Acrolein Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432906 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Acrolein Market Size

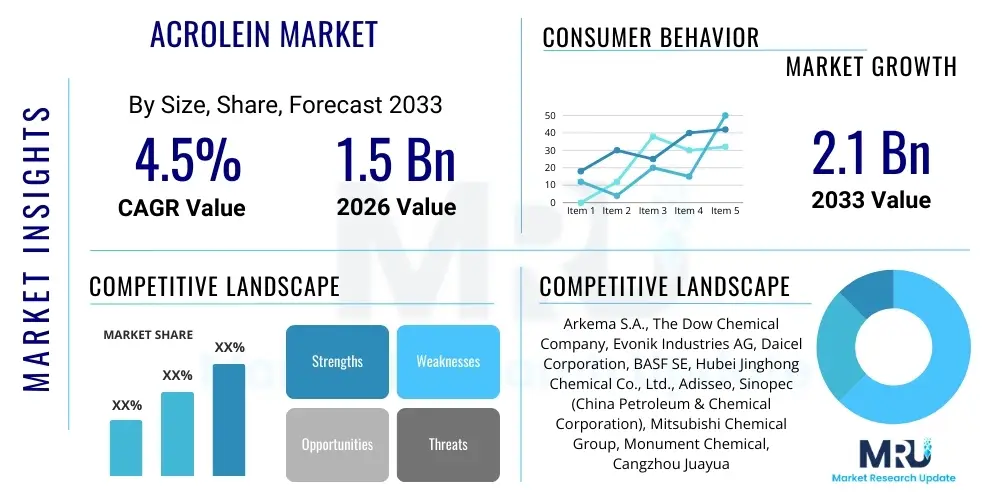

The Acrolein Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.73 Billion by the end of the forecast period in 2033.

Acrolein Market introduction

Acrolein (propenal) is a highly reactive, colorless to yellow liquid aldehyde characterized by a pungent, unpleasant odor. It serves primarily as a critical chemical intermediate rather than an end-use product due to its inherent toxicity and high reactivity. The global Acrolein market is fundamentally driven by its application in synthesizing high-value downstream derivatives, notably methionine, glutaraldehyde, and various specialty chemicals. Methionine, a crucial essential amino acid utilized heavily in animal feed, accounts for the largest share of acrolein consumption, linking the market growth directly to the expansion of the global poultry and aquaculture industries, particularly across fast-developing economies in Asia Pacific.

The core manufacturing process for acrolein involves the catalytic oxidation of propylene, a widely available petrochemical feedstock. However, increasing environmental scrutiny and volatility in petrochemical prices are spurring interest in bio-based routes, specifically the oxidation of glycerol, which is a major byproduct of the biodiesel industry. This shift toward sustainable feedstocks represents a significant evolutionary trend within the acrolein production landscape, offering potential benefits in terms of carbon footprint reduction and feedstock supply stability, although the technology still faces cost and optimization hurdles compared to traditional methods.

Beyond animal nutrition, acrolein derivatives find extensive use in water treatment applications (e.g., as biocides and algicides, primarily via glutaraldehyde), chemical synthesis (especially in pharmaceuticals, acrylic acid esters, and polyurethane precursors), and textile finishing. The distinct chemical properties of acrolein, including its double bond and aldehyde functional group, make it an indispensable building block for complex organic molecules. Market expansion is highly correlated with regulatory environments regarding feed additives and water quality standards, demanding continuous innovation in safe handling, storage, and transport protocols due to its hazardous nature.

Acrolein Market Executive Summary

The Acrolein market is experiencing robust growth, primarily propelled by the exponential demand for methionine in the burgeoning global animal feed industry. Business trends indicate a strong focus on capacity expansion, particularly in the Asia Pacific region, where dense livestock populations and rising consumption of protein-rich diets necessitate increased feed additive production. Key market players are strategically investing in efficient catalytic technologies to optimize yields from propylene and are simultaneously exploring viable, sustainable alternatives, such as glycerol-based processes, to mitigate reliance on petrochemical inputs and address growing environmental compliance pressures globally.

Regionally, Asia Pacific (APAC) stands out as the dominant market, driven by massive production capabilities in China and increasing domestic consumption in Southeast Asian countries. North America and Europe maintain stable, mature markets characterized by stringent safety regulations and high technological adoption, focusing mainly on specialty chemical applications and high-purity derivatives. Future growth trajectories suggest that the balance of power may shift slightly toward regions emphasizing sustainable sourcing and advanced regulatory frameworks governing chemical intermediates and biocides, thereby increasing the importance of product stewardship across all geographies.

Segmentally, the market is overwhelmingly governed by the methionine application segment, which dictates global acrolein production volumes. However, segments like glutaraldehyde (used in disinfectants and oilfield chemicals) are expected to show accelerated growth due to stricter hygiene standards post-pandemic and increased exploration activities requiring effective corrosion inhibitors and biocides. Manufacturers are actively managing the inherent risks associated with handling acrolein, focusing on closed-loop systems and developing safer delivery mechanisms for downstream manufacturers, thereby ensuring continuous supply chain reliability necessary for these critical end-use sectors.

AI Impact Analysis on Acrolein Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Acrolein market often center on maximizing production efficiency, ensuring safety given acrolein's toxicity, and accelerating the discovery of novel, safer derivative pathways. Users are keenly interested in how AI and Machine Learning (ML) can be applied to optimize complex catalytic reactions involved in acrolein synthesis, predicting catalyst life cycle, and modeling reactor performance under varied conditions. Furthermore, concerns about supply chain resilience and cost management drive queries about predictive maintenance models and feedstock price forecasting. The overall theme reflects an expectation that AI will be a core enabler of cost reduction, safety improvement, and R&D acceleration within this capital-intensive and hazardous chemical segment.

- AI-driven optimization of catalytic reactors, maximizing yield from propylene or glycerol feedstocks by precisely controlling temperature, pressure, and flow dynamics.

- Predictive maintenance algorithms for production equipment, reducing unplanned downtime and mitigating risks associated with handling highly volatile intermediates like acrolein.

- Machine learning models used to forecast volatile feedstock prices (propylene, glycerol), enabling strategic procurement decisions and minimizing cost fluctuations.

- AI application in process safety management (PSM), using real-time sensor data to predict and prevent potential hazardous events related to storage and transport of acrolein.

- Accelerated R&D through computational chemistry, simulating novel derivative synthesis routes (e.g., new bio-based acrylic acid production) that utilize acrolein more efficiently.

- Enhanced supply chain visibility and risk management using AI to track inventory, anticipate logistical bottlenecks, and optimize transportation routes for hazardous chemicals.

- Quality control improvement via computer vision and sensor fusion technologies to ensure the purity and consistency of acrolein and its high-value derivatives.

DRO & Impact Forces Of Acrolein Market

The Acrolein market dynamics are significantly influenced by a powerful combination of drivers, restraints, and opportunities. The principal driver remains the escalating global demand for DL-methionine, an essential feed additive crucial for efficient protein utilization in monogastric animals such as poultry and swine. As global populations rise and dietary preferences shift toward meat consumption, particularly in Asian markets, the necessity for efficient animal husbandry ensures continuous, high demand for acrolein. This driver is further amplified by the inherent cost-effectiveness and high conversion efficiency of using acrolein in methionine synthesis compared to alternative chemical routes.

Conversely, the market faces substantial restraints centered on the inherent toxicity and high flammability of acrolein, necessitating extremely stringent regulatory oversight and high capital expenditure for safe manufacturing, storage, and transport. Regulatory bodies globally impose strict occupational exposure limits (OELs) and environmental release standards, increasing operational costs for manufacturers and limiting the potential for widespread adoption outside established, specialized industrial zones. Furthermore, the reliance on petrochemical feedstocks, primarily propylene, exposes the market to significant price volatility and geopolitical supply risks, which can dramatically affect manufacturing margins and profitability.

Opportunities for market expansion are primarily found in technological advancements aimed at sustainable production and diversification of derivative applications. The shift towards bio-based acrolein derived from abundant glycerol presents a key opportunity to stabilize feedstock supply, improve environmental credentials, and tap into green chemistry initiatives. Moreover, the growing use of glutaraldehyde in emerging applications such as sophisticated membrane filtration technologies, enhanced oil recovery (EOR), and specialized cross-linking agents in advanced materials offers pathways for diversification beyond the primary methionine segment, providing resilience against potential saturation in the animal feed sector.

Segmentation Analysis

The Acrolein market is segmented based primarily on its application, reflecting the various high-value derivatives produced from this intermediate, and secondarily based on the end-use industry that consumes these derivatives. The application segmentation clearly demonstrates the market dominance of methionine production, which dictates supply volumes and pricing trends across the industry. End-use segmentation highlights the critical dependency of the market on the animal nutrition sector, while also recognizing the stable contribution from the water treatment and specialty chemicals sectors, which utilize glutaraldehyde and other niche derivatives for diverse purposes.

- By Application:

- Methionine Production

- Glutaraldehyde Production

- Acrylic Acid and Esters

- Pyridine and Picolines Synthesis

- Pharmaceutical and Chemical Intermediates

- Others (e.g., Herbicides, Perfumery)

- By End-Use Industry:

- Animal Nutrition and Feed

- Water Treatment (Biocides and Disinfectants)

- Chemical and Polymer Synthesis

- Oil and Gas (Enhanced Oil Recovery and Corrosion Inhibitors)

- Pharmaceuticals and Healthcare

- Agrochemicals

- By Production Method:

- Propylene Oxidation (Conventional Method)

- Glycerol Oxidation (Bio-based Method)

Value Chain Analysis For Acrolein Market

The Acrolein market value chain begins with the sourcing of upstream raw materials, predominantly petrochemical-grade propylene or, increasingly, bio-based glycerol. Propylene is obtained from naphtha cracking or propane dehydrogenation units, making acrolein producers highly susceptible to the price volatility and supply fluctuations inherent in the global petrochemical market. Glycerol, on the other hand, is a byproduct of biodiesel manufacturing, offering a potential path toward cost stability and sustainability, though requiring different catalytic processes for conversion to acrolein. Upstream stability and feedstock cost management are crucial determining factors for the final profitability of acrolein production.

The core manufacturing stage involves complex, high-temperature, catalytic gas-phase oxidation reactions. Manufacturers employ highly specialized reactor designs and proprietary catalyst systems to ensure efficient conversion while managing the extreme reactivity and inherent safety hazards of acrolein production. Once synthesized, acrolein is rarely transported internationally as a bulk chemical due to safety restrictions; instead, it is typically produced captive or piped directly to adjacent facilities for immediate downstream processing into derivatives. This requirement for integrated production complexes significantly restricts the geographical spread of acrolein manufacturing units.

The downstream segment transforms acrolein into marketable, safer derivatives. Methionine manufacturing consumes the largest volume, followed by glutaraldehyde synthesis. These derivatives are then distributed through distinct channels. Methionine primarily moves through direct sales contracts to large animal feed compounders and integrated livestock operations. Glutaraldehyde and specialty chemicals utilize specialized chemical distributors (indirect channels) to reach varied end-users such as water treatment plants, oilfield services, and specialty polymer manufacturers. The value added rapidly increases at the derivative stage, moving from a hazardous intermediate to stable, high-value functional products.

Acrolein Market Potential Customers

The primary customers for acrolein are large-scale chemical producers who utilize it as a captive intermediate to manufacture vital end-products, rather than the acrolein itself being sold directly to external users. The most significant customer base resides within the animal nutrition sector, specifically integrated feed mill operators and methionine manufacturers who rely on steady, high-volume acrolein supply to produce essential amino acids. These customers demand stringent purity levels and guaranteed supply continuity, often securing long-term supply agreements or operating adjacent, integrated manufacturing sites for optimal efficiency and safety.

A second major customer segment includes companies specializing in water treatment and sanitation chemicals. These customers purchase glutaraldehyde, the acrolein derivative, for its powerful biocide properties. Applications range from municipal water systems and industrial cooling towers to large-scale disinfection programs. These buyers are highly sensitive to regulatory approval and product efficacy against various microbial contaminants, focusing on environmental compatibility and low toxicity profile of the final derivative product in their selection process.

The third key segment comprises specialty chemical and polymer manufacturers. These customers use acrolein and its derivatives (such as acrylic acid, esters, or pyridine bases) for synthesizing advanced materials, coatings, resins, and pharmaceutical intermediates. This segment demands highly customized product specifications and typically involves complex contractual relationships with R&D collaboration, often driving innovation in the diversification of acrolein's end-uses beyond its traditional, high-volume applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.73 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Evonik Industries, Arkema, Daicel Corporation, Sasol, Dow, Mitsubishi Chemical, Nippon Shokubai, BASF SE, Wanhua Chemical Group, China Petroleum & Chemical Corporation (Sinopec), Zhejiang Xingfa Chemical, KH Neochem, Monument Chemical, Celanese Corporation, LG Chem, Johnson Matthey, Sumitomo Chemical, Solvay S.A., Kuraray Co., Ltd., Zibo Luba Chemical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Acrolein Market Key Technology Landscape

The dominant technological landscape in the Acrolein market is anchored in the traditional, two-stage catalytic gas-phase oxidation of propylene. This process relies on proprietary multicomponent metal oxide catalysts, often based on bismuth molybdates, which offer high selectivity toward acrolein and manage the extreme exothermic nature of the reaction. Continuous innovation in this domain focuses on developing more robust, long-lasting catalysts that can operate under milder conditions to reduce energy consumption and further improve selectivity, thereby minimizing the formation of undesirable byproducts such as acrylic acid. Licensing and proprietary catalyst technology are critical competitive factors among key manufacturers, determining efficiency and cost competitiveness.

A significant emerging technological front is the development and commercialization of the glycerol oxidation route. This bio-based methodology utilizes crude glycerol, a readily available and sustainable byproduct from the burgeoning biodiesel industry. The challenge lies in designing catalysts that effectively manage the higher activation energy and potential fouling issues associated with glycerol, while maintaining high acrolein yields. Companies are investing heavily in heterogeneous catalyst systems—often incorporating supported noble metals or acid catalysts—to make this pathway economically competitive with the established propylene route, aligning with global trends toward sustainable chemical manufacturing and carbon footprint reduction.

Furthermore, advancements in reactor technology, particularly in fluidized bed and multitubular fixed-bed reactors, are crucial for handling the immense heat generated during acrolein synthesis and ensuring process stability. Modern production facilities are increasingly incorporating advanced process control systems (DCS/PLC), coupled with computational fluid dynamics (CFD) modeling, to optimize mass and heat transfer dynamics within the reactor. This focus on process intensification and automation not only enhances throughput and yield but also significantly improves the safety protocols required for handling this acutely hazardous chemical intermediate, a mandatory aspect of contemporary chemical technology application.

- Propylene Oxidation Technology: The established process utilizing complex metal oxide catalysts (e.g., bismuth molybdate) in fixed-bed or fluidized-bed reactors.

- Glycerol-to-Acrolein (GTO) Technology: Emerging bio-based route using proprietary supported catalysts to convert crude glycerol, focused on achieving commercial viability and competitive cost structures.

- Advanced Catalyst Development: Research focused on developing novel heterogeneous catalysts for increased selectivity, reduced operating temperatures, and extended catalyst lifespan in both propylene and glycerol routes.

- Reactor Engineering Optimization: Implementation of advanced multitubular reactor designs and process intensification techniques to manage exothermic reactions and improve safety profiles.

- Process Safety Management (PSM) Systems: Integration of highly specialized monitoring and control systems to detect trace levels of acrolein and prevent accidental release or polymerization, essential due to its hazardous classification.

- Integrated Manufacturing Platforms: Tendency towards integrating acrolein production captive facilities immediately adjacent to derivative plants (e.g., methionine or glutaraldehyde units) to eliminate the need for bulk transport of the intermediate.

Regional Highlights

The regional dynamics of the Acrolein market are highly uneven, reflecting disparities in industrial infrastructure, livestock production, and regulatory regimes. Asia Pacific (APAC) dominates the global market, both in terms of production capacity and consumption volume. This leadership is overwhelmingly driven by China, which is the world's largest producer and consumer of methionine, necessary to support its enormous and rapidly growing poultry and swine industries. Southeast Asian countries are also contributing significantly to market expansion, benefiting from industrialization and rising per capita meat consumption. The APAC region sees continuous investment in large-scale, integrated chemical complexes aimed at securing local supply chains for animal feed additives.

North America and Europe represent mature markets characterized by high technological standards and strict regulatory environments. In North America, demand is stable, primarily driven by the established specialty chemicals and glutaraldehyde markets, including significant use in the oil and gas sector for enhanced oil recovery (EOR) operations and biocides. European manufacturers, while focusing heavily on derivative production (methionine), are increasingly pressurized by stringent environmental regulations, prompting heightened investment in sustainable production methods, including the exploration of glycerol-based acrolein synthesis to meet sustainability targets and comply with REACH regulations.

Latin America (LATAM) and the Middle East & Africa (MEA) currently hold smaller market shares but are exhibiting promising growth potential. LATAM, particularly Brazil and Argentina, is driven by its strong agricultural and livestock export sectors, requiring increasing volumes of feed additives. The MEA region's growth is primarily linked to ongoing industrialization efforts and investment in water treatment infrastructure, which boosts demand for glutaraldehyde biocides. However, these regions often rely on imports or localized captive production facilities established by global players, and market maturity is slower compared to APAC and established Western economies.

- Asia Pacific (APAC): Market leader due to overwhelming demand for methionine driven by China's colossal animal husbandry sector; strong focus on capacity expansion and feedstock security.

- China: Largest consumer and producer; backbone of global methionine supply.

- India: Rapid growth in feed consumption and chemical processing capacity.

- Southeast Asia: Increasing industrialization and rising protein consumption driving local demand for feed additives and biocides.

- North America: Mature market; stable demand from specialty chemical manufacturing, glutaraldehyde use in the oil & gas industry (EOR, biocide applications), and high regulatory compliance standards.

- United States: Key hub for specialty chemical and water treatment applications; significant focus on process safety and compliance.

- Europe: Highly regulated market; steady demand for high-quality methionine; strong emphasis on sustainable and bio-based production routes (glycerol); rigorous implementation of REACH regulations influencing production methods.

- Germany and France: Centers for specialized chemical synthesis and major derivative producers.

- Latin America (LATAM): Growth driven by robust agricultural exports and expansion of the livestock industry, necessitating imported or locally produced feed additives.

- Brazil: Largest market in the region due to extensive agricultural sector and high livestock density.

- Middle East & Africa (MEA): Emerging market, growth concentrated in water treatment infrastructure development and oilfield chemical applications requiring glutaraldehyde-based biocides and inhibitors.

- Saudi Arabia and UAE: Key adopters for industrial water treatment and oilfield services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Acrolein Market.- Evonik Industries

- Arkema

- Daicel Corporation

- Sasol

- Dow

- Mitsubishi Chemical

- Nippon Shokubai

- BASF SE

- Wanhua Chemical Group

- China Petroleum & Chemical Corporation (Sinopec)

- Zhejiang Xingfa Chemical

- KH Neochem

- Monument Chemical

- Celanese Corporation

- LG Chem

- Johnson Matthey

- Sumitomo Chemical

- Solvay S.A.

- Kuraray Co., Ltd.

- WeylChem International GmbH

Frequently Asked Questions

Analyze common user questions about the Acrolein market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary application driving the demand for Acrolein?

The primary application driving the global demand for Acrolein is the synthesis of DL-methionine, an essential amino acid widely used as a critical feed additive in the animal nutrition industry, particularly for poultry and swine.

What are the main risks associated with the Acrolein market?

The main risks stem from Acrolein's high inherent toxicity and flammability, which mandate stringent environmental, safety, and occupational regulations, leading to high operational and capital expenditure for specialized handling and production facilities.

How is the market exploring sustainable Acrolein production?

The market is actively exploring the oxidation of crude glycerol, a byproduct of the biodiesel industry, as a bio-based feedstock alternative to traditional petrochemical propylene. This offers potential benefits in cost stability and reduced carbon footprint.

Which geographical region dominates the Acrolein market in terms of consumption and production?

Asia Pacific (APAC), particularly China, dominates the Acrolein market. This region holds the largest production capacities and consumes the most Acrolein due to the massive demand from its rapidly expanding animal feed sector.

Beyond animal feed, what are the other significant end-use industries for Acrolein derivatives?

Other significant end-use industries include water treatment, where the derivative glutaraldehyde is used as a powerful biocide and disinfectant, and the oil and gas sector, where it is utilized in enhanced oil recovery (EOR) and corrosion inhibition applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Acrolein Market Size Report By Type (Glycerol Dehydration Method, Propylene Oxidation Method), By Application (Glutaraldehyde, Methionine, Pesticide, Water Treatment Agent, Others, End-Use, Paints and Coatings, Polymer, Industrial Manufacturing, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Acrolein Diethyl Acetal Market Statistics 2025 Analysis By Application (Pharmaceutical Industry), By Type (0.96, 0.98, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Acrolein (CAS 107-02-8) Market Statistics 2025 Analysis By Application (Methionine, Pesticide, Glutaraldehyde, Water Treatment Agent, Medicine, Food, Feed, Cosmetics), By Type (Propylene Oxidation, Glycerine Dehydrating), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager