Activated Alumina Ball Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437685 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Activated Alumina Ball Market Size

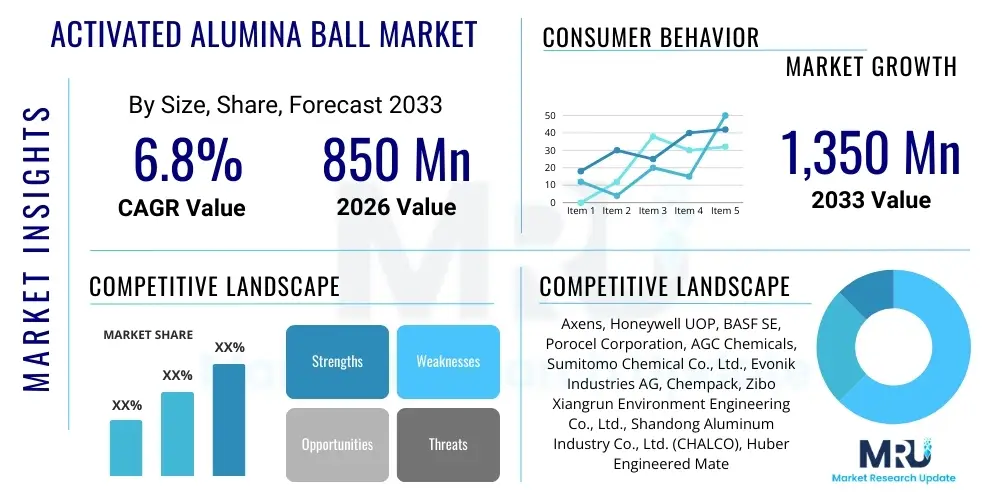

The Activated Alumina Ball Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,350 Million by the end of the forecast period in 2033.

Activated Alumina Ball Market introduction

Activated Alumina Balls (AAB) represent a critical segment within the industrial adsorbent and catalyst support market, fundamentally driven by their exceptional porosity, high surface area, and chemical inertness. This material, derived primarily from aluminum hydroxide through a controlled calcination process, exhibits a strong affinity for water vapor and certain polar molecules, making it indispensable in diverse industrial applications requiring purification, drying, and catalytic reactions. Its spherical shape ensures minimal pressure drop in packed columns and high mechanical strength, crucial characteristics for long-term operational stability in harsh industrial environments such as petrochemical plants and air separation units. The primary function of AAB is twofold: acting as a highly efficient desiccant for gases and liquids, and serving as a robust substrate for various catalytic elements, thereby facilitating cleaner and more efficient manufacturing processes globally.

The product’s versatility extends across numerous high-stakes sectors, positioning it as an essential commodity in modern industrial infrastructure. Major applications include the drying of natural gas (critical for preventing hydrate formation in pipelines), the purification of compressed air systems, and the removal of impurities such as fluoride and arsenic from potable water sources, addressing significant public health and regulatory concerns. Furthermore, AAB plays a vital role as an adsorbent in chromatography and as a medium for the removal of oil vapor from cryogenic applications. The robust physical structure of the ball allows for repeated regeneration cycles without significant degradation in performance, providing a cost-effective and sustainable solution compared to single-use alternatives, thus enhancing its market appeal and driving its consistent adoption in resource-intensive industries.

The market growth trajectory is significantly fueled by global industrialization, stringent environmental regulations necessitating improved emissions control, and the expanding infrastructure for natural gas processing and liquefied natural gas (LNG) production. Activated alumina’s inherent characteristics—such as its high crush strength, thermal stability, and low attrition rate—make it the material of choice for demanding applications where reliability and efficiency are paramount. Moreover, the increasing demand for high-purity industrial gases (like oxygen, nitrogen, and argon) in the electronics and healthcare sectors further amplifies the need for high-performance desiccants. These foundational drivers, coupled with continuous innovation in surface modification techniques to enhance adsorption selectivity, solidify the activated alumina ball market’s pivotal role in global chemical and energy processing industries.

Activated Alumina Ball Market Executive Summary

The Activated Alumina Ball market is experiencing robust expansion, anchored by strong underlying demand from the petrochemical, water treatment, and air separation industries. Current business trends indicate a significant shift towards specialized, high-performance grades of AAB designed for complex purification tasks, such as selective removal of trace contaminants in hydrocarbon streams and optimized catalyst support structures for advanced chemical synthesis. Operational efficiency and sustainability mandates are pushing manufacturers to invest in cleaner production methodologies and to develop AAB products that offer extended life cycles and lower regeneration energy requirements. Furthermore, the market structure is characterized by increasing consolidation, with key players focusing on vertical integration to secure raw material supply (bauxite/aluminum hydroxide) and maintain competitive pricing and quality control across the production chain, thereby stabilizing supply dynamics despite volatile input costs.

Regionally, the Asia Pacific (APAC) area remains the primary engine of market growth, driven by rapid industrial expansion, massive investments in infrastructure development, and growing urbanization leading to substantial demand for municipal and industrial water treatment solutions. China and India, in particular, are witnessing accelerated adoption of AAB in new natural gas processing plants and existing chemical manufacturing facilities seeking to comply with stricter local environmental standards. North America and Europe, while mature markets, maintain high demand due to extensive refining capacities, high-tech industrial gas production, and mandatory compliance with rigorous standards set by regulatory bodies like the EPA regarding water quality and atmospheric emissions. The Middle East and Africa (MEA) are emerging as high-potential regions, primarily due to large-scale oil and gas exploration and production activities necessitating reliable drying solutions for hydrocarbon transportation and storage.

Segment trends reveal that the desiccant application segment holds the largest market share, fundamentally supported by global requirements for drying natural gas, compressed air, and specialty fluids. However, the catalyst support segment is projected to exhibit the highest CAGR, spurred by technological advancements in green chemistry and the increasing complexity of catalytic processes required for producing high-value chemicals and fuels. Within material form, standard spherical balls dominate due to their optimal flow characteristics, though specialized grades, including nano-structured activated aluminas, are gaining traction for applications demanding ultra-high surface area and tailored pore size distribution. The market’s resilience is testament to the material's superior performance attributes that are difficult to replicate cost-effectively using alternative adsorbent technologies, ensuring continued relevance across the industrial spectrum.

AI Impact Analysis on Activated Alumina Ball Market

Common user questions surrounding the integration of Artificial Intelligence (AI) into the Activated Alumina Ball market frequently center on how AI can optimize manufacturing consistency, predict product performance in real-time, and revolutionize material discovery. Key concerns involve the potential for AI-driven process controls to mitigate batch-to-batch variation, which is critical for catalyst supports requiring tight specifications. Users also inquire about AI's role in predictive maintenance for large-scale adsorption units and whether machine learning algorithms can accelerate the development of novel, highly selective activated alumina grades by simulating pore structure modification and adsorption mechanisms. The consensus expectation is that AI will primarily enhance operational efficiency, reduce energy consumption during the high-temperature calcination process, and provide data-driven insights into extending the lifespan and regeneration efficiency of AAB products deployed in field applications.

- AI-driven Predictive Maintenance: Utilizing sensor data from drying towers to forecast operational failures or performance degradation, optimizing regeneration cycles, and extending the service life of AAB columns.

- Manufacturing Process Optimization: Employing machine learning to dynamically adjust calcination temperature, residence time, and chemical precursor ratios, ensuring consistent particle size, pore volume, and surface area, thereby maximizing adsorption capacity.

- Supply Chain and Logistics Forecasting: AI algorithms predict fluctuating demand from key industrial sectors (e.g., LNG, refinery turnarounds) and optimize inventory management of raw materials (bauxite, aluminum hydroxide) and finished goods distribution, mitigating bottlenecks.

- Accelerated Material R&D: Leveraging generative AI and computational chemistry to simulate the effect of dopants and binders on the alumina matrix, leading to the rapid development of specialized, highly selective adsorbents for niche applications (e.g., carbon capture or specific pollutant removal).

- Quality Control Automation: Implementing computer vision systems paired with AI for instantaneous, high-throughput inspection of ball morphology and detection of surface defects, ensuring only the highest quality product batches reach critical industrial clients.

DRO & Impact Forces Of Activated Alumina Ball Market

The Activated Alumina Ball market is propelled by significant drivers, offset by specific restraints, yet presents substantial opportunities driven by evolving global regulatory landscapes and technological imperatives. Key drivers include the exponential growth in global natural gas production and processing, which mandates rigorous moisture removal using AAB desiccants to prevent corrosion and pipeline damage. Furthermore, the global water scarcity crisis and increasing awareness regarding potable water safety are escalating the demand for AAB in fluoride and arsenic removal, particularly in developing economies where groundwater contamination is a pervasive issue. The expansion of industrial gas manufacturing for use in electronics, healthcare, and metal fabrication also necessitates high-purity drying, underpinning sustained demand for activated alumina’s adsorption capabilities. These factors collectively create a strong foundation for continuous market expansion, necessitating increased production capacity and material efficiency.

However, the market faces notable restraints that temper the growth rate. A primary challenge is the high energy intensity required during the calcination process in AAB manufacturing, which results in significant operational costs and a substantial carbon footprint, making manufacturers vulnerable to fluctuating energy prices and increasing regulatory pressure for decarbonization. Competition from sophisticated alternative adsorbents, such as molecular sieves (zeolites) and specialized silica gels, particularly in high-temperature or highly selective applications, presents a continuous threat, forcing AAB manufacturers to innovate constantly to maintain a competitive edge. Moreover, the cyclical nature of end-user industries like petrochemicals and refining can lead to periodic volatility in large-volume orders, complicating long-term capacity planning and investment strategies for alumina producers.

Opportunities for significant market penetration lie primarily in emerging environmental applications, notably in Carbon Capture, Utilization, and Storage (CCUS) technologies, where specialized activated alumina forms can act as effective, regenerable CO2 adsorbents. The growing shift towards sustainable aviation fuels (SAF) and green hydrogen production also opens new avenues, as AAB can be utilized for stringent purification steps required in these novel processes. The market impact forces indicate that technological innovation—specifically surface doping and structural modification to enhance selectivity and durability—will be the dominant force influencing competitive positioning and market share over the forecast period. Successfully mitigating the high energy consumption during production while capitalizing on these green technology applications will be paramount for stakeholders aiming for long-term growth.

Segmentation Analysis

The Activated Alumina Ball Market is comprehensively segmented based on its structural characteristics, functional application, and final end-use industry, reflecting the diverse requirements of industrial clients globally. Segmentation by product form typically distinguishes between standard spherical balls, commonly used for bulk drying and general catalysis, and specialized forms such as crushed or irregularly shaped particles, which may be preferred in certain fixed-bed reactor designs for specific catalytic reactions. The most impactful segmentation revolves around application, dividing the market into desiccant, catalyst support, adsorbent, and filtration segments, each requiring unique material specifications regarding pore size distribution, surface area, and mechanical strength. Understanding these segments is crucial for manufacturers to tailor production processes and marketing strategies effectively, aligning product specifications with stringent client operational needs.

Analyzing the application-based segmentation reveals that the desiccant category consistently dominates the market volume, primarily driven by the mandatory moisture control in natural gas, air separation, and refrigerant systems. These applications demand high dynamic adsorption capacity and excellent mechanical robustness to withstand frequent temperature and pressure swings during regeneration. Conversely, the catalyst support segment, while smaller in volume, holds significant value due to the high-specification requirements for purity and surface characteristics. AAB used as catalyst support must be highly inert and possess tailored porosity to maximize the dispersion and utilization of active metals (e.g., platinum, palladium), often used in complex chemical reactions like the Claus process for sulfur recovery or hydrotreating in refineries, making this segment critical for chemical processing advancements.

Further granularity in segmentation involves grade differentiation, such as high-purity pharmaceutical-grade alumina versus industrial-grade materials used in basic air drying. Regional segmentation also plays a pivotal role, reflecting varying regulatory environments and industrial maturity levels, particularly between developed economies focused on high-specification catalyst supports and developing regions prioritizing large-volume desiccant applications for infrastructure projects. These multi-dimensional segmentations provide a structured framework for market participants to identify lucrative niches, anticipate demand shifts, and strategically allocate resources toward segments exhibiting superior growth potential or requiring specialized technical expertise, ensuring targeted product development efforts meet precise industrial demands.

- By Application:

- Drying and Desiccation (Natural Gas, Air, Refrigerants)

- Catalyst Support (Claus Catalyst, Hydrogen Peroxide Production)

- Adsorption/Purification (Fluoride Removal, Arsenic Removal, Oil Vapor Adsorption)

- Chromatography

- By Grade:

- Standard Grade

- Pharmaceutical Grade

- High Purity/Catalytic Grade

- By Size/Form:

- Standard Spheres (3-5mm, 5-8mm)

- Crushed/Irregular

- Nano-structured

Value Chain Analysis For Activated Alumina Ball Market

The Activated Alumina Ball value chain begins with the highly specialized upstream procurement of raw materials, primarily bauxite ore, which is refined via the Bayer process into aluminum hydroxide (Al(OH)3). This upstream segment is characterized by high capital intensity and reliance on global commodity prices, dictating the cost structure of the final product. Key activities at this stage include efficient bauxite mining and the energy-intensive production of high-purity aluminum hydroxide, often requiring stringent quality control to ensure minimal impurities that could compromise the final adsorption or catalytic properties of the activated alumina. Since only a specific purity of aluminum hydroxide is suitable for high-grade activated alumina, supply chain resilience and long-term contracts with primary aluminum producers are essential for sustained, cost-effective manufacturing operations.

The midstream phase involves the core manufacturing process: conversion of aluminum hydroxide into activated alumina balls through controlled high-temperature calcination, shaping (agglomeration/extrusion), and activation. This stage requires significant technical expertise to manage critical parameters like temperature profile and hydration levels, which define the resultant pore structure, surface area, and mechanical strength—the defining characteristics of the AAB. Manufacturing facilities are often strategically located near raw material sources or major end-use hubs to minimize logistics costs associated with handling bulk chemical precursors. Differentiation in the midstream is achieved through proprietary techniques for surface modification or controlled calcination, enabling the creation of specialized grades tailored for selective adsorption or enhanced catalytic support performance, thereby capturing higher margins in niche applications.

The downstream segment encompasses distribution, sales, and end-user application. The distribution channel is crucial, utilizing both direct sales to large industrial consumers (e.g., refineries, chemical giants) and indirect sales through specialized chemical distributors who provide technical support and smaller volumes to diverse users (e.g., HVAC firms, municipal water plants). Direct distribution ensures quality control and facilitates customized technical consultations, while indirect channels provide wider geographical reach and penetration into fragmented markets. The final consumption is driven by the performance in situ, where AAB regeneration techniques and spent material disposal or recycling also form part of the downstream value proposition, influencing long-term customer relationships and adherence to circular economy principles within the chemical industry.

Activated Alumina Ball Market Potential Customers

The activated alumina ball market targets a diverse array of industrial sectors where purification, drying, and catalytic efficiency are paramount operational requirements. Primary end-users include the oil and gas industry, which utilizes AAB extensively for dehydrating natural gas, particularly in LNG production and pipeline transportation, to prevent corrosion and freeze-ups, making natural gas processors and midstream companies major bulk purchasers. Chemical and petrochemical manufacturers constitute another significant customer base, employing activated alumina as a catalyst support in critical processes such as hydrodesulfurization, the Claus process for sulfur recovery, and the synthesis of various commodity chemicals, where material reliability and high surface area are indispensable for reactor efficiency and throughput.

Municipal and industrial water treatment facilities represent a rapidly growing customer segment, driven by increasing regulatory scrutiny regarding water quality and the need to remove specific contaminants. These customers rely on AAB's high adsorption capacity for selective removal of fluoride, arsenic, and trace heavy metals from drinking water and industrial wastewater streams, particularly in regions with high natural concentrations of these pollutants. The decision-making unit in this sector is often influenced by governmental regulations, public health standards, and the requirement for robust, long-lasting media capable of high flow rates and multiple regeneration cycles, focusing purchasing decisions on certified, high-performance grades.

Furthermore, manufacturers of industrial gases (such as oxygen, nitrogen, and argon) depend on AAB for deep drying of process streams to cryogenic purity levels required for air separation plants and electronics manufacturing, where even trace moisture can severely compromise product quality and operational integrity. HVAC and compressed air industries also purchase activated alumina for general air drying applications, ensuring moisture-free systems to prevent rust and equipment failure. Consequently, the ideal customer profile spans large-scale energy producers, sophisticated chemical processors demanding tailored catalyst supports, and public utility organizations prioritizing environmental compliance and long-term operational cost efficiency.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,350 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Axens, Honeywell UOP, BASF SE, Porocel Corporation, AGC Chemicals, Sumitomo Chemical Co., Ltd., Evonik Industries AG, Chempack, Zibo Xiangrun Environment Engineering Co., Ltd., Shandong Aluminum Industry Co., Ltd. (CHALCO), Huber Engineered Materials, Merck KGaA, Hengye Inc., Tianjin Minjie Chemical, W. R. Grace & Co., Sorbent Technologies, PQ Corporation, Zeochem AG, Calgon Carbon Corporation, Adsorbents & Desiccants Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Activated Alumina Ball Market Key Technology Landscape

The Activated Alumina Ball market is underpinned by continuous advancements in material science and processing technology, aiming to enhance selectivity, durability, and regeneration efficiency. A primary technological focus involves the precise control of the activation process, specifically the temperature and hydration parameters, which determine the crystalline structure and pore size distribution of the final gamma-alumina product. Modern manufacturing techniques leverage advanced process control systems (often integrated with AI) to ensure highly uniform particle morphology and optimized pore volume, critical for maximizing the dynamic adsorption capacity and minimizing flow resistance in large industrial columns. Research efforts are concentrated on methods to create tailored, narrow pore size distributions, allowing the AAB to selectively adsorb target molecules (e.g., water or specific contaminants) while ignoring bulk components, thus increasing efficiency in complex separation tasks.

A significant area of technological evolution is surface modification and doping, where manufacturers introduce trace elements (like rare earths, titania, or silica) during the preparation phase to alter the surface chemistry of the alumina. This modification is essential for enhancing the material’s performance in specialized roles, such as improving the acidity of catalyst supports or boosting the affinity for heavy metals or acidic components like HCl or CO2. For instance, modified alumina desiccants exhibit improved resistance to liquid water slugging and higher thermal stability, extending their lifespan in demanding environments like petrochemical plants. The development of non-thermal regeneration techniques, seeking alternatives to high-temperature swing adsorption (TSA), is also emerging as a pivotal technology to reduce operating costs and lower the overall environmental impact of activated alumina usage.

Furthermore, the nanotechnology frontier is influencing the activated alumina market, leading to the development of nano-structured activated alumina materials. These nano-materials boast significantly higher surface areas and finer control over pore geometry compared to traditional macroscopic balls, enabling breakthrough performance in ultra-purification and high-selectivity applications, particularly within the biomedical and high-end electronics industries. Challenges remain in scaling up these nano-processes while maintaining mechanical integrity and cost-effectiveness. The industry is also investing heavily in characterization techniques, such as advanced porosimetry and spectroscopic analysis, to provide immediate feedback on production quality, guaranteeing that products consistently meet the increasingly stringent performance specifications required by high-value end-users in regulated sectors.

Regional Highlights

The global Activated Alumina Ball Market exhibits distinct growth patterns and maturity levels across key geographical regions, dictated by industrial output, infrastructure investment, and regulatory regimes. Asia Pacific (APAC) currently dominates the market in terms of volume and is projected to maintain the highest growth trajectory throughout the forecast period. This rapid expansion is fundamentally driven by the enormous scale of industrialization in China, India, and Southeast Asian nations, leading to massive infrastructure build-outs in natural gas pipeline networks, chemical manufacturing facilities, and urban water treatment infrastructure. The necessity for reliable desiccation in the burgeoning LNG and petrochemical sectors, combined with intense pressure to provide clean drinking water to large populations, makes APAC the central hub for consumption and capacity expansion for AAB manufacturers.

North America holds a substantial market share, characterized by its mature oil and gas refining industry and rigorous environmental protection standards. Demand here is stable and focused on high-specification, reliable grades of activated alumina for specialized applications, including catalyst support for complex refinery processes (e.g., hydrocracking and isomerization) and stringent emission control systems. The ongoing shale gas revolution necessitates continuous investment in gas processing and dehydration units, sustaining robust demand for high-performance desiccants. Furthermore, innovation in the region, particularly around CCUS technologies and specialized purification of industrial solvents, ensures that North American users often drive demand for premium, technologically advanced AAB products.

Europe represents a mature yet dynamic market, heavily influenced by decarbonization policies and a strong emphasis on the circular economy. While industrial growth may be slower compared to APAC, the demand for activated alumina remains strong, especially in chemical synthesis, air separation (for medical and industrial gases), and adherence to strict EU directives on water quality (particularly concerning nitrate and fluoride limits). European manufacturers often focus on developing sustainable production methods and high-efficiency catalyst carriers that meet the region’s strict quality and environmental mandates. Latin America and the Middle East & Africa (MEA) are emerging regions, where high growth potential is tied directly to new investments in large-scale hydrocarbon processing (MEA) and ongoing mining operations requiring specialized filtration and purification media (Latin America), reflecting localized but intense demand spikes.

- Asia Pacific (APAC): Leading market volume and growth due to massive infrastructure projects in China and India, focusing on LNG, petrochemicals, and municipal water purification projects.

- North America: Stable demand driven by the established refining industry, extensive natural gas processing infrastructure, and early adoption of advanced catalyst supports for environmental compliance and high-purity chemical manufacturing.

- Europe: Focuses on high-specification, environmentally compliant products; strong demand from chemical manufacturing, industrial gas production, and strict adherence to EU water treatment standards.

- Middle East and Africa (MEA): High growth potential directly linked to new upstream oil and gas developments, requiring bulk quantities of desiccants for processing and transportation in the energy sector.

- Latin America: Growing consumption tied to mining activities (requiring water treatment) and regional expansions in petrochemical facilities, particularly in Brazil and Mexico.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Activated Alumina Ball Market.- Axens

- Honeywell UOP

- BASF SE

- Porocel Corporation

- AGC Chemicals

- Sumitomo Chemical Co., Ltd.

- Evonik Industries AG

- Chempack

- Zibo Xiangrun Environment Engineering Co., Ltd.

- Shandong Aluminum Industry Co., Ltd. (CHALCO)

- Huber Engineered Materials

- Merck KGaA

- Hengye Inc.

- Tianjin Minjie Chemical

- W. R. Grace & Co.

- Sorbent Technologies

- PQ Corporation

- Zeochem AG

- Calgon Carbon Corporation

- Adsorbents & Desiccants Corporation

Frequently Asked Questions

Analyze common user questions about the Activated Alumina Ball market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Activated Alumina Balls in industrial applications?

The primary function of Activated Alumina Balls is acting as a highly efficient desiccant for removing moisture from gases and liquids, particularly critical in natural gas drying and air separation processes, due to their large surface area and strong affinity for water molecules.

How does Activated Alumina compare to Molecular Sieves for desiccation?

Activated Alumina generally offers a higher mechanical strength and is more cost-effective for general drying applications; however, Molecular Sieves provide greater capacity and selectivity for very low dew points and specific contaminant removal, often being preferred in specialized cryogenic or ultra-high purity systems.

Which industries are the largest consumers of Activated Alumina Balls?

The largest consuming industries are the oil and gas sector (for natural gas dehydration and LNG production), the chemical and petrochemical industry (for catalyst supports and purification), and municipal water treatment facilities (for fluoride and arsenic removal).

What factors are driving the growth of the Activated Alumina Ball market in the APAC region?

Market growth in the APAC region is primarily driven by massive infrastructure investments, rapid industrial expansion, increasing demand for refined fuels and industrial gases, and stringent regulatory requirements compelling the use of effective water purification technologies.

Can Activated Alumina Balls be regenerated after use, and how?

Yes, Activated Alumina Balls are highly regenerable. Regeneration typically occurs via Thermal Swing Adsorption (TSA), where hot dry gas (usually air or nitrogen) is passed through the column to desorb the accumulated moisture, restoring the adsorption capacity for repeated cycles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager