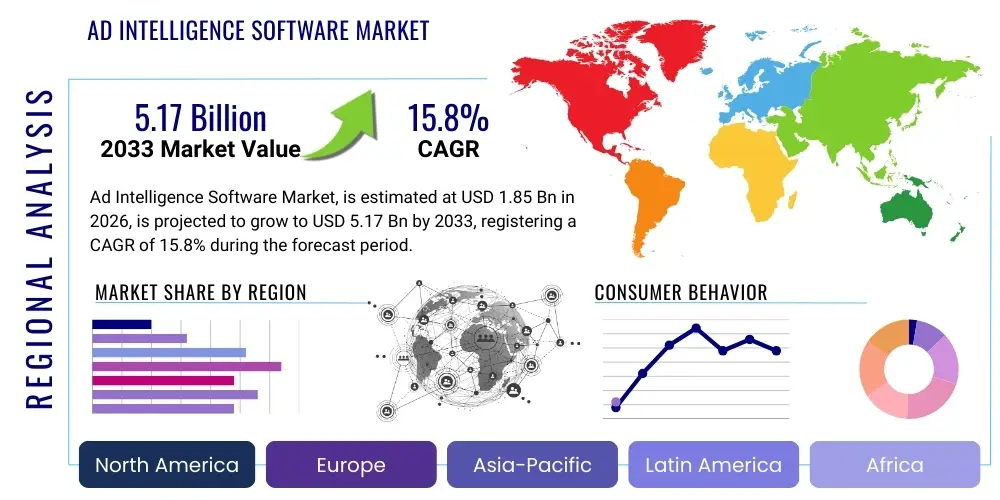

Ad Intelligence Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436312 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Ad Intelligence Software Market Size

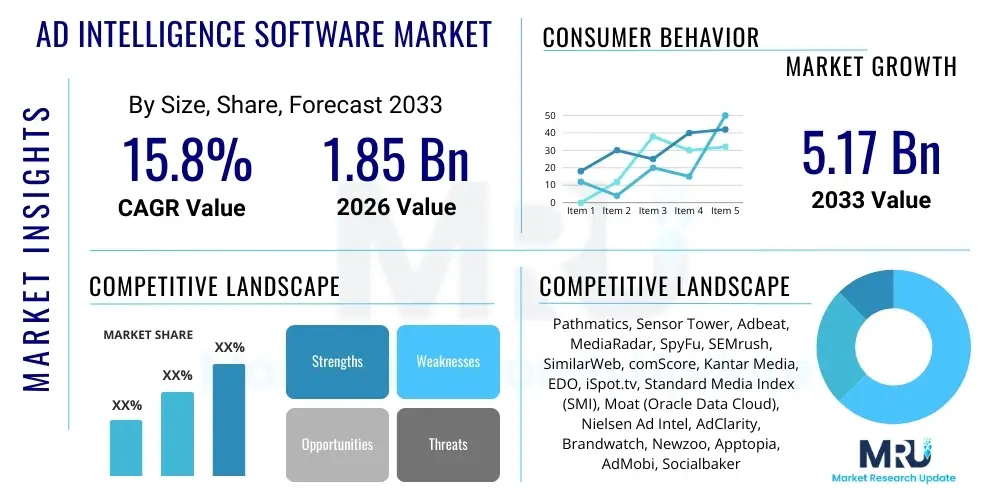

The Ad Intelligence Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. This robust expansion is fueled by the continuous need for granular data analysis in digital advertising, coupled with the increasing adoption of programmatic buying and cross-channel marketing strategies. Businesses globally are investing heavily in sophisticated tools to gain a competitive edge by monitoring competitor strategies, optimizing campaign performance, and identifying emerging market trends in real-time. The complexity of the modern advertising ecosystem, encompassing numerous platforms such as social media, search engines, and streaming services, necessitates automated, data-driven intelligence solutions.

The market is estimated at USD 1.85 billion in 2026 and is projected to reach USD 5.17 billion by the end of the forecast period in 2033. This significant growth trajectory reflects the critical shift among advertisers from intuition-based decisions to highly quantifiable, performance-driven optimization. Ad intelligence software, which provides capabilities ranging from competitive benchmarking and creative analysis to spending transparency and audience insights, has become indispensable for marketing agencies, large enterprises, and e-commerce companies seeking to maximize Return on Advertising Spend (ROAS). Furthermore, the integration of Artificial Intelligence (AI) and Machine Learning (ML) is substantially enhancing the predictive capabilities of these platforms, driving further market adoption.

Ad Intelligence Software Market introduction

Ad Intelligence Software encompasses sophisticated platforms designed to collect, analyze, and interpret vast amounts of data related to digital advertising activities across various channels. These tools provide advertisers, publishers, and agencies with competitive insights, allowing them to track competitor spend, monitor campaign performance, analyze creative strategies, and identify optimal media placements. The fundamental objective of this software is to transform raw, fragmented advertising data into actionable intelligence, facilitating better strategic decision-making and campaign optimization. Key product features typically include tracking ad spend, monitoring ad placements, analyzing creative formats (such as video and display), and segmenting data by geography or platform, offering a comprehensive view of the competitive landscape.

Major applications of Ad Intelligence Software span across competitive analysis, media planning, campaign auditing, and brand safety monitoring. For media agencies, the software is crucial for pitching new clients and demonstrating expertise by presenting data-backed strategies. For brands, it provides transparency into where and how their competitors are allocating resources and what messaging resonates with target audiences. The primary benefits include enhanced campaign efficiency, improved budget allocation, identification of underserved market opportunities, and ultimately, higher profitability derived from advertising investments. Driving factors for this market include the exponential growth in digital advertising expenditure, the proliferation of new digital channels (like CTV and retail media networks), and the rising need for granular, real-time performance data to justify marketing expenditures to executive stakeholders.

Ad Intelligence Software Market Executive Summary

The Ad Intelligence Software Market is experiencing rapid expansion, primarily driven by the escalating complexity of cross-platform digital campaigns and the imperative for real-time competitive insights. Business trends emphasize platform consolidation, with vendors integrating sophisticated AI/ML capabilities for predictive analytics and automated creative testing. Furthermore, a growing focus on privacy-compliant data solutions, particularly in light of cookie deprecation, is prompting software providers to innovate around contextual intelligence and first-party data activation tools. The enterprise segment, characterized by large-scale ad spend and complex organizational structures, remains the dominant revenue generator, demanding robust, customizable solutions with high integration capabilities with existing Marketing Technology (MarTech) stacks. Strategic partnerships between ad intelligence firms and leading social media or ad exchange platforms are also shaping the competitive dynamics.

Regionally, North America maintains the largest market share, underpinned by high digital ad spend, early adoption of advanced analytics, and the presence of major technological innovation hubs. However, the Asia Pacific (APAC) region is forecasted to exhibit the fastest growth rate, fueled by surging internet penetration, rapid e-commerce expansion in markets like China and India, and a burgeoning digital-native consumer base requiring hyper-localized ad strategies. Segment trends indicate a strong shift towards solutions optimized for social media monitoring and mobile advertising intelligence, reflecting where consumers predominantly engage with content. The software deployment model is increasingly leaning towards cloud-based (SaaS) offerings due to their scalability, lower operational overheads, and ease of access, which aligns perfectly with the agile requirements of modern digital marketing teams.

AI Impact Analysis on Ad Intelligence Software Market

Users frequently inquire about how AI can move ad intelligence beyond simple historical data reporting and into predictive strategic planning. Common user questions revolve around AI’s ability to automate competitive benchmarking, forecast the impact of competitor creative changes, and precisely attribute success across fragmented digital paths. There is significant interest in understanding how Machine Learning models can analyze vast, unstructured datasets—such as competitor video transcripts or image recognition for ad elements—to extract actionable insights previously impossible for human analysts. Key concerns often focus on data quality, model transparency (explainability), and the ethical implications of using AI to reverse-engineer competitor strategies. Expectations are high for AI to deliver hyper-personalized intelligence, dynamic budget allocation recommendations, and real-time alerts regarding sudden competitive shifts, fundamentally redefining the role of the human ad strategist from a data gatherer to a high-level decision-maker utilizing AI-generated foresight.

The integration of Artificial Intelligence, specifically Machine Learning (ML) and Natural Language Processing (NLP), is revolutionizing the Ad Intelligence Software market by introducing capabilities that transcend traditional data aggregation. AI algorithms are now deployed to perform complex tasks such as sentiment analysis of ad copy, automated classification of competitor ad creatives by theme and intent, and predicting future ad spend based on historical trends and macroeconomic indicators. This shift allows marketing professionals to not only understand what happened but, more importantly, to anticipate competitive moves and optimize their own campaigns proactively. AI significantly enhances the accuracy of competitive spending estimation by processing massive datasets from various sources, thereby reducing data latency and improving the tactical responsiveness of advertising teams. Furthermore, AI-driven platforms are enabling sophisticated anomaly detection, alerting users to unusual market activities or sudden shifts in competitor strategy that require immediate attention.

AI's most profound impact is seen in its capability to process and derive meaning from unstructured data, a category that constitutes the majority of competitive advertising content, including images, video, and dynamic ad units. By applying computer vision and advanced NLP, ad intelligence software can automatically tag, categorize, and benchmark thousands of competitor creative assets, providing deep insights into messaging evolution, visual trends, and effective calls-to-action. This level of automated, granular analysis ensures that users can maintain a high degree of competitive awareness without requiring extensive manual effort, thereby accelerating the strategic cycle and maximizing the speed at which organizations can adapt to market changes. The ongoing development of sophisticated generative AI tools is also poised to influence the market, potentially allowing for instantaneous, data-informed generation of new ad variants based on successful competitive characteristics identified through intelligence gathering.

- AI enables predictive competitive forecasting and scenario planning based on observed market movements.

- Machine Learning optimizes creative analysis by automating the classification and benchmarking of visual and textual ad elements.

- Natural Language Processing (NLP) extracts key strategic intent and messaging themes from competitor ad copy at scale.

- AI enhances data attribution and accuracy, particularly in estimating competitor ad spend across complex, fragmented digital channels.

- Advanced algorithms facilitate real-time anomaly detection, flagging unusual or aggressive competitive behavior instantly.

- Generative AI is increasingly used to inform dynamic creative optimization strategies based on intelligence derived from competitor performance.

- AI-powered tools improve audience profiling and segmentation insights by correlating competitor targeting strategies with performance data.

DRO & Impact Forces Of Ad Intelligence Software Market

The Ad Intelligence Software market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the primary impact forces shaping its trajectory. The dominant driver is the necessity for businesses to navigate the opaque and highly competitive digital advertising landscape, where massive budgets are allocated daily and accountability is paramount. Complementing this is the opportunity presented by emerging channels, such as Connected TV (CTV) and retail media networks, which require new forms of sophisticated intelligence tools to track performance and competitive presence effectively. However, the market faces significant restraints, chiefly related to stringent data privacy regulations like GDPR and CCPA, which restrict access to certain user-level data essential for traditional ad tracking, forcing platforms to pivot towards contextual and aggregated data solutions. These forces mandate continuous innovation in privacy-by-design architecture, ensuring the market evolves sustainably while adhering to legal requirements globally.

Drivers: The explosive growth in global digital advertising expenditure, projected to surpass traditional media spend significantly, serves as a fundamental catalyst. As organizations increasingly adopt data-driven marketing models, the demand for measurable and attributable performance metrics drives the adoption of ad intelligence tools. Furthermore, the growing sophistication of advertising fraud necessitates robust intelligence platforms capable of providing transparency and ensuring brand safety. The drive for efficiency and maximizing Return on Investment (ROI) across multi-channel campaigns compels enterprises to invest in software that provides comprehensive competitive benchmarking, allowing them to optimize their strategy against market leaders.

Restraints: Significant technical challenges include the inherent difficulty in accurately estimating private network ad spend and the technical barriers imposed by anti-tracking measures deployed by major browser and platform vendors (e.g., Apple’s ATT framework). Furthermore, the prohibitive cost and complexity associated with implementing highly advanced, enterprise-grade ad intelligence platforms can restrain adoption among Small and Medium-sized Enterprises (SMEs). Regulatory fragmentation across different geographies regarding data usage and cross-border data transfer poses continuous compliance burdens on global software providers, necessitating flexible and localized solutions that increase development complexity and operational overhead.

Opportunities: Key opportunities lie in the expansion into niche intelligence areas, such as influencer marketing analytics, gaming advertising (in-game ads), and the development of specialized intelligence for emerging programmatic channels like audio advertising. The massive shift towards first-party data strategies presents an opportunity for ad intelligence platforms to integrate seamlessly with Customer Data Platforms (CDPs) and Data Management Platforms (DMPs) to enrich competitive insights with proprietary customer context. Moreover, geographic expansion into rapidly digitizing markets, particularly in Latin America and Southeast Asia, offers new avenues for market penetration, capitalizing on local advertising spend growth and the rising sophistication of local marketing teams demanding world-class tools.

Segmentation Analysis

The Ad Intelligence Software Market is segmented primarily based on Type, Deployment Model, Application, and End-User, reflecting the diverse needs and operational scales of various market participants. This segmentation is crucial for understanding the targeted offerings within the ecosystem, distinguishing between platforms that focus narrowly on specific aspects, such as search intelligence, and those offering holistic, cross-channel competitive suites. The complexity of digital ad formats and platforms drives the need for highly specialized types of intelligence software, catering specifically to video, mobile, or social media advertising environments. Analyzing these segments helps vendors tailor their product development and go-to-market strategies, ensuring their solutions address the precise pain points of defined customer groups, whether they are large advertising agencies requiring managed services or small businesses needing scalable SaaS tools.

By dissecting the market based on these variables, a clear picture emerges regarding which solution architectures are favored—with the shift toward cloud-based models being a prominent trend—and which applications are receiving the most investment, notably in real-time performance tracking and budget optimization tools. The segmentation by end-user highlights the distinction in feature requirements between Advertising Agencies, which need comprehensive multi-client reporting, and Brands, which prioritize deep insight into specific product categories and global competitive positioning. Furthermore, the segmentation by deployment model clearly indicates that the flexibility and accessibility of Software-as-a-Service (SaaS) platforms are overwhelmingly preferred across all user types due to their low entry barrier and scalability compared to traditional on-premise solutions that require significant internal infrastructure investment and maintenance expertise.

- By Type:

- Search Ad Intelligence

- Display Ad Intelligence

- Social Media Ad Intelligence

- Video Ad Intelligence (Including CTV)

- Native Ad Intelligence

- Mobile Ad Intelligence

- By Deployment Model:

- Cloud-based (SaaS)

- On-premise

- By Application:

- Competitive Analysis and Benchmarking

- Media Planning and Optimization

- Brand Safety and Compliance

- Real-time Performance Monitoring

- Audience Targeting Insights

- By End-User:

- Advertising Agencies

- Brands and Enterprises (Retail, Financial Services, Technology, etc.)

- Publishers and Media Owners

- E-commerce Companies

Value Chain Analysis For Ad Intelligence Software Market

The value chain for the Ad Intelligence Software Market begins with the upstream suppliers responsible for raw data aggregation and technological infrastructure. Upstream activities primarily involve data sourcing from ad exchanges, social platforms, search engines, and proprietary web crawlers, alongside the provision of cloud computing resources and advanced analytical components such as machine learning frameworks. Key players in this stage focus on robust data governance, ensuring the volume, velocity, and variety of data are maintained while adhering to strict privacy protocols. The cost and quality of this foundational data significantly influence the subsequent intelligence products. Direct and indirect data streams are crucial; direct feeds are obtained through partnerships or APIs, while indirect streams rely heavily on sophisticated web crawling and scraping techniques, necessitating continuous technical maintenance against platform changes.

The core stage involves the transformation of raw data into actionable intelligence. Software providers utilize specialized algorithms and proprietary models to cleanse, structure, normalize, and analyze the aggregated data, turning billions of advertising impressions and spend estimations into structured competitive reports and strategic recommendations. This mid-stream processing is where the intellectual property and differentiation of ad intelligence platforms reside. Downstream activities focus on product distribution and service delivery. Distribution channels are predominantly direct, involving subscription-based Software-as-a-Service (SaaS) licenses sold directly to end-users (Agencies, Brands). However, indirect distribution through strategic partnerships with MarTech consultants, data resellers, or complementary platform providers (e.g., DMPs) also plays a role in market penetration and reaching specialized customer segments. Customer support, training, and integration services are vital downstream elements that ensure high user adoption and retention, especially for complex enterprise deployments requiring seamless integration with existing data infrastructure.

In essence, the efficiency of the value chain is determined by the speed and accuracy of data acquisition upstream and the efficacy of analytical transformation in the middle, culminating in a user-friendly and highly integrated downstream product. Optimizing the flow requires strong vendor relationships with data sources and continuous investment in core AI/ML technologies to enhance the predictive power of the intelligence generated. The most significant challenge remains navigating the highly fragmented data sources and the increasing reluctance of major platforms to share comprehensive data, forcing intelligence providers to continually invest in alternative data collection methodologies and superior modeling techniques to maintain data quality and market relevance, thereby impacting overall profitability within the chain.

Ad Intelligence Software Market Potential Customers

The primary consumers of Ad Intelligence Software are organizations with significant stakes in the digital advertising ecosystem, seeking strategic advantage through data-driven competitive insights. These potential customers fall into distinct categories, each utilizing the software for specific, high-value applications. Advertising Agencies, ranging from large global holding companies to boutique digital specialists, are massive consumers, leveraging the tools to win new business pitches, demonstrate competitive mastery to existing clients, optimize client budgets across platforms, and rapidly onboard new market analysts. Agencies require multi-tenant solutions capable of managing hundreds of client accounts and generating customized, executive-level reports that justify media spend decisions.

Secondly, Brands and Enterprises across verticals such as Retail, Financial Services, Telecommunications, and Technology constitute a critical customer segment. These internal marketing teams use ad intelligence for strategic planning, monitoring brand safety, ensuring compliance in regulated industries, and accurately assessing the market positioning of their products relative to key competitors. Their needs often lean towards deep historical trend analysis, creative benchmarking for product launches, and tools that integrate closely with internal Customer Data Platforms (CDPs) for richer context. E-commerce companies, driven by transactional performance, are also key potential customers, using intelligence platforms to monitor price promotions, product-specific ad placements, and fast-moving competitive trends in highly volatile online retail markets, demanding real-time data visibility to execute rapid response marketing strategies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 5.17 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pathmatics, Sensor Tower, Adbeat, MediaRadar, SpyFu, SEMrush, SimilarWeb, comScore, Kantar Media, EDO, iSpot.tv, Standard Media Index (SMI), Moat (Oracle Data Cloud), Nielsen Ad Intel, AdClarity, Brandwatch, Newzoo, Apptopia, AdMobi, Socialbakers (Emplifi) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ad Intelligence Software Market Key Technology Landscape

The Ad Intelligence Software market is technologically intensive, relying heavily on sophisticated Big Data processing capabilities, advanced machine learning (ML) algorithms, and specialized web crawling technologies. Central to the technical architecture is the ability to ingest and normalize petabytes of disparate data from billions of daily advertising events, necessitating the use of highly scalable, cloud-native infrastructure, often built on platforms like AWS, Google Cloud, or Azure. Data ingestion pipelines utilize technologies such as Apache Kafka for real-time streaming and distributed databases like Hadoop or Snowflake for massive data storage and retrieval. Furthermore, proprietary web crawlers and API integrations are continuously refined to bypass technical limitations imposed by platforms and ensure comprehensive coverage of competitor activity across the fragmented digital landscape, requiring continuous investment in anti-detection and data normalization tools to maintain integrity.

Machine Learning and Artificial Intelligence represent the core differentiating technologies, moving the platforms beyond mere reporting towards actionable foresight. Specific ML techniques, including supervised and unsupervised learning, are employed for tasks such as accurate ad spend estimation (which requires sophisticated modeling against limited public data), anomaly detection in competitive activity, and automated classification of creative content using computer vision. Natural Language Processing (NLP) is crucial for analyzing the tone, messaging, and strategic intent of text-based ad creatives, enabling categorization by campaign objective and target audience. These predictive technologies not only streamline the data interpretation process but also empower users with predictive analytics, forecasting potential competitive moves and identifying optimal strategic shifts based on observed market performance trends, dramatically increasing the platform’s value proposition.

Furthermore, the market relies on sophisticated visualization and reporting tools to translate complex data into accessible business intelligence. Modern platforms incorporate interactive dashboards and APIs (Application Programming Interfaces) to facilitate seamless integration with the user’s internal marketing stacks, including CDPs, DMPs, and business intelligence tools. The shift towards privacy-centric data solutions is also driving the adoption of differential privacy techniques and aggregated statistical modeling, ensuring compliance while still providing robust market insights. This technological dependence on rapid iteration and the need for high computational power underscores the barrier to entry and explains why innovation in this market remains highly concentrated among vendors with deep engineering resources and continuous R&D investment in cutting-edge data science.

Regional Highlights

- North America: North America, particularly the United States, holds the dominant market share in Ad Intelligence Software due to the region's massive digital advertising expenditure, technological maturity, and the presence of numerous global headquarters for technology and media companies. Early and widespread adoption of programmatic advertising and the highly competitive nature of the market drive continuous demand for advanced competitive intelligence. Stringent data regulations (e.g., CCPA) also push vendors to develop robust, compliance-focused solutions, solidifying the region as a leader in high-end, sophisticated intelligence offerings.

- Europe: The European market is characterized by high growth potential, driven by accelerating digital transformation across industries and increasing pressure for transparency following GDPR implementation. The need for intelligence platforms that can accurately track ad campaigns across diverse linguistic and cultural markets while ensuring absolute data privacy compliance is a major focus. Countries like the UK, Germany, and France are key adopters, with the market favoring customizable, highly secure, and multilingual intelligence solutions that cater to complex pan-European marketing strategies and the stringent regulatory environment.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid growth in mobile ad spend, vast e-commerce penetration, and increasing internet connectivity across populous nations like China, India, and Southeast Asia. The market here is unique due to the dominance of region-specific platforms (e.g., WeChat, Line) that require specialized intelligence monitoring capabilities. The intense focus on mobile advertising intelligence and the demand for platforms capable of handling high velocity, real-time data in diverse local languages are key drivers, presenting significant opportunities for vendors specializing in hyper-localized competitive insights.

- Latin America (LATAM): LATAM shows promising growth as digital advertising budgets mature and local marketing teams seek efficiency improvements. The adoption is driven by the rise of mobile internet usage and the expansion of global brands into these markets. Key countries like Brazil and Mexico are leading the charge, demanding affordable, scalable SaaS-based ad intelligence tools that help local businesses compete effectively against international players, prioritizing tools for social media and mobile performance tracking.

- Middle East and Africa (MEA): This region is an emerging market, primarily driven by investments in digital infrastructure, high social media penetration, and major government-backed digital initiatives. The Gulf Cooperation Council (GCC) countries lead adoption, utilizing intelligence software to monitor high-value digital campaigns, particularly those targeting affluent consumers in the retail, automotive, and luxury sectors. The market seeks platforms with robust brand safety features and deep insight into regional social media trends.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ad Intelligence Software Market.- Pathmatics (A Sensor Tower Company)

- Sensor Tower

- Adbeat

- MediaRadar

- SpyFu

- SEMrush Holdings Inc.

- SimilarWeb Ltd.

- comScore, Inc.

- Kantar Media

- EDO, Inc.

- iSpot.tv

- Standard Media Index (SMI)

- Oracle Data Cloud (Moat)

- Nielsen Holdings plc (Nielsen Ad Intel)

- AdClarity (Serpstat)

- Brandwatch

- Newzoo

- Apptopia

- AdMobi

- Socialbakers (Now Emplifi)

Frequently Asked Questions

Analyze common user questions about the Ad Intelligence Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Ad Intelligence Software and how does it benefit advertising agencies?

Ad Intelligence Software collects and analyzes competitive data across digital channels (search, social, display) to reveal competitor spending, creative strategies, and media placement choices. Agencies benefit by using this data to create compelling pitches, optimize client budgets, benchmark campaign performance accurately, and identify market opportunities for strategic client growth, ultimately maximizing client ROI.

How is AI transforming the accuracy of competitive ad spend estimation?

AI, through Machine Learning models, processes vast, fragmented datasets and real-time behavioral signals, significantly improving the accuracy of competitor ad spend estimation compared to traditional methods. ML algorithms detect patterns in impression volume and media pricing across exchanges, offering granular, platform-specific spending insights essential for precise budget allocation and competitive scenario planning.

What impact do data privacy regulations like GDPR and CCPA have on the Ad Intelligence market?

Privacy regulations necessitate a pivot away from reliance on third-party cookies and user-level tracking. The Ad Intelligence market is adapting by shifting focus towards contextual intelligence, aggregated data modeling, and privacy-by-design solutions. This ensures compliance while continuing to provide strategic competitive insights based on observed, rather than individual, market behavior and creative analysis.

Which regional market is experiencing the highest growth rate for Ad Intelligence Software?

The Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate. This accelerated expansion is driven by massive growth in mobile advertising, rapid e-commerce expansion, and the need for specialized intelligence to navigate complex, local digital ecosystems unique to markets like China, India, and Southeast Asia, requiring highly adaptable software solutions.

What is the primary difference between search ad intelligence and social media ad intelligence?

Search ad intelligence focuses on competitor keywords, paid search rankings, ad copy analysis (PPC), and landing page strategies used on platforms like Google and Bing. Social media ad intelligence, conversely, monitors creative formats (images, videos), targeting tactics, post engagement, and spending distribution across platforms like Facebook, Instagram, and TikTok, providing insight into audience interaction and visual messaging effectiveness.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager