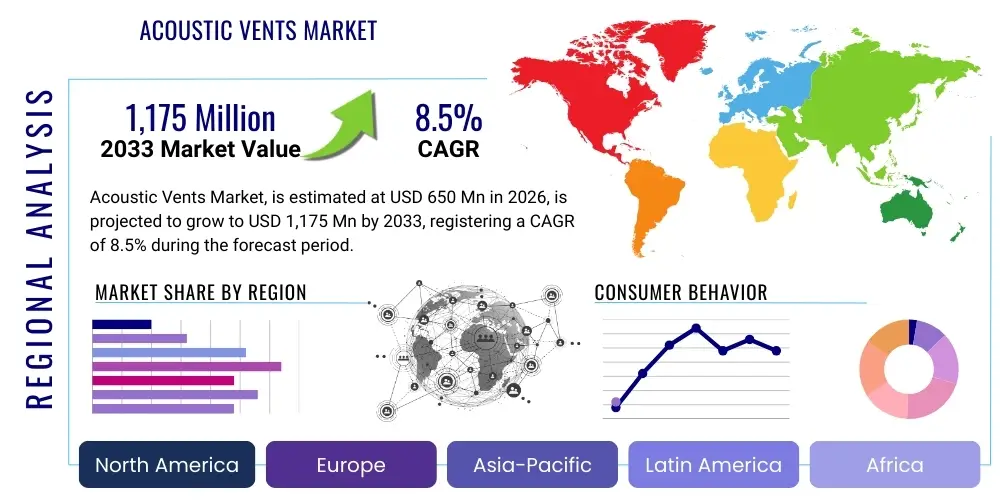

Acoustic Vents Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437283 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Acoustic Vents Market Size

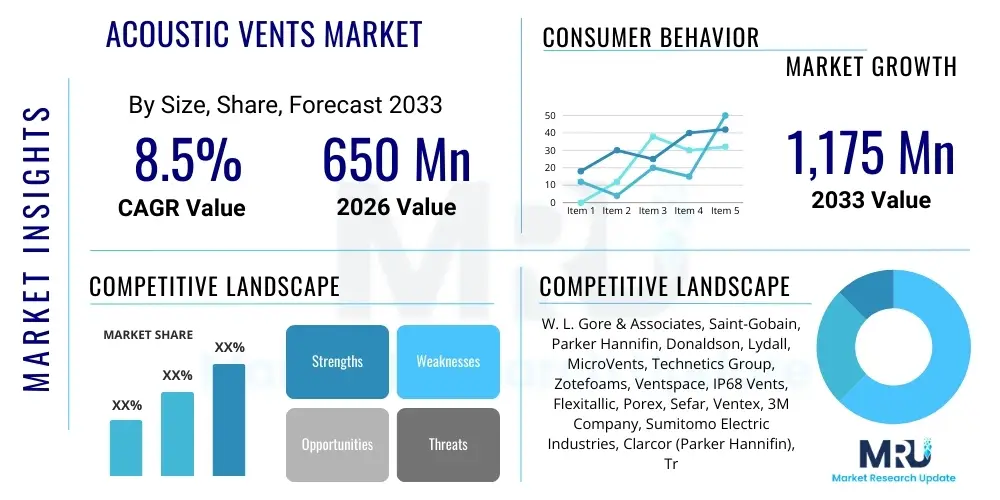

The Acoustic Vents Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% (CAGR 8.5%) between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1,175 Million by the end of the forecast period in 2033.

Acoustic Vents Market introduction

The Acoustic Vents Market encompasses specialized components designed to equalize pressure within electronic enclosures while simultaneously blocking the ingress of dust, liquids, and crucially, maintaining high acoustic performance. These sophisticated venting solutions are essential for devices operating in harsh or fluctuating environmental conditions, preventing structural damage, ensuring longevity of internal components, and optimizing the quality of sound transmission or reception. The core technology often relies on porous, breathable membranes, such as expanded polytetrafluoroethylene (ePTFE), which offer an ideal balance between airflow, pressure equalization, and environmental protection, making them indispensable in modern electronic design, particularly for consumer electronics with stringent water resistance requirements.

Acoustic vents serve a dual purpose: they protect sensitive microphones, speakers, and internal circuits from contaminants while ensuring that sound waves can pass through the enclosure walls with minimal dampening or distortion. Major applications span high-end consumer electronics like smartphones, headphones, and wearable devices, where clear audio quality and robust ingress protection (IP ratings) are paramount. Beyond consumer goods, these vents are critical in automotive systems, such as advanced driver-assistance systems (ADAS) sensors and external microphones, and in industrial equipment where reliability under extreme temperature and humidity swings is mandatory. The continuous miniaturization of electronics and the increasing demand for high-fidelity audio coupled with environmental durability are principal factors fueling market expansion across diverse vertical industries.

The primary benefits of integrating acoustic vents include achieving stringent IP ratings (e.g., IP67 or IP68) without compromising audio functionality, mitigating the effects of pressure differentials caused by rapid temperature changes or altitude shifts, and prolonging the operational lifespan of devices by preventing condensation buildup. The market is heavily driven by the relentless innovation cycles in the consumer electronics sector, particularly the mass proliferation of waterproof earbuds and smart speakers. Furthermore, the growing trend toward vehicle electrification and the integration of sophisticated sensing technologies in connected cars necessitates advanced venting solutions to protect sensitive electronics exposed to external elements, establishing a strong foundation for sustained market growth throughout the forecast period.

Acoustic Vents Market Executive Summary

The Acoustic Vents Market is characterized by robust growth, driven primarily by tightening consumer expectations for device durability and the increasing integration of sophisticated audio components across diverse sectors, notably consumer electronics and automotive. Key business trends include a significant shift towards advanced materials, particularly proprietary ePTFE formulations, offering superior acoustic transparency and environmental resistance, which allows manufacturers to achieve higher IP standards. Strategic partnerships between vent manufacturers and original equipment manufacturers (OEMs) are becoming common, focusing on custom-engineered solutions tailored for specific product geometries and performance requirements. Furthermore, sustainability in manufacturing and the development of vents using bio-based or recyclable materials are emerging business priorities, reflecting broader industry shifts toward environmental responsibility and resource efficiency, which influence procurement decisions in the premium segment.

Regionally, the Asia Pacific (APAC) market dominates the consumption landscape, attributed to the concentration of major global electronics manufacturing hubs in countries like China, South Korea, and Japan, coupled with the massive internal market demand for smartphones and wearables. North America and Europe, however, lead in the adoption of specialized, high-performance venting solutions, particularly within the medical device and high-end automotive segments, prioritizing stringent regulatory compliance and technological sophistication over sheer volume. Emerging markets in Latin America and the Middle East & Africa (MEA) are witnessing accelerated growth, fueled by increasing urbanization, rising disposable incomes, and the consequent surge in demand for durable and feature-rich consumer electronics, positioning these regions as critical future growth vectors, particularly for mid-range product segments requiring reliable protection.

Segment trends reveal that the Application segment dominated by Consumer Electronics, due to the sheer volume of devices manufactured annually that require robust water and dust protection combined with high acoustic fidelity for features like noise cancellation and voice commands. Within the Material segment, ePTFE membranes maintain a commanding lead due to their unparalleled balance of breathability, liquid resistance, and acoustic performance. There is a perceptible trend of diversification, however, with silicone and other proprietary materials gaining traction for specialized, high-temperature, or chemically challenging industrial environments. The consistent push for smaller, lighter, and more powerful devices ensures ongoing innovation in micro-venting solutions, driving average selling prices (ASPs) for specialized, custom-designed products, thereby enhancing overall market value despite continuous pressures for cost optimization in mass-market applications.

AI Impact Analysis on Acoustic Vents Market

User queries regarding the impact of Artificial Intelligence (AI) on the Acoustic Vents Market predominantly revolve around three core themes: the potential of AI to enhance acoustic performance and quality testing, the demand created by AI-powered devices (such as smart speakers and AI-enabled automotive sensors), and the possibility of AI optimizing vent design and manufacturing processes. Users frequently question if AI noise cancellation algorithms will reduce the need for physical acoustic tuning components or if, conversely, the heightened requirement for flawless input audio for AI voice assistants necessitates even more precise venting solutions. The analysis indicates that AI integration does not diminish the role of physical venting but rather elevates the required precision. AI-driven devices, which rely heavily on high-quality microphone input for natural language processing and voice commands, create an increased demand for vents that offer extremely low insertion loss and high uniformity, ensuring the AI model receives clean, undistorted sound data, thus acting as a significant market driver rather than a constraint.

- AI algorithms necessitate pristine audio input, driving demand for ultra-low insertion loss acoustic vents.

- Smart home devices and AI speakers require specialized vents to maintain voice clarity and water resistance.

- AI-powered acoustic testing systems accelerate the validation and quality control of vent performance during manufacturing.

- Generative AI tools are being explored to optimize the complex pore structures of membranes for specific frequency response curves.

- Increased adoption of AI in automotive sensing (LiDAR/Radar) demands robust venting to protect sensitive components exposed to the environment, indirectly supporting the acoustic vent industry through shared protection requirements.

DRO & Impact Forces Of Acoustic Vents Market

The Acoustic Vents Market dynamics are shaped by powerful Drivers, inherent Restraints, and significant Opportunities, which together constitute the primary Impact Forces determining market trajectory. The paramount driver is the exponential growth of the Consumer Electronics sector, specifically the market for wearables and smartphones, where IP ratings (water and dust resistance) have transitioned from luxury features to standard consumer expectations. Simultaneously, the accelerated transition within the automotive industry towards Electric Vehicles (EVs) and Advanced Driver-Assistance Systems (ADAS) introduces numerous new sensors and electronics requiring robust, pressure-equalizing, and acoustically transparent protection, thereby ensuring sustained demand. Opportunities primarily lie in the miniaturization of venting technology and the development of smart vents capable of adapting their permeability based on environmental conditions, particularly for highly demanding medical and aerospace applications where precise pressure management is crucial for operational safety and regulatory compliance.

However, the market faces notable restraints, chiefly related to the technical complexity of achieving high acoustic transparency simultaneously with high IP ratings, often requiring costly specialized materials like ePTFE, which contributes to higher unit costs. Furthermore, the global supply chain volatility and the dependence on specialized chemical inputs can periodically affect the production capacity and pricing stability of these highly engineered components. Another restraint is the rapid obsolescence of consumer electronics, necessitating continuous and expensive redesign cycles for vent manufacturers to keep pace with changing device geometries and material specifications. The competitive landscape is also challenging, marked by intense pricing pressure in high-volume segments where differentiation is often difficult, forcing companies to invest heavily in proprietary manufacturing techniques to maintain competitive advantage and profit margins.

The impact forces driving market evolution are rooted in technological advancement and regulatory requirements. Technological innovation in membrane science, leading to thinner, more durable, and acoustically optimized films, acts as a primary positive impact force. Regulatory standards, particularly those governing IP ingress protection and industry-specific certifications (e.g., ISO standards for medical devices), compel manufacturers to adopt high-performance venting solutions, guaranteeing a baseline level of market adoption. Conversely, the negative impact force stems from the risk of patent expiration and subsequent proliferation of lower-cost alternatives, potentially diluting the value proposition of established, premium solutions. Overall, the market remains strongly oriented toward growth, as the demand for devices that are both high-fidelity and environmentally robust shows no sign of saturation, continuously fueling innovation in membrane technology and custom design services, maintaining a focus on performance-driven market strategies.

Segmentation Analysis

The Acoustic Vents Market is strategically segmented based on Material, Application, and End-User, allowing for granular analysis of market demand drivers and competitive dynamics. The segmentation by Material is crucial as the performance characteristics—acoustic transparency, water resistance, and longevity—are directly tied to the polymer technology used, with ePTFE membranes dominating due to their microporous structure providing superior performance balance. The Application segmentation clearly defines the highest value and volume drivers; Consumer Electronics represent the bulk volume, while Automotive and Medical sectors represent high-value, specialized segments demanding stricter tolerances and compliance. Understanding these segments is key for manufacturers to allocate R&D resources effectively and tailor marketing strategies to specific industry compliance requirements and functional demands.

- By Material:

- ePTFE (Expanded Polytetrafluoroethylene)

- Polypropylene

- Silicone

- Other Polymers and Materials

- By Application:

- Consumer Electronics (Smartphones, Wearables, Headphones, Smart Speakers)

- Automotive (ADAS Sensors, Headlamps, ECU Housing, Exterior Microphones)

- Medical Devices (Hearing Aids, Monitoring Equipment)

- Industrial and Telecom Equipment (Outdoor Enclosures, Sensors)

- By End-User:

- Original Equipment Manufacturers (OEM)

- Aftermarket/MRO (Maintenance, Repair, and Overhaul)

Value Chain Analysis For Acoustic Vents Market

The Value Chain of the Acoustic Vents Market commences with Upstream activities involving the sourcing and processing of specialized polymer resins, primarily PTFE, and the subsequent manufacturing of highly specific porous membranes. This initial stage requires significant capital investment in proprietary technology, such as stretching and thermal processing, to achieve the required microporous structure for acoustic and ingress protection functions. Key upstream suppliers include major chemical and material science companies specializing in fluoropolymers and high-performance plastics. Efficiency and technological differentiation at this stage are critical, as the quality of the base membrane directly dictates the final product's performance and acoustic impedance characteristics, forming a crucial barrier to entry for potential competitors.

The Midstream segment involves the conversion of the raw membrane material into finished acoustic vent products. This includes lamination, die-cutting, molding, and integration into various forms such as adhesive patches, screw-in vents, or molded components tailored to specific OEM specifications. Distribution channels play a vital role in connecting manufacturers with end-users. Direct channels are predominantly used for large volume OEM deals, particularly in the consumer electronics and automotive sectors, where manufacturers work closely with device designers to integrate custom vent solutions early in the product development cycle. Indirect channels, involving specialized industrial distributors and technical sales representatives, cater primarily to the Aftermarket, MRO, and smaller volume industrial clients requiring standard or semi-custom venting solutions, offering inventory and technical support.

Downstream analysis focuses on the integration of acoustic vents into the final electronic devices across major applications. The most demanding and high-volume integration occurs within the assembly lines of Consumer Electronics manufacturers globally, requiring precision application machinery and rigorous quality control protocols to ensure IP integrity. The specialized nature of these components necessitates close collaboration between vent suppliers and assembly engineers to ensure seamless fit and function. The final stage involves the end-user (consumer, industrial client, or medical institution) benefiting from the device's enhanced durability and reliable acoustic performance, validating the entire value chain. The trend towards globalized manufacturing means that logistics efficiency and global inventory management are increasingly significant components of successful downstream market operations.

Acoustic Vents Market Potential Customers

Potential customers for acoustic vents are predominantly Original Equipment Manufacturers (OEMs) across technologically intensive industries that prioritize device protection, acoustic clarity, and environmental robustness. The largest segment of buyers comprises consumer electronics giants developing smartphones, tablets, headphones (both wired and truly wireless), and smart home devices (e.g., smart speakers and environmental sensors) where maintaining high IP ratings is a critical competitive differentiator. These buyers seek suppliers capable of high-volume production, consistent quality, and rapid customization to align with short product lifecycle demands, placing a premium on suppliers with global manufacturing and fulfillment capabilities to support their diverse assembly operations across Asia.

Another major segment includes manufacturers in the Automotive industry, particularly those focused on electric vehicles and advanced safety systems. Acoustic vents are purchased by Tier 1 suppliers and OEMs for use in critical external components such as headlamp assemblies, electronic control units (ECUs), exterior microphones utilized for active noise cancellation, and various sensors (pressure, humidity) that require protection from road elements, high-pressure washes, and temperature extremes. These customers prioritize long-term reliability (often requiring 10+ years of performance), compliance with stringent automotive quality standards (like IATF 16949), and resistance to harsh chemical exposures, making cost a secondary concern compared to validated performance and traceability.

Furthermore, the Medical Device industry represents a high-value, albeit lower volume, customer base. Buyers include manufacturers of hearing aids, implantable electronic devices, portable monitoring equipment, and diagnostic tools. In this sector, acoustic vents are critical for ensuring both water resistance and breathability in devices that often contact human skin or require sterilization, where the material must be biocompatible and the venting capability must be precisely calibrated to prevent moisture damage while allowing necessary gas exchange or sound transmission. Industrial equipment manufacturers, specifically those producing outdoor security cameras, telecom infrastructure components, and industrial sensors, also represent significant potential customers, demanding vents capable of withstanding extreme environmental exposure (e.g., UV radiation, high salinity, wide temperature fluctuations) for extended operational periods without failure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1,175 Million |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | W. L. Gore & Associates, Saint-Gobain, Parker Hannifin, Donaldson, Lydall, MicroVents, Technetics Group, Zotefoams, Ventspace, IP68 Vents, Flexitallic, Porex, Sefar, Ventex, 3M Company, Sumitomo Electric Industries, Clarcor (Parker Hannifin), Trelleborg AB, Ufi Filters, Pall Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Acoustic Vents Market Key Technology Landscape

The technological landscape of the Acoustic Vents Market is primarily defined by advanced membrane science, focusing heavily on enhancing permeability, durability, and acoustic transparency concurrently. The fundamental technology relies on highly engineered microporous materials, with expanded Polytetrafluoroethylene (ePTFE) remaining the gold standard. The manufacturing process for ePTFE involves specific proprietary stretching and processing techniques that create a uniform matrix of microfibers and nodes, resulting in nanoscale pores. This precise pore structure allows air and sound waves to pass freely while effectively repelling liquid water molecules and fine particulate matter, forming the basis for high IP ratings coupled with minimal acoustic signal loss (low insertion loss), crucial for device functionality.

Recent technological advancements are centered around improving the application methods and form factors of these membranes. This includes the development of highly reliable adhesive systems that ensure long-term bonding to various enclosure materials, even under extreme temperature cycling or vibration, which is particularly relevant in the automotive sector. Furthermore, there is a growing trend toward integrated venting solutions, where the membrane is insert-molded directly into plastic or metal components, offering superior structural integrity and simplified assembly processes for OEMs. Research is also progressing into "smart" or adaptive membranes that could potentially change their characteristics (e.g., breathability or filtering capability) based on environmental input, although these remain largely in the developmental and early patent phases.

Another critical area of technological focus is the optimization of acoustic performance through digital simulation and precise material characterization. Manufacturers leverage sophisticated computational fluid dynamics (CFD) and acoustic simulation software to model how different vent geometries and membrane thicknesses affect sound transmission and pressure equalization within specific device enclosures. This predictive modeling capability allows for the development of custom-tuned acoustic vents that mitigate resonance and maintain frequency response uniformity, directly supporting the high-fidelity requirements of premium audio equipment and precise microphone arrays used in AI-enabled devices. The integration of advanced quality control systems, utilizing non-destructive testing techniques, ensures the porosity and waterproofing integrity of every vent produced, maintaining high standards necessary for critical applications.

Regional Highlights

- Asia Pacific (APAC) Market Dominance: APAC commands the largest share of the Acoustic Vents Market, fundamentally driven by its status as the global manufacturing hub for consumer electronics. Countries like China, Vietnam, South Korea, and Taiwan house the assembly operations of nearly all major global smartphone, tablet, and wearable technology brands. This high concentration of OEM production necessitates massive localized demand for acoustic venting solutions. Furthermore, the region’s vast and expanding consumer base exhibits strong demand for high-end, waterproof gadgets, continuously fueling volume growth and requiring localized supply chain support for custom-engineered components.

- North America Market: North America is characterized by high adoption rates of advanced, specialized venting technology, particularly within the medical device manufacturing and high-end automotive sectors. The region prioritizes R&D and technological innovation, often acting as the early adopter for premium, high-margin venting solutions, such as those used in sophisticated sensor protection for autonomous vehicles and critical portable medical monitoring equipment. Stringent safety and quality regulations in these sectors necessitate the use of certified, high-performance materials, contributing significantly to the market value.

- Europe Market: Europe holds a strong position, driven primarily by its powerful automotive industry, especially in Germany and France, where regulations concerning vehicle safety and increasing integration of external electronics demand robust IP-rated protection. Furthermore, Europe is a key center for specialized industrial and telecom equipment manufacturing (e.g., outdoor 5G infrastructure), requiring vents capable of long-term environmental durability and high resistance to chemical exposure and wide temperature swings. European market growth is stable, focusing on quality, regulatory compliance, and customized technical solutions rather than high volume.

- Latin America (LATAM) and Middle East & Africa (MEA) Growth: These regions are emerging rapidly due to increasing penetration of smartphones and a growing middle class that demands durable consumer goods. While current consumption volumes are lower compared to APAC, the accelerating urbanization, coupled with significant investments in telecom infrastructure (e.g., 5G rollouts), is boosting the demand for both consumer electronic protection and robust outdoor enclosure venting. Market growth in LATAM and MEA is expected to outpace developed regions, offering new avenues for standard and mid-range venting product suppliers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Acoustic Vents Market.- W. L. Gore & Associates

- Saint-Gobain

- Parker Hannifin

- Donaldson Company Inc.

- Lydall Inc.

- MicroVents

- Technetics Group

- Zotefoams plc

- Ventspace

- IP68 Vents

- Flexitallic Group

- Porex Corporation (A Public Company of Filtration Group)

- Sefar AG

- Ventex Technology Inc.

- 3M Company

- Sumitomo Electric Industries Ltd.

- Clarcor (A division of Parker Hannifin)

- Trelleborg AB

- Ufi Filters SpA

- Pall Corporation (A Danaher Company)

Frequently Asked Questions

Analyze common user questions about the Acoustic Vents market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an acoustic vent in consumer electronics?

The primary function of an acoustic vent is to equalize pressure differentials inside the device enclosure while maintaining high Ingress Protection (IP) ratings against water and dust. Crucially, it must allow sound waves to pass through with minimal acoustic attenuation, ensuring clear audio transmission for microphones and speakers.

Which material dominates the Acoustic Vents Market and why?

Expanded Polytetrafluoroethylene (ePTFE) dominates the market because its unique microporous structure provides an optimal balance of high air permeability (for pressure equalization), excellent hydrophobic and oleophobic properties (for water and contaminant resistance), and superior acoustic transparency (low insertion loss).

How does the automotive industry utilize acoustic vents?

The automotive industry uses acoustic vents extensively to protect sensitive electronic components, such as Advanced Driver-Assistance Systems (ADAS) sensors, electronic control units (ECUs), and exterior microphones, from environmental factors like moisture, road debris, and pressure fluctuations caused by temperature changes.

What major factor is driving the growth of the Acoustic Vents Market in APAC?

The growth in APAC is primarily driven by its overwhelming concentration as the global manufacturing center for high-volume consumer electronics, specifically smartphones and wearables, where water resistance (IP ratings) is a mandatory feature for product differentiation and consumer acceptance.

What are the key technological challenges in manufacturing acoustic vents?

Key technological challenges include achieving ultra-low acoustic insertion loss simultaneously with stringent IP68 water resistance, developing highly durable adhesive systems for permanent attachment, and miniaturizing vent size while maintaining performance for ever-smaller electronic devices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager