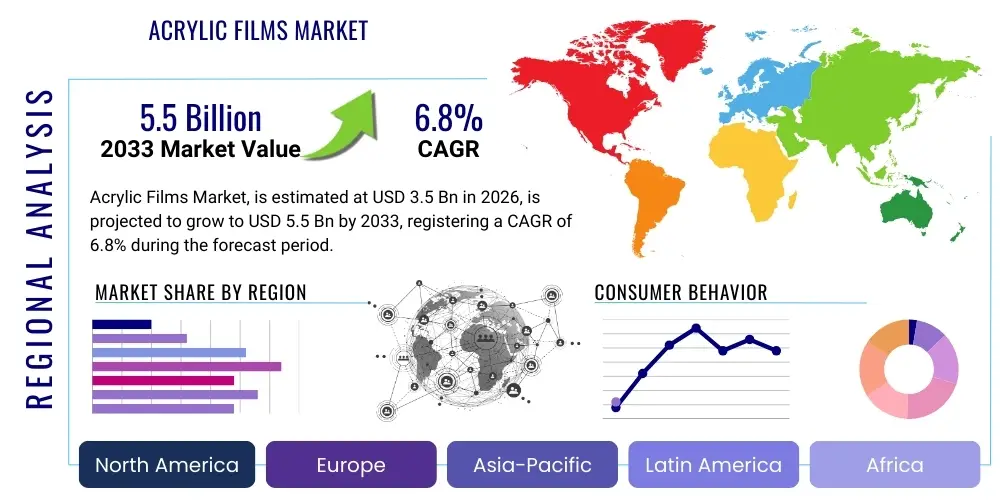

Acrylic Films Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436059 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Acrylic Films Market Size

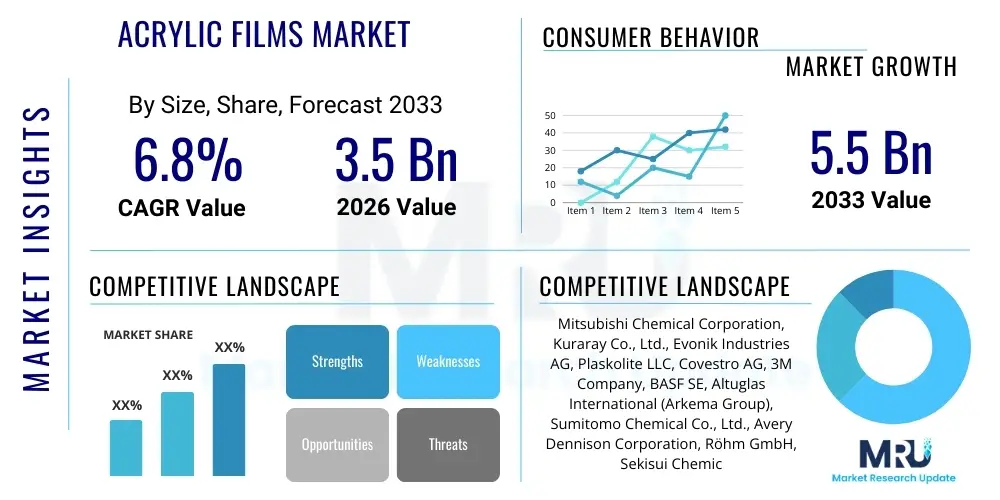

The Acrylic Films Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.5 Billion by the end of the forecast period in 2033.

Acrylic Films Market introduction

Acrylic films, primarily derived from polymethyl methacrylate (PMMA) or modified acrylic polymers, are high-performance thermoplastic materials characterized by exceptional clarity, superior weather resistance, high gloss, and excellent mechanical strength. These attributes make them indispensable in applications requiring aesthetic appeal combined with long-term durability, particularly against UV radiation and abrasion. The films serve as protective overlays or decorative surfaces in various consumer and industrial products, notably offering anti-scratch and anti-glare functionalities. Their versatility allows for processing methods such as lamination, thermoforming, and extrusion, catering to diverse geometric and functional requirements across multiple sectors.

The core product description centers on their functional role as a surface solution that enhances product longevity and visual quality. Major applications span the automotive sector, where they are used for interior trim and exterior protection; the construction industry, utilized in window profiles and cladding; and the electronics segment for touchscreens, displays, and protective covers for durable goods. The unique selling proposition of acrylic films lies in their ease of coloration, excellent adhesion properties, and robust resistance to chemical exposure, ensuring color stability and structural integrity over extended periods, which is critical for high-value consumer goods.

Driving factors propelling market expansion include the surging demand for lightweight, high-gloss finishes in the automotive industry, fueled by electric vehicle production and stringent regulatory requirements for interior material safety and aesthetics. Furthermore, the rapid growth of the consumer electronics market, necessitating durable, scratch-resistant film for premium devices, contributes significantly. Technological advancements in film manufacturing, such as multi-layer extrusion and advanced coating techniques, are continually improving film performance, lowering production costs, and broadening the scope of potential applications, thereby solidifying acrylic films as a preferred material over traditional alternatives.

Acrylic Films Market Executive Summary

The Acrylic Films Market is experiencing robust growth driven by accelerating demand from the automotive, construction, and electronics sectors, particularly within emerging economies in the Asia Pacific. Business trends indicate a strong focus on sustainability, leading manufacturers to invest heavily in bio-based or recycled acrylic film production technologies to align with global environmental mandates and consumer preferences for eco-friendly materials. Strategic mergers, acquisitions, and collaborations are frequent, aiming to consolidate raw material supply chains, enhance geographic presence, and acquire specialized coating and lamination expertise, optimizing operational efficiencies and expanding product portfolios into niche, high-performance applications such as medical devices and advanced display screens.

Regionally, Asia Pacific maintains its dominance, primarily due to large-scale manufacturing hubs for automotive components and consumer electronics in countries like China, Japan, and South Korea, coupled with significant governmental investment in infrastructure and construction projects requiring durable exterior finishes. North America and Europe demonstrate mature market characteristics, focusing primarily on premium, high-specification acrylic films for luxury automotive finishes and advanced construction applications requiring superior fire resistance and weatherability. The trend across all regions is moving towards customized film solutions, including anti-fingerprint, anti-microbial, and specialized optical films, reflecting end-user needs for enhanced functionality beyond basic protection.

Segmentation trends highlight the increasing prominence of PMMA-based acrylic films due to their unmatched clarity and weather resistance, securing significant usage in demanding exterior applications. By application, the decorative lamination segment exhibits the fastest expansion, driven by aesthetic requirements in interior design and automotive cabin enhancements. In terms of end-users, the automotive industry remains the largest consumer, valuing the lightweight properties and high-gloss aesthetics offered by acrylic films, crucial for weight reduction targets and premium brand positioning. This segment’s growth is intrinsically linked to the global expansion of electric vehicle manufacturing, which demands advanced, yet lightweight, interior and exterior protective materials.

AI Impact Analysis on Acrylic Films Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Acrylic Films Market predominantly focus on how AI can optimize manufacturing processes, enhance material quality control, and revolutionize end-use application design. Key themes involve leveraging machine learning for predictive maintenance in complex extrusion lines, utilizing vision systems for real-time defect detection during film production, and employing algorithms to optimize chemical formulations for specific performance characteristics (e.g., maximizing UV stability or gloss retention). There is an expectation that AI will significantly reduce material waste, accelerate research and development cycles for novel acrylic film blends, and enable highly customized production runs, thereby improving operational profitability and responding faster to evolving market demands in the automotive and electronics sectors.

- AI-driven predictive maintenance optimizes polymer processing equipment, minimizing unexpected downtime and maximizing throughput of film manufacturing lines.

- Machine Vision systems integrated into extrusion processes enable real-time, non-destructive quality inspection, identifying microscopic defects and ensuring consistency in film thickness and optical clarity.

- Optimization algorithms assist in raw material blending and formulation development, predicting the physical properties of new acrylic compositions, thus accelerating the innovation cycle for specialized films.

- Supply chain management utilizes AI for demand forecasting and inventory optimization of acrylic monomers and additives, crucial for maintaining steady production schedules.

- Generative design tools, powered by AI, help automotive and construction designers integrate complex thermoformed acrylic film shapes more efficiently into final product designs.

- AI analytics monitor energy consumption in high-temperature manufacturing processes, leading to significant reductions in operational costs and contributing to sustainability goals.

DRO & Impact Forces Of Acrylic Films Market

The dynamics of the Acrylic Films Market are heavily influenced by a combination of strong drivers, inherent restraints, and compelling opportunities that dictate strategic direction and market growth. The primary driving force is the escalating global demand for high-performance, aesthetically superior, and durable surface solutions across high-value consumer goods and transportation. This demand is intrinsically linked to rising disposable incomes, urbanization, and a consumer preference for products with extended lifecycles and premium finishes. The shift toward sustainable materials also creates a pressure-cooker environment, forcing innovation towards bio-based and recycled acrylic polymers, which, when successfully commercialized, act as a significant market accelerant. Favorable regulatory policies promoting energy efficiency in building and construction also drive the adoption of acrylic films in fenestration applications.

However, the market faces significant restraints, chiefly stemming from the high volatility of raw material prices, particularly petrochemical-derived acrylic monomers like Methyl Methacrylate (MMA), which directly impacts production costs and profit margins. Furthermore, the inherent susceptibility of acrylic films to solvents and certain chemicals restricts their use in highly demanding industrial environments, allowing competing materials like polycarbonate or fluoropolymers to capture these niche segments. The intensive capital requirement for setting up high-precision film extrusion and coating lines also poses a barrier to entry for smaller players, leading to market concentration among established chemical giants with extensive backward integration capabilities.

Opportunities for growth are plentiful, centered primarily around technological innovation and geographic expansion. The development of functional acrylic films, such as conductive films for advanced touch displays, anti-microbial films for healthcare environments, and self-healing coatings for automotive finishes, opens new, high-margin revenue streams. Geographically, untapped potential lies in expanding market penetration within developing regions of Africa and specific parts of Latin America, where rapid infrastructure development and growing automotive assembly require reliable surface protection solutions. Furthermore, the transition toward personalized electronics and custom interior design offers manufacturers opportunities to differentiate products through unique aesthetic and tactile film properties.

Segmentation Analysis

The Acrylic Films Market is comprehensively segmented based on Type, Application, and End-Use Industry, providing a granular view of market dynamics and adoption patterns across diverse sectors. Segmentation is critical for strategic planning, allowing manufacturers to tailor their production, marketing, and distribution efforts toward specific high-growth areas. The differentiation of films by polymer type (PMMA, Modified Acrylic) reflects performance characteristics, while application segmentation (e.g., Decorative, Protection, Optical) defines their functional utility. Analyzing the End-Use segmentation helps identify the largest consuming sectors, such as automotive and construction, which are pivotal in driving overall market volume and value.

- By Type:

- Polymethyl Methacrylate (PMMA) Films

- Modified Acrylic Films (e.g., Acrylic/ABS Blends, Acrylic/PVC)

- By Application:

- Protective Films (Scratch resistance, Anti-UV)

- Decorative Films (High Gloss, Matt Finishes, Color Effects)

- Optical Films (Display screens, Lenses)

- Lamination Films (Furniture, Panels)

- By End-Use Industry:

- Automotive (Interior Trim, Exterior Components, Glazing)

- Building and Construction (Window Profiles, Cladding, Decorative Panels)

- Electronics (Display Covers, Touch Panels, Housings)

- Solar (Back sheets, Encapsulation)

- Industrial and Others (Signage, Medical Devices)

Value Chain Analysis For Acrylic Films Market

The value chain for the Acrylic Films Market begins with the upstream procurement of essential petrochemical raw materials, primarily Methyl Methacrylate (MMA) and various co-monomers and additives necessary for polymerization. The efficiency and cost-effectiveness of this stage are critically dependent on global crude oil prices and the operational scale of major chemical producers. Key players often pursue backward integration to secure a stable and cost-effective supply of MMA, minimizing exposure to market volatility. The subsequent manufacturing process involves polymerization, followed by sophisticated film production techniques such as casting, calendering, or multi-layer co-extrusion, which transform the acrylic resin into thin, precise films. High technical expertise and capital investment are prerequisites for competitive film manufacturing, ensuring the final product meets stringent quality standards regarding thickness uniformity, surface finish, and optical performance.

The midstream phase focuses on post-processing, including specialized surface treatments and coating applications, such as anti-scratch coatings, UV stabilizers, and functional layers (e.g., anti-glare, conductive). This value-add step is crucial for differentiating products and catering to high-specification applications like automotive interiors and advanced electronic displays. Distribution channels are varied, involving both direct sales to major Original Equipment Manufacturers (OEMs) in the automotive and electronics sectors, particularly for large volume customized orders, and indirect sales through specialized distributors and laminators who serve smaller fabrication shops and construction projects. Effective inventory management and rapid logistical capabilities are vital in the midstream to ensure just-in-time delivery for high-volume end-users.

Downstream analysis highlights the role of fabricators and converters who purchase the films in large rolls, cut, shape, and laminate them onto substrates (e.g., ABS, PVC, wood panels) before final integration into consumer products or construction elements. The end-user industries, such as major automotive companies, consumer electronics giants, and large construction developers, represent the final consumption point, determining market demand through their product design cycles and material specifications. Direct distribution is favored when dealing with Tier 1 suppliers in the automotive industry, ensuring tight quality control and specific logistical requirements. Indirect channels thrive in the construction and general industrial markets, relying on distributors to provide localized inventory, technical support, and smaller batch deliveries, thereby maximizing market reach and penetration.

Acrylic Films Market Potential Customers

The primary consumers and end-users of acrylic films are major manufacturing enterprises across the automotive, building and construction, and consumer electronics industries. Automotive OEMs and their Tier 1 suppliers are paramount customers, utilizing acrylic films extensively for interior decorative trim, high-gloss exterior pillars, and protective overlays on lighting elements, valuing the material's aesthetic versatility, scratch resistance, and lightweight nature for fuel efficiency and electric vehicle weight reduction. These customers typically demand custom formulations tailored to meet rigorous thermal stability and crash safety standards, requiring strong, long-term partnerships with film manufacturers to ensure compliance and consistent supply chain security for global production lines. The shift toward larger, integrated digital displays in vehicles further solidifies this segment's position as a dominant consumer of specialized optical acrylic films.

The Building and Construction sector, comprising large-scale commercial developers, window profile manufacturers, and producers of decorative interior and exterior panels, represents another significant customer base. Acrylic films are essential for exterior applications where they provide superior weatherability, color fastness, and protection against UV degradation when laminated onto PVC window frames or aluminum cladding. Customers in this segment prioritize films with long warranties, excellent dimensional stability, and specific certifications related to fire resistance and environmental impact. The films must withstand harsh environmental elements without yellowing or cracking, making long-term material performance a critical purchasing criterion for construction customers who require low maintenance and high durability.

Consumer Electronics manufacturers, including producers of smartphones, tablets, laptops, and specialized industrial displays, constitute a rapidly growing customer segment. These companies require high-quality optical acrylic films for protective display covers, touch-sensitive surfaces, and functional lenses. Key requirements include high transparency, anti-glare properties, and sophisticated anti-fingerprint coatings to enhance user experience. Due to the rapid innovation cycles in electronics, these customers demand fast turnaround times for new film specifications and highly precise manufacturing tolerances, often necessitating high-volume production of thin-gauge, technologically advanced films. The industrial sector, including medical device manufacturers requiring transparent, durable housings, also forms a valuable, albeit niche, customer group for specialized, certified acrylic film products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mitsubishi Chemical Corporation, Kuraray Co., Ltd., Evonik Industries AG, Plaskolite LLC, Covestro AG, 3M Company, BASF SE, Altuglas International (Arkema Group), Sumitomo Chemical Co., Ltd., Avery Dennison Corporation, Röhm GmbH, Sekisui Chemical Co., Ltd., Nitto Denko Corporation, LG Chem, Hanwha Solutions, Toray Industries, Inc., Lucite International (Mitsubishi Chemical), Eastman Chemical Company, Trelleborg AB, Novacel. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Acrylic Films Market Key Technology Landscape

The Acrylic Films Market is characterized by advanced manufacturing technologies focused on achieving higher precision, better functional properties, and enhanced cost-efficiency. Key technological advancements include multi-layer co-extrusion, which allows manufacturers to combine different polymer layers (e.g., acrylic with ABS or PC) within a single film structure. This technology enables the production of films that leverage the superior weatherability and aesthetic of the acrylic outer layer while utilizing a core layer for enhanced mechanical properties or cost reduction. Furthermore, precision casting techniques are employed for specialized applications like optical films, ensuring exceptional clarity, minimal internal stress, and highly uniform thickness distribution, critical for large format display screens.

Surface modification technologies are central to modern acrylic film production. These include sophisticated hard-coating processes utilizing UV-curing or thermal cross-linking chemistries to drastically increase the scratch and abrasion resistance of the acrylic surface without compromising its optical clarity. The development of anti-glare, anti-fingerprint, and anti-reflective coatings applied in highly controlled cleanroom environments is crucial for serving the demanding electronics and automotive display markets. These functional coatings utilize nanotechnology and specialized compounding techniques to integrate performance-enhancing particles directly into the film structure or surface layer, offering durability superior to traditional films.

Sustainability-driven innovations are rapidly reshaping the technology landscape. Manufacturers are increasingly adopting chemical recycling technologies for PMMA, allowing post-consumer or industrial acrylic waste to be depolymerized back into high-purity MMA monomer for reuse in film production. This circular economy approach is supported by new additive packages that improve the processing window for recycled acrylic, maintaining the quality required for high-end applications. Furthermore, the development of specialized bio-based acrylic precursors, derived from non-fossil sources, signals a long-term technological trajectory aimed at reducing the overall carbon footprint associated with acrylic film manufacturing, appealing directly to sustainability-conscious end-use industries.

Regional Highlights

The global Acrylic Films Market exhibits varied dynamics influenced by regional economic growth, industrial specialization, and regulatory frameworks. Asia Pacific (APAC) holds the largest market share and is projected to experience the fastest growth throughout the forecast period. This dominance is attributed to the presence of vast manufacturing bases for consumer electronics and automotive assembly, particularly in China, India, Japan, and South Korea. Rapid urbanization and massive government investment in infrastructure and construction projects across Southeast Asia drive significant demand for durable and aesthetic acrylic films for architectural applications, ranging from window profiles to exterior cladding. The competitive manufacturing environment in APAC encourages rapid adoption of cost-effective, high-volume production technologies.

North America and Europe represent mature markets characterized by high demand for premium, high-specification acrylic films. In North America, the market growth is underpinned by the robust automotive sector, particularly the manufacturing of high-end vehicles and electric vehicle components, requiring customized decorative and protective films for sophisticated interiors. European demand is driven by stringent environmental regulations and a strong emphasis on architectural aesthetics and energy efficiency in construction. Key European countries, notably Germany and Italy, utilize acrylic films for high-performance window systems and specialized industrial laminations. Market participants in these regions focus heavily on innovation in functional films, such as anti-microbial and specialized optical films, commanding higher price points.

Latin America, the Middle East, and Africa (MEA) are emerging regions poised for substantial growth, albeit from a smaller base. The market expansion in MEA is largely fueled by significant investments in commercial and residential construction projects, particularly in the Gulf Cooperation Council (GCC) countries, requiring weather-resistant exterior materials. Automotive manufacturing expansion in regions like Mexico and South Africa also contributes to increased consumption of acrylic films for local vehicle assembly. While these regions often rely on imports from APAC and Europe, increasing localized fabrication and lamination facilities suggest a growing capacity for converting films domestically, leading to higher localized demand and improved supply chain efficiency over the forecast period.

- Asia Pacific (APAC): Dominates the global market volume due to high production capacity for electronics and automotive components; key growth drivers are China, India, and South Korea.

- North America: Strong market for premium, customized acrylic film solutions; major consumer in high-end automotive interior finishes and specialized building applications.

- Europe: Focuses on high-performance films meeting stringent environmental and fire safety standards; growth driven by sustainable construction and luxury automotive trim.

- Latin America (LATAM): Emerging market characterized by increasing infrastructural development and automotive assembly capacity, particularly in Brazil and Mexico.

- Middle East and Africa (MEA): Growth stimulated by large-scale construction projects and demand for UV-resistant films in harsh climatic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Acrylic Films Market.- Mitsubishi Chemical Corporation

- Kuraray Co., Ltd.

- Evonik Industries AG

- Plaskolite LLC

- Covestro AG

- 3M Company

- BASF SE

- Altuglas International (Arkema Group)

- Sumitomo Chemical Co., Ltd.

- Avery Dennison Corporation

- Röhm GmbH

- Sekisui Chemical Co., Ltd.

- Nitto Denko Corporation

- LG Chem

- Hanwha Solutions

- Toray Industries, Inc.

- Lucite International (Mitsubishi Chemical)

- Eastman Chemical Company

- Trelleborg AB

- Novacel

Frequently Asked Questions

Analyze common user questions about the Acrylic Films market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for acrylic films in the automotive industry?

The primary driver is the increasing focus on lightweight materials and high-gloss aesthetics for interior components and exterior trim. Acrylic films offer superior scratch resistance and UV stability required for premium vehicle finishes, aiding in weight reduction critical for electric vehicle range optimization.

How do PMMA films differ from modified acrylic films in terms of application?

PMMA films (Polymethyl Methacrylate) are favored for applications requiring maximum optical clarity, weatherability, and high surface hardness, such as external architectural cladding and optical displays. Modified acrylic films often blend acrylic with polymers like ABS or PVC, providing improved impact resistance and enhanced thermoformability for complex interior parts.

What technological advancements are impacting the cost and quality of acrylic films?

Multi-layer co-extrusion technology is a major advancement, enabling cost-efficient production of hybrid films with specialized functional layers. Furthermore, UV-curing hard-coating systems significantly enhance scratch resistance, improving the film’s durability and expanding its applicability in high-wear consumer electronics and automotive sectors.

Which geographic region is projected to exhibit the highest growth rate in the market?

Asia Pacific (APAC) is projected to achieve the highest growth rate. This growth is fueled by massive expansion in manufacturing capabilities across electronics and automotive sectors, coupled with rapid urbanization and extensive infrastructure projects in major economies like China, India, and Southeast Asian nations.

Are acrylic films considered sustainable, and what alternatives exist?

While traditional acrylic films are petrochemical-derived, the industry is moving towards sustainability through chemical recycling of PMMA waste and the development of bio-based acrylic precursors. Alternatives include polycarbonate (PC) and polyethylene terephthalate (PET) films, which offer different performance profiles, particularly higher impact resistance (PC) or lower cost (PET).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager