Actigraphy Sensors And Polysomnography Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432449 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Actigraphy Sensors And Polysomnography Devices Market Size

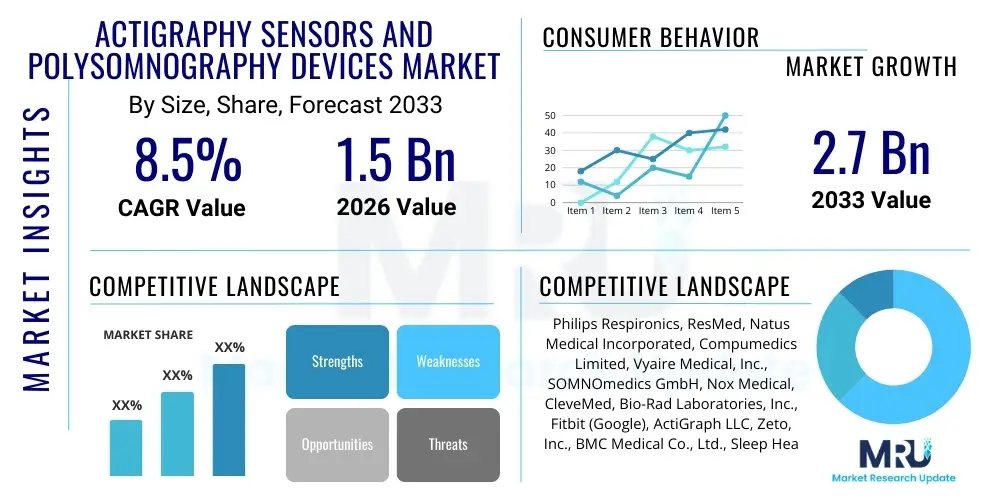

The Actigraphy Sensors And Polysomnography Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.7 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by the escalating global prevalence of sleep disorders, particularly Obstructive Sleep Apnea (OSA) and chronic insomnia, coupled with significant advancements in sensor technology that enhance monitoring accuracy and patient comfort. The market encompasses a dual landscape, featuring high-fidelity, clinic-based Polysomnography (PSG) systems, which remain the diagnostic gold standard, alongside increasingly sophisticated, portable, and cost-effective Actigraphy sensors used for longitudinal and home-based monitoring.

The valuation reflects the critical need for advanced diagnostic tools in sleep medicine. While Actigraphy sensors are rapidly penetrating the consumer and clinical trial segments due to their non-invasive nature and ease of long-term data collection, PSG devices continue to command higher revenue share due to the complexity and comprehensiveness of the physiological data they capture (EEG, EOG, EMG, ECG, respiratory effort). The projected growth rate of 8.5% is indicative of a successful market pivot towards decentralized monitoring solutions, where hybrid models integrating Actigraphy data into preliminary diagnostic pathways are becoming commonplace, thereby streamlining the patient journey and reducing the burden on specialized sleep centers.

Actigraphy Sensors And Polysomnography Devices Market introduction

The Actigraphy Sensors and Polysomnography Devices Market involves instruments used for objective assessment of sleep patterns and diagnosing sleep-related disorders. Actigraphy sensors are wrist-worn, non-invasive devices that monitor rest/activity cycles based on movement, offering a cost-effective and practical solution for long-term data collection in both clinical and research settings, particularly for conditions like circadian rhythm disorders and insomnia. Polysomnography (PSG) devices, conversely, are multi-channel systems that simultaneously record numerous physiological variables—including brain waves (EEG), oxygen saturation, heart rate, respiration, and muscle activity—during sleep, serving as the definitive diagnostic tool for complex conditions such as sleep apnea and narcolepsy. These technologies are crucial components in the clinical workflow for sleep health management.

Major applications of these devices span comprehensive sleep disorder diagnosis, efficacy testing of therapeutic interventions, monitoring patient adherence to Continuous Positive Airway Pressure (CPAP) therapy, and large-scale epidemiological studies. The primary benefit derived from these technologies is the ability to provide objective, quantifiable data regarding sleep duration, efficiency, latency, and fragmentation, moving beyond subjective patient reporting. For patients, Actigraphy offers ease of use and the ability to gather data in their natural sleep environment, while PSG provides unparalleled diagnostic depth required for definitive clinical decisions, particularly concerning life-threatening respiratory events during sleep.

The driving factors propelling market expansion include the increasing geriatric population globally, which exhibits a higher prevalence of sleep disorders; the rising awareness among both consumers and primary care physicians regarding the serious health implications of untreated sleep pathology (e.g., cardiovascular disease, diabetes); and significant technological innovations. These innovations include the miniaturization of PSG sensors, the development of wireless and portable PSG systems that enable accurate home sleep testing (HST), and sophisticated algorithms integrated into Actigraphy devices that enhance the differentiation between wakefulness and true sleep state, thus improving overall data validity and clinical utility in diverse settings.

Actigraphy Sensors And Polysomnography Devices Market Executive Summary

The Actigraphy Sensors and Polysomnography Devices market is characterized by dynamic business trends, marked by a dual strategy focusing on integrating high-end diagnostic accuracy with widespread accessibility and portability. Key business trends include aggressive mergers and acquisitions aimed at consolidating expertise in data analytics and sensor manufacturing, alongside increasing investment in software platforms capable of handling large volumes of complex sleep data. Furthermore, partnerships between medical device manufacturers and telehealth providers are reshaping distribution channels, particularly accelerating the adoption of home sleep testing (HST) solutions, which rely heavily on portable PSG and advanced Actigraphy for preliminary screening and monitoring. The emphasis is shifting towards subscription-based software services accompanying the hardware, offering recurrent revenue streams derived from AI-powered data interpretation.

Regional trends indicate North America maintains market dominance due to robust healthcare spending, established clinical guidelines promoting sleep disorder diagnosis, and rapid technological adoption, particularly in wearable medical-grade Actigraphy. However, the Asia Pacific (APAC) region is projected to register the highest growth rate, fueled by improving healthcare infrastructure, rising disposable incomes, increasing awareness of sleep health in populous nations like China and India, and government initiatives aimed at reducing the burden of non-communicable diseases linked to poor sleep. Europe demonstrates steady growth, driven by stringent regulatory frameworks ensuring device quality and a strong focus on clinical research utilizing these technologies, particularly in countries such as Germany and the UK where reimbursement policies support advanced sleep diagnostics.

Segment trends highlight a sustained preference for PSG devices in terms of revenue, primarily driven by hospital and specialized sleep clinic purchases for definitive diagnosis. Nevertheless, the Actigraphy segment is experiencing faster growth in terms of unit volume, propelled by consumer wearables entering the 'medical device' gray area and the pervasive use of Actigraphy in pharmaceutical trials requiring objective measures of sleep-wake cycles. The application segment is overwhelmingly dominated by Obstructive Sleep Apnea (OSA) diagnosis, which constitutes the largest addressable patient population. However, the chronic insomnia segment is showing accelerating demand for Actigraphy, as it provides a practical, objective method for monitoring the long-term efficacy of cognitive behavioral therapy for insomnia (CBT-I) and pharmacological interventions across various end-user settings, including home care and research institutions.

AI Impact Analysis on Actigraphy Sensors And Polysomnography Devices Market

User inquiries regarding the role of Artificial Intelligence (AI) in the Actigraphy and PSG market frequently center on automated data analysis, diagnostic accuracy improvement, and reducing the heavy workload associated with manual sleep stage scoring. Users are keen to know if AI can reliably replace human sleep technicians, accelerate the turnaround time for diagnoses, and improve the consistency of results across different clinical settings. Key concerns revolve around the validation of AI algorithms against the 'gold standard' human scoring, the need for transparent explainable AI (XAI) in clinical decision-making, and the integration challenges when combining AI-driven analysis from diverse sensor types (e.g., proprietary Actigraphy data versus standard PSG physiological signals). The overarching expectation is that AI will democratize high-quality sleep diagnostics by making accurate interpretation faster, cheaper, and more accessible, especially in non-clinic environments like home sleep testing.

The integration of deep learning and machine learning algorithms is fundamentally transforming how sleep data is processed and interpreted. For Polysomnography, AI automates the laborious process of sleep staging (categorizing NREM stages 1-3 and REM sleep) and identifying critical events such as apneas, hypopneas, and limb movements, significantly reducing the time spent by technicians and improving inter-scorer reliability. This automation enhances clinical throughput, allowing sleep centers to diagnose and initiate treatment for more patients efficiently. For Actigraphy, AI models are essential for refining the distinction between quiet wakefulness and actual sleep, compensating for the inherent limitations of movement-only data by integrating advanced pattern recognition and predictive analytics, thus increasing the clinical relevance of long-term, ecologically valid monitoring.

Furthermore, AI algorithms are being leveraged for predictive modeling, allowing clinicians to forecast the progression of sleep disorders or predict patient response to specific therapies, such as CPAP. This capability moves the market beyond mere diagnosis into personalized sleep medicine. The application of sophisticated neural networks enables the analysis of massive, multimodal datasets generated by combination Actigraphy/PSG studies, potentially uncovering subtle physiological markers previously undetectable by standard visual scoring or basic analysis. This drive towards predictive, personalized diagnostics establishes AI as a core competitive differentiator and a primary catalyst for innovation within the sleep technology sector, assuring faster patient care pathways.

- AI enables automated sleep staging and event detection, drastically reducing manual scoring time for PSG data.

- Machine learning algorithms improve the sensitivity and specificity of Actigraphy data, enhancing the reliability of home-based monitoring.

- Deep learning facilitates the development of predictive models for sleep disorder prognosis and personalized treatment response prediction.

- AI standardizes diagnostic interpretations, minimizing inter-scorer variability and improving consistency across multiple sleep labs.

- Integration of AI supports the expansion of cost-effective, high-accuracy home sleep testing (HST) solutions.

DRO & Impact Forces Of Actigraphy Sensors And Polysomnography Devices Market

The Actigraphy Sensors and Polysomnography Devices Market is shaped by a confluence of accelerating drivers (D) related to public health and technology, significant restraining factors (R) concerning cost and regulatory burdens, and transformative opportunities (O) arising from decentralized healthcare models, collectively known as DRO & Impact Forces. The primary driver is the exponentially rising global incidence of sleep disorders, particularly Obstructive Sleep Apnea (OSA), fueled by obesity and sedentary lifestyles, which necessitates robust, objective diagnostic capabilities. Technological innovation in sensor miniaturization and wireless connectivity further drives adoption by enabling more patient-friendly and portable devices. However, significant restraints include the exceptionally high initial capital expenditure and complexity associated with traditional in-lab PSG systems, coupled with reimbursement challenges in certain global markets, limiting access for lower-income populations.

Opportunities are strongly concentrated in the shift towards Home Sleep Testing (HST) and remote monitoring, leveraging portable PSG and advanced Actigraphy to deliver care outside the hospital setting, thereby improving patient convenience and reducing costs. The integration of these devices with telehealth platforms offers a scalable model for remote diagnostics and therapeutic management, especially beneficial in rural or underserved areas. The impact forces acting on this market emphasize the trade-off between diagnostic depth (high-end PSG) and accessibility (portable Actigraphy). Regulatory changes, such as revised guidelines promoting HST as a valid diagnostic pathway for uncomplicated OSA, further accelerate the market penetration of portable solutions, while consumer demand for wellness tracking pushes manufacturers to develop clinically validated, yet user-friendly, wearable Actigraphy devices capable of bridging the gap between consumer fitness tracking and medical-grade diagnostics.

Another crucial impact force is the pharmaceutical industry's need for objective, quantifiable sleep endpoints in clinical trials, driving the specialized demand for high-precision, research-grade Actigraphy devices compliant with stringent regulatory standards. The market dynamic is increasingly characterized by competition not just on hardware specifications, but on the sophistication of the accompanying software and data analytics platforms, which is essential for translating raw physiological signals into clinically actionable insights. Addressing data security and privacy concerns related to patient sleep data also constitutes a significant impact force, demanding rigorous compliance with global data protection regulations like HIPAA and GDPR, thereby influencing product design and cloud infrastructure deployment strategies across the entire value chain.

Segmentation Analysis

The Actigraphy Sensors and Polysomnography Devices market segmentation is crucial for understanding the diverse needs of the sleep health ecosystem, dividing the market based on device type, application, and end-user. The segmentation reflects the dichotomy between highly complex, multi-channel diagnostic tools (PSG) and simpler, long-term monitoring tools (Actigraphy). This differentiation directly impacts pricing, volume sales, and target end-users. The device type segment is dominated by PSG in revenue terms due to its high cost and clinical indispensability, while Actigraphy leads in unit volume growth driven by its increasing use in research, home monitoring, and adjunct diagnosis for conditions like Insomnia and Circadian Rhythm Disorders. Understanding these segments is key for manufacturers to allocate resources effectively, focusing either on high-margin, clinically intensive PSG technology or high-volume, accessibility-focused Actigraphy solutions.

Application-wise, the market is heavily skewed towards the diagnosis and management of sleep-related breathing disorders, primarily Obstructive Sleep Apnea (OSA), given its high prevalence globally. However, the rapidly growing recognition of other sleep pathologies, such as chronic insomnia, restless legs syndrome, and narcolepsy, is diversifying the revenue streams. Insomnia, in particular, is proving to be a substantial driver for Actigraphy adoption, as clinicians require long-term, objective monitoring outside the lab setting to track treatment response to non-pharmacological therapies. This diversification ensures that market resilience is not singularly dependent on OSA diagnosis but is supported by a broader spectrum of sleep health needs across the clinical spectrum.

End-user segmentation reveals that traditional settings like Hospitals and Sleep Centers remain the largest revenue contributors, driven by the requirement for full diagnostic PSG studies, often mandated for initial OSA confirmation. Nevertheless, the fastest-growing segment is Home Care Settings, fueled by the accelerating trend of Home Sleep Testing (HST), which utilizes portable PSG and medical-grade Actigraphy. This shift is cost-driven and patient-centric, significantly expanding the market reach beyond specialized clinics. Additionally, pharmaceutical and biotechnology companies form a robust niche end-user segment, relying on the precision of these devices for objective clinical endpoint measurements in drug development trials, thereby ensuring continued investment in highly accurate, research-grade systems.

- By Device Type:

- Polysomnography (PSG) Devices

- Portable PSG Devices (Type 2, 3, 4)

- Clinical/In-Lab PSG Devices (Type 1)

- Actigraphy Sensors

- Wearable Devices

- Non-Wearable/Embedded Systems

- Polysomnography (PSG) Devices

- By Application:

- Obstructive Sleep Apnea (OSA)

- Insomnia

- Narcolepsy and Idiopathic Hypersomnia

- Restless Legs Syndrome (RLS) and Periodic Limb Movement Disorder (PLMD)

- Circadian Rhythm Disorders

- Clinical Trials and Research

- By End User:

- Hospitals and Sleep Laboratories

- Home Care Settings/Telehealth

- Academic and Research Institutions

- Pharmaceutical and Biotechnology Companies

- By Component:

- Hardware (Sensors, Recorders, Monitors)

- Software (Scoring, Analysis, and Interpretation Platforms)

- Services (Consulting, Maintenance, Data Management)

Value Chain Analysis For Actigraphy Sensors And Polysomnography Devices Market

The value chain for Actigraphy Sensors and Polysomnography Devices is intricate, starting with upstream activities focused on advanced material sourcing and sophisticated sensor development. Upstream analysis involves highly specialized manufacturing of microelectromechanical systems (MEMS) accelerometers essential for Actigraphy, and high-fidelity physiological sensors (EEG, ECG, pressure transducers) required for PSG systems. Key value addition at this stage comes from research and development (R&D) focused on miniaturization, enhanced signal-to- noise ratio, and power efficiency, crucial for portable devices. Regulatory compliance, particularly FDA clearance or CE marking, is a significant gating factor upstream, influencing design protocols and material choices, making the R&D intensity high within the major manufacturing hubs globally.

Midstream activities encompass the manufacturing, assembly, and rigorous testing of the final devices. This phase integrates complex software algorithms necessary for data capture, filtering, and pre-processing. The distribution channel is segmented into direct sales, particularly for high-capital equipment like in-lab PSG systems sold directly to large hospital networks and specialized sleep centers, ensuring installation support and comprehensive training. Indirect channels, involving third-party medical device distributors and value-added resellers (VARs), are predominantly used for portable Actigraphy sensors and simplified Home Sleep Testing (HST) kits, allowing for broader geographic penetration and leveraging existing distribution networks within primary care and telehealth services.

Downstream analysis focuses on end-user deployment and post-sale support, including data management and analysis services. Direct customer engagement is crucial for potential customers like sleep clinics and researchers, who require specialized technical support and continuous software updates to maintain diagnostic accuracy and regulatory compliance. Indirectly, patients acquire Actigraphy devices either through clinical prescription or increasingly, through over-the-counter channels (though often requiring clinical validation for medical use). The most critical value capture downstream lies in the proprietary software platforms and cloud services that interpret the raw data, offer automated scoring, and integrate results directly into electronic health records (EHRs), enhancing the overall clinical workflow and ensuring the hardware's long-term utility beyond the initial purchase.

Actigraphy Sensors And Polysomnography Devices Market Potential Customers

Potential customers for Actigraphy Sensors and Polysomnography Devices are varied, encompassing the full spectrum of healthcare providers, specialized clinical research organizations, and, increasingly, the individual patient consumer under specific medical guidance. The primary and most lucrative customer segment remains specialized Sleep Centers and Hospital Cardiology/Pulmonology Departments, which require high-fidelity, Type 1 in-lab PSG systems for conclusive diagnosis of complex sleep-related breathing disorders and other pathologies. These facilities serve as critical referral centers and demand robust, multi-channel hardware capable of continuous operation and seamless integration with existing IT infrastructures, making long-term service contracts and upgradeability key decision factors in the purchasing process.

A rapidly expanding segment consists of independent Diagnostic Imaging Centers and Telehealth Providers that leverage portable PSG devices (Type 3 and 4) and medical-grade Actigraphy sensors for conducting Home Sleep Testing (HST). These buyers prioritize ease of use, swift data transmission capabilities, and reliable battery life, aiming to increase patient throughput and offer convenient diagnostic options outside the traditional clinical environment. The shift towards decentralized diagnostics, often driven by favorable reimbursement policies for HST, makes these mid-sized and distributed healthcare models significant growth areas, focusing heavily on Actigraphy for pre-screening and post-treatment monitoring, and portable PSG for initial diagnostic confirmation.

Furthermore, pharmaceutical and biotechnology companies constitute a high-value potential customer base. They utilize precise Actigraphy and PSG devices in Phase II and Phase III clinical trials to objectively measure drug efficacy on sleep architecture, duration, and quality. Their requirements are highly stringent, demanding devices with superior data validation, global regulatory compliance, and specialized analytical software capable of handling large-scale, multisite study data. Finally, individual consumers, often suffering from conditions like chronic insomnia or circadian rhythm disorders, are increasingly becoming direct buyers of consumer-grade, clinically validated Actigraphy devices prescribed by neurologists or sleep specialists for long-term self-monitoring and adherence tracking, albeit the revenue contribution here is predominantly driven by lower-cost, high-volume sensor sales.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.7 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Philips Respironics, ResMed, Natus Medical Incorporated, Compumedics Limited, Vyaire Medical, Inc., SOMNOmedics GmbH, Nox Medical, CleveMed, Bio-Rad Laboratories, Inc., Fitbit (Google), ActiGraph LLC, Zeto, Inc., BMC Medical Co., Ltd., Sleep HealthCenters, Advanced Brain Monitoring, Inc., MRA-Medical Research Apparatus, Inc., Curative Medical, Inc., Lifelines Neuro. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Actigraphy Sensors And Polysomnography Devices Market Key Technology Landscape

The technological landscape of the Actigraphy Sensors and Polysomnography Devices market is rapidly evolving, driven by the need for enhanced accuracy, increased portability, and superior data analytics capabilities. A fundamental technology advancement involves the transition from bulky analog systems to highly miniaturized, digital, and wireless sensor technology. Modern PSG devices utilize advanced biosensors for electrophysiological monitoring, including sophisticated dry electrodes and specialized physiological sensors (e.g., oximetry, capnography, effort belts) designed for clinical precision. For Actigraphy, the core technology relies on high-precision Microelectromechanical Systems (MEMS) accelerometers, which are essential for accurately recording subtle movements and differentiating between low-intensity activity and genuine sleep states, significantly improving the efficacy of these devices outside specialized laboratories.

A major area of innovation is in data transmission and cloud-based architecture. Wireless connectivity, leveraging Bluetooth Low Energy (BLE) and Wi-Fi, enables real-time data streaming from portable PSG and Actigraphy devices directly to secure cloud platforms, facilitating remote data viewing and analysis. These platforms are crucial for the growth of telehealth and HST, ensuring data integrity and compliance with medical data security standards. Furthermore, software development is pivotal; proprietary algorithms and Machine Learning (ML) models are increasingly integrated to automate sleep scoring, identify complex sleep disorder events, and correct for potential sensor artifacts. This shift towards smart diagnostics powered by advanced algorithms is defining the next generation of competitive advantage.

Moreover, the integration of multi-modal sensing is becoming standard, particularly in portable PSG units that increasingly incorporate Actigraphy capabilities to provide context for long-term sleep-wake patterns alongside the required physiological data. There is also a nascent trend toward incorporating non-contact sensors, such as radar technology or ballistocardiography, into beds or mattresses, offering less intrusive monitoring options that complement traditional Actigraphy. The overall technological direction emphasizes seamless patient integration, minimal setup time, cross-compatibility with EHR systems, and the ability to process complex physiological data efficiently through sophisticated, often AI-driven, analytical software that enhances clinical relevance and reduces the labor cost associated with traditional sleep diagnostics.

Regional Highlights

The market for Actigraphy Sensors and Polysomnography Devices exhibits distinct regional dynamics, influenced by healthcare spending, regulatory frameworks, and the prevalence of obesity and related sleep disorders. North America, encompassing the United States and Canada, currently holds the largest market share, driven by high awareness levels, sophisticated healthcare infrastructure, and favorable reimbursement policies supporting both in-lab PSG and Home Sleep Testing (HST). The region benefits from early adoption of advanced medical technologies, significant investment in R&D by major sleep technology companies headquartered there, and a high incidence of diagnosed sleep apnea, resulting in a robust demand for both high-end clinical devices and portable monitoring solutions, accelerating the market growth.

Europe represents the second-largest market, characterized by mature healthcare systems and strong government focus on clinical excellence and patient safety. Growth in Europe is steady, supported by well-defined clinical pathways and centralized research initiatives. Countries such as Germany, the UK, and France are key contributors, driven by aging populations and increasing utilization of portable PSG devices to manage growing waiting lists for sleep studies. The market here is highly regulated, necessitating compliance with strict European medical device regulations (MDR), which influences product development and technology selection, often favoring established, clinically validated systems and standardized Actigraphy protocols.

The Asia Pacific (APAC) region is projected to be the fastest-growing market during the forecast period. This accelerated growth is primarily attributed to rapidly developing healthcare infrastructure in emerging economies like China, India, and South Korea, coupled with massive, underserved patient populations. Rising urbanization and changes in lifestyle contributing to higher rates of obesity and sleep disorders are creating an urgent need for diagnostic tools. While adoption of high-cost in-lab PSG is slower, the APAC market is rapidly embracing cost-effective, portable PSG and Actigraphy devices, particularly those integrated with mobile health solutions, addressing the dual challenges of high patient volume and limited access to specialized sleep physicians. Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets, experiencing steady expansion driven by increasing healthcare expenditure and growing medical tourism focused on specialized care.

- North America: Dominates the global market share, high expenditure on healthcare, strong reimbursement for HST, early adoption of AI-driven scoring platforms, and high prevalence of diagnosed sleep disorders.

- Europe: Steady growth, driven by stringent regulatory standards (MDR), aging demographics, focus on reducing diagnostic wait times through portable devices, and robust clinical research activities.

- Asia Pacific (APAC): Fastest projected growth, fueled by massive unmet patient needs, improving healthcare access and infrastructure, increasing awareness campaigns, and high demand for cost-effective, portable diagnostic solutions.

- Latin America (LATAM): Emerging market expansion, characterized by increasing private healthcare investment, rising incidence of obesity, and gradual adoption of Actigraphy for clinical research purposes and initial screening.

- Middle East and Africa (MEA): Growth driven by healthcare diversification initiatives in Gulf Cooperation Council (GCC) countries, medical tourism, and improving access to imported medical technology, focused on specialized sleep clinics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Actigraphy Sensors And Polysomnography Devices Market.- Philips Respironics

- ResMed

- Natus Medical Incorporated

- Compumedics Limited

- Vyaire Medical, Inc.

- SOMNOmedics GmbH

- Nox Medical

- CleveMed

- Bio-Rad Laboratories, Inc.

- Fitbit (Google)

- ActiGraph LLC

- Zeto, Inc.

- BMC Medical Co., Ltd.

- Sleep HealthCenters

- Advanced Brain Monitoring, Inc.

- MRA-Medical Research Apparatus, Inc.

- Curative Medical, Inc.

- Lifelines Neuro

- Embla Systems LLC (a part of Natus)

- Medtronic (via acquisition of relevant sleep monitoring tech)

Frequently Asked Questions

Analyze common user questions about the Actigraphy Sensors And Polysomnography Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Actigraphy sensors and Polysomnography (PSG) devices?

PSG is the comprehensive, multi-channel diagnostic gold standard, typically conducted in a lab, recording variables like EEG, ECG, and respiratory effort. Actigraphy sensors are portable, wrist-worn movement trackers used for long-term, non-invasive monitoring of rest/activity cycles, primarily utilized for screening and monitoring circadian rhythm disorders or treatment response outside the clinical environment, offering ease of use over diagnostic depth.

How is Artificial Intelligence (AI) influencing the Actigraphy and PSG market?

AI is fundamentally transforming the market by automating sleep stage scoring and event detection in PSG data, significantly reducing analysis time and improving consistency. For Actigraphy, AI algorithms enhance data accuracy by more reliably differentiating between wakefulness and sleep based on complex movement patterns, supporting the growth of high-accuracy home sleep testing (HST).

Which application segment drives the highest revenue share in this market?

The diagnosis and management of Obstructive Sleep Apnea (OSA) drive the highest revenue share. OSA requires complex diagnostic procedures, usually involving either full in-lab PSG or advanced portable PSG devices, which command high capital costs and generate substantial recurring revenue through software and consumables, making it the most significant application segment globally.

What are the key drivers for the adoption of Home Sleep Testing (HST) devices?

The key drivers for HST adoption include the high prevalence of undiagnosed sleep disorders, the significantly lower cost of HST compared to in-lab PSG, increasing patient preference for monitoring at home, and the rising availability of accurate, portable PSG and clinically validated Actigraphy devices, which streamline the diagnostic pathway and reduce clinical burden.

Which geographical region is expected to show the fastest growth rate and why?

The Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR). This growth is attributed to improving healthcare infrastructure, substantial untapped patient populations in large economies like China and India, increasing public awareness of sleep disorders, and the growing demand for affordable, accessible, and portable diagnostic solutions suitable for expansive and distributed healthcare systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager