Acoustics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431763 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Acoustics Market Size

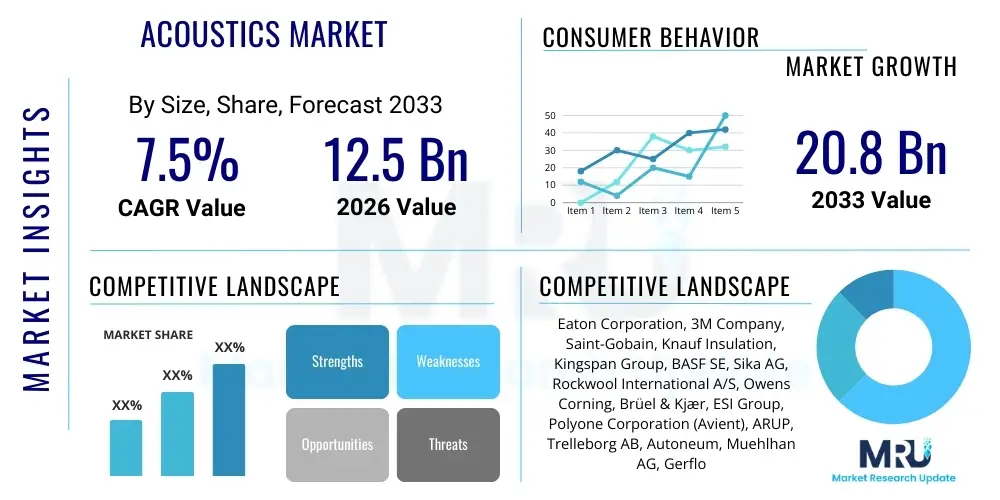

The Acoustics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 20.8 Billion by the end of the forecast period in 2033.

Acoustics Market introduction

The Acoustics Market encompasses the industry dedicated to the study, design, and implementation of sound control technologies, including materials, components, software, and services used to optimize acoustic environments. This sector addresses both unwanted sound (noise and vibration control) and desired sound (architectural acoustics, audio systems). Key products range from traditional sound-absorbing materials, noise barriers, and mufflers to advanced active noise cancellation systems, acoustic sensors, and sophisticated simulation software. Major applications span critical infrastructure sectors, including residential and commercial construction (improving occupant comfort and privacy), transportation (reducing vehicle noise, vibration, and harshness—NVH), and industrial settings (meeting occupational safety regulations). The primary benefits derived from market offerings include improved health and productivity, enhanced product quality, and adherence to increasingly stringent environmental noise regulations globally.

The core of the acoustics market lies in managing the interaction between sound waves and physical structures. Driving factors for sustained market growth are multifold, anchored by urbanization which necessitates quieter living and working spaces, coupled with the rapid expansion of the automotive sector, particularly electric vehicles (EVs), which require specialized acoustic management due to the absence of traditional engine noise masking road and wind noise. Furthermore, the integration of acoustics into product design across consumer electronics and industrial machinery ensures that noise reduction is a feature of quality rather than an afterthought. The market dynamics are highly influenced by material science advancements, particularly in developing lighter, more efficient, and sustainable acoustic solutions that cater to modern architectural and engineering demands.

The continuous push towards smart infrastructure and high-performance buildings globally significantly accelerates the adoption of advanced acoustic systems. These systems often integrate smart sensors and monitoring capabilities, providing real-time data on noise levels and enabling dynamic adjustments to the environment. The growing awareness regarding the adverse health effects of noise pollution, such as sleep disturbance, cardiovascular issues, and cognitive impairment, is compelling governments and corporations to invest heavily in robust acoustic mitigation strategies. Consequently, the scope of acoustics has broadened from simple soundproofing to comprehensive noise environment management, including vibration isolation crucial for sensitive equipment and precision manufacturing processes.

Acoustics Market Executive Summary

The Acoustics Market is characterized by steady expansion, driven primarily by regulatory pressures and technological innovation focused on smart noise control and high-performance materials. Business trends highlight a significant shift towards sustainable and bio-based acoustic materials, driven by corporate environmental, social, and governance (ESG) commitments. Furthermore, consolidation among specialized acoustic solution providers and larger material manufacturers is observed, aiming to offer integrated solutions spanning design, manufacturing, and installation. The fastest-growing segments are those related to active noise control (ANC) technologies, particularly in consumer electronics and the burgeoning electric vehicle market, where premium sound quality and cabin comfort are critical differentiators for consumers. Service providers specializing in acoustic consulting and predictive modeling software are experiencing high demand due to the complexity of modern noise challenges.

Regionally, Asia Pacific (APAC) stands out as the major growth engine, fueled by massive infrastructure development, rapid urbanization, and expanding manufacturing bases, particularly in China and India. North America and Europe, characterized by mature markets, lead in the adoption of sophisticated acoustic modeling software and regulatory compliance solutions. These regions demonstrate high penetration of specialized architectural acoustics in educational and healthcare facilities. Regional trends also show variances in regulatory focus; while Europe focuses heavily on outdoor environmental noise (e.g., railway noise), North America prioritizes indoor acoustic comfort and privacy in commercial spaces. Latin America and MEA are emerging markets, primarily driven by large-scale construction projects and increasing foreign direct investment in manufacturing capabilities.

Segment trends reveal that the materials segment, encompassing acoustic panels, foam, and barriers, maintains the largest market share, but the software and service segment is projected to grow at the highest CAGR. Within applications, the transportation sector, encompassing aerospace, marine, and road vehicles, demands highly specialized and lightweight acoustic solutions, driving innovation in composite materials and damping sheets. Residential construction continues to be a stable segment, increasingly adopting premium insulation products to meet consumer demand for quiet living. Overall, the market's trajectory is moving away from passive absorption towards integrated, smart systems capable of dynamic noise management, reflecting a high level of technological maturity and consumer expectation for quiet performance.

AI Impact Analysis on Acoustics Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Acoustics Market frequently center on its ability to transcend the limitations of passive noise reduction, asking how AI can personalize sound environments, optimize material design for non-obvious acoustic performance, and streamline complex simulation workflows. Users are keen to understand the shift from traditional acoustic engineering to AI-driven generative design for acoustic structures. Key themes revolve around the potential for predictive maintenance of acoustic systems, the enhancement of active noise cancellation (ANC) through machine learning algorithms that adapt instantly to changing soundscapes, and the integration of smart acoustic sensing for real-time monitoring and environmental impact assessment. The primary concern often relates to the cost and data infrastructure required to implement these advanced AI models versus the resulting performance gains and return on investment.

AI's application in the acoustics domain is fundamentally transforming product development cycles and performance capabilities. Generative AI algorithms are now capable of designing acoustic metamaterials and structural components that achieve optimal sound absorption or reflection characteristics far exceeding the performance achievable through traditional human-led iterative design. This capability drastically reduces the time-to-market for specialized acoustic solutions required in demanding environments like aerospace or high-end recording studios. Moreover, AI models are central to developing next-generation active noise control systems. These systems use deep learning to analyze ambient noise in real-time, accurately predict the waveform needed for destructive interference, and generate an anti-noise signal with unparalleled precision, moving beyond simple repetitive noise cancellation to address highly complex and dynamic sound fields.

Furthermore, AI significantly enhances the simulation and testing phases of acoustic projects. Machine learning models trained on vast datasets of material properties and structural responses allow engineers to run thousands of virtual tests simultaneously, optimizing designs for weight, cost, and acoustic performance before physical prototyping even begins. In the operational phase, AI-powered acoustic monitoring systems are used extensively in smart cities and industrial facilities. These systems can differentiate noise sources (e.g., construction vs. traffic vs. specific machinery fault noise), providing granular data for targeted mitigation strategies, improving environmental compliance reporting, and facilitating predictive maintenance by identifying abnormal acoustic signatures indicative of impending equipment failure.

- AI-driven optimization of material microstructure for superior sound absorption and damping characteristics.

- Enhanced performance and adaptability of Active Noise Cancellation (ANC) systems through machine learning algorithms.

- Accelerated acoustic simulation and modeling, reducing prototyping cycles and optimizing design validation.

- Implementation of predictive maintenance in industrial machinery by analyzing subtle acoustic anomalies.

- Development of personalized and dynamic sound environments in smart buildings and automotive interiors (Acoustic Scene Recognition).

- Generative design for complex acoustic structures and metamaterials previously unattainable via manual design processes.

DRO & Impact Forces Of Acoustics Market

The Acoustics Market is propelled by stringent regulatory frameworks concerning noise pollution, coupled with increasing consumer demand for quiet, high-quality environments in urban settings and transportation. Restraints primarily involve the high upfront costs associated with implementing advanced acoustic materials and complex active systems, alongside challenges related to the seamless integration of acoustic solutions with other building systems, particularly in retrofit projects. Opportunities lie in the rapidly evolving sectors of electric vehicles (NVH management) and virtual/augmented reality (spatial audio), alongside the development of smart, self-adjusting acoustic systems utilizing advanced sensors and IoT integration. These elements combine to form powerful impact forces that shape investment decisions and technological advancements within the industry, requiring stakeholders to continuously balance performance requirements, cost-efficiency, and compliance.

Drivers: Stricter global noise pollution regulations (e.g., EU Environmental Noise Directive, OSHA occupational exposure limits) necessitate mandatory adoption of noise control measures across various industries, providing a baseline demand for acoustic products and services. The phenomenal growth of the automotive sector, especially the transition to electric vehicles, introduces new NVH challenges that require advanced, lightweight sound damping and absorption solutions to ensure premium cabin experience. Furthermore, increasing construction activity in high-density urban areas drives the demand for high-performance architectural acoustics to minimize noise transfer between units and improve occupant wellness, recognized increasingly as a crucial component of green building certification and quality construction.

Restraints: A significant restraint is the initial high investment required for state-of-the-art acoustic solutions, such as specialized materials (e.g., aerogels, specialized composites) and sophisticated active noise control software, which can deter adoption, particularly among small and medium-sized enterprises (SMEs). Another challenge is the lack of universal standardization in acoustic testing and reporting across different regions and product types, leading to fragmentation and potential confusion for end-users comparing product efficacy. Additionally, the complexity involved in integrating advanced acoustic materials into existing infrastructures or specific product designs often requires specialized engineering expertise, increasing the overall project complexity and cost.

Opportunity: The market presents significant opportunities through the development of advanced acoustic metamaterials, which offer unprecedented levels of sound control (absorption or insulation) with minimal weight and thickness, crucial for aerospace and automotive applications. The burgeoning market for spatial audio and personalized acoustics in consumer electronics and virtual reality (VR/AR) is opening new revenue streams for acoustic software and sensor companies. Moreover, the focus on sustainable building practices and circular economy principles is creating a strong opportunity for manufacturers specializing in eco-friendly and recycled acoustic materials, appealing to environmentally conscious consumers and developers seeking LEED or BREEAM certification.

Segmentation Analysis

The Acoustics Market is highly diversified, typically segmented based on product type (materials, components, software, services), application (construction, automotive, industrial, consumer electronics), and end-use sectors. The segmentation highlights the varied needs across different industries, from the requirement for highly durable, fire-resistant acoustic materials in the industrial sector to lightweight, vibration-damping solutions in aerospace. Understanding these segments is crucial as manufacturers increasingly tailor their offerings—such as highly optimized computational acoustics software for design engineers versus easy-to-install decorative acoustic panels for commercial office spaces—to address specific performance criteria and cost sensitivities of the end-users.

The material segment dominates in volume due to the necessity of passive sound control in nearly every physical environment, encompassing porous absorbers, resonators, and sound barriers. However, the software and services segment, driven by the increasing complexity of noise modeling and the demand for compliance testing and consulting, exhibits the highest growth rate. Application-wise, the construction sector holds the largest overall share, reflecting continuous investment in residential, commercial, and institutional infrastructure globally. However, the transportation sector, particularly the NVH focus within the EV market, is rapidly closing this gap as regulatory and consumer expectations for quiet mobility intensify, requiring unique R&D investments in new composite and damping polymer technologies.

Further analysis of segmentation reveals specialization within consulting services, including architectural acoustics (room design and reverberation control), environmental acoustics (noise mapping and regulatory compliance), and product noise reduction (machinery and appliance quieting). This granular specialization reflects the highly technical nature of sound control. The market is increasingly moving toward integrated solutions, where a single provider offers both the physical materials (products) and the computational expertise (software/services) needed for comprehensive noise management, particularly valued by major automotive OEMs and large-scale commercial developers who seek turnkey acoustic solutions to minimize risk and streamline project management.

- By Product Type:

- Acoustic Materials (Foam, Panels, Barriers, Composites, Fibers)

- Acoustic Components (Microphones, Sensors, Actuators, Transducers)

- Software (Simulation, Modeling, Measurement, Monitoring)

- Services (Consulting, Testing, Installation, Maintenance)

- By Application:

- Architectural (Residential, Commercial, Institutional, Healthcare)

- Transportation (Automotive NVH, Aerospace, Marine, Rail)

- Industrial (Manufacturing, Power Generation, HVAC Systems)

- Consumer Electronics (Headphones, Smart Speakers, Active Noise Control)

- By End-Use Industry:

- Construction & Building

- Manufacturing & Process Industries

- Automotive & Transportation

- Energy & Utilities

- Healthcare

Value Chain Analysis For Acoustics Market

The Acoustics Market value chain begins with the sourcing of raw materials, which include polymers, specialty fibers, metals, and composite components, followed by their processing into fundamental acoustic materials like foams, insulation boards, and damping sheets by material processors. Upstream analysis involves optimizing the supply chain for specialized materials, such as those required for high-performance acoustic metamaterials or sustainable, recycled content. Key players in this phase focus on R&D to enhance material performance (e.g., higher absorption coefficient, lower density) and ensure regulatory compliance, particularly regarding flammability and toxicity standards, which is critical for architectural and aerospace applications. Efficient logistics and stable pricing of raw polymer inputs are vital for maintaining profitability at this stage.

The core manufacturing stage involves converting these materials into finished acoustic products, which includes panels, barriers, and integrated systems, often requiring high-precision fabrication and assembly. Simultaneously, the software segment involves developers creating advanced Finite Element Method (FEM) and Boundary Element Method (BEM) simulation tools necessary for complex acoustic design. Downstream analysis focuses on the distribution channels, which are highly diversified. Direct channels are commonly used for large, custom projects involving sophisticated industrial noise control or high-end architectural acoustics, where manufacturers or consulting firms engage directly with the client (e.g., an automotive OEM or a major construction contractor).

Indirect channels primarily utilize specialized distributors and building material suppliers to reach smaller construction companies, retailers, and consumer markets. Acoustic consultants often act as crucial intermediaries in the value chain, specifying which materials and solutions are appropriate for a given project, thereby strongly influencing purchasing decisions. The value chain concludes with installation, often performed by specialized contractors, and post-installation services, including periodic noise monitoring and maintenance, increasingly supported by IoT-enabled acoustic sensors. The integration of software simulation with physical product delivery is a key competitive advantage, optimizing the entire process from design specification to final performance validation.

Acoustics Market Potential Customers

The potential customers for the Acoustics Market are highly diverse, spanning major industrial sectors, commercial entities, government bodies, and individual consumers, all seeking solutions to manage, reduce, or optimize sound environments. End-users are broadly categorized into entities involved in construction and infrastructure development, transportation manufacturing, industrial production, and consumer product manufacturing. Major buyers include large General Contractors and Architectural Firms that require certified materials for commercial and residential buildings to comply with noise regulations and meet consumer comfort expectations. Automotive OEMs are critical customers, specifically purchasing NVH solutions (damping sheets, absorption foams, resonators) to enhance vehicle quality and meet stringent noise emission standards, particularly for electric and hybrid models.

In the industrial segment, major purchasers include power generation companies, processing plants, and HVAC manufacturers, which require custom-engineered noise barriers, enclosures, and mufflers to protect worker health and comply with environmental noise limits imposed by local authorities. The government and public sector are substantial buyers, investing in solutions for infrastructure (road and rail noise barriers), educational facilities (classroom acoustics), and healthcare environments (privacy and healing soundscapes). The healthcare sector, recognizing the therapeutic value of quiet environments, invests heavily in specialized acoustic ceiling tiles and wall treatments designed to minimize noise and reverberation.

Lastly, technology and consumer electronics companies represent a rapidly growing customer base, purchasing advanced acoustic components (microphones, MEMS sensors) and active noise cancellation software solutions for integration into smartphones, headphones, and smart home devices. These buyers prioritize miniaturization, high performance, and seamless integration of acoustic technology. Specialized acoustic consultants and testing laboratories also act as key purchasers of highly accurate measurement equipment and modeling software, which they subsequently use to provide analytical services to the broader end-user base, effectively influencing upstream product demand.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 20.8 Billion |

| Growth Rate | CAGR 7.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eaton Corporation, 3M Company, Saint-Gobain, Knauf Insulation, Kingspan Group, BASF SE, Sika AG, Rockwool International A/S, Owens Corning, Brüel & Kjær, ESI Group, Polyone Corporation (Avient), ARUP, Trelleborg AB, Autoneum, Muehlhan AG, Gerflor Group, Quiet Solution, Inc., AcoustiControl, G+H Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Acoustics Market Key Technology Landscape

The Acoustics Market technology landscape is rapidly evolving, moving beyond traditional porous and fibrous materials toward highly engineered, smart solutions. A pivotal technological shift is the increasing sophistication of Active Noise Control (ANC) systems, which use inverse sound waves generated via advanced algorithms and transducers to cancel unwanted noise. Modern ANC systems are miniaturized and integrated into diverse products, from headphones and vehicles to ductwork, utilizing adaptive filtering and machine learning to handle dynamic noise profiles more effectively than static passive absorption methods. This reliance on digital signal processing (DSP) and specialized micro-electromechanical systems (MEMS) sensors is redefining the component sub-segment of the market, prioritizing computational performance and low power consumption.

Another critical area of innovation is the development and commercialization of acoustic metamaterials. These are artificial, structured materials engineered to exhibit acoustic properties not found in nature, such as negative density or bulk modulus. Metamaterials allow for highly efficient sound insulation or absorption using significantly reduced material volume and weight, making them indispensable for weight-sensitive applications like aerospace and high-performance automotive manufacturing. Research is focused on scaling up production and reducing the manufacturing complexity of these cellular or lattice structures, often achieved through advanced 3D printing and precision injection molding techniques, pushing the boundaries of sound management capability.

Furthermore, the widespread adoption of advanced computational acoustics software, often incorporating cloud-based simulation capabilities, is fundamentally changing the design process. Technologies such as high-fidelity acoustic Finite Element Analysis (FEA) and Boundary Element Method (BEM) allow engineers to accurately model complex noise propagation paths and material interactions in virtual environments, minimizing physical prototyping costs and accelerating time-to-market. The integration of IoT sensors for real-time acoustic monitoring and data feedback loops allows for continuous system optimization and predictive maintenance, particularly in large industrial installations and smart city noise mapping projects, thereby connecting the physical products with sophisticated digital services.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, primarily driven by massive infrastructure investments, rapid urbanization in countries like China, India, and Southeast Asian nations, and the expansion of the regional automotive manufacturing sector. Stringent noise pollution regulations, particularly concerning construction site noise and industrial environmental impact, are forcing high adoption rates of noise control solutions. The market here is characterized by high volume demand for basic acoustic materials, alongside a burgeoning, highly sophisticated demand for NVH solutions driven by regional luxury automotive brands and increasing adoption of complex residential acoustics.

- North America: This region is a mature market characterized by high spending on advanced acoustic technologies and strong regulatory enforcement (e.g., OSHA, local building codes). The demand is concentrated in the commercial building sector, focusing on acoustic privacy (speech intelligibility) and noise mitigation in offices and healthcare facilities. North America leads in the adoption of acoustic simulation software and high-tech components, fueled by large R&D investments in aerospace, defense, and high-fidelity consumer electronics, emphasizing high performance and sustainable material sourcing.

- Europe: Europe exhibits strong growth rooted in stringent environmental noise regulations (e.g., controlling noise from rail, roads, and machinery) and a robust focus on sustainable construction practices. European markets show high maturity in specialized architectural acoustics, particularly in public buildings and retrofitting older structures. Key drivers include the region’s strong automotive manufacturing base, particularly the early adoption and production scaling of EVs, which mandates innovative NVH solutions, and widespread integration of passive house and near-zero energy building standards that often require superior acoustic insulation.

- Latin America (LATAM): LATAM is an emerging market with potential driven by increasing infrastructure development and expanding manufacturing capacities, particularly in Brazil and Mexico. Market growth is closely tied to economic stability and foreign investment in commercial real estate and industrial projects. While price sensitivity remains a factor, the professional segment is increasingly adopting imported advanced acoustic materials and consulting services to meet global project standards.

- Middle East and Africa (MEA): Growth in MEA is primarily project-driven, highly dependent on large-scale government construction and diversification efforts (e.g., megacity development in Saudi Arabia, commercial hubs in the UAE). The demand focuses on high-performance materials suitable for extreme climates and large public venues, with increasing regulatory emphasis on fire safety and specialized noise control for oil & gas and power generation facilities, making industrial acoustics a significant sub-segment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Acoustics Market.- Eaton Corporation

- 3M Company

- Saint-Gobain

- Knauf Insulation

- Kingspan Group

- BASF SE

- Sika AG

- Rockwool International A/S

- Owens Corning

- Brüel & Kjær

- ESI Group

- Polyone Corporation (Avient)

- ARUP

- Trelleborg AB

- Autoneum

- Muehlhan AG

- Gerflor Group

- Quiet Solution, Inc.

- AcoustiControl

- G+H Group

Frequently Asked Questions

Analyze common user questions about the Acoustics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the most significant growth in the Acoustics Market?

The most significant growth is driven by the global increase in stringent governmental noise pollution regulations, coupled with the rapid transition to electric vehicles (EVs), which necessitates specialized noise, vibration, and harshness (NVH) solutions to address new acoustic challenges in vehicle interiors and exteriors.

How is Active Noise Control (ANC) technology influencing industrial applications?

ANC technology is moving beyond consumer electronics and is now actively used in industrial settings, particularly within HVAC ducting and specific machinery enclosures, to generate opposing sound waves that neutralize low-frequency and persistent background noise, significantly improving occupational health compliance and worker comfort without requiring heavy physical barriers.

What role do acoustic metamaterials play in modern construction?

Acoustic metamaterials are crucial for modern construction as they offer superior sound insulation and absorption properties in ultra-thin and lightweight forms. They enable architects to meet high acoustic standards in structures with limited space and weight restrictions, fulfilling the demand for high-performance, non-traditional acoustic solutions.

Which geographical region holds the largest market share for acoustic products?

While Asia Pacific is the fastest-growing region, North America and Europe currently hold the largest market share due to high regulatory maturity, substantial investment in commercial and institutional infrastructure, and the early adoption of high-value specialized acoustic consulting services and sophisticated materials.

What are the primary restraints affecting the wider adoption of advanced acoustic systems?

The primary restraints are the high initial capital expenditure required for installing advanced acoustic materials and complex active noise control systems, along with the technical challenge of integrating these specialized solutions seamlessly into existing, multi-faceted architectural and engineering projects.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Liquid Crystal Polymer (LCP) Films and Laminates Market Statistics 2025 Analysis By Application (Electrical & Electronics, Acoustics and Optics), By Type (Films, Laminates), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Micro Electronic-Acoustics Market Statistics 2025 Analysis By Application (Mobile Communications, Laptop, FPTV, Automotive Electronics, Headset, Audiphone), By Type (Microphone, Speaker, Receiver), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Vintage Acoustic Guitars Strings Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Bronze, Chrome, Copper, Nickel Plated Steel, Other), By Application (Dreadnought Acoustics Guitars, Concert Acoustics Guitars, Grand Auditorium Acoustics Guitars, Jumbo Acoustics Guitars, Mini and Travel Acoustics Guitars), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager