Abrasive Paper Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433256 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Abrasive Paper Market Size

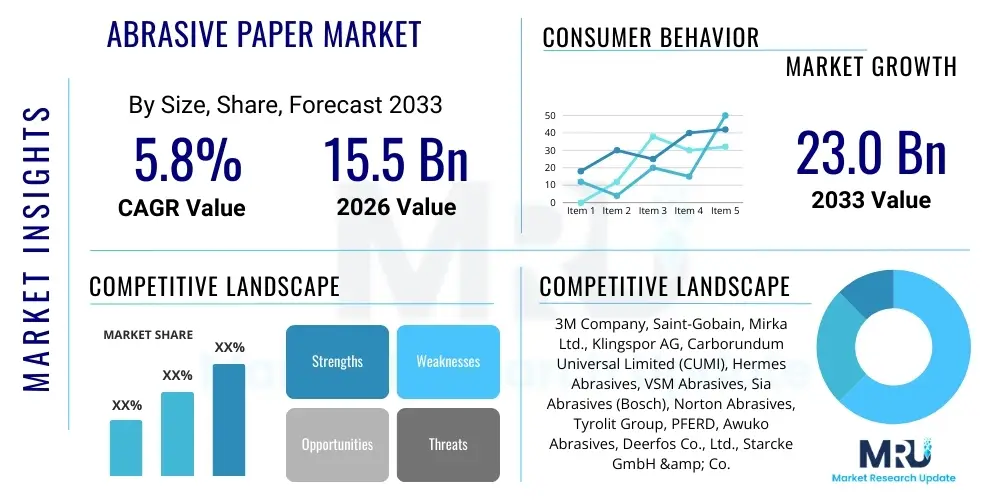

The Abrasive Paper Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 23.0 Billion by the end of the forecast period in 2033.

Abrasive Paper Market introduction

The Abrasive Paper Market encompasses the production and distribution of coated abrasive products where the abrasive grains are adhered to a flexible backing material, primarily paper. These products are fundamentally utilized across various industrial and consumer applications for material removal, finishing, sanding, polishing, and preparation of surfaces such as wood, metal, plastics, and composites. The core function of abrasive paper is to ensure precise surface conditioning, critical for subsequent processing like painting, welding, or bonding, thereby enhancing both the aesthetic quality and functional integrity of the end product. The versatility in grit size, backing flexibility, and abrasive grain type (e.g., aluminum oxide, silicon carbide) allows these papers to cater to a spectrum of tasks, ranging from heavy stock removal to ultra-fine finishing.

Major applications driving the demand for abrasive paper are deeply rooted in high-volume manufacturing sectors. The automotive industry utilizes large quantities for vehicle manufacturing, body repair, and refinishing, demanding specific qualities like dust extraction capabilities and uniform finishing. Similarly, the woodworking and furniture industries rely heavily on abrasive paper for smoothing surfaces before staining or varnishing. In construction, these materials are essential for drywall sanding and surface preparation. The consistent performance, coupled with the ease of use and cost-effectiveness compared to alternative methods, solidifies abrasive paper's integral role in modern manufacturing workflows, particularly where surface quality dictates overall product acceptance.

Key benefits associated with the adoption of high-quality abrasive paper include improved efficiency in material processing, reduced cycle times, and the attainment of superior surface finishes necessary for demanding industrial specifications. Driving factors propelling market expansion include the rapid growth of the global construction sector, increased production volumes in the automotive and aerospace manufacturing industries, and continuous innovation in abrasive technology, such as the development of ceramic grains and specialized stearate coatings to prevent clogging. Furthermore, the growing DIY (Do-It-Yourself) and home improvement segments contribute significantly, particularly in developed economies, sustaining a stable demand for consumer-grade abrasive sheets and rolls.

Abrasive Paper Market Executive Summary

The Abrasive Paper Market is characterized by robust growth underpinned by strong industrial activity in the Asia Pacific region and technological advancements focused on product longevity and performance across all major geographical areas. Business trends indicate a strategic shift toward high-performance, specialized abrasive types, suchverting from general-purpose products to application-specific solutions that minimize processing time and maximize material yields. Companies are investing heavily in dust-free sanding systems and ergonomic designs, catering to stringent occupational health and safety standards while enhancing user efficiency. Furthermore, sustainability is becoming a pivotal business focus, driving the development of abrasive papers made with recycled content or less harmful bonding agents, positioning the industry for compliance with evolving global environmental mandates.

Regionally, Asia Pacific maintains its dominance, primarily fueled by massive infrastructure projects, burgeoning automotive production in China and India, and a rapidly expanding electronics manufacturing base demanding ultra-fine finishing capabilities. North America and Europe, while representing mature markets, exhibit steady demand, driven by stringent quality standards in aerospace and medical device manufacturing, alongside a resilient repair and maintenance (R&M) sector. Segment trends highlight the increasing preference for film-backed abrasives over traditional paper backing in precision applications due to enhanced tear resistance and flatness. The Aluminum Oxide segment continues to hold the largest market share owing to its cost-effectiveness and versatility, but the faster cutting, longer life Ceramic abrasive segment is experiencing the highest growth trajectory, reflecting the industry's continuous need for efficiency gains when working with tough alloys and composite materials.

Overall, the market landscape is moderately consolidated, dominated by a few multinational conglomerates that possess extensive research and development capabilities and broad distribution networks, alongside numerous smaller, specialized regional players focusing on niche applications. Strategic alliances, mergers, and acquisitions remain common tactical moves as major players seek to expand their geographic footprint, integrate vertical supply chains, and quickly access proprietary technologies related to advanced grain synthesis and coating methods. The emphasis across the entire value chain is directed towards delivering customized solutions that address specific client challenges related to surface roughness, material compatibility, and overall operational expenditure management.

AI Impact Analysis on Abrasive Paper Market

Common user questions regarding AI's impact on the Abrasive Paper Market revolve primarily around three core themes: optimization of manufacturing processes, predictive maintenance for sanding equipment, and automated quality control for finished surfaces. Users inquire whether AI can predict the optimal grit sequencing for a specific material finish, how machine learning algorithms can reduce waste by optimizing the coating process (grain dispersion and resin application), and if AI-driven vision systems can accurately assess surface defects requiring abrasive remediation. The consensus expectation is that AI will not replace the fundamental product but will drastically enhance its efficiency, particularly in highly automated settings like robotic sanding cells in automotive or aerospace production, reducing human variability and ensuring consistent quality, thereby potentially altering the demand cycles for specific abrasive product lines.

- AI-powered predictive maintenance reduces downtime of automated sanding equipment, ensuring higher throughput for abrasive consumables.

- Machine Learning (ML) algorithms optimize the abrasive grain deposition process, leading to more uniform coating and improved product consistency.

- AI vision systems automate quality inspection, accurately classifying surface finish and dictating the precise abrasive paper needed for defect correction.

- Supply chain optimization using AI models predicts fluctuations in demand for various grit sizes, minimizing inventory costs for manufacturers and distributors.

- Data analytics derived from production lines help in formulating superior backing materials and bonding agents by correlating real-time sanding performance with material composition.

- Robotics integrated with AI guides intricate sanding paths on complex geometries (e.g., composite aircraft parts), increasing the consumption of specialized, high-precision abrasive forms.

- AI analyzes customer usage patterns and failure modes, accelerating the R&D cycle for developing new, durable, and clog-resistant abrasive papers.

DRO & Impact Forces Of Abrasive Paper Market

The Abrasive Paper Market dynamics are fundamentally shaped by the growth trajectories of end-use industries, balanced against supply chain vulnerabilities and environmental pressures. Key drivers include the revitalization of infrastructure and housing construction globally, particularly requiring drywall sanding and extensive surface preparation materials, alongside the continuous advancement in automated and robotic finishing technologies which demand precision and longevity from abrasive products. These factors are reinforced by the automotive sector’s sustained need for high-quality refinishing supplies, especially as vehicle longevity increases. Conversely, the market faces significant restraints, notably the fluctuating prices of critical raw materials such as paper pulp, petrochemical resins (for bonding agents), and synthetic abrasive grains, which introduce cost volatility and complicate long-term pricing strategies. Additionally, the industry is grappling with stricter environmental regulations concerning Volatile Organic Compounds (VOCs) emitted by certain bonding agents and the management of sanding dust, pushing manufacturers towards solvent-free and closed-system solutions.

Opportunities for expansion are abundant, particularly in niche and high-margin segments. The rise of advanced manufacturing utilizing carbon fiber and other composite materials in aerospace and wind energy sectors necessitates the development of specialized, non-contaminating abrasive papers capable of finishing these difficult substrates without degradation. Furthermore, a significant opportunity lies in the development and aggressive marketing of sustainable abrasive solutions, incorporating biodegradable backings and bio-based resins, appealing to environmentally conscious industrial buyers and consumers. Technological advancements in grain technology, such as structured abrasives (precisely shaped grains), offer an avenue for market differentiation, delivering superior material removal rates and extending product life, justifying a premium price point in performance-critical applications. These innovations are critical for maintaining competitive advantage against alternative finishing technologies.

The market impact forces are categorized as high due to the non-negotiable requirement for surface preparation in nearly all manufacturing and maintenance processes, making abrasive paper an essential consumable rather than a discretionary purchase. Impact is high from the consumer demand side, as increasing expectations for product finish quality (e.g., in electronics casings or luxury vehicles) directly translate into demand for finer, more precise abrasive grades. Regulatory forces exert a moderate but increasing impact, influencing production methods and disposal norms. The combined effect of these forces drives continuous innovation: manufacturers cannot merely produce standard grit sizes but must constantly refine backing materials, bonding techniques, and anti-clogging treatments to meet evolving industrial performance benchmarks while managing input cost instability.

Segmentation Analysis

The Abrasive Paper Market is broadly segmented based on crucial product characteristics that dictate performance and application suitability, including the backing material, the specific abrasive grain type used, the final product form, and the end-use industry. This segmentation is essential for understanding purchasing behaviors, technological preferences, and the differing growth dynamics across various sectors. For instance, the choice between paper, cloth, or film backing is determined by the required flexibility, durability, and tear resistance needed for the specific sanding task, while the abrasive type dictates the hardness and cutting speed. The complexity of applications, ranging from manual operations to highly automated robotic systems, necessitates a finely tuned portfolio of products addressing material removal, intermediate sanding, and final polishing requirements.

- By Backing Material:

- Paper Backing (Lightweight A, B weight; Heavyweight C, D, E weight)

- Cloth Backing (J-weight, X-weight, Y-weight)

- Film Backing (Polyester)

- Fiber Backing (Vulcanized Fiber)

- By Abrasive Type:

- Aluminum Oxide (General Purpose)

- Silicon Carbide (Hard Materials, Wet Applications)

- Zirconia Alumina (Heavy Grinding)

- Ceramic Abrasives (High Performance, Automation)

- Garnet and Other Natural Abrasives

- By Product Form:

- Sheets (Hand Sanding)

- Rolls (Bulk Use, Converting)

- Discs (Rotary Tools, Orbital Sanders)

- Belts (Machine Grinding, Wide Belt Sanders)

- Specialty Products (Sponge, Pad Abrasives)

- By End-Use Industry:

- Automotive (OEM & Refinishing)

- Woodworking and Furniture

- Metal Fabrication and Machinery

- Construction (Drywall, Flooring)

- Electronics and Precision Engineering

- Aerospace and Marine

Value Chain Analysis For Abrasive Paper Market

The Abrasive Paper value chain begins with the upstream procurement of specialized raw materials, primarily focusing on the sourcing of abrasive grains (e.g., bauxite for aluminum oxide, silicon for silicon carbide) and high-quality backing materials (pulp, polyester film, cotton fabric). This stage is capital-intensive and often involves highly specialized chemical processing or mining operations. Manufacturers then engage in the complex coating process: applying a base layer (make coat), uniformly depositing the abrasive grains via electrostatic or gravity methods, and finally applying a top layer (size coat) and often a specialized anti-clogging coating (stearates) before curing and converting the jumbo rolls into various product forms (sheets, discs, belts). Efficiency and consistency at this manufacturing stage are paramount, as slight variations can severely impact product performance and cost.

The downstream segments focus on the distribution and delivery of the finished products to a highly fragmented customer base. Distribution channels are typically diverse, including direct sales to major industrial Original Equipment Manufacturers (OEMs) who consume vast quantities in their production lines (e.g., automotive assembly plants). However, the majority of the market utilizes indirect channels through industrial distributors, specialized abrasive wholesalers, and, increasingly, large retail home improvement chains for the DIY and small professional tradesperson segments. The role of distributors is crucial; they manage inventory, provide technical support, and offer product selection guidance tailored to specific end-user applications (e.g., recommending a ceramic belt for stainless steel grinding versus an aluminum oxide disc for wood sanding).

Market success is strongly linked to the effectiveness of this distribution network. Direct channels allow for closer relationships and customization, crucial for high-volume, high-performance contracts in aerospace and critical metal fabrication. Conversely, indirect channels provide the necessary market penetration for standard products and maintenance, repair, and operations (MRO) supplies, maximizing geographic reach and servicing smaller workshops efficiently. Effective inventory management and robust logistics capabilities across this value chain are essential for meeting immediate MRO demand and mitigating risks associated with long lead times for specialized raw materials, ensuring a steady supply of consumables to the global manufacturing base.

Abrasive Paper Market Potential Customers

The potential customer base for abrasive paper is exceptionally broad, spanning nearly every sector involved in material fabrication, maintenance, or finishing. The largest and most demanding customers are typically large industrial entities (B2B). These include major global automotive manufacturers requiring vast amounts of precision abrasives for body sanding and final paint preparation, and Tier 1 suppliers in the construction industry that use wide belt sanding for engineered wood products or specialized discs for concrete surfacing. Another significant buyer segment comprises the general metal fabrication industry, utilizing abrasive papers for welding seam removal, deburring, and metal finishing across various machinery and structural components.

In addition to large-scale industrial consumers, the market heavily relies on smaller professional trades and maintenance sectors (B2C and B2B). Professional woodworkers, cabinet makers, body shop operators, and general contractors constitute a continuous demand stream for various grits and forms. The DIY consumer market, serviced primarily through retail channels, also represents a critical segment, driving sales of standardized sheets and basic orbital sanding discs for home renovation and craft projects. Furthermore, highly specialized end-users, such as aerospace maintenance facilities and electronics manufacturers, form the high-value customer segment, demanding premium, certified, and often unique abrasive products designed for exotic materials like titanium alloys and delicate circuit boards, where surface contamination and tolerance adherence are non-negotiable.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 23.0 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Saint-Gobain, Mirka Ltd., Klingspor AG, Carborundum Universal Limited (CUMI), Hermes Abrasives, VSM Abrasives, Sia Abrasives (Bosch), Norton Abrasives, Tyrolit Group, PFERD, Awuko Abrasives, Deerfos Co., Ltd., Starcke GmbH & Co. KG, United Abrasives, Sankyo Rikagaku Co., Ltd., Arc Abrasives Inc., Radiac Abrasives, Merit Abrasives, Kovax Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Abrasive Paper Market Key Technology Landscape

The Abrasive Paper market is characterized by continual technological evolution aimed at increasing efficiency, extending product life, and improving surface finish quality, driven largely by automation requirements in end-user industries. One of the most critical recent technological advancements is the implementation of Structured Abrasives (also known as P-grade or precision-shaped grain technology). Unlike conventional abrasives, where grains are randomly deposited, structured abrasives use proprietary processes to form uniform, precise grain shapes (e.g., triangular or pyramidal) on the backing surface. This precise geometry ensures that the grain cuts the material consistently rather than ploughing it, leading to significantly higher material removal rates, prolonged product life, and a more uniform, scratch-free finish, especially crucial for demanding applications in aerospace and medical implants.

Another major area of technological focus involves sophisticated backing materials and bonding agents. Film backings, typically made of polyester, are increasingly replacing traditional paper backings in high-precision and wet sanding applications because they offer superior flatness, tear resistance, and dimensional stability, crucial for maintaining tight tolerances. Furthermore, the development of advanced resin systems and specialized anti-clogging treatments (stearate coatings) is vital. These coatings prevent the loading of abrasive paper when sanding soft materials like paint, varnish, or certain woods, ensuring sustained cutting action and significantly reducing material consumption and processing time. The continuous refinement of these chemical components directly correlates to the performance metrics valued by industrial customers.

The integration of advanced coating processes, such as electrostatic grain orientation, ensures optimal positioning of abrasive particles for maximum cutting effectiveness. Manufacturers are also focusing on eco-friendly technology, exploring water-based resins to replace solvent-based bonding systems, aligning with stricter environmental standards, particularly in Europe and North America. This technological push is not limited to performance but also includes user experience, leading to innovations like multi-hole dust extraction patterns in discs and belts, designed specifically for integration with vacuum sanding systems, minimizing dust exposure and cleanup, thereby meeting contemporary occupational safety requirements.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing region in the Abrasive Paper Market, driven primarily by massive investments in infrastructure development, rapidly expanding automotive manufacturing hubs in countries like China, India, and Southeast Asia, and robust industrialization. The construction sector’s demand for drywall and flooring preparation, coupled with the flourishing electronics assembly industry requiring high-precision finishing, solidifies APAC's dominance. Competitive pricing and significant domestic production capacity characterize this region, making it a critical area for both consumption and manufacturing.

- North America: This region represents a mature market characterized by high demand for specialized, high-performance abrasives, particularly in the aerospace, high-end automotive refinishing, and specialized metal fabrication sectors. Growth is driven by the strict quality standards and reliance on automated sanding and finishing processes, leading to increased consumption of premium products such as ceramic and structured abrasives. The focus here is less on volume and more on technical performance, efficiency, and worker safety features (e.g., dust extraction systems).

- Europe: Europe maintains a strong position, distinguished by stringent environmental and safety regulations, which mandates the use of water-based resins and dust-free sanding solutions. Key markets like Germany and Italy benefit from robust automotive, machinery, and woodworking industries. Technological leadership in developing environmentally friendly and high-durability products is a hallmark of the European market, fostering steady demand for innovative film-backed and premium coated abrasives.

- Latin America (LATAM): The LATAM market is experiencing steady growth, highly correlated with economic recovery and investment in civil construction projects, particularly in Brazil and Mexico. Demand is concentrated in general-purpose and medium-grade abrasives for local manufacturing and repair sectors, with increasing adoption of higher-quality products as industrial sophistication rises.

- Middle East and Africa (MEA): Growth in MEA is largely project-driven, tied to major oil and gas infrastructure maintenance, construction booms (especially in the GCC countries), and burgeoning localized manufacturing efforts. While the market is relatively smaller, the high demand for durable products suitable for harsh operating environments, such as those used in pipe coating and industrial maintenance, drives localized sales surges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Abrasive Paper Market.- 3M Company

- Saint-Gobain

- Mirka Ltd.

- Klingspor AG

- Carborundum Universal Limited (CUMI)

- Hermes Abrasives

- VSM Abrasives

- Sia Abrasives (Bosch)

- Norton Abrasives

- Tyrolit Group

- PFERD

- Awuko Abrasives

- Deerfos Co., Ltd.

- Starcke GmbH & Co. KG

- United Abrasives

- Sankyo Rikagaku Co., Ltd.

- Arc Abrasives Inc.

- Radiac Abrasives

- Merit Abrasives

- Kovax Corporation

Frequently Asked Questions

Analyze common user questions about the Abrasive Paper market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Aluminum Oxide and Ceramic Abrasive Paper?

Aluminum Oxide is a cost-effective, versatile abrasive suitable for general-purpose sanding on wood and soft metals. Ceramic abrasives, however, utilize precision-shaped, tougher grains, offering significantly higher material removal rates, superior durability, and longer life, making them preferred for heavy-duty, automated grinding of hard alloys and demanding industrial applications.

How do environmental regulations affect the Abrasive Paper Market?

Regulations, particularly in Europe and North America, drive manufacturers to innovate by developing eco-friendly products, including utilizing water-based bonding resins (reducing VOCs) and implementing dust-free sanding systems, influencing product formulation and manufacturing processes to enhance worker safety and compliance.

Which backing material is best suited for precision wet sanding applications?

Film backing (typically polyester) is superior for precision wet sanding. Unlike paper, film backing resists tearing, offers high dimensional stability, and ensures a flatter sanding surface, which is critical for achieving tight tolerances and ultra-fine finishes, particularly in automotive and electronics production.

What factors are driving the high growth rate in the Asia Pacific Abrasive Paper Market?

The high growth in APAC is primarily driven by rapid urbanization and infrastructure development, expansion of automotive and electronics manufacturing sectors, and increasing industrial automation, which boosts demand for both high-volume standard abrasives and specialized, automated sanding consumables.

What is Structured Abrasive technology and why is it important?

Structured Abrasive technology involves precisely orienting and shaping abrasive grains (often triangular) on the backing surface. This is important because it ensures consistent cutting, minimizes scratching, reduces heat generation, and drastically extends the life of the abrasive paper compared to traditional randomly coated products, maximizing efficiency in high-performance robotic applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager