Active Epoxy Toughening Agent Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435717 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Active Epoxy Toughening Agent Market Size

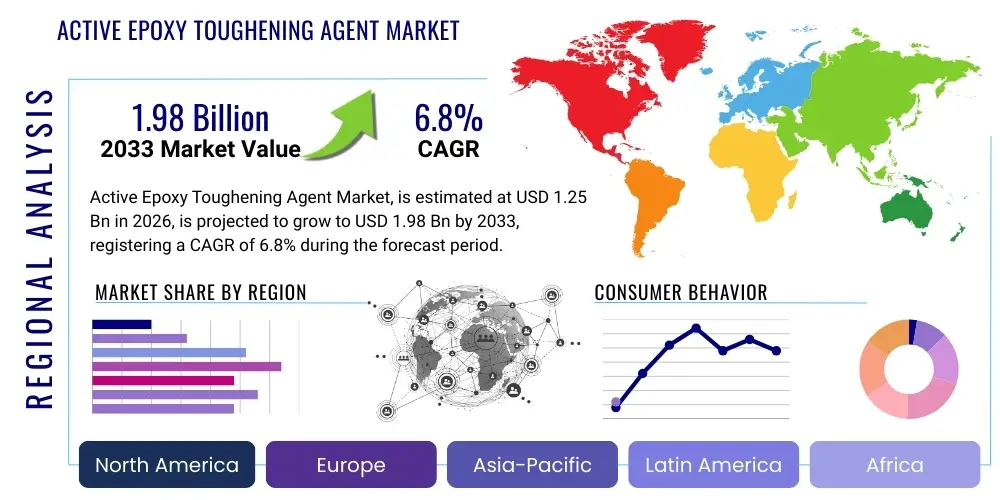

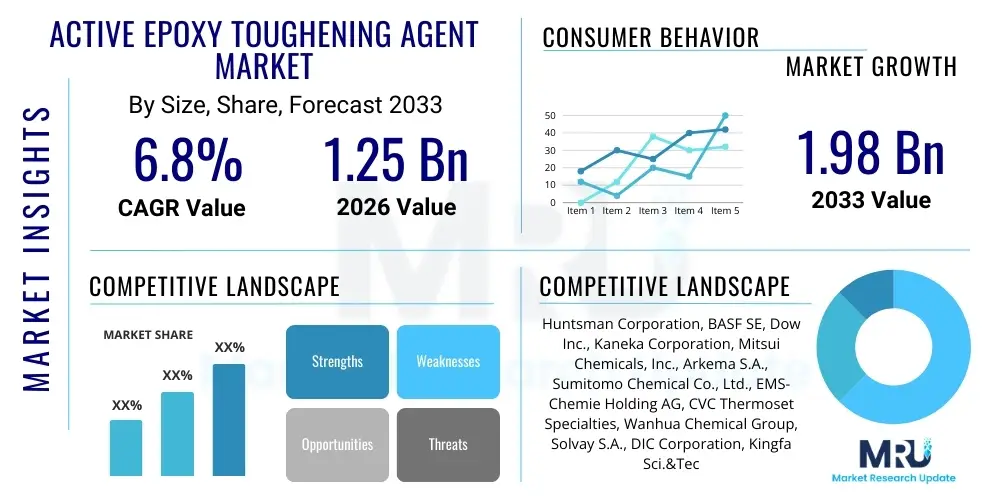

The Active Epoxy Toughening Agent Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.98 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating demand for high-performance composite materials across critical industries such as aerospace, automotive, and wind energy, where superior impact resistance and fatigue strength are non-negotiable requirements for structural integrity.

Active Epoxy Toughening Agent Market introduction

The Active Epoxy Toughening Agent Market involves specialized chemical additives designed to significantly enhance the fracture toughness, impact strength, and overall durability of thermosetting epoxy resin systems without excessively compromising essential mechanical properties like glass transition temperature (Tg) or stiffness. These agents, which primarily include core-shell rubber (CSR) particles, liquid rubbers (such as carboxyl-terminated butadiene acrylonitrile, CTBN), and specific block copolymers, function by inducing mechanisms like crack pinning, shear banding, and crack path deflection within the brittle epoxy matrix. The primary objective is to absorb energy during stress application, thereby preventing catastrophic failure and extending the operational lifespan of the final product.

Major applications for active epoxy toughening agents span a vast range of demanding environments, including structural adhesives for automotive lightweighting, advanced composite matrices for aircraft primary structures, protective coatings requiring extreme impact resistance, and encapsulation materials in electronics. The core benefit derived from their use is the transformation of traditionally brittle epoxy systems into materials possessing enhanced structural reliability and performance under dynamic loading conditions. Furthermore, these agents often allow material formulators to meet increasingly stringent industry standards related to safety and material longevity, especially in high-stress applications.

Key driving factors accelerating market expansion include the global push for lightweight materials to improve fuel efficiency and reduce emissions in transportation sectors, the rapid expansion of the wind energy sector requiring extremely durable blade composites, and continuous innovation in electronics requiring reliable thermal management and protection. Additionally, advancements in nanotechnology are enabling the development of next-generation toughening agents, such as functionalized carbon nanotubes and specialized nano-silica, which offer superior dispersion stability and toughening efficiency at lower loading levels, further appealing to high-performance application segments.

Active Epoxy Toughening Agent Market Executive Summary

The Active Epoxy Toughening Agent Market is experiencing robust expansion, characterized by a fundamental shift toward core-shell rubber (CSR) technology due to its exceptional efficacy and minimal viscosity increase compared to traditional liquid rubber modifiers. Business trends indicate strong vertical integration among key manufacturers aiming to control raw material sourcing and optimize proprietary particle synthesis processes, ensuring consistent quality and supply security, particularly for high-demand aerospace and defense customers. The market is highly competitive, focusing heavily on R&D for creating multifunctional agents that simultaneously enhance toughness and improve fatigue resistance or thermal stability. Strategic partnerships between material suppliers and end-product manufacturers (OEMs) are crucial for tailoring solutions to specific application requirements, especially in the complex composites segment.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, primarily fueled by the burgeoning automotive manufacturing base in China and India, alongside significant investments in infrastructure development and electronics production across Southeast Asia. North America and Europe maintain dominance in terms of technology adoption and high-value applications, particularly aerospace and advanced wind turbine production, where strict regulatory compliance drives demand for certified, high-performance toughening systems. Regulatory environments concerning chemical handling and sustainable materials are also influencing innovation, pushing manufacturers toward developing halogen-free and environmentally conscious toughening solutions, driving regional investment in green chemistry.

Segmentation trends reveal that the core-shell rubber segment holds the largest market share and is projected to exhibit the highest CAGR, benefiting from its superior performance metrics in demanding composite applications. Functionally, agents used in structural adhesives and specialized coatings segments are witnessing rapid growth, driven by their critical role in modern vehicle assembly and complex repair operations. In terms of end-use, the automotive and aerospace industries collectively represent the largest consumers, demonstrating an inelastic demand for toughened epoxy systems essential for manufacturing lighter, safer, and more structurally resilient components. The overall market trajectory is firmly positive, underpinned by continuous material innovation and expanding penetration into diverse industrial and infrastructure projects globally.

AI Impact Analysis on Active Epoxy Toughening Agent Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Active Epoxy Toughening Agent Market center on how computational methods can accelerate material discovery, optimize formulation parameters, and predict material performance under various stress conditions. Users frequently ask about the role of machine learning in correlating molecular structure with fracture toughness characteristics, the use of generative AI for designing novel toughening agent chemistries, and the potential for AI-driven quality control in manufacturing. The analysis indicates that users expect AI to significantly compress the R&D cycle for new epoxy systems, moving formulation optimization from laborious trial-and-error experimentation to precise, predictive modeling. Key themes revolve around efficiency gains, predictive quality assurance, and the bespoke design of toughening solutions for highly specialized applications like extreme-temperature composites or ballistic protection materials, ensuring optimal material selection and reducing waste during development.

- AI-driven Predictive Modeling: Machine learning algorithms are used to predict the optimal loading level, particle size distribution, and chemical modification of toughening agents required to achieve specific fracture toughness targets, drastically reducing physical testing time.

- Accelerated Material Discovery: Generative AI models synthesize potential new toughening agent structures (e.g., novel block copolymers or functionalized nanoparticles) that exhibit superior compatibility and efficiency with epoxy resins.

- Process Optimization and Quality Control: AI integrates sensor data from manufacturing lines (mixing, curing) to dynamically adjust parameters, ensuring uniform dispersion of the agent and minimizing defects, thereby guaranteeing consistent product quality.

- Simulation and Performance Prediction: AI enhances Finite Element Analysis (FEA) by processing vast amounts of experimental data, allowing for highly accurate simulations of structural performance, fatigue life, and impact resistance of the toughened epoxy composites.

- Supply Chain and Inventory Management: Predictive analytics assist in forecasting demand for specific toughening agent types across different geographies and end-use sectors, optimizing inventory levels and reducing lead times.

DRO & Impact Forces Of Active Epoxy Toughening Agent Market

The dynamics of the Active Epoxy Toughening Agent Market are dictated by a complex interplay of internal and external forces summarized as Drivers, Restraints, and Opportunities (DRO). The primary drivers stem from the pervasive requirement for lightweight yet high-strength materials in high-growth sectors, particularly the aerospace commitment to composite usage and the automotive sector’s drive toward electric vehicle (EV) lightweighting, both of which require superior structural bonding and impact absorption capabilities. Simultaneously, the market faces restraints, chiefly concerning the complexity of incorporating active agents without increasing viscosity excessively, which can hinder processing and scalability. High material costs associated with specialized agents like nano-rubber modifiers and block copolymers, coupled with stringent regulatory hurdles in certain geographies regarding novel chemical inputs, also act as significant brakes on widespread adoption.

Opportunities abound in developing multifunctional agents that offer secondary benefits, such as flame retardancy or enhanced electrical conductivity, alongside improved toughness. The surging demand for advanced materials in 5G infrastructure, reusable space launch vehicles, and large-scale wind turbine blades presents niche, high-value markets for customized toughening solutions. Furthermore, adopting advanced manufacturing techniques, such as automated fiber placement (AFP) and resin transfer molding (RTM), necessitates agents that perform optimally under specific processing conditions, driving innovation in low-viscosity, highly dispersible systems. The overarching impact forces—technological advancements, economic conditions influencing infrastructure spend, and regulatory shifts toward safety standards—continuously shape the competitive landscape and product development cycles within this specialized chemical sector.

The ultimate impact forces determine the profitability and long-term viability of market participants. Technological force is arguably the strongest, with continuous research pushing the boundaries of what these agents can achieve in terms of balancing strength, stiffness, and toughness—a traditionally difficult material science challenge. Economic forces govern the willingness of manufacturers to adopt higher-cost, high-performance materials; in premium markets like aerospace, performance outweighs cost, whereas in general industrial coatings, cost-efficiency remains paramount. Regulatory oversight mandates material safety and performance specifications, compelling manufacturers to certify their agents and providing a barrier to entry for smaller, non-compliant players. This continuous pressure to innovate while maintaining compliance ensures that only robust, high-quality toughening solutions gain market traction.

Segmentation Analysis

The Active Epoxy Toughening Agent Market is comprehensively segmented based on the type of agent, its functional application, and the ultimate end-use industry. This structure allows for precise analysis of market demand, technological preferences, and regional consumption patterns. The segmentation by type is critical, reflecting the fundamental differences in chemical structure and toughening mechanism, where Core-Shell Rubber (CSR) dominates due to its efficient energy absorption capabilities and minimal impact on epoxy matrix viscosity. Functional segmentation highlights the diverse roles these agents play, ranging from enhancing structural adhesives for critical bonding to improving the durability of composite matrices in aerospace structures.

The complexity of end-user requirements heavily influences the choice of toughening agent; for instance, the aerospace sector demands agents capable of withstanding extreme thermal cycles and fatigue loading, driving demand for high-purity, specialized block copolymers. Conversely, the construction industry may prioritize cost-effective liquid rubber modifiers for large-scale flooring and coating applications. Understanding these interdependencies is crucial for strategic market positioning, enabling suppliers to align their R&D and manufacturing efforts with specific sector needs. This granular analysis facilitates the identification of high-growth segments, such as automotive electric vehicle components and renewable energy infrastructure, which are undergoing rapid material innovation.

- By Type:

- Core-Shell Rubber (CSR)

- Liquid Rubbers (e.g., CTBN, ATBN)

- Block Copolymers (e.g., SBS, SIS, SEBS)

- Thermoplastic Particles/Nanoparticles

- Others (e.g., Hyperbranched Polymers)

- By Application:

- Composite Matrices

- Structural Adhesives

- Coatings and Paints

- Potting and Encapsulation

- Laminates

- By End-Use Industry:

- Aerospace and Defense

- Automotive and Transportation

- Electrical and Electronics (E&E)

- Construction (Coatings and Flooring)

- Wind Energy

- Marine

Value Chain Analysis For Active Epoxy Toughening Agent Market

The value chain for the Active Epoxy Toughening Agent Market begins with the highly specialized upstream segment, dominated by raw material suppliers providing base chemicals such as monomers (e.g., butadiene, acrylonitrile, styrene), specialty surfactants, and functional initiators required for the synthesis of complex polymer agents. Key activities at this stage include polymerization, functionalization, and, crucially, the precise manufacturing of highly engineered core-shell particles or block copolymers. The quality and purity of these raw inputs directly influence the final performance of the toughening agent, establishing a strong dependency between agent manufacturers and their chemical suppliers, often leading to long-term collaborative agreements for material specification and delivery.

The midstream involves the core business of formulating and manufacturing the active toughening agents, where companies invest heavily in proprietary synthesis and dispersion technologies. These manufacturers then integrate the agents into epoxy systems, offering customized masterbatches or pre-dispersed solutions. The downstream focuses on distribution and application. Distribution channels typically involve specialized chemical distributors who provide warehousing, technical support, and localized delivery to smaller end-users, alongside direct sales and technical service teams that cater to large OEMs in the aerospace and automotive sectors. The shift toward direct engagement with major end-users allows manufacturers to provide bespoke technical services and ensures seamless integration into complex fabrication processes like Resin Transfer Molding (RTM) or Automated Fiber Placement (AFP).

Direct channels are preferred by large-scale consumers in high-tech industries requiring technical consultation and product customization, ensuring traceability and quality control throughout the supply chain. Indirect channels, leveraging regional distributors, are essential for penetrating fragmented markets like general construction, smaller electronics assembly, and general industrial maintenance, repair, and overhaul (MRO) operations. The efficiency of the distribution network is crucial for maintaining market responsiveness, particularly as demand for specific toughening agents fluctuates based on aerospace production cycles or automotive model launches. The entire chain is underscored by stringent quality checks and technical validation, necessary because failure of the toughened epoxy system can lead to catastrophic structural failure in critical applications.

Active Epoxy Toughening Agent Market Potential Customers

The potential customers for active epoxy toughening agents are highly sophisticated end-users requiring materials that exhibit maximum performance under extreme conditions, prioritizing reliability and structural integrity over marginal cost savings. The largest group of buyers includes Tier 1 and Tier 2 suppliers in the aerospace and defense industries, procuring agents for manufacturing carbon fiber reinforced polymer (CFRP) primary structures, engine components, and specialized structural adhesives used in aircraft assembly. These customers demand agents with exceptional heat resistance, fatigue life, and validated traceability, often specified under rigorous industry standards such as those set by regulatory bodies.

Another significant customer base resides within the automotive sector, specifically manufacturers focusing on Electric Vehicles (EVs) and high-performance gasoline vehicles. These companies utilize toughened epoxies for battery module encapsulation, assembly adhesives for mixed-material body structures (lightweighting), and high-impact resistance coatings for chassis components. Their purchasing decisions are driven by the need to meet crash safety standards, improve vehicle durability, and reduce overall weight. Furthermore, major producers of wind turbine blades represent a rapidly growing customer segment, seeking agents to increase the lifespan and fatigue resistance of massive composite blades subjected to continuous, dynamic loading and harsh environmental exposure, directly impacting the long-term operational costs of renewable energy projects.

Beyond transportation, the electronics industry acts as a crucial buyer, utilizing these agents in potting compounds and encapsulation resins for sensitive components, where enhanced thermal shock resistance and protection against mechanical damage are paramount for product reliability. Finally, large-scale industrial coaters and chemical formulators serving the construction and marine industries purchase these agents to improve the durability and crack resistance of industrial flooring, protective pipe coatings, and specialized vessel structures. The procurement process for these potential customers often involves extensive qualification testing and a preference for agents supplied by established manufacturers offering robust technical support and consistent product quality across global facilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.98 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Huntsman Corporation, BASF SE, Dow Inc., Kaneka Corporation, Mitsui Chemicals, Inc., Arkema S.A., Sumitomo Chemical Co., Ltd., EMS-Chemie Holding AG, CVC Thermoset Specialties, Wanhua Chemical Group, Solvay S.A., DIC Corporation, Kingfa Sci.&Tech. Co., Ltd., The Lubrizol Corporation, Jiangsu Litian Technology Co., Ltd., Air Products and Chemicals, Inc., PPG Industries, Altana AG, Henkel AG & Co. KGaA, Resonac Holdings Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Active Epoxy Toughening Agent Market Key Technology Landscape

The technological landscape of the Active Epoxy Toughening Agent Market is defined by continuous advancements in polymer synthesis and particle engineering aimed at maximizing toughening efficiency while minimizing negative effects on other crucial mechanical properties, such as thermal stability and modulus. The dominant technological trend revolves around Core-Shell Rubber (CSR) technology, which utilizes emulsion polymerization to create nano-scale particles comprising a soft, elastomeric core (for energy absorption) and a rigid, epoxy-compatible polymer shell (for dispersion and chemical anchoring). Recent innovations focus on developing multi-layered or gradient-shell CSR structures to improve the interfacial adhesion between the particle and the epoxy matrix, leading to superior stress transfer and optimized toughening mechanisms under dynamic load conditions.

Another crucial technological area involves the engineering of specialty block copolymers. These materials are designed to self-assemble into defined nanostructures (such as micelles or cylinders) when mixed into the epoxy resin, creating micro-phase separated domains that effectively dissipate crack energy. Advances in this field include tailoring the molecular weight and composition of the copolymer blocks to control the morphology and size of these domains, ensuring optimal interaction with the curing epoxy network. Furthermore, the integration of bio-based or sustainable monomers into liquid rubber chemistries (e.g., using vegetable oils or renewable feedstock) is gaining traction, responding to growing regulatory and consumer pressure for greener chemical solutions without sacrificing performance parameters like glass transition temperature (Tg).

Beyond traditional polymer modification, nanotechnology plays a critical role through the use of functionalized inorganic nanofillers, such as graphene oxide, carbon nanotubes (CNTs), and nano-silica, often used synergistically with polymeric toughening agents in hybrid systems. These hybrid technologies leverage the synergistic benefits of both approaches—the polymers providing bulk toughness through plastic deformation and the nanoparticles offering localized reinforcement and crack pinning. The combination allows material formulators to achieve extremely high levels of fracture toughness without the excessive viscosity rise often associated with high loading levels of single-component modifiers, thus maintaining processing efficiency for complex composite manufacturing techniques like vacuum infusion or high-pressure RTM utilized extensively in the aerospace and wind sectors.

Regional Highlights

Regional dynamics play a crucial role in shaping the Active Epoxy Toughening Agent Market, with distinct consumption patterns and technological adoption rates across major global zones.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by massive manufacturing scale-up, particularly in the automotive (including EV) and electronics sectors across countries like China, South Korea, and Japan. Increased investments in localized wind energy infrastructure and general infrastructure development (bridges, high-speed rail) necessitate high volumes of construction and protective coatings, favoring cost-effective but reliable toughening solutions.

- North America: This region holds significant market share, primarily fueled by the demanding aerospace and defense sectors, which prioritize high-performance CSR and block copolymers for certified, mission-critical composite components. Strong R&D capabilities and stringent material safety standards also contribute to high-value consumption and technological innovation, especially concerning lightweighting and advanced structural adhesives.

- Europe: Europe is a mature market, strongly influenced by the wind energy sector (offshore turbines), strict environmental regulations (REACH), and robust automotive manufacturing (premium and luxury vehicles). The demand here centers on sustainability-compliant agents and those that facilitate automated composite manufacturing processes, maintaining high standards for fatigue resistance and structural durability.

- Latin America (LATAM): Growth in LATAM is linked to expanding oil and gas infrastructure, where protective and corrosion-resistant coatings require toughened epoxy systems for extreme environments. The region’s construction sector also drives moderate demand for industrial flooring and repair materials.

- Middle East and Africa (MEA): This region shows potential, driven by significant government investments in infrastructure megaprojects (especially in the GCC countries) and the need for durable coatings in harsh, high-temperature coastal environments. Demand focuses on high-performance coatings and industrial adhesives capable of withstanding extreme heat and abrasion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Active Epoxy Toughening Agent Market.- Huntsman Corporation

- BASF SE

- Dow Inc.

- Kaneka Corporation

- Mitsui Chemicals, Inc.

- Arkema S.A.

- Sumitomo Chemical Co., Ltd.

- EMS-Chemie Holding AG

- CVC Thermoset Specialties

- Wanhua Chemical Group

- Solvay S.A.

- DIC Corporation

- Kingfa Sci.&Tech. Co., Ltd.

- The Lubrizol Corporation

- Jiangsu Litian Technology Co., Ltd.

- Air Products and Chemicals, Inc.

- PPG Industries

- Altana AG

- Henkel AG & Co. KGaA

- Resonac Holdings Corporation

Frequently Asked Questions

Analyze common user questions about the Active Epoxy Toughening Agent market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an Active Epoxy Toughening Agent?

The primary function of an Active Epoxy Toughening Agent is to significantly enhance the fracture toughness, impact resistance, and overall durability of intrinsically brittle epoxy resin systems. These agents achieve this by creating internal structures that dissipate stress energy, such as core-shell particles or micro-phase separated domains, preventing catastrophic crack propagation.

Which type of toughening agent is currently leading the market?

Core-Shell Rubber (CSR) technology is currently leading the market. CSR agents are highly favored because they offer superior toughening efficiency at low loading levels and typically cause a minimal increase in the epoxy resin's viscosity, which is crucial for composite manufacturing processes like infusion and injection.

What major industries are the largest consumers of these agents?

The largest consuming industries are Aerospace and Defense, followed closely by Automotive and Transportation, particularly for structural adhesives and advanced composite matrices used in lightweighting initiatives and high-stress applications such as aircraft primary structures and electric vehicle battery protection.

How does the addition of a toughening agent affect the epoxy's viscosity?

The addition of any filler or modifier generally increases viscosity. However, modern active agents, especially nano-scale Core-Shell Rubbers and certain block copolymers, are designed to minimize this increase. Controlling viscosity is critical because high viscosity complicates manufacturing processes like resin transfer molding (RTM) and prepreg saturation.

What is the projected growth driver for the Active Epoxy Toughening Agent Market through 2033?

The primary projected growth driver is the escalating global demand for lightweight, high-performance composites across the renewable energy (wind turbine blades) and electric vehicle sectors, coupled with continuous stringent requirements for enhanced structural reliability and fatigue resistance in military and commercial aviation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager