AC and DC Solar Water Pumps Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435996 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

AC and DC Solar Water Pumps Market Size

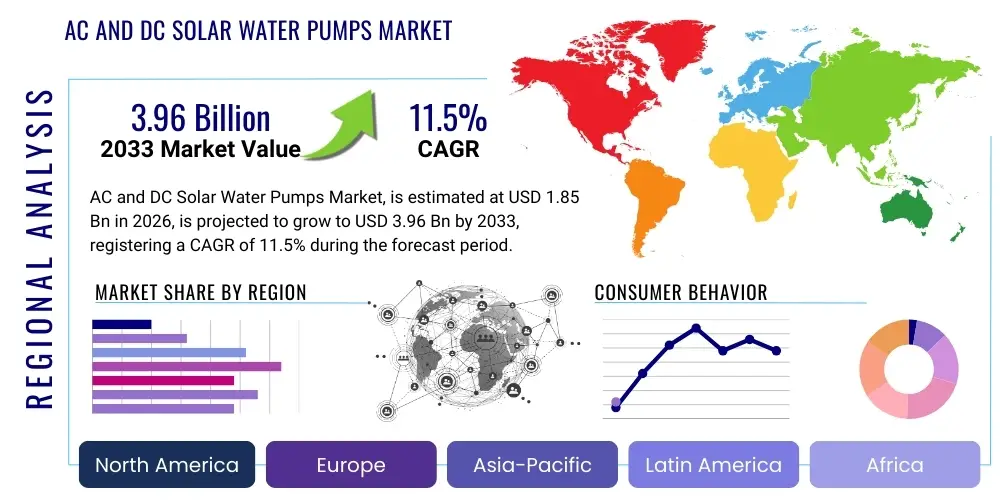

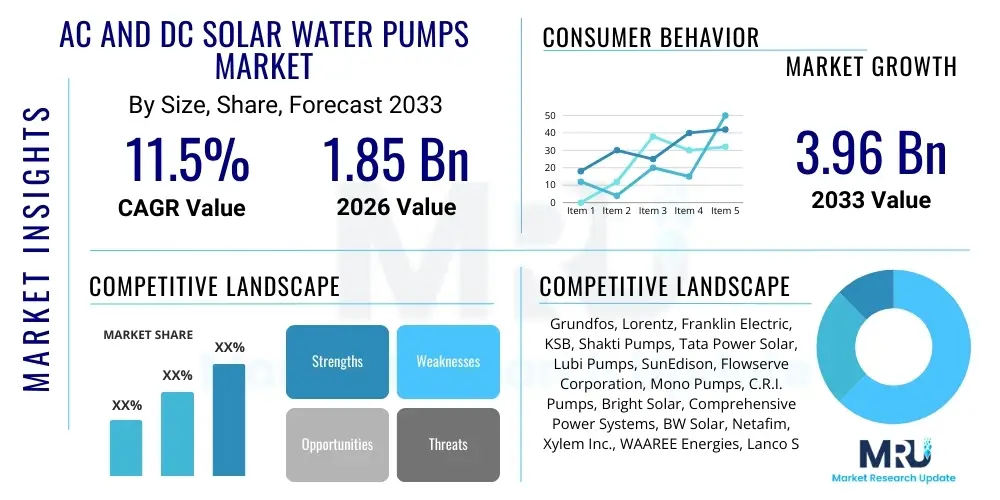

The AC and DC Solar Water Pumps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 3.96 Billion by the end of the forecast period in 2033.

AC and DC Solar Water Pumps Market introduction

The AC and DC Solar Water Pumps Market encompasses systems that utilize photovoltaic (PV) solar energy to power water pumping apparatus, serving critical applications primarily in remote or off-grid locations where access to conventional electricity is limited or expensive. These systems replace traditional diesel pumps, offering significant environmental and economic advantages by eliminating fuel costs and reducing carbon emissions. The product range includes both submersible and surface pumps, categorized primarily by the type of power current they utilize: DC pumps, which are directly compatible with solar panels and are common in smaller, residential, and micro-irrigation systems, and AC pumps, which require an inverter but are preferred for higher power requirements and large-scale agricultural or municipal water supply projects, often utilizing existing infrastructure.

Major applications of solar water pumps span agriculture, residential water supply, livestock watering, and commercial use. In agriculture, these pumps are essential for micro-irrigation, drip irrigation, and sprinkler systems, allowing farmers in arid and semi-arid regions to ensure crop viability irrespective of grid connectivity. Residential applications focus on providing clean drinking water and household utility water, improving the quality of life in rural communities. The core benefits driving market adoption include reduced operational expenses, enhanced energy independence, scalability, and robust performance in harsh climatic conditions. These systems represent a sustainable solution for global water scarcity challenges and contribute directly to food security initiatives worldwide, especially in developing economies.

Driving factors for sustained market growth are multifaceted, anchored by increasing government support through subsidies and financing schemes, particularly in regions like India, China, and Africa, aimed at promoting sustainable agriculture and rural electrification. Simultaneously, the declining cost of solar PV panels and advancements in pump technology, such as the integration of highly efficient Brushless DC (BLDC) motors and sophisticated Maximum Power Point Tracking (MPPT) controllers, are making these systems more economically attractive. Furthermore, growing environmental awareness and international mandates focused on climate change mitigation compel end-users to transition away from polluting diesel counterparts, cementing the solar pump as a preferred, long-term asset for water management infrastructure globally.

AC and DC Solar Water Pumps Market Executive Summary

The global AC and DC Solar Water Pumps Market is experiencing robust expansion, fundamentally driven by pervasive business trends towards decentralized power generation and sustainable agricultural practices. Key growth segments include large-scale AC submersible pumps used in commercial irrigation and the increasing penetration of smart, IoT-enabled DC pumps for precision farming applications. Business trends highlight strategic collaborations between solar panel manufacturers and pump system integrators to offer comprehensive, turnkey solutions, reducing installation complexity for end-users. The market is also seeing a shift toward standardized, modular systems that are easier to maintain and scale. Crucially, the necessity for reliable water access in climate-vulnerable regions positions solar pumping technology as essential infrastructure, attracting significant investment from development banks and private equity.

Regional trends indicate Asia Pacific (APAC) and the Middle East & Africa (MEA) as the primary growth engines, accounting for the largest share of both installed capacity and future growth potential. This dominance is attributable to large agrarian populations, high solar irradiation levels, and substantial government subsidy programs designed to alleviate water stress. Specifically, countries like India, with massive schemes targeting millions of pumps, and various nations across the Sahel region of Africa, prioritizing water access for livestock and human consumption, are accelerating regional demand. Conversely, mature markets in North America and Europe focus on replacing aging infrastructure and implementing highly specialized, energy-efficient solutions for niche commercial farming and groundwater remediation projects, favoring high-quality, long-lifespan components.

Segment trends emphasize the rapid proliferation of DC solar water pumps, particularly in smaller systems (below 5 HP), owing to their direct compatibility with PV panels, simplified installation, and high energy efficiency derived from BLDC technology. However, the AC segment maintains strong growth, driven by the increasing need for high flow rates and high head applications in large farms and community water schemes, where AC motors offer superior power delivery and utilize readily available standard three-phase infrastructure. Component-wise, the market is characterized by intense focus on optimizing the solar controller, integrating advanced MPPT algorithms, and ensuring robust protection features against dry running, overheating, and voltage fluctuations, thereby maximizing system uptime and longevity.

AI Impact Analysis on AC and DC Solar Water Pumps Market

Common user inquiries regarding the intersection of Artificial Intelligence (AI) and the AC and DC Solar Water Pumps Market frequently center on optimizing efficiency, reducing operational expenditures, and enhancing system reliability in remote installations. Users are keenly interested in how AI can facilitate predictive maintenance to prevent costly downtimes, especially in hard-to-reach agricultural settings. Furthermore, there is significant curiosity about AI's role in smart irrigation scheduling—determining the precise amount of water needed based on soil moisture, weather forecasts, and crop type—to maximize water use efficiency, which is paramount in water-stressed regions. Expectations revolve around AI-driven controllers that can dynamically adjust pump speed and flow rates based on real-time solar irradiance and water demand fluctuations, transforming solar pumps from simple devices into integrated components of sophisticated farm management systems. The market seeks tangible proof points demonstrating increased yield and reduced energy waste through AI implementation.

The application of AI is moving beyond basic automation and into complex operational intelligence, particularly within large-scale solar pumping installations. AI algorithms, embedded either in the pump controllers or cloud-based platforms, analyze vast datasets related to system performance (voltage, current, temperature, vibration) and external environmental variables (irradiance, atmospheric pressure, water level). This analytical capability allows the system to establish baseline operational norms and immediately detect deviations indicative of potential failures, such as impeller wear, bearing damage, or panel degradation. This shift from reactive repair to proactive intervention significantly lowers the Total Cost of Ownership (TCO) for end-users and enhances the reliability metrics required by financing institutions and government agencies supporting pump installations.

Furthermore, AI is pivotal in maximizing the economic return of solar pumping investments through sophisticated energy management. For hybrid systems that might utilize solar, battery storage, and sometimes a grid connection, AI determines the optimal source mix at any given time, prioritizing solar utilization to minimize costs. In pure off-grid solar systems, AI ensures that pumping schedules align perfectly with peak solar production hours while accounting for reservoir capacity and actual demand. This intelligent orchestration reduces the need for oversized systems or expensive battery backups, contributing to the overall affordability and widespread adoption of solar pumping technology globally, fundamentally changing how water resources are managed in agriculture and remote communities.

- AI-driven Predictive Maintenance: Monitoring pump vibration and motor performance to anticipate failures, minimizing downtime.

- Smart Irrigation Scheduling: Optimizing water delivery based on real-time sensor data, weather forecasting, and crop needs, maximizing Water Use Efficiency (WUE).

- Dynamic MPPT Optimization: Using machine learning to refine Maximum Power Point Tracking algorithms for higher energy harvest under variable irradiance conditions.

- Remote Diagnostic and Control: AI algorithms enabling remote fault detection and system recalibration, critical for geographically dispersed installations.

- Energy Source Hybridization: Optimizing the blending of solar, grid, or generator power to ensure lowest operational cost and highest reliability.

DRO & Impact Forces Of AC and DC Solar Water Pumps Market

The dynamics of the AC and DC Solar Water Pumps Market are governed by a robust interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the impactful forces shaping its trajectory. The primary driver is the global imperative for sustainable water management, fueled by increasing water scarcity dueout to climate change and the resultant governmental and organizational push toward high-efficiency, zero-emission pumping solutions. This is powerfully supported by significant subsidies and incentive programs across developing economies aimed at replacing millions of polluting diesel pumps. Restraints include the high initial capital investment required for quality solar arrays and advanced controllers, which can be prohibitive for small-scale farmers without financial assistance. Furthermore, the specialized skills required for installation and maintenance in remote areas, coupled with vulnerabilities to component theft, present logistical hurdles that temper market expansion. However, the opportunity for hybrid systems (solar plus grid or battery storage) and the vast untapped potential of the agricultural sector in Africa and South Asia offer substantial future growth avenues.

Key drivers include the dramatic reduction in the Levelized Cost of Energy (LCOE) for solar photovoltaic modules, making the long-term operational costs of solar pumping significantly lower than traditional alternatives. Simultaneously, energy security concerns, especially in regions prone to grid instability or frequent power outages, position solar pumps as an indispensable resource for maintaining critical water supply functions. The technological progress in Brushless DC (BLDC) motors and advanced MPPT solar pump controllers has fundamentally improved system efficiency and lifespan, directly addressing reliability concerns that previously restricted adoption. These technological leaps translate directly into better economic viability for large-scale projects, further cementing solar pumping as a commercially viable utility solution, rather than just an environmental choice. The sheer necessity for reliable irrigation to secure food production in the face of unpredictable climate patterns acts as a compelling, non-negotiable driver.

The impact forces influencing the market are structural and regulatory. Regulatory tailwinds, such as favorable import duties and standardized quality mandates (e.g., ISO certifications for PV components and pumps), accelerate market maturity and consumer confidence. Conversely, the market faces disruptive impact forces from macroeconomic volatility, including fluctuating commodity prices (copper, steel, silicon) that affect manufacturing costs. The rapid emergence of localized, decentralized manufacturing capabilities, especially in China and India, is exerting downward pressure on component prices, making the technology more accessible. Overall, the dominant force remains the combination of supportive environmental policies, the undeniable necessity of water security, and continuous technological innovation, collectively overriding the short-term financial restraints and driving consistent, high-volume market growth globally, especially in regions with high solar irradiation.

Segmentation Analysis

The AC and DC Solar Water Pumps Market segmentation provides a granular view of demand based on technology type, key components, and diverse application landscapes, reflecting specialized user requirements across different operational scales. The market is primarily bifurcated into AC and DC pump types, where DC pumps typically cater to smaller, lower-power needs characteristic of micro-irrigation and domestic use due to their seamless integration with PV panels. AC pumps, requiring an inverter, dominate high-power, high-volume applications such as community water supply or large commercial farms, leveraging existing infrastructure compatibility. Component analysis reveals that controllers and solar panels constitute the most capital-intensive parts of the system, while the pump itself is undergoing continuous optimization toward higher efficiency motors like BLDC.

Application segmentation highlights that agriculture remains the foundational and largest consumer segment, driven by global food security needs and the need to irrigate vast tracts of land efficiently without relying on costly and polluting diesel. Within agriculture, the shift towards precision and smart farming models is accelerating demand for technologically advanced pumping systems integrated with IoT capabilities. Beyond agriculture, significant growth is observed in the residential segment, primarily in rural and remote areas lacking grid connectivity, and in the municipal/industrial sectors where solar pumps are adopted for supplementary water management, particularly in regions where environmental regulations strictly limit groundwater extraction and promote sustainable energy use for essential services.

The structured segmentation framework allows stakeholders to tailor product development and marketing strategies effectively. For instance, manufacturers targeting the African residential market prioritize rugged, easy-to-install DC systems with advanced dry-run protection, whereas companies focusing on large Indian farming cooperatives emphasize durable, high-head AC submersible pumps coupled with robust service networks. This detailed analysis ensures that innovation is directed towards solving specific regional and application challenges, whether related to optimizing energy yield in harsh deserts or minimizing water wastage in intensive horticultural setups, thereby supporting sustained market viability and achieving high customer satisfaction.

- By Product Type:

- AC Solar Water Pumps (Require Inverter)

- DC Solar Water Pumps (Direct PV connection, common in smaller systems)

- By Component:

- Pumps (Submersible, Surface, Booster)

- Solar Panels (PV Modules)

- Controllers (MPPT Controllers, Inverters)

- Storage Devices (Batteries, rarely used but critical for 24/7 operation)

- By Capacity/Rating:

- Below 1 HP

- 1 HP to 5 HP

- Above 5 HP

- By Application:

- Agriculture (Irrigation, Livestock Watering)

- Residential & Domestic Use

- Municipal & Community Water Supply

- Industrial & Commercial (Mining, Construction, Water Treatment)

Value Chain Analysis For AC and DC Solar Water Pumps Market

The value chain for the AC and DC Solar Water Pumps Market begins with upstream analysis centered on the sourcing and manufacturing of core components. This involves the production of PV modules (silicon processing, cell fabrication, module assembly), the manufacture of specialized motors (primarily BLDC motors for DC pumps and standard AC motors), and the development of sophisticated electronic controllers (MPPT technology, inverters). Upstream efficiency is heavily influenced by global solar supply chain dynamics, particularly the cost and availability of raw silicon and the technological leadership of Asian manufacturers in PV and motor components. Strategic relationships at this stage focus on ensuring quality control, component longevity, and achieving scale economies to drive down the overall system cost, which is crucial for market penetration in price-sensitive developing regions.

The midstream segment involves system integration and assembly. This is where specialized solar pump companies design the complete system, selecting compatible PV arrays, pump size, and controller specifications tailored to specific flow and head requirements. The integration process is highly localized, often involving regional distributors who package imported components with locally sourced hardware (like piping and mounting structures) to create market-ready solutions. Distribution channels are diverse, encompassing direct sales to large governmental agricultural projects, indirect distribution through vast networks of local dealers and installers targeting individual farmers, and e-commerce platforms for smaller, standardized systems. Effective midstream management is critical for providing technical support and ensuring adherence to local regulatory standards and subsidy criteria.

Downstream analysis focuses on installation, commissioning, after-sales service, and end-user uptake. Installation typically requires certified technicians due to the complexity of integrating electrical systems with plumbing infrastructure, especially for submersible setups. Post-sale support, including warranty services, preventative maintenance contracts, and spare parts availability, significantly influences customer satisfaction and system longevity, particularly in remote areas. Direct channels are often utilized by major manufacturers dealing with large commercial or governmental tenders, ensuring strict quality control and customized solutions. Indirect channels, relying on local service providers and retailers, are paramount for reaching the dispersed rural customer base, requiring robust training programs for these partners to maintain service quality and system performance over the long operational life of the solar pump infrastructure.

AC and DC Solar Water Pumps Market Potential Customers

Potential customers for AC and DC Solar Water Pumps span several key sectors, unified by the need for reliable, cost-effective, and sustainable water access, often in areas underserved by centralized electricity grids. The largest and most immediate customer base resides within the agricultural sector, ranging from smallholder farmers utilizing DC pumps for micro-irrigation systems to large commercial farms requiring high-volume AC submersible pumps for extensive field coverage. Farmers are incentivized by the promise of predictable irrigation costs, especially as diesel prices fluctuate, coupled with government subsidies that significantly mitigate the initial capital outlay. This cohort values system durability, operational simplicity, and the guarantee of water availability during critical growing seasons, directly impacting their crop yields and economic stability.

Another crucial customer segment is the rural and residential population in developing nations and remote regions globally. These end-users typically require smaller DC pumping systems for domestic water supply, including drinking water and household use. Their primary motivation is improved health outcomes, reduced labor associated with manual water fetching, and enhanced quality of life. Humanitarian organizations and NGOs frequently act as intermediaries, procuring these systems for community water projects, making ruggedness, ease of repair, and standardized parts essential buying criteria. The market is increasingly seeing demand from semi-urban areas and peripheral settlements seeking to reduce dependency on often unreliable municipal water supplies.

Furthermore, the market serves specialized industrial and infrastructure applications. This includes construction sites requiring temporary dewatering solutions, mining operations needing water management in remote locations, and municipal water authorities utilizing solar pumps for supplementary reservoir filling, aeration, or sewage treatment in off-grid facilities. These professional customers prioritize high-efficiency, industrial-grade pumps with advanced monitoring capabilities, often integrating them into larger SCADA or IoT networks. The increasing prevalence of decentralized utility services and the pursuit of corporate sustainability targets further expand the scope of potential commercial and industrial buyers globally, focusing on long-term asset value and minimal environmental footprint.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 3.96 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Grundfos, Lorentz, Franklin Electric, KSB, Shakti Pumps, Tata Power Solar, Lubi Pumps, SunEdison, Flowserve Corporation, Mono Pumps, C.R.I. Pumps, Bright Solar, Comprehensive Power Systems, BW Solar, Netafim, Xylem Inc., WAAREE Energies, Lanco Solar Energy, GreenPumps, Jain Irrigation Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

AC and DC Solar Water Pumps Market Key Technology Landscape

The technological evolution of the AC and DC Solar Water Pumps Market is fundamentally centered on enhancing energy conversion efficiency, reliability, and smart functionality. The most critical advancement lies in the widespread adoption of Maximum Power Point Tracking (MPPT) technology within solar pump controllers. MPPT controllers dynamically adjust the electrical load to match the instantaneous maximum power output of the solar array under varying irradiance and temperature conditions, ensuring the pump operates optimally throughout the day, significantly increasing the volume of water pumped compared to non-MPPT systems. For DC systems, the shift towards advanced Brushless DC (BLDC) motors is a game-changer. BLDC motors eliminate the need for brushes, reducing wear and tear, enhancing system longevity, and achieving significantly higher efficiencies (often over 90%) compared to older brushed DC motors, making them ideal for remote, maintenance-sensitive applications.

Further technological differentiation is provided by the continuous development of submersible pump designs. Modern submersible pumps feature robust, corrosion-resistant materials (like stainless steel) and innovative sealing mechanisms to withstand harsh groundwater environments and minimize maintenance requirements. Emphasis is also placed on integrating electronic protection features directly into the pump or controller, such as dry-running protection, which automatically shuts down the pump when the water level drops too low, preventing motor burnout. This feature is crucial for preventing catastrophic failures and extending the lifespan of the asset, directly addressing a major concern for farmers dependent on fluctuating water sources.

The integration of Information and Communication Technology (ICT), often referred to as IoT (Internet of Things) functionality, represents the cutting edge of the market. Modern solar pump controllers are increasingly equipped with cellular or satellite connectivity, allowing remote monitoring of system performance, water levels, energy yield, and fault diagnosis from centralized platforms. This connectivity facilitates proactive maintenance and allows for the implementation of smart irrigation protocols based on real-time environmental data. For large commercial installations, the capability to remotely adjust pump speeds and track performance metrics is essential for optimizing water distribution across vast agricultural landscapes, turning the solar pump system into an integral part of a comprehensive, data-driven farm management solution.

The technological landscape is further defined by the evolution of hybrid solar pumping systems. These systems are designed to maximize water delivery by intelligently utilizing solar power as the primary source while seamlessly drawing supplementary power from the grid, a generator, or a battery bank when solar irradiance is low or demand is high. The complexity of managing these multiple power sources is handled by sophisticated hybrid inverters and controllers that prioritize the use of free solar energy, thereby ensuring continuous water availability without sacrificing the economic benefits of renewable energy. This ability to ensure 24/7 reliability overcomes one of the primary historical drawbacks of solar-only pumping systems, making them viable for essential services like municipal water supply and critical industrial processes. These hybrid solutions require advanced power electronics and load management algorithms to switch power sources instantaneously and efficiently, protecting the pump motor from voltage spikes and ensuring smooth operation regardless of the fluctuating availability of solar power.

Furthermore, material science improvements play a quiet but vital role in market advancement. The development of advanced polymer materials and specialized coatings for impellers and pump casings enhances hydraulic efficiency and resistance to abrasion from sand and particulates often found in groundwater, a critical factor for pump longevity in harsh environments. Simultaneously, solar panel technology continues to improve with higher efficiency PERC (Passivated Emitter Rear Cell) and bifacial modules, allowing for more power generation from smaller array footprints, which reduces installation space and component costs. The synergy between high-efficiency panels, smart MPPT controllers, and robust BLDC motors is collectively driving the overall system efficiency upward, directly impacting the market's value proposition by requiring fewer components to achieve the desired water output, accelerating the return on investment for end-users across all application segments, from residential to large-scale infrastructure projects requiring extreme reliability and minimum field maintenance.

Regional Highlights

Regional variations in the AC and DC Solar Water Pumps Market are pronounced, reflecting differences in solar irradiation, agricultural dependency, and government policies. Asia Pacific (APAC) holds the dominant market share and exhibits the highest growth potential, largely driven by massive government initiatives in India (e.g., KUSUM scheme) and China focused on replacing diesel pumps to manage energy costs and reduce environmental impact in vast agricultural belts. The high population density, coupled with reliance on monsoon-dependent agriculture, makes reliable water access critical. The region's market is characterized by intense price competition and a strong preference for high-quality, subsidized systems, making it a volume-driven market where local manufacturing capability is a significant competitive advantage.

The Middle East and Africa (MEA) region represents the fastest-growing market, driven by the acute necessity for off-grid water solutions. Many countries in Sub-Saharan Africa lack reliable grid infrastructure, making solar pumps the default choice for domestic use, livestock watering, and community water schemes funded by international development organizations. High solar irradiance and pressing climate change impacts, which necessitate drought mitigation strategies, provide powerful impetus. In the Middle East, high-efficiency systems are adopted in specialized large-scale farming projects and remote oil and gas operations to reduce reliance on expensive conventional energy sources and meet growing sustainability mandates, focusing on low-maintenance, robust systems built for extreme heat.

North America and Europe constitute mature markets characterized by replacement demand, stringent quality standards, and adoption in niche, high-value applications. In North America, solar pumps are primarily used in remote ranching operations, environmental remediation, and specialized organic farming where adherence to renewable energy mandates is important. The focus is on technologically sophisticated systems integrated with smart monitoring and capable of high performance in deep well applications. Europe leverages solar pumping for small-to-medium sized farms, particularly in Southern countries, and increasingly for rainwater harvesting and residential landscaping, demanding highly durable, aesthetically pleasing, and silent-running systems that comply with strict EU environmental and electronic standards.

- Asia Pacific (APAC): Dominates market size due to massive government subsidy schemes (India, China) targeting millions of farmers and high dependence on agricultural output.

- Middle East & Africa (MEA): Fastest growing market driven by urgent need for off-grid water access, high solar potential, and development projects focusing on rural water supply.

- North America: Focus on specialized, high-efficiency pumps for remote agricultural operations (ranching) and environmental management (groundwater remediation).

- Europe: Stable growth driven by replacement demand, adherence to environmental regulations, and niche applications in horticulture and specialty agriculture.

- Latin America: Emerging market with strong potential in Brazil and Argentina, supported by growing agricultural exports and expanding solar energy infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the AC and DC Solar Water Pumps Market.- Grundfos

- Lorentz

- Franklin Electric

- KSB

- Shakti Pumps

- Tata Power Solar

- Lubi Pumps

- SunEdison

- Flowserve Corporation

- Mono Pumps

- C.R.I. Pumps

- Bright Solar

- Comprehensive Power Systems

- BW Solar

- Netafim

- Xylem Inc.

- WAAREE Energies

- Lanco Solar Energy

- GreenPumps

- Jain Irrigation Systems

Frequently Asked Questions

Analyze common user questions about the AC and DC Solar Water Pumps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the key difference between AC and DC solar water pumps, and which is more efficient?

DC solar pumps connect directly to the solar panels, eliminating inverter losses, making them generally more efficient for low-power (below 5 HP) and small-scale applications. AC solar pumps require an inverter to convert DC power, but they are necessary for high-power, high-head applications and compatibility with standard infrastructure, offering higher flow rates for commercial farms.

What is the typical lifespan and maintenance requirement for a solar water pumping system?

The lifespan of the entire system is typically 15 to 25 years, contingent upon component quality; PV panels last over 25 years, while pump motors usually last 5 to 10 years before requiring service. Maintenance is minimal, primarily involving cleaning solar panels, checking electrical connections, and occasionally servicing the pump motor or replacing wear-and-tear parts like seals or bearings.

How do MPPT controllers improve the performance of solar water pumps?

Maximum Power Point Tracking (MPPT) controllers continuously optimize the electrical load impedance to ensure the solar panels operate at their peak power voltage, regardless of changes in solar irradiance or temperature. This dynamic optimization maximizes the energy harvest throughout the day, significantly increasing the total volume of water pumped compared to fixed-voltage controllers, directly improving the system's economic output.

Are solar water pumps suitable for deep well applications, and what capacity is typically needed?

Yes, solar water pumps are highly suitable for deep well applications. Specialized submersible pumps (both AC and DC) designed for high head (lifting distance) are available. Systems often range from 3 HP to over 10 HP for deep wells exceeding 100 meters, requiring high-quality motors and robust solar arrays to generate sufficient pressure and flow rates necessary for extracting water from significant depths.

What role do government subsidies play in the adoption of solar water pumps globally?

Government subsidies are the single most significant driver of mass adoption, especially in developing nations (like India and African countries). Subsidies reduce the high initial capital cost burden for farmers, making the long-term operational savings immediately accessible and accelerating the transition from polluting diesel pumps to sustainable solar alternatives, thereby ensuring food and water security.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager