Actuarial Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431524 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Actuarial Services Market Size

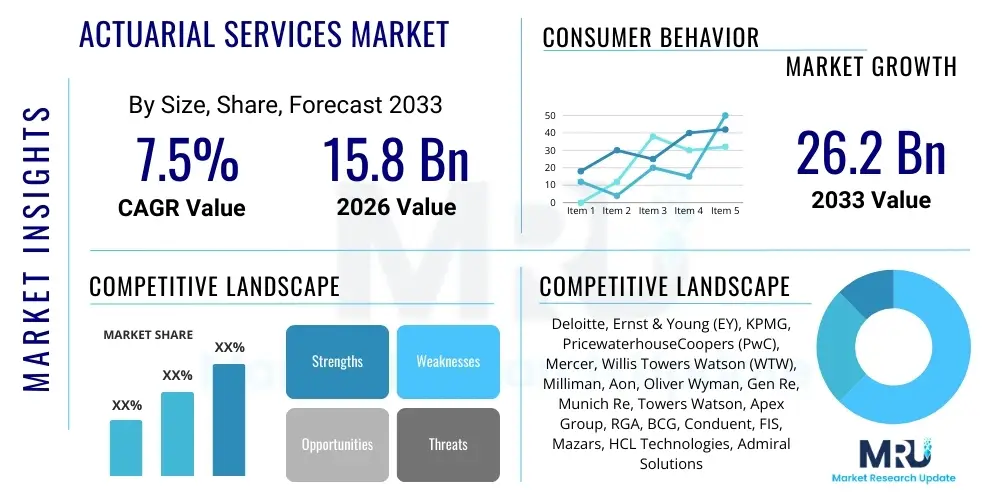

The Actuarial Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 15.8 Billion in 2026 and is projected to reach USD 26.2 Billion by the end of the forecast period in 2033.

Actuarial Services Market introduction

The Actuarial Services Market encompasses professional consulting, analysis, and strategic advice centered on assessing, managing, and mitigating financial risks associated with uncertain future events. Actuarial science applies mathematical and statistical methods, particularly probability theory, to solve complex business and societal problems involving risk and security, primarily in the insurance, pension, finance, and healthcare sectors. Core offerings include liability valuation, reserving, pricing, capital management, and enterprise risk management (ERM).

Major applications of these services span life and health insurance, property and casualty (P&C) insurance, retirement planning, regulatory compliance (such as Solvency II and IFRS 17), and emerging fields like climate risk modeling and cyber risk assessment. The crucial benefit derived from specialized actuarial services is enhanced financial stability, optimized capital allocation, accurate pricing models, and robust compliance structures, enabling organizations to make data-driven decisions under conditions of uncertainty. The persistent evolution of regulatory landscapes globally, coupled with the increasing complexity of risks, particularly those driven by demographic shifts and technological disruption, are primary factors fueling the demand for sophisticated actuarial expertise.

Actuarial Services Market Executive Summary

The Actuarial Services Market is characterized by robust expansion, driven primarily by stringent regulatory reforms, the growing imperative for Enterprise Risk Management (ERM) across non-traditional sectors, and the massive data sets generated by digitalization which require advanced statistical modeling. Business trends highlight a significant shift towards technology integration, with firms increasingly leveraging predictive analytics, machine learning, and automation tools to enhance model efficiency, speed compliance reporting, and reduce operational costs. This transformation is fostering a competitive environment where traditional consulting models are being augmented by tech-enabled solutions and managed services, particularly in areas like reserving and claims optimization.

Regionally, North America and Europe remain the dominant markets due to mature insurance industries and demanding regulatory frameworks (e.g., US GAAP modernization, Solvency II). However, the Asia Pacific (APAC) region is demonstrating the highest growth velocity, propelled by rapid insurance penetration, substantial economic development, and evolving regulatory standards in key economies like China, India, and Southeast Asia. Within market segments, the demand for non-traditional actuarial advice—specifically related to climate change risk, healthcare cost projections, and cyber liability—is outpacing growth in traditional life and P&C services. Furthermore, the segmentation by service highlights a rising preference for outsourcing and co-sourcing models among mid-sized insurers seeking to access specialized skills without incurring high fixed costs, emphasizing the market’s pivot towards flexibility and specialized risk consulting.

AI Impact Analysis on Actuarial Services Market

Common user inquiries concerning the influence of Artificial Intelligence (AI) on actuarial services frequently revolve around job displacement, the accuracy and transparency of AI-driven models, and the scalability of AI solutions for risk assessment. Users often question whether AI tools, such as machine learning algorithms, will fully automate core actuarial tasks like reserving and pricing, thereby reducing the need for human actuaries. A central concern is the 'black box' nature of deep learning models, prompting queries about regulatory acceptance and the explainability required for auditors and regulators, particularly in high-stakes areas like capital adequacy and liability valuation. Furthermore, businesses are keenly interested in understanding how AI can integrate with existing legacy systems, what skills actuaries must acquire to remain relevant (focusing on prompt engineering and data science), and which specific areas—such as claims processing, fraud detection, and customer personalization—are seeing the most immediate and tangible productivity gains from AI adoption, signaling a clear shift in the profession from pure calculation to strategic interpretation.

- AI automates routine data processing and model calibration tasks, shifting actuaries' focus to strategic interpretation and complex, non-standard risk modeling.

- Machine learning enhances the precision of pricing models and reserving calculations by identifying complex, non-linear relationships in large datasets, surpassing traditional linear regression methods.

- Predictive analytics driven by AI improves claims management efficiency, identifying fraudulent activities and forecasting claims severity more accurately, leading to reduced indemnity costs.

- Natural Language Processing (NLP) speeds up compliance reporting by rapidly analyzing complex regulatory documents and contractual data extraction.

- AI introduces new ethical and explainability challenges (XAI), requiring actuaries to bridge the gap between model output and regulatory transparency (e.g., IFRS 17 or GAAP requirements).

- Development of specialized AI tools focused on emerging risks, such as climate risk scenario generation and cyber risk quantification, expanding the scope of actuarial practice beyond traditional insurance lines.

DRO & Impact Forces Of Actuarial Services Market

The trajectory of the Actuarial Services Market is dictated by a critical interplay of strong driving forces, persistent restraints, and significant opportunities, generating powerful impact forces that reshape operational models. Key drivers include the global adoption of complex reporting standards like IFRS 17 and Solvency II, mandating deep actuarial involvement in financial reporting and capital management, alongside the secular growth in global insurance premiums and the subsequent need for accurate risk transfer pricing. Restraints often center on the high costs associated with bespoke actuarial software implementation, the critical shortage of senior actuarial talent with data science proficiency, and the inherent reluctance of highly regulated industries to rapidly adopt transformative, AI-driven models that lack historical precedent and full regulatory acceptance. Opportunities abound in the burgeoning demand for specialized consultancy in non-traditional areas such as climate change, longevity risk, and pension de-risking, providing new avenues for service diversification and higher-margin engagements, especially through cloud-based, subscription model offerings.

The impact forces are fundamentally transforming the competitive landscape. Globalization is pressuring firms to harmonize methodologies across diverse regulatory jurisdictions, forcing smaller providers into niche specialization or consolidation. Regulatory tightening acts as a perpetual demand generator, ensuring a foundational level of sustained market activity regardless of economic cycles. Conversely, technological innovation is the most disruptive force; while it promises efficiency gains, it also lowers barriers to entry for specialized tech startups offering targeted risk solutions, pressuring established actuarial consultants to rapidly integrate technology into their core offerings. Successful market navigation requires a strategic balance between maintaining regulatory compliance expertise and aggressively investing in advanced analytical capabilities to address novel, complex risks.

Segmentation Analysis

The Actuarial Services Market is meticulously segmented based on the type of service offered, the specific industry served, and the deployment model utilized for analytical tools. Service segmentation distinguishes between traditional consulting (high-level strategy and bespoke modeling) and outsourcing (routine calculations and compliance functions), reflecting varied client needs for external support versus core strategic advice. Industry segmentation emphasizes the dominance of the Life & Health sector due to complex long-term liability calculations and demographic volatility, juxtaposed against the growing need for specialized P&C risk management and government benefit program valuation. Furthermore, deployment segmentation tracks the shift from traditional on-premise software to flexible, scalable cloud-based platforms, catering to clients seeking operational agility and reduced infrastructure investment, thereby highlighting the move toward tech-enabled service delivery across all segments.

- By Service Type:

- Actuarial Consulting

- Actuarial Outsourcing/Managed Services

- Reserving and Valuation

- Pricing and Product Development

- Mergers and Acquisitions Support

- Capital and Risk Management (ERM)

- By Industry:

- Insurance (Life & Health, Property & Casualty, Reinsurance)

- Banking and Financial Services (BFSI)

- Government and Public Sector (Social Security, Pensions)

- Healthcare Providers

- Corporate (Employee Benefits, Captives)

- By Deployment Model (Software/Solutions):

- On-Premise

- Cloud-Based

Value Chain Analysis For Actuarial Services Market

The value chain for Actuarial Services commences with upstream activities centered on rigorous data acquisition and validation. This stage involves securing vast, disparate datasets—covering policyholder behavior, mortality rates, economic indicators, and climate data—and applying sophisticated data cleansing and quality assurance protocols to ensure input integrity. Key upstream suppliers include data providers, regulatory bodies (providing guidelines), and specialized software vendors offering modeling platforms.

The core processing stage involves the actuarial service provider, which transforms raw data into strategic insights through modeling, calculation of reserves, pricing scheme development, and regulatory compliance reporting. This requires highly skilled human capital (actuaries) and advanced analytical tools. Distribution channels, both direct and indirect, define how these services reach the end-customer. Direct channels involve large consulting firms engaging directly with major insurers and corporations. Indirect channels increasingly utilize technology platforms, partnerships with system integrators, or specialized boutique firms focusing on niche risk areas (e.g., longevity swaps).

Downstream activities involve the practical application of actuarial advice by the end-user (e.g., insurance companies implementing new pricing schemes or adjusting capital reserves) and post-service monitoring. The effectiveness of the service is judged by improved solvency margins, reduced risk exposure, and compliant financial statements. The rise of cloud-based solutions is significantly streamlining the distribution and deployment of complex models, making services more accessible and facilitating continuous model updates and auditing, enhancing overall efficiency and responsiveness throughout the value chain.

Actuarial Services Market Potential Customers

The primary customers for actuarial services are institutions facing significant financial risks tied to uncertain future events and those operating under strict solvency and liability reporting regulations. Insurance companies, spanning life, health, property, casualty, and reinsurance, constitute the largest segment, requiring services for product pricing, liability reserving (e.g., IFRS 17 implementation), and capital adequacy assessment (e.g., Solvency II). These organizations rely on actuaries to ensure their long-term financial stability and competitive positioning.

Beyond the insurance sphere, large corporations utilizing self-insured employee benefit plans, defined benefit pension schemes, and captive insurance arrangements are crucial buyers. They utilize actuarial expertise for plan valuation, risk transfer strategies, and optimizing benefit costs. Government entities and public sector organizations, particularly those managing national social security, state pension funds, and public healthcare systems, also rely heavily on actuarial modeling to project long-term financial sustainability under varied demographic and economic scenarios. The expanding definition of risk has also drawn non-traditional buyers, such as banks requiring support for stress testing and credit risk modeling, and large energy companies seeking specialized expertise in climate risk quantification and hedging strategies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.8 Billion |

| Market Forecast in 2033 | USD 26.2 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deloitte, Ernst & Young (EY), KPMG, PricewaterhouseCoopers (PwC), Mercer, Willis Towers Watson (WTW), Milliman, Aon, Oliver Wyman, Gen Re, Munich Re, Towers Watson, Apex Group, RGA, BCG, Conduent, FIS, Mazars, HCL Technologies, Admiral Solutions |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Actuarial Services Market Key Technology Landscape

The technological landscape supporting the Actuarial Services market is rapidly evolving from reliance on proprietary, on-premise projection software to integrated, cloud-native platforms leveraging sophisticated computational power. Key technologies include high-performance computing (HPC) environments crucial for running complex nested stochastic simulations required under modern solvency and capital modeling frameworks. The transition to cloud infrastructure, particularly managed services (SaaS and PaaS), allows actuaries to access scalable computing resources instantaneously, significantly accelerating model run times for iterative scenario testing and end-of-quarter reporting, thereby improving regulatory responsiveness.

Furthermore, the integration of advanced analytical tools, such as machine learning (ML) and predictive modeling, is paramount. ML algorithms are increasingly used for granular risk classification, demand forecasting in healthcare, and optimizing pricing elasticity in competitive insurance markets. These tools require sophisticated data warehousing solutions and APIs capable of handling real-time data ingestion. The ongoing development of explainable AI (XAI) is also gaining traction, addressing the regulatory requirement for transparency by providing insights into model decision-making processes, bridging the gap between cutting-edge technology and conservative regulatory oversight.

Finally, blockchain technology is being explored, particularly for streamlining the processing and verification of complex reinsurance treaties and smart contracts, potentially reducing administrative overhead and improving data security across the value chain. Core actuarial software vendors are focusing on modular, interconnected platforms that support simultaneous compliance across multiple jurisdictions (e.g., IFRS 17, Solvency II, US GAAP), ensuring that technological upgrades translate directly into enhanced efficiency and multi-jurisdictional operational capability.

Regional Highlights

- North America: North America, encompassing the United States and Canada, represents the most mature and largest market for actuarial services, driven by a highly developed insurance sector, complex tort law, and mandatory pension funding regulations. The market is characterized by a strong demand for specialized consulting related to long-term care insurance, predictive modeling for health risk management, and cyber risk quantification. Regulatory modernization efforts, such as updates to Long-Duration Targeted Improvements (LDTI) in the U.S., mandate significant actuarial involvement in financial reporting, sustaining high demand for valuation and reserving services. The region leads in the adoption of advanced analytics and cloud-based actuarial solutions, fostering innovation in risk transfer mechanisms and capital modeling.

- Europe: Europe is a highly regulated market, with demand fundamentally shaped by the Solvency II directive and the ongoing transition to IFRS 17 across the continent. These frameworks necessitate constant and complex actuarial calculations related to technical provisions, capital requirements, and risk mitigation strategies. The market is witnessing high growth in specialized areas such as climate-related financial risk (driven by EU mandates) and pension de-risking solutions as demographic pressures mount. Western European countries, particularly the UK, Germany, and France, host major actuarial hubs and demonstrate strong adoption of innovative approaches to longevity risk and complex reinsurance structures.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rising middle-class disposable incomes, historically low insurance penetration rates, and supportive government initiatives promoting retirement security and health coverage. Markets such as China, India, and Indonesia are undergoing rapid regulatory maturation, adopting international standards which necessitate professional actuarial oversight. Demand is strong for new product development, particularly in personalized health insurance and microinsurance schemes. Furthermore, the rapid digitalization in APAC is creating massive data pools, driving investment in actuarial services that can leverage machine learning for efficient market penetration and risk assessment in emerging economies.

- Latin America (LATAM): The LATAM market, while smaller, offers considerable growth potential driven by economic stability improvements and increasing globalization of financial services. Countries like Brazil and Mexico require actuarial expertise to manage high inflation environments, currency volatility, and evolving local regulatory frameworks. The focus here is primarily on basic reserving and compliance services for both local and international insurers, alongside consulting for pension plan restructuring to ensure long-term fiscal viability.

- Middle East and Africa (MEA): Growth in the MEA region is concentrated around major financial hubs, notably the UAE, Saudi Arabia, and South Africa. Demand is spurred by regulatory reforms aimed at enhancing solvency and risk governance (e.g., GCC regulations for insurance standardization) and the expansion of Takaful (Islamic insurance) schemes. Actuarial services are essential for pricing and managing unique financial products tailored to regional demographic and religious requirements, alongside navigating challenges related to geopolitical instability and localized healthcare cost inflation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Actuarial Services Market.- Deloitte

- Ernst & Young (EY)

- KPMG

- PricewaterhouseCoopers (PwC)

- Mercer (A Marsh McLennan Company)

- Willis Towers Watson (WTW)

- Milliman

- Aon

- Oliver Wyman (A Marsh McLennan Company)

- Gen Re

- Munich Re

- Towers Watson (Legacy)

- Apex Group

- RGA

- BCG

- Conduent

- FIS (Financial Information Systems)

- Mazars

- HCL Technologies (Providing BPO/Outsourcing Services)

- Admiral Solutions

Frequently Asked Questions

Analyze common user questions about the Actuarial Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current demand for Actuarial Services in the insurance sector?

The demand is primarily driven by global regulatory mandates, specifically the implementation of IFRS 17 and Solvency II, which require rigorous actuarial input for financial reporting, liability valuation, and capital allocation. Increasing complexity in risk exposure, such as climate change and cyber threats, also necessitates specialized consulting services for product development and Enterprise Risk Management (ERM).

How is Artificial Intelligence (AI) transforming traditional Actuarial Services?

AI is transforming actuarial services by automating labor-intensive tasks like data processing and model calibration, particularly through machine learning (ML) algorithms. This shift allows actuaries to concentrate on strategic interpretation, complex non-standard risk modeling, and the integration of predictive analytics for more precise pricing and reserving, enhancing efficiency but requiring new skill sets focused on data science.

Which geographical region exhibits the highest growth potential for Actuarial Services?

The Asia Pacific (APAC) region demonstrates the highest growth potential, driven by significant economic expansion, rapidly increasing insurance penetration rates among the growing middle class, and the adoption of modern, sophisticated regulatory frameworks in key emerging markets like China and India, requiring extensive external actuarial support.

What role do Actuarial Services play in managing non-traditional risks like climate change?

Actuarial services are crucial in quantifying and managing non-traditional risks like climate change by developing sophisticated catastrophe modeling, assessing long-term liability impacts from severe weather events, and supporting the creation of specialized climate-related financial products and sustainability reporting required by regulators and stakeholders.

What is the current trend regarding the deployment of Actuarial Services solutions?

The current trend heavily favors the adoption of cloud-based deployment models (SaaS and PaaS). Cloud platforms offer superior scalability, high-performance computing necessary for complex stochastic modeling, and enhanced collaborative features, allowing firms to reduce infrastructure costs and accelerate the implementation of regulatory updates compared to traditional on-premise systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager