Activated Carbon Mobile Filters Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436278 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Activated Carbon Mobile Filters Market Size

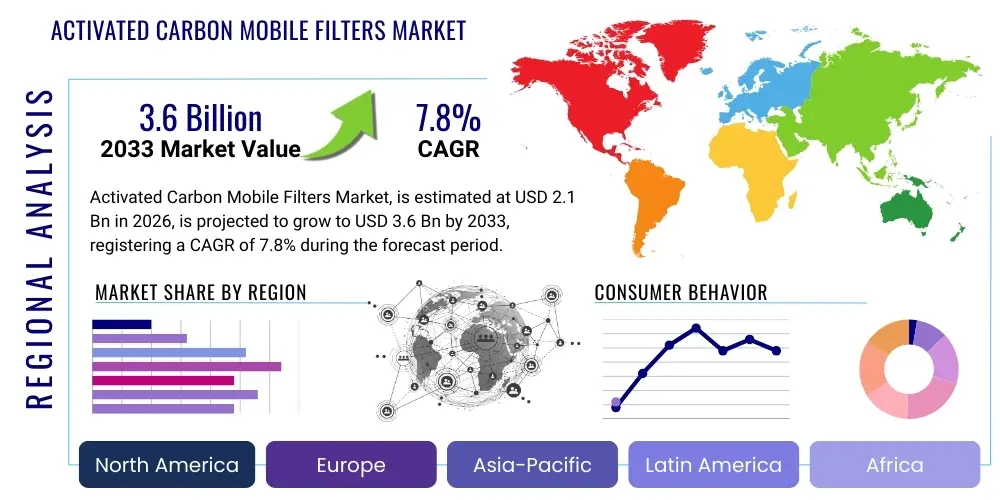

The Activated Carbon Mobile Filters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.6 Billion by the end of the forecast period in 2033.

Activated Carbon Mobile Filters Market introduction

The Activated Carbon Mobile Filters Market encompasses portable, scalable filtration systems utilizing granular or powdered activated carbon to effectively remove organic and inorganic pollutants, volatile organic compounds (VOCs), and odors from air or liquid streams. These mobile units are engineered for rapid deployment, making them essential tools for temporary environmental remediation, emergency spill response, construction site dewatering, and intermittent industrial processes where fixed filtration infrastructure is impractical or unavailable. The core product relies on the high adsorption capacity of activated carbon derived primarily from coconut shells, wood, or coal sources, offering a sustainable and highly efficient solution for meeting stringent environmental discharge standards.

Major applications of activated carbon mobile filters span across diverse sectors, including chemical manufacturing, petrochemical refining, municipal water treatment (especially for addressing peak flow demands or emerging contaminants), ground water remediation, and air purification in temporary manufacturing enclosures. These systems provide immediate relief from contamination issues, ensuring compliance with local and federal environmental regulations without the long lead times associated with permanent installations. The flexibility and ease of transport associated with mobile units significantly reduce operational downtime and capital expenditure for end-users facing unpredictable or short-term filtration needs.

Key benefits driving market adoption include their high efficacy in removing a broad spectrum of pollutants, modular design allowing for customized flow rates and contaminant removal levels, and inherent portability. Driving factors fueling the market growth are the increasing global focus on environmental protection, the proliferation of temporary industrial projects, and the rising complexity and severity of environmental regulations, particularly concerning groundwater protection and air quality standards in densely populated or industrialized regions. The demand for immediate, reliable, and scalable purification solutions continues to propel innovation in mobile adsorption technology.

Activated Carbon Mobile Filters Market Executive Summary

The Activated Carbon Mobile Filters Market is characterized by robust growth driven by escalating environmental compliance pressures and the increasing frequency of temporary remediation projects globally. Business trends indicate a strong shift towards leasing and service-based models, rather than outright sales, allowing end-users to manage operational expenditures efficiently while gaining access to advanced, well-maintained filtration technology. Technological advancements are focusing on enhancing the regeneration capability of activated carbon units on-site and integrating remote monitoring systems to optimize adsorption performance and minimize service interruptions. Furthermore, strategic partnerships between environmental service providers and activated carbon manufacturers are becoming commonplace, aimed at delivering integrated, full-cycle solutions, encompassing filter media supply, deployment, monitoring, and disposal or regeneration.

Regionally, North America and Europe dominate the market due to established, strict environmental regulatory frameworks (such as EPA mandates and REACH regulations) and high levels of industrial activity requiring rigorous pollution control. However, the Asia Pacific (APAC) region is poised for the fastest growth, fueled by rapid industrialization, massive infrastructure development, and increasing governmental focus on mitigating severe air and water pollution problems. Developing economies in APAC are adopting mobile filtration solutions as a quick and effective measure to address legacy contamination and manage industrial waste streams generated by new manufacturing hubs. The Middle East and Africa (MEA) region shows emerging potential, primarily driven by large-scale oil and gas infrastructure projects and increasing demands for potable water treatment solutions in arid environments.

Segmentation trends highlight the dominance of the air filtration segment, particularly for VOC abatement in manufacturing and petrochemical sites, though the liquid filtration segment, especially for groundwater and process water treatment, is exhibiting accelerated growth due to increased infrastructure spending and complex remediation requirements. The market is also seeing differentiation based on carbon type, with coconut shell-based carbon gaining traction due to its high microporosity and lower environmental impact compared to coal-based variants. The mobile rental segment remains the largest service type, reflecting the temporary and emergency nature of many applications, demanding scalable and readily deployable assets.

AI Impact Analysis on Activated Carbon Mobile Filters Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and the Activated Carbon Mobile Filters Market frequently center on how machine learning can enhance the efficiency and predictive capability of these essential environmental remediation tools. Common questions revolve around AI’s role in optimizing carbon bed saturation prediction, automating the regeneration process, and dynamically adjusting filter flow rates based on real-time pollutant detection and concentration changes. Users are keenly interested in reducing operational expenditure (OPEX) through smarter usage cycles and minimizing the environmental footprint associated with premature carbon replacement or inefficient operation. The overarching theme is the transition from scheduled maintenance to predictive, data-driven filtration management, ensuring peak performance and regulatory compliance with minimized human intervention.

AI's integration offers significant advancements over traditional fixed-schedule maintenance protocols. By utilizing machine learning algorithms trained on historical adsorption data, flow rates, temperature, humidity, and real-time sensor inputs (e.g., photoionization detectors or conductivity meters), AI can accurately predict the remaining effective life of the activated carbon media. This capability is paramount for mobile units, which often operate under highly variable load conditions and diverse contaminant matrices. Predictive maintenance prevents breakthrough events—where contaminants pass through saturated filters—thereby safeguarding environmental compliance and reducing liability for the operator.

Furthermore, AI facilitates Generative Engine Optimization (GEO) in the context of mobile deployment by allowing operational data from multiple disparate units across various locations to inform a centralized optimization model. This feedback loop enhances the overall fleet management strategy, recommending the ideal carbon type and unit configuration for newly encountered environmental challenges. The ability to autonomously adjust parameters such as contact time and backwash frequency based on predictive models translates directly into improved contaminant removal efficiency and reduced labor costs associated with manual system checks and performance validation, cementing AI as a pivotal technology for future market growth.

- AI-driven predictive maintenance optimizes carbon replacement schedules, reducing operational waste and costs associated with premature media disposal.

- Machine learning algorithms enhance real-time monitoring and dynamic adjustment of flow rates, maximizing contact time efficiency under varying contaminant loads.

- Integration of smart sensors and AI permits automated identification and classification of complex pollutant mixtures, enabling targeted treatment strategies.

- AI modeling allows for the simulation of contaminant adsorption curves, assisting operators in selecting the optimal mobile filter unit size and carbon type for specific project requirements.

- Fleet-level optimization through centralized AI platforms improves asset utilization, minimizing idle time and speeding up deployment logistics for urgent environmental responses.

- Enhanced reporting and compliance verification: AI automatically generates detailed performance logs and compliance reports, significantly reducing administrative burden and ensuring regulatory adherence.

- Optimization of energy consumption: AI adjusts pump speeds and fan operations based on real-time needs, minimizing power usage for environmentally conscious operations.

DRO & Impact Forces Of Activated Carbon Mobile Filters Market

The Activated Carbon Mobile Filters Market is principally driven by stringent global environmental legislation necessitating immediate and flexible pollution abatement solutions, particularly in temporary operational settings. Restraints include the high cost associated with the transportation and regeneration of spent activated carbon, coupled with growing competition from alternative filtration technologies like ion exchange resins and membrane filtration systems that offer different operational efficiencies for specific applications. However, significant opportunities exist in the development of modular, high-capacity adsorption systems and the expansion of the market into emerging economies grappling with newly implemented industrial pollution control policies. These factors, alongside broader economic and technological trends, exert significant impact forces shaping the market trajectory over the forecast period.

Key drivers center around the global increase in remediation projects aimed at cleaning up contaminated land and groundwater, particularly sites affected by PFAS (per- and polyfluoroalkyl substances) and other emerging contaminants that activated carbon effectively targets. The mobility and scalability of these filter units make them the preferred choice for immediate response to accidental spills, industrial emergencies, and construction dewatering, where the speed of deployment is critical. Furthermore, the growing trend of temporary industrial setups, such as modular refineries or short-term manufacturing facilities, requires readily available, temporary air and water purification systems, directly boosting the demand for rental fleets of mobile carbon filters. The environmental liability associated with non-compliance further compels businesses to invest in these reliable, deployable solutions.

Conversely, the market faces headwinds primarily related to the logistics and sustainability challenges of activated carbon media. The high energy and operational costs involved in thermal regeneration—the standard method for reactivating spent carbon—can deter adoption, prompting end-users to seek cheaper disposal or alternative methods. Moreover, competition from sophisticated, highly specific non-carbon filtration systems (such as specialized media for nitrate removal or advanced oxidation processes) poses a restraint, particularly when carbon filters might require complex pre-treatment steps. Market penetration also depends heavily on the robustness of the rental infrastructure, which is still nascent in many developing regions, limiting access to these crucial environmental tools.

- Drivers:

- Escalating global environmental regulations concerning VOCs and waterborne contaminants (e.g., PFAS).

- Increasing frequency and scale of environmental remediation and emergency response operations requiring rapid deployment.

- Growth in temporary industrial and construction projects necessitating short-term, scalable filtration infrastructure.

- Favorable economics of rental and service-based models compared to high-capital permanent installations.

- Restraints:

- High costs associated with transportation, handling, and thermal regeneration or disposal of spent activated carbon media.

- Intense competition from sophisticated alternative filtration technologies (e.g., specialized polymeric adsorbents and membrane filtration).

- Fluctuating raw material prices for activated carbon production (e.g., coal and coconut shells).

- Logistical complexities in maintaining large, geographically dispersed fleets of mobile filtration units.

- Opportunities:

- Development and commercialization of advanced, low-energy, and on-site activated carbon regeneration technologies.

- Integration of IoT and AI for remote monitoring, predictive maintenance, and optimized adsorption performance.

- Expansion into niche applications such as biogas purification, pharmaceutical wastewater treatment, and odor control in waste management facilities.

- Untapped growth potential in industrializing nations lacking comprehensive fixed pollution control infrastructure.

- Impact Forces:

- Environmental Compliance: Extremely high, as mobile filters are often mandated to maintain regulatory discharge limits during temporary or emergency situations.

- Technological Advancements: Moderate to High, driven by demand for increased efficiency, smaller footprints, and smarter operations (AI/IoT).

- Supply Chain Vulnerability: Moderate, linked to global sourcing and processing of raw carbon media and large-scale metal fabrication for vessel construction.

- Total Cost of Ownership (TCO): High, as TCO is a critical decision-making factor, balancing initial rental costs against operational expenses and media handling.

Segmentation Analysis

The Activated Carbon Mobile Filters Market is extensively segmented based on application (air filtration, liquid filtration), end-user industry (industrial, municipal, remediation), and filter media type (granular activated carbon (GAC), powdered activated carbon (PAC), extruded activated carbon (EAC)). The segmentation allows market participants to tailor their services and product offerings precisely to the diverse operational needs and regulatory environments encountered by various end-users. Liquid filtration, particularly for groundwater and process water, constitutes a major revenue segment due to increasingly strict wastewater discharge standards and the complexity of treating emerging contaminants.

Within the application segment, air filtration demand is strong, specifically in managing Volatile Organic Compounds (VOCs) and hazardous air pollutants (HAPs) generated by batch chemical processes, tank ventilation, and soil vapor extraction (SVE) systems during environmental cleanups. The preference for GAC remains dominant across both air and liquid segments due to its robust structure, ease of handling, and suitability for large mobile vessel applications. However, newer formulations and specialized impregnated carbons are gaining prominence where specific chemical removal capabilities are required, such as enhanced mercury or hydrogen sulfide scavenging.

The end-user segmentation clearly indicates that the industrial sector, including petrochemicals, manufacturing, and pharmaceuticals, is the primary consumer, utilizing mobile filters for managing intermittent discharges and accidental releases. The remediation segment, encompassing short-term groundwater pump-and-treat projects, represents the highest growth potential due to the sheer volume of global contaminated sites requiring active cleanup. Municipal utilities leverage these mobile units for pilot studies, emergency chlorine removal, taste and odor control during source water changes, or managing temporary peak demands outside the capacity of permanent treatment plants, showcasing the versatile utility of mobile adsorption technology.

- Application:

- Liquid Filtration (Groundwater Remediation, Industrial Process Water, Municipal Water Treatment)

- Air Filtration (Soil Vapor Extraction (SVE), Tank Venting, Odor Control, VOC Abatement)

- Carbon Type:

- Granular Activated Carbon (GAC)

- Powdered Activated Carbon (PAC)

- Extruded Activated Carbon (EAC)

- Impregnated Carbon

- End-User Industry:

- Industrial (Chemical, Petrochemical, Pharmaceutical, Food & Beverage)

- Environmental Remediation Services

- Municipal Water and Wastewater Utilities

- Construction and Mining

- Unit Capacity:

- Small Capacity (Below 1,000 lbs Carbon)

- Medium Capacity (1,000 lbs - 5,000 lbs Carbon)

- Large Capacity (Above 5,000 lbs Carbon)

Value Chain Analysis For Activated Carbon Mobile Filters Market

The value chain for Activated Carbon Mobile Filters is intricate, starting from the sourcing and preparation of raw materials and extending through complex manufacturing, robust logistics, and comprehensive end-of-life media management. The upstream segment is dominated by suppliers of precursor materials, primarily bituminous coal, lignite, coconut shells, and wood, which are then processed into activated carbon. This activation process, usually involving high-temperature pyrolysis followed by steam or chemical activation, is highly energy-intensive and critical for determining the final adsorption performance characteristics, such as surface area and pore size distribution, which directly impact the filter unit's effectiveness against targeted contaminants.

The midstream involves the design, fabrication, and assembly of the mobile filter vessels, often constructed from durable materials like carbon steel or fiberglass reinforced plastics (FRP) to withstand harsh operating environments. Key players in this stage focus on engineering modular and skid-mounted systems that are easily transportable and adaptable to various flow rates and pressure requirements. Distribution channels are highly dependent on the service model: direct sales are common for large industrial clients purchasing permanent backup systems, whereas the rental model heavily relies on a network of specialized environmental service companies that manage and maintain large fleets of these mobile units, ensuring immediate deployment capability.

Downstream activities include the actual deployment, monitoring, and ongoing technical support provided to the end-user. Crucially, the final stage involves the handling of spent carbon. This segment is characterized by specialized logistics for contaminated materials and either off-site thermal reactivation (regeneration) or compliant disposal. Companies that offer integrated services, combining carbon supply, filter rental, and media regeneration, capture the most value by controlling the entire lifecycle of the product and offering clients a closed-loop, sustainable solution, thus strengthening client loyalty and maximizing operational efficiency through indirect channels like environmental consulting firms and engineering procurement construction (EPC) contractors.

Activated Carbon Mobile Filters Market Potential Customers

Potential customers for Activated Carbon Mobile Filters are highly diversified across industrial, municipal, and government sectors, driven by their universal need for flexible and immediate pollution control. The primary target segment includes large industrial facilities, such as petrochemical plants and chemical manufacturers, which generate complex wastewater and air emissions that require rigorous, often temporary, treatment during shutdowns, maintenance, or process modifications. These facilities utilize mobile units to manage non-routine discharges, ensuring uninterrupted regulatory compliance, which represents a critical operational requirement for continuous processing industries. The demand here is centered on high-capacity units capable of handling substantial flow rates and highly concentrated pollutants.

Another significant customer base comprises specialized environmental service providers and consulting firms that manage remediation projects. These firms contract with property owners or governmental agencies (like the EPA or equivalent bodies) to clean up contaminated soil and groundwater sites. For pump-and-treat or soil vapor extraction operations, mobile activated carbon units are indispensable as they offer the necessary flexibility to move between treatment zones and scale operations up or down based on contaminant plume characteristics and regulatory milestones. This customer segment places a premium on reliability, rapid mobilization, and documented performance verification.

Municipal water and wastewater treatment utilities represent a growing customer base, particularly in response to emerging regulatory mandates (e.g., controlling trace pharmaceuticals or disinfection byproducts) or infrastructure failures. Mobile filters are utilized for emergency responses to source water contamination, short-term deployment during maintenance of fixed plant filters, or for pilot testing new treatment chemistries prior to committing to major capital expenditures. Furthermore, the construction and mining industries are increasingly using these filters for dewatering activities, where extracted groundwater must meet strict discharge criteria before being released into surface water bodies, establishing them as essential equipment for temporary infrastructure projects.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.6 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Evoqua Water Technologies, Calgon Carbon Corporation (Kuraray), Jacobi Carbons (Osaka Gas Chemicals), Clean Harbors, TIGG Corporation, Carbon Service & Equipment Co., Cabot Corporation, Carbtrol Corporation, Desotec, Pure Effect Inc., Filtration Group, SUEZ, Veolia Water Technologies, Continental Carbon Group, Waterlink, RSE, General Carbon Corporation, Chemviron Carbon, Filtec Ltd., Puragen Activated Carbons |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Activated Carbon Mobile Filters Market Key Technology Landscape

The Activated Carbon Mobile Filters market is heavily influenced by advancements in adsorption science, materials engineering, and digital connectivity, focusing on enhancing performance, extending media life, and improving operational efficiency. A pivotal technological focus is the development of specialized activated carbon media designed to target specific, difficult-to-treat contaminants, such as PFAS compounds, 1,4-dioxane, and various endocrine-disrupting chemicals. This involves precise control over the porosity profile and surface chemistry of the carbon during the activation phase, often incorporating chemical impregnation with elements like sulfur or iodine to boost chemisorption capabilities beyond physical adsorption alone, thereby increasing the filter’s overall efficacy and extending the service interval between media changes.

Furthermore, the physical design of the mobile filtration units is undergoing continuous refinement. Innovations include highly modular skid designs that allow for easy linking and configuring of multiple vessels in series or parallel, ensuring adaptability to variable contaminant concentrations and flow requirements without requiring extensive site modification. The adoption of robust, lightweight materials for vessel construction, such as high-density polyethylene (HDPE) or advanced composites, facilitates easier transport and rapid deployment, especially in remote or difficult-to-access remediation sites. Emphasis is also placed on designing filters with streamlined inlet/outlet piping and quick-connect couplings to minimize setup time and potential leak points.

The most transformative trend in the technology landscape is the integration of Industrial Internet of Things (IIoT) sensors and telematics into mobile units. These systems enable real-time monitoring of crucial operational parameters, including flow rate, differential pressure, pH, and surrogate contaminant levels (e.g., TOC or UV254 absorbance). Data gathered by these IoT devices is relayed to cloud platforms, where AI-powered analytics predict saturation curves, optimize backwash cycles, and generate automated alerts for media change-out. This digitalization significantly enhances the remote management capabilities of large rental fleets and provides essential, auditable data to ensure continuous regulatory compliance, driving the market towards smarter, self-optimizing filtration solutions.

- Advanced Media Development: Focus on high-performance activated carbons (e.g., coconut shell-based) with optimized pore structures for targeting emerging contaminants like PFAS and 1,4-Dioxane.

- Chemical Impregnation: Use of chemically treated carbon (e.g., acid-washed or sulfur-impregnated) to enhance removal of specific air pollutants like hydrogen sulfide and mercury vapor through chemisorption.

- Modular Skid Integration: Design of compact, standardized, and stackable skid-mounted vessels for enhanced transport efficiency and customizable configuration (series/parallel operation).

- IIoT and Remote Telemetry: Deployment of wireless sensors (pressure, temperature, flow, PID) and cloud-based analytics platforms for real-time performance tracking and predictive maintenance scheduling.

- Automated Valve and Flow Control: Implementation of smart actuators and control loops that autonomously adjust operational parameters based on sensor input, optimizing contaminant contact time.

- On-site Regeneration Technology: Research into microwave or low-energy catalytic regeneration processes to reduce the logistical and cost burden associated with off-site thermal reactivation of spent carbon.

- Compliance Reporting Automation: Software integration to automatically generate and archive detailed performance reports required by environmental regulatory bodies, minimizing manual effort.

Regional Highlights

North America maintains a commanding position in the Activated Carbon Mobile Filters Market, driven primarily by the exceptionally mature and stringent regulatory environment enforced by the Environmental Protection Agency (EPA) across the United States and Canada. Regulations governing air quality (MACT standards, VOC reduction) and water treatment (Superfund sites, Safe Drinking Water Act) necessitate proactive, high-efficiency remediation. The region benefits from a well-established infrastructure of rental companies and environmental service providers, ensuring the rapid deployment and professional servicing of mobile filtration assets. Furthermore, the prevalence of large-scale petrochemical and manufacturing industries, coupled with ongoing, significant environmental remediation efforts focused on contaminated groundwater plumes, sustains high demand for readily available mobile carbon units, particularly in the liquid phase filtration segment.

Europe represents the second-largest market, characterized by a strong focus on circular economy principles and comprehensive environmental directives such as REACH and the Water Framework Directive. European demand is bolstered by industrial modernization projects and strict adherence to emission limits, driving continuous investment in mobile air purification for intermittent industrial sources and extensive use in municipal wastewater treatment to combat trace contaminants like pharmaceuticals. Germany, the UK, and the Benelux countries are major consumers, emphasizing the need for advanced, energy-efficient filtration solutions. The market here is highly competitive, with a strong preference for sustainable carbon sources and specialized, high-capacity mobile units capable of fitting within constrained urban industrial sites, facilitating the growth of on-site media regeneration capabilities to reduce transport burdens.

The Asia Pacific (APAC) region is projected to experience the fastest growth rate throughout the forecast period. This accelerated expansion is attributed to rapid, large-scale industrialization in economies such as China, India, and Southeast Asian nations, leading to severe localized air and water pollution challenges. Governments in these regions are increasingly implementing and enforcing stricter environmental standards under intense public scrutiny, driving immediate demand for reliable pollution control technologies. Since permanent infrastructure often lags behind industrial growth, mobile filtration units serve as an essential bridging technology for compliance and temporary pollutant management. The vast number of new construction and infrastructure projects, coupled with the need for immediate air and water quality improvements, positions APAC as the dominant growth engine, though logistical complexity remains a hurdle.

Latin America (LATAM) exhibits moderate growth potential, concentrated primarily in resource-rich nations like Brazil, Mexico, and Chile, driven by the mining, oil and gas, and food and beverage sectors. The market is characterized by intermittent demand tied to specific industrial projects and regional regulatory enforcement variability. Mobile filters are valued here for their ability to manage complex process water treatment in remote areas where fixed infrastructure is expensive and difficult to maintain. However, market adoption faces challenges related to economic volatility and less mature rental fleet infrastructure compared to North America and Europe, often requiring local distributors to maintain smaller, highly localized inventory supplies to service demand effectively.

The Middle East and Africa (MEA) market is nascent but rapidly developing, predominantly fueled by massive investments in the oil and gas sector, desalination projects, and the expansion of urban infrastructure. In the Middle East, mobile filters are critical for managing process water and air emissions from refineries and petrochemical plants, as well as for emergency water treatment needs in arid areas. In Africa, particularly South Africa and North African nations, demand is gradually increasing due to growing mining activity and nascent governmental efforts to enhance municipal water security and sanitation. The need for robust, reliable, and easily deployable solutions in harsh climatic conditions drives interest in high-durability mobile units, emphasizing robust construction and minimized maintenance requirements.

- North America: Dominance due to stringent EPA regulations (Superfund, VOCs) and mature environmental service infrastructure; high demand in industrial and groundwater remediation sectors.

- Europe: Strong growth driven by EU environmental directives, circular economy goals, and high usage in municipal water treatment for emerging contaminants; focus on sustainable carbon sourcing.

- Asia Pacific (APAC): Highest CAGR expected, propelled by rapid industrial expansion, increasing government enforcement against pollution, and large-scale infrastructure development in China and India.

- Latin America (LATAM): Moderate growth tied to resource extraction (mining, oil & gas); emphasis on mobile solutions for remote or temporary industrial operations and regulatory compliance.

- Middle East and Africa (MEA): Emerging market driven by oil & gas investments, desalination projects, and localized requirements for rapid water purification in arid zones.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Activated Carbon Mobile Filters Market.- Evoqua Water Technologies

- Calgon Carbon Corporation (A Kuraray Company)

- Jacobi Carbons AB (An Osaka Gas Chemicals Company)

- Desotec NV

- TIGG Corporation

- Clean Harbors Inc.

- Carbon Service & Equipment Co.

- Cabot Corporation

- Carbtrol Corporation

- Pure Effect Inc.

- Continental Carbon Group

- Veolia Water Technologies

- SUEZ

- Filtration Group Corporation

- RSE Environmental

- General Carbon Corporation

- Waterlink Environmental Systems

- Chemviron Carbon (A Calgon Carbon Company)

- Clarcor Industrial Air (Part of Filtration Group)

- Puragen Activated Carbons

Frequently Asked Questions

Analyze common user questions about the Activated Carbon Mobile Filters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Activated Carbon Mobile Filters Market?

Market growth is primarily driven by increasingly stringent global environmental regulations governing air and water quality, demanding rapid, temporary, and highly efficient pollution control solutions. The rising number of environmental remediation projects and the favorable economics of rental and service-based models also significantly contribute to market expansion.

How does the integration of AI impact the operational efficiency of mobile carbon filters?

AI integration, specifically through IoT sensors and machine learning, allows for predictive maintenance, optimizing the timing of carbon media replacement to maximize service life and prevent pollutant breakthrough. This data-driven approach enhances removal efficiency, reduces manual labor costs, and ensures continuous regulatory compliance.

Which end-user segment is the largest consumer of activated carbon mobile filters?

The industrial sector, including petrochemical, chemical manufacturing, and pharmaceutical industries, remains the largest consumer, utilizing mobile units for managing non-routine process emissions, tank venting, and emergency spill response, where temporary, high-volume filtration is essential.

What challenges exist regarding the sustainability of activated carbon mobile filtration systems?

The main sustainability challenges involve the energy-intensive process of thermal regeneration for spent carbon and the logistics of transporting contaminated media. Efforts are focused on developing low-energy, on-site regeneration methods and utilizing more sustainable carbon feedstocks like coconut shells and wood.

What is the typical lifespan of activated carbon media in a mobile filter?

The lifespan of activated carbon media is highly variable, depending heavily on the contaminant concentration, flow rate, temperature, and specific media type. In general, it can range from a few weeks in highly contaminated emergency applications to several months in routine odor control applications before regeneration or disposal is required.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager