Accenture Connected Truck Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438876 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Accenture Connected Truck Market Size

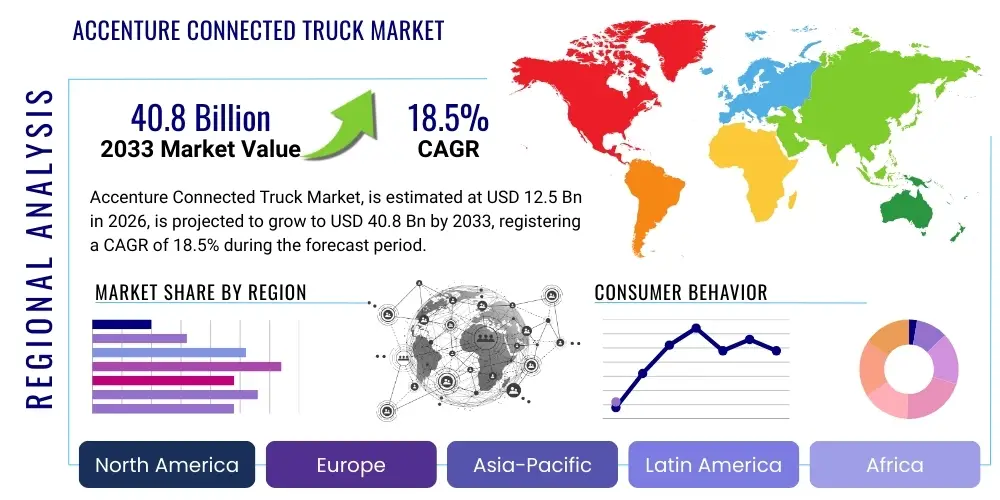

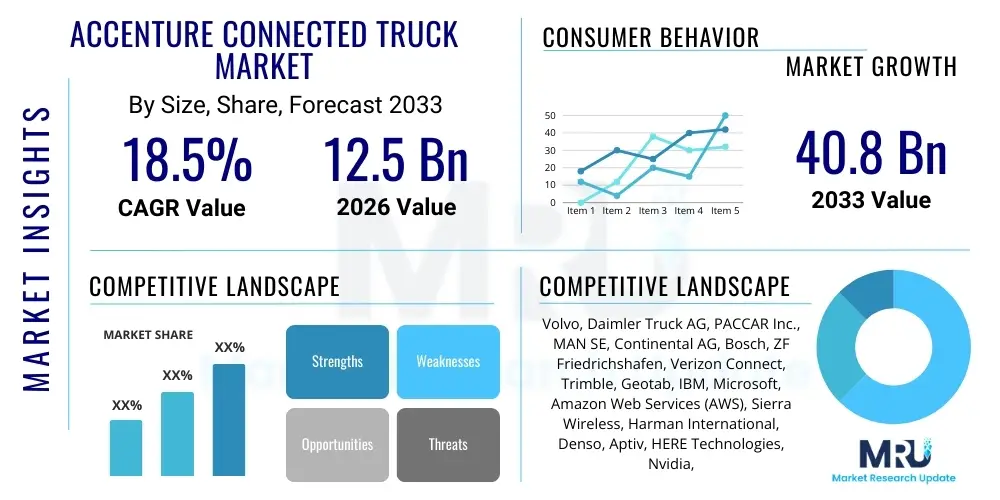

The Accenture Connected Truck Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 40.8 Billion by the end of the forecast period in 2033.

Accenture Connected Truck Market introduction

The Accenture Connected Truck Market encompasses the deployment of advanced digital solutions, telematics, Internet of Things (IoT) technologies, and robust data analytics frameworks within the commercial trucking sector. This ecosystem focuses on enhancing vehicle performance, operational efficiency, safety, and regulatory compliance through real-time data exchange between the vehicle, its infrastructure, and cloud-based management systems. Products within this market include specialized hardware (sensors, electronic control units, communication modules), proprietary software platforms for data processing and visualization, and comprehensive professional services provided by firms like Accenture, covering integration, cybersecurity, and strategic consulting for digital transformation.

Major applications of connected truck solutions span critical areas such as sophisticated fleet management, highly accurate predictive maintenance, optimization of supply chain logistics, driver behavior monitoring, and advanced driver assistance systems (ADAS). The integration of 5G connectivity and edge computing is fundamentally transforming the capabilities of these systems, allowing for low-latency communication essential for autonomous driving features and real-time decision-making processes. Accenture plays a pivotal role in this transformation by offering end-to-end digital services, from defining digital strategy to implementing scalable, secure cloud architectures tailored for large-scale fleet operations.

The primary benefits driving market adoption include substantial reductions in operational costs achieved through optimized routing and fuel consumption, improved uptime realized via preemptive component failure warnings, and significant enhancements in road safety through continuous monitoring and coaching. Furthermore, the ability to generate verifiable data aids regulatory compliance (e.g., Electronic Logging Devices—ELDs) and provides valuable business intelligence for strategic asset investment and resource allocation. The market is primarily driven by increasing global demand for efficient logistics, stringent emissions regulations requiring optimized engine performance, and the accelerating commercialization of Level 4 and Level 5 autonomous truck technologies.

Accenture Connected Truck Market Executive Summary

The Accenture Connected Truck Market is experiencing rapid expansion, fueled by macro-level business trends centered on supply chain digitalization and the critical need for operational resilience. Key business trends include the convergence of traditional Original Equipment Manufacturers (OEMs) with technology giants, leading to integrated vehicle-as-a-service (VaaS) models, and the prioritization of data monetization strategies by fleet operators seeking to leverage vehicle telemetry for insurance, financing, and parts ordering optimization. The ongoing global shortage of skilled truck drivers further accelerates the demand for automation and advanced driver assistance systems, positioning connected technology as a core strategic investment rather than a peripheral luxury. Cybersecurity remains a significant market focal point, demanding comprehensive, multilayered solutions to protect sensitive operational data and prevent remote system manipulation.

Regionally, North America maintains market dominance due to high levels of technological adoption, robust telematics mandates (such as the ELD mandate), and the presence of major logistics hubs and technology development centers. Europe follows closely, driven by stringent environmental standards, regulatory pressure for enhanced driver safety, and heavy investment in cross-border logistics infrastructure supported by smart road initiatives. Asia Pacific (APAC) is projected to exhibit the fastest growth, propelled by the massive scale of its emerging logistics markets, rapid infrastructure development, and governmental initiatives promoting smart city and intelligent transportation systems, particularly in countries like China and India.

Segment trends indicate a strong shift towards the Software and Services components, which are increasingly differentiated by advanced Artificial Intelligence (AI) and Machine Learning (ML) capabilities for predictive analytics. While Hardware deployment remains foundational, its value proposition is transitioning from mere data acquisition to complex edge processing capabilities. Within applications, Predictive Maintenance and Advanced Fleet Management solutions capture the largest market share, reflecting fleet operators' immediate return-on-investment requirements related to asset uptime. The heavy-duty truck segment continues to be the largest consumer of connected technology, primarily due to the higher capital investment and critical nature of long-haul operations, where even minor efficiency gains result in substantial savings.

AI Impact Analysis on Accenture Connected Truck Market

User inquiries regarding the influence of AI on the Accenture Connected Truck Market frequently center on themes of autonomy, operational cost reduction, and data security. Common questions explore how AI models enable true predictive maintenance beyond simple diagnostics, the role of machine learning in optimizing dynamic route planning in real-time traffic conditions, and the necessary cybersecurity frameworks required to protect AI-driven decision-making processes embedded at the vehicle level (edge AI). Users are also keen to understand how AI-powered driver monitoring systems enhance safety protocols and mitigate liability risks, often asking about the ethical implications and data privacy issues associated with continuous driver surveillance. The consensus expectation is that AI will transition connected trucks from merely reporting data to actively optimizing and automating core driving and maintenance functions, leading to significant disruption across the trucking value chain.

AI is fundamentally reshaping the operational landscape by introducing unprecedented levels of efficiency and foresight. Machine learning algorithms analyze vast datasets generated by connected vehicles—including engine parameters, geographical data, weather conditions, and driver input—to generate actionable insights that surpass traditional rule-based systems. This capability is critical for achieving truly optimized fuel consumption, where AI adjusts driving profiles and transmission settings dynamically based on topography and load conditions. Furthermore, AI facilitates complex logistical planning, enabling fleets to adjust delivery schedules and routes autonomously in response to unforeseen delays or congestion, ensuring just-in-time delivery efficiency and minimizing empty miles.

The integration of AI also significantly enhances safety and maintenance protocols. Deep learning models power vision systems and sensors for ADAS and autonomous driving, enabling complex environmental perception, hazard detection, and collision avoidance far faster and more reliably than human intervention. In maintenance, AI predictive failure models can isolate specific components that require attention days or weeks before a diagnostic trouble code (DTC) is generated, transforming maintenance from a reactive or scheduled process to a precise, condition-based activity. Accenture's role involves architecting the necessary scalable cloud infrastructure and edge compute power to run these computationally intensive AI models securely and reliably across diverse fleet sizes.

- AI-powered Predictive Maintenance: Utilizes ML algorithms to forecast component failure with high accuracy, minimizing unplanned downtime.

- Dynamic Route Optimization: Real-time traffic and weather analysis driven by AI ensures the most efficient route and time-of-arrival (ETA) predictions.

- Enhanced Driver Assistance Systems (ADAS): AI enables sophisticated sensor fusion and decision-making for advanced collision mitigation and automated driving functions.

- Optimized Fuel Consumption: Machine learning adjusts engine and transmission parameters dynamically based on driving environment and load weight.

- Fraud and Cybersecurity Detection: AI models rapidly identify anomalous data patterns indicative of attempted system intrusion or sensor tampering.

DRO & Impact Forces Of Accenture Connected Truck Market

The Accenture Connected Truck Market is propelled by strong Drivers related to global efficiency demands and restrained by challenges predominantly concerning technological integration and data governance, creating substantial Opportunities through emerging standards and infrastructure development. The primary driving forces include the intensified global focus on reducing logistics costs, mandatory regulatory compliance (e.g., driver hours of service tracking and emissions monitoring), and the compelling business case for enhancing vehicle utilization and asset tracking accuracy. These drivers compel fleet owners, particularly large logistics providers and OEMs, to adopt comprehensive connected solutions to maintain competitiveness and adhere to legal requirements across disparate jurisdictions. Simultaneously, the promise of achieving fully autonomous trucking represents the ultimate catalyst, driving massive investment into necessary foundational technologies like high-bandwidth 5G connectivity and sophisticated sensor arrays.

Restraints primarily revolve around the high initial capital investment required for comprehensive fleet digitalization, particularly concerning retrofitting older vehicles with advanced telematics and sensor hardware. Furthermore, data security and privacy concerns pose a significant barrier; fleet operators are cautious about managing sensitive operational data and protecting proprietary routing information from external threats. Lack of standardized communication protocols across different OEM platforms and varying regulatory frameworks globally also hinder seamless large-scale deployment. The technical complexity of integrating multiple legacy systems (e.g., dispatch, enterprise resource planning, vehicle diagnostics) with new cloud-based connected platforms requires specialized expertise, often leading to implementation delays and increased service costs.

Opportunities are extensive, particularly in developing sophisticated data monetization strategies where the generated vehicle telemetry is leveraged beyond operational improvement to create new revenue streams, such as bespoke insurance products based on driving behavior (Usage-Based Insurance, UBI) or predictive parts ordering for supply chain partners. The growing trend toward electrification of commercial vehicles presents a substantial opportunity for connected solutions focused on battery health monitoring, charging infrastructure management, and range optimization. Furthermore, the expansion into underserved regional markets, especially across Latin America and parts of Africa, represents untapped potential for basic and intermediate telematics deployments focused initially on security and location tracking. The key impact forces dictating market evolution include rapid advancements in edge computing capabilities, the accelerating rollout of global 5G networks providing necessary bandwidth for high-definition data streaming, and intensifying competitive pressure among telematics providers to offer differentiated, AI-powered predictive services.

Segmentation Analysis

The Accenture Connected Truck Market is meticulously segmented based on components, connectivity, application, and vehicle type, allowing for precise market targeting and strategic development of specialized solutions. This structure reflects the diverse operational needs within the commercial logistics sector, ranging from short-haul light-duty operations requiring basic fleet management to complex long-haul heavy-duty fleets demanding integrated autonomous functionality and predictive maintenance. The Component segmentation highlights the shift in market value capture from proprietary hardware towards scalable, subscription-based software and high-value professional services, which drive continuous revenue streams and facilitate ongoing customer relationship management and technological upgrades.

The Application segments clearly demonstrate where immediate ROI is achieved, with Fleet Management and Predictive Maintenance dominating the current adoption curve due to their direct impact on reducing operational expenses and enhancing vehicle uptime. The emerging segment of Driver Assistance and Safety Systems, however, is projected to witness the highest growth, driven by increasing safety mandates and the technological maturity of ADAS required for semi-autonomous operations. The segmentation by connectivity further distinguishes between solutions requiring high-frequency, long-range communication (e.g., cellular 4G/5G for real-time telemetry and over-the-air updates) and those utilizing short-range protocols (e.g., Bluetooth, Wi-Fi) primarily for localized diagnostics, sensor aggregation, and secure vehicle-to-infrastructure (V2I) communications at depots or loading docks.

Vehicle Type segmentation recognizes the fundamental difference in requirements between light, medium, and heavy-duty vehicles. Heavy-duty trucks represent the largest revenue contributor due to their long operational lifecycles, high annual mileage, and the necessity for sophisticated engine and load monitoring systems. Accenture's strategy must align segmentation insights with tailored service offerings, such as providing advanced data analytics for heavy-duty fleet OEMs and focusing on cost-effective, scaled solutions for small to medium-sized light-duty fleet operators.

- By Component: Hardware (Telematics Control Units, Sensors, Communication Modules, Displays), Software (Fleet Management Solutions, Data Analytics Platforms, Security Software), Services (Managed Services, Professional Consulting, Integration and Implementation).

- By Connectivity: Short-range Communication (Bluetooth, Wi-Fi), Long-range Communication (Cellular 4G/LTE, 5G, Satellite).

- By Application: Fleet Management (Monitoring, Tracking, Routing, Dispatch), Predictive Maintenance, Driver Assistance and Safety Systems (ADAS, Driver Monitoring), Infotainment and Telematics, Vehicle Diagnostics.

- By Vehicle Type: Light-Duty Trucks, Medium-Duty Trucks, Heavy-Duty Trucks.

Value Chain Analysis For Accenture Connected Truck Market

The value chain of the Accenture Connected Truck Market begins with Upstream activities dominated by component manufacturers and hardware suppliers responsible for producing specialized IoT sensors, communication modules, edge computing units, and embedded operating systems. These suppliers, often large global technology firms like Qualcomm, Nvidia, and various sensor manufacturers, focus on miniaturization, robustness, and compliance with automotive standards. Raw data is generated at this stage, captured by sophisticated vehicle sensors and transmitted via hardware provided by telematics control unit (TCU) specialists. The quality and security of these upstream components are paramount, as they determine the integrity of the data stream that informs all subsequent decision-making processes.

Midstream processing involves data aggregation, security, and integration, where firms specializing in connectivity (telecom operators providing 5G/4G infrastructure) and platform providers (like Accenture, AWS, or Microsoft Azure) play a crucial role. Accenture primarily operates in this midstream and downstream segment, focusing on providing the secure cloud architecture, analytics platforms, and integration services required to transform raw vehicle data into meaningful business intelligence. This stage includes applying machine learning models for predictive insights and ensuring data is securely partitioned and managed in compliance with global data residency regulations. The effectiveness of the connected truck ecosystem hinges on the seamless and secure flow of data through this complex integration layer.

The Downstream phase focuses on service delivery and end-user consumption. This involves original equipment manufacturers (OEMs) who integrate these connected features into new vehicles, and aftermarket service providers who retrofit existing fleets. Distribution channels are categorized into direct channels, where major OEMs offer proprietary telematics solutions bundled with the truck sale (often integrated via Accenture’s OEM consulting practices), and indirect channels, involving independent telematics service providers (TSPs) and authorized third-party installers who target small and medium-sized enterprises (SMEs). The final delivery is the provision of actionable insights and software-as-a-service (SaaS) subscriptions to the end-users: the fleet operators, logistics companies, and truck owners who utilize the intelligence for operational decision-making, safety improvements, and resource optimization.

Accenture Connected Truck Market Potential Customers

The potential customer base for the Accenture Connected Truck Market is expansive, spanning various segments of the logistics and transportation ecosystem, all unified by the need to maximize asset utilization, enhance safety, and reduce operational expenditures. The primary and largest customers are major Commercial Fleet Operators, including dedicated logistics companies, common carriers, and third-party logistics (3PL) providers managing thousands of vehicles across vast geographical territories. These customers require enterprise-grade, highly scalable solutions that integrate seamlessly with existing Transportation Management Systems (TMS) and Enterprise Resource Planning (ERP) software, seeking advanced features such as optimized fuel management, complex routing, and integration with supply chain visibility platforms.

Another crucial customer segment includes Original Equipment Manufacturers (OEMs) of heavy and medium-duty trucks. OEMs are increasingly shifting their business model to offer connectivity as a standard feature, bundling telematics and digital services as a competitive differentiator. Accenture partners closely with these OEMs to design, implement, and manage these connected vehicle platforms (e.g., remote diagnostics, Over-the-Air—OTA—updates, proprietary fleet portals), essentially acting as a technology enabler for the OEM’s captive digital services division. This segment focuses heavily on achieving seamless digital integration and establishing new recurring revenue streams through subscription services.

Beyond these major players, the market extends to specialized niche customers, including insurance providers who leverage connected data for dynamic risk assessment and Usage-Based Insurance (UBI) models, governmental transportation and regulatory bodies requiring verifiable data for compliance and infrastructure planning, and utility companies or specialized industrial fleets operating mission-critical vehicles. Small and Medium-sized Enterprises (SMEs) operating smaller localized fleets also represent significant potential, though their requirements often necessitate more cost-effective, straightforward plug-and-play telematics solutions focused predominantly on basic tracking and regulatory compliance, offering a high-volume, low-margin opportunity for scaled deployment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 40.8 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Volvo, Daimler Truck AG, PACCAR Inc., MAN SE, Continental AG, Bosch, ZF Friedrichshafen, Verizon Connect, Trimble, Geotab, IBM, Microsoft, Amazon Web Services (AWS), Sierra Wireless, Harman International, Denso, Aptiv, HERE Technologies, Nvidia, Qualcomm, Telefonica, AT&T, Orange Business Services, Teletrac Navman, CalAmp, Octo Telematics, WirelessCar, Webfleet Solutions, Samsara, Omnitracs. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Accenture Connected Truck Market Key Technology Landscape

The technology landscape underpinning the Accenture Connected Truck Market is characterized by the confluence of advanced connectivity, robust cloud infrastructure, and intelligent data processing capabilities. High-speed, low-latency communication is critical, primarily facilitated by the rapid deployment of 5G cellular technology. 5G enables massive machine-to-machine communication necessary for streaming high-definition video feeds, transmitting detailed sensor data from hundreds of components simultaneously, and facilitating the near-instantaneous responsiveness required for vehicle-to-everything (V2X) communication, which is essential for collaborative maneuvering and autonomous platooning operations. The reliability of this continuous data flow is foundational to delivering real-time operational insights.

Complementing high-bandwidth connectivity is the reliance on Edge Computing, which allows data processing and analysis to occur directly within the vehicle’s specialized Telematics Control Unit (TCU) or at localized network gateways before being transmitted to the centralized cloud. This architecture is vital for time-sensitive applications, such as collision avoidance and autonomous system decision-making, where the fraction of a second saved by avoiding cloud latency can prevent catastrophic events. Edge computing also significantly reduces the bandwidth demands and cloud storage costs associated with continuously transmitting petabytes of raw vehicle data. Accenture focuses on deploying proprietary edge solutions that integrate seamlessly with hyperscale cloud environments (e.g., Azure, AWS, GCP).

Furthermore, the market relies heavily on sophisticated geospatial technologies, including high-definition mapping, real-time GPS tracking, and Geographic Information Systems (GIS) analysis. Cybersecurity protocols, particularly those focused on securing over-the-air (OTA) software updates and protecting the CAN bus (Controller Area Network) from external compromise, are non-negotiable technological requirements. The transition toward electric and hydrogen-powered trucks is also driving the development of specialized connected technologies focused on power management, predictive battery degradation modeling, and optimization of charging schedules based on grid availability and energy pricing, integrating the vehicle deeply into smart energy ecosystems.

Regional Highlights

- North America: Market Leader in Advanced Telematics and Autonomy Trials

North America holds the dominant market share, primarily driven by early adoption of sophisticated telematics mandated by regulations such as the ELD requirements, which standardize driver hours-of-service tracking. The region benefits from a highly advanced logistics infrastructure and the presence of leading technology developers and major OEMs deeply invested in connected vehicle R&D. The large scale of long-haul trucking operations across the U.S. and Canada necessitates high-efficiency solutions, accelerating the deployment of advanced predictive maintenance and fuel management systems. Furthermore, North America is the global epicenter for the testing and commercialization of Level 4 autonomous trucking technologies, creating intense demand for secure, high-bandwidth V2X connectivity and specialized AI platforms for perception and decision-making.

The market in this region is characterized by fierce competition among dedicated telematics service providers (TSPs) and major cloud solution providers. Fleet operators are not only focused on cost savings but are increasingly leveraging connectivity to address the chronic driver shortage by improving driver retention through better safety features and simplified digital workflows. Key markets like the United States and Mexico are also seeing significant cross-border connected services integration, requiring complex data security and compliance solutions managed by firms specializing in international standards, such as Accenture.

- Europe: Focus on Regulatory Compliance, Safety, and Environmental Standards

The European market is the second-largest, distinguished by its strong emphasis on stringent environmental regulations (e.g., Euro 6/7 standards), demanding precision in emissions monitoring and engine performance optimization, often achieved through connected diagnostics. European regulators are proactive in mandating safety technologies, driving high penetration of ADAS and intelligent speed assistance (ISA) systems. The market is fragmented due to diverse national regulations and multiple languages, requiring highly adaptable software platforms and specialized regional integration expertise.

The emphasis on multimodal transport and seamless cross-border logistics across the European Union encourages investment in sophisticated tracking and supply chain visibility tools. The rapid development of dedicated smart road corridors and vehicle platooning initiatives, particularly in Germany, Netherlands, and Scandinavia, further stimulates demand for advanced V2X communication technologies. The transition towards electric commercial vehicles in major urban centers also makes battery management and charging optimization a high-growth application segment in this region.

- Asia Pacific (APAC): Fastest Growth Driven by Infrastructure Development and Scale

APAC is projected to be the fastest-growing region, fueled by rapid urbanization, massive infrastructure investment, and the sheer scale of the transportation and logistics sectors in populous economies like China, India, and Japan. While adoption rates vary significantly, major markets are leapfrogging older technologies directly to 5G and sophisticated cloud-based solutions. Government initiatives aimed at Intelligent Transportation Systems (ITS) and smart cities are significant market drivers, particularly in China, where state-owned enterprises are heavily investing in large-scale connected fleet deployments.

The primary focus in many APAC sub-regions remains on basic security, asset tracking, and theft prevention, but rapidly advancing economies are moving quickly toward advanced fleet management and driver monitoring. India’s push for digitalization and the growth of e-commerce logistics create immense potential for medium and heavy-duty truck connectivity solutions. The fragmented nature of the logistics industry across Southeast Asia, characterized by numerous small fleet owners, necessitates flexible, modular, and affordable connected truck solutions.

- Latin America (LATAM) and Middle East & Africa (MEA): Emerging Markets with Security Focus

These regions represent significant opportunities for initial market penetration. In LATAM, the primary driver for connected truck adoption is security and asset protection, combating high rates of cargo theft and ensuring vehicle recovery. Basic and intermediate telematics solutions focused on GPS tracking and immobilization are highly prevalent. Brazil and Mexico are leading the adoption curve due to their large domestic logistics sectors.

The MEA region, particularly the Gulf Cooperation Council (GCC) countries, is investing heavily in smart infrastructure and diversifying their economies away from oil dependence, which includes modernizing logistics corridors. The harsh operating environments in the Middle East necessitate specialized connected systems for monitoring temperature, tire pressure, and component wear under extreme conditions. Both regions require robust satellite and hybrid connectivity solutions due to often-inconsistent terrestrial cellular coverage across long, remote routes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Accenture Connected Truck Market.- Volvo

- Daimler Truck AG

- PACCAR Inc.

- MAN SE

- Continental AG

- Bosch

- ZF Friedrichshafen

- Verizon Connect

- Trimble

- Geotab

- IBM

- Microsoft

- Amazon Web Services (AWS)

- Sierra Wireless

- Harman International

- Denso

- Aptiv

- HERE Technologies

- Nvidia

- Qualcomm

- Telefonica

- AT&T

- Orange Business Services

- Teletrac Navman

- CalAmp

- Octo Telematics

- WirelessCar

- Webfleet Solutions

- Samsara

- Omnitracs

Frequently Asked Questions

Analyze common user questions about the Accenture Connected Truck market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary role of AI in optimizing connected truck performance?

AI's primary role is to transition connected trucks from reporting status to actively predicting and optimizing operations. This includes using machine learning for predictive maintenance to minimize unexpected downtime, enabling dynamic route optimization based on real-time factors, and enhancing driver safety through highly accurate ADAS and driver behavior monitoring systems.

How does 5G connectivity impact the development of autonomous trucking?

5G is critical for autonomous trucking because it provides the necessary high bandwidth and ultra-low latency required for V2X communication, allowing vehicles to exchange critical safety and operational data almost instantaneously. This reliability is essential for supporting sensor fusion, remote operations, and secure, high-speed over-the-air (OTA) software updates.

What are the greatest challenges regarding data security in the connected truck ecosystem?

The greatest challenges involve securing the multiple entry points, including the vehicle's embedded systems (CAN bus), the communication channels (OTA updates), and the cloud infrastructure storing massive amounts of fleet data. Protecting sensitive operational data from cyber-attacks, preventing system manipulation, and ensuring compliance with varied global data privacy regulations (e.g., GDPR) are paramount concerns.

Which component segment is expected to show the highest revenue growth during the forecast period?

The Software and Services segments are projected to exhibit the highest growth rate. While hardware provides the foundation, the increasing reliance on subscription-based Fleet Management Systems (FMS), advanced data analytics platforms, and high-value professional consulting services provided by firms like Accenture drives recurring revenue and value differentiation.

How does the connected truck market contribute to sustainability and decarbonization goals?

Connected truck technology significantly supports sustainability goals by enabling precision optimization of vehicle performance, leading to substantial reductions in fuel consumption and carbon emissions. Predictive maintenance extends asset life, and advanced routing algorithms minimize total travel distance, directly contributing to fleet decarbonization and adherence to stringent environmental mandates.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager