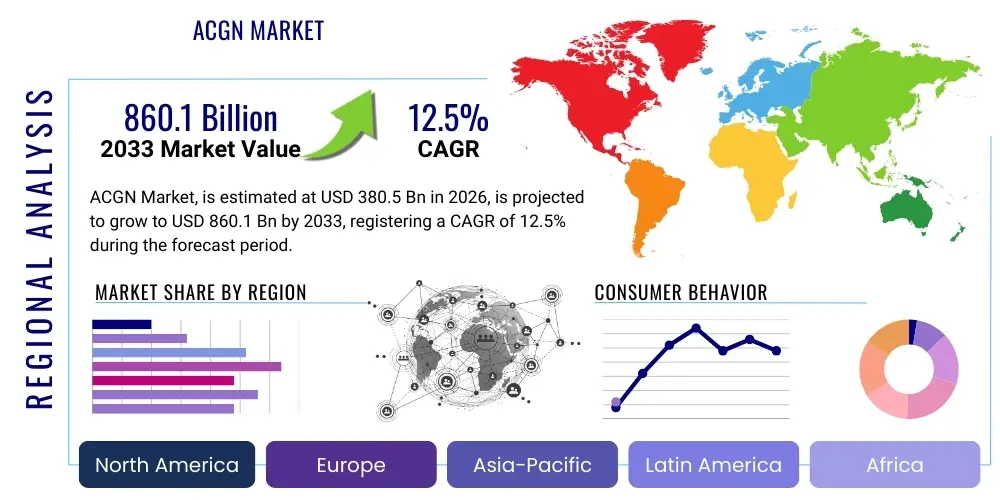

ACGN Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437901 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

ACGN Market Size

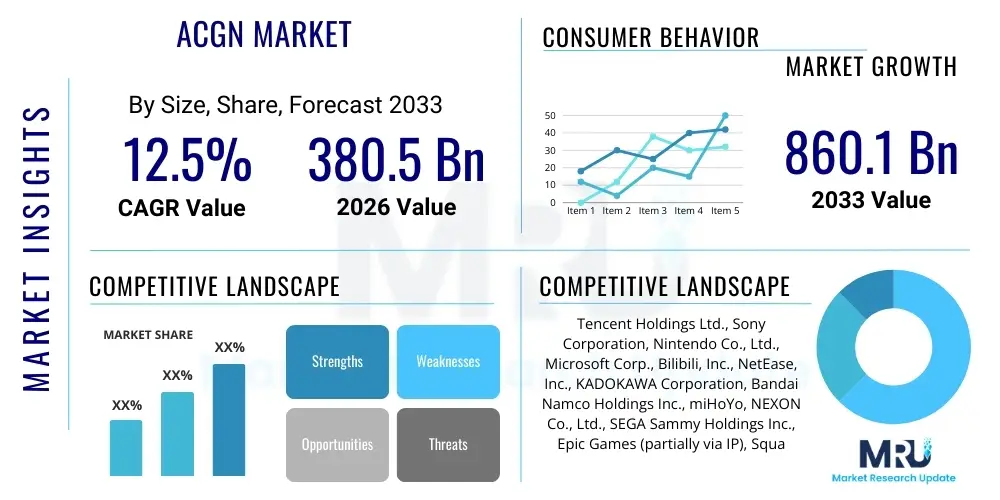

The ACGN Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 380.5 billion in 2026 and is projected to reach USD 860.1 billion by the end of the forecast period in 2033. This robust expansion is primarily driven by the increasing integration of digital technologies, the proliferation of global streaming platforms, and the massive cultural influence exerted by Japanese, Chinese, and Korean intellectual properties (IPs) across international borders, establishing ACGN as a cornerstone of global digital entertainment infrastructure and consumer spending.

ACGN Market introduction

The Animation, Comics, Games, and Novels (ACGN) market represents a dynamic, cross-media ecosystem encompassing digitally consumed or physically distributed intellectual property (IP) centered on narrative entertainment. This market is characterized by profound synergy, where successful content in one medium—such as a manga or light novel—is rapidly adapted into high-grossing animated series, blockbuster video games, and expansive merchandise lines, generating significant recurring revenue streams. Major applications of ACGN content include personal entertainment, social interaction (via gaming communities and fan culture), and educational resources, particularly in digital art and narrative design. Key benefits driving market adoption include highly immersive experiences, strong community engagement, and accessible cross-platform availability, catering to a diverse global demographic ranging from Gen Z to older enthusiasts who appreciate serialized, character-driven storytelling.

The primary driving factors sustaining the exceptional growth trajectory of the ACGN market are the widespread global adoption of high-speed internet, particularly 5G networks, which enhance the quality and accessibility of demanding content like mobile games and 4K animation streaming. Furthermore, the rising disposable income in emerging economies, particularly across Asia Pacific, fuels consumer spending on premium content, subscriptions, and in-game microtransactions. The continuous innovation in content delivery methods, such as subscription models (e.g., Crunchyroll, Tencent Video) and advanced rendering technologies, keeps the content fresh and engaging. The market thrives on cultural globalization, where once niche content from East Asia has now become mainstream worldwide, necessitating sophisticated localization and marketing strategies to maintain global appeal and capture consumer attention across disparate regional tastes.

ACGN Market Executive Summary

The ACGN market's executive summary highlights a significant pivot towards digital consumption and cross-platform IP monetization, driven overwhelmingly by the mobile gaming sector, which remains the single largest revenue contributor. Business trends indicate a focus on vertical integration, with major technology conglomerates acquiring or forming partnerships with content creation studios (e.g., Tencent’s extensive investment portfolio) to control the entire value chain from production to distribution. The rise of Web3 technologies, particularly Non-Fungible Tokens (NFTs) and blockchain integration within gaming and collectible platforms, represents a critical emerging business model aimed at enhancing consumer ownership and generating new digital revenue streams, though regulatory scrutiny remains a challenge. Companies are heavily investing in robust data analytics to tailor personalized content recommendations, thereby increasing user retention and maximizing lifetime customer value across their diverse media offerings.

Regionally, the Asia Pacific (APAC) area, particularly China, Japan, and South Korea, serves as the undeniable epicenter of ACGN production, innovation, and consumption, setting global trends in content genres, art styles, and monetization strategies. While APAC maintains dominance, North America and Europe show accelerated growth, primarily fueled by the increasing appetite for licensed Japanese content (anime and manga) and the massive success of global free-to-play (F2P) gaming titles originating from Asia. Segment trends emphasize the continued evolution of the gaming segment towards live-service models and the surging popularity of web novels and digitally native comics (webtoons/manhua), often bypassing traditional print publishing routes entirely. This shift necessitates swift adaptation of production pipelines to handle rapid, serialized content release schedules demanded by digital consumers, putting pressure on traditional animation and publishing houses to modernize their workflows.

AI Impact Analysis on ACGN Market

User inquiries regarding AI's influence on the ACGN market frequently center around the duality of technological disruption: efficiency gains versus job displacement and the authenticity of art. Common questions probe whether AI generated artwork will dilute the unique quality of human creativity in comics and animation, how AI can optimize game development pipelines, and what regulatory frameworks will govern the intellectual property rights of AI-assisted creations. Concerns also revolve around AI’s role in deep-faking and unauthorized content replication, threatening creators’ livelihoods. Conversely, users expect AI to revolutionize content personalization, making game narratives and character interactions more dynamic, and drastically reducing the time required for repetitive tasks like animation in-betweening, asset generation, and basic translation/localization, thereby accelerating global content distribution cycles and enabling smaller studios to compete more effectively with industry giants.

The integration of sophisticated AI tools, leveraging generative adversarial networks (GANs) and large language models (LLMs), is poised to fundamentally reshape creative production within the ACGN ecosystem. In animation, AI is already optimizing rendering times, automating texture generation, and assisting in complex physics simulations, drastically cutting production costs and increasing output volume, enabling studios to meet the relentless demand for new series. For the gaming sector, AI enhances non-player character (NPC) behavior realism, improves procedural content generation (PCG) for map design and quests, and refines player matching algorithms in competitive multiplayer environments. However, the adoption necessitates significant investment in specialized AI training data (often requiring massive datasets of pre-existing artistic styles) and requires careful ethical governance to manage concerns related to plagiarism and derivative works, ensuring that AI remains a tool to augment, rather than replace, human artistic talent and narrative mastery.

- Accelerated Content Creation: AI tools rapidly generate background assets, character concepts, and animation frames, reducing reliance on manual labor.

- Enhanced Personalization: AI algorithms tailor game difficulty, novel recommendations, and advertising content based on granular user behavior data, optimizing engagement.

- Automated Localization: Machine learning models improve the speed and accuracy of translating text, voiceovers, and subtitles for global distribution, minimizing market entry barriers.

- Risk of IP Litigation: Increased legal complexity surrounding copyright ownership for content generated by AI trained on copyrighted artistic databases.

- Improved Game Testing: AI agents perform automated quality assurance (QA) testing and balance analysis in games, identifying complex bugs and gameplay issues faster than human testers.

- Dynamic Storytelling: Implementation of AI allows narrative branches and character dialogues in games and interactive novels to adapt dynamically to player choices.

DRO & Impact Forces Of ACGN Market

The ACGN market is propelled by key drivers (D) such as the exponential growth in mobile computing power and global 5G network penetration, enabling high-fidelity gaming and seamless streaming on portable devices, making content accessible anytime, anywhere. Furthermore, the aggressive adoption of cross-media intellectual property (IP) strategies, where a successful comic immediately spawns a game, an anime, and merchandise, ensures continuous revenue maximization from a single creative asset. However, significant restraints (R) impede growth, including pervasive digital piracy and illegal streaming, which erode potential revenues, especially in emerging markets. Additionally, highly stringent and often politically motivated content censorship and regulatory oversight in major markets like China pose substantial operational hurdles, forcing content localization teams to navigate complex ethical and political landscapes that require costly modifications or complete withdrawal of content.

Opportunities (O) for future expansion lie significantly in the burgeoning Metaverse and Web3 space, where ACGN IPs are establishing virtual worlds and leveraging NFTs for digital collectibles, unlocking entirely new avenues for fan engagement and high-margin revenue streams based on digital scarcity and verifiable ownership. Furthermore, the massive, untapped potential in non-traditional geographic markets, particularly in Latin America, Southeast Asia (outside established centers like Japan/Korea), and parts of Africa, represents a critical frontier for market penetration, requiring customized distribution partnerships. These forces collectively exert considerable impact (Impact Forces), primarily through the rapid consolidation of media companies striving for unified IP control, leading to oligopolistic market structures where a few giants dictate content trends and distribution methodologies. This consolidation is pushing smaller independent creators to rely heavily on platforms (like Patreon or specialized developer funding programs) to secure financial viability and maintain creative autonomy amidst the dominance of major global entertainment ecosystems.

Segmentation Analysis

The ACGN market is fundamentally segmented by the core media type, the distribution platform utilized by consumers, and the prevalent monetization models employed by content creators and distributors. Understanding these divisions is critical for targeted marketing and strategic investment, as consumer behavior varies drastically between, for instance, a dedicated PC gamer focused on high-fidelity graphics and a casual mobile novel reader seeking daily serialized updates. The growth differential across segments highlights the technological shifts; mobile platforms dominate due to ease of access, while the increasing professionalization of webtoons and digitally published novels showcases a strong shift away from physical media reliance, compelling publishers to rapidly overhaul their content management systems and distribution channels to prioritize instantaneous digital release schedules globally.

- By Content Type

- Animation (Anime, Western Animation, 3D CGI)

- Comics (Manga, Manhua, Webtoons, Western Comics, Graphic Novels)

- Games (Console, PC, Mobile, Arcade, Cloud Gaming)

- Novels (Light Novels, Web Novels, Digital Serials)

- By Platform

- Digital Distribution (Streaming Services, Online Stores, App Stores)

- Physical Distribution (Retail Copies, Print Comics/Manga, Collectibles)

- Dedicated Gaming Hardware (PC, Console, Handheld Devices)

- By Revenue Model

- Subscription Models (SVOD, Monthly Passes)

- In-App Purchases/Microtransactions (Gacha Systems, Cosmetic Items)

- Advertising Revenue (Ad-supported Free Content)

- Upfront Sales/Licensing Fees (Game Purchases, IP Licensing)

- By Demographics

- Age Group (Children, Teenagers, Young Adults, Adults)

- Geographic Location (APAC, North America, Europe, etc.)

Value Chain Analysis For ACGN Market

The ACGN value chain is intricate, beginning with the upstream segment dominated by independent creators, writers, illustrators, software developers (e.g., game engines like Unity/Unreal), and animation studios responsible for generating the initial IP. This phase involves significant capital expenditure in talent acquisition, technology licensing, and initial production costs, often financed by major publishers or investment funds seeking high-potential IPs. Key activities here include storyboarding, character design, engine development, and initial content production, relying heavily on specialized artistic talent and proprietary technological know-how. Efficiency in the upstream segment dictates the speed and quality of market entry, making rapid iteration and access to state-of-the-art creative tools paramount for competitive advantage in the highly saturated content landscape.

The midstream of the value chain focuses on manufacturing, aggregation, localization, and marketing. This involves printing and binding (for physical media), mass manufacturing of game discs/consoles, and, crucially, the rigorous localization process for global distribution, including cultural adaptation and high-quality translation. Large media conglomerates and global distributors manage aggregation, packaging diverse content libraries for market release, alongside intensive global marketing campaigns designed to build initial audience hype and sustain long-term fan loyalty. This segment requires robust operational logistics and sophisticated marketing data analytics to maximize visibility and minimize inventory risk, especially for physical goods like manga or collectibles where demand forecasting is highly volatile and susceptible to shifts in popular culture.

The downstream segment revolves around distribution and consumption, facilitated through two main channels: direct and indirect. Direct distribution channels involve content owners selling directly to consumers through their proprietary platforms (e.g., Nintendo eShop, Sony PlayStation Network, Bilibili’s content hub), allowing for maximum control over pricing and customer data. Indirect distribution relies on third-party aggregators, retailers, and marketplaces (e.g., Amazon, Google Play Store, specialized comic book shops, global streaming services like Netflix or Crunchyroll), which offer broader reach but involve revenue sharing and reduced data access for the original content creator. This final stage is crucial for revenue generation, relying on seamless user experience, secure payment gateways, and highly resilient digital infrastructure capable of handling massive concurrent user loads during peak consumption periods, such as major game launches or new anime season premieres.

ACGN Market Potential Customers

The primary consumers, or End-Users/Buyers, in the ACGN market are predominantly digital natives, spanning Generation Z (ages 10-25) and Millennials (ages 26-40), who prioritize personalized, high-quality digital entertainment and actively participate in fan communities. These demographics are characterized by high levels of technological proficiency, a readiness to engage with microtransactions (especially in free-to-play mobile games), and a significant appetite for cross-media consumption, moving effortlessly between watching a character in an anime and playing as them in a companion game. Their purchasing behavior is often driven by emotional connection to the Intellectual Property (IP), leading to high expenditure on collectibles, merchandise, and premium digital content, often influenced heavily by social media trends and peer recommendations, making influencer marketing a crucial strategy for reaching this segment effectively.

A secondary, yet highly valuable, customer segment includes IP licensing partners and advertisers. Businesses, including major retailers, fashion brands, and food and beverage companies, are increasingly licensing popular ACGN characters and franchises to drive consumer engagement and product relevance, especially towards youth markets. These B2B customers seek established, globally recognized IPs (e.g., Pokémon, Genshin Impact) that guarantee high visibility and consumer appeal. Furthermore, the massive, highly engaged user bases of major ACGN platforms (particularly gaming platforms and streaming sites) attract significant advertising revenue from third parties seeking targeted placement. The sustained engagement and long playtime hours associated with ACGN content makes these audiences premium targets for digital advertisers looking to maximize impression rates and conversion efficiency across diverse marketing funnels, securing the longevity of ad-supported business models within the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 380.5 billion |

| Market Forecast in 2033 | USD 860.1 billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tencent Holdings Ltd., Sony Corporation, Nintendo Co., Ltd., Microsoft Corp., Bilibili, Inc., NetEase, Inc., KADOKAWA Corporation, Bandai Namco Holdings Inc., miHoYo, NEXON Co., Ltd., SEGA Sammy Holdings Inc., Epic Games (partially via IP), Square Enix Holdings Co., Ltd., Com2uS, Kakao Entertainment, Garena (Sea Ltd.), Cygames, Aniplex, Crunchyroll (Sony), Huya Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

ACGN Market Key Technology Landscape

The ACGN market's technological landscape is rapidly evolving, moving beyond traditional rendering and distribution methods towards highly immersive and decentralized consumer experiences. Central to this evolution is the widespread adoption of advanced cloud computing infrastructure, which powers seamless cross-platform play and enables graphics-intensive gaming on lower-end hardware through services like NVIDIA GeForce NOW and Microsoft xCloud. This shift minimizes the capital outlay required by consumers for dedicated gaming hardware, vastly expanding the total addressable market globally, particularly in regions where high-cost consoles or powerful PCs are economically inaccessible. Furthermore, high-fidelity 5G connectivity is essential, providing the low latency and high bandwidth necessary to deliver real-time cloud gaming and high-definition video streaming without buffering or input lag, making previously niche services mainstream entertainment choices for hundreds of millions of users.

Augmented Reality (AR) and Virtual Reality (VR) technologies are increasingly being integrated, especially in the gaming and interactive animation sectors, offering deeper immersion and novel forms of fan engagement, though mass adoption remains constrained by device cost and user comfort. VR is particularly impactful in niche segments for highly immersive narrative experiences and virtual concert events featuring ACGN IP characters. Crucially, the rise of Web3 technologies, leveraging decentralized ledger technology (Blockchain), is fundamentally altering digital ownership models. Non-Fungible Tokens (NFTs) are being deployed for verifiable ownership of in-game assets, digital collectibles, and limited-edition fan art, creating circular economies where consumers can trade or sell digital goods, generating new revenue streams for developers and providing intrinsic value back to the user base, driving unprecedented user participation and investment in the ACGN ecosystem.

Finally, Artificial Intelligence (AI) and Machine Learning (ML) algorithms are pervasive across the production and monetization pipelines. Beyond content creation assistance, AI is critical for predictive analytics, forecasting the success potential of new IPs based on genre characteristics and previous user engagement data, allowing companies to allocate resources more efficiently. ML is also vital in optimizing advertising spend, personalizing the gaming difficulty curve in real-time to maintain optimal player retention, and refining content recommendation engines across streaming platforms (e.g., recommending a related manga after a user finishes an anime series), thereby maximizing the cross-promotion potential inherent in the ACGN ecosystem. The convergence of these technologies—Cloud, 5G, AR/VR, Web3, and AI—creates a synergistic environment where content delivery is faster, experiences are more personalized, and digital ownership is verifiable and tradeable.

Regional Highlights

- Asia Pacific (APAC): APAC remains the dominant market globally, driven by the colossal influence of core markets—China, Japan, and South Korea—which lead in terms of IP creation, consumption, and technological innovation (especially mobile gaming and webtoon platforms). China is the world's largest gaming market and a primary consumer of domestic animation (donghua) and web novels, characterized by high spending on microtransactions and strict regulatory environments. Japan is the undisputed leader in high-quality traditional anime, manga, and console gaming IP, maintaining strong global licensing revenue. South Korea leads innovation in digital comics (webtoons) and sophisticated mobile MMORPGs, demonstrating high monetization efficiency.

- North America: North America is a critical revenue hub, particularly for console and PC gaming (AAA titles) and a rapidly expanding consumer base for imported Asian content. Streaming services like Crunchyroll and Funimation (now unified) drive significant subscription revenue for animation. The region is characterized by high disposable income and strong consumer interest in large-scale cross-media franchises, making it a primary target for global IP licensing and adaptation into Hollywood productions.

- Europe: Europe exhibits substantial and accelerating growth, especially in the consumption of manga and streamed anime, with markets such as France, Germany, and Italy showing particular cultural affinity for Japanese animation. While gaming consumption is robust (both console and PC), the region lags APAC and North America in mobile gaming market share. Regulatory challenges, particularly regarding data privacy (GDPR) and digital content taxation, influence operational strategies for global distributors operating within the European Union.

- Latin America (LATAM): LATAM represents a major emerging market characterized by rapid growth in internet penetration and a youthful population enthusiastic about digital entertainment. Mobile gaming and ad-supported content consumption dominate due to lower average disposable incomes. Challenges include fragmented distribution channels, high prevalence of piracy, and the need for greater localization efforts to cater to specific linguistic and cultural nuances across countries like Brazil and Mexico.

- Middle East and Africa (MEA): MEA is the smallest but fastest-growing regional market, showing significant investment in digital infrastructure and media development, particularly in the Gulf Cooperation Council (GCC) nations. Consumption is rapidly increasing, focusing primarily on mobile games and globally popular streaming services. Content must navigate complex social and cultural sensitivities, requiring rigorous content filtering and adaptation to meet diverse regional standards and religious requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the ACGN Market.- Tencent Holdings Ltd. (China)

- Sony Corporation (Japan)

- Nintendo Co., Ltd. (Japan)

- Microsoft Corporation (USA)

- Bilibili, Inc. (China)

- NetEase, Inc. (China)

- KADOKAWA Corporation (Japan)

- Bandai Namco Holdings Inc. (Japan)

- miHoYo (China)

- NEXON Co., Ltd. (South Korea)

- SEGA Sammy Holdings Inc. (Japan)

- Square Enix Holdings Co., Ltd. (Japan)

- Epic Games, Inc. (USA)

- Com2uS Holdings Corporation (South Korea)

- Kakao Entertainment Corp. (South Korea)

- Garena (Sea Ltd.) (Singapore)

- Cygames, Inc. (Japan)

- Aniplex Inc. (Japan, Sony Subsidiary)

- Crunchyroll, LLC (USA, Sony Subsidiary)

- Huya Inc. (China)

Frequently Asked Questions

Analyze common user questions about the ACGN market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the massive growth in the global ACGN market?

The ACGN market's substantial growth is primarily fueled by the dominance of mobile gaming platforms, accelerated 5G network expansion globally, and the highly successful cross-media utilization of intellectual property (IP), where characters and stories are rapidly adapted across anime, games, and novels, maximizing fan engagement and revenue from a single source asset.

How is digital distribution affecting traditional ACGN content providers?

Digital distribution is forcing traditional content providers (publishers and animation studios) to rapidly pivot from physical sales to subscription-based models and direct-to-consumer platforms. This shift minimizes reliance on physical retail, accelerates global release schedules, and increases the importance of personalized content recommendations and digital rights management (DRM) to combat piracy.

Which geographic region holds the largest market share in the ACGN industry?

The Asia Pacific (APAC) region, spearheaded by China, Japan, and South Korea, maintains the largest market share and acts as the global innovation hub for the ACGN industry. Its dominance is attributed to massive consumer bases, high spending on mobile gaming, and being the primary source of globally influential content like anime, manga, and webtoons.

What is the primary impact of Artificial Intelligence (AI) on ACGN content creation?

AI primarily impacts ACGN content creation by accelerating production pipelines, particularly in asset generation, animation in-betweening, and localization, leading to significant cost reductions and faster time-to-market. However, this introduces challenges concerning copyright ownership and maintaining artistic authenticity amidst increased automation.

What are the key monetization models in the ACGN market beyond direct sales?

Key monetization strategies include subscription video-on-demand (SVOD) for animation and comics, in-app purchases (IAPs) and microtransactions (especially gacha systems) within mobile games, premium content licensing to global streaming platforms, and increasingly, leveraging Non-Fungible Tokens (NFTs) for digital collectibles and verifiable in-game asset ownership in Web3 integrated content.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager