Acetazolamide Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435829 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Acetazolamide Market Size

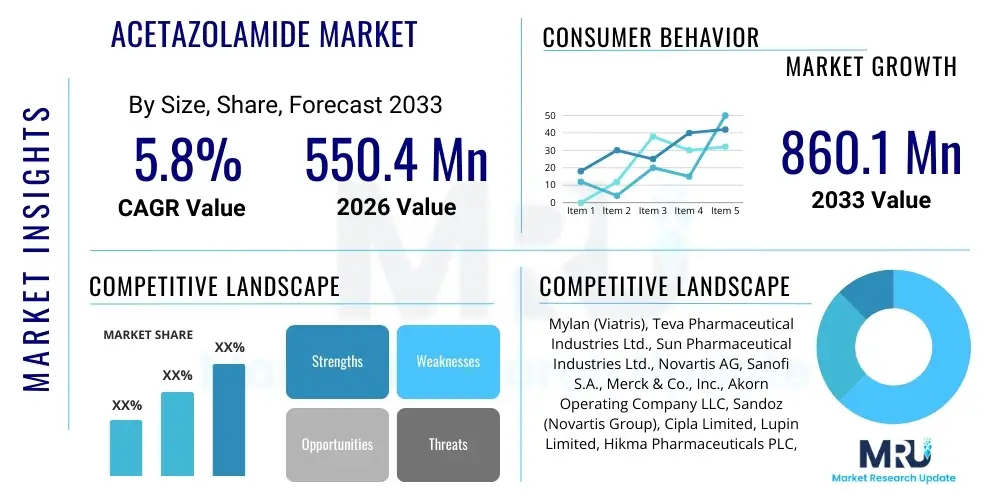

The Acetazolamide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $550.4 Million USD in 2026 and is projected to reach $860.1 Million USD by the end of the forecast period in 2033.

Acetazolamide Market introduction

Acetazolamide, a carbonic anhydrase inhibitor (CAI), is a crucial pharmaceutical compound widely utilized for treating various medical conditions stemming from fluid balance and pressure regulation issues. Developed initially as a diuretic, its primary mechanism involves inhibiting the enzyme carbonic anhydrase, which reduces the production of aqueous humor, cerebrospinal fluid, and bicarbonate ions in the renal tubules. This pharmacological action makes it highly effective in managing intraocular pressure in glaucoma patients, a major driver of market demand globally. Furthermore, its efficacy in treating high-altitude sickness (acute mountain sickness) has cemented its status in specialized medicine, particularly among adventure travelers and military personnel operating in high-elevation environments. The stable and proven safety profile of acetazolamide, coupled with its inclusion in essential medicines lists by global health organizations, ensures consistent market relevance and adoption across diverse healthcare systems.

The core applications of acetazolamide extend beyond ophthalmology and altitude sickness treatment. It is routinely prescribed as an adjuvant therapy for certain types of epilepsy, particularly petit mal seizures, due to its influence on neurological excitability through fluid and pH regulation in the brain. Moreover, it serves as an effective diuretic in managing fluid retention and edema, especially when related to congestive heart failure or drug-induced edema, although loop and thiazide diuretics often take precedence in general practice. The versatile application spectrum of this drug—ranging from chronic disease management (glaucoma) to acute symptom relief (altitude sickness)—underpins the continuous demand within the pharmaceutical sector. Market growth is further stimulated by an aging population, which is more susceptible to chronic conditions like open-angle glaucoma, necessitating long-term pharmacological intervention.

Market expansion is also intrinsically linked to geographical factors and technological advancements in formulation. While the established tablet form dominates consumption, research into sustained-release formulations and improved intravenous preparations for acute settings, such as acute angle-closure glaucoma or severe neurological edema, presents significant opportunities. Key driving factors include the rising prevalence of ocular disorders, particularly in developing economies where screening and treatment accessibility are improving, leading to increased diagnoses and subsequent prescription volume. However, the market must continuously address challenges related to generic competition and the development of newer, more targeted drug classes, requiring manufacturers to focus on cost-efficiency, supply chain robustness, and maximizing clinical utility through comprehensive physician education initiatives.

Acetazolamide Market Executive Summary

The Acetazolamide Market exhibits resilient growth, driven fundamentally by the increasing global burden of chronic ocular diseases, particularly primary open-angle glaucoma, and the sustained demand for altitude prophylaxis solutions in adventure tourism and high-altitude industrial operations. Business trends highlight a strong shift toward consolidation among generic drug manufacturers aiming for economies of scale, counterbalanced by modest innovation in delivery mechanisms to improve patient compliance and reduce side effects associated with immediate-release formulations. Investment remains focused on enhancing manufacturing efficiency for active pharmaceutical ingredients (APIs) to maintain competitive pricing against established alternatives. The regulatory landscape, while generally stable for this established molecule, increasingly emphasizes post-marketing surveillance data regarding long-term use and potential drug interactions, influencing prescribing patterns and market dynamics.

Regionally, North America and Europe currently represent the largest revenue generators, characterized by high healthcare expenditure, comprehensive reimbursement policies, and a well-established infrastructure for diagnosing and treating glaucoma. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate throughout the forecast period. This acceleration is attributed to rapidly improving healthcare accessibility, increasing awareness of ocular health, and the vast, often undiagnosed, patient pool requiring chronic care. Furthermore, substantial investment in public health initiatives in major APAC economies, aimed at reducing preventable blindness, directly translates into higher consumption of effective, first-line treatments like acetazolamide. The Middle East and Africa (MEA) and Latin America (LATAM) markets also show promising expansion, driven by urbanization and rising disposable incomes allowing access to specialized medical treatment.

Segment trends underscore the dominance of the Glaucoma application segment, which dictates the overall volume and value trajectory of the market. Within distribution channels, hospital pharmacies maintain a crucial position due to the acute nature of many treated conditions (e.g., angle-closure glaucoma attacks, initial management of cerebral edema). Nonetheless, online and retail pharmacies are rapidly gaining traction, propelled by the shift towards chronic disease management prescriptions that require continuous refills and the growing convenience demanded by modern consumers. Tablets remain the primary product type due to ease of administration and cost-effectiveness, although the limited adoption of novel dosage forms, such as extended-release capsules or specialized ophthalmic drops, suggests untapped potential for premiumization within the product segment.

AI Impact Analysis on Acetazolamide Market

User queries regarding the impact of Artificial Intelligence (AI) on the Acetazolamide market primarily revolve around three central themes: AI's role in optimizing glaucoma diagnosis and patient stratification, its potential in accelerating drug repurposing or identifying novel CAI applications, and the use of AI in streamlining clinical trial execution for new formulations. Users are keen to understand if AI-driven diagnostics, such as deep learning algorithms applied to fundus photography and Optical Coherence Tomography (OCT) scans, can enhance the timely detection of ocular hypertension and early glaucoma, thereby increasing the patient population requiring acetazolamide therapy. There is also significant curiosity about how AI could predict patient response variability to carbonic anhydrase inhibitors (CAIs) based on genetic or physiological markers, leading to personalized dosing regimens and reduced adverse effects. Ultimately, the market expects AI to improve therapeutic outcomes and operational efficiencies across the Acetazolamide value chain, from initial diagnosis to personalized patient management strategies in chronic conditions.

- AI enhances early diagnosis of glaucoma using retinal image analysis, increasing the addressable patient population for acetazolamide.

- Predictive modeling algorithms utilize patient data to optimize acetazolamide dosing, minimizing systemic side effects and improving adherence.

- AI-driven clinical trial matching accelerates the development of novel or sustained-release acetazolamide formulations.

- Machine learning identifies potential drug-drug interactions involving acetazolamide, enhancing prescription safety in polypharmacy patients.

- Natural Language Processing (NLP) analyzes vast pharmacological literature to uncover potential off-label uses or synergistic treatments involving CAIs.

- AI aids in optimizing pharmaceutical supply chains by forecasting demand fluctuations for essential drugs like acetazolamide based on seasonality and regional disease outbreaks.

- Robotic process automation (RPA) in manufacturing reduces production variability and enhances quality control for bulk acetazolamide API synthesis.

DRO & Impact Forces Of Acetazolamide Market

The market dynamics for Acetazolamide are shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces, determining the overall growth trajectory and competitive landscape. The primary driver is the global rise in the prevalence of chronic diseases sensitive to intraocular or intracranial pressure regulation, most notably open-angle glaucoma, which requires long-term carbonic anhydrase inhibition. Concurrently, the increasing popularity of high-altitude tourism and recreational activities across demographics contributes significantly to the demand for acetazolamide as a prophylactic measure against acute mountain sickness. These demand factors are reinforced by the drug's long-standing efficacy, cost-effectiveness, and established position as a first-line or adjuvant treatment in international clinical guidelines, providing a foundation for steady volume growth across established and emerging markets.

However, significant restraints temper this expansion. The widespread availability of generic alternatives leads to intense price erosion, squeezing profit margins for manufacturers and shifting the focus purely to volume sales rather than value-added innovation. Furthermore, the notable side effect profile of systemic acetazolamide, including paresthesias, gastrointestinal disturbances, and the risk of metabolic acidosis, often leads to patient non-compliance or physician preference for newer, more localized or targeted therapies (e.g., topical CAIs or prostaglandin analogs for glaucoma). Regulatory hurdles, particularly in obtaining approvals for new sustained-release or reformulated products, also pose a restraint, as the cost of clinical trials for minor formulation improvements often outweighs the potential returns given the drug's generic status.

Opportunities for market stakeholders lie primarily in geographical expansion into underserved regions, particularly in APAC and LATAM, where diagnostic rates for glaucoma are improving but access to treatment remains inconsistent. Developing fixed-dose combination therapies, pairing acetazolamide with other complementary drugs (e.g., beta-blockers or alpha agonists), offers a promising pathway for enhancing therapeutic efficacy and improving patient adherence by simplifying dosing schedules. The critical impact forces include technological advancements in diagnostic imaging (driving early case detection) and evolving clinical guidelines that may either reinforce or diminish acetazolamide's role relative to novel pharmacological alternatives. Sustained geopolitical stability, ensuring consistent global supply chains for key APIs, also exerts a strong systemic impact on market profitability and reliable availability.

Segmentation Analysis

The Acetazolamide market is critically segmented based on application, product type, and distribution channel, providing a granular view of demand patterns and value capture across the pharmaceutical ecosystem. The application segmentation reveals the therapeutic areas generating the highest demand, with glaucoma management dominating due to the chronic nature of the disease and the drug's efficacy in reducing intraocular pressure (IOP). This segment is expected to maintain its leadership position, underpinned by global demographic shifts toward older age groups. However, the high-altitude sickness prophylaxis segment, while smaller in volume, exhibits seasonal and travel-dependent peaks, providing robust niche demand. Understanding these segmental dynamics is essential for manufacturers to tailor production volumes and marketing strategies effectively, ensuring alignment with diverse clinical needs.

Segmentation by product type primarily includes oral tablets, intravenous injections, and specialized ophthalmic solutions, reflecting varying clinical needs from chronic outpatient care to acute hospital intervention. Oral tablets constitute the bulk of the market due to their utility in long-term glaucoma management and altitude sickness prophylaxis. Conversely, the smaller yet higher-value injectable segment is crucial for rapid IOP reduction in emergency settings, such as acute angle-closure glaucoma, demanding higher manufacturing standards and quicker distribution networks. The shift in distribution channels, from traditional hospital pharmacies to burgeoning online platforms, is transforming access, particularly for chronic refills, compelling pharmaceutical wholesalers and distributors to invest in robust direct-to-consumer fulfillment capabilities.

- By Application

- Glaucoma (Primary Open-Angle, Secondary, Acute Angle-Closure)

- High Altitude Sickness (Acute Mountain Sickness Prophylaxis and Treatment)

- Edema (Drug-Induced, Congestive Heart Failure related)

- Epilepsy and Neurological Disorders (Adjuvant Therapy)

- Other Applications (e.g., Idiopathic Intracranial Hypertension)

- By Product Type

- Tablets (Immediate and Sustained Release)

- Injectable Solutions (Intravenous)

- Ophthalmic Solutions (Less Common, primarily topical CAIs)

- By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies (Community Pharmacies)

- Online Pharmacies/E-commerce

- By End-User

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Specialty Ophthalmic Centers

- Government and Military Agencies (for altitude sickness)

Value Chain Analysis For Acetazolamide Market

The value chain for Acetazolamide begins with the upstream segment, dominated by the synthesis and sourcing of the Active Pharmaceutical Ingredient (API). Since Acetazolamide is an older, off-patent molecule, the API production is heavily concentrated in low-cost manufacturing hubs, predominantly in Asia Pacific, where economies of scale are maximized. Key activities at this stage involve sourcing raw chemical precursors, highly specialized synthesis processes, and rigorous quality control testing to meet international pharmaceutical standards (cGMP). The competition upstream is intense, driven by price sensitivity, which necessitates efficient supply chain management and reliable long-term contracts between generic pharmaceutical companies and large-scale API manufacturers to ensure a stable, cost-effective supply, directly impacting the final formulation cost and market competitiveness.

The midstream segment involves formulation, manufacturing, and packaging, transforming the raw API into finished dosage forms—primarily tablets and injections. Manufacturing companies, ranging from large multinational generics firms to smaller regional players, focus on achieving high throughput and minimizing batch variations. Packaging is critical for ensuring drug stability and compliance with diverse international labeling regulations. The distribution channel forms the bridge to the downstream market. Both direct and indirect distribution methods are utilized. Large pharmaceutical firms often distribute directly to major hospital networks and centralized government purchasers (direct distribution), especially for institutional sales and large tenders. This provides greater control over inventory and pricing but requires extensive logistical infrastructure.

Indirect distribution relies heavily on pharmaceutical wholesalers, distributors, and logistics providers, who manage the complex network reaching retail pharmacies, online pharmacies, and smaller clinics globally. This indirect channel is essential for market penetration and managing regional inventory needs for chronic prescriptions. Downstream activities involve prescribing by healthcare professionals (ophthalmologists, internists, neurologists), dispensing by pharmacists, and final consumption by the patient. The success downstream is heavily influenced by physician awareness, payer reimbursement policies, and patient affordability, especially in regions lacking universal healthcare coverage. Efficient cold chain management, while less critical than for biologics, is still necessary for injectable forms, requiring robust supply chain integrity from factory gate to patient administration.

Acetazolamide Market Potential Customers

The primary potential customers for Acetazolamide are diverse institutional entities and specialized healthcare providers focused on chronic disease management and acute care intervention. Hospitals and large clinical systems represent a cornerstone of demand, particularly for the injectable form used in managing acute glaucoma attacks or treating severe neurological conditions requiring rapid cerebrospinal fluid reduction. Ophthalmic specialty centers constitute another significant customer base, as Acetazolamide remains a fundamental component of the pharmacological arsenal against various forms of glaucoma. These institutions purchase in bulk, prioritizing reliable supply, favorable volume discounts, and adherence to stringent quality and regulatory certifications from the supplying pharmaceutical manufacturers.

Beyond traditional healthcare institutions, government agencies, particularly military services and bodies overseeing disaster preparedness or high-altitude rescue operations, are crucial niche customers. These entities procure Acetazolamide in large quantities for prophylactic use among personnel deployed to high-elevation areas, where the prevention of Acute Mountain Sickness (AMS) is mission-critical. Furthermore, retail and online pharmacies serve as the critical interface for the vast population of patients managing chronic glaucoma or edema on an outpatient basis. Their purchasing behavior is often dictated by prescription volume, inventory turnover rates, and competitive pricing offered by generic manufacturers, emphasizing the need for robust retail distribution strategies.

Finally, individual consumers, though accessing the drug through prescriptions, represent the ultimate demand driver. Patients suffering from Idiopathic Intracranial Hypertension (IIH), chronic open-angle glaucoma, and those undertaking high-altitude expeditions are recurrent buyers. Market strategies must therefore focus not only on institutional sales but also on physician education and patient engagement initiatives that highlight the long-term benefits and safety profile of Acetazolamide, ensuring patient adherence and minimizing switching to alternative drug classes due to perceived side effects or cost concerns. The complexity of the customer base demands differentiated sales and marketing approaches tailored to institutional procurement cycles versus retail consumer refill patterns.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550.4 Million USD |

| Market Forecast in 2033 | $860.1 Million USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mylan (Viatris), Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Ltd., Novartis AG, Sanofi S.A., Merck & Co., Inc., Akorn Operating Company LLC, Sandoz (Novartis Group), Cipla Limited, Lupin Limited, Hikma Pharmaceuticals PLC, Dr. Reddy's Laboratories Ltd., Pfizer Inc., Aurobindo Pharma, Wockhardt Ltd., Torrent Pharmaceuticals, Zydus Lifesciences, Alkem Laboratories, Strides Pharma Science Limited, Unichem Laboratories. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Acetazolamide Market Key Technology Landscape

The technological landscape surrounding the Acetazolamide market is not characterized by radical molecular innovation, given the drug's established nature, but rather by advancements in drug delivery systems and manufacturing optimization, particularly through continuous processing. A key area of technological focus is the development of sustained-release or extended-release formulations. Immediate-release Acetazolamide requires frequent dosing, which contributes significantly to patient non-adherence and exacerbates systemic side effects. Newer technological approaches, such as osmotically controlled release systems or specialized polymeric matrix tablets, aim to maintain stable therapeutic drug concentrations over extended periods, thereby reducing dosing frequency to once daily. This technological shift is crucial for differentiating premium-priced products in a heavily genericized environment and addressing long-term patient compliance challenges inherent in chronic treatments like glaucoma management.

Furthermore, significant technological investments are directed toward enhancing the purity and bioavailability of the Active Pharmaceutical Ingredient (API) through advanced crystallization techniques and particle size reduction technologies, such as micronization or nanomilling. While Acetazolamide has relatively poor solubility, optimizing particle characteristics can improve dissolution rates and potentially enhance overall absorption, although systemic bioavailability is generally good. These manufacturing innovations, often coupled with Process Analytical Technology (PAT), ensure consistent quality, reduce batch failure rates, and ultimately lower the cost of goods sold, maintaining competitiveness against global generic suppliers. The incorporation of robust automation and data analytics in API synthesis lines is becoming standard practice, ensuring compliance with increasingly stringent global regulatory quality mandates.

Another emerging technological area involves the integration of diagnostic technologies that indirectly impact Acetazolamide prescribing patterns. Advances in non-invasive monitoring of intraocular pressure (IOP) and remote patient monitoring systems for high-altitude travelers are crucial. For instance, sophisticated wearable devices capable of tracking physiological parameters relevant to altitude sickness could lead to more personalized prophylactic dosing recommendations for Acetazolamide. Similarly, improved OCT angiography and Artificial Intelligence (AI) tools for detecting subtle changes in the optic nerve head can lead to earlier diagnosis of glaucoma, expanding the treated population. These technological advancements, while not directly altering the Acetazolamide molecule, refine its clinical application and expand its utilization by enhancing diagnostic precision and optimizing patient management protocols.

Regional Highlights

- North America: North America, encompassing the United States and Canada, remains the largest and most mature market for Acetazolamide, characterized by high pharmaceutical expenditure, sophisticated healthcare infrastructure, and robust insurance coverage for chronic disease medications. The region's market dominance is primarily driven by the high prevalence of diagnosed glaucoma cases and the widespread adoption of established treatment protocols that include CAIs. Furthermore, the presence of major pharmaceutical companies and strong regulatory oversight ensuring high product quality contributes to market stability. The demand for altitude sickness medication is also notable, driven by recreational travel to high-altitude areas within the Rocky Mountains and Alaska. However, intense generic competition is a major characteristic of this market, leading to aggressive pricing strategies among large generic players.

- Europe: Europe is a substantial market, second only to North America, characterized by diverse healthcare systems and varying reimbursement policies across key countries like Germany, France, the UK, and Italy. The market growth here is sustained by an aging demographic prone to glaucoma and neurological disorders requiring Acetazolamide therapy. European guidelines often position Acetazolamide as a secondary or adjuvant therapy, sometimes favoring prostaglandin analogs or beta-blockers as first-line glaucoma treatments, which influences prescription volume. Eastern European nations offer significant growth potential as their healthcare systems modernize and pharmaceutical access improves. Regulatory harmonization through the European Medicines Agency (EMA) streamlines approval processes, benefiting market entry for generic formulations.

- Asia Pacific (APAC): The APAC region is forecast to be the fastest-growing market during the projection period, driven by massive, underserved patient populations, increasing healthcare expenditure, and rising public awareness regarding ocular health. Countries like China and India, with their rapidly expanding middle classes and improving diagnostic capabilities, are pivotal growth engines. While pricing remains highly sensitive due to stringent government control over drug costs in many nations, the sheer volume potential offsets lower unit prices. Infrastructure development in remote areas and increased training of ophthalmologists are key factors translating undiagnosed cases into active treatment populations, directly boosting Acetazolamide demand. The region also exhibits diverse demand for altitude sickness prophylaxis due to the Himalayas and other high-altitude tourist destinations.

- Latin America (LATAM): The LATAM market is experiencing steady growth, fueled by urbanization, improved access to essential medicines, and increasing investment in specialty healthcare services. Key markets such as Brazil, Mexico, and Argentina contribute significantly to regional revenue. Challenges include economic instability, which can affect drug affordability and reimbursement consistency, and varying regulatory approval timelines across different countries, complicating market penetration strategies. Nonetheless, the high burden of chronic non-communicable diseases, including glaucoma, ensures consistent, if sometimes volatile, demand for established, cost-effective drugs like Acetazolamide.

- Middle East and Africa (MEA): The MEA region represents a nascent but promising market, particularly in the Gulf Cooperation Council (GCC) countries where high per capita income allows for advanced healthcare adoption. Market growth in this region is patchy, driven by robust infrastructure development in the UAE and Saudi Arabia, contrasting with slower adoption rates in Sub-Saharan Africa, where access and affordability remain significant hurdles. Initiatives focused on combating infectious diseases and improving overall healthcare access are gradually laying the groundwork for increased treatment of chronic conditions, including those requiring Acetazolamide. Regional growth is highly dependent on governmental tenders and aid programs focused on essential medicines.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Acetazolamide Market.- Mylan (Viatris)

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Novartis AG

- Sanofi S.A.

- Merck & Co., Inc.

- Akorn Operating Company LLC

- Sandoz (Novartis Group)

- Cipla Limited

- Lupin Limited

- Hikma Pharmaceuticals PLC

- Dr. Reddy's Laboratories Ltd.

- Pfizer Inc.

- Aurobindo Pharma

- Wockhardt Ltd.

- Torrent Pharmaceuticals

- Zydus Lifesciences

- Alkem Laboratories

- Strides Pharma Science Limited

- Unichem Laboratories

- Bausch Health Companies Inc.

- Fresenius Kabi AG

Frequently Asked Questions

Analyze common user questions about the Acetazolamide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of the Acetazolamide Market growth?

The key driver is the global escalation in the prevalence of chronic ocular conditions, primarily glaucoma, which necessitates long-term medication to control intraocular pressure. Secondary drivers include the persistent demand for high-altitude sickness prophylaxis among travelers and military personnel worldwide.

Which geographical region holds the largest market share for Acetazolamide?

North America currently holds the largest market share, driven by high healthcare expenditure, established diagnostic infrastructure for chronic diseases, and comprehensive reimbursement systems supporting the sustained use of carbonic anhydrase inhibitors.

What are the main product segments of the Acetazolamide market?

The market is primarily segmented into Tablets (including immediate and sustained-release oral forms), and Injectable Solutions (Intravenous). Tablets dominate the volume share due to their widespread use in chronic and prophylactic treatments.

How does the generic nature of Acetazolamide affect market profitability?

The off-patent status of Acetazolamide leads to intense generic competition, resulting in significant price erosion and low profit margins for manufacturers. This drives companies to focus on volume sales and supply chain efficiency rather than high-value product innovation.

What is the role of Artificial Intelligence (AI) in the future of Acetazolamide prescribing?

AI is expected to significantly enhance the clinical utility of Acetazolamide by improving glaucoma detection precision, optimizing patient-specific dosing regimens based on predictive analytics, and accelerating research into novel fixed-dose combination therapies.

Are there significant side effects limiting Acetazolamide adoption?

Yes, the systemic use of Acetazolamide is associated with common side effects such as paresthesias, fatigue, and potential metabolic acidosis, which often lead to patient non-adherence and prompt physicians to explore alternative, better-tolerated glaucoma medications.

Which distribution channel is experiencing the fastest growth for Acetazolamide sales?

While Hospital Pharmacies remain critical for acute care, Online Pharmacies and e-commerce platforms are experiencing the fastest growth, capitalizing on the convenience required by chronic glaucoma patients who need regular, reliable refills delivered directly.

What technological advancements are relevant to this market?

Key technological advancements focus on enhanced drug delivery systems, specifically sustained-release formulations aimed at improving patient compliance, as well as optimization of API manufacturing through Process Analytical Technology (PAT) to ensure quality and cost control.

How does the market for Acetazolamide interact with the management of Idiopathic Intracranial Hypertension (IIH)?

Acetazolamide is a primary pharmacological treatment for IIH, often referred to as pseudotumor cerebri, due to its ability to decrease cerebrospinal fluid production. Growing awareness and improved diagnosis of IIH contribute consistently to specialized market demand.

Why is the Asia Pacific region projected to exhibit the highest CAGR?

The high CAGR in APAC is driven by massive, previously undiagnosed patient pools, significant investments in healthcare infrastructure, increasing rates of ocular disease screening, and improving accessibility to pharmaceutical treatments in large economies like China and India.

What are the main applications outside of Glaucoma for Acetazolamide?

Major secondary applications include prophylaxis and treatment of Acute Mountain Sickness (High Altitude Sickness), management of certain types of edema (e.g., drug-induced), and use as an adjuvant therapy in specific forms of epilepsy, particularly those responsive to pH manipulation.

Does the market see high investment in new molecule development within the CAI class?

Investment in completely novel carbonic anhydrase inhibitor molecules is generally modest, as the focus has largely shifted to optimizing delivery mechanisms (e.g., topical CAIs or extended-release oral formulations) to compete in the established generic market segment.

What is the impact of regulatory guidelines on Acetazolamide market penetration?

Regulatory guidelines, such as those from the FDA or EMA, significantly influence market penetration by defining acceptable manufacturing standards (cGMP) and clinical indications. Strict adherence to these global quality standards is mandatory for successful market access and sustained supply, especially for institutional buyers.

How critical is the pharmaceutical supply chain for Acetazolamide API?

The supply chain is extremely critical, as the Acetazolamide API is predominantly sourced from a few low-cost manufacturing hubs globally. Any disruption in these complex upstream supply chains, due to geopolitical issues or manufacturing halts, can severely impact global drug availability and pricing stability.

What opportunities exist for manufacturers to differentiate their Acetazolamide products?

Differentiation opportunities primarily involve the development and successful marketing of sustained-release formulations to improve patient adherence, the creation of fixed-dose combination products with complementary antihypertensives, and achieving impeccable quality standards that exceed generic minimums.

Is Acetazolamide usage increasing in veterinary medicine?

While primarily a human therapeutic, Acetazolamide does see limited, specialized use in veterinary medicine, particularly in managing specific cases of glaucoma in companion animals like dogs, contributing a small, niche segment to the overall market demand.

How do pricing strategies vary between developed and developing markets?

In developed markets (North America, Europe), pricing is often dictated by complex negotiations with payers and is highly influenced by generic competition. In contrast, developing markets often rely on government tenders and bulk purchasing, leading to significantly lower, volume-driven unit prices.

Which end-user segment drives the highest volume demand for Acetazolamide?

Ambulatory patients managing chronic glaucoma through retail and online pharmacies drive the highest consistent volume demand, while hospitals and specialty clinics account for critical, high-value bulk purchases, particularly of the injectable form.

What financial metrics are essential for evaluating the performance of Acetazolamide manufacturers?

Key financial metrics include Gross Margin (often tight due to generic competition), Cost of Goods Sold (COGS), inventory turnover rates (critical for managing API stock), and regional sales volume, particularly within the dominant glaucoma application segment.

How is the Acetazolamide market affected by changes in lifestyle and travel trends?

Increased global travel, especially adventure tourism involving treks to high-altitude regions (Himalayas, Andes), directly boosts the demand for Acetazolamide as a mandatory prophylactic measure against Acute Mountain Sickness, creating seasonal demand peaks.

Does the Acetazolamide market face competition from non-pharmacological treatments?

Yes, particularly in glaucoma management, Acetazolamide competes with surgical interventions (trabeculectomy) and laser procedures (Selective Laser Trabeculoplasty or SLT), which offer long-term intraocular pressure reduction, potentially limiting chronic drug dependence.

What is the current trend regarding the use of Acetazolamide for chronic kidney disease (CKD) patients?

The use of Acetazolamide is highly cautious in CKD patients due to the risk of exacerbating metabolic acidosis and accumulation of the drug. However, its use for managing certain types of edema remains selectively applied under strict medical supervision, representing a complex sub-segment of demand.

Are there differences in prescribing practices for pediatric versus adult patients?

Acetazolamide is used in pediatric patients for certain conditions like hydrocephalus and specific seizure types, but dosing and monitoring are more intricate due to body weight variations and higher susceptibility to side effects, requiring specialized pediatric formulations or careful dose titration.

How significant is the role of patent expiration in defining the current market structure?

Patent expiration defined the market structure decades ago, transforming it into a highly competitive generic landscape. This structural constraint forces existing players to focus intensely on operational efficiency, large-scale production, and cost leadership to secure market volume.

What is the anticipated future role of Acetazolamide in managing neurological conditions?

Its role is anticipated to remain strong as an established treatment for Idiopathic Intracranial Hypertension (IIH). Research continues into its potential adjunctive use in other neurological conditions involving fluid dynamics or pH imbalance, reinforcing its niche relevance in specialty neurology.

How do inventory management strategies differ between the tablet and injectable segments?

Tablet inventory management focuses on continuous, high-volume supply to retail chains for chronic care. Injectable inventory is often managed through specialized hospital distributors, emphasizing quick replenishment, strict expiry tracking, and contingency planning for acute institutional demand.

What impact does the development of topical carbonic anhydrase inhibitors have on the systemic Acetazolamide market?

Topical CAIs (like dorzolamide) directly compete with systemic Acetazolamide for glaucoma treatment, often being preferred due to significantly fewer systemic side effects, thereby limiting the growth potential of the oral systemic forms in chronic outpatient ophthalmology.

What ethical considerations are relevant to the global distribution of Acetazolamide?

Ethical considerations include ensuring equitable access and affordability in low-income regions where glaucoma burden is high, managing quality control to prevent substandard generics, and ensuring informed consent regarding the potential systemic side effects of the medication.

How are environmental factors influencing the Acetazolamide API manufacturing?

Manufacturers are increasingly pressured by stricter environmental regulations concerning chemical waste management and energy consumption during API synthesis. Adopting green chemistry principles and optimizing processes are essential for regulatory compliance and sustainable operations.

What is the average shelf life for standard Acetazolamide tablets, and why is this important for distribution?

Standard Acetazolamide tablets typically have a shelf life of 2 to 3 years. This longevity is crucial for wholesalers and retailers, allowing them to manage stock efficiently across extensive distribution networks without excessive losses due to product expiry, a key factor in maximizing profitability in the generic sector.

How does the economic recessionary environment affect the demand for Acetazolamide?

As a highly essential and cost-effective generic drug, demand for Acetazolamide remains relatively inelastic during economic downturns, particularly for chronic conditions like glaucoma. However, patients may seek cheaper generic versions more actively, further intensifying price competition.

What role do ophthalmologists play in driving the market?

Ophthalmologists are the primary prescribers of Acetazolamide, particularly for glaucoma and IIH. Their clinical decisions, guided by evolving therapeutic guidelines and personal experience with side effect management, are the strongest determinant of market volume and product preference.

What is the significance of the tablet coating technology in product differentiation?

Advanced tablet coating technologies are critical for creating enteric or delayed-release systems that protect the drug, mask undesirable tastes, or facilitate sustained drug delivery. This technological refinement is one of the few avenues available to generic firms for slight product differentiation and improved patient acceptance.

Does the availability of over-the-counter alternatives impact the Acetazolamide market?

Currently, there are no direct over-the-counter (OTC) alternatives to prescription-strength Acetazolamide. However, OTC supplements marketed for eye health or altitude discomfort may influence consumer behavior or delay diagnosis, indirectly impacting the market size for prescriptive CAIs.

How has the COVID-19 pandemic affected the Acetazolamide supply chain?

The pandemic initially strained the supply chain, particularly regarding API sourcing from Asia and disruptions in global shipping logistics. However, demand remained steady due to the essential nature of the drug, leading to temporary price volatility until supply chains stabilized through diversification and inventory buildup.

What is the expected long-term impact of personalized medicine on Acetazolamide treatment?

Personalized medicine, especially pharmacogenomics, is expected to refine Acetazolamide usage by identifying patients who are genetically predisposed to better therapeutic outcomes or those who are at higher risk of developing severe side effects, leading to more targeted and safer prescribing practices.

How are contract manufacturing organizations (CMOs) contributing to the Acetazolamide market?

CMOs play a vital role, especially for mid-sized pharmaceutical companies, by providing cost-effective, high-volume manufacturing and specialized formulation expertise (like sustained-release technologies) without requiring massive capital investment from the brand owners.

What is the regulatory status of Acetazolamide in emerging markets compared to established markets?

In established markets, Acetazolamide is a well-understood, long-approved drug. In emerging markets, regulatory pathways might be simpler or faster for generic approval, but enforcement of cGMP standards can be more variable, leading to a wider range of product quality across regional segments.

To what extent do academic research institutions influence Acetazolamide market trends?

Academic research institutions continually influence the market by publishing new clinical trial data, establishing treatment efficacy in novel indications (e.g., specific metabolic disorders), and contributing to evolving clinical practice guidelines, which physicians follow for prescribing decisions.

What is the primary technical challenge in developing a high-quality injectable Acetazolamide solution?

The main technical challenge is ensuring high stability and solubility of the drug in solution for intravenous use, avoiding crystallization or precipitation, and maintaining sterility throughout the shelf life, which requires precise pH control and excipient selection during formulation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager