Accounts Payable (AP) Automation Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432768 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Accounts Payable (AP) Automation Software Market Size

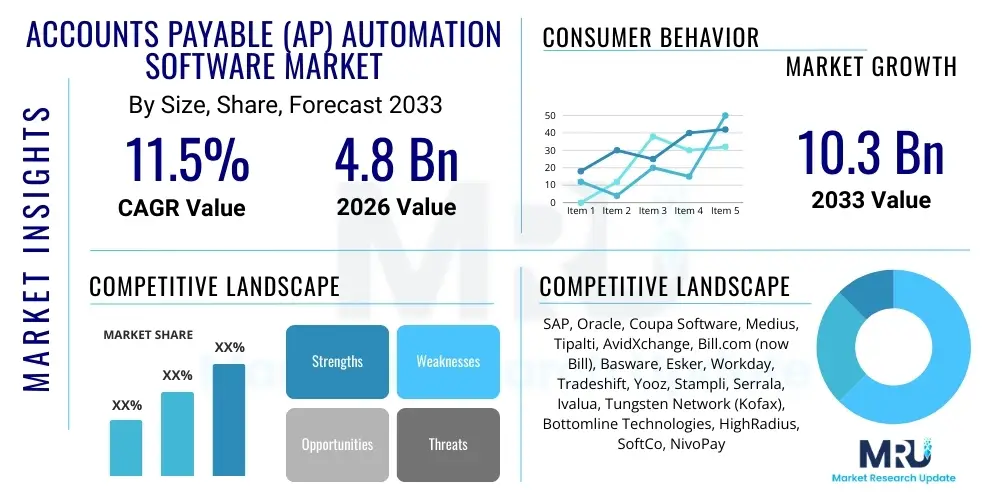

The Accounts Payable (AP) Automation Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 10.3 Billion by the end of the forecast period in 2033.

Accounts Payable (AP) Automation Software Market introduction

The Accounts Payable (AP) Automation Software Market encompasses solutions designed to streamline and automate crucial financial processes, including invoice processing, vendor management, expense reporting, and payment execution. These software platforms leverage technologies such as Optical Character Recognition (OCR), Robotic Process Automation (RPA), and machine learning to minimize manual data entry, reduce processing cycle times, and mitigate human error associated with traditional paper-based or semi-automated AP workflows. The core function of these solutions is to transform incoming invoices, regardless of format (paper, PDF, email), into structured data, enabling touchless processing from receipt through reconciliation and payment, thereby enhancing financial control and improving cash flow management.

Major applications of AP automation software span across invoice capture and matching, approval routing, discrepancy resolution, and integrated payment execution. The widespread adoption of these solutions is primarily driven by the imperative for large and mid-sized organizations to achieve operational efficiencies, reduce high labor costs associated with manual handling, and ensure stringent regulatory compliance, particularly concerning tax regulations and financial reporting standards. Furthermore, the increasing complexity of global supply chains and the rapid shift towards remote working models necessitate robust, cloud-based AP systems that offer secure, scalable, and accessible financial management capabilities across geographically dispersed teams.

The continuous evolution of digital transformation strategies across various industry verticals, coupled with rising expectations for real-time visibility into financial liabilities, positions AP automation as an indispensable tool for modern finance departments. The benefits extend beyond mere cost savings, offering improved vendor relationships through timely payments, enhanced security via advanced fraud detection mechanisms, and providing actionable business intelligence through comprehensive spend analytics, which are critical factors propelling market expansion throughout the forecast period.

Accounts Payable (AP) Automation Software Market Executive Summary

The Accounts Payable (AP) Automation Software Market is experiencing significant acceleration, primarily fueled by the surging global adoption of Software-as-a-Service (SaaS) models, which facilitate rapid deployment and scalability, particularly among Small and Medium Enterprises (SMEs). Key business trends highlight a decisive move towards integrated platforms that combine AP functionality with comprehensive Procure-to-Pay (P2P) suites, offering end-to-end expenditure control and maximizing enterprise resource planning (ERP) system synergy. Regionally, North America maintains its dominance due to a mature technological landscape and high expenditure on digital infrastructure, while the Asia Pacific (APAC) region is projected to register the highest growth rate, driven by aggressive digitalization initiatives in emerging economies like India and China, seeking efficiency gains across rapidly expanding manufacturing and services sectors. The competitive landscape is characterized by intense innovation focusing on incorporating Artificial Intelligence (AI) and Machine Learning (ML) for advanced intelligent document processing (IDP) and predictive analytics capabilities.

Segmentation trends indicate that solutions deployed via the cloud segment hold the majority market share, reflecting the widespread preference for flexibility and lower upfront capital expenditure, moving away from traditional on-premise infrastructure. Furthermore, the invoice management segment, which directly addresses the critical pain point of processing high volumes of varied invoice formats, remains the largest application area. Large enterprises continue to be the primary revenue generators, owing to the complexity and volume of their transaction flows, although the SME segment represents the fastest-growing opportunity, spurred by tailored, cost-effective SaaS offerings. Vertical-specific automation solutions, particularly those customized for the Banking, Financial Services, and Insurance (BFSI) sector and the retail industry, are witnessing increased uptake due to stringent industry-specific compliance requirements and high transactional throughput.

The market trajectory confirms a shift from basic automation towards intelligent, autonomous financial operations. Challenges related to integrating AP software with legacy ERP systems, data security vulnerabilities, and initial high implementation costs persist, but these restraints are increasingly mitigated by sophisticated integration middleware and robust cloud security protocols. Overall, the market outlook remains strongly positive, underpinned by regulatory mandates for greater financial transparency and the undeniable operational advantage gained from transforming the AP department from a cost center into a strategic source of business intelligence.

AI Impact Analysis on Accounts Payable (AP) Automation Software Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Accounts Payable (AP) Automation market center intensely on themes of operational efficiency, accuracy improvement, and strategic workforce reallocation. Users frequently question the reliability of AI-driven Optical Character Recognition (OCR) and Intelligent Document Processing (IDP) systems in handling non-standard or highly varied invoice formats globally. Significant concern also revolves around the ability of AI models to accurately detect sophisticated payment fraud and anomalies, moving beyond rule-based checks to predictive analysis. Furthermore, finance professionals seek clarification on the extent to which AI will require upskilling of existing AP staff and how AI integration affects compliance mandates like data retention and auditability. The primary expectation is that AI will completely eliminate manual intervention in the invoice lifecycle, achieving a true "touchless AP" environment.

AI, specifically through machine learning (ML) and natural language processing (NLP), is fundamentally transforming the AP function by automating complex decision-making processes that were previously dependent on human oversight. ML algorithms are continuously trained on historical transactional data, significantly improving the accuracy of initial invoice capture, automatic general ledger (GL) coding, and three-way matching verification by identifying patterns and correcting inconsistencies far faster than conventional rules engines. This technological leap enables AP software to manage exceptions and discrepancies with minimal human intervention, dramatically shortening the cash conversion cycle and unlocking significant working capital benefits for organizations.

The predictive capabilities inherent in advanced AI systems are further impacting the market by offering enhanced strategic value. Instead of merely processing past transactions, AI can forecast payment needs, optimize payment timing based on vendor terms and organizational cash flow projections, and identify potential compliance issues before they escalate. This shift positions AP automation solutions not just as transactional tools, but as critical components of organizational financial planning and risk management frameworks. Consequently, vendors are competitively focusing their R&D efforts on proprietary AI models optimized for finance data interpretation and proactive risk identification.

- AI-driven Intelligent Document Processing (IDP) increases invoice data extraction accuracy, handling varying layouts and languages seamlessly.

- Machine Learning (ML) enables dynamic, automated three-way matching (invoice, purchase order, receipt), reducing manual exception handling significantly.

- Predictive analytics supports optimal payment scheduling, maximizing early payment discounts and improving overall working capital management.

- Natural Language Processing (NLP) enhances the understanding of contextual data within unstructured documents, improving approval routing logic.

- AI enhances fraud detection by identifying unusual spending patterns, suspicious vendor modifications, and payment anomalies in real-time.

- Autonomous GL coding suggestion and automatic categorization of expenses minimize human input errors and accelerate financial closing processes.

- Generative AI tools are starting to be implemented for generating responses to routine vendor inquiries, improving vendor relationship management efficiency.

DRO & Impact Forces Of Accounts Payable (AP) Automation Software Market

The dynamics of the Accounts Payable (AP) Automation Software Market are shaped by powerful drivers, necessitating efficiency and resilience, counterbalanced by significant restraints concerning security and integration complexity, while numerous opportunities exist in technological convergence and geographical expansion. The central driver is the global push for digital transformation across finance functions, motivated by a desire to cut operational expenditure (OPEX) and improve governance. Restraints include the high initial capital investment required for comprehensive enterprise-level systems and persistent concerns over the security of sensitive financial data, particularly within multi-tenant cloud environments. Key opportunities arise from the integration of blockchain technology for transparent payment tracking and the massive untapped market potential within the SME sector, where adoption rates are rapidly accelerating. These forces collectively dictate the strategic priorities of market vendors, emphasizing the development of highly secure, scalable, and easy-to-integrate solutions that offer rapid return on investment (ROI).

The impact forces within the market are predominantly characterized by high regulatory pressure and rapid technological obsolescence. Regulatory compliance, such as mandates related to e-invoicing (e.g., Peppol in Europe, specific country mandates in Latin America and Asia) and international tax standards (e.g., VAT reporting), acts as a compulsory driver for AP automation adoption, as manual processes struggle to keep pace with evolving legal frameworks. Furthermore, the competitive impact force is high, pushing vendors to continually innovate in areas like AI-driven functionality and seamless integration with a myriad of enterprise resource planning (ERP) systems, Customer Relationship Management (CRM) tools, and specialized procurement platforms. Economic volatility, while generally stimulating demand for cost-saving measures like automation, can also temper immediate investment decisions by organizations, leading to a complex demand environment where strategic necessity clashes with capital constraints.

Ultimately, the successful deployment and adoption of AP automation solutions depend heavily on vendor capabilities in addressing interoperability challenges, ensuring robust data privacy measures, and demonstrating measurable productivity gains. The market’s equilibrium is shifting toward providers that offer holistic P2P platforms rather than standalone AP solutions, recognizing that maximizing the value of automation requires connectivity across the entire procurement lifecycle. The enduring need for greater financial accuracy, coupled with the increasing volume of global business transactions, ensures that the pressure to automate remains high, overriding most technological hurdles and driving continuous market expansion.

Segmentation Analysis

The Accounts Payable (AP) Automation Software market is comprehensively segmented based on several critical dimensions, including the type of solution component, deployment model, size of the organization adopting the technology, and the specific industry vertical served. This structured segmentation allows for a detailed analysis of market dynamics, identifying which configurations and delivery methods are currently driving the most significant revenue and which segments are poised for exponential future growth. Component segmentation highlights the distinction between software platforms (the core automation engine) and associated services (implementation, consulting, maintenance), both of which are crucial for successful enterprise deployment. Deployment categorization reflects the ongoing transition from traditional on-premise installations to highly flexible and scalable cloud-based (SaaS) environments, which profoundly impacts market accessibility and operational expenditure.

Organization size segmentation provides insight into adoption maturity, with large enterprises historically dominating the market due to complex processing needs and budget capacity, while the SME segment represents a rapidly accelerating consumer base, leveraging affordable, modular cloud solutions. Vertical segmentation reveals nuanced requirements across industries; for instance, BFSI and healthcare demand extremely high security and compliance features, whereas manufacturing and retail focus heavily on managing high-volume, variable invoices originating from vast supply chains. Understanding these specific sectoral requirements is vital for vendors developing specialized features and integration capabilities, ensuring their solutions align perfectly with the unique compliance and transactional needs of target industries.

The evolving landscape shows a convergence of segments, particularly the push for integrated solutions delivered via the cloud to SMEs. This confluence of deployment and size preference is optimizing the cost-benefit ratio for smaller organizations, making sophisticated AP automation accessible without requiring massive IT infrastructure overhauls. This tailored approach is crucial for sustaining the market's high projected Compound Annual Growth Rate (CAGR) by broadening the addressable market beyond the established large corporate consumers.

- By Component:

- Software (Platform and Solutions)

- Services (Consulting, Integration, Support, and Maintenance)

- By Deployment Model:

- Cloud-based (SaaS)

- On-Premise

- By Organization Size:

- Large Enterprises

- Small and Medium Enterprises (SMEs)

- By Application/Function:

- Invoice Management (Capture, Processing, Matching)

- Payment Management (Execution, Reconciliation)

- Expense Management

- Vendor Management

- By Industry Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Retail and E-commerce

- Manufacturing

- IT and Telecom

- Healthcare and Life Sciences

- Government and Public Sector

- Others (Energy, Utilities, etc.)

Value Chain Analysis For Accounts Payable (AP) Automation Software Market

The value chain for the Accounts Payable (AP) Automation Software Market begins with upstream activities focused on foundational technology development and infrastructure provision. This stage involves core technology providers supplying essential components such as advanced Optical Character Recognition (OCR) engines, machine learning libraries for data interpretation, and underlying cloud infrastructure (e.g., AWS, Azure, Google Cloud). Successful software vendors heavily rely on robust, high-performance cloud services to ensure scalability, availability, and geographic redundancy for their SaaS offerings. This upstream dependency necessitates strong strategic partnerships between AP automation developers and leading infrastructure providers to ensure high latency and security standards are met, forming the critical backbone for the final software product.

Midstream activities involve the crucial stages of software development, platform integration, and solution customization. AP automation vendors synthesize the foundational technologies into proprietary platforms, focusing intensely on user experience (UX), complex workflow configuration, and seamless integration capabilities with enterprise resource planning (ERP) systems like SAP, Oracle, and Microsoft Dynamics. Given that integration complexity is a major adoption restraint, the ability to offer standardized, plug-and-play connectors defines competitive advantage. Distribution channels, both direct and indirect, play a pivotal role here. Direct sales teams focus on securing large enterprise accounts, offering customized implementation and long-term service contracts. Indirect channels involve value-added resellers (VARs), system integrators, and strategic alliance partners who market, sell, and implement solutions, particularly to SMEs and in niche geographic markets, leveraging localized expertise.

Downstream activities center around deployment, maintenance, and end-user engagement. This includes extensive consulting and professional services required for initial system setup, data migration, and workforce training. Post-implementation support and maintenance services are critical for long-term customer retention, ensuring system uptime and continuous adaptation to changing compliance requirements. The end-users—finance departments, procurement teams, and CFOs—are the final consumers whose continuous feedback drives iterative software updates and feature enhancements. The efficiency of this downstream segment, particularly the quality of integration and ongoing support, directly impacts the perceived value and ROI delivered by the AP automation solution.

Accounts Payable (AP) Automation Software Market Potential Customers

The primary potential customers and end-users of Accounts Payable (AP) Automation Software span a diverse range of roles and organizational types, fundamentally unified by the need to optimize financial operations and manage vendor relationships efficiently. At the executive level, Chief Financial Officers (CFOs) and Vice Presidents of Finance are key decision-makers, viewing AP automation as a strategic investment to improve cash flow visibility, ensure regulatory compliance, and mitigate financial risk. Their objective is to move the AP function from a transactional back-office cost center to a strategic component that provides real-time financial insights necessary for enterprise-wide decision-making, emphasizing solutions that offer superior security and advanced reporting capabilities.

At the operational level, potential customers include Accounts Payable Managers, Controllers, and Procurement Directors. AP Managers are directly concerned with daily processing efficiency, focusing on solutions that drastically reduce manual data entry, streamline invoice approval workflows, and minimize processing cycle times. Procurement Directors seek integration with P2P systems to ensure compliance with negotiated contract terms and optimize the management of purchase orders and vendor master data. These users prioritize ease of use, high accuracy in data capture, and seamless integration with existing ERP and procurement platforms, demanding flexible and configurable approval hierarchies that reflect organizational structure.

Across industry verticals, potential customers in high-volume, regulatory-intensive sectors such as BFSI (Banking, Financial Services, and Insurance) require automation to handle massive transaction throughput while adhering to strict audit trails and Know Your Customer (KYC) regulations. Similarly, the retail and manufacturing sectors, characterized by complex, global supply chains and high volumes of inventory-related invoices, rely on AP automation for accurate three-way matching and timely settlement to maintain strong supplier relationships. Ultimately, any organization struggling with high manual processing costs, frequent payment errors, poor visibility into liabilities, or difficulties achieving regulatory compliance represents a high-potential customer for modern AP automation software.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 10.3 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SAP, Oracle, Coupa Software, Medius, Tipalti, AvidXchange, Bill.com (now Bill), Basware, Esker, Workday, Tradeshift, Yooz, Stampli, Serrala, Ivalua, Tungsten Network (Kofax), Bottomline Technologies, HighRadius, SoftCo, NivoPay |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Accounts Payable (AP) Automation Software Market Key Technology Landscape

The technological foundation of the Accounts Payable (AP) Automation Software market is built upon several interconnected, advanced technologies designed to maximize data accuracy and process throughput. Optical Character Recognition (OCR) and its more sophisticated iteration, Intelligent Document Processing (IDP), form the critical front-end technology. These systems leverage machine learning algorithms to accurately extract, classify, and validate data from various invoice formats, moving beyond simple template matching to semantic understanding, which drastically improves straight-through processing rates and reduces the need for manual review. IDP is crucial for handling the unstructured nature of global financial documentation, acting as the primary accelerator for digitizing the AP function.

Robotic Process Automation (RPA) plays a significant role in automating repetitive, rule-based tasks within the AP workflow. RPA bots are deployed for tasks such as data entry into ERP systems, cross-referencing vendor databases, and automating reconciliation processes, bridging integration gaps between disparate systems. Furthermore, the pervasive adoption of Cloud Computing, particularly the Software-as-a-Service (SaaS) model, has revolutionized deployment. SaaS provides vendors with the infrastructure to offer robust security, continuous feature updates, and unparalleled scalability, making sophisticated AP solutions accessible to SMEs that lack the internal resources for complex on-premise infrastructure management. This cloud shift is fundamentally driving the market growth and facilitating the rapid deployment cycle.

Emerging technologies are also shaping the future landscape, notably the incorporation of blockchain and advanced AI for strategic finance applications. Blockchain technology offers immutable transaction records and enhanced transparency for cross-border payments, potentially reducing friction and cost associated with global vendor settlement and increasing auditability. Advanced AI applications, including predictive analytics, are being used to forecast cash outflow needs, optimize discount capture, and perform proactive compliance monitoring, positioning the AP system as a strategic financial planning tool rather than just a processing engine. These combined technologies establish a platform capable of achieving true autonomous finance operations.

Regional Highlights

- North America: This region dominates the global AP Automation market, characterized by early and high adoption rates of advanced SaaS solutions, large corporate presence, and substantial IT infrastructure spending. The U.S. and Canada benefit from a mature vendor landscape and high technological literacy, driving continuous innovation in AI and machine learning for financial processing. High labor costs also provide a compelling economic incentive for automation adoption, securing North America's leading market share and serving as the benchmark for global technological standards.

- Europe: Europe represents a highly dynamic market, propelled by stringent regulatory mandates, particularly the shift toward e-invoicing (e.g., Peppol standards in the EU). Countries like Germany, the UK, and France are major contributors, prioritizing solutions that ensure compliance with GDPR and country-specific tax regulations. The market growth is strong, characterized by a substantial uptake among the mid-market segment seeking secure, localized, and multi-lingual solutions that facilitate cross-border trade efficiency.

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing market during the forecast period. This rapid expansion is driven by aggressive governmental initiatives supporting digital transformation, particularly in rapidly industrializing nations such as China, India, and Southeast Asian countries. Increasing foreign direct investment, expanding manufacturing bases, and a growing emphasis on optimizing global supply chain logistics necessitate AP automation to handle rising transaction volumes and complex local regulatory environments, despite initial challenges related to infrastructure variances.

- Latin America (LATAM): The LATAM market growth is uniquely driven by mandatory e-invoicing and e-accounting regulations imposed by governments (e.g., Brazil, Mexico). These strict compliance requirements compel businesses to adopt specialized AP solutions that can integrate and conform to highly specific governmental digital tax reporting formats, making compliance, rather than just efficiency, the primary market driver.

- Middle East and Africa (MEA): This region is at an emergent stage of AP automation adoption. Growth is concentrated in the Gulf Cooperation Council (GCC) countries, fueled by large-scale infrastructure and economic diversification projects, alongside significant investments in digital governance. However, adoption remains uneven, constrained by varying IT maturity levels and capital constraints, making targeted, modular SaaS solutions increasingly attractive.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Accounts Payable (AP) Automation Software Market.- Coupa Software Inc.

- SAP SE

- Oracle Corporation

- Bill.com (now Bill)

- AvidXchange Holdings Inc.

- Basware Corporation

- Medius (formerly MediusFlow)

- Tipalti Inc.

- Esker SA

- Workday Inc.

- HighRadius Corporation

- Stampli

- Tradeshift

- Yooz Inc.

- Ivalua

- Kofax (incorporating Tungsten Network)

- Bottomline Technologies Inc.

- FIS (Fidelity National Information Services)

- Serrala Group GmbH

- SoftCo

Frequently Asked Questions

Analyze common user questions about the Accounts Payable (AP) Automation Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the typical Return on Investment (ROI) period for AP automation software?

The typical ROI period for AP automation software generally ranges from 6 to 18 months, depending on the volume of invoices processed and the initial level of manual inefficiency. Benefits are realized through reduced labor costs, maximized early payment discounts, and the elimination of late payment penalties.

How does AP automation address complex cross-border payments and multi-currency handling?

Modern AP automation solutions integrate global payment rails and currency conversion tools, ensuring compliance with international payment regulations (such as SWIFT/SEPA) and providing centralized visibility into multi-currency liabilities, simplifying global vendor management and reconciliation.

What are the primary differences between Cloud-based (SaaS) and On-Premise AP solutions?

Cloud-based solutions offer lower upfront costs, faster deployment, and automatic updates, ideal for scalability and SMEs. On-premise solutions provide maximum control over data security and customization, often favored by large enterprises in highly regulated sectors like finance or government.

Is seamless integration with existing ERP systems guaranteed for all AP automation software?

No, seamless integration is not guaranteed. While most top-tier AP automation vendors provide robust, pre-built connectors for major ERPs (e.g., SAP, Oracle), successful integration relies heavily on the age and customization level of the existing ERP infrastructure and may require specialized consulting services.

How effective is AI in preventing payment fraud within AP workflows?

AI is highly effective in preventing fraud by employing machine learning algorithms to monitor transactional data, identify anomalies, detect suspicious changes in vendor bank details, and flag deviations from established spending patterns, providing a proactive layer of security beyond traditional rule-based controls.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager