Activated Alumina Spheres Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432838 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Activated Alumina Spheres Market Size

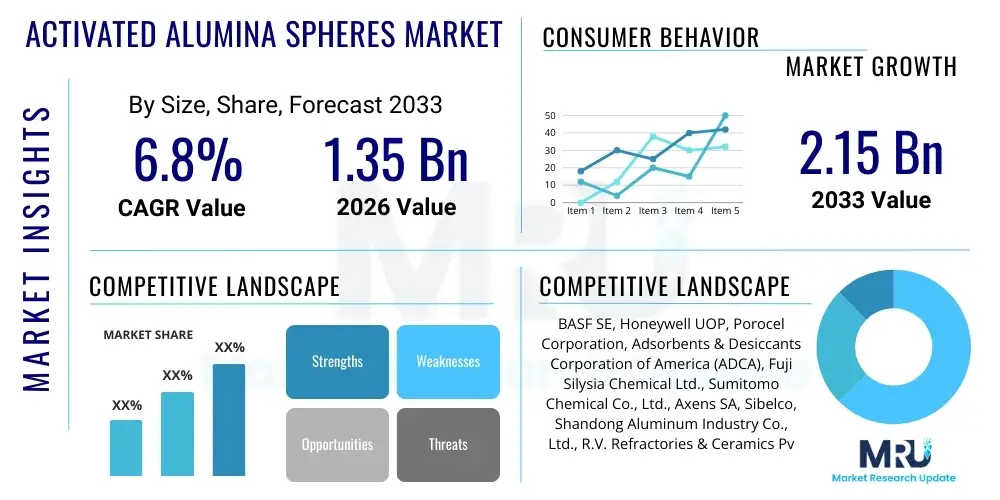

The Activated Alumina Spheres Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.35 Billion in 2026 and is projected to reach USD 2.15 Billion by the end of the forecast period in 2033.

Activated Alumina Spheres Market introduction

The Activated Alumina Spheres Market encompasses the production, distribution, and application of highly porous, spherical forms of aluminum oxide (Al2O3). Activated alumina is a critical material utilized primarily for its exceptional adsorption and desiccant properties, which stem from its high surface area-to-mass ratio and specific pore structure. These properties make it indispensable across numerous heavy industries, particularly in drying gases and liquids, purifying water streams, and serving as a robust catalyst or catalyst support in complex chemical reactions. Its high chemical stability and mechanical strength further enhance its usability in challenging industrial environments, driving consistent demand across diverse sectors globally.

The primary applications of Activated Alumina Spheres include air and gas drying (especially in compressed air systems and natural gas processing), fluoride removal from drinking water, and chromatography. In the petrochemical industry, activated alumina plays a vital role in removing trace impurities, such as arsenic and sulfur compounds, ensuring the quality and safety of finished products. Moreover, the material's unique crystalline structure allows for tailored modifications, enhancing its selectivity for specific contaminants, which is crucial for meeting stringent environmental and quality control standards imposed by regulatory bodies worldwide. This specialized functionality ensures activated alumina remains a high-value product within the specialty chemical and industrial materials segment.

Key market driving factors include the escalating global demand for purified industrial gases (such as oxygen, nitrogen, and hydrogen), the increasing need for advanced water treatment solutions, and stricter environmental regulations concerning emissions and water quality. The natural gas industry, in particular, relies heavily on activated alumina for dehydration processes to prevent pipeline corrosion and hydrate formation. Furthermore, the burgeoning requirement for highly efficient and reusable desiccants in large-scale industrial drying operations, coupled with technological advancements leading to the development of higher-performance alumina grades, consistently fuels market expansion and technological innovation across manufacturing capabilities globally.

Activated Alumina Spheres Market Executive Summary

The Activated Alumina Spheres Market demonstrates robust growth driven primarily by structural business trends favoring industrial efficiency and environmental compliance. Business trends emphasize sustainable manufacturing practices, leading to higher adoption rates of activated alumina in closed-loop systems for solvent recovery and contaminant removal. Key industry players are focusing on backward integration to secure raw material supply (bauxite) and forward integration into advanced application services, such as modular drying units and customized adsorption systems. Regional expansion, particularly in emerging economies undergoing rapid industrialization and infrastructural development, represents a significant avenue for revenue generation. Furthermore, the shift toward specialty alumina grades designed for highly selective adsorption, such as enhanced arsenic removal media, is reshaping the competitive landscape and commanding premium pricing.

Regional trends indicate that Asia Pacific (APAC) currently dominates the market, largely owing to massive investments in chemical processing, power generation, and natural gas infrastructure in countries like China and India. However, North America and Europe are pivotal regions driving innovation, especially in advanced water purification technologies and the utilization of activated alumina as catalyst supports for sustainable chemical synthesis processes. Increased regulatory scrutiny on PFAS (per- and polyfluoroalkyl substances) and other persistent organic pollutants in Western economies is accelerating the demand for sophisticated adsorption media. Meanwhile, the Middle East and Africa (MEA) exhibit strong growth potential due to substantial ongoing investments in oil and gas processing facilities and necessary regional desalination projects.

Segmentation trends highlight the increasing importance of the Water Treatment segment, projected to experience the fastest growth due to global water scarcity concerns and regulatory mandates on potable water standards. By application, the Desiccant segment maintains the largest market share, essential for preventing corrosion and ensuring product integrity across various industrial applications, including air conditioning, refrigeration, and insulation materials production. Segment analysis also reveals a growing preference for smaller sphere sizes (micro-spheres) in catalytic applications, offering higher reaction kinetics and improved efficiency compared to traditional larger particle sizes, thereby influencing material design and manufacturing processes among key vendors.

AI Impact Analysis on Activated Alumina Spheres Market

Users frequently inquire about how Artificial Intelligence (AI) can optimize the synthesis, application, and life cycle management of Activated Alumina Spheres. Common concerns revolve around predictive maintenance for drying towers, optimizing regeneration cycles to minimize energy expenditure, and using machine learning algorithms to fine-tune the material's pore structure during manufacturing for targeted contaminant adsorption. Users expect AI to reduce operational inefficiencies often associated with manual monitoring of adsorption capacity saturation and breakthrough points. The consensus expectation is that AI-driven process control will lead to significant cost savings, extend the lifespan of the adsorption media, and enable manufacturers to develop 'smart' alumina products with self-monitoring capabilities, thereby enhancing performance in highly regulated and automated industrial environments.

- AI algorithms optimize the synthesis parameters (temperature, pH, concentration) of activated alumina to achieve specific surface area and porosity characteristics, ensuring high selectivity.

- Predictive modeling utilizes real-time sensor data from desiccant drying units to forecast saturation and breakthrough, maximizing the utilization rate of the activated alumina bed.

- Machine learning improves energy efficiency in regeneration processes by calculating the optimal heating duration and temperature required based on adsorbed moisture or contaminant load.

- AI-powered simulation tools accelerate the development of novel activated alumina derivatives for emerging applications, such as carbon capture or selective gas separation.

- Automated quality control systems use computer vision and deep learning to inspect sphere uniformity and integrity during high-volume manufacturing, minimizing defects and improving product consistency.

DRO & Impact Forces Of Activated Alumina Spheres Market

The dynamics of the Activated Alumina Spheres Market are significantly shaped by a confluence of accelerating drivers (D), persistent restraints (R), and compelling opportunities (O), collectively establishing the impact forces. The primary driver remains the global industrial shift towards cleaner processes, mandating highly efficient desiccation and purification technologies across petrochemicals, air separation, and environmental cleanup sectors. Simultaneously, the restraint of high energy consumption associated with the regeneration process, necessary to reuse the adsorbent material, presents a continuous challenge for cost-sensitive operations. The major opportunity lies in the burgeoning hydrogen economy, where activated alumina is crucial for purifying hydrogen streams, positioning the material at the forefront of the global energy transition. These three elements — regulatory compliance necessity, operational cost pressures, and emerging high-growth end-user sectors — define the competitive forces that determine market growth trajectory.

Impact forces stemming from global economic volatility, such as fluctuating raw material costs (primarily bauxite and specialized chemicals), directly influence the manufacturing costs of activated alumina, impacting pricing strategies and profit margins. Furthermore, the availability and cost effectiveness of competing adsorbents, such as molecular sieves, silica gel, and specialized polymeric resins, exert a competitive force that necessitates continuous product innovation in the alumina segment. Market penetration is also influenced by environmental regulations; while regulations drive demand for water purification applications, they simultaneously impose strict disposal guidelines for spent alumina media contaminated with toxic substances, adding complexity to the product life cycle management and often increasing operational expenditures for end-users.

The combination of these factors dictates market equilibrium. The strong demand pulled by essential industrial needs (such as compressor air drying) acts as a powerful stabilizing driver, mitigating the effects of price volatility and regeneration costs. However, capitalizing on opportunities like new catalytic applications requires substantial R&D investment and regulatory approval, creating a high barrier to entry for smaller manufacturers. The net impact force is moderately positive, indicating sustained, but heavily competitive, growth, contingent upon manufacturers' ability to continuously innovate products that offer lower regeneration costs and higher adsorption selectivity compared to existing alternatives and competitive materials available in the market.

Segmentation Analysis

The Activated Alumina Spheres Market is comprehensively segmented based on its structural characteristics, application methodology, and geographical concentration, providing granular insights into demand patterns and growth vectors. Segmentation by function (Desiccant, Catalyst, Adsorbent) provides clarity on the primary utility of the product, with desiccation commanding the highest volume usage. Further segmentation by end-use industry (Oil & Gas, Chemical & Petrochemical, Water Treatment, Air Separation) highlights the diverse industrial dependency on activated alumina, driven by specific regulatory and quality requirements within each sector. Analyzing these segments is essential for identifying high-growth niches, such as specialized environmental remediation or advanced chromatographic separation processes, which often utilize premium-grade materials.

- By Function:

- Desiccant

- Catalyst & Catalyst Support

- Adsorbent (Non-drying applications)

- Others (e.g., Filtering, Chromatographic Separation)

- By Form/Size:

- Granular

- Spheres (1/8 inch, 3/16 inch, 1/4 inch)

- Powder

- By End-Use Industry:

- Oil & Gas (Natural Gas Drying, Refinery Processes)

- Chemical & Petrochemical Industry

- Water Treatment (Fluoride, Arsenic, Silica Removal)

- Air Separation & Drying (Compressed Air, Industrial Gases)

- Healthcare and Pharmaceutical

- Food & Beverage Industry

- By Region:

- North America (US, Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain)

- Asia Pacific (China, Japan, India, South Korea)

- Latin America (Brazil, Argentina)

- Middle East & Africa (Saudi Arabia, UAE, South Africa)

Value Chain Analysis For Activated Alumina Spheres Market

The value chain for Activated Alumina Spheres begins with upstream analysis, focusing heavily on the mining and processing of high-purity bauxite ore, the fundamental raw material. This stage involves the complex Bayer process to extract aluminum hydroxide, which is subsequently calcined to produce alumina. Maintaining stringent quality control at the raw material stage is paramount, as the chemical purity and crystalline structure of the resulting alumina directly impact the final product's adsorption capacity and mechanical strength. Key challenges upstream include securing consistent supply of metallurgical-grade bauxite and managing the energy-intensive nature of the calcination process, which significantly dictates initial production costs and environmental footprint.

Midstream activities involve the specialized manufacturing process of activated alumina spheres, including molding, drying, and final activation treatments (e.g., thermal and chemical modifications) that establish the material’s specific porosity and surface area. Manufacturers differentiate themselves here through proprietary technology focused on optimizing pore size distribution for targeted applications, such as developing high-capacity desiccants or selective fluoride adsorbents. Distribution channels are varied: direct sales often dominate for large-volume purchasers in the Oil & Gas and petrochemical sectors, ensuring technical support and tailored logistics. Indirect channels, involving specialized industrial chemical distributors and regional agents, cater effectively to smaller end-users in water treatment and general industrial applications, providing localized inventory and quicker turnaround times.

Downstream analysis centers on the deployment and end-use sectors, particularly large industrial plants requiring bulk media for fixed-bed adsorption towers. The effectiveness and longevity of the product are evaluated at this stage, leading to repeat business or shifts in supplier preference. Direct customers include major engineering, procurement, and construction (EPC) firms that specify the material for new plant builds, while indirect customers are the operational plant managers responsible for maintenance and media replacement. The reverse logistics associated with handling and potentially regenerating or safely disposing of spent activated alumina media, particularly those contaminated with toxic substances, represents a growing and complex element of the downstream value chain, increasingly influencing procurement decisions based on total cost of ownership rather than just initial material price.

Activated Alumina Spheres Market Potential Customers

Potential customers for Activated Alumina Spheres are concentrated in large-scale industrial and infrastructure sectors where moisture control, fluid purification, and catalytic processes are non-negotiable operational requirements. The largest segment of potential customers includes operators of natural gas processing plants and petroleum refineries, which require activated alumina for dehydration and impurity removal to meet pipeline specifications and protect expensive downstream equipment. These buyers are typically large, multinational corporations with substantial procurement budgets, emphasizing product performance specifications, reliability, and long-term supply agreements over marginal cost savings, making technical superiority a critical competitive factor for suppliers.

Another major segment comprises municipal water treatment authorities and specialized environmental engineering firms globally. These customers utilize activated alumina primarily for the selective removal of contaminants like arsenic and fluoride from municipal drinking water sources, responding directly to public health mandates and strict regulatory limits. This customer base often demands products certified under various international standards (e.g., NSF/ANSI), focusing heavily on material safety, efficacy under varying pH conditions, and regeneration frequency. Sales cycles in this segment can be longer due to public tendering and rigorous field testing requirements before large-scale adoption.

Furthermore, manufacturers of industrial gases (such as oxygen, nitrogen, and argon) and compressed air system providers represent steady customers. These companies rely on activated alumina as the primary desiccant to ensure the ultra-low dew points necessary for high-purity gas production and equipment longevity. These customers prioritize high mechanical crush strength, dust resistance, and optimal bulk density to maximize the efficiency of their adsorption towers. The trend towards miniaturization in industrial drying equipment also opens opportunities with original equipment manufacturers (OEMs) specializing in portable air dryers and small-scale gas purification units, requiring tailored packaging and specific particle sizing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.35 Billion |

| Market Forecast in 2033 | USD 2.15 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Honeywell UOP, Porocel Corporation, Adsorbents & Desiccants Corporation of America (ADCA), Fuji Silysia Chemical Ltd., Sumitomo Chemical Co., Ltd., Axens SA, Sibelco, Shandong Aluminum Industry Co., Ltd., R.V. Refractories & Ceramics Pvt. Ltd., Sorbead India, Chempack, Zibo Xiangrun Environment Engineering Co., Ltd., Dynamic Adsorbents, Inc., Hengye Inc., AGC Inc., Saint-Gobain, General Chemical, Sorbent Technologies, CECA S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Activated Alumina Spheres Market Key Technology Landscape

The technological landscape of the Activated Alumina Spheres market is characterized by continuous refinement in synthesis methods aimed at controlling pore size distribution, surface chemistry, and thermal stability. A pivotal technology involves controlled precipitation and hydrothermal synthesis, which allow manufacturers to produce highly uniform spheres with tailored porosity profiles, distinguishing high-performance adsorbents from standard grades. Furthermore, impregnation technology is critical, where activated alumina spheres are doped with various metal oxides or specific chemical agents (such as potassium permanganate for specialized purification) to enhance their selectivity for difficult-to-capture contaminants like mercury vapor or ethylene, significantly broadening the product’s application scope beyond simple desiccation.

Process engineering improvements represent another significant technology area, particularly focusing on reducing the energy consumption required during the activation and regeneration phases. Innovations in low-temperature activation methods and the development of energy-efficient adsorption cycling systems are key focus areas for major players seeking to lower the total operational cost for end-users. The increasing integration of Internet of Things (IoT) sensors into adsorption towers allows for real-time monitoring of pressure, temperature, and moisture content, facilitating data-driven decisions on media replacement and regeneration timing, thereby optimizing the performance and extending the service life of the material while minimizing energy waste.

Finally, the development of specialized alumina-based composites and hybrid materials is an emerging technological frontier. These new materials combine the high surface area of activated alumina with the structural benefits of other supports (like zeolites or metal-organic frameworks) to create superior adsorbents for advanced applications, such as small-scale modular air separation units or complex catalytic converters. Nanotechnology also plays a role, with research dedicated to creating nano-porous alumina structures that offer unprecedented adsorption kinetics and capacity, though mass commercialization of these ultra-high-performance grades is still in nascent stages, focusing primarily on high-value pharmaceutical and electronic manufacturing requirements.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant and fastest-growing region, driven by extensive industrial expansion, particularly in the Oil & Gas, refining, and manufacturing sectors of China, India, and Southeast Asian nations. High population density and resulting environmental pressures necessitate massive investments in municipal water treatment infrastructure, creating immense demand for activated alumina in fluoride and arsenic removal programs. Government initiatives supporting industrial development and foreign direct investment further solidify the region's leading position, although pricing remains highly competitive due to large local production capacity.

- North America: North America represents a mature, high-value market characterized by stringent environmental protection agency (EPA) regulations, particularly concerning natural gas purity and industrial emissions. The region is a key adopter of advanced activated alumina grades used in specialized petrochemical catalyst supports and high-efficiency compressed air drying systems. The focus here is on product performance, longevity, and sustainability, often demanding materials with lower dusting characteristics and enhanced mechanical integrity for long operational periods.

- Europe: Europe maintains a strong focus on sustainable chemical processing and environmental technology. Demand is robust due to strict European Union directives mandating precise control over industrial effluent and drinking water quality. Activated alumina is heavily utilized in specialty gas purification, particularly for industrial gases used in semiconductor manufacturing, and increasingly in addressing emerging contaminants like pharmaceutical residues and trace hydrocarbons in water recycling efforts. Innovation in regeneration technology to improve energy efficiency is a regional priority.

- Middle East and Africa (MEA): This region exhibits significant growth potential primarily linked to large-scale infrastructure projects in the Oil & Gas sector, demanding substantial quantities of activated alumina for natural gas dehydration and refinery processes. Furthermore, water scarcity in the Middle East drives demand for specialized adsorbents in desalination pre-treatment and water reuse schemes. South Africa and Saudi Arabia are key markets, benefiting from government diversification efforts that increase localized industrial activity and power generation requirements.

- Latin America (LATAM): Growth in LATAM is driven by investments in mining, petrochemical production, and expanding infrastructure, particularly in Brazil and Mexico. The market is moderately fragmented, with local industries seeking cost-effective solutions for basic desiccation and industrial air drying. Demand for municipal water purification, particularly for arsenic mitigation in geographically affected areas, is a critical emerging driver, necessitating affordable and reliable activated alumina supplies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Activated Alumina Spheres Market.- BASF SE

- Honeywell UOP

- Porocel Corporation

- Adsorbents & Desiccants Corporation of America (ADCA)

- Fuji Silysia Chemical Ltd.

- Sumitomo Chemical Co., Ltd.

- Axens SA

- Sibelco

- Shandong Aluminum Industry Co., Ltd.

- R.V. Refractories & Ceramics Pvt. Ltd.

- Sorbead India

- Chempack

- Zibo Xiangrun Environment Engineering Co., Ltd.

- Dynamic Adsorbents, Inc.

- Hengye Inc.

- AGC Inc.

- Saint-Gobain

- General Chemical

- Sorbent Technologies

- CECA S.A.

Frequently Asked Questions

Analyze common user questions about the Activated Alumina Spheres market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary industrial applications of Activated Alumina Spheres?

Activated Alumina Spheres are primarily used as highly efficient desiccants for drying industrial gases (like air and natural gas), as adsorbents for removing trace contaminants (such as fluoride, arsenic, and sulfur) from liquids, and as catalyst supports in various petrochemical processes due to their high surface area and chemical stability.

How does the Activated Alumina Market compare to the Molecular Sieves Market?

Activated alumina competes directly with molecular sieves, especially in drying applications. Activated alumina is generally more cost-effective and structurally robust, favored for large-volume bulk desiccation. Molecular sieves offer higher selectivity and greater capacity for low water concentrations but typically come at a higher initial cost, positioning them for high-purity or specialized separation requirements.

What factors determine the effective lifespan of activated alumina?

The lifespan of activated alumina is primarily determined by the quality and effectiveness of its regeneration cycle, the presence of poisoning agents in the feed stream (which can block pores irreversibly), operating temperature, and the frequency of thermal cycling, which affects mechanical integrity. Proper regeneration practices are essential for maximizing media longevity.

Which regional segment drives the highest growth in Activated Alumina demand?

The Asia Pacific (APAC) region currently drives the highest growth in Activated Alumina demand. This rapid expansion is attributed to large-scale industrialization, significant investments in natural gas infrastructure and refining capacity, and critical requirements for advanced municipal water purification projects across major economies like China and India.

Is activated alumina safe and sustainable for use in drinking water treatment?

Yes, when manufactured to required standards (such as NSF/ANSI certifications), activated alumina is safe for drinking water treatment, specifically for the removal of arsenic and fluoride. It is considered a sustainable adsorbent because it can be regenerated numerous times, although the disposal of spent media contaminated with toxic heavy metals requires careful, regulated handling.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Activated Alumina Spheres Market Size Report By Type (0 5 mm, 5 mm 0 8 mm, 0 8 mm), By Application (Catalyst, Desiccant, Fluoride Adsorbent, Bio Ceramics, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Activated Alumina Spheres Market Statistics 2025 Analysis By Application (Refining, Air Separation, Natural Gas, Petrochemicals), By Type (??5mm, 5mm???8mm, ??8mm), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager