Absorbable Surgical Sutures Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436148 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Absorbable Surgical Sutures Market Size

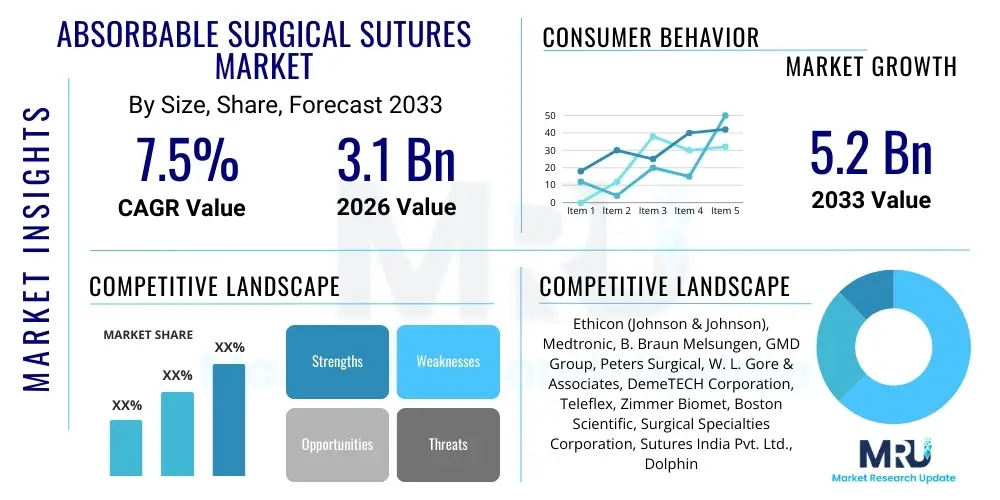

The Absorbable Surgical Sutures Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 3.1 Billion in 2026 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2033.

Absorbable Surgical Sutures Market introduction

The Absorbable Surgical Sutures Market encompasses sterile surgical threads designed to hold tissue together after surgery, which are naturally broken down and absorbed by the body over time, eliminating the need for removal. These medical devices are critical components in a vast array of surgical procedures, including general surgery, cardiovascular surgery, orthopedic surgery, and gynecology, providing temporary wound support until the natural healing process is sufficiently advanced. The design and material science surrounding absorbable sutures focus heavily on controlling the tensile strength retention period and the absorption profile to match the specific wound healing characteristics of different tissues, thereby minimizing foreign body reaction and optimizing recovery outcomes.

Major applications of absorbable sutures include deep tissue closure, ligation, and subcutaneous closure, where temporary support is essential but permanent foreign material presence is undesirable. The primary materials used are synthetic polymers, such as polyglycolic acid (PGA), polyglactin 910 (PGLA), and polydioxanone (PDO), which offer predictable degradation rates through hydrolysis. The continuous advancement in polymer chemistry allows manufacturers to tailor the suture properties, such including antibacterial coatings and surface modifications that enhance knot security and reduce tissue drag, further boosting their clinical acceptance over traditional non-absorbable alternatives.

The core benefits driving market expansion include reduced patient discomfort associated with suture removal, lower risk of chronic inflammation or infection linked to permanent implants, and improved cosmetic results in certain superficial closures. The major driving factors fueling market growth are the global rise in the volume of surgical procedures, particularly complex surgeries related to chronic diseases like cardiovascular disorders and cancer, coupled with the increasing preference among surgeons for advanced synthetic absorbable materials that offer enhanced handling characteristics and reliable in-vivo performance. Furthermore, rising healthcare expenditure and technological investments in developing countries are expanding the accessibility of sophisticated surgical tools, solidifying the market's upward trajectory.

Absorbable Surgical Sutures Market Executive Summary

The Absorbable Surgical Sutures Market trajectory is defined by robust demand stemming from the aging global population and the corresponding increase in surgical intervention frequency across diverse medical specialties. Business trends indicate a strong move toward product differentiation through specialized coatings and composite materials aimed at reducing infection rates, such as sutures coated with triclosan, positioning advanced products at the forefront of market adoption. Strategic mergers, acquisitions, and partnerships focusing on broadening product portfolios and securing distribution networks, particularly in high-growth Asia Pacific markets, characterize the competitive landscape, ensuring rapid deployment of innovative suture technology across global surgical theaters.

Regional trends highlight North America and Europe as mature markets characterized by stringent regulatory environments and high rates of adoption of premium, synthetic absorbable sutures, driven by sophisticated healthcare infrastructure and established surgical protocols. Conversely, the Asia Pacific region is anticipated to demonstrate the fastest growth rate, fueled by substantial improvements in healthcare access, rising incidence of trauma and chronic diseases requiring surgery, and increasing governmental investments in modernizing hospital facilities. Latin America and the Middle East & Africa are emerging markets showing accelerated growth, primarily driven by expanding medical tourism and greater awareness regarding the benefits of advanced surgical materials.

Segment trends reveal that the synthetic segment, particularly polyglactin 910 (Vicryl-like materials), continues to dominate due to its predictable absorption profile and superior handling, overshadowing traditional natural materials like catgut. In terms of application, general and cardiovascular surgeries represent the largest revenue generators, reflecting the high volume and critical nature of these procedures. The institutional segment, comprising hospitals and specialty clinics, remains the primary end-user, though ambulatory surgical centers (ASCs) are quickly gaining prominence, demanding cost-effective yet high-quality absorbable solutions for shorter stay procedures.

AI Impact Analysis on Absorbable Surgical Sutures Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and the Absorbable Surgical Sutures Market frequently revolve around optimizing manufacturing efficiency, enhancing quality control, and integrating AI into surgical planning systems to minimize material failure. Users are concerned about how AI can predict the performance of novel polymer formulations and simulate the biological absorption process in silico, thereby accelerating R&D timelines and reducing dependence on lengthy physical testing. Furthermore, a major theme is the expectation that AI-powered inventory management and demand forecasting systems will significantly reduce waste and ensure timely supply of specialized sutures to hospitals, particularly those with complex supply chains or those requiring specific short-shelf-life absorbable materials.

The primary influence of AI is observed upstream in manufacturing and quality assurance. Machine learning algorithms are increasingly being deployed to analyze real-time data from extrusion and coating processes, ensuring uniformity in suture diameter, tensile strength, and coating thickness, which are critical determinants of clinical performance. This level of precision minimizes batch variation, leading to higher product reliability and reduced recall rates. By applying predictive analytics, manufacturers can identify potential equipment failures or material flaws before they impact production, dramatically improving overall operational efficiency and adherence to stringent medical device standards.

Downstream, AI is beginning to influence surgical decision-making, though indirectly impacting suture selection. While AI does not directly manufacture the suture, sophisticated surgical planning software, often leveraging AI image recognition, helps surgeons determine the optimal tissue tension and number of stitches required for complex closures, thus indirectly guiding the necessary suture type (e.g., short-term vs. long-term absorption profiles) and size. This integration ultimately drives demand for customized or specialized absorbable sutures that can meet the precise, data-driven requirements generated by AI surgical recommendations, pushing the market towards personalized surgical kits.

- AI optimizes polymer formulation for predictable absorption kinetics and improved biocompatibility.

- Machine Vision systems enhance quality control, identifying microscopic defects in suture coatings and braids.

- Predictive Maintenance reduces downtime in high-volume suture manufacturing lines.

- AI-driven supply chain management forecasts surgical demand, preventing stockouts of critical absorbable products.

- Integration into robotic surgery platforms supports real-time feedback on tissue handling and suture tension.

DRO & Impact Forces Of Absorbable Surgical Sutures Market

The market is primarily propelled by the global surge in surgical procedures and the preference for advanced synthetic absorbable materials (Drivers). However, growth is tempered by substantial regulatory hurdles and intense price competition from local manufacturers in developing economies (Restraints). Opportunities lie predominantly in developing smart sutures with integrated drug delivery capabilities and expanding market penetration in underserved emerging regions. These forces collectively shape the market's trajectory, where technological superiority and cost-efficiency compete fiercely to capture market share, forcing manufacturers to balance R&D investment against competitive pricing strategies.

Key drivers include the technological shift from natural catgut to high-performance synthetic polymers, which offer enhanced predictability in degradation and reduced immunogenicity, making them the standard of care in high-risk surgeries. Furthermore, the rising prevalence of lifestyle diseases such as obesity (leading to bariatric surgery) and cardiovascular conditions necessitates frequent surgical interventions, directly fueling the consumption of absorbable sutures. The increasing focus on infection prevention in hospitals also boosts demand for antimicrobial-coated absorbable sutures, which command a premium price and offer superior patient outcomes, justifying their higher cost.

Significant restraints include the stringent and lengthy approval process mandated by regulatory bodies like the FDA and EMA for new biomaterials and coating technologies, which increases time-to-market and R&D costs. Additionally, the challenge of disposing of medical waste, including contaminated suture packaging and used materials, poses environmental and cost concerns for healthcare providers. The impact forces are further complicated by the fluctuating raw material prices (polymers derived from petroleum) and intense pressure from centralized purchasing organizations (GPOs) to maintain low procurement costs for standard commodity sutures, necessitating continuous efficiency improvements from market leaders.

Segmentation Analysis

The Absorbable Surgical Sutures Market is segmented comprehensively based on product type, material, application, and end-user, offering a granular view of demand drivers across the healthcare continuum. The complexity of surgical procedures dictates the preference for specific suture types, with the synthetic material segment maintaining significant dominance due to its predictable performance characteristics. Analysis of these segments reveals that while high-volume applications like general surgery drive overall market size, high-value specialties such as orthopedic and cardiovascular surgery contribute disproportionately to revenue due to the requirement for premium, high-tensile strength absorbable materials.

In terms of product type, the segmentation clearly divides the market into sutures (the primary product) and surgical needles (often packaged with the suture), though the material composition is the most critical differentiator. Synthetic absorbable sutures, including PGLA and PGA, offer advantages such as excellent handling, superior tissue passage, and controlled hydrolysis, establishing them as the gold standard. In contrast, the market for natural absorbable materials, historically catgut, is steadily declining, reserved mostly for niche or cost-sensitive applications in specific geographical regions where regulatory standards allow their use, indicating a fundamental shift toward engineered solutions globally.

The application-based segmentation reflects global disease burdens and surgical procedure volumes. General surgery, covering gastrointestinal and abdominal procedures, constitutes the largest segment, demanding medium-term absorption profiles. However, specialized segments such as neurosurgery and ophthalmic surgery require extremely fine sutures with very precise absorption rates to prevent complications in delicate tissues. End-user analysis underscores the continuing central role of large hospitals, although the burgeoning trend of shifting minor and intermediate procedures to Ambulatory Surgical Centers (ASCs) necessitates tailored packaging and procurement models suited for these high-efficiency, outpatient environments.

- By Product Type:

- Sutures

- Surgical Needles

- By Material:

- Synthetic Absorbable Sutures (Polyglycolic Acid (PGA), Polyglactin 910 (PGLA), Polydioxanone (PDO), Poliglecaprone (PGCL))

- Natural Absorbable Sutures (Catgut)

- By Application:

- General Surgery

- Cardiovascular Surgery

- Orthopedic Surgery

- Gastrointestinal Surgery

- Ophthalmic Surgery

- Neurology

- Gynecological Surgery

- Other Applications

- By End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

Value Chain Analysis For Absorbable Surgical Sutures Market

The value chain for the Absorbable Surgical Sutures Market begins with the upstream procurement of specialized polymer raw materials, primarily focusing on high-purity monomers for synthetic sutures (e.g., glycolide and lactide), which requires highly specialized chemical suppliers due to strict biocompatibility and polymerization requirements. This upstream phase is capital-intensive and subject to quality control constraints, as the final suture performance is dictated by the purity and consistency of these initial monomers. The manufacturing stage involves complex polymerization, extrusion, braiding or monofilament formation, sterilization (usually ethylene oxide or radiation), and coating, representing the core value addition where intellectual property in material science is crucial for competitive advantage.

The midstream phase centers on packaging and meticulous quality assurance, ensuring that the sterile barrier is maintained and that the sutures adhere precisely to specifications regarding tensile strength, needle attachment, and absorption profile. Given that sutures are classified as Class II or Class III medical devices, compliance with ISO standards (like ISO 13485) and regional regulatory bodies (FDA, CE Mark) is non-negotiable. Efficient manufacturing logistics and inventory management are essential here, as absorbable sutures have defined shelf lives and must be readily available in various sizes and needle combinations to meet immediate surgical demand.

Downstream analysis focuses on the distribution channels, which are bifurcated into direct sales to large hospital systems and indirect distribution through medical device wholesalers and group purchasing organizations (GPOs). Direct channels allow manufacturers to maintain control over pricing and education, essential for premium and specialized products, while indirect channels provide the necessary reach into smaller clinics and international markets. End-users (hospitals and ASCs) procure based on clinical trust, GPO contracts, and documented evidence of patient safety and performance, making clinical education and robust sales support critical elements in the final leg of the value chain.

Absorbable Surgical Sutures Market Potential Customers

The primary and most significant customers for Absorbable Surgical Sutures are institutional healthcare providers, specifically large multi-specialty hospitals and specialized surgical centers, as these entities perform the vast majority of complex and elective surgical procedures globally. These large institutional buyers prioritize sutures that offer predictable clinical outcomes, standardized quality across high volumes, and cost-effectiveness facilitated through bulk purchasing agreements or GPO affiliations. Their purchasing decisions are heavily influenced by clinical efficacy data, regulatory compliance, and the training and familiarity of their surgical staff with specific brand handling characteristics.

A rapidly growing segment of potential customers includes Ambulatory Surgical Centers (ASCs), which specialize in outpatient procedures requiring shorter operating times and faster patient turnover. ASCs typically demand absorbable sutures optimized for minimally invasive surgery (MIS) and those that facilitate rapid healing to minimize post-operative complications and readmissions. For ASCs, inventory efficiency and minimizing waste are critical, leading them to prefer pre-packaged surgical kits that include the required suture types and sizes, driving demand for tailored logistical solutions from manufacturers.

Furthermore, government and military hospitals, particularly in regions with centralized healthcare systems, represent substantial customers, often procuring through large, competitive tenders based significantly on price and large-scale supply capacity. Specialty surgical clinics, such as those focusing on plastic surgery or ophthalmology, constitute a high-value niche segment demanding premium, often very fine, aesthetically focused absorbable sutures (such as barbed sutures) where the ability to minimize scarring and optimize cosmetic results is a primary purchasing criterion, often irrespective of marginal cost differences.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.1 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ethicon (Johnson & Johnson), Medtronic, B. Braun Melsungen, GMD Group, Peters Surgical, W. L. Gore & Associates, DemeTECH Corporation, Teleflex, Zimmer Biomet, Boston Scientific, Surgical Specialties Corporation, Sutures India Pvt. Ltd., Dolphin Sutures, Unimed Medical Supplies, Lotus Surgical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Absorbable Surgical Sutures Market Key Technology Landscape

The technological landscape of the Absorbable Surgical Sutures Market is rapidly evolving, driven by advancements in polymer science and materials engineering aimed at enhancing clinical performance and patient safety. Key innovations revolve around controlling the degradation kinetics and improving the functional surface of the sutures. Modern manufacturing utilizes advanced extrusion and braiding techniques to create monofilament and multifilament sutures with superior smoothness and reduced capillarity, minimizing the potential for harboring bacteria. The synthesis of novel co-polymers, particularly variations of lactide and glycolide, allows manufacturers to fine-tune the tensile strength retention period from a few days up to several months, perfectly matching the required support duration for different tissue types, such as fast-absorbing for mucosal tissue and slow-absorbing for fascia closure.

A significant technological focus is the integration of bioactive components. Antimicrobial coatings, most notably triclosan, are widely adopted to provide a localized defense against Surgical Site Infections (SSIs), a critical concern in high-risk procedures. Research is progressing into "smart sutures" which incorporate drug delivery systems, capable of releasing anti-inflammatory agents or growth factors directly into the wound bed over the absorption period, thereby promoting faster and more organized tissue healing. Furthermore, the development of barbed sutures, which feature tiny bidirectional barbs to eliminate the need for surgical knots, has simplified the closure process, particularly in laparoscopic and robotic surgeries, reducing operative time and enhancing wound approximation, albeit requiring specialized handling techniques.

Advanced sterilization techniques, ensuring the polymer's integrity and preserving the efficacy of embedded coatings, form another crucial area of technological investment. Manufacturers are also improving the surgical needle technology, optimizing the needle-suture junction to prevent breakage and incorporating specialized coatings on needles to reduce friction and tissue drag during passage. These integrated technological improvements—from monomer purity and controlled degradation kinetics to bioactive functionalities and optimized handling—collectively aim to transform the suture from a passive closing material into an active healing device, setting new standards for post-operative care and minimizing long-term patient morbidity associated with wound complications.

Regional Highlights

North America maintains its leadership position in the Absorbable Surgical Sutures Market, largely attributed to the region's robust healthcare expenditure, high adoption rate of advanced surgical techniques (including robotics and MIS), and the pervasive presence of major market players (such as Johnson & Johnson's Ethicon). The U.S. market is characterized by stringent quality standards and a strong emphasis on reducing hospital-acquired infections, driving premium pricing and high utilization of antimicrobial-coated synthetic sutures. Investment in sophisticated polymer research and a streamlined regulatory pathway for clinically proven innovative devices further cement North America's position as the primary revenue generator and technology leader, setting global trends in surgical materials.

Europe represents a stable and mature market, marked by universal healthcare coverage and a high volume of geriatric surgeries. Countries such as Germany, the UK, and France are early adopters of innovative absorbable materials, particularly PDO and PGLA sutures, often influenced by evidence-based medicine and centralized tender procurement processes focusing on both quality and cost-effectiveness. The regulatory environment, standardized under the European Medicines Agency (EMA), fosters steady growth, although economic constraints in certain Southern European nations sometimes favor generic or slightly lower-cost alternatives, creating a dynamic balance between premium and standard offerings.

Asia Pacific (APAC) is projected to be the fastest-growing region, presenting vast untapped potential driven by rapid economic development, significant investments in healthcare infrastructure, and rising medical tourism. Countries like China and India, with their massive populations and increasing incidence of chronic diseases, are undergoing a critical transition from traditional reusable or non-absorbable materials to modern synthetic absorbable sutures. While price sensitivity remains high, the increasing establishment of sophisticated private hospital chains and the growing middle class demanding Western standards of care are creating substantial new opportunities for both global and regional manufacturers.

Latin America and the Middle East & Africa (MEA) are emerging regions offering varied growth profiles. Latin America's market growth is volatile but promising, fueled by improving access to surgical care in nations like Brazil and Mexico, though restricted by economic instability and reliance on imported medical devices. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, exhibits significant investment in modern hospitals and advanced surgical technologies driven by oil wealth and medical tourism initiatives, leading to high-value consumption of premium absorbable sutures, contrasting sharply with Sub-Saharan Africa where affordability and basic healthcare needs still dominate procurement decisions.

- North America: Dominates the market share due to advanced healthcare infrastructure, high incidence of chronic diseases requiring surgical intervention, and rapid adoption of barbed and antimicrobial-coated sutures.

- Europe: Characterized by stable growth, regulatory harmonization, and a strong clinical preference for synthetic biodegradable polymers in high-volume general and orthopedic surgeries.

- Asia Pacific (APAC): Fastest-growing region, driven by expanding healthcare access, high unmet surgical needs in populous countries, and significant government spending on new hospital capacity.

- Latin America: Growth is supported by medical device imports and increasing volume of elective surgeries, though economic volatility remains a factor impacting capital investment.

- Middle East & Africa (MEA): High growth in GCC countries fueled by medical tourism and government initiatives to modernize healthcare, demanding high-quality, specialized absorbable materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Absorbable Surgical Sutures Market.- Ethicon (Johnson & Johnson)

- Medtronic plc

- B. Braun Melsungen AG

- GMD Group

- Peters Surgical

- W. L. Gore & Associates

- DemeTECH Corporation

- Teleflex Incorporated

- Zimmer Biomet Holdings, Inc.

- Boston Scientific Corporation

- Surgical Specialties Corporation

- Sutures India Pvt. Ltd.

- Dolphin Sutures

- Unimed Medical Supplies

- Lotus Surgical

- Meril Life Sciences Pvt. Ltd.

- Healthium Medtech Limited

- Assut Medical Sarl

- Kono Seisakusho Co., Ltd.

- CP Medical Inc.

Frequently Asked Questions

Analyze common user questions about the Absorbable Surgical Sutures market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of synthetic absorbable sutures over natural alternatives?

Synthetic absorbable sutures, such as PGLA and PGA, offer highly predictable degradation kinetics and absorption profiles via hydrolysis, minimizing tissue reaction and ensuring reliable tensile strength retention, unlike natural sutures (catgut) which vary biologically.

Which material segment holds the largest share in the absorbable surgical sutures market?

The synthetic absorbable sutures segment, specifically Polyglactin 910 (PGLA) and Polyglycolic Acid (PGA), dominates the market share due to their widespread clinical acceptance, superior handling characteristics, and predictable performance across diverse surgical applications.

How is the rising demand for minimally invasive surgery (MIS) impacting the suture market?

The shift toward MIS is boosting the demand for specialized absorbable sutures, including barbed sutures and fine-gauge materials, optimized for laparoscopic and robotic procedures that require enhanced knotless closure efficiency and precise tissue approximation in confined spaces.

What key technological advancements are shaping the future of absorbable sutures?

Future market growth is being shaped by the development of antimicrobial-coated sutures to prevent surgical site infections, the creation of barbed (knotless) designs for faster closure, and the introduction of "smart sutures" capable of localized drug delivery to accelerate wound healing.

Which geographical region is projected to exhibit the fastest growth in this market?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), driven by significant government investment in healthcare infrastructure, increasing accessibility to surgical services, and the rising prevalence of chronic diseases requiring surgical intervention.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager