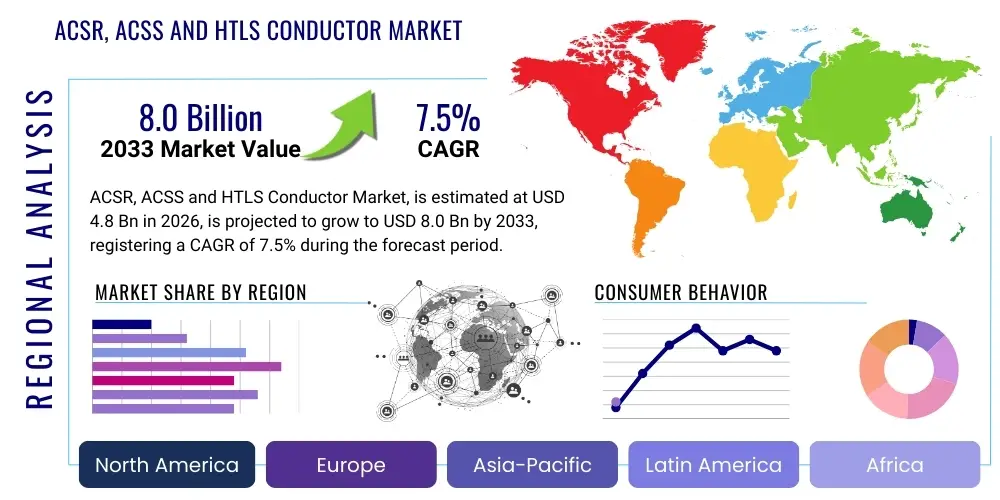

ACSR, ACSS and HTLS Conductor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436125 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

ACSR, ACSS and HTLS Conductor Market Size

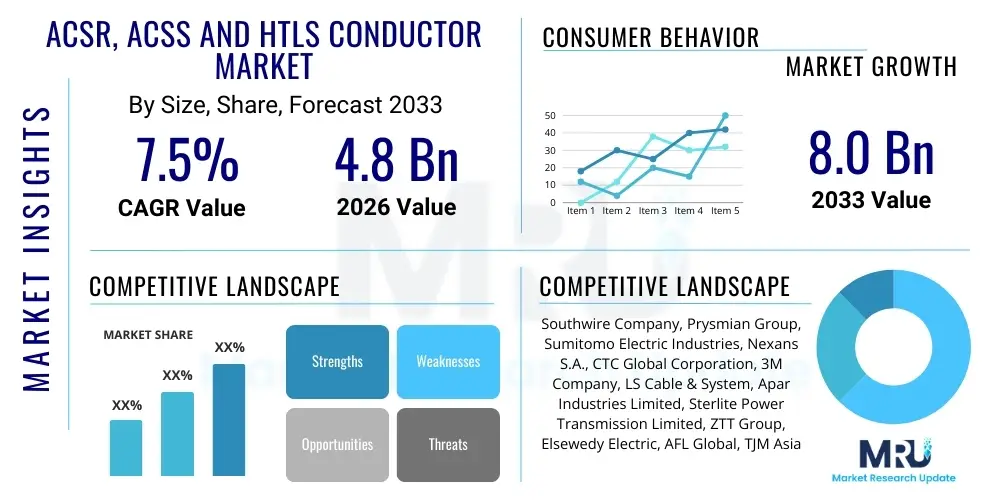

The ACSR, ACSS and HTLS Conductor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 8.0 Billion by the end of the forecast period in 2033.

ACSR, ACSS and HTLS Conductor Market introduction

The ACSR (Aluminum Conductor Steel Reinforced), ACSS (Aluminum Conductor Steel Supported), and HTLS (High-Temperature Low Sag) Conductor Market encompasses essential components of electrical transmission and distribution infrastructure globally. These conductors are critical for efficiently transporting electrical power from generation sources to end-users over vast distances. While ACSR, characterized by its high strength-to-weight ratio and cost-effectiveness, remains a foundational conductor type, the market is undergoing a significant transition toward higher performance solutions. ACSS offers superior operating temperatures and reduced annealing effects, making it a viable upgrade path for congested transmission corridors.

The core application driving demand for these conductors is the modernization and expansion of aging power grids, especially in developed economies, coupled with extensive new construction activities in rapidly industrializing regions. The shift is notably pronounced in the adoption of HTLS conductors, which include technologies like Aluminum Conductor Composite Core (ACCC) and others utilizing thermal-resistant alloys. HTLS conductors are engineered to operate at significantly higher temperatures than traditional conductors without exceeding maximum allowable sag limits. This capability allows utilities to increase the power transfer capacity of existing lines—a necessity given the constraints on securing new rights-of-way (ROW)—thereby providing substantial economic and environmental benefits.

Major driving factors include the global push for renewable energy integration, such as wind and solar farms, which often require extensive new transmission lines to connect remote generation sites to load centers. Furthermore, government initiatives focused on improving grid resilience, reducing transmission losses, and meeting escalating energy demands in urbanized areas are bolstering investment. The inherent benefit of HTLS, which minimizes installation complexity while maximizing power throughput, positions it as the dominant technology for future long-distance, high-capacity transmission projects, ensuring that the conductor market remains vibrant and technologically innovative.

ACSR, ACSS and HTLS Conductor Market Executive Summary

The ACSR, ACSS, and HTLS Conductor market is defined by a strategic evolution away from traditional materials toward advanced, high-performance composites, primarily driven by urgent global requirements for grid enhancement and decarbonization. Business trends indicate a strong emphasis on capacity upgrades rather than new line construction, propelling the demand for HTLS technologies which provide substantial thermal and sag advantages over legacy ACSR and ACSS lines. Manufacturers are investing heavily in research and development to improve material science, focusing on reducing line losses and enhancing the lifespan of conductors, thereby aligning with utility goals for operational efficiency and sustainability.

Regional trends are diverse, with Asia Pacific exhibiting the highest growth due to rapid urbanization, massive infrastructure projects, and the installation of extensive intra-country transmission systems, particularly in China and India. North America and Europe, conversely, are focused primarily on replacement cycles and reinforcing existing grids to handle intermittent renewable energy flows and address power bottlenecks caused by aging infrastructure. In these regions, regulatory frameworks promoting grid resilience and energy efficiency directly favor the adoption of specialized conductors like HTLS, necessitating complex engineering solutions for high-voltage direct current (HVDC) and high-voltage alternating current (HVAC) lines.

Segment trends reveal that while ACSR still maintains a significant market share in low-voltage distribution and cost-sensitive emerging markets, the HTLS segment, particularly ACCC and specialized aluminum alloy conductors, is projected to command the highest Compound Annual Growth Rate (CAGR). This shift is underpinned by utilities prioritizing total lifetime cost savings, reduced line sag, and the environmental advantage of transmitting more power with the same or smaller physical footprint. The transmission segment (above 200 kV) remains the largest application segment, demanding stringent quality standards and long-term durability, thereby sustaining high barriers to entry for new market participants.

AI Impact Analysis on ACSR, ACSS and HTLS Conductor Market

User inquiries regarding the role of Artificial Intelligence (AI) in the conductor market frequently center on how these advanced tools can transition conductor installation and operation from reactive maintenance to predictive asset management. Key themes include the use of AI for real-time thermal rating (RTTR) optimization, assessing conductor health and fatigue, and minimizing unexpected outages caused by environmental factors or load fluctuations. Users seek confirmation that AI integration can genuinely extend the operational lifespan of high-value HTLS assets and accurately forecast necessary replacement cycles, especially under extreme weather conditions. The primary expectation is that AI, combined with IoT sensors embedded in or adjacent to conductors, will deliver unprecedented levels of grid awareness and operational efficiency, fundamentally transforming the utility planning and maintenance paradigm.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms to analyze sensor data (temperature, vibration, sag) to forecast conductor failure probability, reducing downtime and optimizing replacement schedules for ACSR, ACSS, and HTLS lines.

- Real-Time Thermal Rating (RTTR) Optimization: AI systems calculate the maximum permissible current flow by integrating real-time environmental data (wind speed, solar radiation) and conductor operating conditions, maximizing power throughput safely, especially crucial for HTLS conductors.

- Fault Detection and Localization: Implementation of AI in Supervisory Control and Data Acquisition (SCADA) systems to quickly identify and isolate faults along long transmission routes, minimizing disruption and enhancing grid resilience.

- Manufacturing Quality Control: AI vision systems and process optimization algorithms improving consistency and material usage efficiency during the production of specialized composite and alloy conductors, ensuring compliance with stringent safety standards.

- Optimized Infrastructure Planning: Using AI models to simulate future energy demand scenarios and grid expansion requirements, enabling utilities to make data-backed decisions on the optimal conductor type (ACSS vs. HTLS) and sizing for new projects.

DRO & Impact Forces Of ACSR, ACSS and HTLS Conductor Market

The ACSR, ACSS, and HTLS Conductor Market dynamics are critically shaped by powerful external and internal forces, encapsulated by Drivers, Restraints, and Opportunities (DRO). Major drivers include the global imperative for electricity grid modernization and expansion, particularly in developing nations where access to reliable power is increasing, and the need to integrate substantial amounts of intermittent renewable energy sources, which necessitates resilient and high-capacity transmission infrastructure. The rapid adoption of HTLS conductors is primarily driven by their ability to significantly increase power transfer capacity within existing rights-of-way, mitigating regulatory and land acquisition challenges, thus minimizing capital expenditure and environmental impact associated with new corridor construction. This emphasis on efficiency and sustainability acts as a profound market accelerator.

Conversely, significant restraints hinder growth and adoption. The high initial capital cost associated with HTLS conductors, especially those employing advanced composite core materials (like carbon fiber), presents a financial hurdle for many smaller utilities and municipalities, often favoring the lower upfront investment of traditional ACSR, despite the higher long-term operational losses. Furthermore, stringent regulatory approval processes and the specialized engineering knowledge required for the installation and maintenance of HTLS technologies can slow down adoption rates. Market stability is also occasionally threatened by volatile global prices of raw materials, such as aluminum, steel, and specialty alloys, which directly impact manufacturing costs and project budgeting.

Opportunities for market expansion are abundant, centered largely on the deployment of smart grid technologies and the integration of advanced monitoring systems (IoT and AI) to maximize conductor performance and lifecycle management. The global drive toward energy efficiency and minimizing transmission and distribution (T&D) losses creates a robust environment for high-efficiency conductors, opening niches for specialized low-loss ACSS and advanced HTLS variants. Furthermore, significant opportunities exist in the refurbishment market in mature economies like North America and Europe, where aging ACSR infrastructure is due for mandatory replacement, presenting a natural transition point toward higher-capacity, high-temperature conductors to handle future load growth and decarbonization mandates. These opportunities, supported by technological advancements and supportive regulatory frameworks favoring infrastructure spending, are expected to exert a strong positive impact force throughout the forecast period.

Segmentation Analysis

The ACSR, ACSS, and HTLS Conductor market is comprehensively segmented based on technology type, application voltage, and end-user, reflecting the diverse requirements of the global power infrastructure landscape. Technology segmentation clearly delineates between foundational, cost-effective ACSR, the intermediate, higher-temperature ACSS, and the premium, high-performance HTLS conductors, which include various composite and high-strength alloy core designs. This segmentation is crucial as it dictates the optimal conductor choice based on required sag performance, operating temperature, and budgetary constraints of specific projects, ranging from distribution-level lines to ultra-high voltage transmission corridors.

Application segmentation differentiates the market by the use case—Transmission (high voltage, long distance) versus Distribution (low to medium voltage, local grid)—with transmission typically commanding the greater market value due to the necessity for high-capacity HTLS solutions. End-user categorization separates demand generated by large Public and Private Utilities, which constitute the majority of the market, from demand arising from Industrial Consumers and Independent Power Producers (IPPs) focused on captive power plants or renewable energy connections. Voltage level segmentation, ranging from low voltage (under 132 kV) to ultra-high voltage (UHV, above 800 kV), further refines purchasing decisions, directly influencing material specifications and structural requirements for long-term reliability and safety compliance across different global regions.

- By Technology Type:

- ACSR (Aluminum Conductor Steel Reinforced)

- ACSS (Aluminum Conductor Steel Supported)

- HTLS (High-Temperature Low Sag) Conductors

- ACCC (Aluminum Conductor Composite Core)

- ACFR (Aluminum Conductor Fiber Reinforced)

- Invar/Zirconium Alloy Conductors

- By Voltage Level:

- Low Voltage (Below 132 kV)

- Medium Voltage (132 kV – 330 kV)

- High Voltage (331 kV – 800 kV)

- Ultra-High Voltage (Above 800 kV)

- By Application:

- Transmission Lines

- Distribution Networks

- By End-User:

- Public Utilities

- Private Utilities

- Industrial & Commercial Sector

Value Chain Analysis For ACSR, ACSS and HTLS Conductor Market

The value chain for ACSR, ACSS, and HTLS conductors begins with the upstream sourcing and processing of core raw materials, primarily high-purity aluminum rods, galvanized steel wires, and advanced composite materials such as carbon fiber and glass fiber utilized in HTLS technology. Key upstream activities involve aluminum refining and drawing processes, along with specialized manufacturing of steel cores designed for high strength and corrosion resistance. The quality and stable supply of these core materials are paramount, significantly influencing the final conductor performance and price volatility, making strong supplier relationships crucial for manufacturers.

The midstream phase involves the core conductor manufacturing process, including stranding, heat treatment, and quality assurance testing. This stage is highly capital-intensive, requiring specialized machinery for creating concentric layers of aluminum over the core structure (steel or composite). For HTLS conductors, this stage includes complex thermal resistant alloying and precise application of composite materials, demanding stringent adherence to international standards (e.g., ASTM, IEC). Distribution channels subsequently move the finished conductors, often highly customized for specific grid projects, either directly to major public/private utilities or through engineering, procurement, and construction (EPC) contractors who manage large-scale transmission projects.

The downstream segment encompasses the final installation, stringing, and long-term maintenance carried out by utilities or specialized construction firms. Direct distribution is common for large, strategic orders from national utilities, ensuring technical specifications are met precisely, while indirect distribution through specialized regional distributors or procurement agencies services smaller distribution network upgrades and maintenance requirements. The increasing complexity of HTLS installations, which often require specialized handling and expertise due to their lighter weight and different thermal properties, emphasizes the importance of robust post-sales support and technical training within the downstream activities, ensuring successful integration into the existing grid infrastructure.

ACSR, ACSS and HTLS Conductor Market Potential Customers

The primary customers for ACSR, ACSS, and HTLS conductors are entities responsible for the generation, transmission, and distribution of electrical power across national and regional grids. Foremost among these are large, state-owned national Transmission System Operators (TSOs) and Distribution System Operators (DSOs), which undertake massive capital investment programs for infrastructure expansion and system replacement. These organizations represent the largest volume purchasers, driven by regulatory mandates to maintain grid reliability, reduce line losses, and meet national decarbonization targets, making them highly receptive to the benefits offered by HTLS conductors in existing corridors.

A rapidly expanding customer base includes private utility companies and Independent Power Producers (IPPs), especially those involved in large-scale renewable energy projects (solar farms, offshore and onshore wind parks). These developers require extensive and efficient transmission infrastructure to connect remote generation sites to the main grid. Their purchasing decisions are often highly sensitive to conductor efficiency (low loss) and the ability to integrate into time-constrained project timelines, making advanced ACSS and HTLS solutions appealing due to their enhanced operational capabilities and ease of integration into modern smart grids. The industrial sector, specifically heavy manufacturing facilities and mining operations requiring dedicated high-capacity power feeds, also represents a consistent, though smaller, customer segment, focusing primarily on robust ACSR or standard ACSS for reliability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 8.0 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Southwire Company, Prysmian Group, Sumitomo Electric Industries, Nexans S.A., CTC Global Corporation, 3M Company, LS Cable & System, Apar Industries Limited, Sterlite Power Transmission Limited, ZTT Group, Elsewedy Electric, AFL Global, TJM Asia Pacific, General Cable Corporation (acquired by Prysmian), LME Power, Qingdao Hanhe Cable Co. Ltd., Alfanar Group, Midal Cables, KEI Industries Limited, Hengtong Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

ACSR, ACSS and HTLS Conductor Market Key Technology Landscape

The technology landscape for ACSR, ACSS, and HTLS conductors is characterized by continuous material science innovation aimed at achieving higher operational temperatures, minimizing sag, and maximizing energy efficiency. The foundational technology remains ACSR, utilizing standard aluminum strands around a steel core for strength. However, the rapidly advancing HTLS segment leverages composite core technologies, notably Aluminum Conductor Composite Core (ACCC), which uses a carbon and glass fiber composite core. This core is approximately 70% lighter and twice as strong as steel, allowing for larger aluminum content without increasing the conductor weight, thereby significantly reducing resistive losses and boosting thermal rating compared to traditional ACSR or ACSS designs. This material evolution is central to grid capacity enhancement projects globally.

A second critical technological focus involves advanced thermal resistant aluminum alloys (e.g., Zirconium or Invar alloys), which constitute the stranding material in ACSS and specialized HTLS conductors. These alloys are designed to withstand sustained operating temperatures exceeding 200°C without suffering significant creep or structural degradation, a limitation often faced by conventional EC-grade aluminum used in ACSR. Innovations also extend to the manufacturing process itself, including continuous transposition techniques and specialized stranding methods that enhance conductor flexibility and ease of installation while ensuring uniform current distribution and reduced radio interference, critical factors for ultra-high voltage (UHV) applications.

Furthermore, the digital integration of conductors into the smart grid infrastructure is becoming a key technological differentiator. This includes the development and integration of sensing capabilities, such as fiber optic cables embedded within the conductor bundle or external sensor clamps (IoT devices), to facilitate Real-Time Thermal Rating (RTTR) monitoring. These technologies enable utilities to dynamically adjust current loads based on real-time environmental conditions, maximizing power transfer safely. The convergence of material science (composites and alloys) and digital technology (IoT, AI, and monitoring) defines the competitive edge in the modern conductor market, emphasizing lifetime asset performance and data-driven operational decision-making.

Regional Highlights

The regional dynamics of the ACSR, ACSS, and HTLS conductor market are diverse, reflecting varying stages of grid maturity, regulatory environments, and rates of electrification and urbanization across continents. These regional distinctions heavily influence the demand mix between cost-effective ACSR/ACSS solutions and premium HTLS products.

- Asia Pacific (APAC): This region is the undisputed leader in market growth and consumption volume, driven by massive public sector investments in new transmission infrastructure, particularly in China and India. The rapid connection of new generation capacity (including vast solar and wind projects) and the urgent need to expand grid coverage for highly populated areas fuel demand for both bulk ACSR for distribution and advanced HTLS for long-distance, high-capacity transmission corridors. Government initiatives focusing on UHV transmission networks are major market accelerators.

- North America: The market here is predominantly characterized by grid replacement and modernization efforts, addressing aging infrastructure that frequently utilizes decades-old ACSR lines. Demand is heavily skewed toward HTLS technologies, as utilities seek to increase power throughput and enhance resilience without incurring the political and financial costs of acquiring new rights-of-way. Regulatory frameworks supporting grid reliability and reduced transmission losses incentivize the rapid adoption of high-efficiency conductors.

- Europe: The market is defined by ambitious renewable energy targets and the urgent need to integrate decentralized power generation (offshore wind, rooftop solar) into existing networks. The focus is strongly on upgrading transmission corridors to handle bidirectional power flows and cross-border interconnectivity. While ACSR/ACSS is used in localized distribution, the high-voltage transmission segment shows significant adoption of specialized HTLS and low-sag conductors to minimize visual impact and maximize efficiency in densely populated areas.

- Latin America: Market growth is driven by ongoing electrification projects, resource exploitation (mining and oil & gas), and necessary infrastructure build-out, particularly in Brazil and Mexico. Demand shows a balanced mix of traditional ACSR for cost-effective distribution expansion and strategic HTLS deployment for connecting new, often remote, hydro or large-scale solar power generation sites to major load centers.

- Middle East and Africa (MEA): Infrastructure development, especially related to smart cities and industrial hubs (e.g., Saudi Arabia’s Vision 2030), fuels demand in the Middle East. High ambient temperatures in the region make ACSS and specific HTLS conductors highly desirable due to their superior thermal performance. In Africa, the market is characterized by essential rural electrification projects, leading to substantial demand for cost-efficient ACSR, although growing investments in cross-country transmission projects are driving interest in HTLS.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the ACSR, ACSS and HTLS Conductor Market.- Southwire Company

- Prysmian Group

- Sumitomo Electric Industries

- Nexans S.A.

- CTC Global Corporation

- 3M Company

- LS Cable & System

- Apar Industries Limited

- Sterlite Power Transmission Limited

- ZTT Group

- Elsewedy Electric

- AFL Global

- TJM Asia Pacific

- General Cable Corporation (acquired by Prysmian)

- LME Power

- Qingdao Hanhe Cable Co. Ltd.

- Alfanar Group

- Midal Cables

- KEI Industries Limited

- Hengtong Group

Frequently Asked Questions

Analyze common user questions about the ACSR, ACSS and HTLS Conductor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between ACSR, ACSS, and HTLS conductors?

The distinction lies primarily in core material and thermal capacity. ACSR uses a standard steel core and operates at standard temperatures (typically 75°C to 100°C). ACSS uses a steel core treated to resist annealing, allowing slightly higher continuous temperatures. HTLS conductors, often utilizing advanced composite cores (e.g., carbon fiber) or thermal alloys, are designed for sustained operation at significantly higher temperatures (up to 250°C) with minimal sag, enabling maximum power transfer in existing corridors.

How does the shift to renewable energy affect the conductor market?

The global integration of large-scale, often remotely located, renewable energy sources (wind and solar) necessitates extensive high-capacity transmission infrastructure. This significantly drives the demand for HTLS conductors due to their ability to efficiently transmit large blocks of power over long distances with minimal loss, ensuring grid stability and maximizing the utilization of new green energy projects.

Which geographic region exhibits the fastest growth in conductor adoption?

The Asia Pacific (APAC) region, particularly driven by large-scale electrification and infrastructure modernization projects in countries like China and India, demonstrates the highest Compound Annual Growth Rate (CAGR) for ACSR, ACSS, and HTLS conductor adoption, propelled by increasing energy demand and governmental investments in ultra-high voltage (UHV) transmission networks.

What are the main advantages of using HTLS conductors for grid modernization?

The key advantages of HTLS conductors are their significantly increased current-carrying capacity (ampacity) and their low-sag performance at high temperatures. This allows utilities to effectively 're-rate' or upgrade existing transmission lines without costly and time-consuming modifications to towers or securing new rights-of-way (ROW), dramatically improving grid efficiency and reducing project deployment timelines.

Are raw material price fluctuations a significant constraint in this market?

Yes, volatility in the global prices of key raw materials, including aluminum, galvanized steel, and specialty alloys used in HTLS cores, represents a material constraint. These fluctuations directly impact the manufacturing costs, making long-term project budgeting challenging for utilities and manufacturers, particularly in the production of cost-sensitive ACSR and aluminum-intensive HTLS variants.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager