral components of the midstream value proposition, ensuring safe and effective utilization of the complex equipment.

The downstream segment focuses on the end-users—Hospitals, ASCs, and Specialty Clinics—and the subsequent impact of reimbursement policies and clinical utilization rates. Direct distribution allows manufacturers to maintain tight control over product messaging and user education, which is crucial for maximizing adoption. Indirect channels provide broader geographical reach and logistical efficiency. Key downstream factors influencing the chain's profitability include post-market surveillance (required for regulatory compliance), service contracts for generator maintenance, and the effective management of device recalls or upgrades. The feedback loop from the clinical end-user back to R&D is vital for continuous product refinement, ensuring that new generations of ablation equipment directly address real-world clinical challenges, such as reducing procedure time or increasing lesion predictability.

Ablation Equipment Market Potential Customers

The primary consumers and end-users of ablation equipment are institutional healthcare providers that possess the necessary specialized infrastructure and trained medical personnel to perform complex, image-guided interventional procedures. Hospitals, particularly large tertiary and quaternary care centers, constitute the largest segment of potential customers. These institutions house specialized units, such as interventional radiology suites, cardiac catheterization labs, and dedicated electrophysiology departments, which require the full spectrum of high-end ablation technologies, including robotic navigation systems and capital-intensive generators. Their purchasing decisions are often driven by clinical necessity, high patient volume, and the need for comprehensive service and maintenance contracts provided by the manufacturers.

Ambulatory Surgical Centers (ASCs) represent the fastest-growing customer segment, particularly in developed markets like North America, driven by the increasing financial and logistical feasibility of migrating less complex, high-volume procedures out of traditional hospital settings. ASCs typically purchase streamlined, cost-effective ablation systems suitable for routine procedures like pain management nerve ablations, specific gynecological procedures, and increasingly, simpler cardiac arrhythmia treatments. The attractiveness of ASCs as customers stems from their focus on efficiency, quicker patient turnover, and favorable reimbursement policies that incentivize outpatient care, leading to significant volume purchases of disposable ablation accessories and probes.

Specialty Clinics, including dedicated pain clinics, oncology centers, and urology centers, also constitute a significant customer base, often specializing in specific ablation technologies relevant to their niche. For instance, a dedicated oncology clinic might invest heavily in microwave or cryoablation systems for localized tumor treatment, while a pain management clinic focuses exclusively on RF generators and electrodes. The buying behavior of these smaller customers is highly sensitive to the cost-per-procedure and requires evidence of superior long-term patient outcomes to justify the initial capital investment. These customers rely heavily on clinical data supporting efficacy and efficiency provided directly by the manufacturers, emphasizing the importance of sales force technical expertise and clinical support.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 9.8 Billion |

| Growth Rate | 11.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic PLC, Johnson & Johnson (Biosense Webster), Boston Scientific Corporation, Abbott Laboratories, AngioDynamics, Inc., AtriCure, Inc., ConMed Corporation, Becton, Dickinson and Company (Bard), Olympus Corporation, Elekta AB, St. Jude Medical, Hologic, Inc., Teleflex Incorporated, Varian Medical Systems (A Siemens Healthineers Company), Galil Medical (A Boston Scientific Company), Misonix, Inc., Advanced Cardiac Therapeutics, Inc., Stereotaxis, Inc., Smith & Nephew PLC, Terumo Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ablation Equipment Market Key Technology Landscape

The technology landscape of the Ablation Equipment Market is characterized by intense innovation centered on improving energy efficiency, enhancing procedural control, and increasing the overall safety profile of treatments. Radiofrequency (RF) ablation has seen significant evolution with the advent of irrigated-tip catheters, which prevent charring and increase the size of the lesion achievable while maintaining surface tissue temperature control, crucial for effective cardiac procedures. Furthermore, unipolar and bipolar RF systems are continually refined to optimize energy delivery in various tissue types. Microwave Ablation (MWA) technology is rapidly maturing, utilizing higher operating frequencies (915 MHz and 2.45 GHz) that allow for faster energy deposition and result in larger, more spherical ablation zones, making it highly preferred for large volume tumors in organs like the liver and lung, where it minimizes the heat-sink effect.

Beyond thermal methods, the market is embracing non-thermal and mechanical energy modalities that offer distinct clinical advantages. Irreversible Electroporation (IRE), a non-thermal technology, uses high-voltage electrical pulses to create permanent nanoscale pores in the cell membrane, inducing apoptosis without causing thermal damage to the surrounding vital structures like blood vessels, nerves, and bile ducts. This makes IRE an invaluable tool for treating tumors situated near critical anatomical structures, such as pancreatic or prostate cancer. High-Intensity Focused Ultrasound (HIFU) represents another non-invasive frontier, leveraging acoustic energy precisely focused to generate heat deep within the tissue, used predominantly in uterine fibroids and increasingly investigated for neurological applications, showcasing a trend toward completely non-incisional therapies.

The integration of advanced visualization and navigation tools is perhaps the most significant technological accelerator. Three-dimensional electroanatomical mapping systems (e.g., Carto, EnSite) in cardiology provide highly accurate, real-time geometric models of the heart, allowing for precise catheter maneuvering and visualization of lesion placement, dramatically improving procedure success rates for complex arrhythmias. Similarly, merging conventional imaging (CT/MRI) with real-time ultrasound and fluoroscopy during interventional radiology procedures enhances target localization and confirmation of complete lesion coverage. Robotic systems are further automating the placement of probes with sub-millimeter accuracy, reducing physician fatigue and promoting procedure standardization, thereby pushing the boundaries of what is surgically feasible with minimally invasive ablation techniques across oncology and cardiology.

Regional Highlights

- North America: Market Dominance and Innovation Hub

North America, particularly the United States, holds the largest market share in the global ablation equipment market. This dominance is attributed to several critical factors, including exceptionally high healthcare spending, the presence of major industry leaders (e.g., Medtronic, Johnson & Johnson), and robust governmental support for research and development activities. The region benefits from highly favorable reimbursement policies, especially for complex cardiovascular ablation procedures and oncological treatments, which encourages the widespread adoption of the latest, high-cost technologies. Furthermore, the increasing prevalence of obesity and sedentary lifestyles contributes to a high incidence of cardiovascular diseases and certain cancers, continuously feeding the demand for advanced ablation solutions. The rapid proliferation of Ambulatory Surgical Centers (ASCs) is also a distinctive regional trend, accelerating the demand for streamlined, efficient ablation devices suitable for outpatient settings, focusing heavily on value-based care models and procedural efficiency optimization.

The regulatory environment, primarily driven by the U.S. FDA, while stringent, supports quick market entry for technologies demonstrating significant clinical improvement, ensuring the region remains the primary incubator for next-generation ablation systems, including sophisticated robotic guidance and AI-powered planning tools. Competition is intense, forcing manufacturers to constantly upgrade their offerings and provide comprehensive training and service support packages to maintain clinical loyalty. Investment in large-scale clinical trials and the early adoption of high-power, short-duration ablation protocols signify the region's commitment to leading global procedural standards and improving efficiency in complex interventional specialties.

- Europe: Steady Growth and Harmonized Regulations

Europe represents the second-largest market, characterized by mature healthcare systems and a strong emphasis on clinical guidelines established by organizations like the European Society of Cardiology (ESC). Market growth is sustained by the high incidence of cardiac arrhythmias and oncological conditions across Western Europe and the steady expansion of ablation access into Central and Eastern European countries. The regulatory pathway via the CE Mark provides a standardized, albeit rigorous, entry point for new devices, facilitating broader commercialization across member states once approval is secured. The push for minimally invasive techniques is strong, driven by public healthcare systems aiming to reduce hospital stay durations and associated costs.

Germany, France, and the UK are primary revenue contributors, marked by high procedural volumes and technological uptake. However, pricing pressures are more pronounced than in the US, often requiring manufacturers to demonstrate clear cost-effectiveness alongside clinical superiority. The region is increasingly focused on Cryoablation for pulmonary vein isolation and standardized protocols for liver tumor ablation, utilizing advanced imaging guidance systems. Collaboration between academic centers and industry is robust, particularly in developing clinical evidence necessary for inclusion in national reimbursement schemes, which is crucial for market penetration in publicly funded healthcare systems.

- Asia Pacific (APAC): Highest Growth Potential

The Asia Pacific region is forecast to exhibit the highest CAGR during the forecast period, driven by rapid improvements in healthcare infrastructure, substantial government investments in medical technology, and the rising prevalence of chronic diseases across its vast population base. Economic growth in nations like China, India, Japan, and South Korea is leading to increased per capita healthcare expenditure and greater accessibility to specialized medical treatments. Japan and South Korea already boast technologically advanced healthcare markets, showing high adoption rates for sophisticated microwave and robotic ablation systems, similar to Western standards.

The immense, largely underserved patient pool in developing economies within APAC presents a massive opportunity. Market entry strategies in these countries often focus on providing cost-effective, durable equipment suitable for high-volume use. Challenges include fragmented regulatory landscapes, the need for increased medical professional training, and variability in healthcare access between urban and rural areas. Manufacturers are actively establishing local partnerships and manufacturing facilities to reduce supply chain costs and tailor devices to regional clinical needs, focusing on mass education and technology transfer to accelerate adoption of standard ablation protocols.

- Latin America (LATAM): Emerging Opportunities and Infrastructure Development

The LATAM market is characterized by emerging infrastructure and selective adoption of advanced ablation technologies, concentrated primarily in major urban centers of countries such as Brazil, Mexico, and Argentina. Growth is stimulated by increasing awareness of minimally invasive procedures, improving insurance coverage, and foreign investment aimed at upgrading hospital systems. The market is highly price-sensitive, meaning product uptake is often slower for high-end, capital equipment compared to the US or Europe.

Demand is steadily rising for basic and mid-range RF and microwave ablation systems for common oncological and pain management applications. Market penetration requires navigating complex import tariffs and local regulatory requirements. Strategic partnerships with local distributors who possess established relationships with public and private hospital groups are essential for successful market entry. The focus remains on demonstrating clear clinical value and economic benefit to justify purchases within constrained healthcare budgets.

- Middle East and Africa (MEA): Investments in Specialization

The MEA region shows growth driven by significant healthcare infrastructure investments, particularly in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia, Qatar). These nations are heavily investing in establishing world-class specialty centers, including advanced cardiology and oncology facilities, which necessitates the procurement of state-of-the-art ablation technology, often sourced from US and European manufacturers. Demand is concentrated in specialized hospitals catering to medical tourism and wealthy domestic populations.

In Africa, adoption is limited outside of South Africa due to constrained economic resources, infrastructure deficiencies, and high disease burdens requiring foundational medical interventions. However, opportunities exist in specialized private hospitals in key economies. The market typically demands robust, reliable equipment, and manufacturers must provide extensive logistical support, maintenance, and ongoing specialized clinical training to facilitate technology adoption and sustained utilization.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ablation Equipment Market.- Medtronic PLC

- Johnson & Johnson (Biosense Webster)

- Boston Scientific Corporation

- Abbott Laboratories

- AngioDynamics, Inc.

- AtriCure, Inc.

- ConMed Corporation

- Becton, Dickinson and Company (Bard)

- Olympus Corporation

- Elekta AB

- Hologic, Inc.

- Teleflex Incorporated

- Varian Medical Systems (A Siemens Healthineers Company)

- Misonix, Inc.

- Advanced Cardiac Therapeutics, Inc.

- Stereotaxis, Inc.

- Smith & Nephew PLC

- Terumo Corporation

- MicroPort Scientific Corporation

- Sensus Healthcare, Inc.

Frequently Asked Questions

Analyze common user questions about the Ablation Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Ablation Equipment Market?

The primary driver is the accelerating global prevalence of chronic diseases, particularly cardiovascular disorders (like atrial fibrillation) and various solid tumors (liver, lung, kidney), coupled with the strong clinical shift towards adopting minimally invasive, high-precision treatment modalities over traditional open surgery, enhancing patient outcomes and recovery times.

Which ablation technology segment holds the largest market share currently?

Radiofrequency (RF) ablation currently holds the largest share due to its well-established safety profile, extensive clinical history, versatility across cardiology and pain management, and continuous innovation through advanced technologies like irrigated-tip catheters, ensuring its sustained application in high-volume procedures globally.

How is Artificial Intelligence (AI) influencing ablation procedures?

AI is transforming ablation by enabling highly accurate, automated target delineation from complex imaging data, providing real-time procedural guidance and dynamic energy adjustment, and optimizing probe trajectory via robotic systems, ultimately leading to greater procedure standardization and increased rates of complete lesion coverage.

Which geographical region is projected to have the highest market growth rate?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This is driven by large-scale investments in modernizing healthcare infrastructure, increasing patient access to advanced treatments, and a rapidly expanding patient pool in major economies like China and India.

What are the main restraints impacting the adoption of advanced ablation equipment?

The main restraints include the significant high initial capital cost required for sophisticated systems (e.g., robotic and cryoablation units), coupled with the need for extensive, specialized training for medical personnel to safely and effectively operate complex navigation and energy delivery platforms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager