Active Vibration Isolation Workstation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436352 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Active Vibration Isolation Workstation Market Size

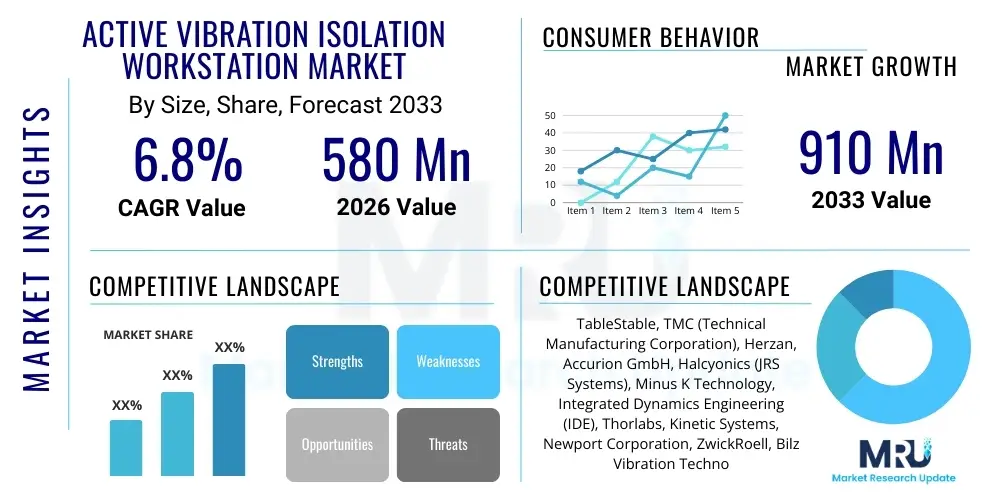

The Active Vibration Isolation Workstation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 580 Million in 2026 and is projected to reach USD 910 Million by the end of the forecast period in 2033. This sustained growth trajectory is underpinned by the increasing global demand for ultra-high precision measurement and manufacturing across critical industries such as semiconductor fabrication, advanced metrology, and life science research. The necessity of isolating sensitive equipment from environmental disturbances—including low-frequency structural vibrations—is becoming non-negotiable as device miniaturization and analytical demands intensify.

The valuation reflects robust investment in foundational scientific research and industrial quality control mechanisms worldwide. Active vibration isolation solutions, unlike their passive counterparts, utilize sensors, controllers, and actuators to dynamically counter external vibrations, offering superior performance, particularly at low frequencies (below 5 Hz). This technological superiority justifies the premium pricing and drives adoption in fields requiring nanometer-level stability, such as atomic force microscopy (AFM), scanning electron microscopy (SEM), and specialized laser interferometry experiments. Market expansion is particularly pronounced in regions scaling up their semiconductor and photonics research infrastructure, which heavily rely on these stable platforms.

Furthermore, the market size calculation incorporates the growing trend toward customized and integrated isolation solutions. End-users are increasingly seeking workstations that can be seamlessly integrated into cleanroom environments or specialized lab setups, often requiring sophisticated control algorithms and remote monitoring capabilities. The replacement and upgrade cycles of existing passive systems in established research facilities also contribute significantly to the projected market value, as institutions transition to active systems to accommodate new generations of highly sensitive instruments. The demand for modularity and greater load capacity in active systems also influences the overall market valuation favorably.

Active Vibration Isolation Workstation Market introduction

Active Vibration Isolation Workstations are highly specialized technological platforms designed to protect ultra-sensitive equipment from external mechanical vibrations and disturbances. These systems employ advanced feedback control loops, incorporating high-resolution accelerometers or geophones, powerful digital controllers, and high-response actuators (often piezoelectric or voice coil-based) to detect, analyze, and actively cancel ground or floor vibrations across a broad frequency spectrum, particularly the crucial low-frequency range where passive methods struggle. The primary product is a stable, vibration-free surface essential for maintaining the integrity and precision of measurements in high-magnification microscopy, lithography, and precision metrology applications, ensuring research reproducibility and manufacturing reliability.

Major applications span critical sectors globally, including semiconductor manufacturing, where vibration affects nanometer-scale patterning; academic and industrial research labs focusing on nanotechnology, materials science, and quantum computing; and biological sciences, particularly high-resolution imaging techniques like super-resolution microscopy. The key benefits derived from using active systems include enhanced throughput, improved signal-to-noise ratios, dramatically increased image resolution, and reduced data acquisition time. By mitigating disturbances originating from HVAC systems, nearby traffic, or machinery, these workstations allow precision instruments to operate at their theoretical performance limits, which is paramount for competitive technological advancement.

The market is predominantly driven by the relentless pursuit of smaller features in microelectronics, necessitating higher stability in lithography and inspection tools; massive government and private sector investment in nanotechnology research and development (R&D); and the accelerating sophistication of high-resolution microscopy used in drug discovery and cell biology. Furthermore, the rising adoption of automation and robotic systems within these precision environments requires equally stable operational platforms, reinforcing the demand for robust and reliable active isolation solutions capable of handling dynamic load changes while maintaining performance.

Active Vibration Isolation Workstation Market Executive Summary

The Active Vibration Isolation Workstation Market is witnessing dynamic shifts driven by escalating requirements for nanometer precision across industrial and scientific domains. Current business trends highlight consolidation among established players, with a strong emphasis on developing highly integrated, networked, and smart isolation platforms capable of real-time environmental monitoring and remote diagnostics. Key manufacturers are focusing on miniaturization of controller components and refining algorithms to improve low-frequency performance below 1 Hz, which is crucial for advanced materials characterization and long-duration, highly stable quantum experiments. Strategic partnerships between isolation providers and high-end instrument manufacturers (e.g., SEM or AFM producers) are becoming commonplace to offer bundled, validated solutions, streamlining the procurement process for end-users and ensuring optimized performance immediately upon installation.

Geographically, Asia Pacific (APAC) is emerging as the fastest-growing region, fueled by massive government investments in establishing advanced semiconductor fabrication plants (fabs) and state-of-the-art academic research centers, particularly in China, South Korea, and Taiwan. North America and Europe maintain dominance in terms of market value, driven by robust established R&D infrastructure, high adoption rates of advanced microscopy techniques, and stringent quality control standards in aerospace and defense sectors. Regional trends also show increasing compliance requirements, particularly in Europe, prompting facilities to upgrade aging passive systems to modern active solutions that provide certified performance metrics necessary for regulatory adherence.

Segment trends underscore the dominance of the sub-kilogram to 200kg load capacity segment, reflecting the prevalent use of workstations for benchtop analytical instruments like AFMs and small interferometers. Technologically, voice coil actuators are gaining traction due to their higher bandwidth and smoother operation compared to older pneumatic or certain piezoelectric systems, although piezoelectric actuators remain critical for high-stiffness, high-frequency dampening requirements. The application segment growth is robustly led by Life Sciences, where advanced cell manipulation and imaging demand absolute stability, closely followed by the Semiconductor and Microelectronics sectors, which require non-stop, ultra-stable environments for crucial inspection and lithography steps, thereby defining the immediate investment priorities for market participants.

AI Impact Analysis on Active Vibration Isolation Workstation Market

User inquiries regarding AI's influence often center on its potential to move active isolation systems from reactive to truly predictive and self-optimizing platforms. Common questions include: Can AI algorithms improve the efficiency and accuracy of vibration cancellation? How will machine learning handle transient, unpredictable vibration sources that traditional systems miss? Will AI enable proactive maintenance and remote diagnostics, reducing downtime? The core themes reveal user expectations for smarter systems capable of learning ambient vibration signatures (the 'noise floor'), distinguishing operational disturbances from external environmental threats, and automatically tuning isolation parameters for optimal performance without manual input from highly specialized technicians. There is also significant interest in AI integration for comprehensive data analysis of the instrument's operational environment, providing granular insights into stability performance over time.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming the control architecture of Active Vibration Isolation Workstations, migrating them toward cognitive systems. ML algorithms are employed to analyze vast streams of sensor data collected over time, enabling the system to learn complex, non-linear patterns of environmental noise specific to the installation location. This allows for predictive modeling of recurrent disturbances (like daily traffic cycles or intermittent machinery operation), leading to anticipatory adjustments of the actuators before the vibration actually impacts the instrument's performance. Such predictive capabilities significantly enhance the system's ability to maintain ultra-stability during highly sensitive measurement cycles, exceeding the limits of purely reactive Proportional-Integral-Derivative (PID) control mechanisms.

Furthermore, AI facilitates advanced system diagnostics and self-calibration, crucial components for maintaining uptime in high-cost research and manufacturing environments. Deep Learning models can automatically detect subtle component drift, sensor degradation, or impending actuator failures, alerting maintenance teams well in advance. This proactive approach minimizes unexpected system failures. Additionally, in multi-axis isolation systems, AI optimizes the coupling and decoupling of control channels, ensuring that isolation performance in one dimension does not negatively impact stability in another, a common challenge in complex six-degrees-of-freedom setups. The overall result is a transition toward 'zero-touch' stable platforms that guarantee environmental stability autonomously.

- AI-driven Predictive Control: Utilizing ML to forecast localized vibration events based on historical data and making anticipatory adjustments to actuator settings.

- Real-time Optimal Tuning: Automated optimization of control parameters (PID gains, filter settings) based on instrument load changes or shifting ambient conditions.

- Advanced Anomaly Detection: Machine learning flags subtle mechanical faults or sensor degradation for proactive maintenance, maximizing system lifespan and reliability.

- Environmental Fingerprinting: AI creates detailed models of site-specific noise profiles, allowing for superior cancellation of complex, intermittent, or non-stationary noise sources.

- Enhanced Multi-Axis Decoupling: Optimization algorithms ensure robust, independent vibration cancellation across all six degrees of freedom (X, Y, Z, Roll, Pitch, Yaw).

- Remote Performance Validation: AI systems provide validated, objective stability metrics, essential for regulatory compliance and guaranteeing data integrity for highly sensitive experiments.

DRO & Impact Forces Of Active Vibration Isolation Workstation Market

The Active Vibration Isolation Workstation Market is fundamentally driven by the escalating demand for high-resolution capabilities in research and industrial processes, necessitating the elimination of environmental noise. The primary drivers include massive government R&D investment in emerging fields like quantum technology and advanced materials science, and the critical need for nanometer-level precision in semiconductor manufacturing inspection and lithography. Restraints, however, revolve around the high initial capital expenditure associated with active systems, often limiting adoption in smaller academic institutions or budget-constrained labs, coupled with the complexity of integrating these specialized systems into existing facility infrastructure, requiring trained personnel for setup and maintenance. Opportunities lie in the rapidly expanding market for personalized medicine demanding high-throughput microscopy, the burgeoning sector of micro-electromechanical systems (MEMS) requiring highly stable production environments, and geographical expansion into developing economies that are building new high-tech research campuses. These forces collectively exert significant impact, pushing manufacturers toward more user-friendly, cost-effective, and higher-performance solutions.

Drivers are strongly supported by technological trends. The constant miniaturization of electronic components, adhering to Moore's Law, directly translates into a requirement for dramatically improved stability, as environmental disturbances disproportionately affect smaller feature sizes during fabrication. Furthermore, the global race in quantum computing R&D is a powerful catalyst; quantum experiments, such as those involving atomic clocks or superconducting qubits, are notoriously sensitive to minute vibrations, making active isolation systems indispensable components rather than optional accessories. The increasing reliance on non-contact measurement techniques and high-magnification optical systems, which are highly susceptible to vibration-induced blurring, solidifies the requirement for these sophisticated stability platforms across industrial metrology.

Conversely, the key restraint of high cost is a persistent barrier. An advanced, high-load active system can represent a substantial percentage of the overall instrument budget, often requiring rigorous justification through capital expenditure processes. This cost sensitivity drives competition from advanced passive systems that, while offering lower performance, are significantly cheaper and simpler to install. Furthermore, the operational challenge of complex calibration and maintenance, often specific to the vendor's proprietary control system, mandates continuous technical training for facility staff, adding to the total cost of ownership (TCO). Addressing these restraints through modular design, simplified user interfaces, and remote diagnostic capabilities is a core strategic focus for market leaders aiming for broader market penetration beyond elite research centers.

Opportunities are clearly defined by application expansion and geographical market penetration. The life sciences sector, particularly bio-nanotechnology and sophisticated cell sorting, presents a lucrative opportunity as precision instrument stability directly correlates with successful experimental outcomes and data yield. Geographically, the industrialization and rapid establishment of new R&D hubs in Southeast Asia and parts of the Middle East, coupled with governmental initiatives to attract high-tech manufacturing, create new greenfield sites demanding immediate installation of best-in-class vibration isolation infrastructure. The development of advanced, networked, and remotely monitored isolation workstations also opens avenues for managed service offerings, transforming the business model from product sale to performance-as-a-service (PaaS), potentially mitigating the high upfront cost restraint.

The impact forces within the market are predominantly characterized by high customer switching costs once an isolation solution is integrated into a cleanroom or high-precision lab, favoring established suppliers with proven reliability and long-term support. Regulatory impact is growing, especially in medical device manufacturing and precision defense applications, where certified, quantifiable stability performance is mandatory, favoring active systems that provide continuous data logging and verifiable cancellation metrics. Finally, the competitive intensity is high, with technology innovation focused on energy efficiency and improved performance at the critical 0.5 Hz to 5 Hz range, necessitating continuous R&D investment from key players to maintain technological differentiation and market leadership.

Segmentation Analysis

The Active Vibration Isolation Workstation Market is segmented primarily based on the type of technology employed, the load capacity the platform supports, the final application area, and the specific end-user industry. This granular segmentation provides valuable insights into diverse user needs, ranging from lightweight benchtop research microscopes to massive, multi-ton industrial metrology machines. Understanding these segments is crucial for strategic market positioning, product development, and tailoring marketing efforts, as the performance metrics and cost sensitivities vary dramatically between a nanotechnology research lab and a high-volume semiconductor fabrication facility, demanding distinct product attributes and service agreements.

Segmentation by technology is vital, distinguishing between systems based on piezoelectric actuators, voice coil motors, and hybrid systems. Piezoelectric solutions offer very high stiffness and quick response times, suitable for high-frequency isolation and small displacements, whereas voice coil systems excel in providing superior performance at the challenging low-frequency range (below 2 Hz) and accommodating larger displacements. Hybrid systems attempt to leverage the benefits of both, combining technologies for optimal broadband isolation. Load capacity segmentation is equally important, typically divided into segments such as ultra-low load (1-10 kg), medium load (10-200 kg), and high/heavy load (200 kg and above), directly corresponding to instrument weight and facility scale.

Application and End-User segmentation reveals the primary growth drivers. Key applications include metrology and inspection, microscopy (SEM, TEM, AFM), lithography, and specialized laser/optical systems. The end-user groups, such as academic research institutes, semiconductor manufacturers, electronics companies, and life sciences R&D organizations, dictate purchasing patterns, required technical specifications, and regulatory compliance needs. The life sciences sector, driven by genomics and proteomics, is particularly sensitive to stability for imaging live cells, while the semiconductor sector mandates the highest possible performance and reliability for long-term industrial operations, making these two segments critical focus areas for market participants.

- Technology

- Piezoelectric Actuators

- Voice Coil Motors (VCM)

- Electromagnetic Systems

- Hybrid Solutions (Active-Passive Combined)

- Load Capacity

- Low Load (Up to 50 kg)

- Medium Load (51 kg to 200 kg)

- High Load (Above 200 kg)

- Application

- Microscopy (AFM, SEM, TEM)

- Metrology and Inspection Systems

- Lithography Tools

- Laser and Optics Experiments

- Precision Manufacturing/Assembly

- Quantum Technology Experiments

- End-User Industry

- Semiconductor & Electronics

- Life Sciences & Biotechnology

- Academic & Research Institutions

- Aerospace & Defense

- Metrology and Quality Control Labs

- Isolation Type

- Benchtop Workstations

- Floor-Standing Platforms

- OEM Integrated Systems

Value Chain Analysis For Active Vibration Isolation Workstation Market

The value chain for the Active Vibration Isolation Workstation Market begins with upstream activities centered on the procurement and manufacturing of highly specialized components. This includes securing advanced materials for the mechanical structure (e.g., highly rigid alloys or granite), sourcing sensitive sensors (accelerometers, geophones), and manufacturing the core actuation components (piezoelectric stacks, voice coil motors). The profitability and competitive advantage at this stage depend heavily on material science expertise, component precision, and securing reliable supply lines for sophisticated electronics, particularly high-speed Digital Signal Processors (DSPs) used in the control systems. Key strategic concerns upstream involve component miniaturization and integration capability, ensuring system responsiveness and minimizing internal noise generation.

Midstream activities involve the design, assembly, testing, and integration of the complete isolation workstation. This stage is dominated by specialized isolation equipment manufacturers who possess proprietary control algorithms and system integration expertise. Value addition here is maximized through rigorous quality control, calibration processes specific to the target application (e.g., cleanroom compatibility), and the development of intuitive user interfaces and remote monitoring software. Extensive R&D investment is required to continuously improve isolation efficiency, particularly in dampening low-frequency environmental noise, which requires sophisticated modeling and simulation capabilities. Certification processes and compliance with industry standards (e.g., seismic stability, cleanroom standards) are critical midstream deliverables.

Downstream activities focus on distribution, installation, and post-sales support. Distribution channels are typically a mix of direct sales (especially for highly customized, high-value systems sold to major industrial clients like semiconductor fabs) and indirect channels utilizing specialized technical distributors who offer localized sales, installation, and maintenance services to academic and smaller industrial clients. Post-sales support, encompassing maintenance contracts, calibration checks, and software updates, is a vital part of the revenue stream and a key differentiator, as users rely heavily on continuous, certified performance. The technical complexity of the product means that detailed, high-quality technical support, often involving remote diagnostics facilitated by the system's smart capabilities, is paramount for ensuring high customer satisfaction and repeat business.

Active Vibration Isolation Workstation Market Potential Customers

The core potential customers for Active Vibration Isolation Workstations are organizations that utilize high-precision instruments where external mechanical noise directly compromises data integrity, research outcomes, or manufacturing yields. These end-users are characterized by their reliance on nanometer-scale resolution or feature size, justifying the significant investment in advanced isolation technology. Key buyers include research departments within leading universities and national laboratories focused on physics, materials science, and bio-engineering. These academic institutions typically purchase systems tailored for microscopy (AFM, high-resolution optical microscopes) and specialized experimental setups, such as gravitational wave detectors or high-energy physics components, emphasizing flexibility and extreme low-frequency performance.

A second major customer segment comprises industrial entities, specifically semiconductor fabrication plants (fabs) and advanced microelectronics manufacturers. For this segment, Active Vibration Isolation Workstations are non-negotiable components of the manufacturing chain, supporting critical processes like photolithography, wafer inspection (metrology), and defect review systems. Their purchasing criteria prioritize robustness, cleanroom compatibility, high load capacity, ultra-reliability for 24/7 operation, and seamless integration with complex process tools. Investment in isolation directly translates to yield improvement and consistency in production quality, making them high-volume, high-value customers with stringent performance demands and rigorous service level agreements (SLAs).

Furthermore, biotechnology and pharmaceutical companies form a rapidly growing customer base, driven by the shift towards precision medicine, drug discovery, and advanced cell analysis. Instruments like high-content screening systems, patch clamp rigs, and super-resolution microscopes require exceptional stability to perform accurate live-cell imaging and manipulation. Aerospace and defense contractors also represent potential customers, utilizing these platforms for precision gyroscopic testing, inertial sensor calibration, and quality control of highly sensitive components, where performance validation under vibration-free conditions is mandatory. These diverse end-users collectively represent the established market demand, all sharing the fundamental requirement for certified environmental stability that only active isolation technology can consistently provide.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 580 Million |

| Market Forecast in 2033 | USD 910 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TableStable, TMC (Technical Manufacturing Corporation), Herzan, Accurion GmbH, Halcyonics (JRS Systems), Minus K Technology, Integrated Dynamics Engineering (IDE), Thorlabs, Kinetic Systems, Newport Corporation, ZwickRoell, Bilz Vibration Technology, WaveCrest, Max-Planck-Gesellschaft, Scie-Tech Instruments, PICO-VA (Precision Isolation Company), Vibra-Stop, Terra Universal, K&S Instruments, Halyard |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Active Vibration Isolation Workstation Market Key Technology Landscape

The technology landscape of the Active Vibration Isolation Workstation Market is defined by the continual evolution of control algorithms and actuator technology, striving for superior isolation performance, particularly at sub-Hertz frequencies, which are the most challenging to mitigate. The primary technological distinction lies between the types of actuators utilized: piezoelectric systems and voice coil motors (VCMs). Piezoelectric actuators are favored for their high bandwidth, rapid response time, and high stiffness, making them ideal for canceling high-frequency mechanical noise and for providing precise, rapid corrective positioning. However, their limitations traditionally include smaller stroke capacity and sensitivity to temperature fluctuations. Voice Coil Motors, based on electromagnetic principles, offer larger displacement capabilities and excel in providing robust, smooth cancellation of extremely low-frequency vibrations, making them highly suitable for isolating systems from building sway and major ground disturbances.

Beyond actuators, the core technological advancement resides in the sophisticated digital controllers and integrated sensor packages. Modern systems utilize high-speed Digital Signal Processors (DSPs) to run complex, multi-input, multi-output (MIMO) feedback control algorithms, often incorporating feed-forward elements to anticipate and negate periodic disturbances. State-of-the-art systems are increasingly integrating advanced inertial sensors, such as high-sensitivity geophones and broadband accelerometers, which provide the crucial low-noise, wide-dynamic-range input necessary for effective cancellation across the entire operational frequency range. The trend toward networking and IoT integration means these systems often include Ethernet capabilities for remote monitoring, performance logging, and diagnostic feedback, significantly enhancing their operational utility in large-scale facilities.

Furthermore, hybrid isolation technology is gaining prominence, combining the strengths of active and passive approaches. These hybrid systems utilize passive elements, such as highly optimized air springs or mechanical springs, to support the static load and filter high-frequency noise, while the active components (piezo or VCM) focus their energy on precisely canceling the troublesome low-frequency vibrations where passive systems exhibit resonance issues. This integration provides a cost-effective path to superior broadband performance, reducing the power consumption required by the active elements and optimizing overall system reliability. Research is also intensifying on magnetic levitation technologies for ultra-precise, friction-free platforms, positioning these advancements as the next frontier for extremely high-load, ultra-stable systems required in advanced industrial applications.

Regional Highlights

North America maintains a dominant position in the Active Vibration Isolation Workstation Market, primarily driven by the presence of a robust ecosystem encompassing world-class academic research institutions, leading technology giants in semiconductor and aerospace, and significant private and government funding directed toward advanced R&D. The United States, in particular, is a major consumer due to its high concentration of facilities engaged in advanced physics, materials science, and cutting-edge bio-nanotechnology. Early adoption of advanced microscopy techniques (AFM, high-resolution electron microscopy) and continued investment in defense-related precision manufacturing necessitate the mandatory use of the highest-performance active isolation solutions. The region is characterized by high demand for customized, integrated solutions and is a key innovation hub for control algorithm development and smart system integration.

Europe represents a mature and technologically advanced market, characterized by stringent industrial quality standards and strong government support for foundational research, particularly within the Eurozone's established semiconductor and automotive R&D clusters. Countries such as Germany, Switzerland, and the Netherlands exhibit high demand, driven by their specialization in high-precision engineering, metrology, and advanced optics manufacturing. The European market focuses heavily on certified performance metrics and compliance with various EU directives regarding industrial environments and laboratory safety. The adoption rate is steady, supported by continuous modernization efforts in major research laboratories and universities seeking to upgrade infrastructure to accommodate next-generation analytical instruments.

Asia Pacific (APAC) is projected to be the fastest-growing region throughout the forecast period, fueled by unprecedented capital expenditure on new semiconductor fabrication facilities (especially in Taiwan, South Korea, and China) and the massive establishment of new industrial parks and government-funded research centers. The rapid expansion of electronics manufacturing, coupled with escalating domestic investment in life sciences R&D, creates immense greenfield opportunities for active vibration isolation providers. While North America and Europe typically prioritize ultra-high performance, the APAC market is characterized by both high-end demand (for leading fabs) and growing volume demand for cost-effective, reliable solutions in emerging industrial applications and rapidly scaling academic facilities. Japan also remains a significant market, known for its expertise in precision instrument manufacturing and rigorous quality standards.

Latin America (LATAM) and the Middle East & Africa (MEA) currently represent smaller but developing markets. Growth in these regions is patchy, largely centered around national strategic investments, such as major new university campuses, specialized petroleum and materials testing facilities, and localized semiconductor assembly plants. The demand is often tied to large, one-off governmental procurement projects aimed at building foundational research capacity or establishing high-tech industrial capabilities. Infrastructure challenges, including unstable electrical grids or building construction that generates high levels of environmental vibration, paradoxically increase the necessity for robust active isolation systems in these specific locations. However, market penetration remains lower due to budget constraints and a lower concentration of specialized high-precision industries compared to the established global hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Active Vibration Isolation Workstation Market.- TableStable

- TMC (Technical Manufacturing Corporation)

- Herzan

- Accurion GmbH

- Halcyonics (JRS Systems)

- Minus K Technology

- Integrated Dynamics Engineering (IDE)

- Thorlabs

- Kinetic Systems

- Newport Corporation

- ZwickRoell

- Bilz Vibration Technology

- WaveCrest

- Max-Planck-Gesellschaft

- Scie-Tech Instruments

- PICO-VA (Precision Isolation Company)

- Vibra-Stop

- Terra Universal

- K&S Instruments

- Halyard

Frequently Asked Questions

Analyze common user questions about the Active Vibration Isolation Workstation market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between active and passive vibration isolation systems?

Active vibration isolation systems dynamically sense incoming vibrations using accelerometers and employ actuators (like voice coils or piezo stacks) and electronic feedback control to actively cancel the disturbances in real-time. Passive systems rely purely on mechanical components, such as air springs, rubber pads, or metal springs, to absorb and dampen vibrations. Active systems offer superior performance, especially in the critical low-frequency range (below 5 Hz), which is essential for high-magnification microscopy and nanometer-scale precision tools.

Which industries are the primary consumers of high-load active isolation platforms?

The primary consumers of high-load platforms (supporting hundreds or thousands of kilograms) are the semiconductor manufacturing industry for photolithography and wafer metrology equipment, and advanced aerospace and defense sectors for testing large, sensitive inertial sensors and optical systems. These industrial applications require robust, reliable isolation capable of handling massive instruments while maintaining stability under continuous operational conditions and often require custom floor-standing installations.

How does the integration of AI benefit the performance of Active Vibration Isolation Workstations?

AI significantly enhances performance by enabling predictive control and self-optimization. Machine learning algorithms analyze historical and real-time vibration data to create an environmental fingerprint, allowing the system to anticipate disturbances (e.g., HVAC cycles, intermittent traffic) and make anticipatory adjustments. This moves the system beyond reactive control, ensuring maintained ultra-stability and reducing downtime through proactive anomaly detection and automated system tuning without manual intervention.

What factors determine the selection between piezoelectric and voice coil actuator technologies?

The selection hinges on frequency range and displacement requirements. Piezoelectric actuators are chosen when high stiffness and rapid response are needed for canceling higher-frequency noise and for precise positioning. Voice coil motors (VCMs) are preferred for exceptional performance in the challenging ultra-low frequency range (0.5 Hz to 5 Hz) and when larger corrective displacements are necessary to counter major floor disturbances, offering smoother, broader cancellation capabilities.

Is Active Vibration Isolation necessary for standard optical microscopy in a typical laboratory setting?

For standard, low-magnification optical microscopy, advanced passive systems or even isolation pads might suffice. However, Active Vibration Isolation becomes necessary and often mandatory when transitioning to high-resolution techniques such as super-resolution fluorescence microscopy, high-numerical-aperture imaging, or Atomic Force Microscopy (AFM), where even minute vibrations severely degrade image quality, experimental fidelity, and data reproducibility at the nanoscale.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager