Account Takeover Protection Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438728 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Account Takeover Protection Market Size

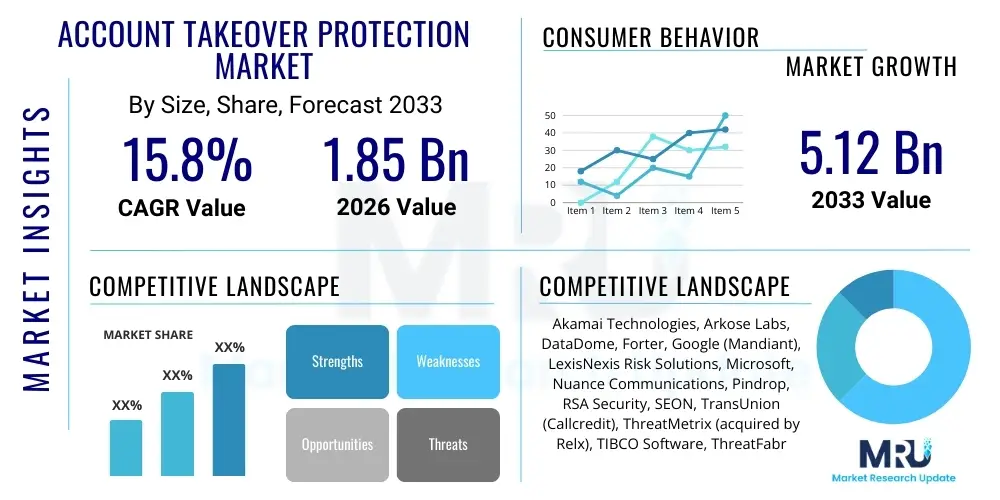

The Account Takeover Protection Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 1.85 billion in 2026 and is projected to reach USD 5.12 billion by the end of the forecast period in 2033.

Account Takeover Protection Market introduction

The Account Takeover Protection (ATP) Market encompasses sophisticated security solutions designed to detect and prevent unauthorized access to user accounts, safeguarding organizations against financial fraud, data breaches, and reputational damage. As digital interactions become pervasive across e-commerce, banking, and social platforms, the volume and sophistication of credential stuffing, phishing, and malware attacks aimed at compromising user identities have surged dramatically. ATP solutions utilize advanced techniques such as behavioral biometrics, device fingerprinting, real-time risk scoring, and machine learning to differentiate legitimate user activity from malicious attempts, ensuring continuous protection throughout the user journey from login to transaction execution.

ATP products are fundamentally critical for any organization operating a digital platform with stored user credentials or transactional capabilities. They function as a crucial layer of defense, often integrated with identity and access management (IAM) frameworks, by continuously analyzing context, behavior, and location data rather than relying solely on static authentication factors. Major applications span high-risk sectors including Banking, Financial Services, and Insurance (BFSI), where financial losses due to fraud are substantial, and the retail and e-commerce sector, which faces persistent threats from bots and organized fraud rings attempting to misuse loyalty points or stolen credit card details. The rise of mobile-first strategies necessitates ATP solutions that are equally effective across various device types and operating systems, providing a seamless yet secure user experience.

Key benefits derived from adopting robust ATP mechanisms include a significant reduction in fraud losses, improved customer trust and loyalty through enhanced security measures, and compliance with stringent regulatory requirements such as GDPR, CCPA, and PSD2, which mandate robust consumer data protection. The primary driving factors fueling market expansion are the exponential growth of online transactions globally, the increasing availability of stolen credentials on the dark web, and the persistent pressure on businesses to reduce operational friction while simultaneously bolstering security postures against evolving cyber threats. Furthermore, the shift towards remote work and the reliance on cloud-based infrastructure have broadened the attack surface, making comprehensive ATP indispensable for modern enterprises.

Account Takeover Protection Market Executive Summary

The Account Takeover Protection market is experiencing robust growth, primarily driven by critical business trends centered around digital transformation, regulatory compliance, and the escalating cost of cyber fraud. Businesses are moving away from traditional, reactive security models towards proactive, predictive ATP solutions that incorporate behavioral analytics and contextual authentication. Key industry participants are focusing on delivering solutions integrated via APIs and SDKs that offer minimal deployment friction and high scalability, particularly in cloud environments. Mergers, acquisitions, and strategic partnerships are defining the competitive landscape, as established cybersecurity firms integrate specialized AI-driven fraud detection startups to enhance their offering portfolios and achieve full-spectrum protection against evolving ATO methodologies.

Regional trends indicate North America currently dominates the market, largely due to early technology adoption, the presence of major technological hubs, and stringent regulatory environments in the financial sector that mandate robust fraud prevention measures. Europe follows closely, propelled by mandates like the Payment Services Directive 2 (PSD2), which emphasizes Strong Customer Authentication (SCA), thereby significantly driving demand for advanced, real-time risk assessment tools. Meanwhile, the Asia Pacific region is anticipated to demonstrate the highest Compound Annual Growth Rate (CAGR), fueled by the explosive growth of mobile banking, digital payments, and e-commerce across emerging economies, coupled with increasing governmental focus on establishing robust national cybersecurity frameworks.

Segmentation trends highlight the solution segment, particularly behavioral biometrics and threat intelligence platforms, as experiencing rapid adoption, overshadowing traditional rule-based systems. Cloud-based deployment models are preferred over on-premise solutions due to their elasticity, reduced maintenance overhead, and rapid deployment capabilities, aligning with the agile infrastructure requirements of modern enterprises. Furthermore, the BFSI vertical remains the largest consumer of ATP solutions, given the high-value transactions and sensitive customer data involved. However, the retail and gaming sectors are showing accelerated adoption rates, driven by the need to combat large-scale bot attacks targeting promotional offers, inventory, and loyalty programs.

AI Impact Analysis on Account Takeover Protection Market

User queries regarding the impact of Artificial Intelligence (AI) on the Account Takeover Protection market frequently revolve around its ability to predict novel attack vectors, reduce false positives, and counter sophisticated human-mimicking botnets. Users are concerned about whether AI can truly distinguish between complex automated attacks and genuine user behavior under unusual circumstances, seeking assurance on the accuracy and reliability of machine learning models in high-stakes environments. Common expectations include AI's role in enabling adaptive authentication, analyzing massive datasets in real-time to uncover subtle anomalies indicative of fraud, and integrating predictive threat intelligence into existing security orchestration platforms. There is also a recurring theme of concern regarding the potential misuse of generative AI by attackers (Adversarial AI) to craft highly convincing social engineering or credential compromise schemes, necessitating equally advanced defensive AI models.

AI and Machine Learning (ML) have fundamentally transformed the efficacy of ATP solutions by introducing predictive capabilities that move beyond mere signature matching or fixed rules. ML algorithms, particularly deep learning networks, are adept at ingesting vast amounts of telemetry data—including typing speed, mouse movements, device configurations, network details, and geographical data—to establish highly accurate baseline profiles of normal user behavior. This advanced profiling capability allows security systems to instantaneously score the risk associated with every login and session activity, flagging deviations that traditional systems would overlook. The continuous learning nature of these models allows the ATP platform to adapt rapidly to new fraud patterns, providing a dynamic defense against zero-day ATO techniques, which is a significant improvement over static security measures.

The implementation of AI/ML is directly correlated with a substantial reduction in false positives, a historical challenge for robust security systems where legitimate users were often unnecessarily inconvenienced by security checks. By refining risk scoring based on contextual evidence rather than isolated events, AI ensures that strong authentication challenges (like MFA) are only deployed when the risk score crosses a pre-defined threshold, thereby optimizing the balance between security and user experience (UX). Furthermore, AI enables automation in incident response, allowing security teams to automatically block high-risk sessions or initiate step-up authentication processes without manual intervention, dramatically improving response times against fast-moving, orchestrated ATO campaigns.

- AI enhances real-time behavioral biometrics analysis, enabling accurate identification of human versus automated traffic.

- Machine learning facilitates predictive risk scoring, identifying subtle anomalies in session data indicative of compromised credentials before fraud occurs.

- AI-driven fraud detection minimizes false positives, improving user experience by reducing unnecessary friction during authentication.

- Generative AI models are utilized defensively to simulate adversarial attacks (Adversarial AI Simulation), bolstering the resilience of the ATP system.

- Automation of response mechanisms (e.g., dynamic blocking, adaptive MFA triggering) is enabled by high-speed, AI-powered decision-making.

DRO & Impact Forces Of Account Takeover Protection Market

The dynamics of the Account Takeover Protection Market are governed by a robust interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively shape the competitive and technological landscape, acting as defining Impact Forces. Key drivers include the exponential growth in global e-commerce and digital services adoption, the corresponding surge in data breaches exposing credentials, and increasing regulatory pressure demanding sophisticated consumer protection measures, particularly in financial services. These drivers create an undeniable and urgent demand for proactive security solutions. However, market growth is constrained by high implementation costs, especially for smaller enterprises, the inherent complexity in integrating ATP solutions with legacy IT infrastructure, and the continuous challenge of managing false positives which can degrade the legitimate user experience. These elements require vendors to focus intensely on solution usability and cost-effectiveness to overcome adoption barriers.

Significant opportunities are emerging from the continued advancement in AI and behavioral biometrics technologies, offering unprecedented accuracy and adaptation to new threats. The market is also seeing expansion opportunities in new industry verticals, such as gaming, streaming services, and healthcare, which are rapidly digitizing their operations and accumulating high-value user data susceptible to ATO attacks. Furthermore, the global shift towards cloud-native architectures provides an ideal environment for deploying scalable, API-driven ATP services. These opportunities necessitate continuous innovation, pushing vendors to integrate advanced identity verification techniques and move towards a Zero Trust security model, where every access attempt is rigorously verified based on context and behavior, rather than assumed trust.

The overall impact forces driving the market expansion are overwhelmingly positive, dominated by the increasing frequency and sophistication of cyber threats. Organized cybercrime syndicates are investing heavily in automated tools for credential stuffing and phishing, creating a non-negotiable requirement for enterprises to invest in advanced protective layers. Regulatory mandates, particularly those related to consumer data privacy and financial transaction security (e.g., GDPR, PSD2), serve as powerful external forces accelerating adoption across regulated industries. The need to maintain high customer lifetime value and brand integrity in the face of publicized security failures further solidifies ATP as a strategic business investment rather than just an IT expense, ensuring sustained market growth and technological innovation aimed at preemptively neutralizing fraud attempts.

Segmentation Analysis

The Account Takeover Protection market is comprehensively segmented based on Solution Type, Service, Deployment Mode, Organization Size, and Industry Vertical, allowing for a granular analysis of adoption patterns and tailored technological requirements across diverse user groups. Solution types include sophisticated components such as behavioral biometrics, device fingerprinting, threat intelligence, and user authentication management tools, reflecting the necessary multilayered defense strategy required against modern ATO attacks. Deployment modes are primarily divided between cloud and on-premise, reflecting the ongoing global migration towards flexible cloud infrastructure, particularly among organizations prioritizing scalability and rapid deployment cycles. The diverse segmentation allows vendors to target specific high-risk needs, such as the stringent security demands of large financial institutions versus the scalability and API integration requirements of mid-sized e-commerce platforms.

Service segmentation includes professional services like consulting, integration, and training, which are crucial for successful deployment and operationalization of complex ATP platforms, ensuring optimal integration with existing security frameworks like SIEM and SOAR systems. Managed services, which involve outsourcing the monitoring and mitigation of ATO threats to specialized third-party providers, are gaining significant traction, particularly among small and medium-sized enterprises (SMEs) lacking dedicated in-house cybersecurity expertise. Segmentation by industry vertical clearly highlights the varying levels of risk and compliance requirements, with BFSI demanding the most robust and technologically advanced solutions due to high financial exposure, while other sectors like media, entertainment, and travel increasingly adopt solutions tailored to protect high volumes of customer accounts and loyalty programs.

Understanding these segments is vital for market forecasting and strategic investment, as specific segments exhibit disparate growth rates. For instance, while large enterprises historically favored on-premise solutions for perceived data control, the rapid scaling and maintenance ease of cloud deployments are making them the dominant choice across all organization sizes. Similarly, the rapid technological maturity of behavioral biometrics as a solution type is driving its market share, offering a frictionless yet highly secure alternative to traditional MFA methods. The segmentation analysis underscores the trend toward holistic, platform-based ATP offerings that integrate multiple detection techniques rather than relying on point solutions, meeting the demand for comprehensive digital identity protection.

- By Component: Solution (Behavioral Biometrics, Device Fingerprinting, Threat Intelligence, User Authentication Management), Service (Professional Services, Managed Services)

- By Deployment Mode: Cloud, On-Premise

- By Organization Size: Small and Medium Enterprises (SMEs), Large Enterprises

- By Industry Vertical: Banking, Financial Services, and Insurance (BFSI), Retail and E-commerce, Media and Entertainment, Healthcare, IT and Telecom, Government and Defense, Others (Travel, Gaming)

Value Chain Analysis For Account Takeover Protection Market

The Value Chain for the Account Takeover Protection market starts with upstream activities focused on foundational technological development, involving providers of core enabling technologies such as advanced machine learning frameworks, data analytics platforms, and specialized behavioral modeling algorithms. These upstream providers supply the intelligence and technological building blocks necessary for ATP solution developers to craft their proprietary platforms. Research and development teams within ATP firms focus intensely on aggregating global threat intelligence feeds, refining anomaly detection heuristics, and innovating frictionless authentication methods. Strategic partnerships with specialized AI/ML research institutions and data science experts are crucial at this stage to maintain a technological edge against rapidly evolving adversarial techniques.

The midstream segment of the value chain is dominated by the ATP solution providers themselves, who integrate the foundational technologies into marketable products. This involves developing robust, scalable platforms delivered typically via API or SDK, which are designed for seamless integration into customer applications and enterprise security ecosystems. Activities at this stage include software development, rigorous quality assurance testing, platform hardening, and ensuring compliance with regional data privacy regulations. Managed Security Service Providers (MSSPs) also play a critical midstream role, offering outsourced implementation, monitoring, and ongoing threat analysis, thereby enabling organizations without deep internal cybersecurity expertise to leverage sophisticated ATP capabilities effectively.

Downstream activities involve the crucial distribution channels and interaction with the end-users. Direct distribution, often favored by large vendors, involves direct sales teams engaging with large enterprises, particularly in the BFSI sector, offering customized deployments and high-touch professional services. Indirect distribution utilizes a network of value-added resellers (VARs), system integrators, and channel partners who help tailor the solution to local market needs and provide localized support. The final step involves the end-user deployment and continuous monitoring, where feedback loops inform the upstream R&D process, ensuring the ATP platform remains effective against current threats and adaptive to changes in user behavior and technological infrastructure.

Account Takeover Protection Market Potential Customers

Potential customers for Account Takeover Protection solutions are any entities that manage high-value digital accounts and conduct sensitive online transactions, placing them at significant risk of financial or reputational damage due to compromised user identities. The primary end-users fall into sectors characterized by high transaction volumes, sensitive personal data handling, or strong regulatory oversight regarding consumer protection. These customers are actively seeking solutions that can enhance security without compromising the speed or convenience of their user experience, driving demand for invisible authentication mechanisms like behavioral biometrics and dynamic risk assessment.

The largest segment of buyers remains the Banking, Financial Services, and Insurance (BFSI) sector, encompassing retail banks, wealth management firms, and insurance carriers. These institutions are mandated by regulations like PSD2 and FINRA to implement rigorous security protocols, making them continuous investors in advanced ATP solutions to mitigate colossal losses associated with wire transfer fraud, synthetic identity fraud, and malicious account activity. The rapid digitalization of these services, moving from branch-based interactions to mobile and online platforms, has accelerated their reliance on real-time fraud detection capabilities tailored for digital channels.

Other significant buyers include large-scale e-commerce and retail companies, which face constant automated attacks (botnets) aimed at inventory skimming, coupon abuse, and credential stuffing attacks that misuse stored payment information or loyalty points. Furthermore, the burgeoning online gaming, social media, and streaming service industries are increasingly becoming critical consumers, as they must protect vast numbers of user accounts (often with linked payment methods) from phishing and credential stuffing to maintain subscriber trust and reduce customer support costs associated with compromised accounts. Government services and healthcare organizations are also emerging buyers, motivated by the need to secure citizen portals and electronic health records (EHR) against sophisticated cyber intrusions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 billion |

| Market Forecast in 2033 | USD 5.12 billion |

| Growth Rate | CAGR 15.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Akamai Technologies, Arkose Labs, DataDome, Forter, Google (Mandiant), LexisNexis Risk Solutions, Microsoft, Nuance Communications, Pindrop, RSA Security, SEON, TransUnion (Callcredit), ThreatMetrix (acquired by Relx), TIBCO Software, ThreatFabric, BioCatch, F5 Networks, Imperva, Splunk, OneSpan |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Account Takeover Protection Market Key Technology Landscape

The technology landscape of the Account Takeover Protection market is defined by a convergence of cutting-edge identity verification methods and advanced analytical capabilities, moving significantly beyond simple password and username checks. The core technological foundation rests on sophisticated Machine Learning (ML) algorithms that are trained on massive datasets of legitimate and malicious user behavior. These algorithms power real-time risk engines that continuously assess session parameters. Key technologies include behavioral biometrics, which analyzes unique patterns such as typing cadence, scrolling speed, and navigation paths to verify identity invisibly. This technique provides a layer of continuous authentication throughout the session, making it extremely difficult for an attacker to maintain control of a compromised account without detection.

Another pivotal technology is device fingerprinting, which uniquely identifies the specific hardware and software configuration of the accessing device, including operating system, browser version, installed fonts, and network characteristics. By establishing a robust profile of the legitimate device, the system can instantly flag access attempts originating from unrecognized or spoofed environments, providing critical contextual data for the risk engine. Furthermore, advanced bot detection and mitigation technologies are essential, using cryptographic challenges and specialized heuristics to distinguish sophisticated human-mimicking bot traffic—often used in large-scale credential stuffing attacks—from genuine human interactions, ensuring that automated attacks are blocked at the perimeter before they can compromise user accounts.

Threat intelligence platforms also form a crucial part of the technological defense mechanism, aggregating data from global fraud rings, known compromised credentials databases, and dark web activity. This intelligence is utilized to blacklist known malicious IPs, identify compromised email addresses and phone numbers instantly, and preemptively block brute-force attempts. The integration of ATP solutions is increasingly achieved through lightweight, standards-compliant APIs and SDKs, facilitating easy deployment across web, mobile, and API endpoints. The future technological direction is focused on further integration with broader cybersecurity frameworks, such as Extended Detection and Response (XDR) and Security Information and Event Management (SIEM) systems, enabling a unified, context-aware security posture across the entire enterprise digital infrastructure.

Regional Highlights

The global Account Takeover Protection Market exhibits distinct regional dynamics shaped by varying levels of digital maturity, regulatory environments, and the prevalence of cybercrime.

- North America: This region holds the largest market share due to its high concentration of technology giants, early adoption of advanced cybersecurity solutions, and significant investments in digital commerce and fintech. The presence of numerous sophisticated cybercrime syndicates targeting high-value financial data mandates continuous expenditure on state-of-the-art ATP solutions. Regulatory requirements from bodies like the Federal Financial Institutions Examination Council (FFIEC) further compel BFSI institutions to prioritize robust fraud prevention frameworks.

- Europe: Europe represents a highly mature market, driven primarily by strong regulatory frameworks such as the General Data Protection Regulation (GDPR) and the Payment Services Directive 2 (PSD2). PSD2's mandate for Strong Customer Authentication (SCA) across financial transactions has directly fueled the demand for behavioral biometrics and adaptive risk assessment technologies that comply with these requirements while maintaining a smooth user flow. Western European countries, particularly the UK, Germany, and France, lead in adoption rates.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, characterized by explosive growth in mobile commerce, digital banking, and the swift expansion of the middle class accessing online services for the first time. Countries like China, India, and Southeast Asian nations are facing increasingly sophisticated domestic and international cyber threats. The need for scalable, cloud-based ATP solutions to protect rapidly expanding user bases in markets with diverse linguistic and technological environments is the key growth catalyst.

- Latin America (LATAM): The LATAM market is experiencing accelerated adoption driven by high levels of digital fraud, particularly in countries like Brazil and Mexico. Financial institutions and e-commerce platforms are investing heavily in ATP to combat local cybercrime groups leveraging sophisticated phishing and malware campaigns to compromise accounts. The market is increasingly receptive to managed security services to address internal resource constraints.

- Middle East and Africa (MEA): Growth in MEA is concentrated in the Gulf Cooperation Council (GCC) countries, fueled by massive government investments in digital infrastructure and smart city initiatives. As banks and government services rapidly digitize, the requirement for world-class ATO protection to safeguard critical national assets and consumer trust becomes paramount, driving partnerships with international ATP providers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Account Takeover Protection Market.- Akamai Technologies

- Arkose Labs

- DataDome

- Forter

- Google (Mandiant)

- LexisNexis Risk Solutions

- Microsoft

- Nuance Communications

- Pindrop

- RSA Security

- SEON

- TransUnion (Callcredit)

- ThreatMetrix (acquired by Relx)

- TIBCO Software

- ThreatFabric

- BioCatch

- F5 Networks

- Imperva

- Splunk

- OneSpan

Frequently Asked Questions

Analyze common user questions about the Account Takeover Protection market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Account Takeover Protection (ATP) and why is it critical for digital businesses?

ATP refers to security solutions that detect and prevent unauthorized access to user accounts, often utilizing advanced methods like behavioral biometrics and real-time risk scoring. It is critical because successful account takeovers (ATOs) lead to significant financial losses, data breaches, regulatory fines, and severe reputational damage, especially in high-transaction sectors like BFSI and e-commerce.

How do AI and Machine Learning contribute to effective ATP solutions?

AI/ML models are essential for establishing accurate baseline profiles of normal user behavior, analyzing vast telemetry data (device, location, typing speed) to detect subtle anomalies indicative of fraud attempts. This allows for predictive, dynamic authentication challenges, minimizing friction for legitimate users while blocking sophisticated automated attacks and reducing false positives.

What is the difference between device fingerprinting and behavioral biometrics in ATP?

Device fingerprinting uniquely identifies the hardware, software, and network configuration of the accessing device to verify its authenticity across sessions. Behavioral biometrics, conversely, analyzes the continuous, unique physical interaction patterns of the user—such as mouse movements, scrolling speed, and keyboard dynamics—to confirm identity during an active session.

Which industry vertical is the largest adopter of Account Takeover Protection solutions?

The Banking, Financial Services, and Insurance (BFSI) sector is the largest adopter of ATP solutions globally. This dominance is driven by high-value transactions, the sensitivity of financial data, and stringent regulatory mandates (like PSD2 in Europe and FFIEC guidance in North America) requiring robust fraud and identity protection measures.

What challenges restrain the widespread adoption of ATP solutions, particularly for SMEs?

Primary challenges include the high initial deployment and integration costs associated with advanced, platform-based ATP systems. Furthermore, integrating these complex solutions with existing, often outdated, legacy IT infrastructure presents significant technical hurdles. The continuous operational challenge of fine-tuning risk models to minimize disruptive false positives also acts as a restraint.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager