Active RFID Tags Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439471 | Date : Jan, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Active RFID Tags Market Size

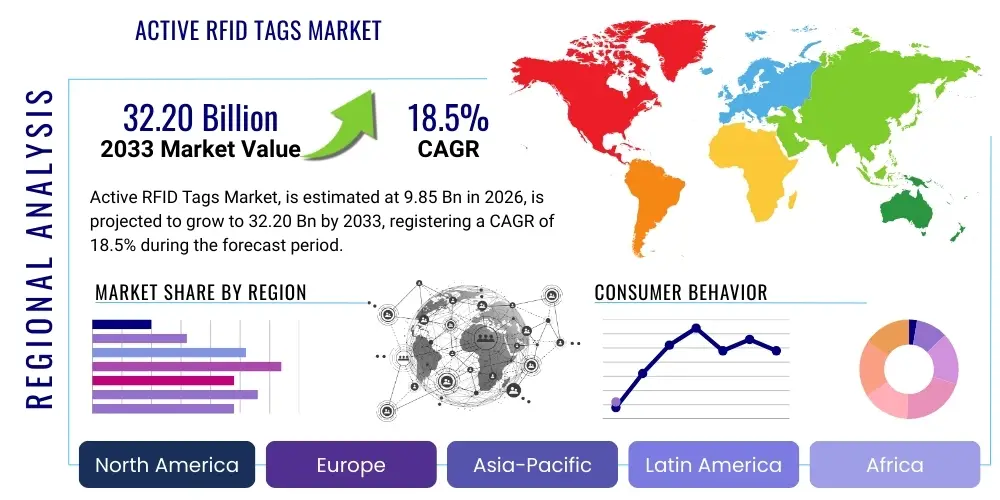

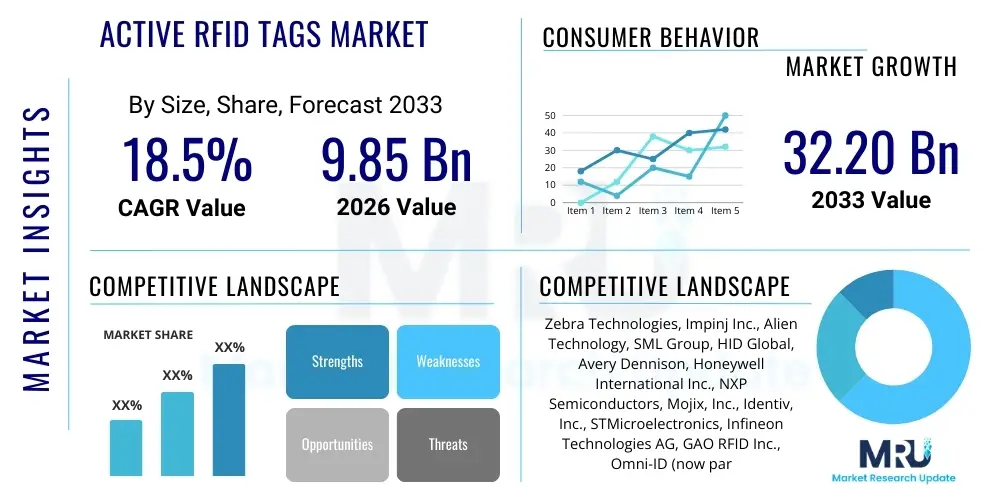

The Active RFID Tags Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 9.85 Billion in 2026 and is projected to reach USD 32.20 Billion by the end of the forecast period in 2033. This robust growth trajectory is underpinned by increasing adoption across diverse industries seeking enhanced operational efficiency, real-time data visibility, and improved asset management capabilities. The continued advancement in tag technology, coupled with the expanding scope of IoT and industry 4.0 initiatives, is expected to fuel this significant market expansion.

Active RFID Tags Market introduction

The Active RFID Tags market encompasses advanced radio-frequency identification systems utilizing battery-powered tags to broadcast signals, enabling real-time, long-range tracking and monitoring of assets. Unlike passive RFID tags that draw power from the reader's electromagnetic field, active tags have their own power source, typically a small battery, allowing for significantly extended read ranges, enhanced data transmission capabilities, and the ability to operate in challenging environments where passive tags might struggle. This inherent power source allows active RFID tags to communicate over hundreds of meters, making them ideal for large-scale industrial and logistical operations.

Major applications for active RFID technology span a wide array of sectors, including high-value asset tracking in logistics and supply chain management, real-time location systems (RTLS) in healthcare for patient and equipment monitoring, security and access control in corporate and governmental facilities, and inventory management in manufacturing and retail. The ability to provide continuous, autonomous data transmission positions active RFID as a critical component in modern smart factories, intelligent warehouses, and connected healthcare ecosystems. Its reliability and robust performance make it an indispensable tool for organizations striving for operational excellence and granular visibility into their physical assets.

The primary benefits driving the adoption of active RFID tags include superior accuracy in asset tracking, reduced manual labor, enhanced security through real-time location data, and significant improvements in operational efficiency and decision-making processes. These systems empower businesses with critical insights into the movement and status of their valuable assets, mitigating losses, optimizing workflows, and ensuring regulatory compliance. The market is propelled by factors such as the burgeoning demand for automation in industrial processes, the rising need for robust supply chain visibility, and the increasing integration of IoT solutions across various industries seeking to leverage real-time data for competitive advantage.

Active RFID Tags Market Executive Summary

The Active RFID Tags Market is experiencing dynamic growth, driven by a convergence of technological advancements and evolving business needs across global industries. Key business trends indicate a significant shift towards integrating active RFID solutions with broader enterprise resource planning (ERP) and supply chain management (SCM) systems, fostering comprehensive operational visibility. The market is witnessing increased investment in advanced analytics platforms that leverage the rich data generated by active tags, transforming raw location information into actionable business intelligence. Furthermore, there is a growing trend of customization, with solutions tailored to specific industry requirements, moving beyond generic tracking to specialized applications like condition monitoring for sensitive assets.

Regionally, North America and Europe continue to be dominant markets, characterized by early adoption of advanced technologies and substantial investments in smart infrastructure, particularly within the logistics, automotive, and healthcare sectors. However, the Asia Pacific (APAC) region is emerging as a high-growth epicenter, fueled by rapid industrialization, expanding manufacturing bases, and increasing government initiatives promoting digital transformation. Latin America, the Middle East, and Africa (MEA) are also demonstrating promising growth, albeit from a smaller base, driven by infrastructure development projects and a growing awareness of the benefits of real-time asset tracking in various burgeoning industries. This regional diversification indicates a global embrace of active RFID technologies, each region contributing unique demand patterns.

In terms of segmentation, the market is broadly categorized by tag type, frequency, application, and industry vertical, each exhibiting distinct growth patterns. Battery-powered active tags, including both beacons and transponders, dominate the type segment due to their robust performance. UHF and Wi-Fi-based tags are gaining traction for their long-range capabilities, while applications in asset tracking and real-time location systems (RTLS) remain paramount. Industry-wise, healthcare is witnessing accelerated adoption for patient and equipment tracking, while manufacturing and logistics continue to be foundational sectors. The continuous innovation in sensor-integrated active tags, which can monitor parameters like temperature, humidity, and shock, is creating new sub-segments and expanding the market's overall utility and value proposition.

AI Impact Analysis on Active RFID Tags Market

Users frequently inquire about how Artificial Intelligence (AI) will enhance the capabilities and efficiency of Active RFID Tags systems, particularly regarding data interpretation, predictive analytics, and autonomous decision-making. Common concerns revolve around whether AI can overcome current limitations such as data overload, improve tracking accuracy in complex environments, and integrate seamlessly with existing infrastructure. Expectations are high for AI to transform active RFID from a data collection tool into a proactive intelligence platform, capable of anticipating events, optimizing asset allocation, and personalizing user experiences, thereby unlocking new levels of operational intelligence and value beyond simple location tracking.

- AI-driven predictive maintenance for active RFID tags, forecasting battery life and potential system failures to ensure uninterrupted operation.

- Enhanced data analytics and pattern recognition by AI algorithms, transforming raw RFID data into actionable insights for inventory optimization and supply chain forecasting.

- Real-time location intelligence improved by AI, enabling more accurate tracking and context-aware insights, especially in dynamic or complex environments with multiple moving assets.

- Autonomous decision-making support systems leveraging AI to optimize asset routing, allocation, and utilization based on real-time active RFID data.

- AI integration with RTLS for intelligent zone management and geofencing, automatically triggering alerts or actions based on asset movement and predefined rules.

- Improved security and anomaly detection through AI analysis of active RFID data, identifying unusual asset movements or unauthorized access attempts.

- Optimized power management for active RFID tags using AI, dynamically adjusting transmission frequencies and power levels to extend battery life.

DRO & Impact Forces Of Active RFID Tags Market

The Active RFID Tags market is driven by several compelling factors, including the escalating demand for real-time asset visibility across diverse industries, particularly in complex supply chains and large-scale operational environments. The increasing adoption of Industry 4.0 initiatives and the Internet of Things (IoT) further propel market growth, as active RFID tags serve as crucial data points within interconnected ecosystems, providing critical information for automation and intelligent decision-making. Moreover, advancements in battery technology, miniaturization of tags, and enhanced data processing capabilities contribute significantly to their broader applicability and performance, making them more attractive for various high-value tracking applications. The cost-efficiency gained through reduced manual tracking and improved loss prevention also acts as a strong incentive for adoption.

However, the market faces notable restraints, primarily the higher initial investment costs associated with active RFID systems compared to their passive counterparts, which can be a barrier for small and medium-sized enterprises (SMEs) or budget-constrained organizations. Technical complexities related to system integration with existing IT infrastructure, potential interference issues in dense radio frequency environments, and data security concerns also pose challenges. The sheer volume of data generated by active RFID systems requires robust data management and analytics capabilities, which can be a hurdle for organizations not adequately prepared. Furthermore, the limited battery life, though improving, still necessitates maintenance and replacement schedules, adding to operational overheads.

Opportunities for growth are abundant, particularly in the expansion into emerging applications such as smart infrastructure, environmental monitoring, and connected agriculture, where long-range and real-time data are paramount. The increasing demand for comprehensive healthcare asset and patient tracking solutions, coupled with the rising focus on employee safety and security in industrial settings, presents significant avenues for market penetration. Innovations in sensor-integrated active RFID tags, which can monitor temperature, humidity, and other environmental parameters, are opening up new markets requiring condition monitoring for sensitive goods. Strategic partnerships between hardware manufacturers, software providers, and system integrators are also creating comprehensive solutions that address complex industry challenges, further expanding the market's reach. These impact forces collectively shape the trajectory and competitive landscape of the active RFID tags market.

Segmentation Analysis

The Active RFID Tags Market is comprehensively segmented to provide a detailed understanding of its diverse components and applications. This segmentation allows for granular analysis of market dynamics, growth drivers, and opportunities across various dimensions, including the type of tag, operating frequency, specific application areas, and the industry verticals utilizing these advanced tracking solutions. Understanding these distinct segments is crucial for stakeholders to identify niche markets, tailor product development, and formulate effective market entry and growth strategies. Each segment reflects unique technological requirements, operational benefits, and end-user demands, contributing to the overall market complexity and potential for innovation. The breakdown provides a clear picture of where value is concentrated and where future growth is most likely to occur, guiding investment and strategic planning across the ecosystem.

- By Type:

- Transponders

- Beacons

- By Frequency:

- Low Frequency (LF)

- High Frequency (HF)

- Ultra-High Frequency (UHF)

- Wi-Fi/Active 2.4 GHz

- By Application:

- Asset Tracking & Monitoring

- Inventory Management

- Access Control & Security

- Supply Chain Management

- Real-Time Location Systems (RTLS)

- Healthcare Patient & Equipment Tracking

- Personnel Tracking

- Logistics & Transportation

- By Industry Vertical:

- Manufacturing

- Logistics & Transportation

- Healthcare

- Retail

- Automotive

- Government & Defense

- Oil & Gas

- Mining

- IT & Data Centers

- Sports & Entertainment

- Aerospace

Value Chain Analysis For Active RFID Tags Market

The value chain for the Active RFID Tags Market begins with upstream activities involving the design and manufacturing of critical components. This includes semiconductor fabrication for RFID chips, battery production for power sources, antenna design and manufacturing, and casing development. Raw material suppliers provide silicon, plastics, metals, and chemicals essential for these components. Research and development teams play a pivotal role in innovating new tag designs, enhancing battery life, improving read range, and integrating additional functionalities such as sensors. Quality control and rigorous testing are integral at this stage to ensure the reliability and performance of the active RFID tags before they move further down the chain, establishing the foundational quality of the final product.

Midstream activities involve the assembly of these components into complete active RFID tags and often include the manufacturing of accompanying RFID readers, antennas, and network infrastructure. System integrators then become crucial, taking these hardware components and integrating them with software platforms, databases, and enterprise systems to create comprehensive, functional solutions tailored to end-user requirements. This phase also includes the development of middleware and application software necessary for data processing, analytics, and user interfaces. The complexity of integrating various hardware and software elements often requires specialized expertise, which is provided by these system integrators, ensuring seamless operation and optimal performance of the entire active RFID ecosystem.

Downstream activities focus on the distribution, sales, installation, and post-sales support of active RFID solutions. Distribution channels can be direct, where manufacturers sell directly to large enterprises, or indirect, involving a network of distributors, resellers, and value-added resellers (VARs) who cater to smaller businesses or specific regional markets. The installation phase often involves site surveys, network setup, tag deployment, and system calibration. Post-sales support, including maintenance, troubleshooting, software updates, and training, is vital for ensuring long-term customer satisfaction and system efficacy. This robust service component, provided by manufacturers or their partners, helps maximize the return on investment for end-users, fostering loyalty and driving repeat business across the dynamic market landscape.

Active RFID Tags Market Potential Customers

The potential customers for Active RFID Tags are incredibly diverse, spanning across various sectors that require robust, real-time asset tracking, inventory management, and security solutions over extended ranges. End-users in the manufacturing sector seek active RFID for tracking work-in-progress, tools, and high-value equipment across large factory floors, optimizing production flows and reducing downtime. In logistics and transportation, major shipping companies and warehouse operators are prime buyers, leveraging active tags for real-time visibility of containers, pallets, and vehicles across vast distribution networks, enhancing efficiency and preventing theft or loss. The ability to monitor assets across significant distances and in complex environments makes these sectors ideal candidates for active RFID deployment, as they directly benefit from the precise and continuous data streams provided by these technologies.

Healthcare institutions represent another significant segment of potential customers, utilizing active RFID for tracking critical medical equipment like wheelchairs, pumps, and diagnostic devices within sprawling hospital campuses, ensuring availability and improving patient care. Furthermore, active tags are increasingly employed for patient tracking in hospitals, especially for vulnerable individuals, and for monitoring staff movements in sensitive areas, enhancing safety and operational efficiency. The retail sector, particularly large department stores and high-value goods retailers, uses active RFID for inventory accuracy, loss prevention, and customer flow analysis. Government and defense agencies also stand as key buyers, employing active RFID for tracking sensitive assets, personnel, and equipment in secure facilities and field operations, where security and real-time location are paramount for strategic and tactical execution.

Beyond these primary sectors, the market extends to specialized industries such as oil and gas for tracking drilling equipment and personnel in remote and hazardous environments, and mining for real-time location and safety monitoring of workers and machinery underground. IT and data centers use active RFID for managing high-value servers and networking equipment, ensuring physical security and facilitating audits. Even sports and entertainment venues can be considered potential customers, deploying active tags for crowd management, VIP tracking, and monitoring event assets. The core driver across all these end-users is the fundamental need for accurate, long-range, and real-time visibility of physical assets and personnel to improve operational efficiency, enhance security, ensure compliance, and ultimately drive business value in a highly competitive global landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 9.85 Billion |

| Market Forecast in 2033 | USD 32.20 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zebra Technologies, Impinj Inc., Alien Technology, SML Group, HID Global, Avery Dennison, Honeywell International Inc., NXP Semiconductors, Mojix, Inc., Identiv, Inc., STMicroelectronics, Infineon Technologies AG, GAO RFID Inc., Omni-ID (now part of HID Global), Savi Technology, Inc., Ubisense Group plc, CenTrak (part of Halma plc), ThingMagic (a Novanta Company), Confidex Ltd., Invengo Technology |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Active RFID Tags Market Key Technology Landscape

The Active RFID Tags market's technological landscape is characterized by continuous innovation aimed at enhancing performance, extending capabilities, and reducing costs. Core technologies include various radio frequency transmission standards such as Ultra-High Frequency (UHF), which provides long read ranges, and Wi-Fi-based solutions, leveraging existing network infrastructure for seamless integration. Battery technologies are pivotal, with advancements in lithium-ion and solid-state batteries contributing to smaller form factors, longer operational lives, and improved energy efficiency. These power sources are critical for enabling the continuous broadcast capabilities that define active RFID, allowing tags to communicate independently without requiring proximity to a reader.

Beyond fundamental transmission and power components, the integration of microcontrollers and specialized firmware is essential for managing data, enabling sensor integration, and facilitating secure communication. Advanced antenna designs are crucial for optimizing signal strength and directionality, ensuring reliable performance in diverse and often challenging environments, from dense urban areas to expansive industrial facilities. Furthermore, encryption and secure authentication protocols are becoming standard, addressing growing concerns about data privacy and system vulnerability, thereby enhancing the trustworthiness of active RFID deployments. These technological underpinnings are continuously evolving, driving the market towards more robust, versatile, and secure solutions.

The broader ecosystem of supporting technologies also plays a significant role, particularly in the realm of Real-Time Location Systems (RTLS), which often leverage active RFID alongside other technologies like Bluetooth Low Energy (BLE), UWB (Ultra-Wideband), and GPS for hybrid positioning capabilities. Cloud computing platforms are increasingly utilized for storing, processing, and analyzing the massive amounts of data generated by active RFID systems, enabling scalable and flexible data management. Furthermore, the convergence of active RFID with IoT platforms and big data analytics tools is transforming raw tracking data into actionable intelligence, facilitating predictive maintenance, operational optimization, and advanced business insights. This continuous integration with complementary technologies positions active RFID as a cornerstone of modern interconnected enterprise solutions.

Regional Highlights

- North America: A mature market with high adoption rates, particularly in logistics, healthcare, and automotive sectors. Driven by technological advancements, significant R&D investments, and a strong emphasis on supply chain optimization and regulatory compliance. The presence of major technology providers and early adopters fuels continuous growth.

- Europe: Demonstrates robust growth, especially in Germany, the UK, and France, propelled by Industry 4.0 initiatives, smart manufacturing, and stringent regulatory requirements for asset tracking. Healthcare and defense sectors are key contributors, along with a focus on sustainable and efficient supply chain practices.

- Asia Pacific (APAC): Emerging as the fastest-growing region, driven by rapid industrialization, expanding manufacturing bases in China, India, and Japan, and increasing government investments in smart cities and digital infrastructure. E-commerce boom and logistics sector expansion are significant demand drivers.

- Latin America: Witnessing steady growth, albeit from a smaller base, primarily due to increasing foreign investments in manufacturing and infrastructure development. Brazil and Mexico are leading the adoption, focusing on improving logistics efficiency and security in various industries.

- Middle East and Africa (MEA): Shows promising potential with investments in smart city projects, oil & gas industry modernization, and expanding healthcare infrastructure. UAE and Saudi Arabia are at the forefront, embracing advanced tracking technologies for large-scale developments and operational efficiency.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Active RFID Tags Market.- Zebra Technologies

- Impinj Inc.

- Alien Technology

- SML Group

- HID Global

- Avery Dennison

- Honeywell International Inc.

- NXP Semiconductors

- Mojix, Inc.

- Identiv, Inc.

- STMicroelectronics

- Infineon Technologies AG

- GAO RFID Inc.

- Omni-ID (now part of HID Global)

- Savi Technology, Inc.

- Ubisense Group plc

- CenTrak (part of Halma plc)

- ThingMagic (a Novanta Company)

- Confidex Ltd.

- Invengo Technology

Frequently Asked Questions

What is an Active RFID Tag and how does it differ from Passive RFID?

An Active RFID Tag is a battery-powered device that actively broadcasts its signal, allowing for longer read ranges (hundreds of meters) and more robust performance in challenging environments. Unlike Passive RFID, which relies on power from the reader's electromagnetic field, active tags have an internal power source, enabling continuous data transmission and additional functionalities like sensor integration. This distinct power source is the primary differentiator, leading to extended capabilities for real-time tracking.

What are the primary applications of Active RFID Tags?

Active RFID Tags are predominantly used for real-time asset tracking and monitoring in large-scale operations, such as logistics and supply chain management for high-value goods, healthcare for patient and equipment location, manufacturing for work-in-progress visibility, and security for access control and personnel tracking. Their long-range capabilities make them ideal for applications requiring continuous, precise location data across expansive areas or complex environments. Key applications also include inventory management and real-time location systems (RTLS).

What are the key benefits of implementing Active RFID solutions?

The key benefits of implementing Active RFID solutions include enhanced real-time visibility into asset locations and status, improved operational efficiency through reduced manual tracking, significant cost savings by minimizing loss and theft, and optimized resource allocation. Additionally, active RFID provides superior accuracy and reliability in challenging environments, better data for compliance and auditing, and the ability to integrate with sensors for condition monitoring, leading to better decision-making and overall operational control.

What factors are driving the growth of the Active RFID Tags Market?

The Active RFID Tags Market growth is primarily driven by increasing demand for real-time asset visibility, accelerated adoption of Industry 4.0 and IoT initiatives, advancements in battery technology and tag miniaturization, and the growing need for enhanced security and operational efficiency across various industries. The expansion of e-commerce, the need for robust supply chain management, and the rising complexity of industrial operations are also significant contributing factors propelling market expansion.

What are the main challenges faced by the Active RFID Tags Market?

The main challenges in the Active RFID Tags Market include higher initial investment costs compared to passive systems, technical complexities associated with system integration into existing IT infrastructures, potential radio frequency interference in crowded environments, and concerns regarding data security and privacy. Furthermore, managing battery life and replacement schedules, along with the need for robust data analytics capabilities to handle large data volumes, represent ongoing operational hurdles for widespread adoption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager