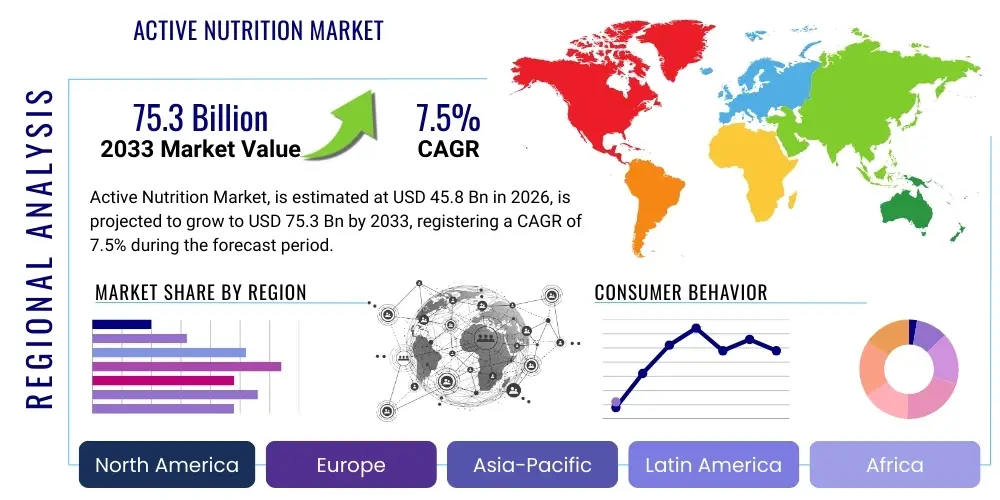

Active Nutrition Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434831 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Active Nutrition Market Size

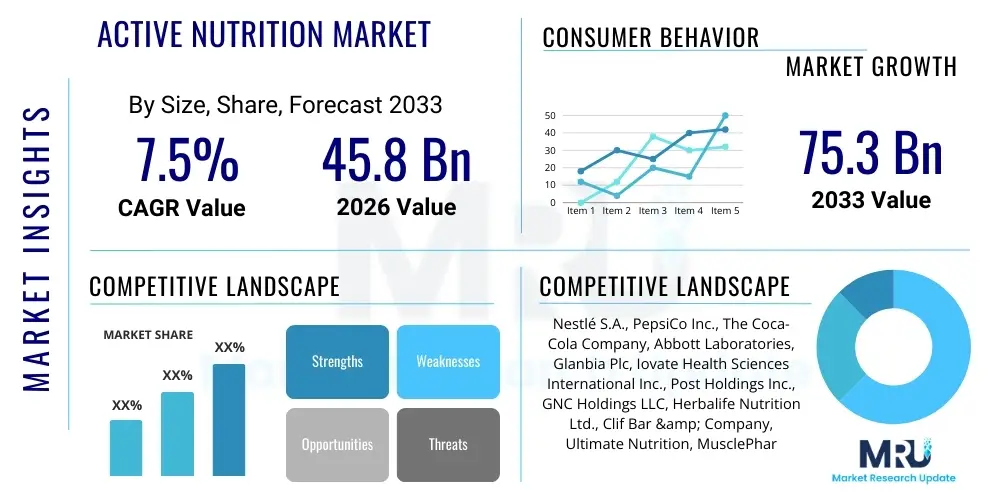

The Active Nutrition Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 45.8 Billion in 2026 and is projected to reach USD 75.3 Billion by the end of the forecast period in 2033.

Active Nutrition Market introduction

The Active Nutrition Market encompasses a diverse range of food, beverages, and supplements formulated to enhance physical performance, speed up recovery, and support overall health and wellness for individuals leading active lifestyles, ranging from elite athletes to casual fitness enthusiasts. Key product categories include protein powders, amino acids, vitamins, minerals, sports drinks, and energy bars, which are specifically designed to meet increased metabolic demands. Major applications span muscle building, weight management, energy and endurance enhancement, and specialized dietary support, reflecting a consumer shift toward preventative health and functional food consumption globally.

The primary benefits delivered by active nutrition products include improved muscle synthesis, enhanced metabolic efficiency, quicker recovery post-exercise, and sustained energy levels necessary for strenuous activities. The market growth is fundamentally driven by the escalating global participation in sports and fitness activities, particularly among younger demographics, alongside a rising awareness concerning the critical role of nutrition in achieving fitness goals. Furthermore, the increasing prevalence of sedentary lifestyles in urban areas has paradoxically boosted the demand for solutions that help counteract the negative health impacts, making active nutrition products a crucial component of modern wellness routines. Innovations in flavor profiles, delivery formats (such as ready-to-drink and gummy supplements), and the integration of plant-based and clean-label ingredients are continuously expanding the market reach beyond traditional bodybuilding demographics into the mainstream consumer segment.

Active Nutrition Market Executive Summary

The Active Nutrition Market is experiencing robust expansion driven by several key factors: persistent consumer interest in healthspan extension, the professionalization of fitness culture, and profound advancements in ingredient science. Business trends indicate a strong move toward personalization, with companies leveraging data analytics and genetic testing to offer tailor-made nutritional regimes, moving away from one-size-fits-all products. Furthermore, sustainability in sourcing and production is becoming a mandatory competitive factor, with consumers favoring brands that demonstrate environmental stewardship and ethical practices, pushing manufacturers toward plant-based proteins and innovative, earth-friendly packaging solutions.

Regionally, North America and Europe currently dominate the market share due to high disposable income, well-established fitness infrastructure, and early adoption of sports supplements; however, the Asia Pacific (APAC) region is projected to register the fastest growth. This rapid expansion in APAC is fueled by urbanization, increasing Western influence on lifestyle, and the burgeoning middle class in countries like China and India, which are rapidly integrating fitness and wellness products into their daily routines. Regulatory standardization across different regional blocs remains a critical challenge that manufacturers are actively addressing to ensure seamless international trade and product compliance.

Segment trends highlight the dominance of the protein category, specifically whey and casein, although the fastest growth is observed in specialized segments such as branched-chain amino acids (BCAAs), creatine, and pre-workout formulations. The Ready-to-Drink (RTD) format is gaining significant traction due to its convenience, appealing to busy professionals and casual users who prioritize ease of consumption. Ingredient diversification, focusing on functional ingredients like probiotics, adaptogens, and cognitive enhancers (nootropics), is a defining segment trend, positioning active nutrition products not just for physical performance but also for holistic well-being and mental acuity.

AI Impact Analysis on Active Nutrition Market

User queries regarding the impact of Artificial Intelligence on the Active Nutrition Market predominantly focus on three critical areas: personalized nutrition, supply chain optimization, and accelerated new product development (NPD). Consumers frequently ask how AI can generate truly personalized supplement stacks based on unique biometric data (wearable fitness trackers, genomics, and gut microbiome analyses) rather than generalized advice. They are also highly concerned with the authenticity and efficacy of products, seeking reassurance that AI-driven quality control can eliminate counterfeits and verify ingredient claims. Finally, businesses are keenly interested in how predictive AI models can forecast ingredient shortages, optimize inventory, and identify nascent consumer preference trends years before they become mainstream, drastically reducing the time-to-market for novel formulations.

AI's role is transformative, moving the industry from mass-market supplement selling to precision performance tailoring. For the consumer, AI-powered diagnostic platforms are becoming the central mechanism for engagement, providing real-time feedback on nutrient timing and dosage adjustments based on daily activity levels, sleep quality, and recovery metrics. This level of algorithmic precision enhances compliance and efficacy, thereby improving user satisfaction and brand loyalty. Furthermore, AI tools are essential for analyzing complex clinical trial data and identifying synergistic ingredient combinations that would be impossible to discover using traditional research methods, driving true innovation in efficacy.

From a manufacturing standpoint, AI is integrated into optimizing factory floor efficiency and ensuring traceability across the supply chain, which directly addresses user concerns about product safety and provenance. Machine learning algorithms analyze spectral data to detect contaminants or verify ingredient purity instantly, establishing a higher standard of quality control. The ability of AI to analyze vast datasets of social media trends and competitor activities allows companies to preempt market shifts, ensuring that new products meet specific, niche consumer demands related to diet (e.g., keto-friendly, high-fiber, low-glycemic) or specific performance goals (e.g., endurance for ultra-marathons, cognitive focus for e-sports), maximizing market relevance and minimizing R&D expenditure risk.

- AI-driven Personalization: Algorithms utilize genomic and biometric data to formulate hyper-specific nutrient profiles and dosage instructions.

- Supply Chain Optimization: Predictive modeling minimizes waste, anticipates ingredient price volatility, and ensures robust cold chain management for sensitive ingredients.

- Accelerated NPD: Machine learning identifies novel ingredient synergies and optimal flavor pairings, drastically cutting down product development cycles.

- Quality Assurance and Traceability: Computer vision and data analytics verify raw material purity and track products from farm to consumer, enhancing consumer trust.

- Consumer Behavior Forecasting: AI analyzes macro trends and niche preferences (e.g., demand for adaptogenic proteins) to inform future product lines.

DRO & Impact Forces Of Active Nutrition Market

The dynamics of the Active Nutrition Market are governed by a complex interplay of Drivers, Restraints, Opportunities, and foundational Impact Forces that shape its competitive landscape and growth trajectory. The primary driver is the pervasive cultural shift towards preventative health and active aging, where consumers view nutritional supplementation as an investment in long-term physical capacity. This societal trend is amplified by widespread fitness influencer marketing and the availability of accessible, affordable fitness technology (wearables) that necessitates performance-enhancing dietary support. Complementing this is the continuous advancement in ingredient technology, such as microencapsulation and enhanced bioavailability, which provides manufacturers with tools to create superior, differentiated products that deliver verifiable results, further fueling consumer demand and confidence.

However, the market faces significant restraints, most notably stringent regulatory hurdles regarding supplement claims and ingredient legality, which vary dramatically across geographies, complicating global market entry and scaling. Another substantial restraint is the pervasive issue of consumer skepticism related to product efficacy and the presence of counterfeit goods, which necessitates significant investment in transparent labeling and third-party testing protocols to rebuild and maintain consumer trust. Furthermore, the rising cost of premium, sustainably sourced protein ingredients presents margin pressures for manufacturers, especially those catering to price-sensitive market segments, potentially leading to increased end-user costs and market resistance.

Opportunities for expansion are abundant, centered around the untapped potential of the senior population, often termed 'Active Agers,' who require specialized nutritional support to combat sarcopenia and maintain mobility, offering a distinct and lucrative market niche. Secondly, the integration of functional foods and beverages into daily diets, blurring the line between conventional food and supplements, represents a massive opportunity for format diversification, moving beyond traditional powders and pills into everyday items like high-protein snacks, fortified breakfast cereals, and specialized functional coffees. Finally, the strategic integration of digital health platforms with nutrition delivery services—such as subscription boxes tailored by AI based on real-time health data—provides a framework for superior customer retention and lifetime value, representing a crucial opportunity for technology-driven market players seeking a competitive edge through personalization.

The impact forces dominating this sector include technological disruption, primarily through synthetic biology and fermentation technologies allowing for sustainable production of novel proteins and vitamins, bypassing traditional agricultural limitations. Societal forces, particularly the increasing acceptance of plant-based and vegan diets, are forcing ingredient reformulation and driving investment into alternatives like pea, rice, and algal proteins. Economic forces, such as fluctuating raw material costs (e.g., dairy pricing), constantly challenge operational stability, requiring sophisticated risk management strategies. Simultaneously, political impact forces related to global trade agreements and national labeling requirements continue to mandate adaptation and compliance, defining the accessibility and cost structure of active nutrition products worldwide.

Segmentation Analysis

The Active Nutrition Market is segmented across multiple dimensions, primarily defined by Product Type, Application, Form, and Distribution Channel, each exhibiting unique growth trajectories and consumer preferences. The segmentation allows market participants to tailor their offerings precisely to distinct consumer groups, such as differentiating high-performance products aimed at professional bodybuilders from lifestyle-focused supplements targeting general wellness users. Understanding these segments is crucial for strategic pricing, ingredient selection, and targeted marketing campaigns that resonate with the specific needs and consumption habits of the identified end-users, ensuring maximum market penetration and efficient resource allocation across the product portfolio.

By Product Type, proteins (including ready-to-drink options, bars, and powders) maintain the largest market share due to their fundamental role in muscle repair and satiety. However, functional ingredients such as energy enhancers, immune support compounds, and specialized recovery aids (like specific vitamins and minerals) are growing rapidly as consumers adopt a more holistic view of performance, recognizing that overall health dictates athletic capacity. The segmentation by Form is increasingly critical, with consumers showing a strong preference for convenient formats like gels, shots, and gummies over traditional powders and capsules, particularly in the mass market and lifestyle segments, necessitating flexible manufacturing capabilities.

Geographically, market segmentation reveals disparities in preferred ingredients; for instance, European markets often show stronger demand for clean-label, non-GMO, and organic certifications, while North American consumers demonstrate high volume consumption across all categories, heavily influenced by sports marketing. Segmentation by Distribution Channel emphasizes the shift towards e-commerce and direct-to-consumer (D2C) platforms, which allow brands greater control over messaging, faster inventory turnover, and direct access to valuable consumer data, challenging the traditional dominance of physical retail stores and specialized supplement outlets.

- By Product Type:

- Sports Supplements (Protein Powder, Creatine, BCAAs, Glutamine, Pre-Workout)

- Sports Drinks (Isotonic, Hypotonic, Hypertonic)

- Energy Bars and Gels

- Functional Foods and Beverages

- Vitamin and Mineral Supplements (Targeted Performance)

- By Application:

- Weight Management

- Muscle Building and Repair

- Endurance and Energy Enhancement

- Immune and Cognitive Support

- Recovery and Rehydration

- By Form:

- Powders

- Ready-to-Drink (RTD) Beverages

- Tablets and Capsules

- Gummies and Chews

- Bars and Snacks

- By Distribution Channel:

- Online Retail (E-commerce, D2C Websites)

- Specialty Stores (GNC, Vitamin Shoppe)

- Supermarkets and Hypermarkets

- Pharmacies and Drug Stores

- Fitness Centers and Gyms

Value Chain Analysis For Active Nutrition Market

The Value Chain for the Active Nutrition Market is extensive and highly specialized, beginning with the upstream sourcing of high-quality, often proprietary, functional ingredients. Upstream analysis focuses heavily on the procurement of raw materials, including dairy proteins (whey, casein), plant-based isolates (soy, pea, rice), specialized amino acids, and high-purity vitamins. Key upstream activities involve advanced processing techniques, such as microfiltration and hydrolysis, to enhance ingredient purity and bioavailability, requiring significant capital investment in processing facilities and robust quality control systems to ensure compliance with stringent food safety standards. The relationship between manufacturers and specialized ingredient suppliers is critical, often involving long-term contracts to secure supply, especially for proprietary or patented ingredients that provide a functional differentiator in the finished product.

The midstream phase involves research and development (R&D), formulation, flavor system development, and manufacturing. This stage is marked by high complexity due to the need for precise blending and encapsulation technologies to maintain ingredient stability and mask undesirable tastes. Companies must constantly innovate to produce palatable and effective products while managing complex supply chain logistics, inventory of short-shelf-life ingredients, and adhering to Good Manufacturing Practices (GMP). The value is significantly added here through intellectual property related to formulations, clinical efficacy data, and superior product presentation, transforming raw materials into market-ready nutritional products.

Downstream activities center on distribution, sales, and marketing. Distribution channels are bifurcated into direct channels (D2C through brand websites, capitalizing on personalized data) and indirect channels (specialty retail, supermarkets, and increasingly, large e-commerce platforms like Amazon). Indirect distribution relies heavily on efficient logistics and merchandising strategies, while direct channels emphasize digital marketing, influencer collaboration, and educational content to drive consumer engagement and brand loyalty. The final stage involves consumer services and feedback loops, crucial for refining formulations and understanding post-purchase satisfaction. The efficacy of marketing, specifically targeting performance outcomes and lifestyle integration, significantly influences the downstream value capture.

Active Nutrition Market Potential Customers

The potential customer base for the Active Nutrition Market is expanding far beyond the traditional niche of professional athletes and bodybuilders, now encompassing a broad spectrum of health-conscious individuals categorized primarily by activity level, age, and wellness goals. The largest segment remains the dedicated Fitness Enthusiasts (25-45 years old) who regularly engage in high-intensity training, require rapid recovery, and actively seek scientifically-backed products to optimize their performance metrics, focusing heavily on premium proteins and pre-workout supplements. This core demographic is highly informed, utilizing specialized fitness applications and relying on peer recommendations and professional endorsement for purchasing decisions.

A rapidly growing segment comprises Lifestyle and Wellness Consumers (18-65 years old) who are focused on general health maintenance, weight management, and energy levels without necessarily pursuing competitive athletics. These consumers often favor functional foods, fortified beverages, and convenient formats like protein bars or RTD shakes that easily integrate into busy schedules, emphasizing clean labels, natural ingredients, and products that offer benefits like digestive health support or cognitive enhancement alongside basic nutrition. Their consumption is less cyclical and more continuous, driven by daily wellness routines rather than intense training cycles.

Another crucial customer group is the Active Agers (55+ years old), whose purchasing decisions are primarily motivated by health span extension and the critical need to prevent age-related muscle loss (sarcopenia) and improve bone density. This segment specifically demands products with higher concentrations of high-quality proteins, specific amino acid profiles (like HMB), and micronutrients that support joint health and mobility. Companies targeting this demographic must focus on efficacy, palatable flavors, and easy-to-digest formats, often relying on healthcare professional recommendations and emphasizing the clinical evidence supporting the product's benefits for maintaining independence and quality of life.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.8 Billion |

| Market Forecast in 2033 | USD 75.3 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé S.A., PepsiCo Inc., The Coca-Cola Company, Abbott Laboratories, Glanbia Plc, Iovate Health Sciences International Inc., Post Holdings Inc., GNC Holdings LLC, Herbalife Nutrition Ltd., Clif Bar & Company, Ultimate Nutrition, MusclePharm Corporation, Olimp Laboratories, USANA Health Sciences, BioSteel Sports Nutrition Inc., Bulk Powders, Evolve BioSystems, Amway Corp., BSN (Bio-Engineered Supplements and Nutrition), Bodybuilding.com |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Active Nutrition Market Key Technology Landscape

The technological landscape within the Active Nutrition Market is defined by continuous innovation across ingredient synthesis, delivery systems, and consumer interaction platforms. Advanced biotechnology, particularly precision fermentation, is revolutionizing the sourcing of sustainable and highly pure proteins, growth factors, and specialized amino acids, offering alternatives to traditionally resource-intensive dairy or meat sources. This technology not only addresses sustainability concerns but also enables the creation of novel functional ingredients with specific, verifiable biological activities that promise enhanced performance outcomes, moving beyond standard nutritional supplementation into truly therapeutic or bio-optimized solutions.

A significant area of focus is on enhancing the bioavailability and stability of active ingredients, where technologies such as microencapsulation and liposomal delivery systems are paramount. These systems protect sensitive compounds (like certain vitamins, probiotics, or highly reactive flavors) from degradation caused by heat, stomach acids, or oxidation, ensuring that the maximum effective dose reaches the target site in the body. For the consumer, this translates to more effective products and better sensory experiences, mitigating the common issues of poor absorption and unpalatable flavors often associated with performance supplements. The deployment of these sophisticated delivery matrices is a crucial competitive advantage.

Furthermore, digital technologies are playing a central role in transforming the market experience. Smart labeling, utilizing blockchain technology, is being adopted by progressive brands to offer consumers complete transparency regarding the origin, testing, and authenticity of ingredients, combating the prevalence of fraudulent products. Coupled with this, the proliferation of personalized diagnostic tools, including at-home microbiome testing kits and sophisticated wearable devices, feeds essential real-time data into AI-driven platforms. These integrated technologies facilitate genuine personalization of nutritional intake recommendations, marking a fundamental technological shift from standardized production to consumer-centric, dynamic formulation adjustment.

Regional Highlights

- North America: North America, particularly the United States, remains the largest and most established market for active nutrition globally, characterized by high consumer awareness, widespread adoption of health-tracking technology, and a massive fitness culture. The region is a hotbed for innovation in protein supplements, performance enhancers, and novel delivery systems (e.g., gummies and shots). Market growth is sustained by high disposable incomes and a strong regulatory framework (though complex) that encourages product diversity. The region leads in personalization strategies, leveraging AI and genetic testing to cater to highly segmented consumer needs, particularly in sports recovery and cognitive performance enhancement.

- Europe: Europe represents a mature and highly conscious market, exhibiting strong demand for clean-label products, certified organic ingredients, and plant-based alternatives, driven by stringent consumer preferences for sustainability and ethical sourcing. Western European countries like Germany, the UK, and France are key consumers. The European market is seeing rapid growth in functional beverages and fortified foods that bridge the gap between daily nutrition and performance enhancement. Regulatory harmonization across the EU simplifies distribution but mandates strict adherence to ingredient limits and marketing claims, necessitating focused investment in scientific substantiation.

- Asia Pacific (APAC): APAC is the fastest-growing regional market, poised for exponential growth driven by rapid urbanization, increasing middle-class disposable income, and the globalization of fitness trends. Countries such as China, India, Japan, and South Korea are experiencing significant shifts toward Western lifestyles and competitive sports participation. While the region is currently dominated by international brands, local manufacturers are rapidly emerging, focusing on traditional ingredients integrated with modern nutritional science. The market size expansion is largely attributable to the massive, youthful population base beginning to integrate preventative and performance nutrition into their lives, creating high demand for convenient, locally flavored products.

- Latin America (LATAM): LATAM presents a nascent but highly potential market, influenced heavily by US trends but restrained by economic volatility and complex import tariffs. Brazil and Mexico are the dominant markets, where fitness culture is growing, particularly in urban centers. Demand is strongest for foundational products like protein powders and mass gainers. Price sensitivity is a key factor, driving demand toward domestically produced and value-oriented brands, although premiumization is occurring among high-income consumer groups.

- Middle East and Africa (MEA): The MEA region is developing, with growth concentrated in the GCC countries (Saudi Arabia, UAE) due to high wealth, governmental focus on public health and fitness, and a large expatriate population that drives demand for international brands. Challenges include cultural preferences, varied regulatory standards, and logistics in less developed African nations. The market is slowly adopting sports nutrition, often linking consumption to specific health and religious dietary requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Active Nutrition Market.- Nestlé S.A.

- PepsiCo Inc.

- The Coca-Cola Company

- Abbott Laboratories

- Glanbia Plc

- Iovate Health Sciences International Inc.

- Post Holdings Inc.

- GNC Holdings LLC

- Herbalife Nutrition Ltd.

- Clif Bar & Company

- Ultimate Nutrition

- MusclePharm Corporation

- Olimp Laboratories

- USANA Health Sciences

- BioSteel Sports Nutrition Inc.

- Bulk Powders

- Evolve BioSystems

- Amway Corp.

- BSN (Bio-Engineered Supplements and Nutrition)

- Bodybuilding.com

Frequently Asked Questions

Analyze common user questions about the Active Nutrition market and generate a concise list of summarized FAQs reflecting key topics and concerns.What major trends are currently shaping the Active Nutrition Market?

The market is primarily being shaped by the rapid consumer shift towards plant-based protein sources, the demand for complete ingredient transparency via clean-label initiatives, and the increasing integration of personalized nutrition plans driven by AI and diagnostic technologies.

How is the rise of the ‘Active Ager’ demographic influencing product development?

The Active Ager segment is compelling manufacturers to develop specialized products focusing on mitigating sarcopenia, improving joint health, and enhancing bone density. This includes higher protein loads and the incorporation of specific ingredients like HMB and collagen peptides in convenient formats.

Which distribution channel is experiencing the fastest growth in the Active Nutrition sector?

Online retail, particularly direct-to-consumer (D2C) channels and major e-commerce platforms, is exhibiting the fastest growth. This channel offers brands greater control over messaging, enables efficient subscription models, and provides immediate access to crucial consumer data for product iteration.

What are the key technological advancements impacting ingredient formulation?

Key technological advancements include precision fermentation for sustainable protein production, microencapsulation and liposomal delivery systems to improve ingredient bioavailability and flavor profiles, and the application of blockchain for supply chain traceability and authenticity verification.

What are the primary regulatory challenges faced by active nutrition companies?

Regulatory challenges stem primarily from the lack of global harmonization regarding health claims and ingredient safety limits. Companies must navigate complex, jurisdiction-specific rules on labeling, efficacy substantiation, and the categorization of products as food versus dietary supplements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager