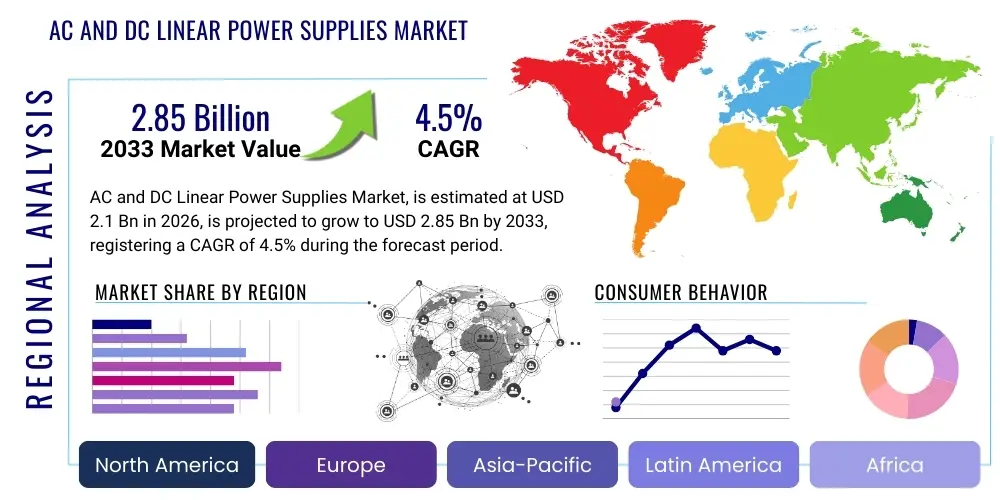

AC and DC Linear Power Supplies Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436865 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

AC and DC Linear Power Supplies Market Size

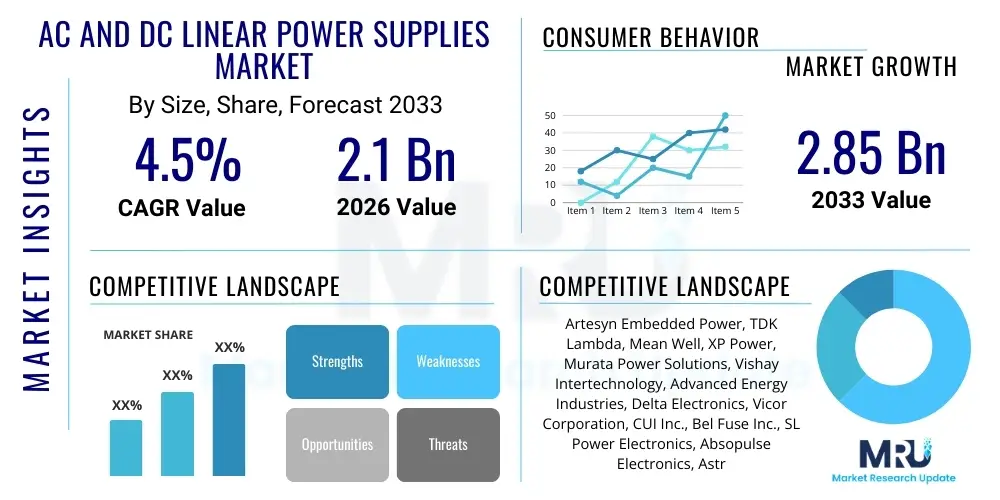

The AC and DC Linear Power Supplies Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 2.85 Billion by the end of the forecast period in 2033.

AC and DC Linear Power Supplies Market introduction

The AC and DC Linear Power Supplies Market encompasses devices that utilize a series pass element (typically a transistor) operating in its linear region to regulate output voltage, offering superior performance in terms of low output noise, ripple, and fast transient response compared to modern switching mode power supplies (SMPS). These characteristics make linear power supplies indispensable in noise-sensitive applications, particularly high-fidelity audio equipment, precision test and measurement instruments, medical imaging devices, and certain critical aerospace and defense systems where electromagnetic interference (EMI) must be minimized to ensure signal integrity. Despite their inherent drawback of lower efficiency, leading to higher heat dissipation and larger physical size, their unmatched stability and low noise floor cement their essential role within niche, high-performance electronics sectors.

The product fundamentally converts incoming AC power into regulated DC power (or uses DC input for DC regulation), relying on transformers to step down voltage and subsequent filtering and regulation stages. Major applications center around environments requiring extremely clean power, such as calibration laboratories, sophisticated semiconductor testing facilities, and specialized communication equipment. The market benefits significantly from the continued proliferation of sensitive digital electronics and sensors that demand stringent power quality specifications. Driving factors include the persistent need for high-precision manufacturing, growing investments in research and development activities across various scientific fields, and the regulatory mandates in sectors like medical devices that prioritize reliability and low noise.

Furthermore, the longevity and inherent robustness of linear power supply designs contribute to their continued market relevance, especially in industrial settings prone to transient disturbances. While the majority of general electronics have transitioned to high-efficiency switching designs, the critical nature of applications relying on linear supplies ensures sustained demand. The low electromagnetic compatibility (EMC) footprint of these supplies is a critical advantage in crowded electronic environments, influencing adoption in complex radar systems and avionics. This specialized demand profile distinguishes the linear power supply market as one focused on quality and precision rather than volume efficiency.

AC and DC Linear Power Supplies Market Executive Summary

The AC and DC Linear Power Supplies market maintains a steady growth trajectory driven primarily by specialized industrial and high-reliability sectors, counteracting the broader industry shift towards switching power technologies. Key business trends indicate manufacturers are focusing on miniaturizing transformer technology and improving thermal management techniques to address the historical efficiency constraints of linear designs. Strategic alliances between power supply vendors and critical equipment manufacturers (e.g., medical device producers) are becoming prevalent, ensuring that power solutions are optimized for application-specific noise and stability requirements. Companies are also investing in hybrid designs that integrate linear regulation stages post-switching stages (LDOs or low-noise linear regulators) to combine high efficiency with ultra-low noise, thereby catering to the most demanding power integrity needs in next-generation high-speed computing and data acquisition systems.

Regionally, Asia Pacific (APAC) represents the largest segment for manufacturing and consumption, propelled by extensive growth in industrial automation, telecom infrastructure development, and substantial investment in defense electronics, particularly in countries like China, Japan, and South Korea. North America and Europe, however, lead in the adoption of high-end, ultra-low-noise linear supplies, driven by established aerospace, medical, and scientific research communities that prioritize performance over cost or footprint. These regions exhibit strong demand for highly regulated, customized power solutions required for sensitive sensor applications, electronic warfare systems, and high-resolution diagnostic equipment. Regulatory standards concerning EMC and power harmonics also influence regional product specifications and adoption rates, creating a competitive landscape focused on certification compliance and application-specific tailoring.

Segment trends highlight the dominance of the test and measurement sector due to the fundamental requirement for absolute accuracy and minimal noise injection during device characterization and calibration processes. Within the product segmentation, single-output supplies remain the most common configuration, though multi-output linear supplies are gaining traction in integrated industrial control systems and certain communication hubs where multiple voltage rails require independent, clean regulation. The high reliability and extended Mean Time Between Failures (MTBF) offered by linear designs make them preferred choices in critical infrastructure applications, including railway signaling and remote telemetry units, ensuring that specialized segmentation continues to support stable market expansion despite the efficiency premium associated with the technology.

AI Impact Analysis on AC and DC Linear Power Supplies Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the linear power supplies market frequently revolve around whether the high-power demands of AI servers will necessitate efficient SMPS entirely, thereby eliminating linear supplies, or if AI's integration into advanced monitoring and control systems will create new niches for ultra-clean power. Users are primarily concerned with the role of linear supplies in supporting the peripheral, sensitive components vital for AI operations, such as high-resolution sensor arrays, analog-to-digital converters (ADCs), and precision testing equipment used to validate AI hardware reliability. The consensus theme is that while AI acceleration cores (GPUs, specialized chips) require high-efficiency switching power, the increasing reliance on highly accurate data acquisition and low-noise sensor data—the inputs feeding the AI algorithms—strengthens the demand for the high fidelity power that only linear supplies, or advanced linear regulators, can provide. Therefore, the integration of AI drives complexity, leading to an increasing use of linear supplies in hybrid power architectures to clean up power at the point of load for sensitive front-end electronics.

- AI drives demand for ultra-low noise power in front-end sensor interfaces essential for accurate data input.

- Increased complexity in semiconductor testing (driven by AI chip development) necessitates precision linear supplies for wafer probing and characterization.

- AI implementation in high-reliability systems (e.g., autonomous vehicles, medical diagnostics) elevates the need for robust, low-EMI power solutions in critical control units.

- Linear power supplies are crucial for precision laboratory equipment used in AI research and hardware validation, where signal integrity is paramount.

- The growth of edge AI and sensor fusion requires clean power for high-speed, low-latency analog components near the data source.

DRO & Impact Forces Of AC and DC Linear Power Supplies Market

The market for AC and DC Linear Power Supplies is shaped by a unique interplay of intrinsic technological advantages and limitations, moderated by external market forces demanding precision and reliability. Drivers center on the unparalleled regulation characteristics and low noise signature of linear supplies, making them irreplaceable in scientific instrumentation, high-fidelity audio equipment, and specialized communication systems where power ripple and EMI must be negligible. The escalating complexity and sensitivity of modern electronic components, requiring purer DC power rails for optimal performance, continuously feed this demand. Furthermore, stringent regulatory requirements in sectors like medical devices (e.g., patient monitoring, diagnostic imaging) and aerospace/defense prioritize proven reliability, robustness against transients, and high MTBF, all inherent features of linear designs, thereby acting as significant positive market forces.

However, the market faces considerable restraints, primarily stemming from the technological constraints of linear regulation. These supplies exhibit notoriously low power conversion efficiency compared to modern switching mode power supplies (typically 40–60% vs. 85–95%), leading to substantial heat dissipation, larger form factors, and higher operating costs. This inefficiency limits their practical application in high-power systems or space-constrained portable devices, restricting the market to niche, specialized applications. The raw material cost of the large transformers and heat sinks necessary for linear operation also contributes to a higher initial product cost, making them uncompetitive for general consumer and mass-market industrial applications where efficiency and cost minimization are paramount decision factors. Overcoming these physical limitations remains the central challenge for manufacturers in this segment.

Opportunities for growth lie significantly in the intersection of high-reliability requirements and technological evolution. The rise of sophisticated photonics and advanced semiconductor manufacturing, which are highly susceptible to minute power fluctuations, offers a strong opportunity for premium linear supplies. Furthermore, the defense and space sectors globally are increasing their expenditure on robust, radiation-tolerant electronics, where the simplicity and inherent resilience of linear regulators are highly valued. Manufacturers are capitalizing on these opportunities by developing hybrid power solutions that integrate the advantages of both linear and switching technology—using high-efficiency front-ends coupled with precision linear regulators at the point of load—to meet demanding power integrity specifications without sacrificing overall system efficiency entirely. This strategic product evolution helps stabilize the market's relevance against technological obsolescence.

Segmentation Analysis

The AC and DC Linear Power Supplies market is segmented based on critical technical characteristics and distinct end-user applications, reflecting the specialized nature of this power technology. Segmentation by output voltage (Low, Medium, High) helps differentiate products based on power handling capability and targeted use cases, with low-voltage segments often catering to sensitive sensor front-ends and low-power lab equipment, while medium- and high-voltage linear supplies are applied in specific industrial control systems and dedicated communication transmitters. The market also segments significantly by output type—single-output being the most prevalent for dedicated voltage rails, versus multi-output designs used for integrated systems requiring several independent, regulated voltage lines, such as complex instrumentation racks.

End-use industry segmentation provides crucial insight into the driving demand sectors. The Test and Measurement industry stands as a cornerstone segment, utilizing linear supplies for precision calibration and highly accurate measurements where power noise interference cannot be tolerated. The Medical sector relies on these supplies for critical applications like MRI coils and patient monitoring systems, emphasizing safety and reliability. Aerospace and Defense mandates the use of robust linear supplies due to their resilience to harsh environments and superior reliability performance over switching counterparts, particularly in radar and avionics systems. The Industrial Automation sector also utilizes linear power for specific control elements requiring exceptional stability and low ripple, such as vision systems and specialized robot controllers.

- By Output Type:

- Single Output

- Multi Output

- By Output Voltage:

- Low Voltage (Below 15V)

- Medium Voltage (15V to 60V)

- High Voltage (Above 60V)

- By End-Use Industry:

- Test and Measurement

- Medical

- Aerospace and Defense

- Industrial Automation

- Telecommunications

- Others (Scientific Research, High-Fidelity Audio)

Value Chain Analysis For AC and DC Linear Power Supplies Market

The value chain for AC and DC linear power supplies begins with the upstream segment, dominated by raw material providers and component manufacturers. Key upstream components include large magnetic cores for transformers, high-grade silicon for power transistors and pass elements (bipolar junction transistors or MOSFETs), heat sinks, and specialized capacitors chosen for their filtering capabilities. Given that linear supplies require larger and often custom-wound transformers, the quality and sourcing efficiency of core materials like steel and copper significantly influence production costs. Upstream analysis focuses on securing stable supply chains for high-purity semiconductors and managing the volatility in raw material pricing necessary for the bulkier components inherent in linear designs. Component specialization, particularly for military or medical-grade power supplies, adds complexity to this initial stage.

The core manufacturing process involves the integration and assembly of these components, including transformer design, circuit board assembly, and rigorous testing and calibration. Due to the precision requirements, linear power supply manufacturing often involves more manual calibration and detailed quality control checks compared to highly automated switching supply production. Distribution channels play a crucial role in connecting manufacturers to highly specific end-user segments. Direct sales models are common for large volume Original Equipment Manufacturers (OEMs) in aerospace or medical sectors that require highly customized specifications and proprietary interfacing. These direct relationships facilitate close collaboration on design validation and supply agreements, ensuring compliance with stringent application standards.

Indirect distribution involves specialized technical distributors and electronic component wholesalers who manage inventory and provide regional sales support, especially to smaller industrial users and research laboratories. Downstream analysis focuses on the final integration into complex systems such as automated testing equipment (ATE), patient monitoring systems, and ground control stations. Post-sale services, including maintenance, calibration support, and long-term reliability guarantees, are crucial factors in the downstream value proposition, particularly given the long operational lifecycles expected of linear power supplies in critical infrastructure. The high reliance on technical support and the need for application engineering expertise distinguish the distribution requirements in this specialized market.

AC and DC Linear Power Supplies Market Potential Customers

Potential customers for AC and DC linear power supplies are concentrated in sectors where the cost of failure or the impact of noise injection significantly outweighs the operational premium associated with lower-efficiency linear technology. The primary end-users are OEMs and research institutions that build or utilize sensitive electronic systems. Major buyers include manufacturers of advanced Test and Measurement equipment, such as oscilloscopes, signal generators, and spectrum analyzers, which require power sources with virtually no ripple noise to maintain measurement integrity across their sensitive circuitry. Additionally, defense contractors procuring systems for radar, electronic warfare, and secure communication rely heavily on the robust and low-EMI characteristics of linear supplies to ensure mission critical reliability in harsh environments, making them key purchasers.

The Medical device manufacturing sector represents another significant customer base, demanding certified linear power supplies for diagnostic equipment like CT scanners, ultrasound machines, and precision laboratory instruments. In these applications, the supplies must adhere to stringent safety standards (e.g., IEC 60601) and deliver exceptionally clean power to ensure accurate readings and prevent noise interference that could compromise patient safety or diagnosis. Furthermore, high-end industrial control and automation companies that deploy sensitive vision systems, machine learning sensors for quality control, and sophisticated process controllers constitute an important growth segment. These buyers prioritize the stability and transient response of linear regulators to ensure uninterrupted and precise operation in complex manufacturing environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 2.85 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Artesyn Embedded Power, TDK Lambda, Mean Well, XP Power, Murata Power Solutions, Vishay Intertechnology, Advanced Energy Industries, Delta Electronics, Vicor Corporation, CUI Inc., Bel Fuse Inc., SL Power Electronics, Absopulse Electronics, Astrodyne TDI, Schaefer Power Systems, Synqor, P-DUKE Power Supplies, GlobTek Inc., Power-One (ABB), Cosel Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

AC and DC Linear Power Supplies Market Key Technology Landscape

The core technology landscape of the AC and DC Linear Power Supplies market remains fundamentally based on the linear regulation principle, utilizing a pass transistor in series with the load to dissipate excess power as heat, thereby maintaining a highly stable and noise-free output voltage. However, modern advancements focus on refining efficiency and thermal performance within this structure. Key technological areas include the integration of Low Dropout Regulators (LDOs) at the output stage, which are highly efficient forms of linear regulators optimized for minimizing voltage drop while maintaining excellent ripple rejection. This integration is crucial for point-of-load regulation in systems that require both high efficiency (from a centralized SMPS input) and ultra-clean local power.

Another significant trend involves sophisticated transformer design, utilizing high-grade magnetic materials and optimized winding techniques to reduce size, weight, and internal losses, partially mitigating the inherent bulkiness of linear supplies. Furthermore, manufacturers are incorporating advanced microprocessor-based control and monitoring systems, transforming traditional linear supplies into "smart" power units. These systems allow for remote programming, dynamic load management, and predictive failure analysis, enhancing reliability and simplifying calibration processes, particularly in complex automated testing environments. Despite being an older technology, the continuous refinement of filtering components, such as high-capacitance, low-ESR (Equivalent Series Resistance) capacitors, is vital for achieving the ultra-low ripple specifications demanded by sensitive analog circuitry.

The competitive technology edge is often found in the thermal management solutions used to handle the significant heat generated by the pass elements. Innovative heat sink designs, forced-air cooling, and integration with specialized cooling plates are essential for increasing the power density of linear supplies without compromising their long-term reliability. For high-reliability applications like defense and aerospace, the use of hermetically sealed units and robust mechanical designs ensures performance integrity under extreme temperature and vibration conditions. These technological refinements ensure that linear supplies remain the optimal choice where purity of power, rather than power efficiency alone, is the dominant design criterion, allowing them to coexist and complement the high-speed demands typically met by switching technologies.

Regional Highlights

North America maintains a robust position in the AC and DC Linear Power Supplies market, distinguished by its high concentration of advanced scientific research facilities, major defense contractors, and leading medical device manufacturers. Demand in this region is characterized by a strong preference for high-precision, customized linear power solutions suitable for stringent applications such as avionics, sophisticated laboratory equipment, and advanced semiconductor testing infrastructure. The presence of stringent regulatory bodies (like the FDA for medical devices) further drives the adoption of reliable, certified linear power supplies. North American manufacturers are often at the forefront of developing hybrid power technologies that offer best-in-class noise performance, catering directly to the specialized needs of R&D and high-tech manufacturing ecosystems. The substantial defense budget also ensures a steady demand for MIL-SPEC linear power supplies known for their ruggedness and stability.

Asia Pacific (APAC) represents the largest and fastest-growing regional market, largely fueled by extensive industrialization, massive investments in telecommunications infrastructure, and the expansion of electronics manufacturing hubs across countries like China, India, and Taiwan. While the APAC region is a high-volume consumer of switching power supplies, the linear segment growth is derived from the increasing complexity of locally manufactured testing equipment, the burgeoning domestic aerospace and defense sectors, and growing clinical research activities. APAC is transitioning from merely being a consumer market to becoming a major producer of high-quality industrial automation and medical electronics, thereby driving up the demand for precision power components domestically. The sheer scale of industrial output here requires significant quantities of linear power supplies for localized control systems and quality assurance processes.

Europe holds a significant share, particularly driven by Germany, the UK, and France, known for their advanced industrial automation, automotive R&D, and strong commitment to scientific instrumentation standards. European industrial users prioritize longevity and extreme reliability, features inherently offered by linear designs. The region’s focus on high-end manufacturing, coupled with strict European Union regulations regarding electromagnetic compatibility (EMC), reinforces the requirement for low-noise power sources. Furthermore, Europe's substantial medical technology sector and its extensive defense manufacturing base contribute strongly to the consumption of high-specification linear power modules. While cost-efficiency remains a factor, the high value placed on operational stability and compliance with stringent environmental and safety standards ensures sustained, premium demand for linear power solutions across the European market.

- North America: Leading adopter of high-precision, low-noise linear supplies for defense, aerospace, and advanced medical diagnostics. Strong R&D focus driving demand for customized solutions.

- Asia Pacific (APAC): Largest market, driven by rapid expansion in industrial automation, telecom infrastructure, and electronics manufacturing (China, South Korea). Increasing domestic demand for quality control and testing equipment.

- Europe: High demand from established industrial automation, automotive testing, and advanced medical sectors (Germany, UK). Compliance with strict EMC regulations favors low-noise linear technology.

- Latin America (LATAM): Moderate growth tied to industrial modernization projects and utility infrastructure upgrades requiring stable power for control systems.

- Middle East and Africa (MEA): Growth driven primarily by defense spending and investment in critical energy infrastructure requiring highly reliable power components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the AC and DC Linear Power Supplies Market.- Artesyn Embedded Power (now part of Advanced Energy Industries)

- TDK Lambda

- Mean Well

- XP Power

- Murata Power Solutions

- Vishay Intertechnology

- Advanced Energy Industries

- Delta Electronics

- Vicor Corporation

- CUI Inc.

- Bel Fuse Inc.

- SL Power Electronics

- Absopulse Electronics

- Astrodyne TDI

- Schaefer Power Systems

- Synqor

- P-DUKE Power Supplies

- GlobTek Inc.

- Power-One (ABB)

- Cosel Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the AC and DC Linear Power Supplies market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of a linear power supply over a switching power supply?

The primary advantage of a linear power supply is its superior output power quality, characterized by significantly lower noise, ripple, and electromagnetic interference (EMI). This clean power output is critical for sensitive analog circuitry, precision instrumentation, and medical devices where signal integrity must be absolute.

In which industries are AC and DC Linear Power Supplies considered essential?

Linear power supplies are essential in Test and Measurement (for calibration and high-accuracy measurements), Medical (for critical diagnostics and patient safety), and Aerospace and Defense (for high reliability and low-EMI performance in avionics and radar systems).

Why do linear power supplies have lower efficiency and generate more heat?

Linear power supplies regulate voltage by forcing the series pass element to operate in its linear (resistive) region, dissipating the excess input power as heat. This process is inherently inefficient, typically achieving efficiency rates significantly lower than modern switching mode power supplies (SMPS).

Is the linear power supply market expected to decline due to SMPS competition?

No, while the overall market share is smaller than SMPS, the linear power supply market is not expected to decline; rather, it will see steady, specialized growth (CAGR 4.5%). Its niche role in precision, low-noise, and high-reliability applications ensures sustained demand that cannot be met by conventional switching technologies.

How is technological advancement influencing the linear power supply design?

Advancements focus on developing hybrid power systems, where high-efficiency SMPS handles bulk power conversion, and ultra-low-noise linear regulators (LDOs) are used at the point of load to provide final, clean power. Improvements in thermal management and magnetic materials also reduce size and heat output.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager