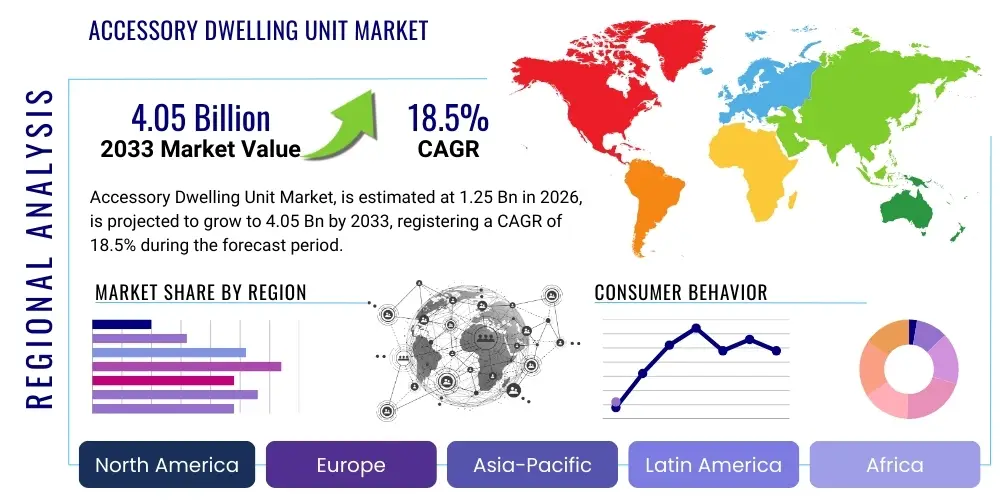

Accessory Dwelling Unit Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439287 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Accessory Dwelling Unit Market Size

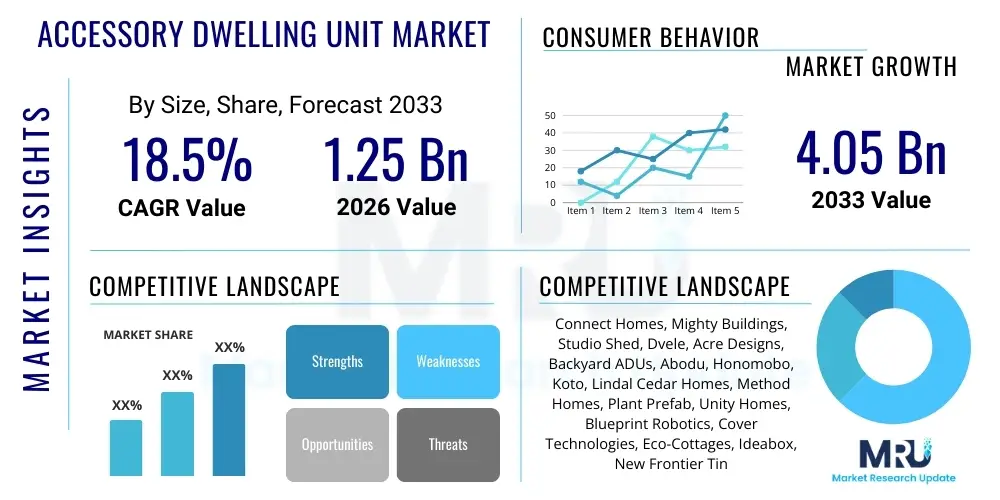

The Accessory Dwelling Unit Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 4.05 Billion by the end of the forecast period in 2033. This substantial growth is driven by evolving housing needs, regulatory shifts, and a growing recognition of ADUs as a flexible and sustainable housing solution across various demographics and geographic regions. The market expansion reflects a global trend towards optimizing existing land use and providing more diverse housing options within established communities, addressing challenges such as housing shortages and affordability.

Accessory Dwelling Unit Market introduction

The Accessory Dwelling Unit (ADU) market encompasses the design, construction, and integration of secondary housing units on properties with existing primary residences. These self-contained units, which can include detached structures, attached additions, or converted spaces within a main home (such as basements or garages), offer independent living facilities with their own kitchens, bathrooms, and sleeping areas. The product, an ADU itself, serves as a versatile solution to various socio-economic challenges, providing supplementary living space for family members, rental income opportunities for homeowners, or flexible accommodations for guests and remote workers. Its increasing popularity is a direct response to a burgeoning need for affordable housing and efficient land utilization in densely populated areas.

Major applications for ADUs span a wide range, from facilitating multi-generational living by housing elderly parents or adult children, to generating passive rental income for homeowners through short-term or long-term leases. They are also widely used as dedicated home offices, studios, or guest houses, offering privacy and flexibility that traditional home expansions might not provide. The benefits of ADUs are manifold, including increased property value, enhanced housing affordability, sustainable urban infill development, and the promotion of compact, walkable communities. Homeowners gain financial flexibility and improved quality of life, while communities benefit from increased housing density without significant infrastructure overhauls.

Several driving factors propel the ADU market forward. Foremost among these is the escalating housing affordability crisis in major urban and suburban areas, pushing both policymakers and homeowners to seek innovative solutions. Progressive zoning reforms and relaxed permitting regulations in many states and municipalities are significantly reducing barriers to ADU construction. Furthermore, demographic shifts, such as an aging population desiring to "age in place" near family and younger generations facing high housing costs, bolster demand for multi-generational living arrangements. The desire for passive income streams, coupled with advancements in modular and prefabricated construction techniques that reduce build times and costs, further accelerates market growth, making ADUs a highly attractive option for a diverse set of consumers.

Accessory Dwelling Unit Market Executive Summary

The Accessory Dwelling Unit (ADU) market is undergoing a period of significant transformation and expansion, driven by a convergence of favorable business trends and shifting societal needs. Key business trends include the emergence of specialized ADU design-build firms offering streamlined services, the proliferation of modular and prefabricated ADU manufacturers reducing construction timelines and costs, and increased investment from traditional construction companies diversifying into this burgeoning sector. Financial institutions are also adapting, introducing more favorable lending products specifically tailored for ADU construction, thereby easing the financial burden for potential homeowners. Digital platforms are playing a crucial role, simplifying the design, permitting, and construction process through online tools and marketplaces, making ADUs more accessible to a broader consumer base.

Regional trends indicate a strong concentration of ADU growth in areas with severe housing shortages and proactive regulatory reforms. North America, particularly states like California, Oregon, and Washington in the US, and provinces like British Columbia in Canada, are leading the charge due to aggressive legislative changes promoting ADU development. Europe is also witnessing a steady uptake, especially in countries addressing urban density and aging populations. The Asia Pacific region shows nascent but growing potential, particularly in developed economies grappling with similar housing pressures. These regional disparities are largely influenced by local zoning laws, cultural acceptance of secondary units, and the overall affordability landscape.

Segmentation trends highlight distinct preferences and evolving market dynamics. The detached ADU segment continues to dominate, offering maximum privacy and design flexibility, while garage and basement conversions remain popular cost-effective options. Prefabricated ADUs are gaining substantial traction due to their speed of deployment, quality control, and often lower upfront costs, challenging traditional site-built methods. Applications for rental income and multi-generational living consistently represent the largest demand drivers, reflecting both economic necessity and familial support structures. The market is also seeing an increase in ADUs designed specifically as dedicated home offices or studios, catering to the growing remote work culture, further diversifying the market's end-use segments.

AI Impact Analysis on Accessory Dwelling Unit Market

User questions regarding AI's impact on the Accessory Dwelling Unit (ADU) market frequently revolve around efficiency, cost reduction, and enhanced personalization. Common inquiries explore how AI can streamline the often-complex permitting and design processes, potentially making ADUs more affordable and accessible. Users are keen to understand if AI can predict optimal ADU placements, identify suitable property types, or even design units tailored to specific needs and local regulations. Concerns often include the initial investment required for AI-powered tools, the reliability of AI-generated designs, and the potential for job displacement within the architectural and construction sectors. There's also a significant interest in AI's role in future-proofing ADUs through smart home integration and sustainable design, balancing technological advancement with practical, user-centric benefits.

- AI can significantly expedite the permitting process by automating compliance checks against local zoning codes and building regulations, reducing manual review times and potential errors.

- Generative AI tools can rapidly produce diverse ADU design options based on user preferences, site constraints, and budget, optimizing space utilization and aesthetic appeal.

- AI-powered predictive analytics can forecast construction costs and timelines more accurately by analyzing historical data, material prices, and labor availability, improving project planning and financial transparency.

- Smart home integration, often enabled by AI, can enhance ADU functionality, offering automated climate control, security systems, and energy management, leading to greater comfort and lower operating costs for occupants.

- AI can optimize material selection and construction scheduling, leading to reduced waste, improved supply chain efficiency, and more sustainable building practices.

- Machine learning algorithms can analyze market data to recommend optimal rental pricing strategies for ADU owners, maximizing income potential and occupancy rates.

- AI-driven virtual reality and augmented reality platforms can provide prospective ADU owners with immersive design walkthroughs, helping them visualize their future unit and make informed decisions before construction begins.

- Automated drone inspections and AI-powered image analysis can enhance quality control during construction, identifying potential issues early and ensuring adherence to safety and design standards.

- AI tools can assist in site analysis, evaluating factors like sun exposure, slope, and existing utility connections to recommend the most efficient and cost-effective ADU placement.

- Chatbots and AI-driven support systems can provide homeowners with instant answers to common questions about ADU regulations, financing, and maintenance, improving the overall customer experience.

DRO & Impact Forces Of Accessory Dwelling Unit Market

The Accessory Dwelling Unit (ADU) market is powerfully shaped by a dynamic interplay of drivers, restraints, and opportunities, all contributing to various impact forces that either accelerate or impede its growth. Key drivers include the pervasive housing affordability crisis across global urban centers, which positions ADUs as a crucial, cost-effective solution for increasing housing stock without requiring extensive new land development. Concurrent with this, progressive legislative and zoning reforms in numerous jurisdictions are actively dismantling historical barriers to ADU construction, making them easier and more feasible to build. Furthermore, shifting demographics, particularly the rise of multi-generational households and the desire for elderly individuals to "age in place," fuel demand for accessible and proximate living solutions. The economic appeal of generating rental income for homeowners and the increasing adoption of sustainable, compact living principles also significantly propel market expansion.

Despite strong tailwinds, the ADU market faces notable restraints. High upfront construction costs, including design, permitting, and material expenses, remain a significant hurdle for many potential homeowners, despite the long-term financial benefits. The complexity and variability of local permitting processes, even with recent reforms, can still be a deterrent, causing delays and increasing project uncertainty. Community opposition, often stemming from concerns about increased traffic, parking strain, or changes to neighborhood character, can slow or even halt ADU projects in certain areas. Financing challenges, where traditional lenders may be hesitant or offer less favorable terms for ADU-specific loans, also limit market penetration. Finally, lot size limitations and restrictive covenants in some communities physically constrain the feasibility of building an ADU, particularly for detached units.

However, substantial opportunities exist to overcome these restraints and further unlock the market's potential. The ongoing innovation in prefabricated and modular ADU construction offers a compelling solution to high costs and long build times, promising increased efficiency and standardization. The integration of smart home technologies and sustainable building practices presents a chance to make ADUs even more attractive and future-proof, appealing to environmentally conscious consumers. Developing innovative financing models, such as specialized ADU loans, grants, or public-private partnerships, could significantly broaden access to capital for homeowners. Moreover, expanding the application of ADUs beyond traditional uses to include dedicated workspaces for the remote economy, specialized senior care units, or even temporary disaster relief housing opens new market segments. These opportunities, when strategically addressed, can amplify the positive impact forces and mitigate the restraining ones, fostering sustained growth in the ADU market.

Segmentation Analysis

The Accessory Dwelling Unit (ADU) market is broadly segmented to reflect the diverse range of unit types, construction methods, applications, and sizes, each catering to specific consumer needs and market dynamics. This detailed segmentation allows for a granular understanding of market trends, identifying key growth areas and niche opportunities within the broader ADU ecosystem. Analyzing these segments helps stakeholders, from policymakers to builders and homeowners, to better understand demand patterns, allocate resources effectively, and develop targeted strategies to address varying market requirements across different regions and demographics. The distinctions within these segments are critical for product innovation, marketing, and regulatory planning, ensuring that ADU solutions are adaptable and responsive to evolving housing demands and consumer preferences.

- By Type:

- Detached ADU: Standalone structures separate from the primary residence, offering maximum privacy.

- Attached ADU: Units physically connected to the primary residence, often sharing a wall or roofline.

- Interior Conversion ADU: Existing interior spaces (e.g., attics, unused rooms) within the primary home converted into an independent living unit.

- Garage Conversion ADU: Transforming an existing garage into a habitable ADU, often a cost-effective option.

- Basement Conversion ADU: Converting a basement or cellar into an independent living space, leveraging existing foundations.

- By Construction Method:

- Site-Built: Traditionally constructed on-site, offering customizability but potentially longer timelines.

- Prefabricated/Modular: Factory-built units delivered to the site for assembly, known for speed, cost efficiency, and quality control.

- By Application:

- Rental Income: Primarily for generating supplementary income through short-term or long-term leases.

- Multi-Generational Living: Housing family members such as elderly parents, adult children, or relatives for support and proximity.

- Guest House: Providing private accommodation for visitors.

- Home Office/Studio: Dedicated space for remote work, creative pursuits, or professional activities.

- Senior Care: Customized units designed for aging family members requiring specific accessibility features.

- Short-Term Rentals: Catering to tourists or temporary residents via platforms like Airbnb.

- By Size:

- Small (Under 500 sq ft): Compact units ideal for single occupants or minimalist living.

- Medium (500-800 sq ft): Versatile units suitable for small families or couples, balancing space and cost.

- Large (Over 800 sq ft): More spacious units offering greater living area, often comparable to small homes.

Value Chain Analysis For Accessory Dwelling Unit Market

The value chain for the Accessory Dwelling Unit (ADU) market begins with comprehensive upstream activities, primarily involving land acquisition and development, although ADUs typically leverage existing residential plots. This initial phase includes site assessment for feasibility, engaging architectural and engineering firms for design and structural integrity, and sourcing raw materials such as lumber, steel, concrete, and various finishing components. Key upstream players also include manufacturers of modular and prefabricated ADU components, who often work with standardized designs and materials to achieve economies of scale. The efficiency and cost-effectiveness of these upstream processes significantly impact the final price and timeline of ADU construction, necessitating strong supply chain management to ensure quality and timely delivery of materials and components. Relationships with material suppliers, architects, and structural engineers are foundational to the overall success of an ADU project.

Midstream activities primarily encompass the construction and assembly phase, where designs are brought to life. For site-built ADUs, this involves local contractors managing foundation work, framing, roofing, plumbing, electrical, and interior finishing. Modular ADUs, in contrast, are largely constructed off-site in controlled factory environments, then transported and assembled on the homeowner's property, which significantly reduces on-site disruption and weather-related delays. This stage also includes obtaining all necessary permits and inspections, which is a critical and often complex part of the process, requiring close coordination with local authorities. Project management, quality control, and adherence to building codes are paramount during this phase, ensuring that the ADU meets all safety standards and homeowner expectations.

Downstream activities focus on the distribution channels and post-construction services that connect the finished ADU to its end-users. Direct channels involve homeowners directly commissioning ADU builders or designers for their personal use. Indirect channels are emerging, where real estate agents or property developers may offer homes with pre-approved ADU plans or completed units as part of their portfolio. The distribution of ADU information and services often happens through online platforms, specialized ADU marketplaces, and local government housing initiatives. After construction, the value chain extends to property management services for rental ADUs, ongoing maintenance and repair services, and potential future upgrades. Financing institutions, legal advisors, and insurance providers also play crucial roles throughout the entire value chain, facilitating transactions and protecting investments for both builders and homeowners, ensuring a robust and well-supported market ecosystem.

Accessory Dwelling Unit Market Potential Customers

Potential customers for Accessory Dwelling Units (ADUs) are incredibly diverse, reflecting a broad spectrum of demographic and socio-economic groups driven by varying needs and motivations. A significant segment comprises existing homeowners seeking to enhance their property's value and utility. These individuals might include those looking to generate additional rental income to offset mortgage costs or provide a stable investment stream. Another large group consists of families requiring flexible living arrangements, particularly those with aging parents who wish to "age in place" close to their families while maintaining independence, or adult children needing an affordable living space as they navigate initial career stages. This multi-generational living trend is a powerful demographic driver for ADU adoption, offering both economic and social benefits.

Beyond traditional homeowners, the market also targets individuals and families interested in sustainable or minimalist living, seeing ADUs as an opportunity to downsize or reduce their environmental footprint while remaining in a desirable neighborhood. Entrepreneurs and remote workers form another growing customer base, utilizing ADUs as dedicated home offices, studios, or workshops that offer privacy and separation from the main living space. Investors and developers represent another critical segment, recognizing the potential for ADUs to increase the density and value of their real estate portfolios, especially in areas with high housing demand and favorable regulatory environments. These professional buyers are often interested in scaling ADU projects for multiple properties or integrating them into larger community development plans.

Finally, there's an emerging segment of customers in regions prone to natural disasters, where ADUs can serve as temporary or semi-permanent housing solutions during recovery efforts. Additionally, short-term rental market operators and hosts represent a specialized niche, looking to expand their lodging capacity and offerings through unique, independent units. The underlying commonality among all these potential customers is a demand for flexible, adaptable, and often more affordable housing solutions that can be customized to their specific lifestyle, financial, or familial requirements, all while maximizing the utility of their existing property or investment. Understanding these diverse motivations is key to effectively serving the expanding ADU market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 4.05 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Connect Homes, Mighty Buildings, Studio Shed, Dvele, Acre Designs, Backyard ADUs, Abodu, Honomobo, Koto, Lindal Cedar Homes, Method Homes, Plant Prefab, Unity Homes, Blueprint Robotics, Cover Technologies, Eco-Cottages, Ideabox, New Frontier Tiny Homes, Prefab ADU, Boxabl |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Accessory Dwelling Unit Market Key Technology Landscape

The Accessory Dwelling Unit (ADU) market is increasingly influenced by a diverse and evolving technology landscape aimed at streamlining the design, construction, and operational aspects of these units. One of the most significant technological advancements is in modular and prefabricated construction techniques. These methods leverage factory-controlled environments to build components or entire units off-site, utilizing advanced robotics, CAD/CAM software, and precise manufacturing processes. This approach significantly reduces construction time, minimizes waste, enhances quality control, and offers cost efficiencies compared to traditional site-built methods. Companies are increasingly adopting digital fabrication tools and Building Information Modeling (BIM) to create highly accurate and repeatable designs, ensuring consistent quality and faster deployment of ADUs.

Another crucial area is the application of smart home technologies and IoT (Internet of Things) integration. Modern ADUs are often equipped with intelligent systems for energy management, climate control, security, and lighting, all controllable via smartphone applications or voice commands. This not only enhances the comfort and convenience for occupants but also contributes to greater energy efficiency and reduced operational costs. Technologies like smart thermostats, automated lighting, networked security cameras, and integrated solar power systems are becoming standard features, making ADUs more appealing to tech-savvy homeowners and tenants. These systems often leverage AI and machine learning to optimize performance based on usage patterns and environmental conditions, further personalizing the living experience.

Furthermore, digital tools for design, permitting, and project management are transforming the ADU development process. Architectural software with advanced rendering capabilities allows homeowners to visualize their ADU designs in 3D, making informed decisions before construction begins. Online platforms and government portals are simplifying the permitting application process, offering digital submission and tracking, which reduces administrative burdens and expedites approvals. Project management software helps coordinate various stakeholders, including designers, contractors, and material suppliers, ensuring projects stay on schedule and within budget. The integration of virtual reality (VR) and augmented reality (AR) is also gaining traction, enabling immersive tours of proposed ADUs and aiding in design modifications, making the entire development lifecycle more transparent and efficient for all parties involved.

Regional Highlights

- North America: The North American market, particularly the United States and Canada, is a dominant force in the global ADU landscape. This region is characterized by progressive regulatory reforms, especially in California, Oregon, and Washington, which have significantly eased zoning restrictions and permitting processes. The acute housing affordability crisis in major metropolitan areas, coupled with a growing demand for multi-generational living arrangements and rental income opportunities, drives robust market growth. Advancements in modular construction and a strong ecosystem of specialized ADU builders and financiers further accelerate adoption.

- Europe: Europe represents a growing market for ADUs, driven by urban densification strategies, an aging population, and a focus on sustainable housing solutions. Countries like the UK, Germany, and the Netherlands are exploring ADU concepts to address housing shortages and provide flexible living options. While regulatory frameworks vary by country and region, there is increasing recognition of ADUs as a valuable tool for urban infill and supporting aging populations. The emphasis here is often on high-quality design, energy efficiency, and integration within existing community aesthetics.

- Asia Pacific (APAC): The APAC region presents a nascent but rapidly emerging market for ADUs, particularly in developed economies like Australia, New Zealand, and parts of Japan and South Korea. Drivers include increasing land prices, urbanization, and a cultural emphasis on multi-generational family support. Australia and New Zealand have seen significant growth due to similar housing pressures and evolving planning policies. The region's diverse regulatory landscape and varying cultural preferences for housing types mean that ADU solutions often need to be highly adapted to local contexts.

- Latin America: The ADU market in Latin America is in its early stages but shows significant potential, especially in urban centers grappling with informal settlements and housing deficits. While formal ADU development is less widespread, the concept of adding secondary units for family or rental income is culturally prevalent. Future growth will depend on supportive government policies, access to financing, and formalization of construction practices. Opportunities exist for affordable, scalable ADU solutions to address housing needs in rapidly urbanizing areas.

- Middle East and Africa (MEA): The MEA region is a diverse market with varying degrees of ADU adoption. In some rapidly developing urban areas in the Middle East, there is a focus on high-end, luxury ADUs as guest houses or amenities for large family compounds. In parts of Africa, ADU-like structures might be integrated into existing properties for family expansion or informal rental income. Formal market development will require significant policy development and investment in construction technology and infrastructure. The market here is highly segmented by economic development and local housing customs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Accessory Dwelling Unit Market.- Connect Homes

- Mighty Buildings

- Studio Shed

- Dvele

- Acre Designs

- Backyard ADUs

- Abodu

- Honomobo

- Koto

- Lindal Cedar Homes

- Method Homes

- Plant Prefab

- Unity Homes

- Blueprint Robotics

- Cover Technologies

- Eco-Cottages

- Ideabox

- New Frontier Tiny Homes

- Prefab ADU

- Boxabl

Frequently Asked Questions

Analyze common user questions about the Accessory Dwelling Unit market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is an Accessory Dwelling Unit (ADU)?

An ADU is a secondary, independent housing unit on the same property as a primary single-family home. It has its own kitchen, bathroom, and sleeping area, and can be detached, attached, or converted from existing space like a garage or basement.

How much does an ADU typically cost to build?

ADU costs vary widely based on size, type (detached, attached, conversion), construction method (site-built vs. prefab), location, and finishes. Generally, costs can range from $100,000 to over $400,000, not including permitting fees and site preparation.

What are the main benefits of building an ADU?

Key benefits include increased property value, potential for rental income, providing housing for multi-generational families or caregivers, creating a dedicated home office, and contributing to local housing supply and affordability.

Are ADUs legal everywhere, and what are the typical regulations?

ADU legality and regulations vary significantly by jurisdiction (city, county, state/province). Many areas are easing restrictions to promote ADUs, but homeowners must research local zoning, size limits, setback requirements, and permitting processes before building.

What are the different types of ADUs available?

Common ADU types include detached (freestanding), attached (part of the main house), garage conversions, basement conversions, and interior conversions (e.g., attic space). Each type offers different advantages regarding cost, privacy, and ease of construction.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager