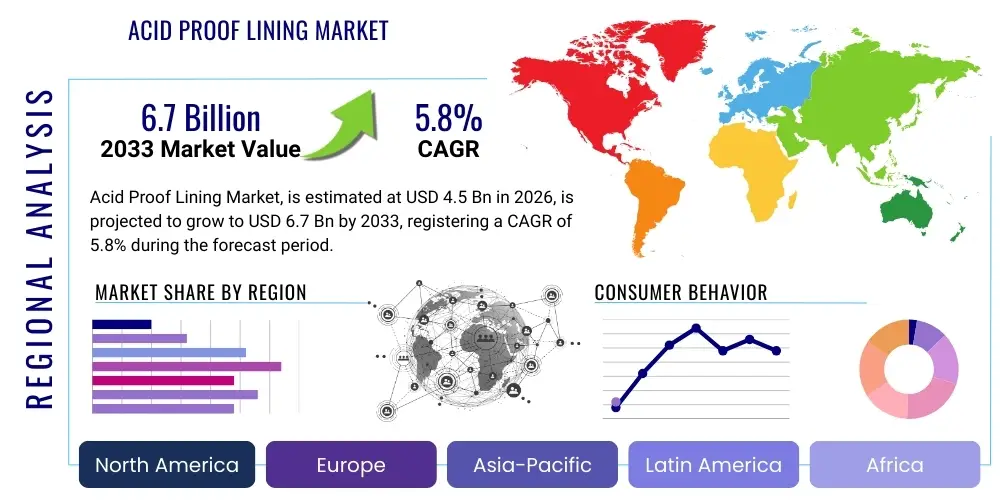

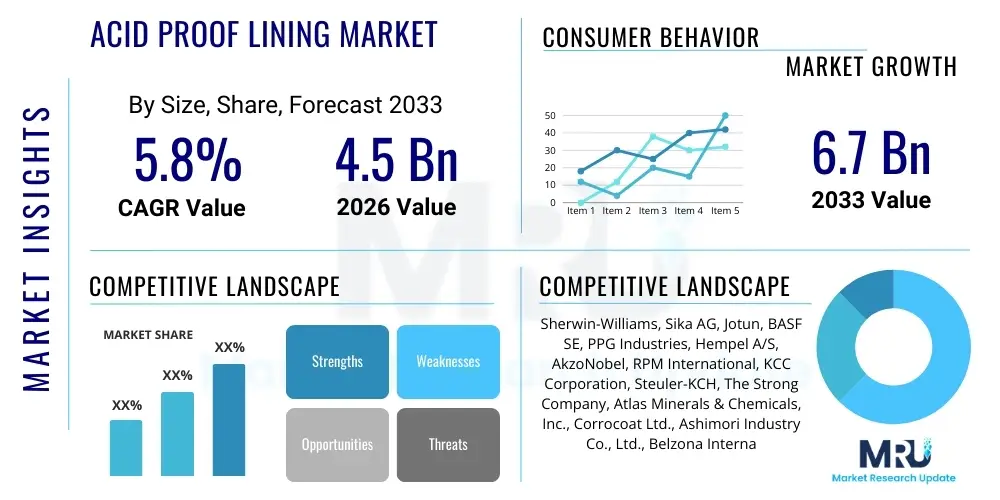

Acid Proof Lining Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438060 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Acid Proof Lining Market Size

The Acid Proof Lining Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 6.7 billion by the end of the forecast period in 2033.

Acid Proof Lining Market introduction

The Acid Proof Lining Market encompasses specialized coating and lining systems designed to protect industrial infrastructure, equipment, and storage vessels from severe chemical attack, particularly highly corrosive acids and bases, often encountered in chemical processing and metallurgical industries. These linings, which include materials such as high-performance polymers, specialized rubber compounds, and acid-resistant bricks or tiles set in chemically resistant mortars, are crucial for ensuring operational safety, extending the service life of assets, and preventing catastrophic failures or environmental incidents resulting from chemical leaks. The core function of these linings is to create an impermeable barrier between the corrosive medium and the substrate, typically steel or concrete.

Products within this market range significantly in terms of material composition, application methodology, and resistance profile. Key product types include fluoropolymers (such as PTFE and PFA), epoxy novolacs, vinyl esters, acid-resistant masonry, and various rubber linings (e.g., butyl and natural rubber). Major applications are predominantly found in chemical manufacturing plants, where sulfuric acid, hydrochloric acid, and nitric acid are commonly handled; in the mining and metallurgy sector for leach tanks and solvent extraction processes; in power generation facilities for flue gas desulfurization (FGD) systems; and in wastewater treatment facilities dealing with aggressive effluent streams. The selection of a specific lining system is highly dependent on factors such as operating temperature, chemical concentration, thermal cycling, and required mechanical durability.

Driving factors for market expansion include the stringent implementation of environmental and safety regulations globally, which mandates robust containment systems to prevent soil and water contamination. Furthermore, the rising investment in infrastructure development across emerging economies, particularly in the chemical and fertilizer sectors, necessitates high-performance corrosion protection. The benefits derived from utilizing effective acid proof linings—such as minimized downtime, reduced maintenance costs, compliance assurance, and enhanced asset integrity—solidify their indispensable role in heavy industrial operations worldwide, promoting consistent demand for advanced, durable lining solutions capable of withstanding extreme conditions.

Acid Proof Lining Market Executive Summary

The Acid Proof Lining Market is experiencing robust growth driven by escalating infrastructural investments in Asia Pacific and the increasing focus on industrial safety and environmental compliance globally. Business trends indicate a shift towards advanced composite materials, particularly thermoplastic and thermoset polymer linings, offering superior chemical and thermal resistance compared to traditional brick or rubber systems. Key market players are concentrating on developing solvent-free, fast-curing application technologies to minimize plant downtime, a critical factor for end-users like chemical manufacturers and power plants. Mergers and acquisitions are common as companies seek to integrate specialized application expertise and expand regional distribution networks, particularly targeting high-growth regions where new chemical parks are being established.

Regional trends highlight Asia Pacific as the dominant and fastest-growing market segment, primarily fueled by the massive expansion of the chemical processing, metal smelting, and fertilizer industries in China, India, and Southeast Asian nations. North America and Europe, characterized by highly regulated and mature industrial bases, show stable demand driven by mandatory maintenance, repair, and overhaul (MRO) activities and the replacement of aging infrastructure. Regulatory bodies, such as the EPA and REACH, continually tighten standards for hazardous material containment, compelling industries to adopt the latest, most reliable lining solutions, thus sustaining market momentum in developed regions, often favoring highly engineered and customized solutions.

Segmentation trends indicate that polymer-based linings, specifically vinyl ester and epoxy novolac systems, maintain the largest market share due to their versatility, ease of application, and balanced cost-performance ratio suitable for a wide range of mild to aggressive chemical environments. However, highly aggressive applications, such as those involving high-temperature concentrated acids, continue to rely on specialized material segments like fluoropolymers (PTFE/PFA) or traditional acid-resistant ceramics. The chemical processing segment remains the largest end-user, but significant growth potential is identified in the metallurgy and mining sectors, driven by the increasing complexity of ore processing techniques utilizing harsh chemical agents for extraction, requiring specialized, heavy-duty protective systems.

AI Impact Analysis on Acid Proof Lining Market

Common user questions regarding AI's impact on the Acid Proof Lining Market revolve around predictive maintenance capabilities, optimization of application processes, and the development of novel materials. Users frequently inquire: "Can AI predict the failure time of existing linings?", "How can machine learning optimize the complex chemical formulation of linings?", and "Will AI integration reduce application costs and inspection downtime?" The analysis reveals that the primary excitement centers on leveraging AI to move from reactive or time-based maintenance to true condition-based monitoring, significantly reducing the risk of catastrophic asset failure. There is a strong expectation that AI will streamline complex quality assurance processes, specifically regarding monitoring curing parameters and identifying microscopic defects during installation, thus enhancing the overall reliability and lifespan of the corrosion protection system.

- AI-powered Predictive Maintenance: Utilization of machine learning algorithms to analyze historical failure data, operational parameters (temperature, pH fluctuations), and sensor data (acoustic emissions, thermal imaging) to accurately forecast the remaining useful life (RUL) of an installed lining, thereby optimizing replacement schedules.

- Optimized Formulation Development: Employing AI and computational materials science to rapidly screen and optimize the complex polymeric and filler compositions required for new acid proof linings, significantly accelerating R&D cycles for materials with enhanced chemical resistance and thermal stability.

- Quality Control and Inspection Automation: Implementation of computer vision and AI-driven image analysis tools (e.g., drones or robotics) to conduct non-destructive testing (NDT) of large lined surfaces, ensuring uniform thickness, detecting porosities, and confirming adhesion integrity more effectively and quickly than manual inspection.

- Supply Chain and Inventory Management: Using AI to forecast regional demand for specific lining components (resins, hardeners, catalysts) based on upcoming industrial projects and MRO cycles, leading to optimized inventory levels and reduced lead times for critical materials.

- Robot-Assisted Application: Development of sophisticated robotics guided by AI pathfinding to ensure highly consistent and uniform application of sprayable or trowelable linings in hazardous or confined spaces, minimizing human error and exposure risks.

DRO & Impact Forces Of Acid Proof Lining Market

The Acid Proof Lining Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces shaping its trajectory. The primary driver is the pervasive and unavoidable threat of corrosion in heavy industries, which necessitates high-integrity protection solutions to maintain structural integrity and operational uptime. This inherent need is amplified by stringent global regulatory frameworks focusing on environmental protection and industrial safety, compelling end-users to invest in durable acid containment systems. However, the market is restrained by the high initial cost associated with specialized materials (like fluoropolymers) and the complexity of application, which requires highly skilled labor and often leads to prolonged plant downtime. The application complexity demands specific climate control and surface preparation protocols, making it a high-CAPEX endeavor. Opportunities arise from technological advancements, particularly the development of hybrid and nano-composite linings offering enhanced properties, and the vast potential in rapidly industrializing regions like Southeast Asia, where substantial capital expenditure on new chemical infrastructure is underway.

A key Driver propelling market growth is the expansion and modernization of the chemical and petrochemical sectors, particularly the construction of new crackers and derivative production units that handle concentrated aggressive chemicals. Furthermore, the global shift towards complex metallurgical processes, such as hydrometallurgy used in battery recycling and critical mineral extraction, drives demand for specialized linings capable of resisting extremely harsh leaching environments. The lifecycle cost advantage of high-quality acid proof linings, which drastically reduce long-term maintenance expenditure compared to frequent repairs or early equipment replacement, also serves as a strong economic incentive for adoption, particularly in capital-intensive industries.

Conversely, the primary Restraint is the fragmentation and variability in the quality of installation services globally. A high-performance lining material can fail prematurely if surface preparation is inadequate or if curing conditions are not meticulously controlled, leading to warranty claims and mistrust in high-end systems. Furthermore, market penetration is sometimes hindered by the end-user preference for cheaper, less durable solutions in less regulated markets. The significant Opportunity lies in providing comprehensive digitalization of asset integrity management, integrating sensor technology within the linings themselves to monitor real-time conditions (e.g., pH, temperature), thereby justifying the premium cost of advanced lining systems by offering verifiable performance data and condition monitoring capabilities.

Segmentation Analysis

The Acid Proof Lining Market is systematically segmented based on Product Type, End-Use Industry, and Installation Method, allowing for a precise understanding of material consumption patterns and application-specific demands. The diversity in segmentation reflects the necessity for highly customized solutions tailored to specific corrosive agents, operating temperatures, and substrate materials (e.g., concrete vs. steel). Polymer-based linings dominate in volume due to their versatility and ease of application, suitable for tanks, flooring, and pits, while specialized segments like fluoropolymers command high value due to their exceptional performance in extreme conditions. End-user analysis shows that the Chemical Processing Industry remains the bedrock of demand, though the growth momentum is increasingly shifting towards infrastructure segments such as power generation (FGD units) and water treatment facilities facing severe chemical effluent.

- By Product Type:

- Polymer-based Linings (Vinyl Ester, Epoxy, Novolac Epoxy)

- Rubber Linings (Natural Rubber, Butyl Rubber, Chloroprene)

- Fluoropolymer Linings (PTFE, PFA, FEP, ETFE)

- Ceramic & Carbon Brick Linings

- Cementitious Linings (Calcium Aluminate Cements)

- By End-Use Industry:

- Chemical Processing (Fertilizers, Petrochemicals, Chlor-alkali)

- Mining & Metallurgy (Leach Tanks, Smelting)

- Power Generation (Flue Gas Desulfurization (FGD), Water Treatment)

- Pharmaceuticals & Food & Beverage (High Purity/Sanitary Applications)

- Waste & Water Treatment

- By Installation Method:

- Sheet/Tile Lining (Pre-fabricated panels or masonry)

- Spray/Coat Lining (Liquid applied polymeric coatings)

- Trowel Applied Linings (Mortars and thick-film mastics)

Value Chain Analysis For Acid Proof Lining Market

The value chain for the Acid Proof Lining Market begins upstream with the sourcing of specialized raw materials, primarily high-grade chemical precursors for polymer resins (e.g., bisphenol A for epoxy, acrylic acids for vinyl ester), specialized fillers (e.g., carbon, silica, ceramic), and fluoropolymer sheets. Key suppliers in the upstream segment are large chemical manufacturers providing proprietary resin systems and specialized rubber compounders. The quality and purity of these raw inputs are paramount, as they directly dictate the chemical resistance and mechanical properties of the final lining system. Manufacturers often engage in vertical integration or secure long-term contracts to ensure a stable supply of high-performance resins, as supply chain disruptions can significantly impact production schedules and pricing variability.

The midstream stage involves the formulation and manufacturing processes, where raw materials are compounded into proprietary lining systems (coatings, mortars, sheets) tailored for specific end-user applications. This stage includes intensive R&D to optimize formulations for adhesion, chemical resistance, abrasion resistance, and curing characteristics. Following manufacturing, the distribution channel plays a critical role. Due to the technical nature of application, the distribution often involves direct sales or highly specialized authorized distributors who possess the technical knowledge required to advise on material selection and installation requirements. Direct channels are generally preferred for large, complex capital projects where customized technical support is mandatory, ensuring the manufacturer maintains strict quality control over material handling and logistics to the project site.

The downstream segment primarily consists of specialized applicators and engineering, procurement, and construction (EPC) firms, which form the direct link to the end-users (chemical plants, power stations). These applicators are responsible for surface preparation, material mixing, application, and rigorous quality assurance testing. Indirect channels exist through EPC firms who subcontract the lining work, yet the manufacturer's technical oversight often remains necessary. Successful execution heavily relies on the applicator's expertise, making training and certification programs essential for maintaining market standards. The final stage involves the end-user utilizing the protected asset, with manufacturers often providing long-term maintenance and inspection services to ensure compliance and longevity.

Acid Proof Lining Market Potential Customers

The primary potential customers and end-users of acid proof lining products are heavy industrial operators managing assets exposed to highly corrosive chemical environments. The largest consuming sector is the Chemical Processing Industry (CPI), which includes manufacturers of basic chemicals (sulfuric acid, hydrochloric acid), specialty chemicals, fertilizers, and petrochemicals. These facilities rely heavily on linings for reactor vessels, storage tanks, trenches, pits, and secondary containment areas to prevent corrosion and meet stringent regulatory requirements for containing hazardous materials. Investment decisions in the CPI are driven by long-term asset protection needs and minimizing unscheduled operational downtime.

Another significant customer base resides in the Mining and Metallurgy sector, particularly operations utilizing hydrometallurgical processes such as leaching, electrowinning, and solvent extraction, where concentrated acids are used to recover base and precious metals. Tanks, scrubbers, and piping systems in these highly aggressive environments demand extremely robust lining materials, often specialized rubber or thick fluoropolymer systems, to withstand both chemical attack and abrasive slurry conditions. Demand from this sector is highly sensitive to global commodity prices and resource extraction trends, particularly the increasing global focus on battery minerals like lithium and cobalt, which require sophisticated acid processing.

Infrastructure-related customers, including power generation plants and municipal water and waste treatment facilities, represent a stable and growing segment. In power plants, especially those using coal, acid proof linings are essential for Flue Gas Desulfurization (FGD) systems designed to scrub sulfur dioxide emissions using acidic slurries. Similarly, wastewater treatment plants dealing with industrial runoff and biogas production require protective coatings for concrete structures to resist sulfuric acid attack caused by microbial activity. These applications often require specialized cementitious or epoxy novolac linings that offer good resistance against low-pH environments and microbial corrosion.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 billion |

| Market Forecast in 2033 | USD 6.7 billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sherwin-Williams, Sika AG, Jotun, BASF SE, PPG Industries, Hempel A/S, AkzoNobel, RPM International, KCC Corporation, Steuler-KCH, The Strong Company, Atlas Minerals & Chemicals, Inc., Corrocoat Ltd., Ashimori Industry Co., Ltd., Belzona International Ltd., Carboline Company, Polycorp Ltd., Denso Group Germany, KCH Services Inc., Rema Tip Top. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Acid Proof Lining Market Key Technology Landscape

The technology landscape of the Acid Proof Lining Market is evolving rapidly, moving beyond traditional materials to incorporate advanced composite systems and smart monitoring capabilities. A critical technological trend is the increasing dominance of high-solids and 100% solid polymeric systems, such as advanced vinyl esters and Novolac epoxies, which comply with stringent volatile organic compound (VOC) emission regulations. These advanced thermoset systems offer superior cross-linking density, translating into enhanced resistance to a broader spectrum of aggressive chemicals, elevated temperatures, and thermal cycling stress often encountered in continuous process operations. Furthermore, the incorporation of specialized fillers, such as microscopic glass flakes or ceramic particles, is a key focus, substantially improving the permeation resistance and abrasion tolerance of the final coating layer, effectively extending the maintenance cycle of critical assets.

In highly specialized applications, the market relies heavily on fluoropolymer technologies (PTFE, PFA) due to their near-universal chemical inertness and superior temperature resistance. Technological innovation in this niche includes developing more sophisticated bonding agents and thermal welding techniques to ensure flawless seam integrity in large-scale lined equipment. Another significant area of technological focus is the advancement of specialty cementitious materials, utilizing polymers and micro-silica additives to enhance the acid resistance and reduce permeability of concrete substrates, particularly crucial in wastewater and sulfuric acid storage applications where the base substrate is concrete and requires protection against moderate acid attack and microbial induced corrosion (MIC).

The future technology trajectory is defined by digitalization and the integration of sensing capabilities, leading to the emergence of "smart linings." Research efforts are focused on embedding non-metallic sensors, such as fiber optics or specialized conductive polymers, directly into the lining structure to monitor critical parameters like pH changes, temperature spikes, or early-stage pinhole formation. This real-time diagnostic capability represents a paradigm shift from routine, potentially disruptive, physical inspections to continuous, predictive asset monitoring. This technological integration not only enhances safety and reliability but also provides verifiable data supporting extended warranties and optimized maintenance planning, significantly increasing the value proposition of high-end lining systems for infrastructure owners.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market, driven by massive investments in infrastructure development, establishment of new chemical parks, and rapid industrialization in nations like China, India, and Southeast Asia. The demand is particularly high in the fertilizer, petrochemical, and base metals processing sectors, necessitating large volumes of standard polymeric and rubber linings for new construction projects.

- North America: A mature market characterized by strict environmental protection agencies (EPA) regulations and high labor costs. Demand is sustained by MRO (Maintenance, Repair, and Overhaul) activities and the replacement of aging industrial infrastructure, focusing on high-performance, specialized, and often fluoropolymer-based linings to ensure long-term regulatory compliance and reduced liability.

- Europe: Driven by the stringent REACH regulatory framework, pushing industries toward highly specialized, low-VOC, and technologically advanced coating systems. The market focuses on optimizing existing facilities, with strong demand from the pharmaceutical, specialty chemical, and power generation sectors, particularly for complex FGD linings and secondary containment solutions.

- Latin America (LATAM): Growth is primarily linked to the mining sector, especially in Chile and Peru, which require robust linings for large-scale hydrometallurgical processing (leach pads, tanks). Infrastructure investments and recovery in the oil and gas sector also contribute, demanding reliable, cost-effective solutions capable of withstanding local climate and operational variables.

- Middle East and Africa (MEA): Growth is concentrated in the Gulf Cooperation Council (GCC) countries due to significant investments in petrochemicals, oil refining, and water desalination plants. These environments require specialized linings that resist both high chemical attack and extreme operating temperatures common to the region's industrial processes, with large-scale projects driving demand for customized engineered solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Acid Proof Lining Market.- Sherwin-Williams

- Sika AG

- Jotun

- BASF SE

- PPG Industries

- Hempel A/S

- AkzoNobel

- RPM International

- KCC Corporation

- Steuler-KCH

- The Strong Company

- Atlas Minerals & Chemicals, Inc.

- Corrocoat Ltd.

- Ashimori Industry Co., Ltd.

- Belzona International Ltd.

- Carboline Company

- Polycorp Ltd.

- Denso Group Germany

- KCH Services Inc.

- Rema Tip Top

Frequently Asked Questions

Analyze common user questions about the Acid Proof Lining market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current demand for Acid Proof Linings?

The primary driver is the necessity for stringent regulatory compliance concerning environmental protection and industrial safety, which mandates robust containment and corrosion protection systems in chemical and heavy industrial facilities globally, amplified by the high costs associated with asset failure and downtime.

Which type of acid proof lining material holds the largest market share?

Polymer-based linings, specifically those derived from Vinyl Esters and Epoxies (including Novolac variants), currently hold the largest market share due to their cost-effectiveness, application versatility, and resistance profile suitable for a wide range of common industrial acids and operational temperatures.

How do operating temperature and chemical concentration affect lining selection?

Operating temperature and chemical concentration are critical determinants; high concentrations and high temperatures usually require specialized, high-performance materials like Fluoropolymers (PTFE, PFA) or specialized Carbon Brick systems, as standard polymeric coatings may suffer chemical degradation or blistering under such severe conditions.

What role does the application process play in the success of acid proof lining systems?

The application process is paramount; even high-quality materials will fail prematurely if surface preparation is inadequate, application thickness is non-uniform, or curing conditions are not strictly monitored, underscoring the necessity of highly specialized and certified installation labor.

Is the market trending towards smart or IoT-integrated acid proof linings?

Yes, technological advancements are driving a trend toward smart linings where embedded sensors (e.g., fiber optics) monitor real-time conditions like pH or temperature inside the containment structure, enabling predictive maintenance and verification of lining integrity, thereby justifying the premium cost of advanced systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Corrosion Protective Coatings and Acid Proof Lining Market Statistics 2025 Analysis By Application (Marine, Oil & Gas, Power Generation, Construction, Automotive, Transportation, Chemicals, Mining & metallurgy), By Type (Solvent-borne, Waterborne, Powder-based), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Corrosion Protective Coatings and Acid Proof Lining Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Ceramic & Carbon Brick Lining, Tile lining, Thermoplastic lining, Vinyl Ester & Flake-Filled Vinyl Ester, Other), By Application (Marine Industry, Oil & Gas, Power Generation, Transportation Vehicles, Chemicals, Mining & Metallurgy, Water Treatment), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager