Acrylonitrile Styrene Acrylate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434225 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Acrylonitrile Styrene Acrylate Market Size

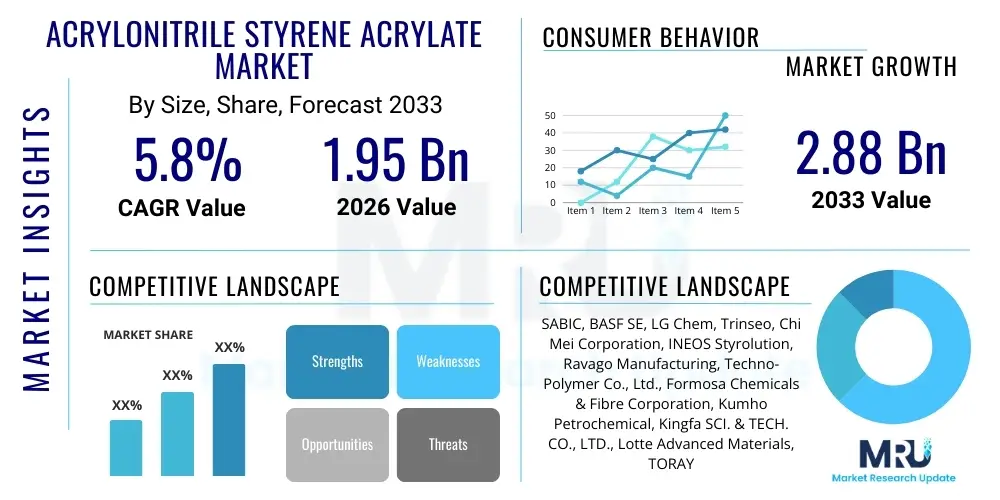

The Acrylonitrile Styrene Acrylate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.95 Billion in 2026 and is projected to reach USD 2.88 Billion by the end of the forecast period in 2033.

Acrylonitrile Styrene Acrylate Market introduction

The Acrylonitrile Styrene Acrylate (ASA) Market encompasses the global trade and utilization of this high-performance engineering thermoplastic, renowned primarily for its outstanding resistance to ultraviolet (UV) radiation and weathering. ASA is a specialized terpolymer, chemically similar to ABS but substituting the highly unstable butadiene component with an acrylate rubber elastomer, which dramatically enhances its durability and color retention when subjected to long-term outdoor exposure. This fundamental structural difference allows ASA to maintain high mechanical strength, impact resistance, and aesthetic appeal over extended service lives, positioning it as a critical material choice across diverse industries, particularly where products must withstand harsh environmental factors while retaining a high-quality finish. The inherent benefits of ASA, such as inherent colorability, rigidity, and chemical resistance, minimize the need for secondary processes like painting or protective coating, offering significant cost efficiencies to manufacturers.

The product’s versatility has led to its major penetration across key application segments. In the automotive industry, ASA is indispensable for exterior components such as radiator grilles, mirror housings, sensor covers, and body trim, supporting the trend towards lightweighting and superior part integration necessary for modern vehicle designs, especially electric vehicles (EVs). Furthermore, the Building and Construction sector represents the largest consumer base, utilizing ASA for extruded profiles, window and door frames, exterior siding, and roofing elements where resistance to heat, moisture, and extreme solar exposure is paramount for compliance with stringent building codes and ensuring long product warranties. The material’s ability to resist yellowing and cracking makes it an ideal substitute for less durable plastics like standard PVC or traditional ABS in exterior applications, driving its steady market expansion globally. The demand for aesthetically pleasing and maintenance-free building components continues to bolster ASA consumption.

The market growth is fundamentally driven by compelling macroeconomic and technological factors. Globally escalating urbanization rates, particularly in the Asia Pacific region, necessitate the construction of durable, energy-efficient residential and commercial structures, directly increasing the consumption of ASA-based profiles and siding. Concurrently, the rigorous standards imposed by the automotive sector, requiring materials that offer long-term performance stability, high heat resistance, and excellent impact properties, continue to favor ASA adoption over alternative polymers. Innovation focused on developing specialty high-heat grades for applications proximal to engine compartments or battery systems, alongside the exploration of sustainable, bio-based ASA alternatives, further solidifies its market position and promises sustained expansion throughout the forecast period, despite challenges related to raw material price volatility.

Acrylonitrile Styrene Acrylate Market Executive Summary

The global Acrylonitrile Styrene Acrylate Market is navigating a phase of sustained moderate growth, underpinned by robust consumption in high-growth end-use sectors. Business trends reveal a highly competitive landscape dominated by a few multinational chemical giants who prioritize vertical integration, ensuring a stable supply of key monomers (acrylonitrile and styrene) and maintaining strict control over polymerization and compounding processes. Strategic business activities are centered on capacity expansion, particularly in high-demand regions like APAC, and rigorous R&D efforts aimed at developing specialized, fire-retardant, and sustainable ASA compounds tailored for niche markets such as electric vehicle battery housings and high-specification architectural cladding. Profitability remains sensitive to the fluctuating prices of petrochemical feedstocks, necessitating sophisticated risk management strategies among leading producers to maintain stable margins and consistent pricing for end-users, thus promoting long-term customer loyalty and supply contracts.

Regional trends unequivocally highlight Asia Pacific (APAC) as the market epicenter, responsible for both the largest production volume and the highest consumption rates, driven by extensive infrastructure development in China, India, and ASEAN nations. This regional growth is further amplified by the relocation and expansion of global automotive and consumer electronics manufacturing facilities seeking lower operational costs and greater proximity to supply chains. Conversely, North America and Europe, characterized by highly mature markets, focus heavily on premiumization and adherence to stringent environmental, health, and safety regulations. In these regions, growth is driven by material substitution strategies, where ASA replaces older, less durable materials, and innovation in aesthetic applications, such as specialized surface finishes for luxury automotive exteriors and high-end residential siding, emphasizing durability and eco-friendly attributes.

A detailed analysis of segment trends indicates that the Building and Construction segment holds the dominant market share by volume, leveraging the cost-effectiveness and durability of extruded ASA profiles. However, the Automotive segment is projected to exhibit the fastest growth trajectory, fuelled by the accelerating global transition towards electric mobility, which relies on lightweight, high-performance polymers for reducing overall vehicle weight and enhancing range efficiency. By processing method, Extrusion molding maintains its leadership due to the high volume of sheets and profiles required by construction, while Injection Molding captures the high-value, complex component market, particularly in consumer goods and automotive parts requiring precision tolerances. Future market dynamics will be significantly shaped by the successful commercialization and acceptance of bio-based and recycled ASA grades, addressing the growing global mandate for material sustainability and circular economy practices across all application segments.

AI Impact Analysis on Acrylonitrile Styrene Acrylate Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) within the Acrylonitrile Styrene Acrylate Market is rapidly moving beyond simple data aggregation toward complex predictive modeling and autonomous process optimization. Common inquiries from industry stakeholders focus on how AI can fundamentally reshape the traditionally lengthy and resource-intensive material development cycle. Users are keen to understand how sophisticated algorithms can analyze vast combinatorial chemical spaces to predict the performance characteristics of novel ASA formulations, such as enhanced flame retardancy or improved thermal stability, thereby significantly reducing the necessity for repetitive, costly physical laboratory experiments. Furthermore, a core concern relates to the integration of AI tools within existing legacy manufacturing systems, assessing the return on investment for digitization efforts in capital-intensive polymerization and compounding facilities and the effective management of the resulting deluge of operational data.

AI's most immediate and transformative impact is seen in operational excellence and quality assurance throughout the ASA production chain. Machine learning models are deployed to monitor real-time sensor data from polymerization reactors, meticulously tracking variables like temperature profiles, pressure fluctuations, and residence times. By identifying subtle correlations invisible to human operators, these systems can predict and proactively adjust parameters to prevent batch inconsistency, minimizing off-spec material production and ensuring that the final ASA resin meets the narrow specifications required by Tier 1 automotive suppliers. This predictive quality control leads to substantial improvements in throughput, reduction in material waste, and optimization of energy consumption during the energy-intensive compounding phase, directly addressing sustainability goals and lowering overall manufacturing costs.

Beyond the factory floor, AI provides critical strategic advantages, particularly in optimizing complex supply chain logistics and navigating raw material price volatility. Generative AI tools are being utilized to create highly accurate, multi-factor forecasting models that integrate global geopolitical events, shifts in crude oil pricing, scheduled refinery maintenance, and fluctuating end-user demand patterns to predict the supply and cost trajectory of acrylonitrile and styrene monomers months in advance. This intelligence enables procurement departments to execute more effective long-term purchasing agreements, utilize derivative contracts for hedging risk, and ensure resilience against sudden supply disruptions. By automating complex material flow scheduling and warehouse inventory management, AI facilitates true just-in-time manufacturing, sharpening the competitive edge of producers capable of consistently delivering high-quality ASA resins reliably and cost-effectively.

- AI-driven optimization of polymerization kinetics enhances product consistency, minimizing batch-to-batch variation in melt flow rate and impact strength.

- Machine learning algorithms predict material degradation rates under simulated conditions, dramatically reducing the time needed for outdoor weatherability certification.

- Predictive maintenance systems utilize vibrational analysis and thermal imaging data to preempt equipment failures in high-volume extrusion and compounding lines, reducing unplanned downtime by up to 20%.

- Advanced demand forecasting and raw material price prediction systems, powered by deep learning, stabilize procurement strategies for petrochemical feedstocks and improve margin protection.

- Automated vision systems and quality inspection tools improve the detection of subtle surface defects, enhancing the aesthetic quality of finished ASA sheets and profiles for premium applications.

- Generative AI supports the rapid design and simulation of new high-performance ASA blend formulations, accelerating R&D cycles for specialized grades, such as those with improved fire resistance or bio-content.

- AI optimizes energy consumption in material drying and heating stages, contributing to reduced carbon footprints in the overall ASA manufacturing process.

DRO & Impact Forces Of Acrylonitrile Styrene Acrylate Market

The market trajectory for Acrylonitrile Styrene Acrylate (ASA) is shaped by powerful synergistic forces. The primary driver is the accelerating global requirement for durable, maintenance-free exterior materials across both residential and commercial construction, particularly in regions prone to high UV radiation and extreme weather patterns. ASA's inherent ability to retain color and structural integrity far surpasses conventional plastics, making it the material of choice for demanding applications like co-extruded window profiles and exterior siding, providing long-term value to homeowners and builders. Coupled with this is the transformative effect of the automotive industry’s shift towards electric vehicles (EVs). ASA facilitates the necessary lightweighting of vehicle bodies and offers indispensable weather resistance for critical exterior components, including charging port doors and sensor housings, ensuring aesthetic appeal and functional reliability over the vehicle's lifespan, thereby generating significant, non-cyclical demand.

However, the market expansion faces two substantial restraints. Foremost among these is the structural instability and high cost fluctuation of key petrochemical feedstocks, acrylonitrile and styrene monomer. Since these are highly sensitive to global crude oil prices and the operational capacity of refineries, ASA manufacturers frequently face compressed margins and difficulty in maintaining predictable pricing structures, which can deter long-term supply agreements. Secondly, intense competition from high-performance alternative polymers poses a continuous threat; polymers such as specialized grades of polycarbonate (PC) and high-impact PMMA (Polymethyl Methacrylate) are being continually optimized to offer comparable UV resistance and mechanical properties, forcing ASA producers to invest heavily in continuous process improvements and product differentiation to justify their material premium.

Significant market opportunities center on technological innovation and market expansion into untapped niche applications. The global mandate for sustainability provides a strong opening for producers pioneering bio-based ASA alternatives derived from renewable feedstocks, appealing to increasingly environmentally conscious consumers and regulators in Europe and North America. Furthermore, the rapid global expansion of 5G infrastructure, smart city development, and the growth of outdoor electronics necessitate robust, tamper-proof, and highly weatherable enclosures for network equipment, generating specialized, high-margin demand for ASA compounds. The combined impact forces suggest that while cost pressures from raw materials remain a critical manageable challenge, the overwhelming demand from non-discretionary sectors (construction and regulated automotive components) ensures that the market will continue its upward trajectory, driven by the unique performance value proposition of ASA.

Segmentation Analysis

The Acrylonitrile Styrene Acrylate Market is meticulously segmented to reflect the diverse applications and technical requirements dictated by end-users, providing a precise roadmap for strategic investment and product focus. Segmentation by product type involves distinguishing between general-purpose grades used widely in standard profiles and high-heat resistant grades critically employed in automotive parts exposed to elevated temperatures, such as under-the-hood components or parts situated near battery packs. This delineation is essential as high-heat grades command a price premium due to the complexity of their compounding and the specialized additives required to maintain structural integrity under thermal stress, providing manufacturers with targeted avenues for value creation.

The segmentation based on the primary processing method—Injection Molding versus Extrusion—is fundamental to understanding volume allocation and market maturity. Extrusion remains the volumetric leader, indispensable for producing the long, continuous profiles and sheets demanded by the massive construction sector for siding, fascia, and decorative trim, where consistent quality and high throughput are prioritized. Conversely, injection molding is utilized for complex, precision-engineered parts in the automotive and electronics industries, such as precise enclosures, handles, and small components requiring intricate geometry and superior surface finish. The emerging segment of Additive Manufacturing (3D Printing) is gaining traction, although currently focused on specialized prototyping and tooling, requiring ultra-pure ASA powders or filaments with tight thermal tolerances.

End-use industry segmentation confirms the dual dominance of Automotive and Building & Construction, which together dictate the global consumption landscape. The construction sector's steady, high-volume requirement for weatherability provides market stability, while the automotive sector, driven by electrification and aesthetic requirements, offers the highest growth potential for specialized, custom-colored compounds. Other vital segments, including Electrical & Electronics and Consumer Goods, offer significant niche opportunities, particularly in outdoor equipment where protecting sensitive components from environmental exposure is paramount. The increasing complexity of consumer electronics and the expansion of outdoor utility infrastructure worldwide ensures a diversified demand base for ASA, minimizing the risk associated with reliance on a single major industrial sector.

- By Type: Standard Grades (General-purpose, high flow), High Heat Grades (Automotive and high-temperature applications), Reinforced Grades (Fiber-glass or mineral filled for enhanced rigidity), Bio-based Grades (Utilizing renewable feedstock monomers).

- By Processing Method: Injection Molding (Complex automotive and electronic parts), Extrusion (Profiles, sheets, and pipes for construction), Blow Molding (Hollow components), 3D Printing/Additive Manufacturing (Specialized prototypes and tooling).

- By End-Use Industry: Automotive (Exterior trim, grilles, mirror caps), Building & Construction (Siding, Window Profiles, Roofing, Decking), Electrical & Electronics (Outdoor enclosures, Junction Boxes, Telecommunications equipment), Consumer Goods (Outdoor furniture, Home appliance components), Leisure & Recreation (Marine, RV parts, Sporting equipment), Others (Industrial components, Signage).

- By Application: Profiles and Sheets (Construction, Signage), Molded Parts (Automotive, Appliances), Films and Foils (Laminates, protective coatings).

Value Chain Analysis For Acrylonitrile Styrene Acrylate Market

The Acrylonitrile Styrene Acrylate Market value chain begins at the highly capital-intensive upstream level, characterized by the production of essential petrochemical monomers: Acrylonitrile, Styrene, and the acrylate components (often butyl acrylate). The profitability and stability of the entire chain are critically dependent on the efficiency and scale of these large chemical producers, who are often integrated with petroleum refining operations, linking ASA costs inextricably to the global energy market. The quality and purity of these monomers are foundational, influencing the final polymerization process, which involves sophisticated, proprietary reactor technologies designed to graft the SAN matrix onto the acrylate elastomer efficiently, thereby determining the final material's impact resistance and UV performance characteristics.

The midstream phase focuses on the transformation of the raw polymer resin into commercial-grade pellets via compounding. This stage is crucial for value addition, where specialized compounders integrate performance-enhancing additives—such as highly effective UV stabilizers, antioxidants, impact modifiers, and precision colorants—using advanced, high-shear twin-screw extruders. This meticulous compounding ensures the ASA pellets are tailored for specific end-user processes (e.g., high flow for complex injection molds or high melt strength for large-profile extrusion) and achieve the stringent weathering and aesthetic requirements of the target application, such as automotive OEM color codes or construction material certifications. Strategic partnerships between polymer manufacturers and dedicated compounding firms are common, allowing for rapid innovation in specialized blends.

The downstream segment involves the extensive distribution network and the fabrication of final goods. Distribution channels are bifurcated: large manufacturers utilize direct sales models for key accounts like Tier 1 automotive suppliers or major profile extruders, offering customized technical support and long-term contracts. Indirect channels involve regional distributors and specialty plastics resellers who manage smaller orders, provide local technical guidance, and maintain inventory for smaller molders and fabricators. The end-users—OEMs and fabricators—then utilize various molding and extrusion techniques to produce components for vehicles, buildings, and consumer products. The increasing emphasis on supply chain transparency and traceability necessitates robust data management throughout the value chain, ensuring compliance with global regulatory standards like REACH and supporting future material circularity initiatives.

Acrylonitrile Styrene Acrylate Market Potential Customers

The primary cohort of potential customers for the Acrylonitrile Styrene Acrylate Market comprises large-volume industrial consumers whose manufacturing processes rely on materials offering predictable, long-term performance stability in external environments. This includes the global automotive supply chain, encompassing Tier 1 and Tier 2 suppliers responsible for producing non-painted exterior components (e.g., bumper parts, door handles, roof rails, and mirror caps). These customers prioritize suppliers who offer precise color consistency across batches and adhere rigorously to automotive quality management standards (like IATF 16949), viewing ASA as a critical enabler for lightweighting and reducing assembly line costs associated with secondary painting operations, thereby making procurement decisions heavily weighted on technical reliability and global supply capability.

Another monumental customer base resides within the building and construction materials industry, specifically major extruders of window and door profiles, siding panels, and specialized architectural cladding manufacturers. These buyers operate on high-volume continuous processes and demand ASA grades optimized for melt strength and weatherability to withstand decades of exposure without significant maintenance or aesthetic degradation. Their purchasing considerations are heavily influenced by material cost-performance ratios, longevity warranties, and compliance with regional fire and safety building codes. The transition toward high-end, aesthetic, and low-maintenance exteriors globally continually expands this customer segment’s dependence on high-quality ASA resins.

Furthermore, specialized niche customers present lucrative growth opportunities. This includes manufacturers of outdoor electrical and telecommunications infrastructure, requiring durable housings for 5G antennae, junction boxes, and utility enclosures that must resist high UV loads and physical impact while maintaining critical safety ratings. Manufacturers of recreational goods, such as specialized boat components, jet ski bodies, and high-end outdoor furniture, also represent key buyers. These customers utilize ASA for its combination of high gloss, scratch resistance, and excellent resistance to chemicals like solvents and cleaning agents. The common thread across all potential customer segments is the requirement for a material solution that significantly extends product lifespan and reduces post-sale maintenance liabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.95 Billion |

| Market Forecast in 2033 | USD 2.88 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SABIC, BASF SE, LG Chem, Trinseo, Chi Mei Corporation, INEOS Styrolution, Ravago Manufacturing, Techno-Polymer Co., Ltd., Formosa Chemicals & Fibre Corporation, Kumho Petrochemical, Kingfa SCI. & TECH. CO., LTD., Lotte Advanced Materials, TORAY INDUSTRIES, INC., RTP Company, Shanghai Kumho Sunny Plastics Co., Ltd., TSRC Corporation, Asahi Kasei Corporation, Hyundai EP, Styron LLC, Polycasa |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Acrylonitrile Styrene Acrylate Market Key Technology Landscape

The technological evolution within the Acrylonitrile Styrene Acrylate Market is primarily focused on achieving higher performance standards, optimizing manufacturing economics, and integrating sustainable practices. A foundational technology involves advanced emulsion or suspension polymerization techniques, which are continuously refined to improve the grafting efficiency of the styrene-acrylonitrile (SAN) copolymer onto the acrylate rubber component. Breakthroughs in reactor design and process control, often leveraging sensor technology and machine learning, are aimed at producing ASA resins with narrower molecular weight distributions, which translates directly into superior flow characteristics for molders and greater physical consistency for extruders, minimizing waste and enhancing end-product quality, especially in aesthetically critical high-gloss applications.

The compounding phase represents a critical area of technological differentiation. Leading manufacturers utilize highly specialized, high-torque twin-screw extrusion systems that allow for the flawless dispersion of high-performance additive packages, including proprietary UV stabilization systems, advanced hindered amine light stabilizers (HALS), and high-performance color pigments. Effective dispersion is paramount because poor mixing can lead to localized degradation points, compromising the material’s long-term weatherability. Furthermore, the development of specialty ASA alloys and blends is a key focus, combining ASA with other engineering polymers like polycarbonate (PC/ASA) to achieve specific characteristics such as ultra-high impact resistance or enhanced flame retardancy, opening up new, high-specification applications in the railway and electronics sectors that require materials meeting stringent safety standards.

The emerging technological focus is sustainability and circularity. This involves significant research into utilizing bio-based feedstocks derived from non-petroleum sources for monomers like acrylonitrile and styrene, allowing producers to market "green" ASA grades that appeal to highly regulated markets like the EU. Concurrently, efforts are intensifying in recycling technology. While mechanical recycling of ASA is challenging due to potential thermal degradation of the acrylate component, advanced chemical recycling methods, such such as pyrolysis or depolymerization, are being explored to recover valuable monomers from end-of-life ASA products. Successful implementation of these circular technologies will be crucial for the long-term viability and public acceptance of ASA, enabling the industry to comply with rising global plastic recycling targets and fostering a truly sustainable material lifecycle.

Regional Highlights

- Asia Pacific (APAC): Global Manufacturing Powerhouse and Growth Driver

The Asia Pacific region commands the largest market share and exhibits the most aggressive growth trajectory in the Acrylonitrile Styrene Acrylate Market, driven by an unparalleled combination of rapid infrastructure development and dominant manufacturing output. Countries like China, India, and South Korea are the nexus of both high-volume ASA production and consumption. China’s immense capacity for both automotive assembly and large-scale residential construction creates a colossal demand for weatherable plastic profiles, siding, and exterior vehicle components. The urbanization wave across Southeast Asia, including Vietnam, Thailand, and Indonesia, fuels substantial new construction, where ASA is increasingly preferred over less durable materials for its long-term cost-efficiency and superior aesthetic retention.

The competitive environment in APAC is intense, characterized by strong local players with cost advantages due to favorable access to petrochemical feedstocks and large-scale operations. Manufacturers in this region focus on optimizing polymerization yields and offering a wide spectrum of ASA grades, ranging from commodity extrusion types for mass housing projects to specialized, high-specification grades for premium Japanese and Korean automotive OEMs. Regional market growth is further amplified by the rapid deployment of electric vehicle manufacturing, as APAC remains at the forefront of the global EV transition, requiring huge volumes of lightweight, durable exterior polymers, securing its position as the undisputed leader in ASA consumption for the foreseeable future.

- North America: Maturity, Premiumization, and Regulatory Compliance

The North American market for Acrylonitrile Styrene Acrylate is characterized by maturity, stable growth, and a distinct preference for high-quality, premium-priced compounds. Demand is heavily concentrated in the US and Canada’s construction sector, where consumers and builders require materials that provide extreme long-term warranties against degradation, especially for exterior decking, siding, and window systems that must endure diverse and often harsh climates, ranging from high-humidity coastal zones to intense solar exposure in the South. This stringent quality requirement drives significant consumption of high-specification ASA products, often co-extruded with PVC or wood composites for enhanced performance.

In the automotive sector, North American manufacturers utilize ASA extensively for aesthetic and functional parts, relying on suppliers for robust technical support and adherence to complex dimensional and color specifications. Market activity is also focused on specialty niches, including the recreational vehicle (RV) industry and marine manufacturing, where ASA’s resistance to saltwater, fuel, and harsh cleaning agents makes it indispensable. Future growth is primarily anticipated through material substitution, replacing materials that fail to meet increasingly stringent quality and environmental standards, and the adoption of advanced ASA compounds specifically formulated for high-end industrial and telecommunications enclosures.

- Europe: Innovation, Environmental Standards, and Automotive Excellence

The European Acrylonitrile Styrene Acrylate Market is distinguished by its leadership in sustainability innovation and adherence to the world’s most stringent regulatory frameworks, notably REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals). This regulatory environment necessitates continuous investment in low-VOC, non-toxic, and circular economy-compliant ASA formulations. The regional market is highly specialized, focusing on high-end applications in the construction sector for architectural profiles that meet exacting aesthetic standards and high thermal insulation requirements, particularly in Germany, France, and Scandinavia.

Europe’s world-class automotive industry, especially the German luxury vehicle manufacturers, drives significant demand for specialized ASA grades requiring superior high-heat performance and pristine surface quality for complex exterior trim and unpainted components. European producers are leading the charge in developing bio-based monomers to reduce reliance on petrochemical sources and investing in sophisticated chemical recycling pilot programs to meet aggressive EU recycling targets. The emphasis on high-specification, specialized batches over commodity volume defines the European ASA landscape, making technical expertise and environmental stewardship key competitive differentiators for market players.

- Latin America, Middle East, and Africa (LAMEA): Infrastructure Expansion and Climate Necessity

The LAMEA regions collectively represent an emerging, high-potential market segment for ASA. Growth is underpinned by massive government investment in infrastructure and housing projects, particularly in rapidly urbanizing areas of Brazil, Mexico, and South Africa. In the Middle East and Africa, ASA is crucial due to the extreme environmental conditions, characterized by intense solar radiation and high ambient temperatures, which necessitate the use of plastics with exceptional UV stability for everything from water piping systems and solar panel installations to exterior air conditioning unit housings. While currently smaller in volume than the established regions, LAMEA is projected to exhibit robust growth, driven by increasing foreign direct investment in manufacturing and local assembly operations, further cementing ASA’s role as the material of necessity in challenging climates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Acrylonitrile Styrene Acrylate Market.- SABIC (Saudi Basic Industries Corporation)

- BASF SE

- LG Chem

- Trinseo

- Chi Mei Corporation

- INEOS Styrolution

- Ravago Manufacturing

- Techno-Polymer Co., Ltd.

- Formosa Chemicals & Fibre Corporation

- Kumho Petrochemical

- Kingfa SCI. & TECH. CO., LTD.

- Lotte Advanced Materials

- TORAY INDUSTRIES, INC.

- RTP Company

- Shanghai Kumho Sunny Plastics Co., Ltd.

- TSRC Corporation

- Asahi Kasei Corporation

- Hyundai EP

- Styron LLC

- Polycasa

Frequently Asked Questions

Analyze common user questions about the Acrylonitrile Styrene Acrylate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Acrylonitrile Styrene Acrylate (ASA) over standard ABS?

The primary advantage of ASA over Acrylonitrile Butadiene Styrene (ABS) is its superior UV and weather resistance. Unlike ABS, whose butadiene rubber component rapidly degrades and yellows upon sun exposure, ASA utilizes an acrylate elastomer, maintaining its color stability, physical properties, and high-gloss surface finish during prolonged outdoor use, making it ideal for exterior automotive and construction applications.

Which end-use industries drive the majority of demand for ASA resins?

The largest demand for ASA resins originates from the Building & Construction and Automotive sectors. The construction segment uses ASA extensively for weather-resistant exterior profiles and siding, while the automotive industry relies on it for exterior trim and components requiring durability and aesthetic longevity, particularly as part of the lightweighting trend in electric vehicles.

How significant is the impact of raw material price volatility on the ASA market?

Raw material price volatility, particularly for petrochemical derivatives like acrylonitrile and styrene monomers, constitutes a major restraint. Fluctuations, driven by global crude oil prices and refinery stability, directly impact manufacturing margins and product pricing, requiring ASA producers to implement sophisticated risk management and supply hedging strategies to stabilize costs.

What role does the Asia Pacific region play in the global ASA market?

The Asia Pacific (APAC) region is the undisputed global leader in the ASA market, both in terms of production capacity and consumption volume. Driven by rapid infrastructure expansion, extensive residential construction, and the concentration of major automotive and electronics manufacturing hubs, APAC dictates global supply trends and drives the fastest market growth.

What are the current trends regarding sustainability in Acrylonitrile Styrene Acrylate production?

Sustainability efforts in the ASA market focus on developing bio-based ASA grades using renewable feedstocks to reduce reliance on petroleum-based monomers. Additionally, manufacturers are investing in advanced chemical recycling technologies to recover monomers from post-consumer waste, aiming to create a closed-loop system and comply with stringent global recycling targets, particularly in Europe.

How does AI technology influence the manufacturing and performance of ASA?

AI technology enhances ASA manufacturing through predictive maintenance, reducing operational downtime, and optimizing complex polymerization processes to ensure batch consistency and high yield rates. In material science, AI accelerates R&D by simulating outdoor exposure and predicting material performance characteristics, drastically shortening the time needed to commercialize new, specialized ASA compounds.

What are the key technical challenges in processing Acrylonitrile Styrene Acrylate?

Processing ASA requires careful management of thermal parameters due to its potential sensitivity to high shear and temperature, which can compromise the long-term UV stability if the material is overheated. Maintaining precise color matching consistency, especially in high-volume extrusion, also poses a consistent technical challenge requiring advanced compounding and process control.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Acrylonitrile Styrene Acrylate (ASA) Polymer Market Statistics 2025 Analysis By Application (Adhesives and Sealants, Plastics, Paints and Coatings, Fabrics, Others), By Type (2-Ethyl Hexyl Acrylate, Methyl Acrylate, Ethyl Acrylate, Butyl Acrylate, N-Butyl Acrylate), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Acrylonitrile Styrene Acrylate (ASA) Polymer Market Statistics 2025 Analysis By Application (Automotive, Building and Construction, Home Appliances, Sports and Leisure, Consumer Electronics), By Type (General Grade, Extrusion Grade, Heat Resistant Grade), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager