Acid Fume Scrubber Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432070 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Acid Fume Scrubber Market Size

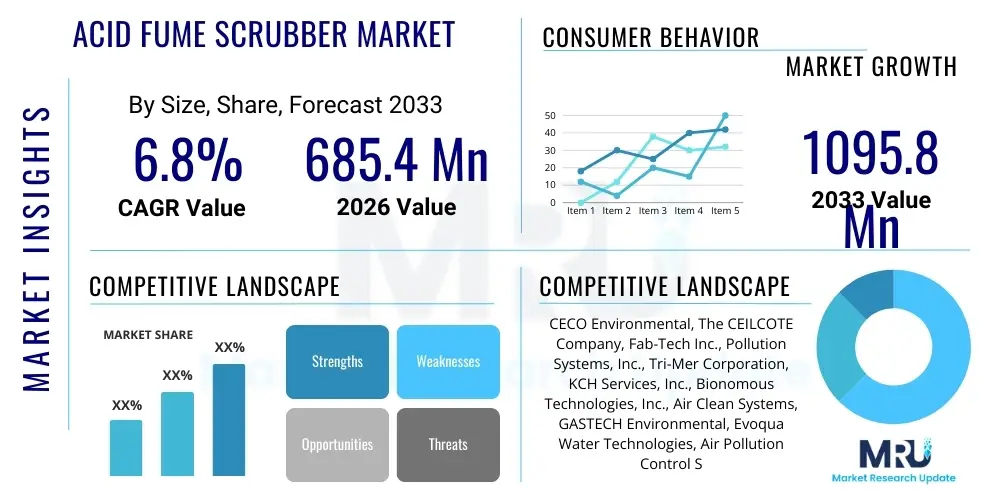

The Acid Fume Scrubber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 685.4 Million in 2026 and is projected to reach USD 1095.8 Million by the end of the forecast period in 2033.

Acid Fume Scrubber Market introduction

The Acid Fume Scrubber Market encompasses specialized air pollution control equipment designed to neutralize or remove hazardous acid mists, gases, and fumes generated during various industrial processes. These systems are essential components of environmental compliance infrastructure, utilizing methods such as wet scrubbing, often involving chemical reagents or water, to absorb and react with acidic compounds like hydrochloric acid (HCl), sulfuric acid (H₂SO₄), nitric acid (HNO₃), and hydrofluoric acid (HF). The primary product categories include packed bed scrubbers, venturi scrubbers, and tray scrubbers, each optimized for specific particulate loading and gas flow characteristics, ensuring efficient emission control before discharge into the atmosphere.

Major applications driving the demand for acid fume scrubbers are concentrated in heavy industrial sectors and high-tech manufacturing, particularly the chemical processing, semiconductor fabrication, metal finishing, and pharmaceutical industries. Chemical plants rely on scrubbers to manage highly corrosive off-gases from synthesis and reaction vessels, while semiconductor manufacturing requires ultra-pure air environments necessitating the rigorous removal of highly toxic etchant fumes. The foundational benefits derived from adopting these systems are twofold: ensuring worker safety by preventing exposure to hazardous substances and achieving stringent regulatory compliance with national and international environmental agencies, thereby avoiding substantial financial penalties and operational shutdowns.

Key driving factors accelerating market expansion include the increasingly stringent global air quality standards, especially across industrialized and rapidly developing economies in Asia Pacific and Europe, which mandate lower permissible emission limits for acidic pollutants. Furthermore, the robust growth in sectors like electronics and pharmaceuticals, which are intrinsically dependent on processes generating acid fumes, fuels continuous investment in advanced scrubbing technologies. Operational efficiency improvements, such as the development of corrosion-resistant materials and smart monitoring systems that reduce maintenance overhead, also contribute significantly to the broader adoption rates of modern acid fume scrubbing solutions.

Acid Fume Scrubber Market Executive Summary

The Acid Fume Scrubber Market is currently experiencing robust growth, primarily propelled by global commitments to environmental sustainability and the tightening of air quality regulations across major industrialized nations. Business trends indicate a significant shift toward modular, energy-efficient, and custom-engineered scrubbing solutions, particularly those utilizing advanced composite materials such such as fiber-reinforced plastics (FRP) and specialized polymers to enhance corrosion resistance and prolong system lifespan. Strategic partnerships focusing on providing comprehensive service contracts, including routine maintenance and reagent supply, are emerging as critical differentiators in the competitive landscape, ensuring maximum uptime and efficiency for end-users operating high-throughput facilities.

Regionally, Asia Pacific (APAC) stands out as the dominant growth engine, driven by massive industrial expansion, particularly in China, India, and South Korea, fueled by increasing investment in the semiconductor, chemical, and metal processing sectors. European and North American markets, while mature, maintain steady demand due to replacement cycles, mandatory upgrades to meet updated regulatory standards (e.g., EU Industrial Emissions Directive), and a focus on advanced scrubbing technologies integrating predictive maintenance and automation. The trend is moving away from purely reactive maintenance toward sophisticated digital solutions that provide real-time performance monitoring and remote diagnostics, thus optimizing operational expenditure (OPEX) globally.

Segmentation trends highlight the packed bed scrubber segment maintaining market leadership due to its high efficiency and adaptability across diverse acid concentrations and flow rates. The increasing complexity of pollutants in industries like microelectronics is driving demand for multi-stage and hybrid scrubbing systems that combine different technologies—such as wet scrubbing followed by activated carbon filtration—to ensure compliance with ultra-low emission standards. Furthermore, the market is observing a rising preference for dry scrubbers in certain niche applications where water conservation is critical or where the waste byproduct can be handled more easily as a solid rather than a liquid effluent.

AI Impact Analysis on Acid Fume Scrubber Market

User queries regarding AI's influence on the Acid Fume Scrubber Market frequently center on how artificial intelligence can move scrubbing operations beyond basic regulatory compliance toward predictive optimization and cost reduction. Key themes involve the integration of Machine Learning (ML) models for real-time emission prediction based on operational parameters, the automation of complex reagent dosing to maintain optimal neutralization efficiency, and the deployment of deep learning algorithms for equipment failure prognosis. Users are keenly interested in reducing system downtime associated with traditional, scheduled maintenance and minimizing the fluctuating costs associated with chemical consumption, expecting AI to deliver higher reliability and a lower total cost of ownership (TCO) for critical air pollution control assets.

The application of AI and Industrial Internet of Things (IIoT) technologies is revolutionizing the monitoring and control aspects of acid fume scrubbers. Sensors deployed throughout the system continuously collect data on pH levels, flow rates, temperature, pressure drop, and effluent composition. AI algorithms analyze this vast stream of data to identify subtle anomalies that precede equipment failure, such as impeller vibration or material degradation due to corrosion, enabling proactive intervention. This shift from preventative maintenance to predictive maintenance drastically reduces unexpected shutdowns and optimizes the scheduling of maintenance activities, aligning them with periods of low production impact, thereby maximizing the overall operational effectiveness of the scrubbing unit.

Moreover, AI plays a crucial role in optimizing the chemical injection process within wet scrubbers. Traditional control systems often rely on fixed or simple feedback loops, which can lead to over-dosing of neutralizing reagents, resulting in unnecessary chemical waste and increased operating costs. Advanced ML models utilize historical data and current input parameters (such as inlet acid concentration measured by spectroscopic sensors) to calculate the precise stoichiometric amount of reagent needed instantaneously. This hyper-efficient dosing not only saves costs but also ensures consistent emission quality control, stabilizing the scrubbing process and minimizing the environmental footprint associated with reagent use and subsequent wastewater treatment.

- AI-driven Predictive Maintenance: Minimizing unplanned downtime by forecasting component failure (e.g., pumps, fans, packing media).

- Optimized Chemical Dosing: Utilizing Machine Learning to precisely control neutralizing reagent injection, reducing operational costs and waste.

- Real-Time Compliance Monitoring: Integrating AI analytics to verify emission standards continuously and generate automated regulatory reports.

- Anomaly Detection in Process Variables: Identifying subtle shifts in pressure drop or pH indicative of system blockage or corrosion early in the process.

- Enhanced Energy Management: Optimizing fan and pump speeds based on predicted load demand, leading to significant energy savings.

- Automated Troubleshooting and Diagnostics: Providing instant root cause analysis for operational disruptions using historical pattern recognition.

DRO & Impact Forces Of Acid Fume Scrubber Market

The dynamics of the Acid Fume Scrubber Market are shaped by a complex interplay of drivers, restraints, and opportunities, underpinned by significant external impact forces, primarily global environmental policies and industrial growth cycles. A primary driver is the global escalation of regulatory pressure, particularly in sectors such as semiconductor manufacturing and specialty chemicals, where the generation of highly toxic and corrosive acid fumes is unavoidable. Governments worldwide, responding to public health concerns and international climate agreements, are continually lowering permissible exposure and emission limits, compelling industries to upgrade or install advanced scrubbing technology. This regulatory compliance mandate acts as a non-negotiable force sustaining market demand.

Conversely, significant restraints hinder market growth and adoption, notably the high initial capital expenditure (CAPEX) required for sophisticated, custom-engineered scrubber systems, especially those constructed from specialized, corrosion-resistant alloys or composite materials. Furthermore, the operational expenditure (OPEX) remains substantial due to the continuous cost of reagents, water consumption, energy needed to run large fans and pumps, and the expense associated with treating and disposing of the resultant hazardous effluent. Technical restraints include the complexity of scrubbing mixed gas streams, which often necessitates multi-stage solutions and specialized expertise for maintenance and calibration, posing challenges particularly for small and medium enterprises (SMEs).

Opportunities for market growth are abundant through technological innovation and geographical expansion. The development of modular, standardized scrubbing units that offer lower installation costs and faster deployment cycles presents a significant opportunity to penetrate SME markets. Furthermore, the growing focus on resource efficiency creates opportunities for vendors offering closed-loop systems that recycle or reclaim scrubbing water and valuable byproducts, aligning with circular economy principles. Impact forces such as rapid urbanization and the continuous expansion of electronic manufacturing and battery production facilities globally ensure a persistent demand for highly effective acid gas removal, making the market inherently resilient against short-term economic fluctuations.

Segmentation Analysis

The Acid Fume Scrubber Market is comprehensively segmented based on technology type, material of construction, capacity, and the specific application industry, allowing for precise market analysis and tailored product development. The technological segmentation differentiates between wet scrubbers, which rely on liquid absorbents, and dry scrubbers, which utilize dry packed media or solid sorbents. Material segmentation reflects the critical need for extreme corrosion resistance, separating solutions based on Fiberglass Reinforced Plastic (FRP), Stainless Steel, Polypropylene (PP), and exotic alloys, chosen based on the acidity and temperature of the fumes being treated. Capacity segmentation helps classify systems suitable for laboratory-scale operations versus large-scale chemical processing plants. These diverse segmentation criteria allow manufacturers to align their offerings with specific end-user requirements for pollution control efficiency and corrosive resistance.

- By Technology

- Wet Scrubbers

- Packed Bed Scrubbers

- Venturi Scrubbers

- Plate/Tray Scrubbers

- Spray Towers

- Dry Scrubbers (e.g., using powdered or granular sorbents)

- Hybrid/Multi-Stage Scrubbers

- Wet Scrubbers

- By Material of Construction

- Fiberglass Reinforced Plastic (FRP)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Stainless Steel (316L, Duplex)

- Exotic Alloys (e.g., Hastelloy)

- By Capacity/Flow Rate

- Small (Less than 10,000 CFM)

- Medium (10,000 – 50,000 CFM)

- Large (Above 50,000 CFM)

- By End-Use Industry

- Chemical Processing

- Semiconductor & Electronics

- Pharmaceuticals & Biotech

- Metal Finishing & Electroplating

- Waste Treatment & Incineration

- Petrochemicals

- Pulp and Paper

Value Chain Analysis For Acid Fume Scrubber Market

The value chain for the Acid Fume Scrubber Market begins with the upstream sourcing of specialized raw materials, a critical phase dominated by suppliers of high-performance, corrosion-resistant polymers (FRP resins, PP/PVC sheets) and specialized metal alloys (stainless steel, titanium). The quality and availability of these materials directly impact the scrubber system's lifespan and its ability to handle highly corrosive environments, making robust supplier relationships essential. Upstream complexity also includes the procurement of critical components such as high-efficiency fans, specialized pumps, instrumentation (pH meters, flow sensors), and engineered packing media (e.g., pall rings, saddles) which are crucial for mass transfer efficiency within the scrubbing tower.

The central manufacturing stage involves detailed engineering, custom fabrication, and assembly. Due to the diverse nature of industrial emissions, a significant portion of the market relies on custom-engineered solutions rather than standardized products. This necessitates strong in-house engineering and design capabilities, focusing on computational fluid dynamics (CFD) modeling to optimize gas contact time and minimize pressure drop. Direct sales channels are highly prevalent in this stage, especially for large, bespoke installations, where the manufacturer engages directly with the end-user's engineering procurement and construction (EPC) firm to ensure the system is integrated seamlessly into the existing facility infrastructure.

Downstream activities are dominated by installation, commissioning, and long-term service and maintenance. Given the continuous operational requirement of these safety-critical systems, post-sales support, including reagent supply logistics, routine inspections, and emergency repairs, represents a substantial revenue stream. While direct channels handle large capital sales, indirect distribution, primarily through specialized regional distributors and value-added resellers (VARs), often manage the sales of standardized or smaller capacity units, especially targeting local metal finishers or smaller chemical labs. The reliability of this distribution network is crucial for providing rapid, localized technical support, which is a key factor in long-term customer satisfaction and contract renewals.

Acid Fume Scrubber Market Potential Customers

The primary customers for acid fume scrubbers are large industrial entities operating processes that intentionally or inadvertently generate regulated acidic air pollutants. The semiconductor and electronics manufacturing sector stands out as a highly valuable end-user segment, driven by the intense use of corrosive chemicals like hydrofluoric acid and nitric acid during etching, cleaning, and deposition processes required for microchip fabrication. These customers require ultra-high efficiency scrubbers (often multi-stage or point-of-use systems) to meet stringent internal quality control standards, protecting sensitive cleanroom environments in addition to meeting external regulatory mandates. Investment decisions in this sector are heavily influenced by system reliability and uptime, given the immense cost associated with process interruptions.

The Chemical Processing Industry (CPI) represents the largest volume purchaser, encompassing manufacturers of bulk chemicals, specialty chemicals, and petrochemicals. CPI customers generate massive volumes of fumes (e.g., HCl, H₂SO₄) and require large-capacity, robustly constructed scrubbers, predominantly utilizing FRP or exotic materials to withstand high acid concentrations and high operational temperatures. Demand from this segment is cyclical, tied to global capacity expansion projects, and favors suppliers capable of providing fully integrated pollution control packages, including advanced monitoring and waste treatment capabilities. Compliance with OSHA standards regarding worker exposure and EPA mandates regarding stack emissions are the primary purchase drivers in this sector.

Other significant buyers include the Metal Finishing and Electroplating industries, which use acid baths for surface preparation, generating mists and fumes that must be contained for workplace safety and environmental protection. Pharmaceutical and Biotechnology companies also constitute a growing customer base, primarily needing scrubbers for controlling off-gases from pilot plants, reaction vessels, and fermentation processes, where validated systems and compliance with Good Manufacturing Practices (GMP) are paramount. This diverse customer landscape requires vendors to offer a wide range of technologies, from compact lab hood scrubbers to complex plant-wide centralized systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 685.4 Million |

| Market Forecast in 2033 | USD 1095.8 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CECO Environmental, The CEILCOTE Company, Fab-Tech Inc., Pollution Systems, Inc., Tri-Mer Corporation, KCH Services, Inc., Bionomous Technologies, Inc., Air Clean Systems, GASTECH Environmental, Evoqua Water Technologies, Air Pollution Control Systems Inc., Ship & Shore Environmental, Inc., Midwest Air Technologies, EnviroAir, Inc., Pure Air Filtration, LLC, Duall Division, Met-Pro Corporation, APC Technologies, Inc., W. W. Grainger, Inc., AGET Manufacturing Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Acid Fume Scrubber Market Key Technology Landscape

The current technology landscape in the Acid Fume Scrubber Market is defined by continuous innovation aimed at enhancing scrubbing efficiency, reducing operational costs, and improving material longevity. A pivotal development is the increased adoption of advanced composite materials, particularly specialized Fiberglass Reinforced Plastic (FRP) resins and high-density polyethylene (HDPE), which offer superior resistance to highly aggressive acid mixtures (including chromic acid and hot sulfuric acid) compared to traditional stainless steel or standard PVC. This material evolution enables the construction of larger, lighter, and more durable scrubbing towers capable of operating in highly corrosive environments with minimal maintenance, significantly extending the mean time between failures (MTBF) for critical assets.

Another major technological advancement centers on the sophisticated integration of sensors and digital monitoring systems, forming the basis of smart scrubbers. These systems utilize continuous emission monitoring systems (CEMS) and IIoT platforms to track key performance indicators such as pressure drop, liquid recirculation rates, and effluent pH in real-time. This digital layer facilitates remote diagnostics and enables the implementation of advanced control strategies, such as adaptive logic controllers (ALCs) that dynamically adjust reagent feed based on fluctuating inlet concentrations. Such precision control minimizes environmental excursions and optimizes chemical usage, marking a key trend toward greater operational sustainability.

Furthermore, the market is witnessing growing interest in hybrid and dry scrubbing solutions for specialized applications. Hybrid systems, which might combine a wet stage for initial acid absorption followed by a subsequent catalytic filter or dry sorbent bed for residual gas removal, are becoming standard for achieving ultra-low emission targets in the semiconductor and fine chemical industries. Dry scrubbers, using processes like dry injection or packed bed adsorption with bicarbonate or activated alumina, are favored in applications with low gas volumes or where the avoidance of hazardous wastewater generation (a major cost driver in wet scrubbing) is a critical requirement. These technological refinements ensure that solutions are available for even the most challenging pollution control scenarios.

Regional Highlights

- Asia Pacific (APAC): Positioned as the fastest-growing and largest regional market, APAC's dominance is fueled by aggressive expansion in chemical manufacturing, electronics, and battery production (especially in China, India, South Korea, and Taiwan). Regulatory enforcement, particularly regarding air quality in dense industrial zones, is rapidly tightening, driving mandatory investments in new and retrofit scrubber installations.

- North America: Characterized by mature industrial processes and stringent, well-established regulations enforced by the EPA. The market growth here is steady, driven primarily by system replacement, regulatory updates (e.g., changes to MACT standards), and a strong preference for highly automated, digitally monitored scrubber systems focusing on energy efficiency and low operational costs.

- Europe: Growth is primarily sustained by the adoption of sophisticated, compliant technologies to meet the demanding requirements of the EU’s Industrial Emissions Directive (IED). Key purchasing sectors include specialty chemicals, pharmaceuticals, and waste incineration facilities, with a strong emphasis on achieving the Best Available Techniques (BAT) criteria and implementing sustainable, closed-loop water usage systems.

- Latin America (LATAM): Exhibits emerging growth potential, largely centered around industrial clusters in Brazil and Mexico, driven by expansion in oil & gas and basic chemical production. Market adoption is often dependent on large-scale infrastructure projects and is characterized by increasing import of reliable, cost-effective scrubbing technology from global leaders.

- Middle East and Africa (MEA): Growth is tied heavily to investment in the petrochemical and power generation sectors. Demand is concentrated in highly industrialized zones (e.g., UAE, Saudi Arabia). The region seeks robust systems capable of handling high temperatures and desert climates, with recent growth driven by diversification away from traditional oil and gas revenues.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Acid Fume Scrubber Market.- CECO Environmental

- The CEILCOTE Company

- Fab-Tech Inc.

- Pollution Systems, Inc.

- Tri-Mer Corporation

- KCH Services, Inc.

- Bionomous Technologies, Inc.

- Air Clean Systems

- GASTECH Environmental

- Evoqua Water Technologies

- Air Pollution Control Systems Inc.

- Ship & Shore Environmental, Inc.

- Midwest Air Technologies

- EnviroAir, Inc.

- Pure Air Filtration, LLC

- Duall Division

- Met-Pro Corporation

- APC Technologies, Inc.

- W. W. Grainger, Inc.

- AGET Manufacturing Company

Frequently Asked Questions

Analyze common user questions about the Acid Fume Scrubber market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between wet scrubbers and dry scrubbers?

Wet scrubbers utilize a liquid absorbent (usually water or a chemical solution) to neutralize or absorb acidic gases via mass transfer, generating a liquid effluent. Dry scrubbers use solid, granular media (sorbents) to chemically react with or adsorb the acid gases, generating a dry, solid waste byproduct, often preferred for minimizing hazardous wastewater.

Which material provides the best corrosion resistance for high-concentration acid fume scrubbing?

Fiberglass Reinforced Plastic (FRP) and specialized thermoplastic materials like Polypropylene (PP) and high-grade Polyvinyl Chloride (PVC) are typically preferred for maximum corrosion resistance against concentrated acids such as HCl, H₂SO₄, and HF, especially where stainless steel alloys might prematurely degrade due to pitting or stress corrosion cracking.

How does regulatory compliance impact the demand for new scrubber systems?

Regulatory compliance is the principal market driver. Increasing global enforcement and the periodic lowering of permissible emission limits (e.g., SOx, NOx, acid mists) by agencies like the EPA and EU regulatory bodies necessitate continuous investment in new, more efficient scrubbing technology or costly retrofits to older, less effective air pollution control systems.

What is the role of the semiconductor industry in driving the acid fume scrubber market?

The semiconductor industry is critical due to its use of highly toxic and corrosive etching chemicals (like HF and nitric acid). This sector demands high-efficiency, point-of-use scrubbers integrated with strict environmental monitoring, driving innovation towards smaller, localized, and technically advanced scrubbing solutions to protect both cleanroom integrity and external environment.

What operational factors contribute most significantly to the total cost of ownership (TCO) of an acid fume scrubber?

The TCO is heavily influenced by energy consumption (for fans and pumps), the recurring cost of neutralizing reagents (e.g., caustic soda), maintenance costs associated with corrosion repair, and the increasing expense of treating and disposing of hazardous liquid or solid waste generated by the scrubbing process.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager