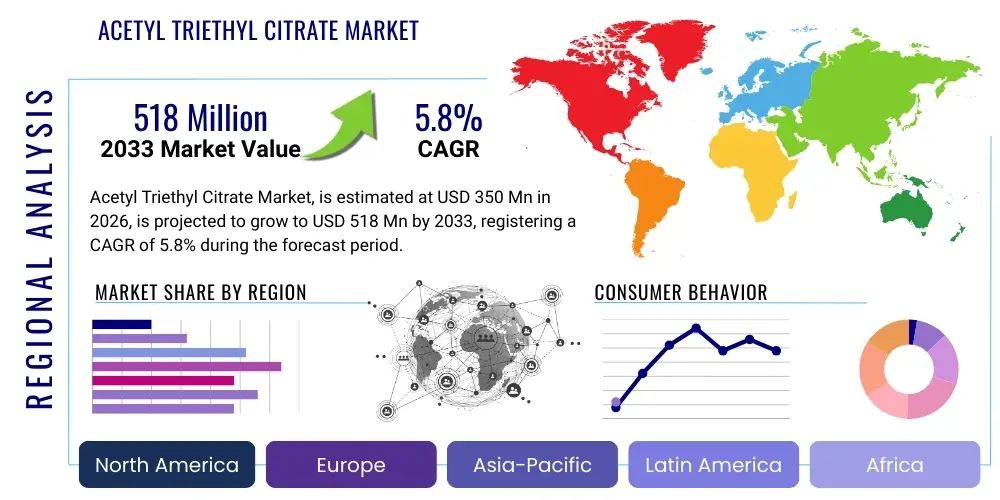

Acetyl Triethyl Citrate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434462 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Acetyl Triethyl Citrate Market Size

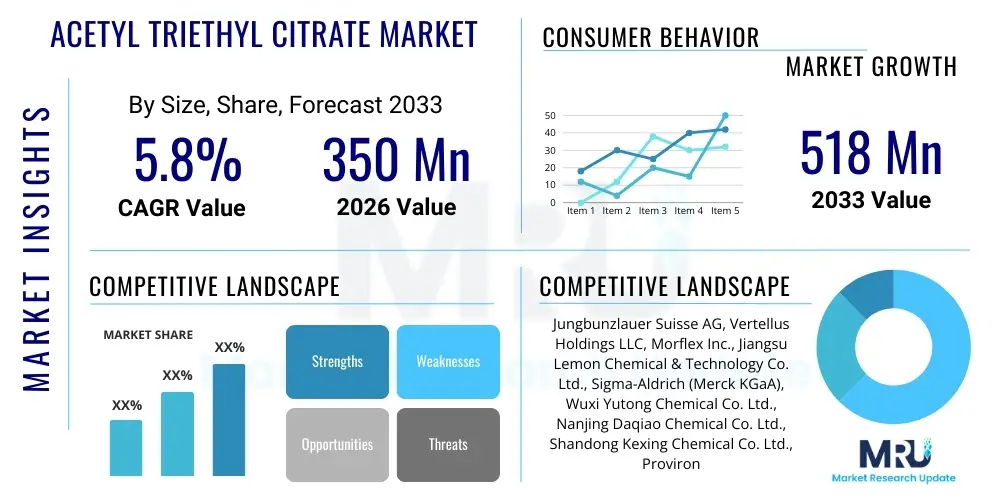

The Acetyl Triethyl Citrate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 518 Million by the end of the forecast period in 2033.

Acetyl Triethyl Citrate Market introduction

Acetyl Triethyl Citrate (ATEC) is a colorless, odorless, non-toxic, and biodegradable plasticizer derived from citric acid. It is widely recognized as a safe and environmentally friendly alternative to traditional phthalate plasticizers, which face increasing regulatory scrutiny due to potential health concerns. ATEC primarily functions by increasing the flexibility, durability, and workability of polymers, particularly cellulose-based plastics and polyvinyl chloride (PVC). Its superior compatibility with various polymers and low migration rate make it highly desirable for applications requiring stringent safety and quality standards, such as medical devices, food contact materials, and pharmaceuticals.

The core applications of ATEC span diverse industrial sectors, driven by the global shift towards sustainable chemistry and green solvents. In the pharmaceutical industry, ATEC is essential as a coating agent and binder in drug formulations, enhancing drug stability and controlled release profiles. Within the cosmetic and personal care industry, it serves as a solvent, fixative, and film former in nail polishes, hair sprays, and perfumes. Furthermore, its role in food packaging materials is expanding rapidly, capitalizing on its acceptance by major regulatory bodies like the FDA and European Food Safety Authority (EFSA) as a safe food contact substance. This multi-sectoral dependence highlights ATEC’s crucial position within the specialty chemicals market.

Major driving factors fueling market expansion include stringent government regulations restricting the use of conventional phthalates, robust growth in the bioplastics and bio-based polymers sector, and increasing consumer demand for non-toxic and eco-friendly products. The versatility of ATEC allows manufacturers to develop high-performance, compliant products across packaging, medical tubing, and children’s toys, ensuring long-term market resilience. Investment in production capacity, particularly in the Asia Pacific region, further contributes to meeting the escalating global demand.

Acetyl Triethyl Citrate Market Executive Summary

The Acetyl Triethyl Citrate (ATEC) market is characterized by robust growth, primarily propelled by global regulatory pressure against conventional plasticizers and the increasing adoption of bio-based substitutes in sensitive applications. Business trends indicate a focus on backward integration among key manufacturers to secure stable raw material supplies, notably citric acid, mitigating price volatility. Strategic partnerships between chemical producers and end-use manufacturers (especially in medical and food sectors) are essential for developing custom formulations that meet increasingly specialized performance requirements. Furthermore, sustainability reporting and certified green chemistry practices are becoming mandatory competitive differentiators, influencing procurement decisions across North America and Europe.

Regional dynamics illustrate that Asia Pacific (APAC) is the dominant and fastest-growing region, driven by rapid industrialization, burgeoning demand for flexible PVC in construction and automotive sectors, and expanding manufacturing bases in China and India. North America and Europe, while mature markets, exhibit high growth rates in premium segments, specifically those utilizing ATEC for medical devices and specialized biopolymer applications where safety compliance is paramount. These developed regions are the primary innovators driving demand for ultra-high purity grades of ATEC. Latin America and the Middle East & Africa (MEA) represent emerging opportunities, stimulated by infrastructural investment and the gradual adoption of international safety standards in packaging and toy manufacturing.

Segment trends reveal that the plasticizers application segment holds the largest market share due to the sheer volume used in PVC compounding and bioplastics. However, the coatings and inks segment is anticipated to register the highest CAGR, spurred by the shift towards environmentally compliant printing and surface treatments. High-purity grades of ATEC, tailored for pharmaceutical and food contact applications, command premium pricing and are expected to outpace commodity grades in terms of value growth. The shift towards bio-based raw material sourcing for citric acid production is also a significant underlying trend impacting segment profitability and consumer acceptance.

AI Impact Analysis on Acetyl Triethyl Citrate Market

Common user questions regarding AI's influence on the Acetyl Triethyl Citrate market center on optimizing synthesis processes, forecasting raw material price fluctuations (citric acid and ethanol), and accelerating new product development for customized plasticizer requirements. Users are keen to understand how AI-driven predictive maintenance can improve operational efficiency in chemical plants and how machine learning algorithms can rapidly screen potential new bio-based feedstocks that maintain or exceed ATEC performance standards. Furthermore, there is significant interest in using AI tools for complex regulatory compliance management, particularly regarding global food contact safety standards and REACH registration updates, minimizing human error and accelerating market entry for new product grades.

AI’s initial impact is most pronounced in optimizing the complex chemical synthesis of ATEC. Machine learning models analyze real-time process parameters, such as reaction temperature, pressure, and catalyst concentration, identifying optimal operating windows that maximize yield and minimize energy consumption. This level of optimization is critical given the pressure on chemical producers to reduce operational costs and environmental footprint. Predictive analytics also play a vital role in supply chain management, offering robust forecasts for raw material supply, especially citric acid, which can be subject to agricultural commodity price volatility. By accurately predicting demand and supply bottlenecks, manufacturers can maintain optimal inventory levels, ensuring cost-effective and continuous production.

Looking ahead, AI and Generative Chemistry tools are expected to revolutionize the formulation and application side of ATEC. AI algorithms can simulate the interaction of ATEC with novel biopolymers and additives, predicting properties such as thermal stability, migration rates, and mechanical strength before physical testing. This drastically reduces the time and resources needed for R&D, allowing companies to rapidly develop specialized ATEC grades for high-performance applications like flexible electronics or advanced medical coatings. The integration of AI into quality control, utilizing vision systems and data analytics for instantaneous purity checks, ensures that pharmaceutical and food-grade ATEC consistently meets ultra-strict specifications, bolstering market confidence and expanding high-value applications.

- AI optimizes chemical reaction parameters to maximize ATEC yield and reduce energy usage.

- Machine learning predicts fluctuations in citric acid raw material costs, enabling better procurement strategies.

- Predictive maintenance schedules minimize downtime in ATEC manufacturing facilities.

- Generative chemistry accelerates the formulation of customized ATEC blends for specific polymers (e.g., PLA, PHA).

- AI tools manage complex global regulatory compliance, particularly for food contact and pharmaceutical standards.

- Automated quality control systems ensure ultra-high purity specifications for medical and cosmetic grades.

DRO & Impact Forces Of Acetyl Triethyl Citrate Market

The market for Acetyl Triethyl Citrate is fundamentally shaped by powerful drivers, notably the accelerating global transition away from phthalate plasticizers (such as DEHP and DBP) mandated by regulatory bodies like the EU’s REACH and the US EPA, pushing manufacturers toward safer alternatives like ATEC. This regulatory push is amplified by strong consumer preference for eco-friendly and non-toxic products, particularly in segments related to children’s toys, medical devices, and food packaging. The opportunity landscape is vast, centered on the growing market for bioplastics and specialized coatings, where ATEC's superior compatibility and low volatility offer a significant performance edge. However, market growth is moderated by restraints, primarily the relatively higher cost of ATEC compared to established, conventional plasticizers and the volatility in the price and supply of citric acid, a key bio-based raw material, which directly impacts production economics and profitability.

The impact forces driving market acceptance are predominantly environmental and health-oriented. ATEC is favored because it is derived from renewable resources and is inherently biodegradable, aligning perfectly with global sustainability goals and circular economy initiatives. This positive environmental profile strengthens its competitive position against petroleum-derived alternatives. The demand force is strongly correlated with the rapid expansion of the healthcare sector globally, particularly the need for flexible, safe materials for IV bags, blood storage containers, and medical tubing, where ATEC is quickly becoming the material of choice due to its excellent toxicological profile and non-leaching properties. Furthermore, the automotive industry's push for lighter, safer interior components also provides a persistent demand stimulus.

Despite the strong drivers, restraints exert considerable pressure. The reliance on citric acid, which is typically produced through fermentation processes, means that ATEC production is susceptible to fluctuations in agricultural commodity markets and energy costs associated with fermentation. Furthermore, although ATEC offers superior safety, achieving cost parity with mass-produced conventional plasticizers remains a technical and economic challenge for broad market penetration, especially in high-volume, cost-sensitive applications like general purpose PVC wire and cable insulation in developing economies. Overcoming these cost challenges through optimized synthesis and scaling up production capacity is critical for capitalizing on the inherent market opportunities, especially in replacing the vast volume of remaining phthalate usage globally.

Segmentation Analysis

The Acetyl Triethyl Citrate market is structurally segmented based on application, function, and grade, reflecting the diverse end-user needs and specific performance requirements across industries. The primary application segments include plasticizers, solvents, coatings and inks, and pharmaceuticals, each demanding a distinct set of physical and chemical characteristics from the ATEC product. Plasticizers dominate the volumetric share, driven by its extensive use in producing flexible PVC products and biopolymer compounds. However, the high-value pharmaceutical segment, where ATEC serves as a non-toxic film former and solvent, contributes significantly to market revenue due to the stringent purity requirements and premium pricing associated with excipients.

Segmentation by function highlights ATEC's versatility, classifying its use as a plasticizer, a solvent/carrier, or a film former. In the capacity of a plasticizer, it imparts flexibility and improved processing characteristics to polymers. As a solvent, it is crucial in cosmetic and flavor industries for dissolving difficult substances and enhancing product stability. The film former function is essential in coatings and pharmaceutical enteric applications, providing durable and protective layers. Analyzing these functions allows manufacturers to tailor marketing and R&D efforts toward specific performance niches, maximizing market penetration across varied end-use industries.

Grade segmentation is critical for compliance and pricing differentiation, categorized primarily into technical grade, food grade, and pharmaceutical grade. The pharmaceutical grade demands the highest purity levels and is subject to the strictest regulatory oversight (USP/NF, EP standards), commanding the highest market price. Food grade ATEC is widely used in packaging films and seals, requiring rigorous testing for non-migration. The technical grade, while having the largest volume, is typically used in industrial coatings, adhesives, and general plastics where regulatory requirements are less stringent than those for direct contact applications. The sustained growth in the food and pharmaceutical sectors is projected to increase the market share contribution of the higher-purity grades over the forecast period.

- By Application:

- Plasticizers (PVC, Biopolymers)

- Coatings and Inks

- Solvents and Carriers

- Pharmaceuticals and Excipients

- Cosmetics and Personal Care

- By Function:

- Plasticizer

- Solvent/Diluent

- Film Former

- Coating Agent

- By Grade:

- Pharmaceutical Grade

- Food Grade (FCC)

- Technical Grade

- By End-Use Industry:

- Packaging

- Medical and Healthcare

- Automotive

- Construction

- Consumer Goods

Value Chain Analysis For Acetyl Triethyl Citrate Market

The Acetyl Triethyl Citrate value chain begins with the upstream procurement of key raw materials: citric acid, ethanol, and acetic anhydride. Citric acid is typically derived through the fermentation of carbohydrate feedstocks (like molasses or corn steep liquor), making this stage highly sensitive to agricultural and energy commodity price volatility. Manufacturers often seek long-term supply agreements or explore backward integration into citric acid production to secure supply stability and maintain cost competitiveness. The quality and purity of these upstream components directly dictate the final grade of ATEC produced, necessitating rigorous supplier vetting, particularly for pharmaceutical and food-grade applications.

The core manufacturing process involves the esterification of citric acid with ethanol, followed by acetylation using acetic anhydride. This midstream process requires specialized equipment and precise control to ensure high yield and purity, generating ATEC, water, and byproducts. Efficiency in the manufacturing stage is crucial for profitability, especially given the cost pressure from competing conventional plasticizers. Successful companies invest heavily in process optimization, including continuous processing technologies and catalyst development, to lower the overall energy input and improve product consistency.

Downstream analysis involves distribution and end-use application. ATEC is distributed through a mix of direct sales channels, particularly to large pharmaceutical and specialty polymer compounders, and indirect channels involving chemical distributors who service smaller cosmetic and coatings manufacturers. Direct distribution allows for tailored technical support and deep integration with key accounts, while indirect channels provide broad market reach. The final stage is consumption across various end-user industries—packaging, medical, and personal care—where ATEC is incorporated into final products, displacing less environmentally favorable alternatives. Success downstream relies on excellent application support and strong regulatory backing, affirming ATEC's safety profile globally.

Acetyl Triethyl Citrate Market Potential Customers

The potential customer base for Acetyl Triethyl Citrate is highly diversified yet fundamentally unified by the need for non-toxic, effective, and regulatory-compliant plasticizers and solvents. The primary buyers include large-scale polymer compounding companies that utilize ATEC to enhance the flexibility and durability of PVC and, increasingly, bio-based resins like polylactic acid (PLA) for sustainable packaging solutions. These compounders are the critical intermediary consumers, integrating ATEC into pellets or masterbatches before sale to final product manufacturers. Their purchasing decisions are primarily driven by cost-in-use, regulatory compliance, and the technical performance metrics of the ATEC product, such as migration resistance and thermal stability.

Another significant group of buyers consists of pharmaceutical and nutraceutical manufacturers. In this sector, ATEC is purchased as a high-purity excipient for tablet coatings, capsule shells, and controlled-release matrices. These customers demand the highest quality certifications (e.g., cGMP, USP/NF) and comprehensive documentation regarding safety and origin. Their purchasing criteria are non-negotiable on purity, stability, and regulatory compliance, making this segment highly valuable despite lower volume consumption compared to plasticizers. The third major consumer group includes manufacturers in the personal care and cosmetics industry, specifically those producing nail lacquers, hair sprays, and perfumes, where ATEC acts as an effective solvent, plasticizer, and film-forming agent, satisfying the demand for 'clean label' ingredients.

Furthermore, specialized industrial customers, such as manufacturers of medical devices (IV bags, catheters, medical tubing) and high-performance adhesives and sealants, represent a continually growing segment. For medical device makers, the non-leaching nature of ATEC is crucial for patient safety, driving large-volume contracts. Inks and coatings producers for food packaging are also high-potential buyers, driven by the global trend to eliminate residual solvents and plasticizers from packaging materials, ensuring minimal risk of chemical transfer to food products. Targeting these specialized sectors with customized, high-purity grades is key to maximizing revenue potential.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 518 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Jungbunzlauer Suisse AG, Vertellus Holdings LLC, Morflex Inc., Jiangsu Lemon Chemical & Technology Co. Ltd., Sigma-Aldrich (Merck KGaA), Wuxi Yutong Chemical Co. Ltd., Nanjing Daqiao Chemical Co. Ltd., Shandong Kexing Chemical Co. Ltd., Proviron Industries NV, Spectrum Chemical Mfg. Corp., KLK Oleo, BASF SE, Eastman Chemical Company, Polynt-Reichhold Group, Hangzhou Primate Chemical Co. Ltd., Chemceed LLC, Finar Chemicals, Parchem fine & specialty chemicals, Hefei TNJ Chemical Industry Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Acetyl Triethyl Citrate Market Key Technology Landscape

The primary technology governing the Acetyl Triethyl Citrate market revolves around optimized esterification and subsequent purification processes. The synthesis of ATEC involves a multi-step chemical reaction starting from citric acid, requiring highly efficient continuous or semi-continuous reactors to handle the esterification with ethanol, followed by the acetylation step. Key technological advancements focus on utilizing advanced heterogeneous catalysts that increase reaction speed and selectivity while minimizing byproduct formation. Innovations in reaction engineering, particularly the use of intensified reactors (e.g., microreactors), are emerging to improve energy efficiency and enhance overall throughput, directly addressing the cost competitiveness challenge faced by ATEC manufacturers.

Purity enhancement technologies represent the second critical area of innovation, particularly for achieving pharmaceutical and food-grade specifications. Traditional purification relies heavily on multi-stage distillation and solvent extraction, which can be energy-intensive. Modern technological improvements include continuous chromatography and advanced membrane filtration techniques designed to remove trace impurities, unreacted starting materials, and color bodies efficiently. These purification steps are vital as regulatory bodies continually tighten limits on residual solvents and heavy metals in excipients and food contact materials. Manufacturers who master these high-efficiency separation technologies gain a significant competitive advantage in the premium grade segments.

Furthermore, technology related to feedstock sourcing and sustainability is gaining traction. This includes research into optimizing the fermentation process of citric acid to use cheaper, non-food-competitive raw materials and developing bio-based acetic anhydride sources. The adoption of digital twin technology in manufacturing plants allows operators to simulate changes in process variables in real-time, optimizing energy use and reducing waste, aligning production processes with strict environmental, social, and governance (ESG) standards. Overall, the technological landscape is shifting towards maximizing efficiency, ensuring purity, and solidifying the bio-based origin of ATEC.

Regional Highlights

The Acetyl Triethyl Citrate market exhibits significant regional variation in both demand structure and growth potential, dictated largely by local regulatory environments and industrial maturity. Asia Pacific (APAC) stands as the undisputed engine of growth, commanding the largest market share globally. This dominance is attributed to robust expansion in manufacturing sectors, particularly packaging, consumer electronics, and automotive industries, driving high-volume consumption of technical-grade ATEC. Countries like China and India are not only major consumers but also key manufacturing hubs for the chemical, increasingly exporting ATEC globally. The less stringent, but rapidly evolving, regulatory landscape regarding phthalates in many APAC countries initially allowed slower adoption, but the swift alignment towards international safety standards is now accelerating the shift toward bio-based alternatives like ATEC.

Europe represents a mature but highly valuable market segment, characterized by stringent regulatory oversight under REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals). The European Union’s aggressive stance on phasing out hazardous chemicals, particularly phthalates in children's articles and food contact materials, provides a powerful, structural driver for ATEC adoption. Demand in Europe is primarily focused on high-purity and pharmaceutical grades, where manufacturers prioritize safety and low migration properties. Germany, France, and the UK are key consumers, demonstrating strong demand from the medical device manufacturing and high-end cosmetic sectors. European manufacturers are also pioneering the use of ATEC in cutting-edge bioplastic formulations, further boosting regional market value.

North America, led by the United States, is a strong adopter of ATEC, driven by significant investment in the healthcare sector and regulatory actions taken by the FDA and EPA concerning chemical safety. The US market exhibits a dual demand pattern: substantial volumes of technical grade ATEC are used in adhesives, sealants, and construction materials, while ultra-high purity grades dominate the pharmaceutical and medical tubing sectors. Innovation in sustainable packaging and the growing consumer demand for certified non-toxic products heavily influence procurement decisions. Latin America and the Middle East & Africa (MEA) are emerging markets, currently characterized by smaller consumption volumes but high growth potential, spurred by infrastructural development, rising health consciousness, and the gradual harmonization of regional product safety standards with global norms. Investment in local processing capabilities and distribution networks will be key to unlocking full market potential in these regions.

- Asia Pacific (APAC): Dominates market volume; driven by expanding packaging and construction sectors in China and India; focus on increasing localized production capacity.

- Europe: High-value market focused on pharmaceutical and food-grade ATEC; growth strongly dictated by strict REACH regulations and innovation in sustainable bioplastics.

- North America: Significant consumption in medical device manufacturing and advanced packaging; market growth supported by FDA and EPA guidelines favoring non-phthalate plasticizers.

- Latin America (LATAM): Emerging market characterized by growing demand in consumer goods and infrastructure; regulatory adoption is slower but accelerating.

- Middle East & Africa (MEA): Smallest market share; gradual expansion driven by foreign investment and the need for international quality standards in imported and locally manufactured goods.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Acetyl Triethyl Citrate Market.- Jungbunzlauer Suisse AG

- Vertellus Holdings LLC

- Morflex Inc.

- Jiangsu Lemon Chemical & Technology Co. Ltd.

- Sigma-Aldrich (Merck KGaA)

- Wuxi Yutong Chemical Co. Ltd.

- Nanjing Daqiao Chemical Co. Ltd.

- Shandong Kexing Chemical Co. Ltd.

- Proviron Industries NV

- Spectrum Chemical Mfg. Corp.

- KLK Oleo

- BASF SE

- Eastman Chemical Company

- Polynt-Reichhold Group

- Hangzhou Primate Chemical Co. Ltd.

- Chemceed LLC

- Finar Chemicals

- Parchem fine & specialty chemicals

- Hefei TNJ Chemical Industry Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Acetyl Triethyl Citrate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Acetyl Triethyl Citrate (ATEC) and why is it replacing traditional plasticizers?

ATEC is a non-toxic, bio-based plasticizer derived from citric acid. It is replacing traditional phthalate plasticizers (like DEHP) due to increasing global regulatory restrictions and consumer demand for safer chemicals, especially in sensitive applications such as medical devices, toys, and food contact materials, owing to its low migration and excellent safety profile.

Which end-use industries are the primary drivers of ATEC market growth?

The primary drivers are the medical and healthcare industry (for safe, flexible tubing and IV bags), the packaging sector (for sustainable and food-compliant films), and the pharmaceutical sector (where it is used as a high-purity excipient for coatings).

How does the volatility of citric acid prices impact the ATEC market?

Citric acid is the major raw material for ATEC synthesis, and its price volatility, often linked to agricultural commodity markets and energy costs for fermentation, significantly affects the overall production cost and pricing strategy for Acetyl Triethyl Citrate manufacturers, posing a key restraint to broad market adoption.

Which region currently holds the largest market share for Acetyl Triethyl Citrate?

The Asia Pacific (APAC) region currently holds the largest market share, driven by rapid industrialization, expanding manufacturing bases in China and India, and high volume usage in the packaging and general plastics sectors.

What are the key technological advancements expected to influence ATEC production?

Key technological advancements include the utilization of advanced catalysts and continuous flow reactors to optimize the esterification process, implementation of highly efficient separation technologies (like membrane filtration) for achieving ultra-high purity grades, and the application of AI for supply chain optimization and R&D acceleration.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager